Overview

The main focus of this article is to guide you through the process of navigating a CP21B notice from the IRS. We understand that receiving such a notice can be concerning, as it typically indicates changes to your tax return that may result in a refund.

Upon receiving the notice, there are immediate steps you can take to address your concerns:

- Review the details for accuracy, as this can help clarify any misunderstandings.

- If you find yourself facing disputes or complexities, seeking professional assistance can be a valuable option.

- Remember, you have rights, and knowing the necessary actions to take can empower you during this time.

You're not alone in this journey; we're here to help you understand the process and ensure you feel supported every step of the way.

Introduction

Receiving a CP21B notice from the IRS can be a pivotal moment for taxpayers. It often signals adjustments to a tax return that may result in a refund. We understand that this notice can bring a mix of emotions—relief at the potential for a refund, but also uncertainty about what it means.

Understanding the details of this notice is essential. It outlines the changes made and the potential financial benefits that may follow. However, it’s common to feel overwhelmed or confused about how to interpret the information or what steps to take next.

How can you ensure you navigate this process effectively? Avoiding costly mistakes is crucial, and we’re here to help you through it. You are not alone in this journey. Let's explore the steps you can take to make sense of your CP21B notice and move forward with confidence.

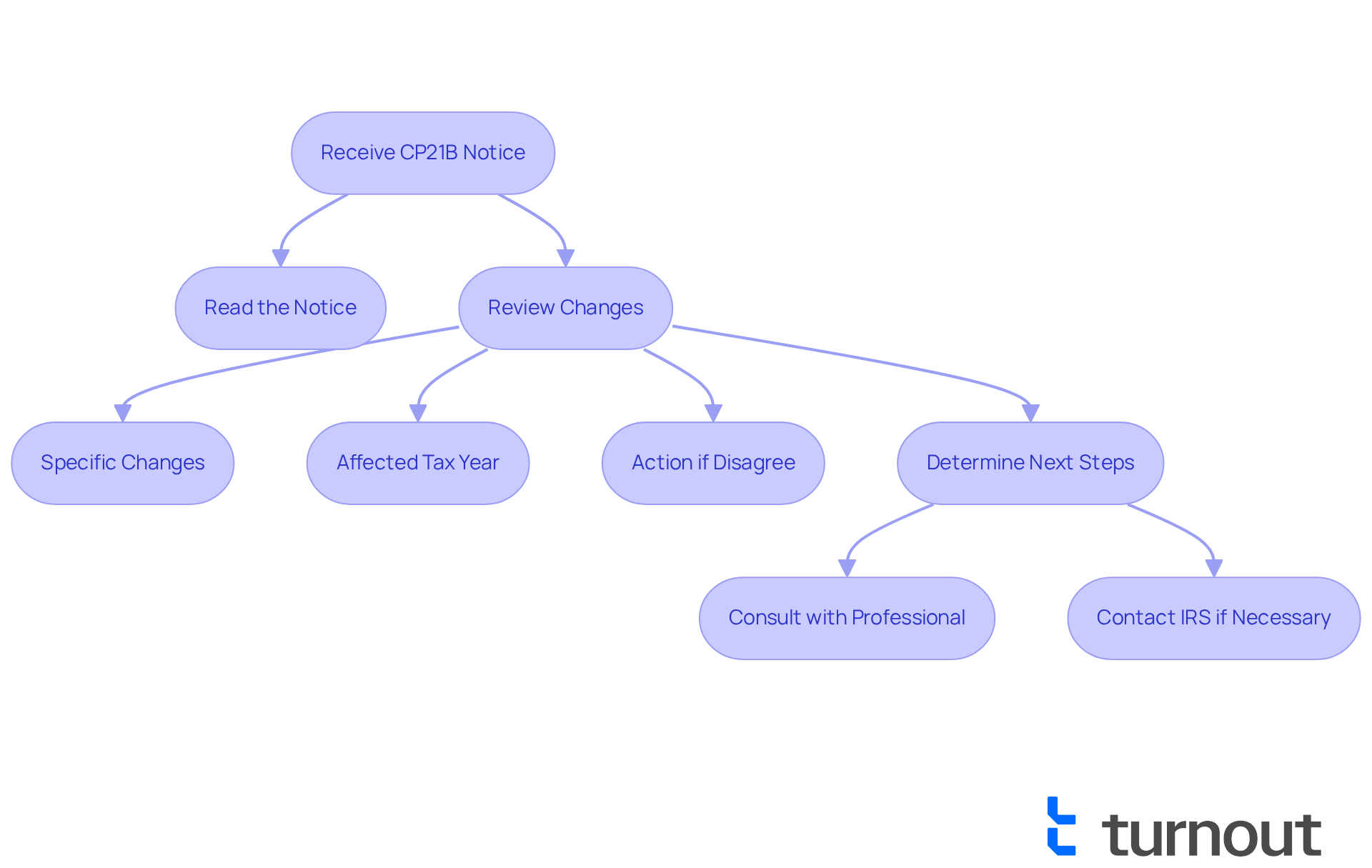

Understand Your CP21B Notice

