Introduction

Navigating the complexities of a lawsuit against an insurance company can feel overwhelming. We understand that many individuals choose to represent themselves, and that can be a daunting task. It's crucial to grasp the intricacies of insurance policies and the claims process if you're looking to assert your rights without legal assistance.

This guide is here to empower you with the knowledge and tools you need to effectively sue an insurance company. We want you to feel supported as you embark on this journey. However, it's common to encounter obstacles and face the often overwhelming tactics employed by insurers.

So, how can you prepare to face these challenges? How can you ensure a fair outcome in your pursuit of justice? You're not alone in this journey, and together, we can navigate these complexities.

Understand Your Insurance Policy and Claim Process

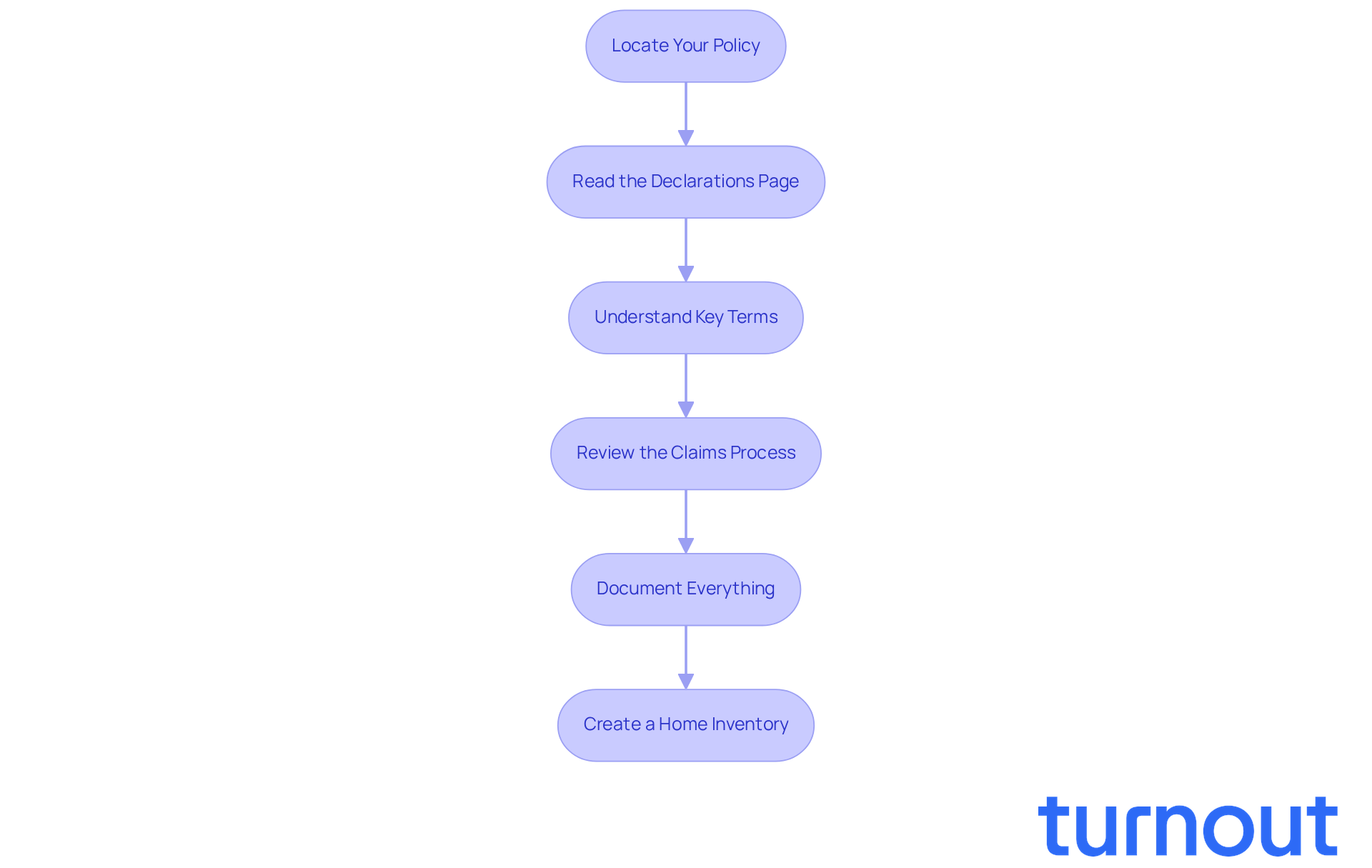

Taking legal action against a provider can feel overwhelming, but you’re not alone in this journey. Let’s walk through the steps together to ensure you’re well-prepared:

