Overview

Navigating your Missouri income tax refund can feel overwhelming, but we’re here to help. Understanding the state's progressive tax system is the first step, and it's common to have questions about your eligibility for refunds based on overpayment. Gathering the necessary documentation for filing can also be daunting.

This article provides a step-by-step guide designed to support you through this process. You'll find essential tax basics, clear eligibility criteria, and documentation requirements that will empower you to take action. We also cover various filing methods and offer troubleshooting tips to ensure a smoother refund experience.

Remember, you are not alone in this journey. With the right information and guidance, you can navigate your tax refund with confidence.

Introduction

Navigating the complexities of income tax can often feel like traversing a maze. We understand that when it comes to understanding the specifics of Missouri's tax system, it can be overwhelming. With a progressive tax structure and various filing statuses, taxpayers have the opportunity to maximize their refunds. However, it's essential to first grasp the basics of eligibility and documentation.

What challenges might arise in this process? It's common to feel uncertain about what is needed to secure your rightful refunds. Rest assured, you are not alone in this journey. This guide offers a step-by-step approach to demystifying the Missouri income tax refund process. Together, we will empower you to confidently navigate your financial obligations.

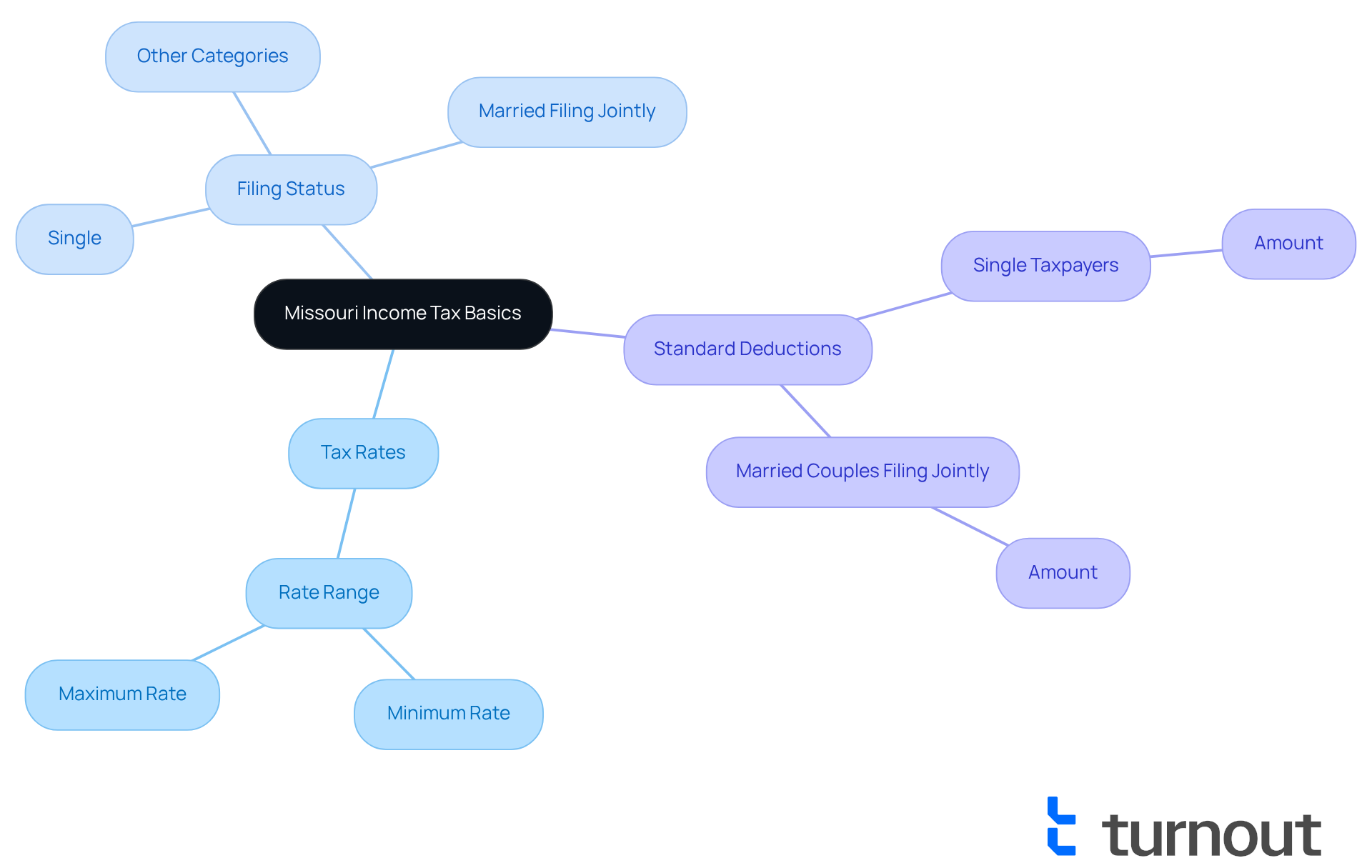

Understand Missouri Income Tax Basics

Missouri employs a progressive income tax system, which means that tax rates increase as your income rises. For the 2025 tax year, these rates range from 1.4% to 4.7%. We understand that navigating taxes can be overwhelming, so it’s essential to know your status for tax purposes—whether you are single, married filing jointly, or in another category—as this affects your tax brackets and deductions.

Additionally, familiarize yourself with the standard deductions available:

- $15,000 for single taxpayers

- $30,000 for married couples filing jointly

Understanding these basics can empower you to determine how much tax you owe and what Missouri income tax refund you can expect. Remember, you are not alone in this journey; we’re here to help you through it.

For more detailed information, please visit the Department of Revenue website. It offers extensive resources on tax rates and submission requirements, ensuring you have the support you need.