The cp21b alert is an important message from the IRS that indicates changes have been made to your tax return, often resulting in a refund. This announcement typically occurs when the IRS processes an amended return or corrects errors based on the information you provided. It’s essential to read the announcement carefully, as it details the specific changes made, the tax year affected, and the refund amount due. Understanding these elements is crucial for verifying the accuracy of the adjustments and determining your next steps.

Statistics show that a significant number of these alerts lead to refunds, with the IRS usually issuing these refunds within two to three weeks after the alert is sent. For instance, if you receive a notification about adjustments made by the IRS, it suggests that these changes could be financially beneficial for you.

Consider practical examples that highlight the importance of understanding the communication regarding cp21b. In one case, a taxpayer received a notice after submitting a revised return, which resulted in a refund due to adjustments made by the IRS. This change not only provided timely financial support but also emphasized the importance of reviewing the announcement for accuracy.

When you receive a tax adjustment communication, there are important details to consider, including:

- The specific changes made to your tax return

- The affected tax year

- Any actions you may need to take if you disagree with the IRS's modifications

Ignoring this alert can lead to significant financial consequences, such as the IRS requesting repayment along with penalties and interest if you received an excess payment. Therefore, we encourage you to consult with a qualified professional for personalized guidance. You may also qualify for free assistance from the Taxpayer Advocate Service (TAS). Additionally, ensure that you update your tax return copy kept for your records to reflect any changes made. If you disagree with the IRS's adjustments, it's essential to contact them promptly to maintain accurate records.

