Introduction

Navigating tax obligations can feel overwhelming, and it’s completely understandable to feel that way. But there’s hope! The IRS Fresh Start Program shines a light for those seeking relief. This initiative offers structured pathways to manage tax debts, from installment agreements to offers in compromise. It’s designed to help you regain control over your financial future.

However, with so many options and eligibility criteria, it’s common to wonder: how can you effectively access these relief opportunities? You’re not alone in this journey. Many people face similar challenges, and we’re here to help you navigate through them. Let’s explore how you can take advantage of these options while avoiding common pitfalls.

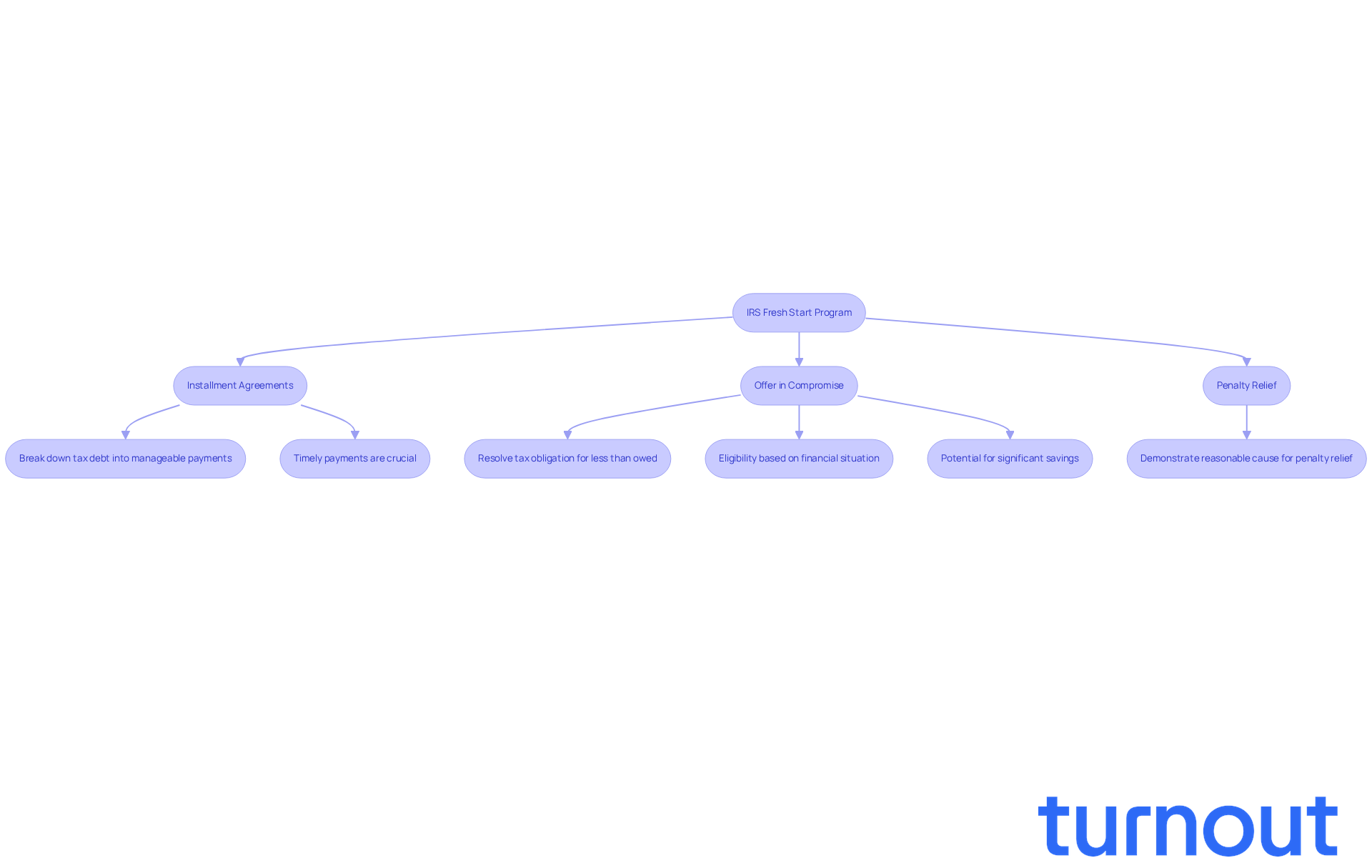

Understand the IRS Fresh Start Program

Facing tax obligations can be overwhelming, but the tax fresh start program offered by the IRS provides a compassionate lifeline for individuals in need. This program provides a systematic approach to managing tax liabilities, helping you regain control of your financial situation.