- Locate Your Policy: Start by finding your coverage document. This is usually provided when you purchase your insurance or can be accessed online through your insurer's website.

- Read the Declarations Page: This page summarizes your coverage, including limits and deductibles. Knowing what is covered is essential for your peace of mind.

- Understand Key Terms: Familiarize yourself with terms like 'coverage limits', 'deductibles', 'exclusions', and 'conditions'. Understanding these will clarify what your insurer is obligated to pay.

- Review the Claims Process: Look for the section detailing how to file a claim. This often includes timelines and required documentation. Knowing this process is vital for your lawsuit.

- Document Everything: Keep a record of all communications with your insurer, including emails, letters, and phone calls. This documentation will be crucial if you need to prove your case later.

- Create a Home Inventory: Consider making a detailed inventory of your major household items. Did you know that 46% of consumers do not possess or are uncertain if they have a home inventory for submitting requests? This can complicate the process.

By understanding your policy and the claims process, you can figure out how to sue an insurance company without a lawyer for any potential violations by the provider. This is the first step in preparing your lawsuit. As Sylvester Mathis, Chief Insurance and Chief Revenue Officer, wisely states, "A cumbersome or disconnected process irritates customers and risks driving them away." This highlights the importance of being knowledgeable to navigate the complexities of policy requests. Remember, we’re here to help you through this.

