Overview

If you’re facing tax debt in Missouri, you’re not alone. Many individuals find themselves overwhelmed by their tax obligations, and it’s completely understandable to feel this way. The first step in resolving your tax debt is to understand what you owe and gather the necessary documentation. This can feel daunting, but we’re here to help you through it.

Next, consider exploring your resolution options. Payment plans and settlements can provide relief, allowing you to manage your debt more effectively. It’s important to communicate openly with the Missouri Department of Revenue; they can offer guidance and support tailored to your situation.

Remember, you don’t have to navigate this process alone. There are resources available to help you manage your tax liabilities. Take a moment to reflect on your situation: What steps can you take today to ease your burden?

By taking action and seeking assistance, you can find a path forward. You deserve peace of mind, and with the right support, you can overcome this challenge. Don’t hesitate to reach out for help; together, we can work towards a resolution.

Introduction

Navigating the complexities of state tax obligations can feel overwhelming, especially for those grappling with tax debt in Missouri. We understand that the various levies and deadlines can be daunting, and missing them might lead to costly penalties. This guide is here to empower you with the knowledge and resources necessary to manage and resolve your tax liabilities effectively. We’ll offer insights into payment plans, settlements, and the importance of keeping the lines of communication open with the Missouri Department of Revenue.

But what happens when the weight of tax debt feels too heavy to bear? It’s common to feel anxious about your financial future. How can you take control and find relief from the burden of state taxes? Remember, you are not alone in this journey. We're here to help you navigate these challenges and find a path forward.

