Introduction

Navigating the complexities of tax filings can feel overwhelming, especially when it comes to correcting mistakes through amended returns. We understand that millions of taxpayers submit Form 1040-X each year, and it’s crucial to grasp the process and the tools available to track refunds. This article explores the significance of amended returns and offers a step-by-step guide on using the 'Where's My 1040X Refund' tool. We’ll address common challenges and provide resources for support.

What happens when the tool doesn’t provide the answers you need? It’s common to feel frustrated in these situations. By exploring this question, we can help demystify the refund tracking process and empower you to take control of your financial records. Remember, you are not alone in this journey; we’re here to help.

Understand Amended Returns and Their Importance

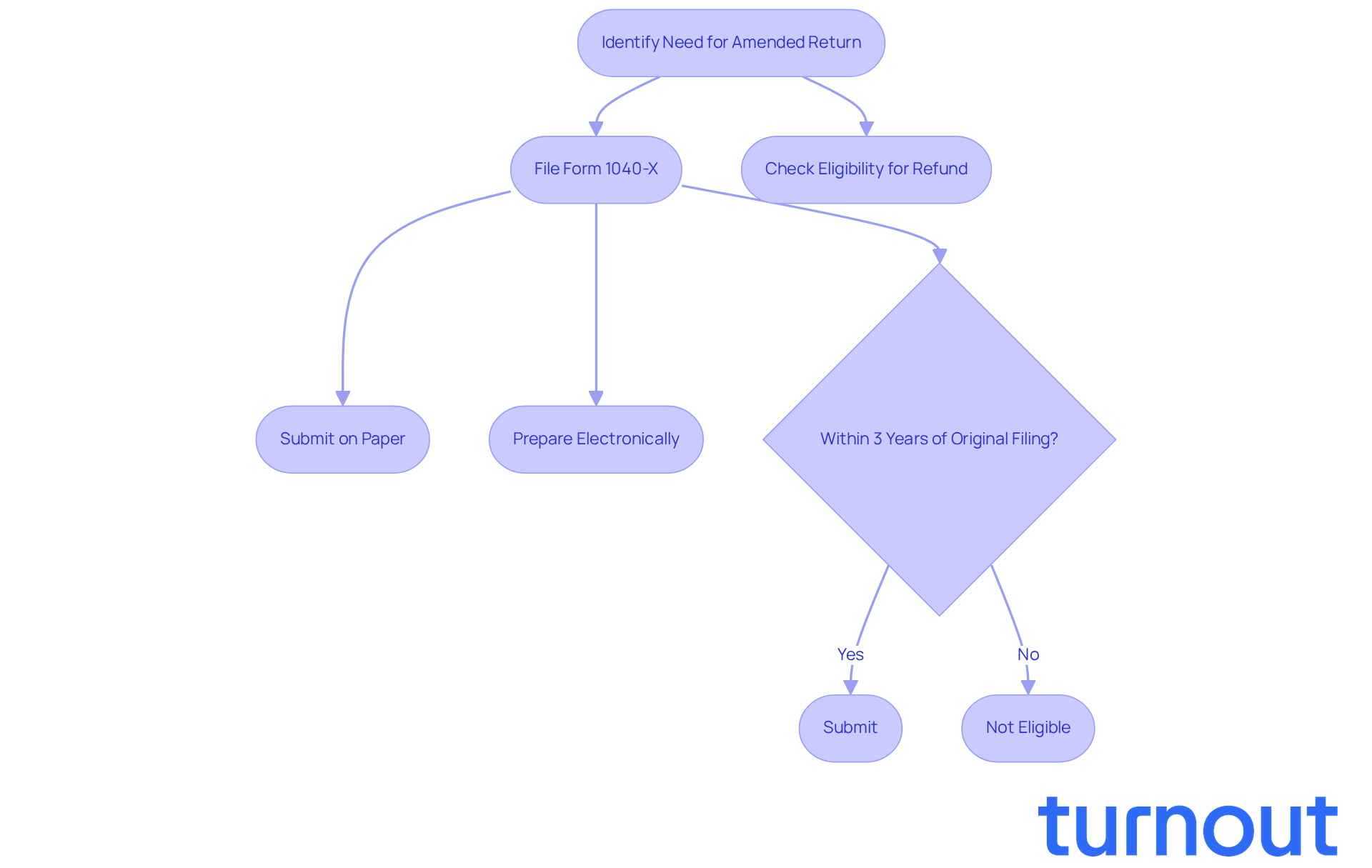

Amended submissions, filed using Form 1040-X, are essential for correcting mistakes on your original tax document. We understand that navigating tax issues can be stressful. Whether you need to adjust your income, claim additional deductions, or correct your filing status, knowing the purpose of a revised submission is the first step toward ensuring your tax records are accurate.