-

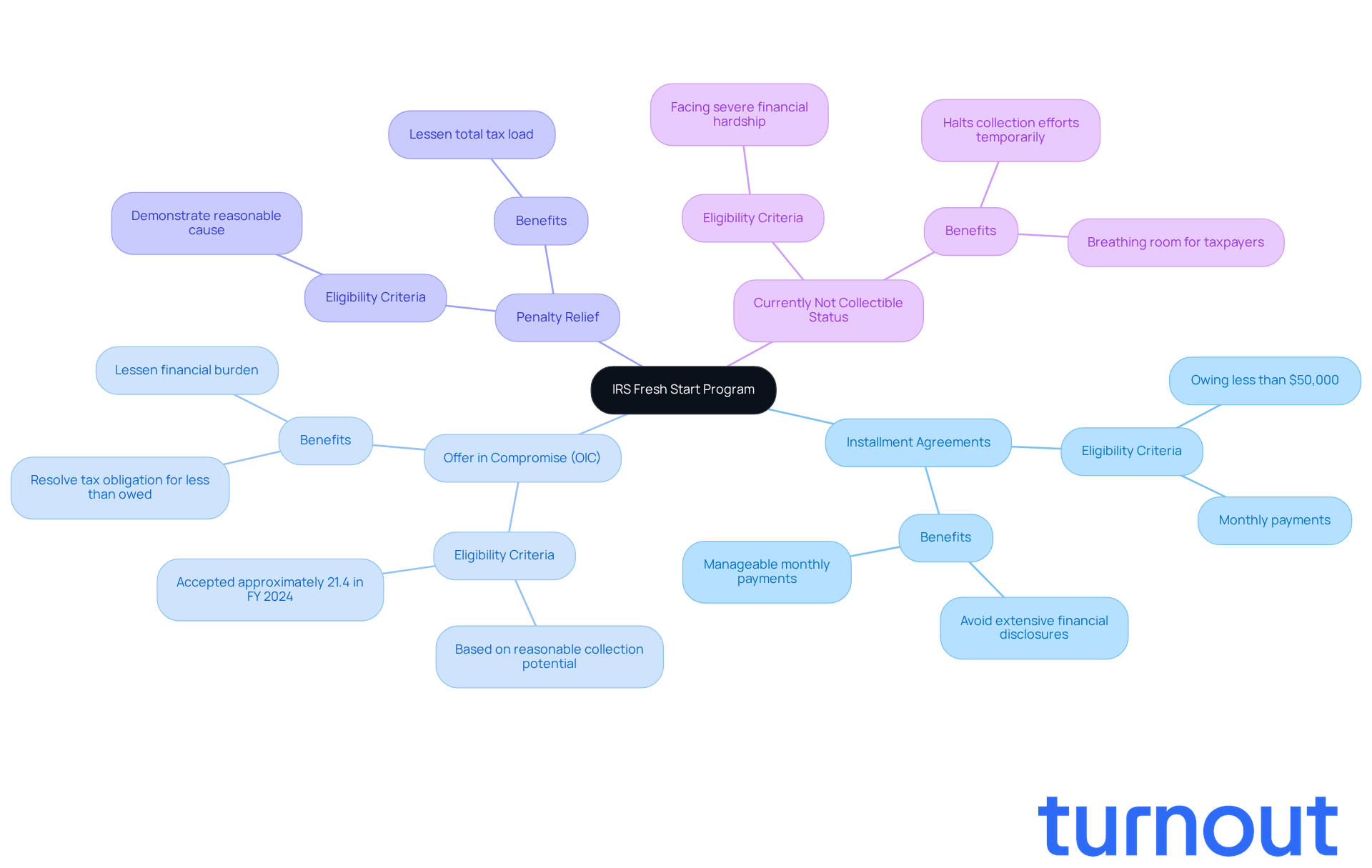

Installment Agreements are one of the key features of this program. They allow you to break down your tax debt into manageable monthly payments, making it easier to stay on track financially. Remember, timely payments are crucial to maintain your eligibility for these agreements.

