Introduction

Receiving an IRS levy notice can feel overwhelming. It’s a serious financial challenge that many Americans face. When the IRS has the power to seize assets to settle unpaid tax debts, it’s crucial to understand what this means for you and what options are available.

We understand that the anxiety of potential asset confiscation can be distressing. What steps can you take to regain control and find relief? This guide aims to illuminate the pathways available for responding to an IRS levy notice. We’re here to empower you with the knowledge and resources needed to navigate this complex landscape. You are not alone in this journey.

Understand the IRS Levy: Definition and Implications

An IRS seizure is a serious matter. It means the IRS can legally take your property to settle an unpaid tax debt. This can include wages, bank accounts, or other assets, and they can do this without going to court. If you receive a notice of assessment, it’s a clear sign that the IRS believes you owe taxes and that you haven’t responded to their payment requests.

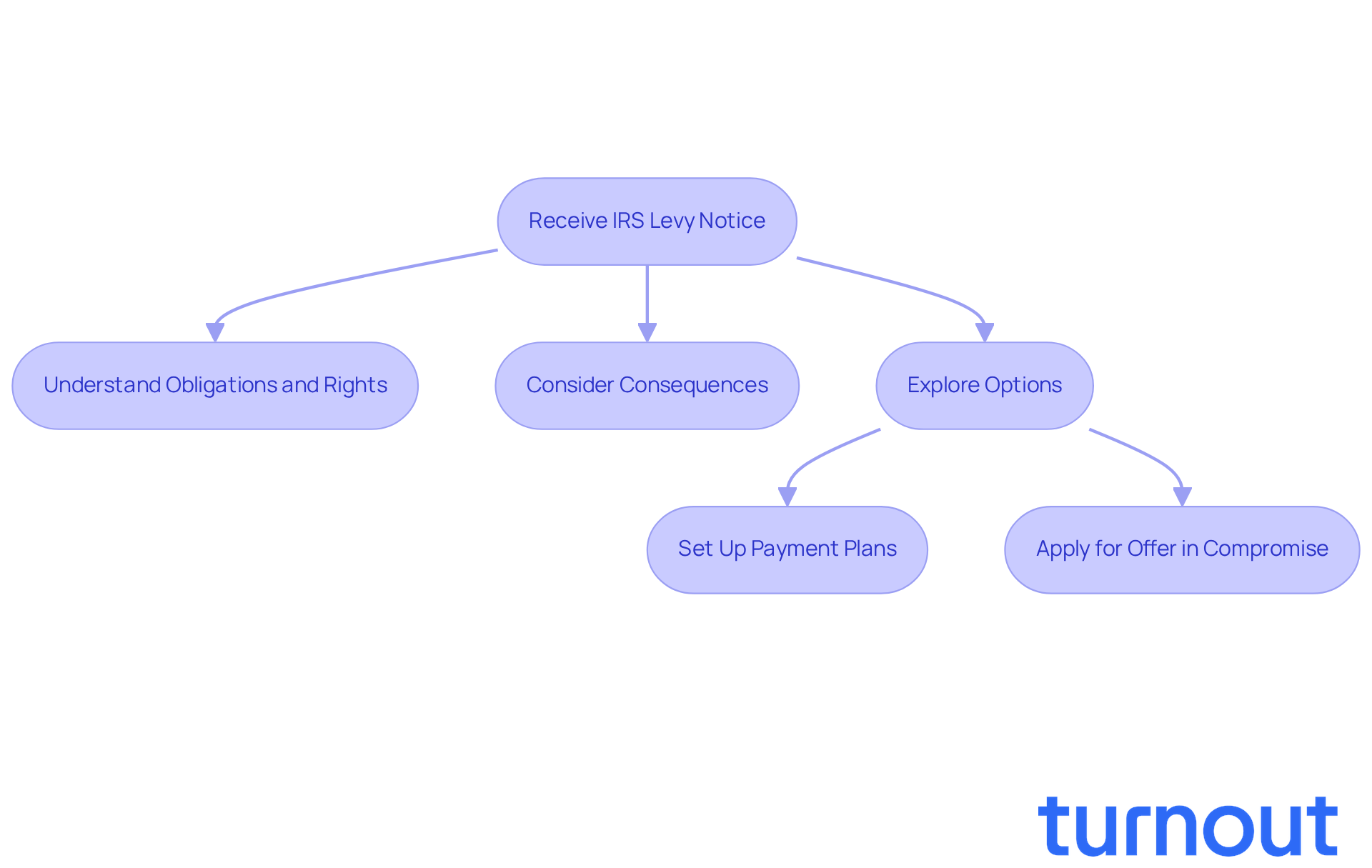

We understand that this can be overwhelming. Before the IRS issues an IRS levy notice, they must inform you about your obligations and rights. This is crucial because the consequences of a tax seizure can be severe, leading to significant income loss and financial instability. In fact, by 2026, around 10% of Americans may face IRS seizures, highlighting just how widespread this issue can be.