Gather Evidence and Document Your Case

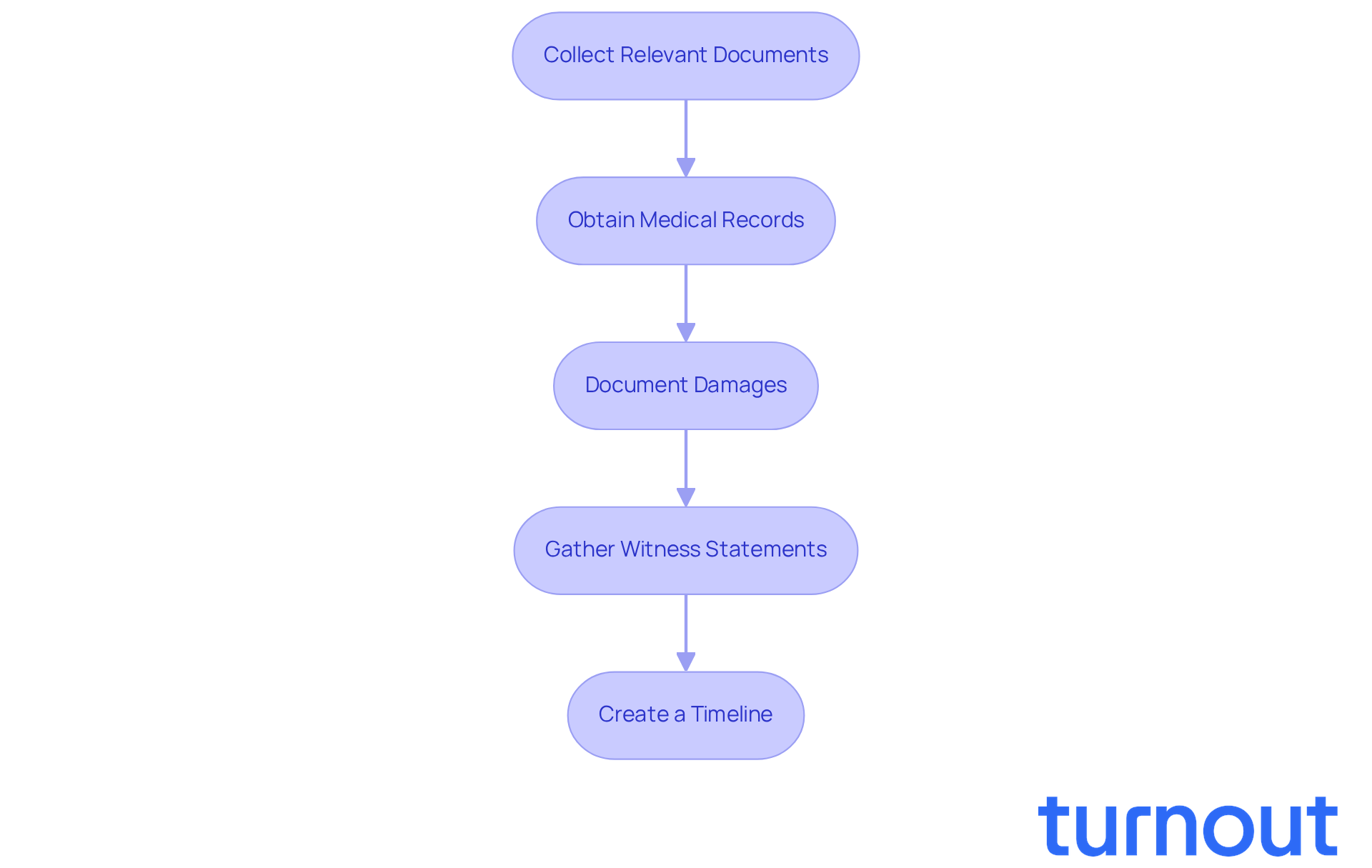

Once you understand your policy, the next step is to gather evidence to support your claim. We know this can feel overwhelming, but following these steps can help you feel more in control:

-

Collect Relevant Documents: Start by gathering all documents related to your request. This includes your insurance policy, any correspondence with the insurer, and notes from phone calls. Having a comprehensive view of your case is essential.

-

Obtain Medical Records: If your request involves health issues, it’s important to ask for copies of your medical records. These should detail your diagnosis, treatment, and prognosis. In 2026, having finalized medical proof is crucial, as insurers often require this documentation before negotiations can begin.

-

Document Damages: Take photographs of any damages or injuries related to your case. Visual evidence can significantly strengthen your argument, providing undeniable proof of the extent of your injuries or losses. Successful claims often hinge on clear visual documentation that illustrates the impact of the incident.

-

Gather Witness Statements: If applicable, collect statements from witnesses who can support your claim. Their accounts can add credibility and context, reinforcing your narrative against the insurer's position.

-

Create a Timeline: Organize all your evidence chronologically. This timeline will help you present your argument clearly and logically, making it easier for both the insurer and, if necessary, the court to understand the sequence of events.

By carefully gathering and documenting evidence, you’ll build a strong foundation for understanding how to sue an insurance company without a lawyer. Remember, as legal experts often say, "Documenting the full extent of your losses is crucial to advance your situation, even when the system slows down." This proactive approach not only strengthens your position but also prepares you for potential disputes over damages, which can extend the timeline of your case significantly. In fact, disputes over damages can stretch personal injury claims from months into years, underscoring the importance of thorough documentation. You're not alone in this journey; we're here to help you every step of the way.