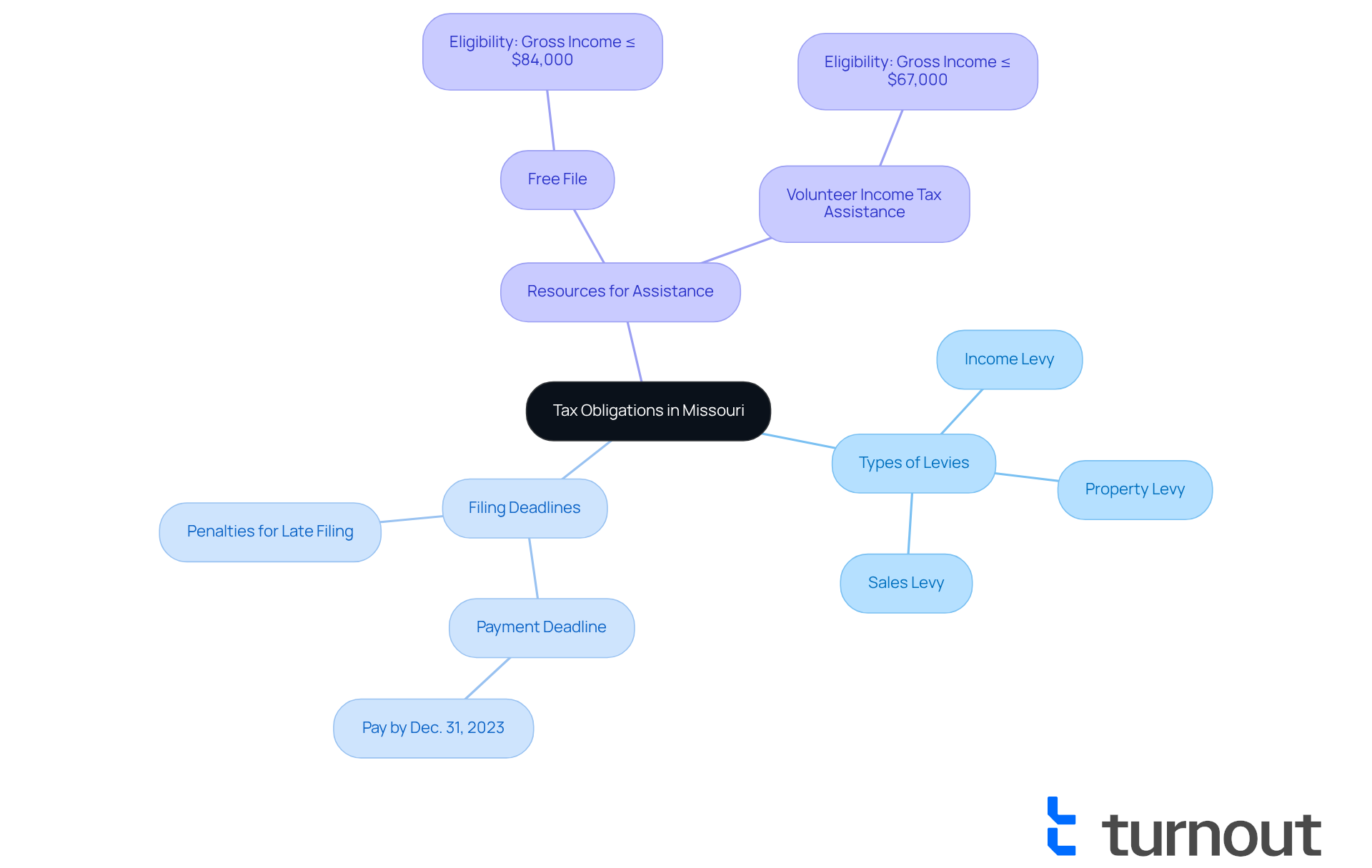

Understand Your Tax Obligations in Missouri

Understanding your tax obligations is essential when you owe Missouri state taxes and are tackling tax debt in the state. We know it can be overwhelming, but getting familiar with the different types of levies—like income, property, and sales levies—can make a significant difference. For the most up-to-date information, visit the Missouri Department of Revenue's website. They offer valuable resources that outline your obligations and the relevant levies for 2025.

It's crucial to pay attention to filing and payment deadlines if you owe Missouri state taxes. Missing these can lead to penalties, particularly if you owe Missouri state taxes, which is the last thing you need. If your gross income is $84,000 or less, you might qualify for free tax preparation software through Free File. This can simplify your filing process and help reduce errors. Additionally, if you earn $67,000 or less, you can access free assistance at Volunteer Income Tax Assistance clinics. This ensures you get the help you need without any costs.

As Michelle D. McBride, Collector of Revenue, reminds us, "Don’t be late! Pay 2023 taxes to St. Charles County Collector of Revenue by Dec. 31, 2023." Consulting with a knowledgeable advocate can also be a great step. They can clarify any confusing aspects of your obligations and help you stay compliant moving forward. Remember, you’re not alone in this journey. By taking these steps, you can navigate the tax landscape of the state with greater confidence and ease.