After you receive the IRS levy notice, remember that you have options. You can set up payment plans or apply for an Offer in Compromise to help manage your debts. Real-life stories, like that of Vincent R., who owed $523,927 but settled for $27,343 with professional help, show that there is hope.

It’s common to feel anxious about these situations, but addressing a tax charge promptly is essential. You have a 30-day window to respond and take action. Don’t hesitate to reach out for assistance; you are not alone in this journey. We’re here to help you regain control over your financial situation.

Review the IRS Levy Notice: Key Information to Identify

Receiving an IRS levy notice can be overwhelming, so it’s crucial to take a moment to examine it closely. Here are some key points to consider:

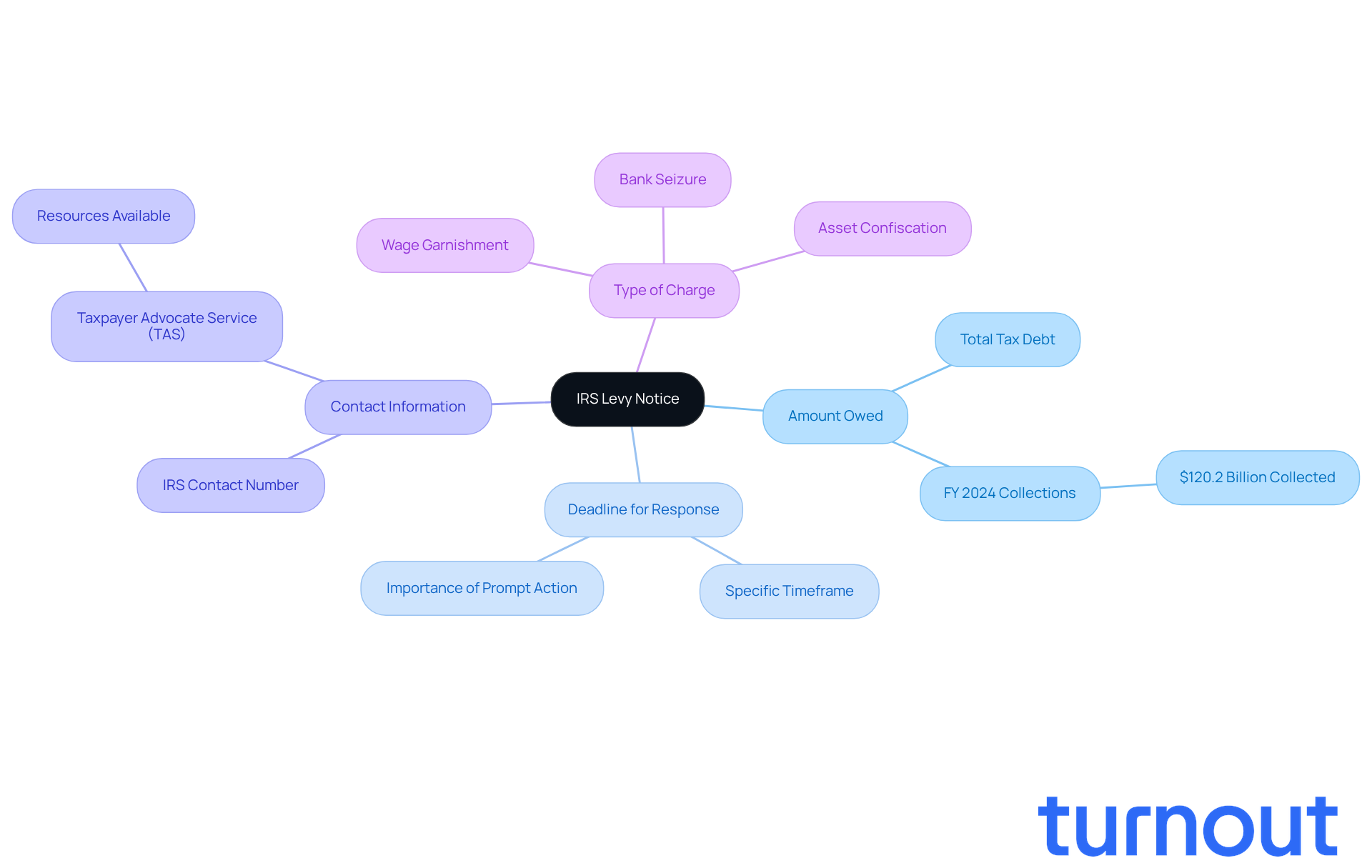

- The Amount Owed: This figure represents your total tax debt that has led to the levy. In FY 2024, the IRS collected $120.2 billion in unpaid assessments. Understanding your financial obligations is vital.