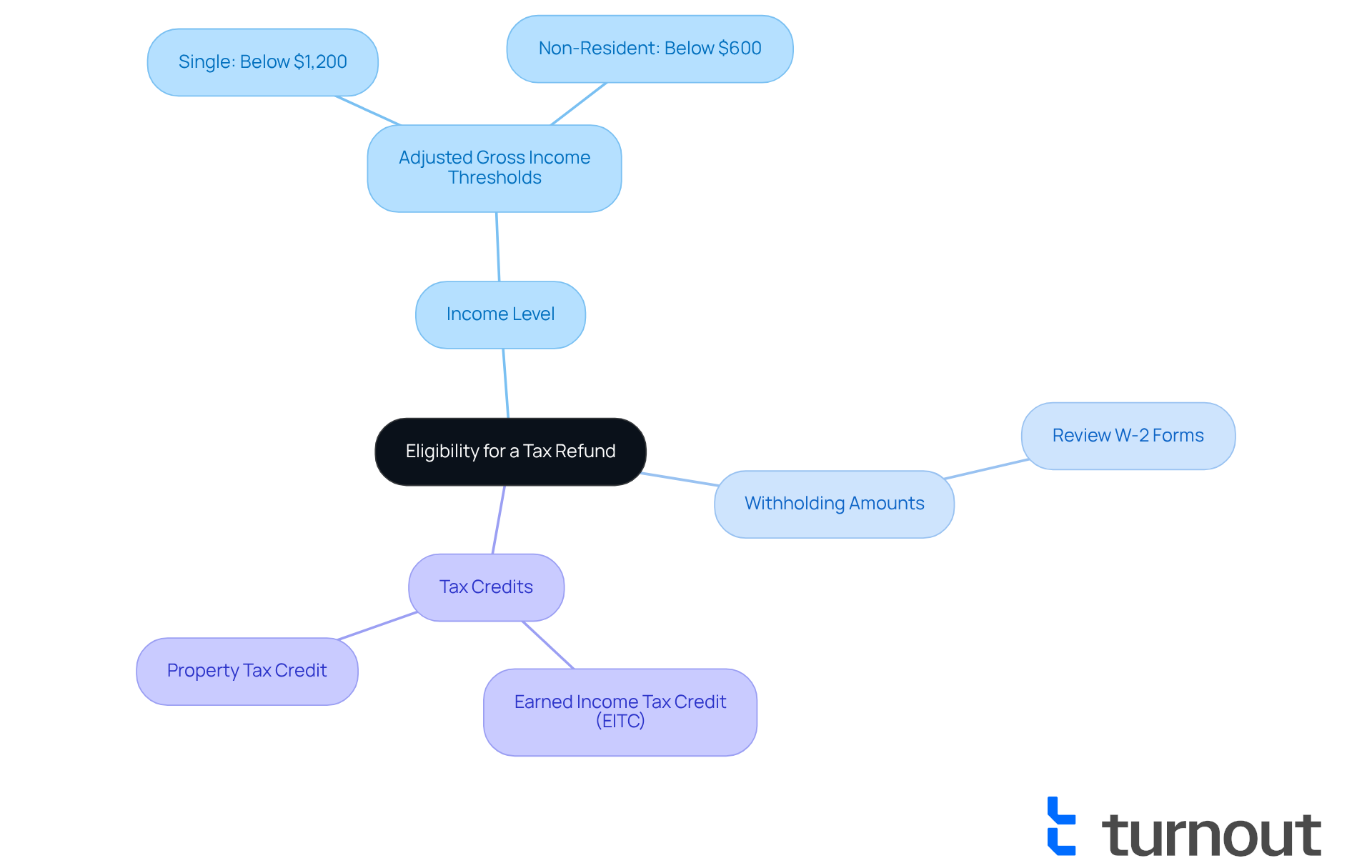

Determine Your Eligibility for a Refund

If you’re hoping for a Missouri tax refund, it’s important to know that you must have overpaid your taxes during the year. This often happens when too much is withheld from your paycheck or if you qualify for certain tax credits. Let’s explore some key factors that can help you determine your eligibility:

- Income Level: We understand that navigating tax requirements can be overwhelming. Make sure your income is below the filing threshold. For 2025, residents with an adjusted gross income below $1,200 (single) or $600 (non-resident) may not need to file.

- Withholding Amounts: It’s a good idea to review your W-2 forms to see how much state tax was withheld. This can provide clarity on your tax situation.

- Tax Credits: You might qualify for credits such as the Earned Income Tax Credit (EITC) or the Property Tax Credit. These can significantly impact your refund.

For more information on eligibility, we encourage you to refer to the Department of Revenue FAQs. Remember, you’re not alone in this journey—we’re here to help you navigate through it.