File Your Lawsuit: Step-by-Step Procedures

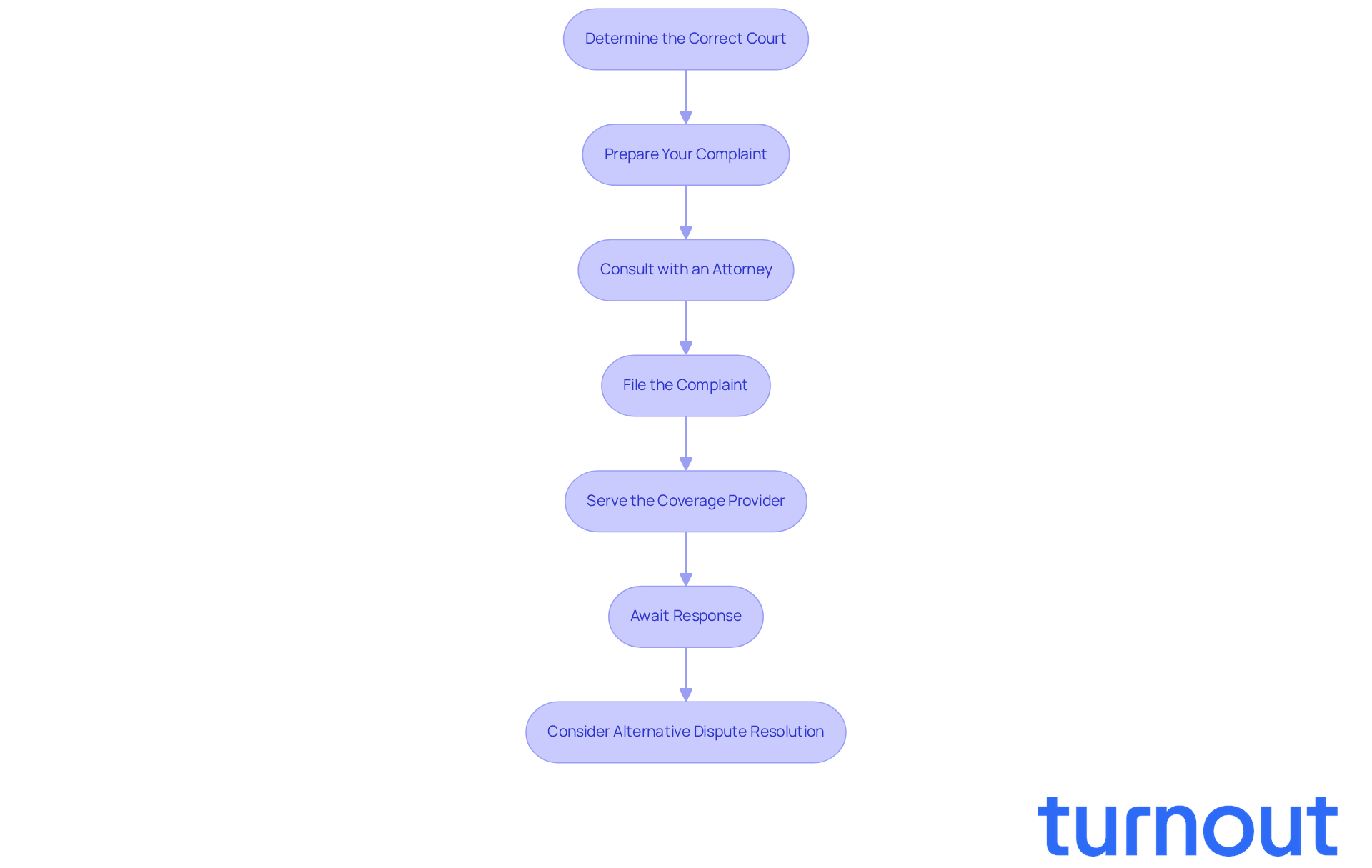

Filing a lawsuit against your insurance company can feel overwhelming, but understanding how to sue an insurance company without a lawyer can help you realize you’re not alone in this journey. Here are some critical steps to guide you through the process:

-

Determine the Correct Court: It’s important to identify the right court for your case, which usually depends on the amount in dispute and your jurisdiction. Understanding local court rules is essential to ensure you file correctly.

-

Prepare Your Complaint: Drafting a clear and concise complaint is crucial. This document should outline your situation, including the facts, the legal basis for your claim, and the relief you’re seeking. A well-structured complaint lays the foundation for your case.

-

Consult with an Attorney: While you can represent yourself, consulting with an attorney can significantly boost your chances of a successful outcome. They can offer valuable guidance and help you navigate the complexities of legal procedures.

-

File the Complaint: Once your complaint is ready, submit it to the court clerk along with any required filing fees. Remember to keep copies of all documents filed; they’re essential for your records and future reference.

-

Serve the Coverage Provider: After filing, it’s necessary to deliver a copy of the complaint and a summons to the coverage provider. This can often be done through a process server, ensuring the company is officially notified of the lawsuit.

-

Await Response: The insurance company will have a specified period to respond to your complaint. Be prepared for potential motions or requests for dismissal, as insurers often have experienced legal teams that may challenge your claims.