-

Another valuable option is the Offer in Compromise (OIC). If you meet specific eligibility criteria, you might be able to resolve your tax obligation for less than what you owe. For instance, one client successfully negotiated a settlement of $41,251 down to just $2,196, achieving an incredible 95% savings. Imagine what that could mean for your financial future!

-

Additionally, there’s Penalty Relief available. If you can demonstrate reasonable cause for your inability to pay, you may qualify for relief from certain penalties, further easing your financial burden.

As we look ahead to 2026, the IRS continues to apply tax fresh start principles, and many individuals are finding hope through these options. For example, a client with a $319,114 debt secured a Partial Payment Plan for only $243 per month, resulting in a staggering 99% savings. However, it’s important to remember that demonstrating financial hardship is essential to qualify for such plans.

We understand that ongoing challenges like economic uncertainty and inflation can weigh heavily on many individuals. But know this: the tax fresh start program remains a crucial tool for those seeking to regain financial stability and effectively manage their tax obligations. You are not alone in this journey, and we’re here to help you navigate these challenges.

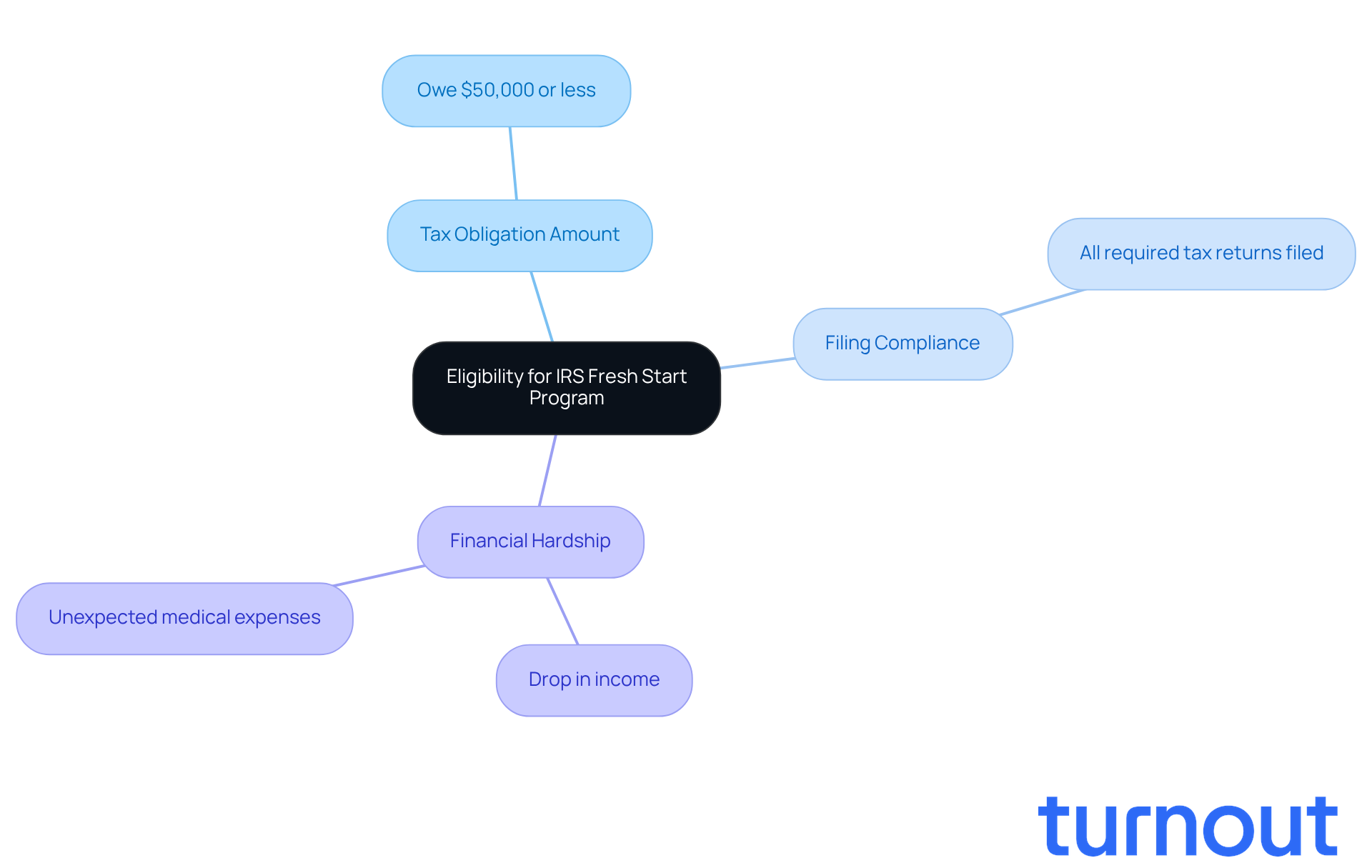

Determine Your Eligibility for the Program

Are you feeling overwhelmed by tax obligations? You’re not alone. Many taxpayers find themselves in challenging situations, but there’s hope. The IRS Fresh Start Program provides a tax fresh start for those who qualify, and understanding the criteria is the first step toward regaining your financial footing.

-

Tax Obligation Amount: To qualify, you must owe $50,000 or less in total tax liability, including penalties and interest. This is crucial, as about 80% of individuals with tax obligations fall within this range. This means you could be eligible for various relief options, like streamlined installment agreements and Offers in Compromise.

-

Filing Compliance: It’s essential to have all required tax returns filed and to be current on all tax filings. The IRS won’t consider applications with outstanding unfiled returns, so ensuring compliance is a key part of the eligibility process.

-

Financial Hardship: You’ll need to show that you’re facing financial hardship. This could be due to a significant drop in income, unexpected medical expenses, or other financial challenges. For example, one individual with a $10,000 state tax debt managed to settle for just $200 by submitting a strategic hardship application. This illustrates how your financial situation can influence your eligibility. The Offer in Compromise option allows you to propose a settlement amount based on your circumstances, potentially reducing your total tax liability.

By carefully assessing these criteria, you can determine if you qualify for relief under the tax fresh start program. Remember, understanding these requirements is the first step toward accessing the support you need. We’re here to help you navigate this journey and find the relief options available to you.