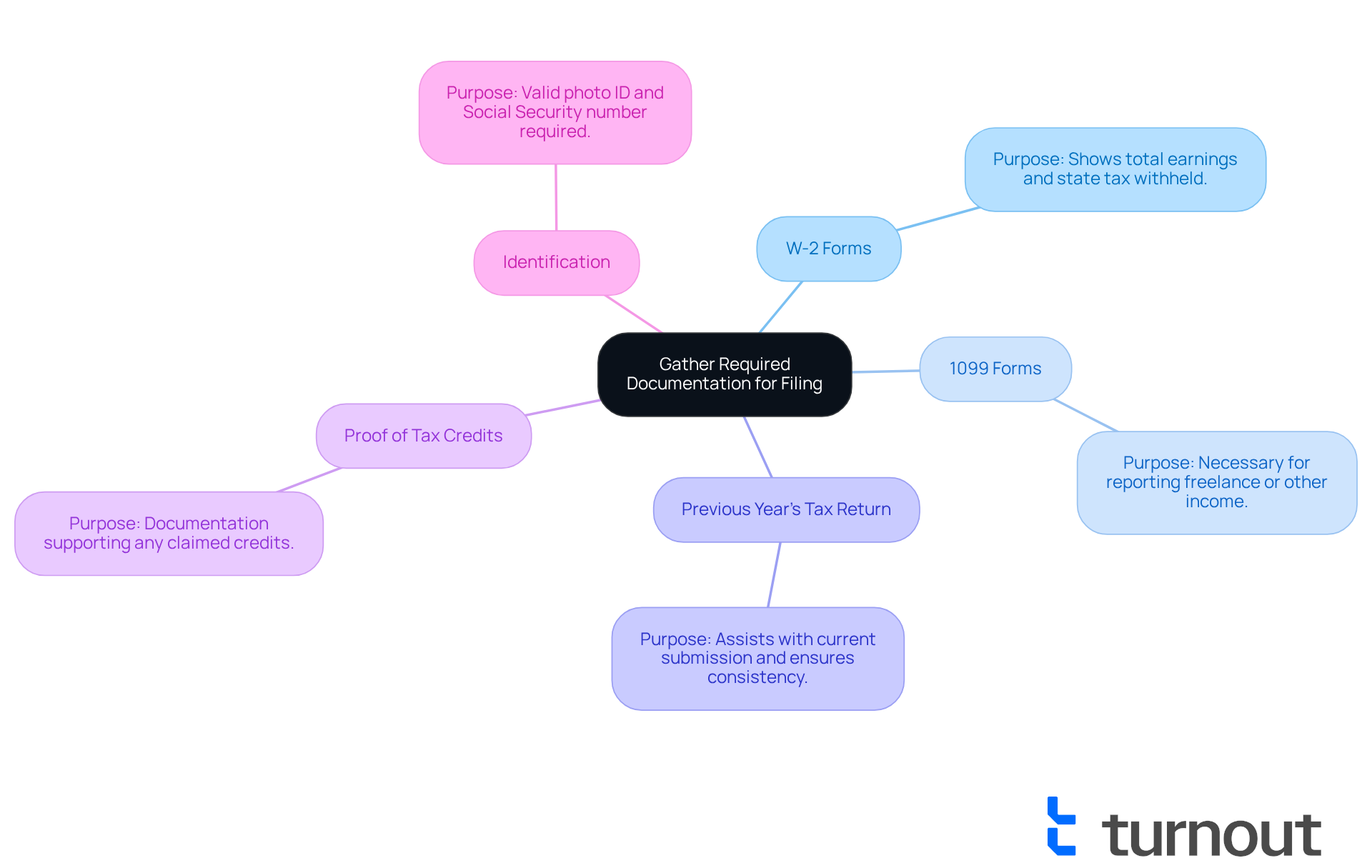

Gather Required Documentation for Filing

We understand that gathering the necessary documents can feel overwhelming before you file for your Missouri income tax refund. To help you through this process, consider collecting the following essential items:

- W-2 Forms: These forms show your total earnings and the amount of state tax withheld, which is vital for your filing.

- 1099 Forms: If you've received income from freelance work or other sources, these forms are necessary to include.

- Previous Year’s Tax Return: This can assist you with your current submission and ensure consistency in your filings.

- Proof of Tax Credits: Keep documentation supporting any credits you are claiming, such as property tax receipts for the Property Tax Credit.

- Identification: A valid photo ID and your Social Security number are also required.

Organizing these documents will streamline your filing process and make it less stressful. Remember, you're not alone in this journey; we're here to help. For a detailed checklist, visit the IRS Gather Your Documents page.

File Your Missouri Income Tax Refund Application

Filing your application for a Missouri income tax refund can feel overwhelming, but we're here to help you through it. Just follow these simple steps to make the process easier:

- Choose Your Filing Method: You have the option to file online through the Missouri Department of Revenue's e-filing system or by mailing a paper return using Form MO-1040.

- Complete the Form: Take your time to fill out the necessary information, ensuring that all details match your documentation. If you choose to submit online, just follow the prompts provided by the e-submission system.