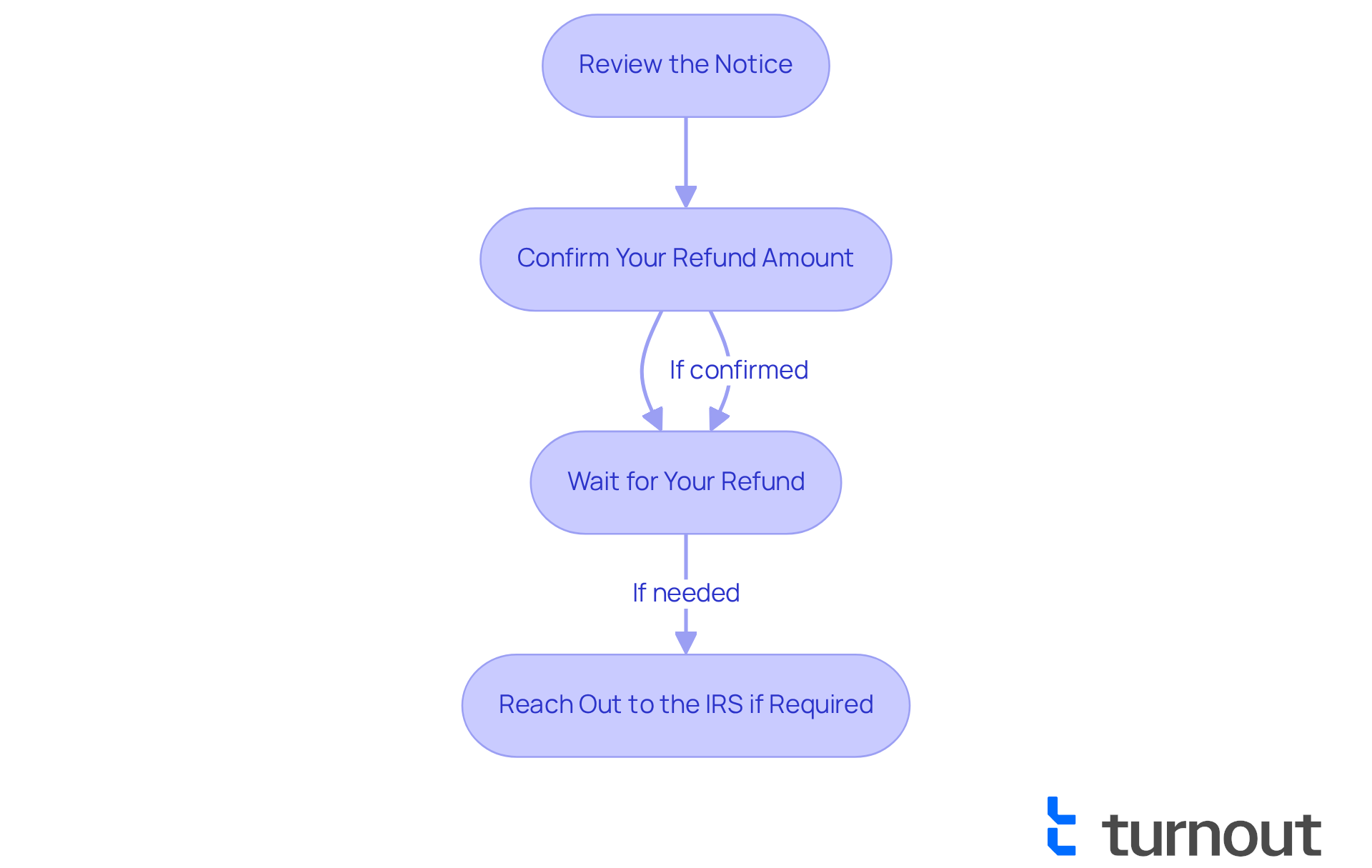

Take Immediate Action Upon Receipt

We understand that receiving your cp21b notice can be a bit overwhelming. Here are some immediate actions you can take to navigate this process with confidence:

-

Review the Notice: Take a moment to carefully examine the details regarding the changes made to your tax return. It’s important to ensure that these adjustments match your records to avoid any discrepancies that might cause concern.

-

Confirm Your Refund Amount: The communication will indicate the refund amount you are entitled to. Cross-check this figure against your own calculations to ensure accuracy. This step is crucial in confirming that you receive what you expect.

-

Wait for Your Refund: If you agree with the modifications described in the communication, you can relax a bit—no additional steps are necessary from you. The IRS will process your refund, which you can expect to receive within two to three weeks. If you do not receive your refund for cp21b within this timeframe and have no other taxes or debts, please don’t hesitate to call the number provided in the communication.

-

Reach Out to the IRS if Required: If you have any disputes regarding the modifications or if any inquiries arise, it’s perfectly okay to contact the IRS using the phone number given in the communication. Be ready with your tax return and the relevant document for reference during the call. Remember, it’s best to reach out to the IRS within 30 to 60 days if you have questions about the related communication.

In real-life situations, many taxpayers have effectively confirmed their refund amounts by carefully examining the document against their own records. Tax specialists emphasize the importance of thoroughly checking the document to ensure all adjustments are accurate, helping to prevent possible issues in the future. If discrepancies arise, contacting the IRS promptly can lead to clarification and resolution. If everything looks good, simply wait for your refund—you’re not alone in this journey.