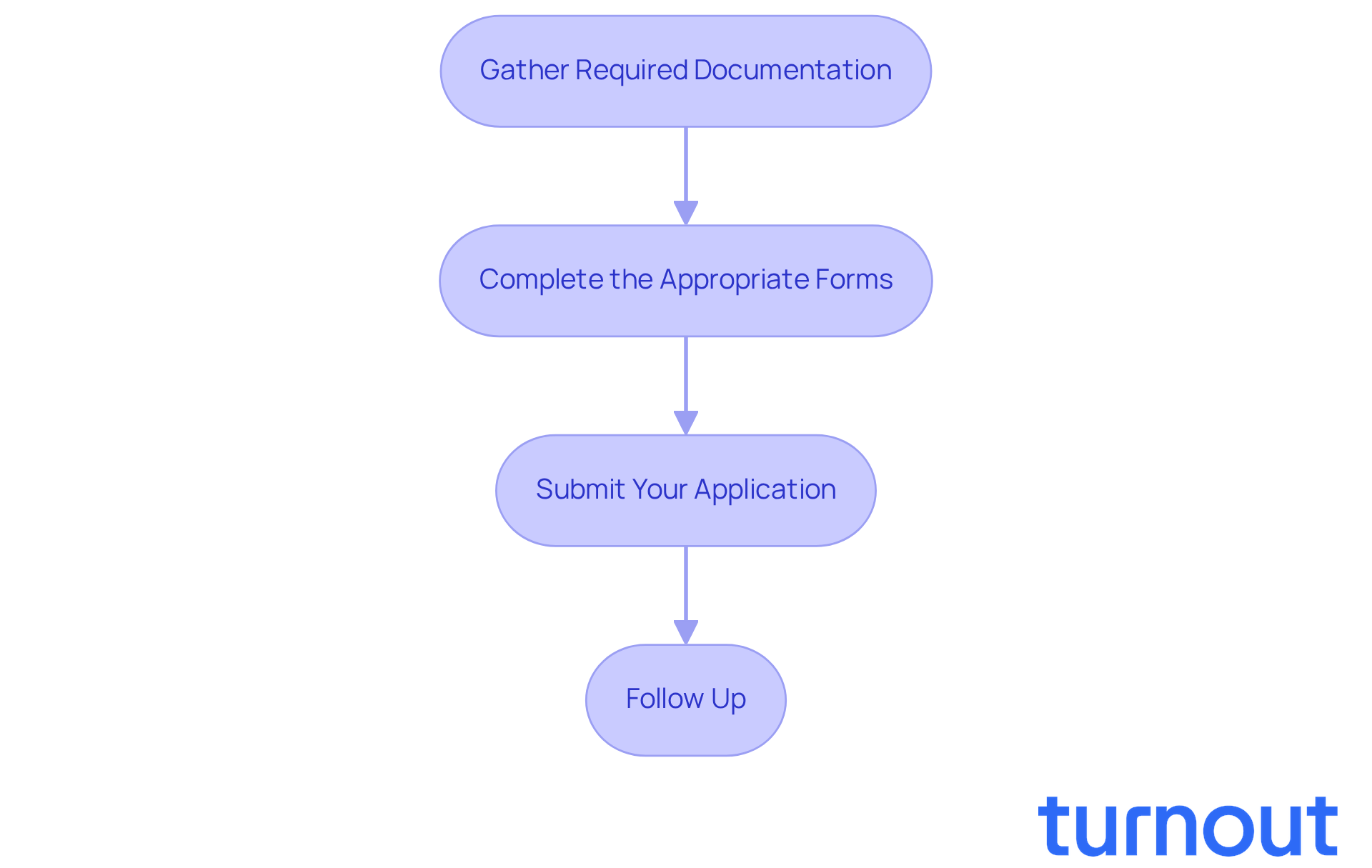

Follow the Application Steps for the Fresh Start Program

Applying for the tax fresh start can feel overwhelming, but we're here to help you through it. By following these steps, you can navigate the process with greater ease and confidence.

-

Gather Required Documentation: Start by collecting essential financial documents. This includes your income statements, recent tax returns, bank statements, and any correspondence from the IRS. Remember, accurate documentation is crucial. Incomplete or inaccurate submissions can lead to automatic denials, and we want to avoid that for you.

-

Complete the Appropriate Forms: Depending on the relief option you’re pursuing - like an Offer in Compromise (OIC) or an installment agreement - make sure to fill out the necessary forms accurately. For an OIC, use Form 656 and include Form 433-A or 433-B to disclose your financial situation. If you’re looking for Installment Agreements, complete Form 9465, and for Penalty Abatement, use Form 843. Taking the time to do this right can make a big difference.

-

Submit Your Application: Once your forms are complete, send them along with your supporting documentation to the designated IRS address. Don’t forget to keep copies of everything you submit for your records. This is important for tracking your application. Submitting a complete application early in the year can also improve processing times, as the IRS handles fewer backlogged cases outside of peak tax season.

-

Follow Up: After you’ve submitted your application, it’s important to actively monitor its status. Respond promptly to any requests for additional information from the IRS. Delays can prolong the process and may lead to wage garnishments and accruing penalties. The average processing time for Installment Agreements can take weeks, while Offers in Compromise may take several months.

By diligently following these steps, you can achieve a tax fresh start and navigate the application process more effectively. Remember, you are not alone in this journey, and taking these actions can significantly increase your chances of securing the relief you need.