- Double-Check Your Information: It’s important to review your application for accuracy, including Social Security numbers and income amounts. We understand that this can be a bit stressful, but double-checking will save you time later.

- Submit Your Application: If you're filing online, simply submit electronically. If you prefer mailing, send your completed form to the Department of Revenue, P.O. Box 329, Jefferson City, MO 65102.

- Track your Missouri income tax refund: After submission, you can use the State Return Tracker to monitor the status of your Missouri income tax refund. Knowing where you stand can bring peace of mind.

Filing early can expedite your refund, so don’t wait until the deadline approaches. Remember, you are not alone in this journey, and taking these steps can help ease your worries.

![]()

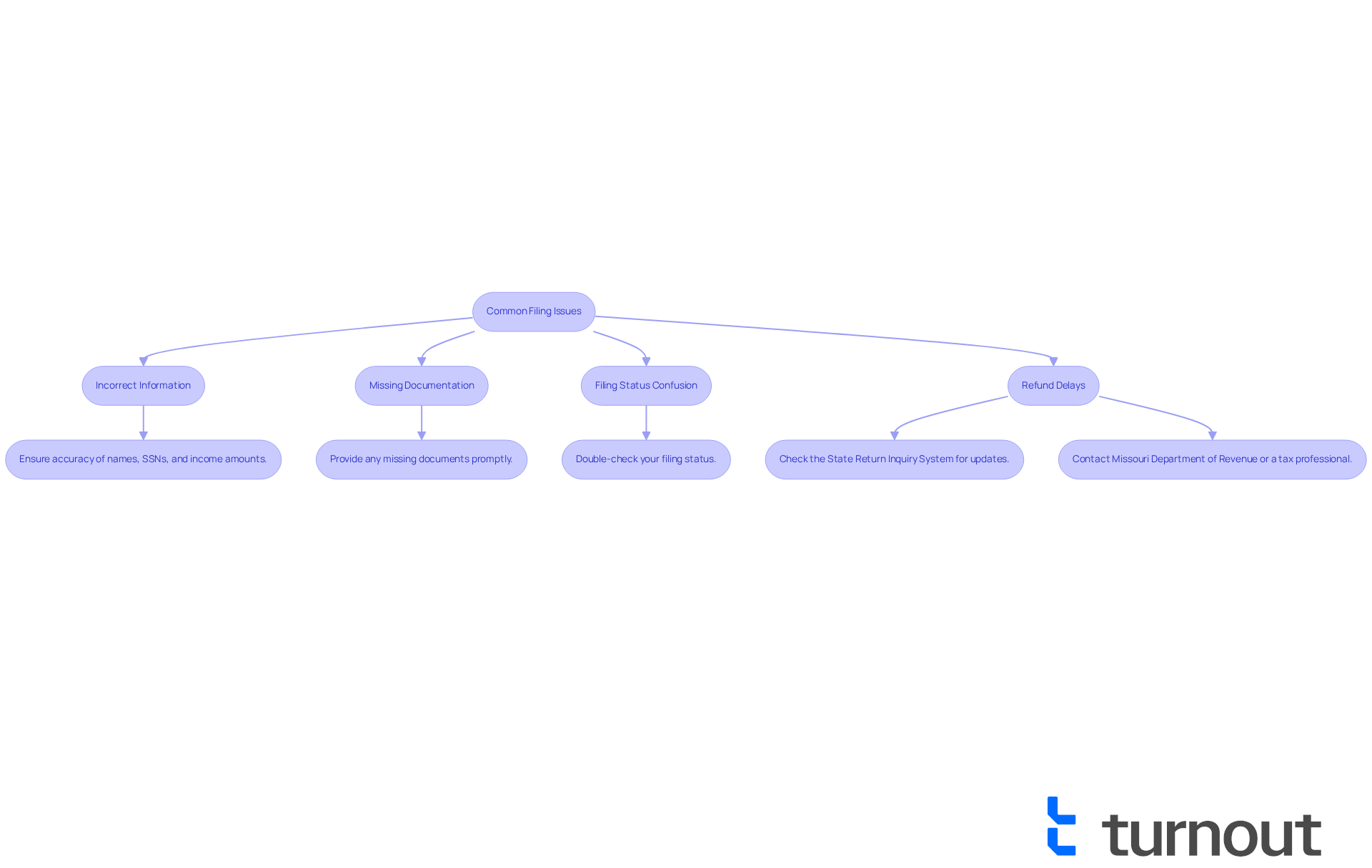

Troubleshoot Common Filing Issues

If you’re facing challenges while processing your Missouri income tax refund, we’re here to help. Understanding the process can be overwhelming, but consider these helpful tips to ease your journey:

- Incorrect Information: It’s essential to ensure that all names, Social Security numbers, and income amounts are accurate. Mismatches can lead to delays, which can be frustrating.

- Missing Documentation: If your application is incomplete, the Department of Revenue may request additional information. This can slow down your refund, and we know how important it is to receive your funds promptly.

- Filing Status Confusion: Selecting the correct filing status is crucial, as it affects your tax calculations and eligibility for credits. Take a moment to double-check this detail.

- Refund Delays: If your Missouri income tax refund is taking longer than expected, we recommend checking the State Return Inquiry System for updates. It’s common to feel anxious during this wait.

Should you continue to experience issues, please don’t hesitate to reach out to the Missouri Department of Revenue for assistance. Alternatively, consulting a tax professional can provide you with personalized guidance. Remember, you are not alone in this journey, and support is available.

Conclusion

Navigating the Missouri income tax refund process can feel overwhelming, but with the right understanding, it becomes manageable. This guide has highlighted essential components of the Missouri income tax system, including tax rates, filing statuses, and the importance of knowing your eligibility for a refund. By familiarizing yourself with these aspects, you can prepare more effectively for filing and increase your chances of receiving a refund.