Submitting a revised filing can lead to a refund if you’ve overpaid taxes or help fix inconsistencies that might result in penalties. Did you know that about five million taxpayers submit corrected filings each year? This highlights just how important this process is. Remember, you must modify a submission within three years of the original filing deadline or within two years of paying the tax for that year.

All revised submissions need to be filed on paper, although they can be prepared electronically. By recognizing the significance of submitting Form 1040-X, you can stay proactive in tracking where's my 1040x refund and your revised filing progress. This way, your financial records will truly reflect your situation.

As Intuit indicates, "If you receive a larger refund or reduced tax owed from a different tax preparation method by submitting a corrected filing, we'll refund the applicable TurboTax federal and/or state purchase price paid." You're not alone in this journey; we're here to help you every step of the way.

Access the 'Where's My 1040X Refund' Tool

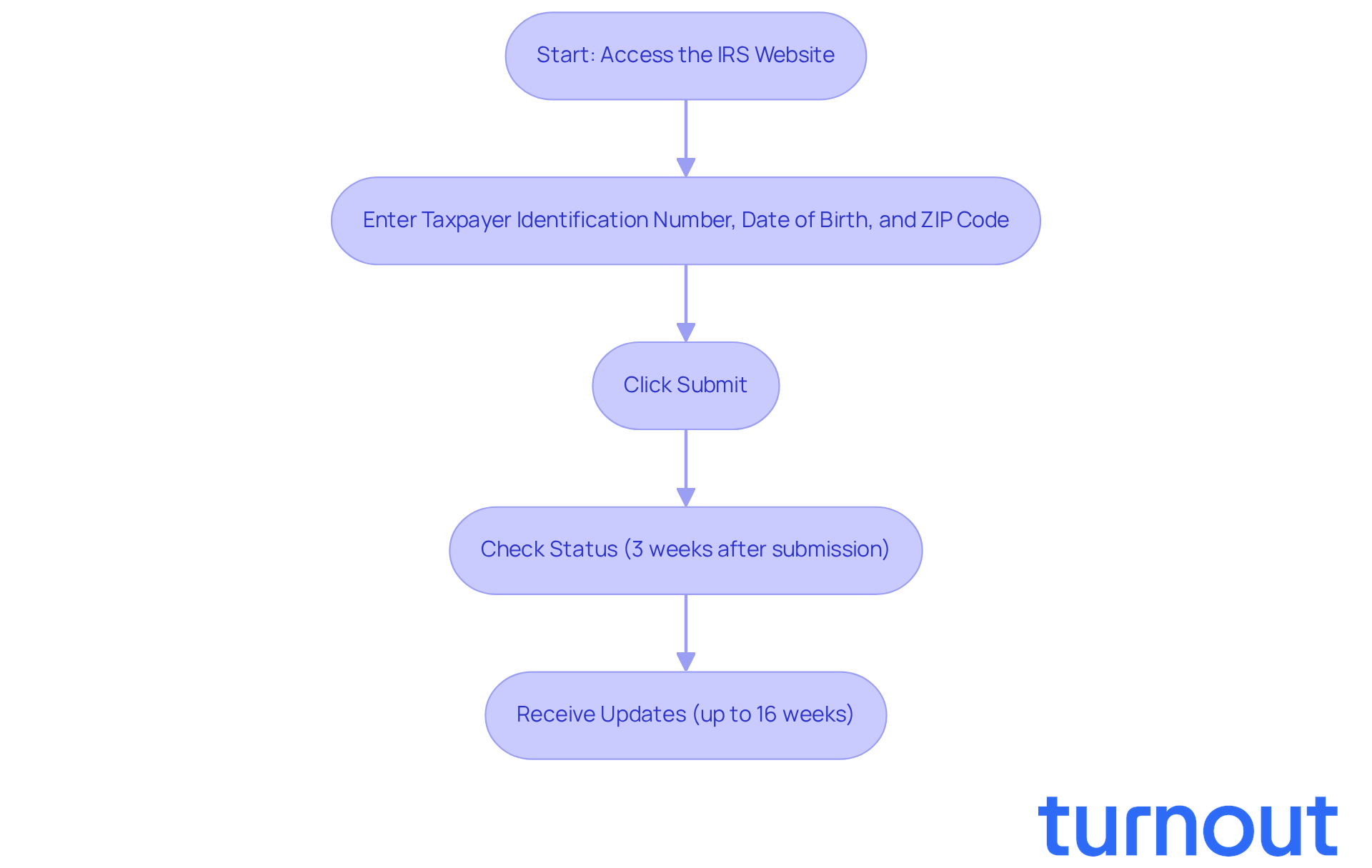

Checking the status of your amended return can feel daunting when you're asking, 'where's my 1040x refund?', but we're here to help you through it. Just follow these simple steps:

- Visit the IRS website at Where's My Amended Return.