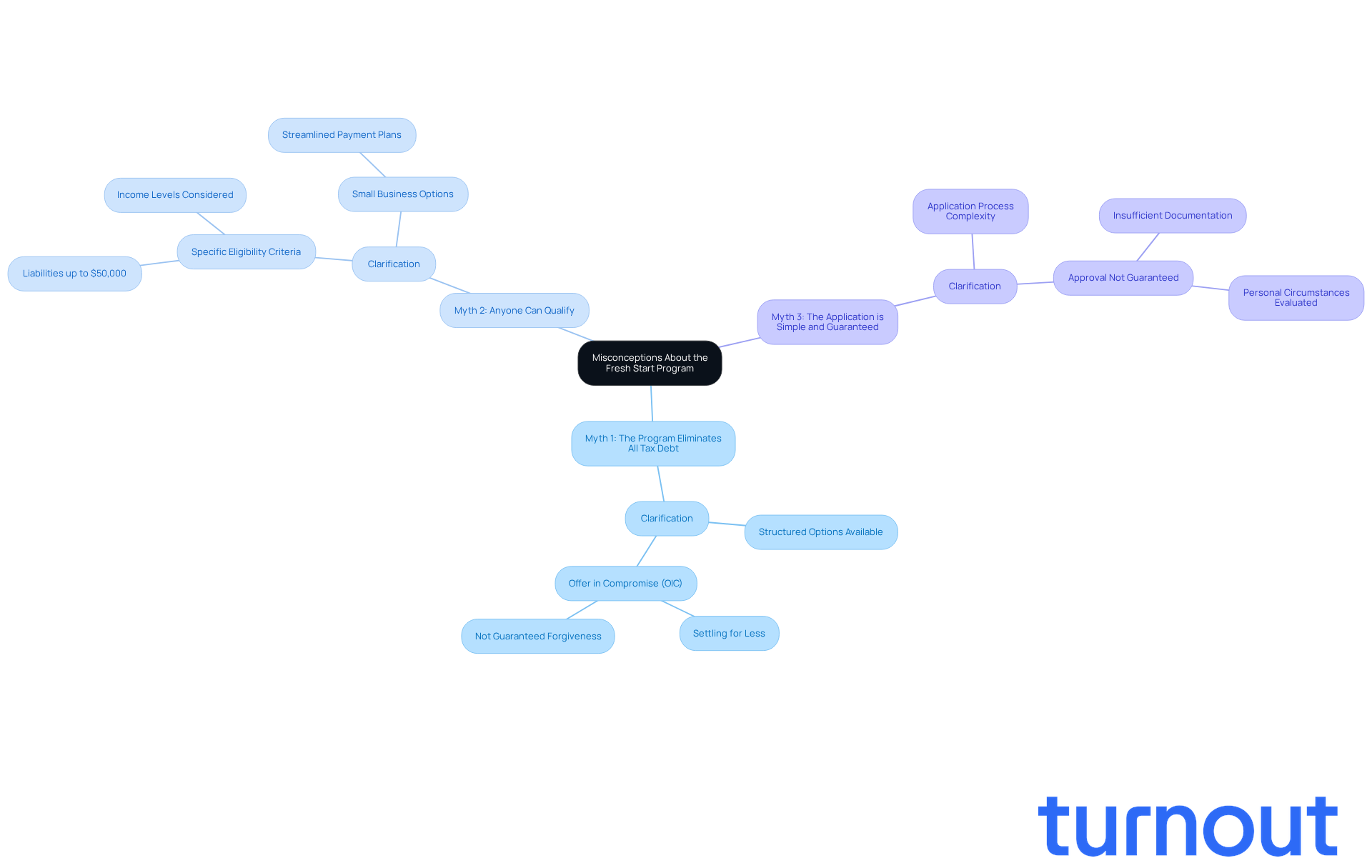

Clarify Misconceptions About the Fresh Start Program

Misunderstandings about the tax fresh start program can create significant confusion for individuals seeking relief. We understand that navigating tax issues can be overwhelming, so let’s clarify some prevalent myths:

-

Myth 1: The Program Eliminates All Tax Debt: It’s a common misconception that the Fresh Start Program erases tax debts entirely. In reality, it offers structured options for a tax fresh start to help manage and potentially reduce them. For example, individuals can negotiate an Offer in Compromise (OIC) to settle their obligations for less than what they owe. However, this doesn’t guarantee complete forgiveness. In fact, only a portion of individuals will see their tax obligations lowered or eliminated through options like offers in compromise and penalty abatement.

-

Myth 2: Anyone Can Qualify: Eligibility for the Fresh Start options isn’t universal. Specific criteria, such as income levels and the amount of financial obligation, determine who qualifies. For instance, individuals with liabilities up to $50,000 can apply for an OIC, but those with greater obligations may face different criteria. Additionally, the IRS allows small businesses with tax liabilities of $25,000 or less to choose a simplified payment plan, which is an important detail for many.

-

Myth 3: The Application is Simple and Guaranteed: While the application process can be straightforward, approval isn’t guaranteed. Each case is evaluated based on personal circumstances, and many may find their applications denied due to insufficient documentation or failure to meet eligibility requirements. For example, a client who owed $106,520.83 in sales tax faced challenges in providing the necessary documentation, complicating their application process.

By understanding these misconceptions, you can approach the tax fresh start program with realistic expectations. Remember, you’re not alone in this journey. We’re here to help you develop a more effective strategy for navigating your tax relief options.