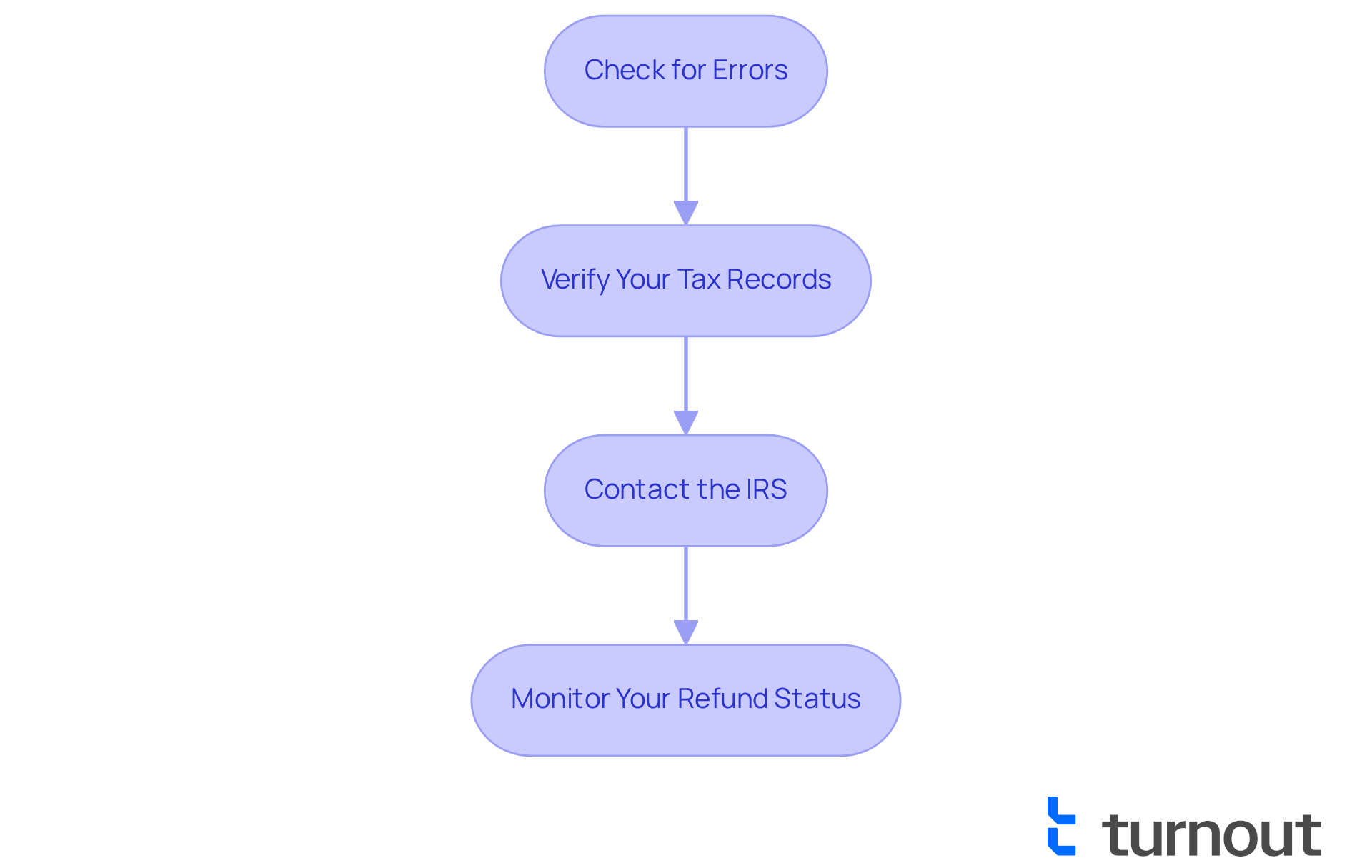

Troubleshoot Common Issues with Your CP21B Notice

If you encounter issues with your cp21b notice, we recognize that dealing with this can be a stressful experience. Here are some troubleshooting steps to help you navigate this situation:

-

Check for Errors: Carefully review the announcement for any mistakes in your personal information, tax year, or refund amount. Document any discrepancies you find. It’s common to feel uncertain about these details.

-

Verify Your Tax Records: Cross-reference the changes made by the IRS with your original tax return and any amendments submitted. This ensures that you have a clear understanding of what was reported. Knowing what you filed can provide peace of mind.

-

Contact the IRS: If you believe there is an error, reach out to the IRS immediately. Be prepared to provide supporting documentation to dispute any incorrect adjustments. Many taxpayers have successfully resolved issues by promptly addressing discrepancies involving cp21b. Remember, you are not alone in this journey.

-

Monitor Your Refund Status: Use the IRS 'Where's My Refund?' tool online to track the status of your refund if it has not arrived within the expected timeframe. This tool can provide updates on your refund process, helping you stay informed.