- Enter your taxpayer identification number (SSN or ITIN), date of birth, and ZIP code.

- Click 'Submit' to see your modified filing progress.

It's common to feel anxious about where's my 1040x refund. You can usually verify your situation about three weeks after submitting your Form 1040-X by checking 'where's my 1040x refund?', as the tool starts to show updates around that time. The IRS estimates that handling a revised filing, like where's my 1040x refund, can take as long as 16 weeks, so patience is essential. Remember, the 'Where's My Amended Return' tool is available 24 hours a day, except Mondays from 12 - 3 a.m. Eastern time and occasional Sundays from 1 - 7 a.m. Eastern time. This tool provides real-time updates on your refund progress, so you can easily check where's my 1040x refund and stay informed throughout the process.

If you need further assistance, don’t hesitate to reach out to the IRS at the amended filing hotline at 866-464-2050. Just keep in mind that the tool may not provide information for certain types of submissions, such as business submissions or those with a foreign address. You're not alone in this journey, and support is just a call away.

Troubleshoot Common Issues with the Tool

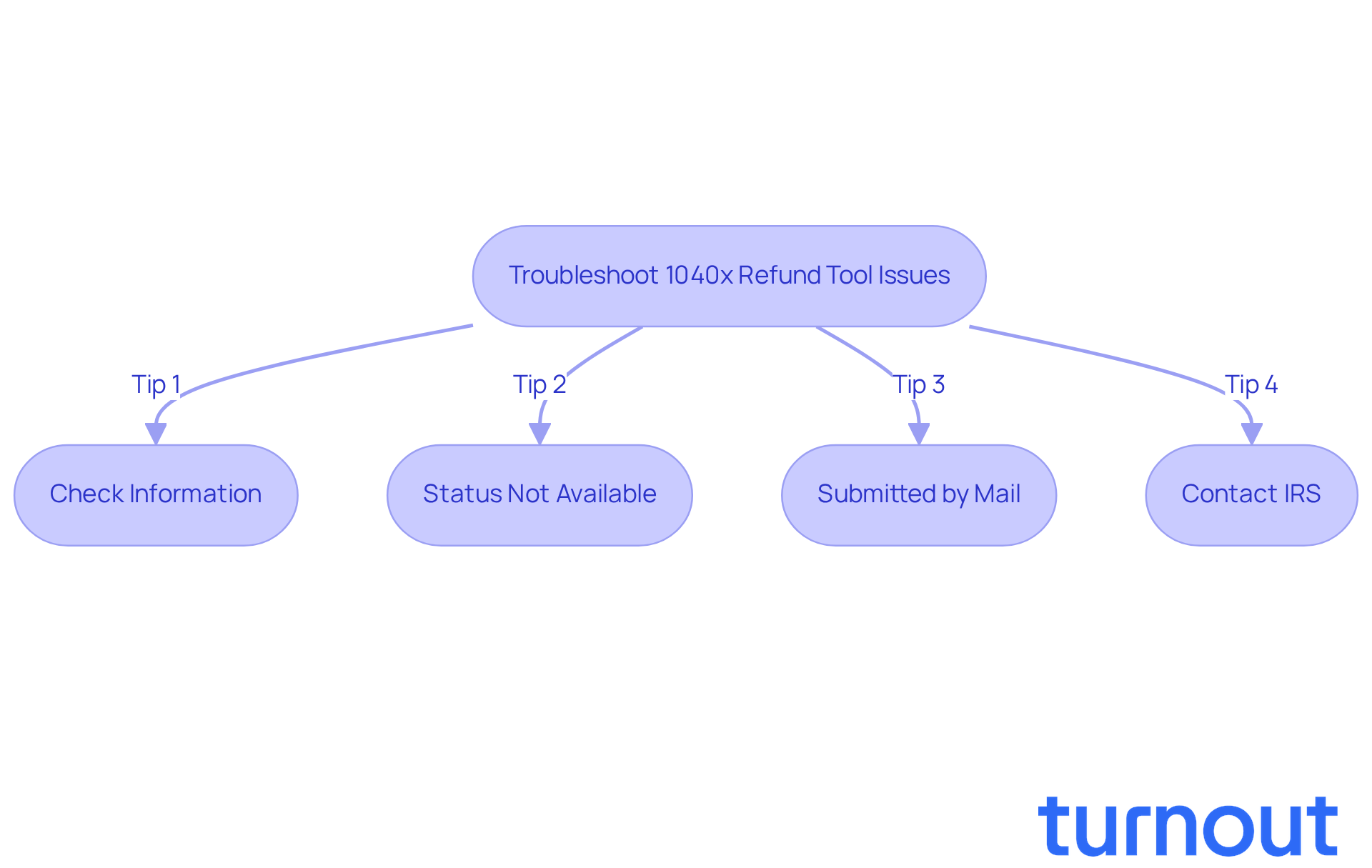

If you're having trouble with the 'where's my 1040x refund' tool, we understand how frustrating that can be. Here are some helpful tips to guide you through:

- Make sure you've entered your information correctly, including your SSN, date of birth, and zip code. It’s easy to overlook a small detail!

- If your status shows 'not available,' don’t worry just yet. It might be too soon to check; give it at least three weeks after filing.

- Did you submit your revised form by mail? It can take a bit longer to process, so check back after 12 weeks.

- If you’re still facing issues, remember that you’re not alone. If you're inquiring about where's my 1040x refund, consider calling the IRS at 866-464-2050 for assistance. They’re there to help you with updates and to resolve any discrepancies.

We’re here to help you navigate this process. You deserve clarity and support!

Explore Additional Resources for Support

If you find yourself needing a bit more help with your amended return or wondering where's my 1040x refund, we’re here for you. Consider these resources:

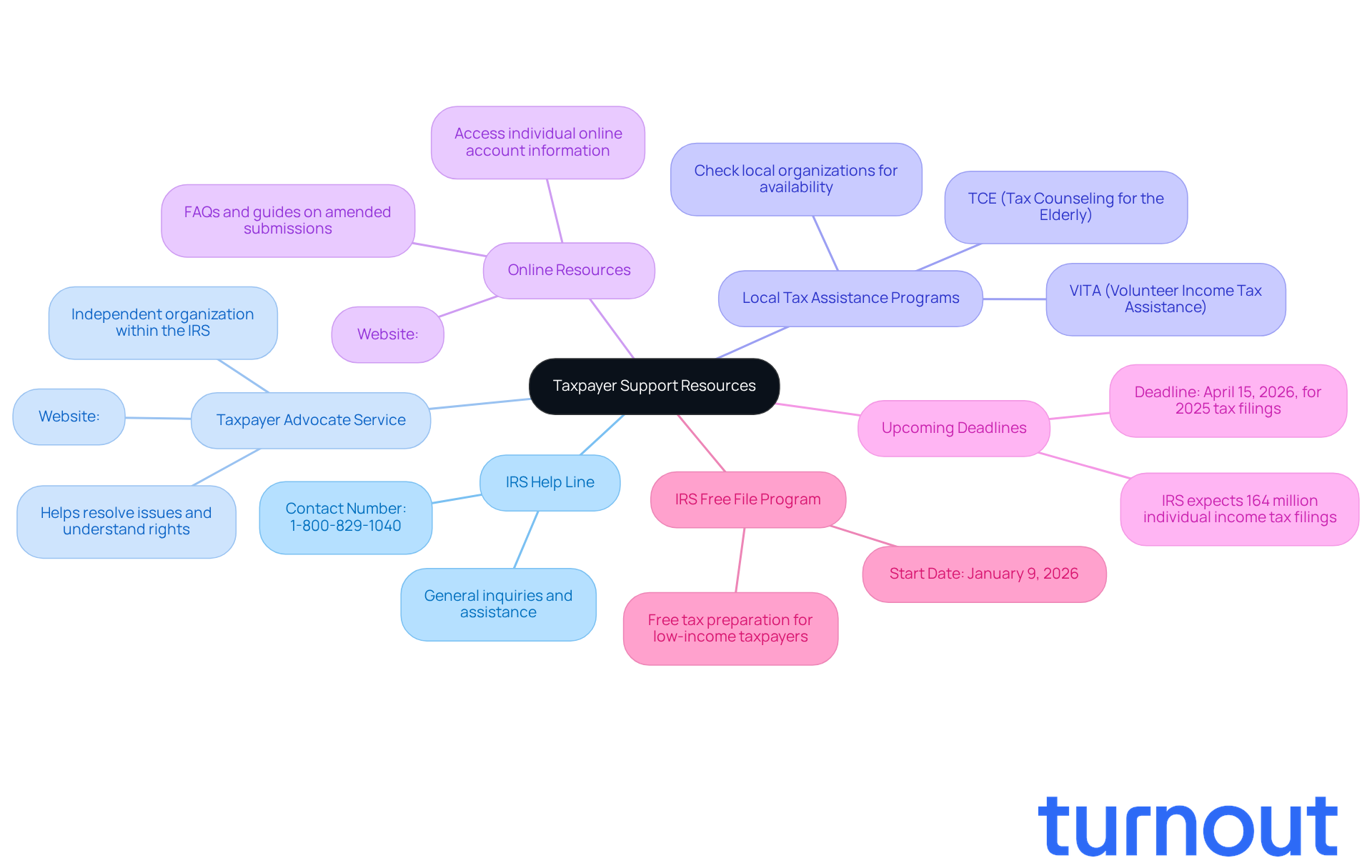

- IRS Help Line: You can call 1-800-829-1040 for general inquiries and assistance. They’re ready to help you navigate your questions.

- Taxpayer Advocate Service: This independent organization within the IRS is dedicated to helping taxpayers like you resolve issues and understand your rights. Visit Taxpayer Advocate Service for more information. Remember, the National Taxpayer Advocate emphasizes that refund delays and unclear disallowance notices can really impact taxpayers and their rights.

- Local Tax Assistance Programs: Many communities offer free tax help through programs like VITA (Volunteer Income Tax Assistance) and TCE (Tax Counseling for the Elderly). It’s worth checking with local organizations to see what’s available in your area.

- Online Resources: Websites such as IRS.gov provide comprehensive details on tax filing, including FAQs and guides on amended submissions. You can also access your individual online account information through the IRS website, allowing you to review previous tax filings and check your refund status.

- Upcoming Deadlines: Don’t forget, you have until April 15, 2026, to submit your 2025 tax filings. The IRS expects to receive around 164 million individual income tax filings this year, and many taxpayers will receive their refunds without delay.

- IRS Free File Program: The IRS Free File program will start accepting individual tax submissions on January 9, 2026. This is a great option for low-income taxpayers to prepare and file their taxes at no cost.

By leveraging these resources, you can navigate the complexities of your amended return and confidently ask, where's my 1040x refund status? Remember, you’re not alone in this journey, and there’s support available to help you every step of the way.

Conclusion

Navigating the complexities of amended tax returns and tracking your refund can feel overwhelming. We understand that this process is crucial for maintaining accurate financial records. Form 1040-X is here to help you correct your filings, potentially leading to refunds and ensuring compliance with tax regulations. By familiarizing yourself with the steps to access the 'Where's My 1040X Refund' tool, you can gain insight into your amended return status and ease some of the anxiety that comes with waiting for a refund.

Throughout this guide, we’ve highlighted key points, including:

- The importance of filing amended returns

- The steps to check the status of your refund

- Troubleshooting tips for common issues

Remember, resources like the IRS help line and local tax assistance programs are available to support you. You’re not alone in this journey. With patience and the right tools, tracking your 1040X refund can become a manageable task.

Ultimately, filing an amended return can lead to greater financial clarity and peace of mind. By leveraging available resources and understanding the process, you empower yourself to take control of your tax situation. Actively engaging with tools like the 'Where's My 1040X Refund' service keeps you informed and confident in your financial decisions. This reinforces the significance of accurate tax filings and the importance of seeking help when needed. Remember, we're here to help you every step of the way.

Frequently Asked Questions

What is an amended return and why is it important?

An amended return, filed using Form 1040-X, is essential for correcting mistakes on your original tax document. It helps ensure your tax records are accurate by allowing you to adjust income, claim additional deductions, or correct your filing status.

What can happen if I submit an amended return?

Submitting an amended return can lead to a refund if you've overpaid taxes or help fix inconsistencies that might result in penalties.

How many taxpayers submit amended returns each year?

About five million taxpayers submit corrected filings each year, highlighting the importance of this process.

What is the time limit for filing an amended return?

You must modify a submission within three years of the original filing deadline or within two years of paying the tax for that year.

How should I file an amended return?

All revised submissions need to be filed on paper, although they can be prepared electronically.

How can I track the status of my amended return?

You can stay proactive in tracking your amended return by checking the status of 'where's my 1040x refund' and monitoring your revised filing progress.

What does Intuit offer regarding amended returns?

Intuit indicates that if you receive a larger refund or reduced tax owed from a different tax preparation method by submitting a corrected filing, they will refund the applicable TurboTax federal and/or state purchase price paid.