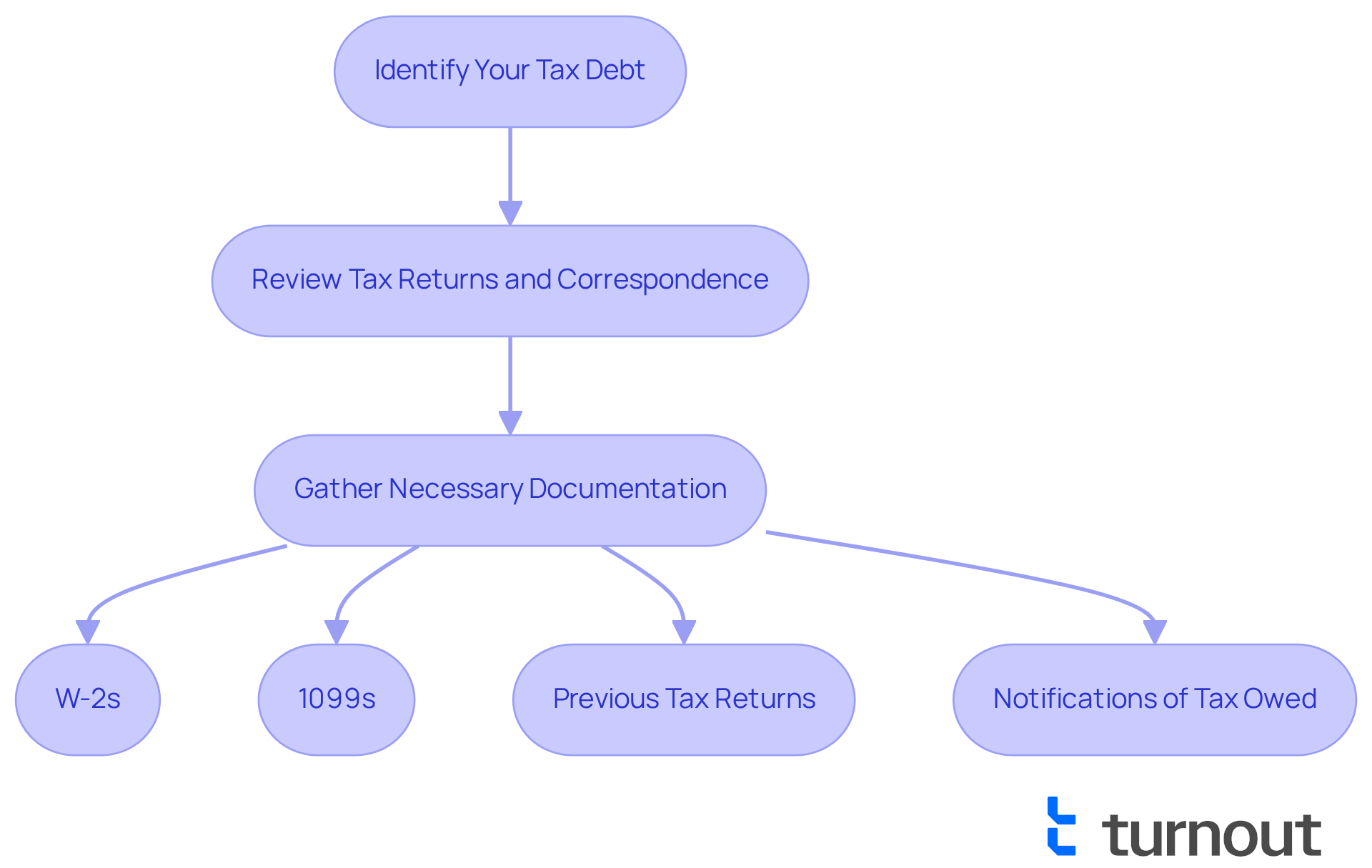

Identify Your Tax Debt and Gather Necessary Documentation

Next, let’s take a moment to understand the tax liability you may owe Missouri state taxes. We know that navigating tax obligations can feel overwhelming, but you’re not alone in this journey. Start by reviewing your tax returns and any correspondence from the Missouri Department of Revenue.

Gather all relevant documentation, such as:

- W-2s

- 1099s

- Previous tax returns

If you’ve received notifications that you owe Missouri state taxes, be sure to keep those as well. Organizing these documents is crucial; it not only helps clarify your financial responsibilities but also prepares you for discussions with tax authorities or an advocate.

Remember, we’re here to help you through this process. Taking these steps can make a significant difference in how you approach your tax situation. You deserve support and clarity as you move forward.