In fact, roughly 33% of these alerts are contested by taxpayers, emphasizing the significance of attentiveness in examining these communications. Engaging with services like TaxCure, which connects individuals with local tax professionals for one-on-one assistance, can provide valuable insights and help navigate these complexities. Moreover, neglecting to correct mistakes in the communication could result in confusion regarding tax obligations, making it vital to act without delay. Remember, we're here to help you through this.

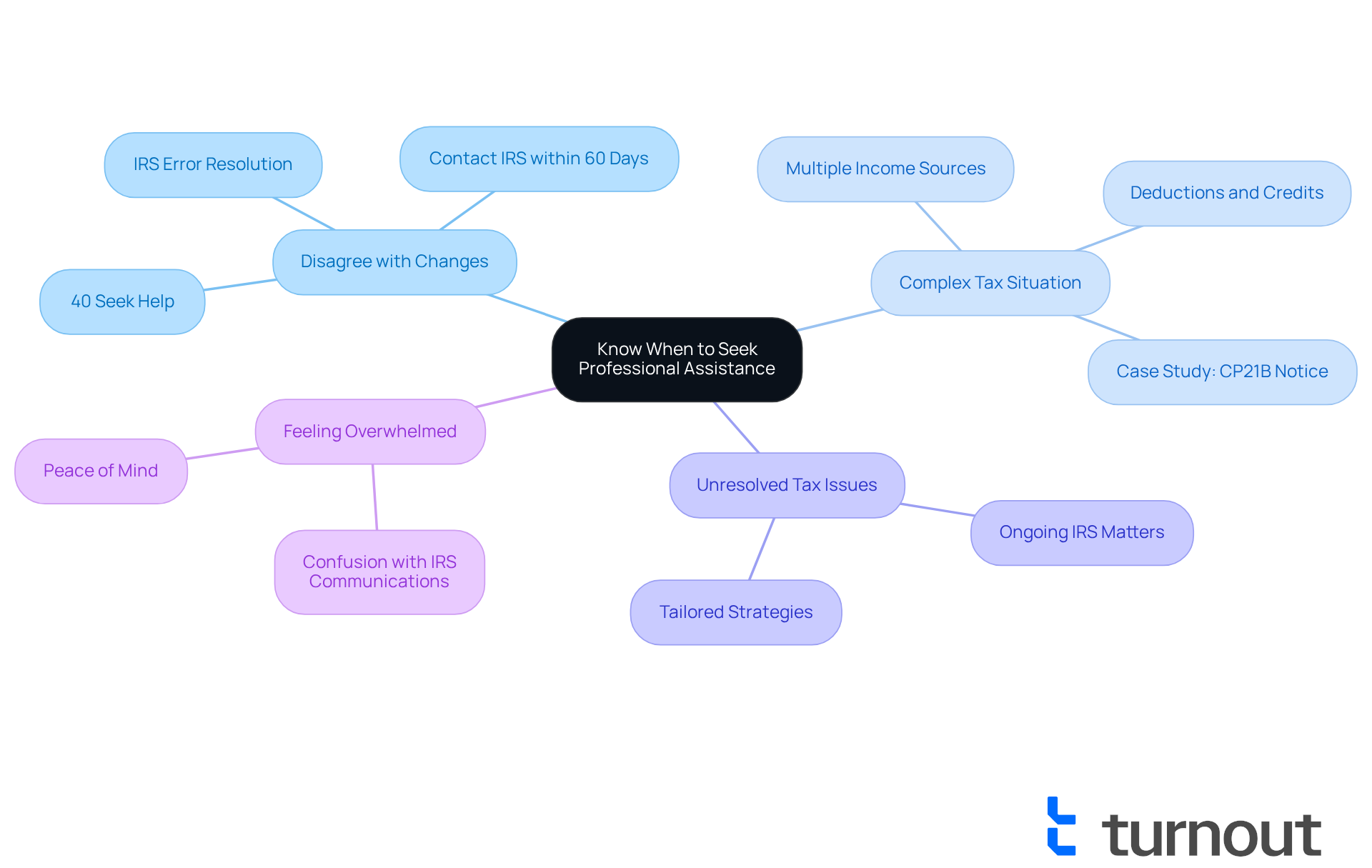

Know When to Seek Professional Assistance

Consider seeking professional assistance if you find yourself in any of these situations:

-

You Disagree with the Changes: If you believe the IRS made an error that you cannot resolve on your own, it's important to know that you’re not alone. A professional can help you navigate the dispute process effectively. Statistics indicate that approximately 40% of taxpayers seek help for IRS disputes, highlighting the importance of expert guidance in these situations.