-

Consider Alternative Dispute Resolution: Before proceeding with legal action, it’s wise to explore all dispute resolution methods, such as mediation or arbitration. These options can help you avoid the high costs associated with litigation.

By carefully following these steps, you can learn how to sue an insurance company without a lawyer, ensuring that your legal case is filed correctly and on time, which increases your chances of a favorable outcome. Remember, as Mackenzie Kerr observes, "95% of personal injury claims conclude with a pre-trial settlement." This highlights the importance of knowing your options before pursuing legal action. We’re here to help you every step of the way.

Navigate Challenges and Considerations During Your Lawsuit

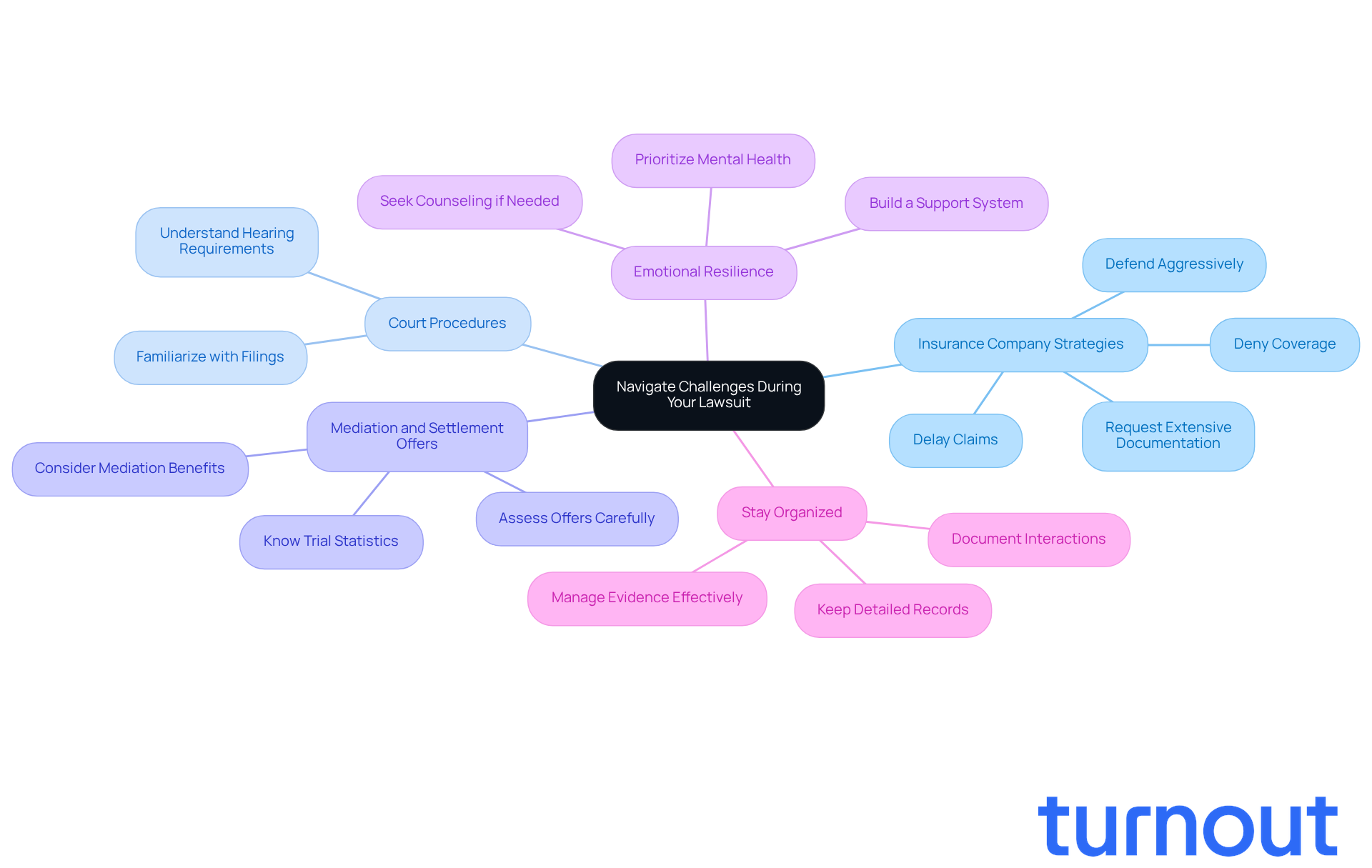

As you navigate your lawsuit, it's important to be aware of potential challenges that may arise:

-

Insurance Company Strategies: We understand that dealing with insurance companies can be daunting, especially when considering how to sue an insurance company without a lawyer. They often employ tactics to postpone or deny your claims. Be prepared for them to request extensive documentation or file motions that challenge your case. Many adjusters adhere to the '3 D's' principle: Delay claims to create desperation, Deny coverage without proper investigation, and Defend aggressively in court, making it crucial for policyholders to learn how to sue an insurance company without a lawyer.

-

Court Procedures: It's common to feel overwhelmed by court procedures. Familiarizing yourself with the specific requirements for filings and hearings in your court can make a significant difference in your experience.

-

Mediation and Settlement Offers: Insurance companies frequently propose mediation or settlement offers. Take your time to assess these thoughtfully; sometimes, settling can be more beneficial than going to trial. Remember, only 3-5% of personal injury cases actually reach trial.

-

Emotional Resilience: Lawsuits can be incredibly stressful and emotionally taxing. It's crucial to have a support system in place. If you find yourself struggling, consider seeking counseling. Research shows that the emotional burden of legal disputes can greatly affect your well-being, so prioritizing your mental health during this process is essential.

-

Stay Organized: Keeping all your documents, evidence, and correspondence organized is vital. Detailed records of every interaction with the insurance company will help you manage your claims effectively and build a strong case.

By anticipating these challenges and preparing accordingly, you can navigate how to sue an insurance company without a lawyer with greater confidence. Remember, you're not alone in this journey; we're here to help.

Conclusion

Navigating the complexities of suing an insurance company without a lawyer can feel overwhelming. We understand that this journey may seem daunting, but with the right knowledge and preparation, it’s entirely possible. By understanding your insurance policy, gathering necessary evidence, and following the proper legal procedures, you can take confident steps toward advocating for your rights and seeking the compensation you deserve.

It’s crucial to thoroughly grasp your insurance policy and the claims process. Documenting all relevant evidence meticulously is equally important. From collecting medical records to organizing a timeline of events, each step builds a solid foundation for your case. Remember, it’s common to face challenges, such as tactics used by insurance companies and the emotional toll of legal disputes. Being aware of these can help you navigate this journey more effectively.

Ultimately, taking action against an insurance company requires diligence and perseverance. By following the outlined steps and staying organized, you can significantly increase your chances of a favorable outcome. The journey may be challenging, but it’s essential to remember that knowledge is power. Equip yourself with the right tools and support. You are not alone in this journey-take the first steps toward reclaiming your rights and securing the justice you seek.

Frequently Asked Questions

What is the first step in preparing to take legal action against an insurance provider?

The first step is to locate your insurance policy, which can usually be found in the coverage document provided at the time of purchase or accessed online through your insurer's website.

Why is it important to read the declarations page of your insurance policy?

The declarations page summarizes your coverage, including limits and deductibles, and knowing what is covered is essential for your peace of mind.

What key terms should I understand when reviewing my insurance policy?

You should familiarize yourself with terms like 'coverage limits', 'deductibles', 'exclusions', and 'conditions' to clarify what your insurer is obligated to pay.

How can I find information about the claims process in my insurance policy?

Look for the section in your policy that details how to file a claim, which often includes timelines and required documentation.

Why is it important to document all communications with my insurer?

Keeping a record of all communications, including emails, letters, and phone calls, is crucial for proving your case later if needed.

What is a home inventory and why should I create one?

A home inventory is a detailed list of your major household items. Creating one is important because many consumers do not have one, which can complicate the claims process.

How can understanding my policy and the claims process help me if I need to sue my insurance company?

By understanding your policy and the claims process, you can better navigate potential violations by the provider, making it easier to prepare your lawsuit.