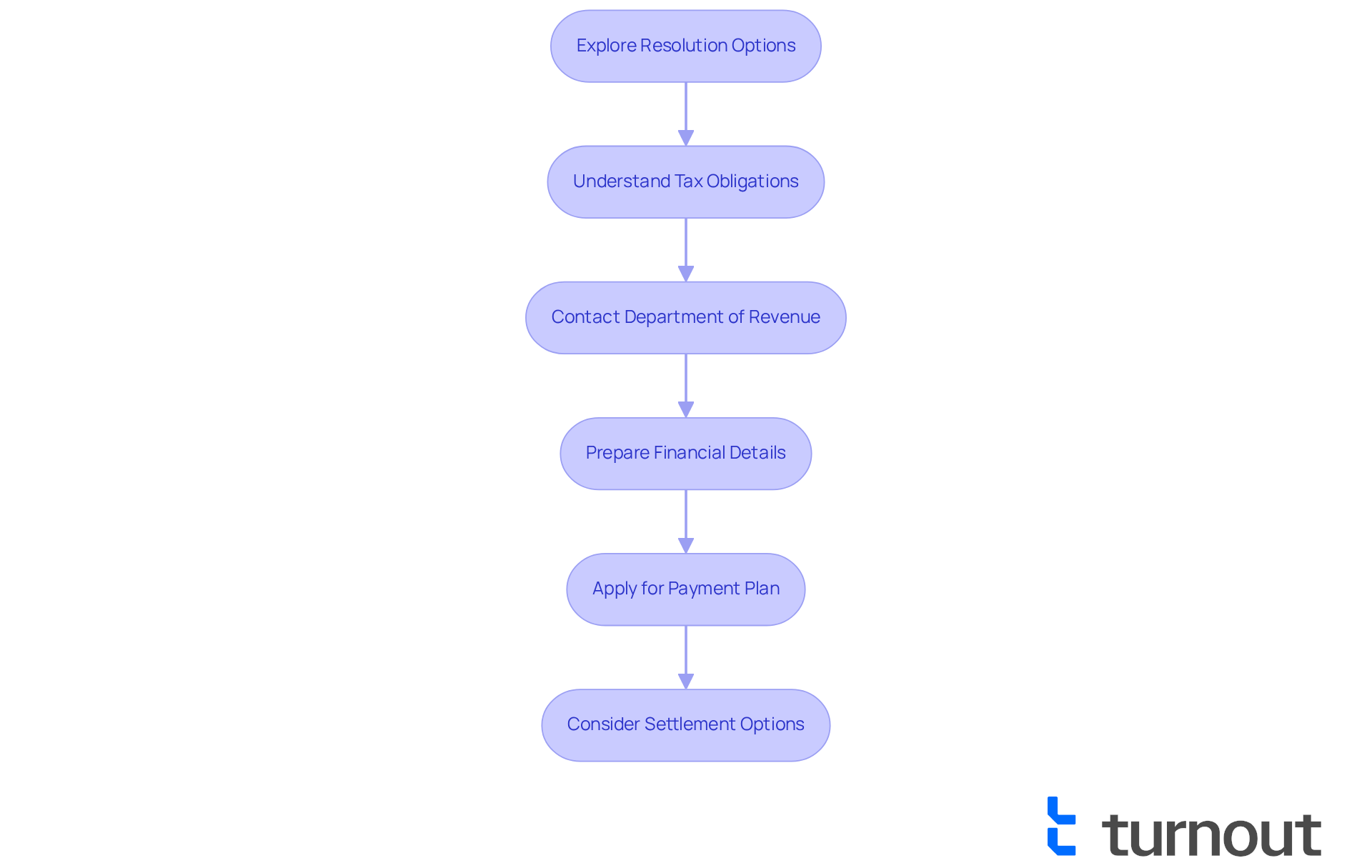

Explore Resolution Options: Payment Plans and Settlements

Understanding your tax obligations can feel overwhelming, but it’s the first step toward finding a resolution. We know that navigating these waters can be tough, which is why the state Department of Revenue offers flexible financing options. These plans allow you to manage your debt over time, typically extending up to 36 months. To get started, simply reach out to the department directly or visit their online portal. Just be ready to provide your financial details to support your application. Remember, monthly payments for the Missouri tax repayment plan need to be at least $50, so it’s important to factor that into your budgeting.

If you’re facing financial hardship, there’s hope. You might qualify for a settlement that could significantly lower your tax liability. A deposit of around 25% may be required, depending on your compliance history. Engaging with a knowledgeable advocate can make a world of difference in negotiating these settlements. Many individuals who have successfully navigated this process often share stories of substantial reductions in their tax burdens, highlighting the benefits of having professional support.

Recently, the Department of Revenue has updated its policies to make the payment plan application process smoother. This change aims to help taxpayers like you access the support you need more easily. However, it’s crucial to meet all requirements during your application to avoid any setbacks. As we look ahead to 2025, the department continues to stress the importance of compliance and timely communication. This way, you can steer clear of penalties, such as liens or wage garnishments, while managing your obligations.

By exploring these options, you’re taking proactive steps toward resolving your tax debt and regaining your financial stability. Remember, you’re not alone in this journey, and we’re here to help.