Explore Available Relief Options Under the Program

The IRS Fresh Start Program offers several relief options designed to help you manage your tax debts with care and understanding:

-

Installment Agreements: This option allows you to pay your tax obligation in monthly installments, making it more manageable. In 2026, the IRS continues to offer streamlined installment agreements for individuals owing less than $50,000. This means you can avoid extensive financial disclosures, making it easier for you to access this relief.

-

Offer in Compromise (OIC): If you meet the criteria, you can resolve your tax obligation for less than the total amount owed. This can significantly lessen your financial burden. The IRS evaluates these offers based on reasonable collection potential. In FY 2024, the IRS accepted approximately 21.4% of OIC proposals, showing that while competitive, this option is worth considering.

-

Penalty Relief: You may qualify for penalty relief if you can demonstrate reasonable cause for your inability to pay on time. This choice can greatly lessen your total tax load, allowing you to focus on resolving your main tax obligation.

-

Currently Not Collectible Status: If you are facing severe financial hardship, you can request to be placed in currently not collectible status. This temporarily halts collection efforts, giving you some breathing room. However, keep in mind that while in CNC status, penalties and interest continue to accrue.

Real-world examples show how effective these options can be. Many individuals have successfully utilized Installment Agreements to manage their debts without the stress of immediate collection actions. Tax advisors emphasize that early engagement with the IRS and proper documentation are crucial for maximizing your chances of approval for these relief options.

By exploring these avenues, you can identify the most suitable approach to achieve a tax fresh start and reduce your tax burden. Remember, you are not alone in this journey, and we're here to help you work towards financial stability.

Conclusion

Navigating tax obligations can feel overwhelming, but the IRS Fresh Start Program offers a structured pathway to financial relief. We understand that facing tax issues can be daunting, yet by exploring options like:

- Installment Agreements

- Offers in Compromise

- Penalty Relief

you can take significant steps toward regaining control over your financial future. This program is here to support you, emphasizing that relief is not just a dream - it's attainable.

Key insights from the article highlight the importance of understanding eligibility criteria. For instance, you need to owe $50,000 or less, maintain filing compliance, and demonstrate financial hardship. It’s common to have misconceptions about the program, so let’s clarify: while it provides valuable options, it doesn’t guarantee the elimination of all tax debts. Instead, it offers a framework for manageable repayment and negotiation, allowing you to pursue a fresh start effectively.

Ultimately, engaging with the IRS Fresh Start Program is a proactive step toward alleviating tax burdens and achieving financial stability. If you’re struggling with tax obligations, exploring these relief options is crucial. Taking the time to understand eligibility requirements and the application process can lead to significant savings and a renewed sense of hope. Remember, the journey to financial recovery may seem daunting, but with the right guidance and resources, a fresh start is within reach. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is designed to help individuals manage their tax liabilities through a systematic approach, providing options like Installment Agreements, Offers in Compromise, and Penalty Relief to regain control of their financial situation.

What are Installment Agreements in the Fresh Start Program?

Installment Agreements allow taxpayers to break down their tax debt into manageable monthly payments, making it easier to stay on track financially. Timely payments are crucial to maintain eligibility for these agreements.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is an option that allows eligible taxpayers to resolve their tax obligation for less than the total amount owed. For example, a client successfully negotiated a settlement from $41,251 down to $2,196, achieving a 95% savings.

How can I qualify for Penalty Relief under the Fresh Start Program?

To qualify for Penalty Relief, you must demonstrate reasonable cause for your inability to pay your tax obligations, which can help ease your financial burden.

What are the eligibility criteria for the IRS Fresh Start Program?

To qualify for the program, you must owe $50,000 or less in total tax liability (including penalties and interest), have all required tax returns filed, be current on all tax filings, and demonstrate financial hardship.

What does it mean to demonstrate financial hardship?

Demonstrating financial hardship means showing that you are facing significant financial challenges, such as a drop in income or unexpected medical expenses, which can influence your eligibility for relief options like the Offer in Compromise.

Can I still apply for the Fresh Start Program if I have unfiled tax returns?

No, the IRS will not consider applications for the Fresh Start Program if you have outstanding unfiled tax returns. It is essential to be compliant with all tax filings.

How can the Fresh Start Program help with ongoing economic challenges?

The Fresh Start Program provides crucial tools for individuals facing economic uncertainty and inflation, helping them regain financial stability and effectively manage their tax obligations.