- Deadline for Response: The letter will outline a specific timeframe for you to respond. It’s common to feel anxious about this, but remember that acting promptly can significantly reduce the chances of further collection actions.

- Contact Information: Make sure to note the IRS contact number included in the letter. This is essential for any follow-up or questions you may have. Additionally, the Taxpayer Advocate Service (TAS) is available to help taxpayers facing challenges, offering valuable resources.

- Type of Charge: It’s important to know whether the charge involves wage garnishment, bank seizure, or another form of asset confiscation. Understanding this will guide your next steps. As J. David Tax Law points out, the IRS’s collection function is one of its most active enforcement tools.

By identifying these elements, you can better prepare to respond to the IRS levy notice and explore your options for relief. Always ensure that any communication you receive is genuinely from the IRS to avoid misunderstandings. Remember, you’re not alone in this journey, and we’re here to help.

Explore Response Options: Payment Plans, Appeals, and More

Once you understand your tax notice, it’s time to explore your response options. We know this can feel overwhelming, but you’re not alone. Here are some potential avenues to consider:

-

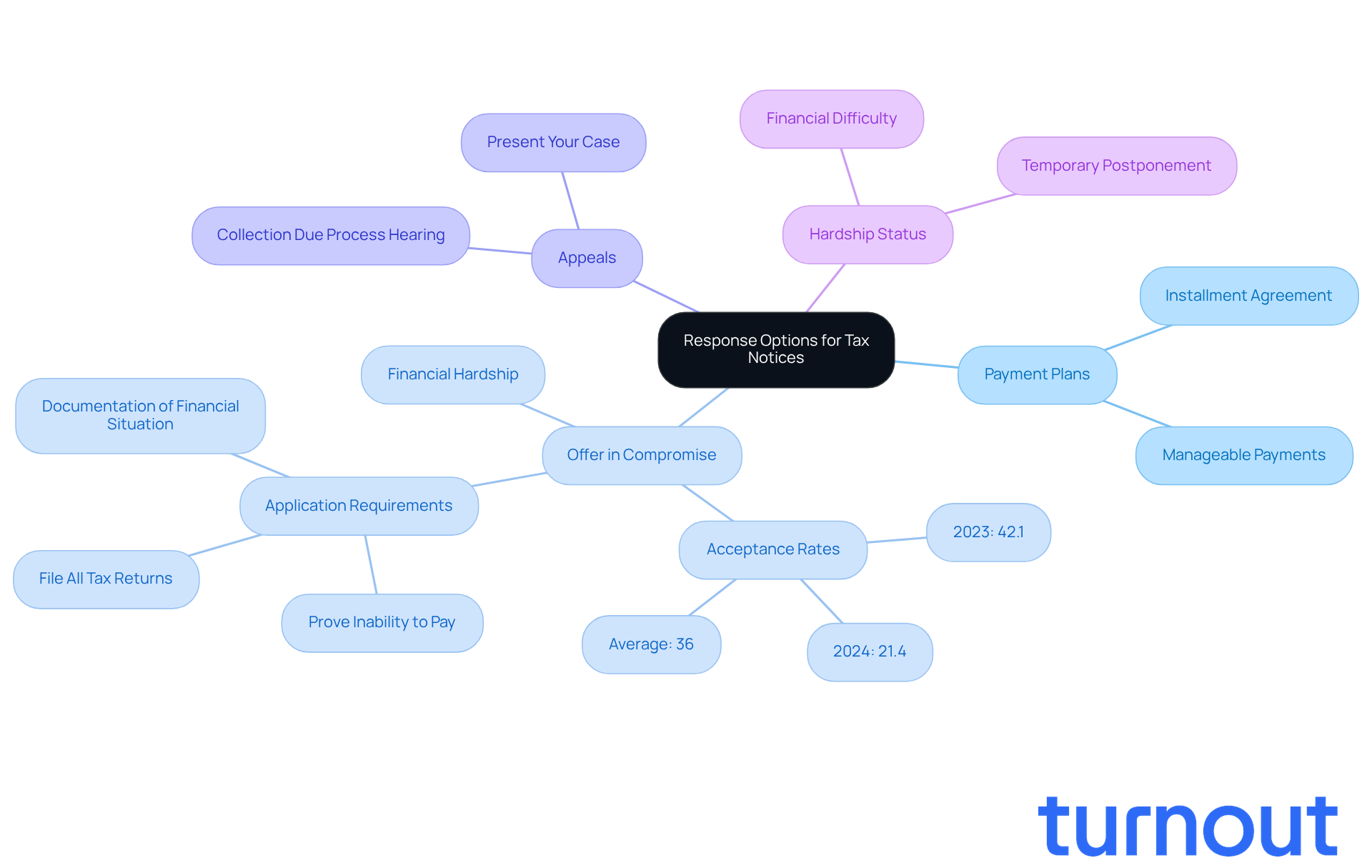

Payment Plans: If paying the full amount owed feels daunting, think about setting up an installment agreement with the IRS. This option allows you to pay your debt over time, making it more manageable and less stressful.

-

Offer in Compromise: This option lets you settle your tax debt for less than the full amount owed, especially if you can show financial hardship. The Offer in Compromise (OIC) program has seen fluctuating acceptance rates, averaging around 36% over the past decade. In 2023, the acceptance rate was approximately 42.1%, but it dropped to 21.4% in 2024, despite an increase in applications. This highlights how competitive the program can be. As TaxRise notes, "Building a strong OIC application and making a realistic offer amount will significantly increase your chance of IRS acceptance."

-

Appeals: If you believe the charge is unfair, you can request a Collection Due Process hearing. This gives you the chance to present your case and possibly stop the charge.

-

Hardship Status: If paying the fee would cause significant financial difficulty, you can ask the IRS to temporarily postpone collection. This status can provide immediate relief while you explore other options.

Each of these options has specific requirements and processes, so it’s essential to choose the one that best fits your situation. Remember, we’re here to help you navigate this journey.

Seek Support: Resources and Advocacy for IRS Levy Challenges

Facing an IRS seizure can feel overwhelming, but remember, you’re not alone in this. Here are some key resources and advocacy options that can help you navigate this challenging situation:

-

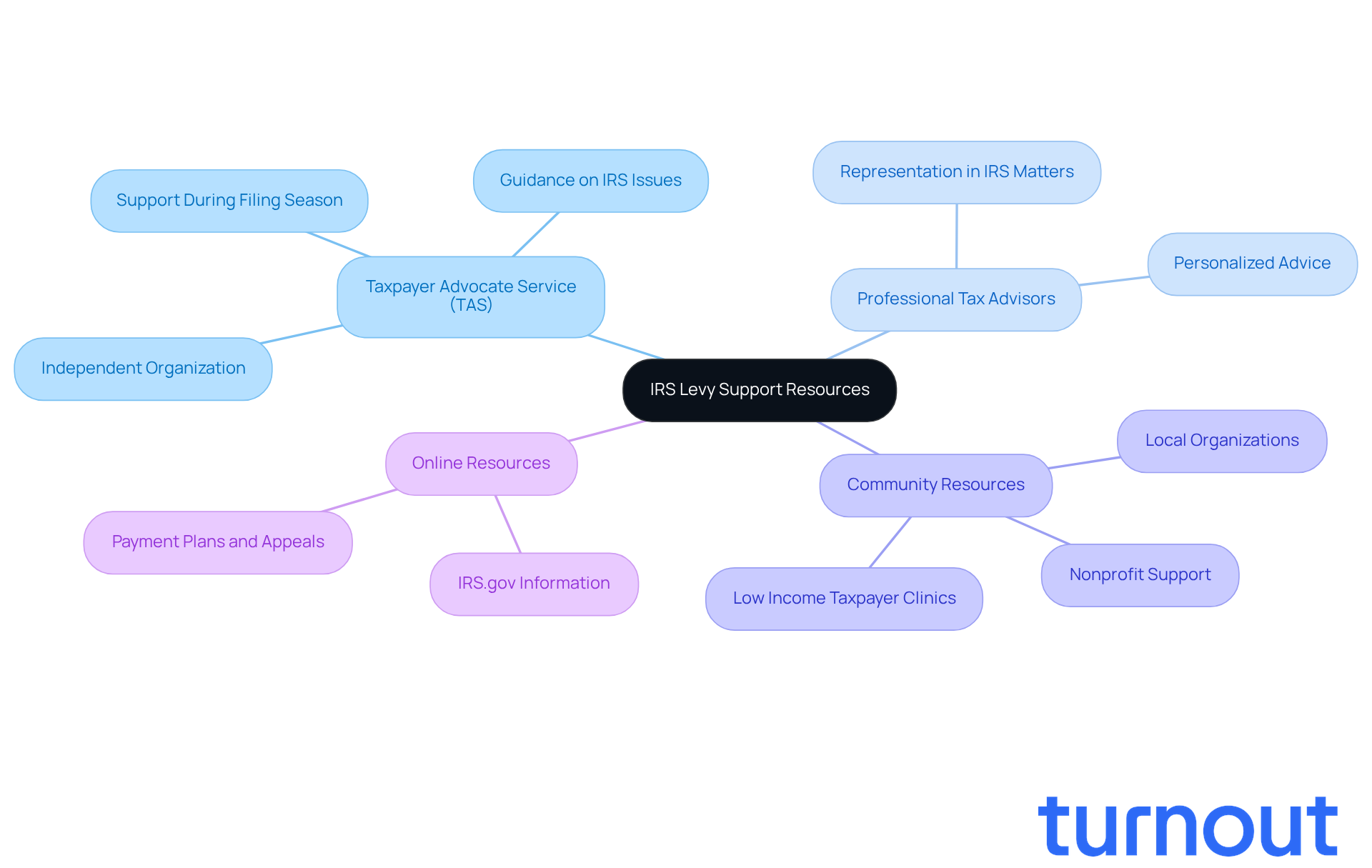

Taxpayer Advocate Service (TAS): This independent organization within the IRS is here to support you. TAS is dedicated to helping taxpayers resolve issues and offers valuable guidance on navigating the complexities of the IRS system. Many have found TAS instrumental in addressing their concerns, especially during the 2026 filing season when the IRS is eager to assist taxpayers with their filing and payment obligations. Utilizing TAS can be a crucial step in finding the support you need.

-

Professional Tax Advisors: Consulting with a tax professional or attorney who specializes in tax law can make a significant difference. They can provide personalized advice and representation tailored to your specific situation, which is essential when dealing with IRS garnishments.

-

Community Resources: Don’t overlook the numerous local organizations that offer free or low-cost tax assistance, especially during tax season. The Taxpayer Advocate Service has recommended expanding access to Low Income Taxpayer Clinics, which can provide vital support for those facing IRS challenges. Community tax clinics and nonprofit organizations focused on tax issues can be excellent resources for you.

-

Online Resources: Websites like IRS.gov are packed with comprehensive details on tax collections, payment plans, and appeals processes. By utilizing these resources, you can empower yourself with the knowledge needed to navigate your situation effectively.

By leveraging these resources, you can gain the support necessary to address your IRS levy notice and work towards a resolution. Remember, we’re here to help you through this journey.

Conclusion

Receiving an IRS levy notice can feel overwhelming. We understand that this situation brings a lot of stress and uncertainty. But knowing what steps to take can truly lighten the load. This guide has highlighted essential actions to respond to an IRS levy notice, stressing the importance of timely and informed responses to help you regain control over your financial situation.

Let’s break it down: what exactly is an IRS levy? It’s crucial to understand its implications. The notice contains key information that you need to identify. You have options available, such as:

- Payment plans

- Offers in Compromise

- Appeals

Remember, you’re not alone in this. Seeking support from resources like the Taxpayer Advocate Service and professional tax advisors can make a significant difference. They offer the guidance and assistance you need during this challenging time.

Navigating an IRS levy notice requires proactive engagement and informed decision-making. By utilizing the resources available and understanding your rights, you can alleviate the stress associated with tax debt. Taking that first step toward resolution not only helps you manage your financial obligations but also empowers you to reclaim your peace of mind.

You are not alone in this journey. We’re here to help you every step of the way.

Frequently Asked Questions

What is an IRS levy?

An IRS levy is a legal seizure of your property by the IRS to settle an unpaid tax debt. This can include wages, bank accounts, or other assets, and can occur without going to court.

What does it mean if I receive a notice of assessment from the IRS?

A notice of assessment indicates that the IRS believes you owe taxes and that you have not responded to their payment requests.

What are the potential consequences of an IRS levy?

The consequences can be severe, leading to significant income loss and financial instability. By 2026, it is estimated that around 10% of Americans may face IRS seizures.

What should I do if I receive an IRS levy notice?

After receiving an IRS levy notice, you have options such as setting up payment plans or applying for an Offer in Compromise to help manage your debts.

Is it common for people to face IRS seizures?

Yes, it is a widespread issue, with projections indicating that about 10% of Americans may experience IRS seizures by 2026.

How much time do I have to respond to an IRS levy notice?

You have a 30-day window to respond and take action after receiving an IRS levy notice.

Can I get help with my IRS levy situation?

Yes, it is advisable to seek assistance. There are professionals who can help you navigate your financial situation and explore options to regain control.