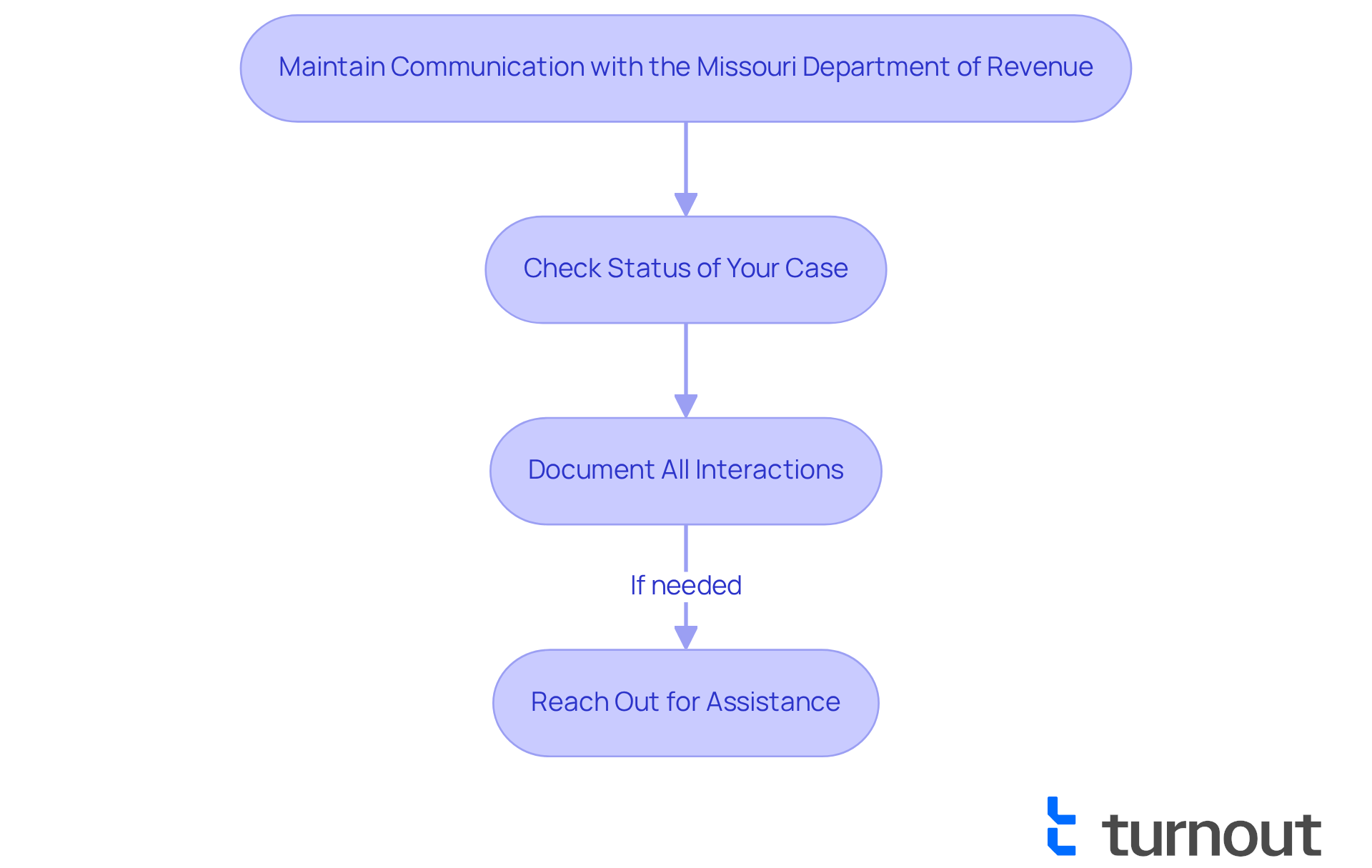

Maintain Communication with the Missouri Department of Revenue

It's important to keep the lines of communication open with the Missouri Department of Revenue. Regularly checking in on the status of your case can make a difference, especially if you've submitted a payment plan or settlement request. Remember to document all interactions—note the dates, names of representatives, and details discussed. This record will be invaluable if any issues arise.

We understand that navigating this process can feel overwhelming at times. If you encounter difficulties, consider reaching out to Turnout. Their trained nonlawyer advocates are here to assist you, ensuring your rights are protected. Turnout specializes in helping individuals with SSD claims and tax debt relief, providing support without the need for legal representation. You're not alone in this journey; help is available.

Conclusion

Understanding and resolving tax debt in Missouri is more than just a task; it’s a vital step toward securing your financial well-being. We know that navigating tax obligations can feel overwhelming, but by familiarizing yourself with what you owe, gathering the necessary documents, and exploring your options, you can take charge of your situation. Open communication with the Missouri Department of Revenue is key. Each step you take not only helps you comply but also empowers you to regain control over your finances.

It’s important to be proactive. Consider:

- Utilizing free tax preparation resources

- Exploring flexible payment plans

- Looking into potential settlements

There are many paths available to help lighten your tax burden. Staying organized and documenting your interactions with tax authorities can prevent misunderstandings and make the resolution process smoother.

Ultimately, addressing tax debt isn’t just about meeting obligations; it’s about reclaiming your peace of mind and achieving financial stability. By taking the initiative to understand and act on these steps, you can pave the way for a brighter financial future. Remember, you’re not alone in this journey. Seeking help and staying informed are vital strategies in overcoming tax-related challenges. We’re here to help you every step of the way.

Frequently Asked Questions

What are the main types of taxes I need to be aware of in Missouri?

In Missouri, you should be aware of different types of levies, including income, property, and sales levies.

Where can I find the most up-to-date information about my tax obligations in Missouri?

The most up-to-date information about your tax obligations can be found on the Missouri Department of Revenue's website.

What are the consequences of missing filing and payment deadlines for Missouri state taxes?

Missing filing and payment deadlines can lead to penalties, which can complicate your tax situation further.

Am I eligible for free tax preparation software in Missouri?

Yes, if your gross income is $84,000 or less, you might qualify for free tax preparation software through Free File.

Is there assistance available for those with lower incomes in Missouri?

Yes, if you earn $67,000 or less, you can access free assistance at Volunteer Income Tax Assistance clinics.

What is the deadline for paying 2023 taxes to St. Charles County?

The deadline for paying 2023 taxes to the St. Charles County Collector of Revenue is December 31, 2023.

How can I get help understanding my tax obligations in Missouri?

Consulting with a knowledgeable advocate can help clarify any confusing aspects of your obligations and ensure compliance.