Key insights from this guide emphasize the importance of gathering proper documentation, such as W-2 and 1099 forms, and being aware of the various tax credits available that could enhance your refund. Additionally, accurate information and timely submission are crucial, as these factors significantly influence your overall experience and the outcome of the refund process.

Ultimately, taking proactive steps in preparing for your Missouri income tax refund can lead to a smoother and more efficient experience. Whether it’s ensuring all documents are in order or utilizing resources like the Missouri Department of Revenue's website, you can empower yourself to navigate the system with confidence. Embrace this process, stay informed, and remember, you are not alone in this journey—success in tax filing is within reach.

Frequently Asked Questions

What is the income tax system like in Missouri?

Missouri employs a progressive income tax system, meaning that tax rates increase as your income rises. For the 2025 tax year, the rates range from 1.4% to 4.7%.

How do my filing status and deductions affect my Missouri income tax?

Your filing status—whether you are single, married filing jointly, or in another category—affects your tax brackets and deductions. The standard deductions for 2025 are $15,000 for single taxpayers and $30,000 for married couples filing jointly.

What factors determine eligibility for a Missouri tax refund?

To be eligible for a Missouri tax refund, you must have overpaid your taxes during the year. This can occur when too much is withheld from your paycheck or if you qualify for certain tax credits.

What is the income threshold for filing taxes in Missouri for 2025?

For 2025, residents with an adjusted gross income below $1,200 (single) or $600 (non-resident) may not need to file.

How can I check my withholding amounts for Missouri state tax?

You can review your W-2 forms to see how much state tax was withheld, which can provide clarity on your tax situation.

What tax credits might I qualify for that could impact my refund?

You might qualify for credits such as the Earned Income Tax Credit (EITC) or the Property Tax Credit, which can significantly affect your refund.

Where can I find more detailed information about Missouri income tax?

For more detailed information, you can visit the Department of Revenue website, which offers extensive resources on tax rates and submission requirements.