-

Your Tax Situation is Complex: It’s common for tax returns to involve multiple sources of income, deductions, or credits. In such cases, professional guidance can ensure accuracy and compliance. For instance, the case study titled 'Steps to Take Upon Receiving a CP21B Notice' illustrates how individuals with intricate tax scenarios often benefit from the expertise of tax professionals who can simplify the CP21B process and maximize potential refunds.

-

You Have Unresolved Tax Issues: If you are dealing with ongoing matters with the IRS or have had prior communications, a specialist can assist you in creating a strategy for resolution. Engaging a tax expert can be crucial in addressing these challenges, as they can provide tailored advice and support based on your unique circumstances.

-

You Feel Overwhelmed: If the process feels daunting, reaching out for help can provide peace of mind and clarity on your next steps. Many taxpayers express feeling confused when handling IRS communications, and expert help can reduce anxiety while ensuring you are knowledgeable and ready to respond. Remember, if you disagree with the IRS changes, you must contact them within 60 days using the toll-free number on your notice.

Additionally, consider resources like the Taxpayer Advocate Service (TAS) or Low Income Taxpayer Clinics, which can provide further support for individuals seeking assistance. We're here to help, and you are not alone in this journey.

Conclusion

Receiving a CP21B notice from the IRS can be a significant moment for taxpayers, often indicating important adjustments to your tax return that may lead to a refund. We understand that navigating this process can feel overwhelming, but grasping the details in this notice is essential. It provides crucial information about the changes made, the affected tax year, and the refund amount due. By carefully reviewing this communication, you can ensure that you are aware of your financial entitlements and take appropriate action if necessary.

Throughout this article, we have highlighted key steps to help you effectively navigate the CP21B notice process. From reviewing the notice and confirming the refund amount to addressing any discrepancies with the IRS, these actions empower you to manage your tax situation confidently. It's common to feel uncertain, but recognizing when to seek professional assistance can further enhance your ability to resolve any complexities that arise, ensuring a smoother experience when dealing with tax adjustments.

Ultimately, staying informed and proactive when faced with a CP21B notice can help mitigate potential financial repercussions. If discrepancies occur, it is essential to engage with the IRS promptly and consider seeking professional guidance when needed. By taking these steps, you can navigate the intricacies of your tax obligations and secure your rightful refunds. Remember, you are not alone in this journey, and understanding and responding to IRS communications effectively is key to your peace of mind.

Frequently Asked Questions

What is a CP21B notice?

A CP21B notice is an important message from the IRS indicating that changes have been made to your tax return, often resulting in a refund. It typically occurs when the IRS processes an amended return or corrects errors based on the information provided.

Why is it important to read the CP21B notice carefully?

Reading the CP21B notice carefully is crucial because it details the specific changes made to your tax return, the tax year affected, and the refund amount due. Understanding these elements helps verify the accuracy of the adjustments and determines your next steps.

How soon can I expect a refund after receiving a CP21B notice?

The IRS usually issues refunds related to CP21B notices within two to three weeks after the alert is sent.

What should I do if I disagree with the IRS's modifications mentioned in the CP21B notice?

If you disagree with the IRS's modifications, it is essential to contact them promptly to maintain accurate records and discuss your concerns.

What are the potential consequences of ignoring a CP21B notice?

Ignoring a CP21B notice can lead to significant financial consequences, such as the IRS requesting repayment of excess payments along with penalties and interest.

Can I get assistance regarding my CP21B notice?

Yes, you may qualify for free assistance from the Taxpayer Advocate Service (TAS) for personalized guidance regarding your CP21B notice.

What details should I consider when I receive a tax adjustment communication?

You should consider the specific changes made to your tax return, the affected tax year, and any actions you may need to take if you disagree with the IRS's modifications.

Should I update my tax return copy after receiving a CP21B notice?

Yes, it is important to update your tax return copy kept for your records to reflect any changes made by the IRS.