Overview

Navigating your amended tax return refund check can feel overwhelming, but we're here to help. By submitting Form 1040-X, you can correct any errors on your original tax return. If mistakes led to an overpayment, this process could result in a refund, alleviating some of your financial concerns.

It's common to feel uncertain about the reasons for amendments. Understanding these common issues is crucial. We want to guide you through the steps to file correctly and clarify the typical processing timelines. This knowledge empowers you to manage your amendments and refunds more efficiently.

Remember, you are not alone in this journey. Many taxpayers face similar challenges, and addressing them can lead to a more positive outcome. Take a deep breath, and know that with the right information, you can navigate this process successfully.

Introduction

Navigating the complexities of tax filings can feel overwhelming, especially when mistakes happen. We understand that each year, about 3% of taxpayers find themselves needing to amend their returns, often due to overlooked deductions or incorrect income reporting. This guide serves as a comprehensive roadmap for understanding and executing the amended tax return process, ensuring that you can reclaim what you are rightfully owed.

But what happens when the IRS takes longer than expected to process these amendments? How can you effectively track your refunds? You're not alone in this journey, and we're here to help.

Understand Amended Tax Returns

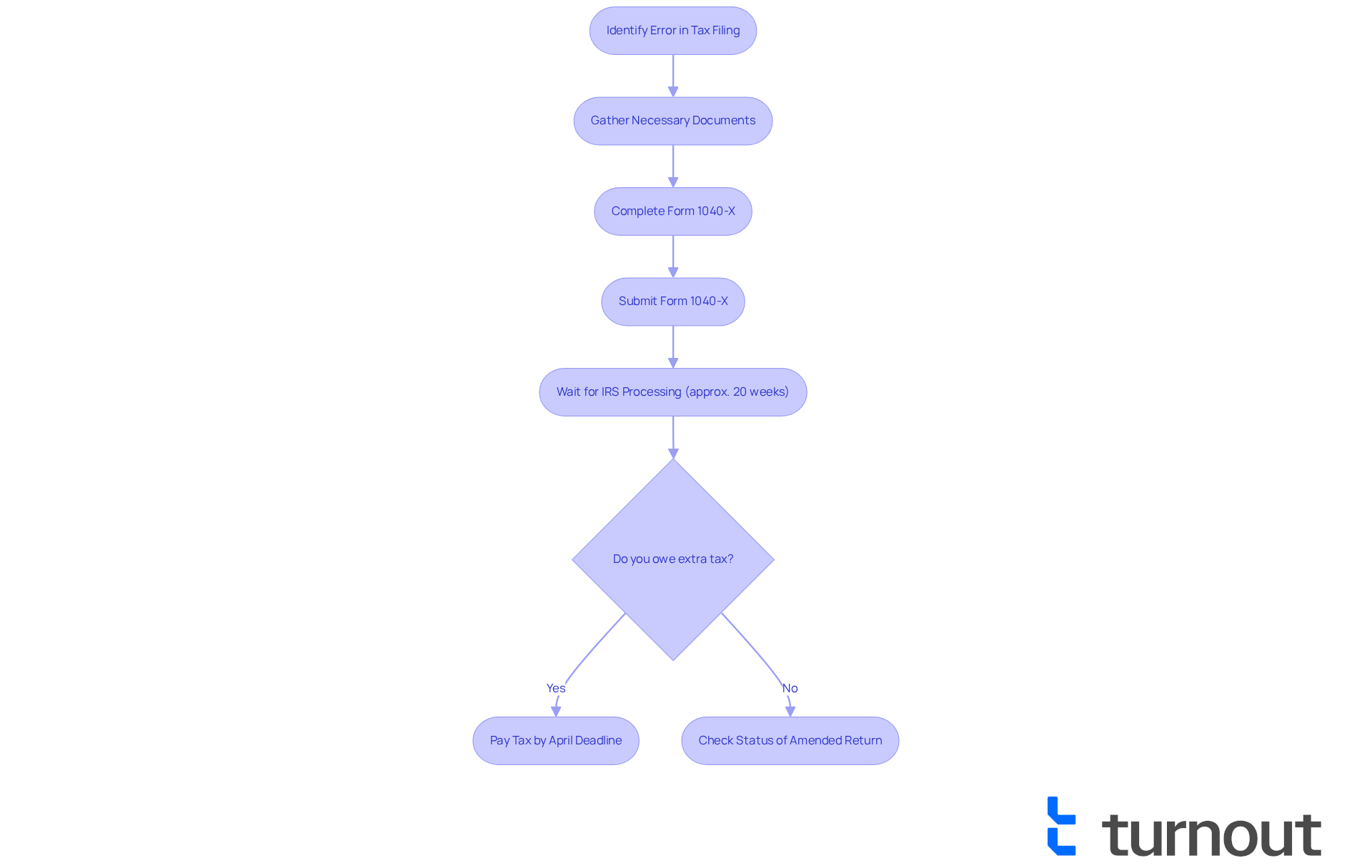

An amended tax document is a form submitted to the IRS to correct mistakes on a previously filed tax document. We understand that mistakes can happen, and this can include errors in income reporting, deductions, or credits. To make these corrections, the IRS requires taxpayers to use Form 1040-X, Amended U.S. Individual Income Tax Return. Understanding this process is vital, as it allows you to rectify mistakes and potentially receive an amended tax return refund check that you are entitled to. Modifying a submission can be essential if you discover mistakes after filing, obtain extra tax documents, or need to alter your filing status.

Statistics show that around 3% of taxpayers adjust their filings each year. This emphasizes the significance of recognizing frequent errors. Tax professionals often highlight that errors in income reporting and missed deductions are common pitfalls. For instance, one taxpayer realized they had overlooked a significant deduction after receiving a revised W-2. This led to a successful amendment and the issuance of an amended tax return refund check for several hundred dollars.

For 2025, the IRS has made updates to Form 1040-X, allowing taxpayers to electronically file amended documents and receive an amended tax return refund check via direct deposit, similar to original tax filings. This change aims to simplify the process. However, it’s important to note that the IRS handles all amended filings manually, which usually takes around 20 weeks. You can start verifying the status of your amended documents approximately three weeks after submission, utilizing the IRS 'Where's My Amended Document?' tool.

To correct mistakes on tax filings, you must submit Form 1040-X within three years of the original document or two years after the tax was paid, whichever is later. This ensures that any missed credits or deductions can be claimed, potentially resulting in a larger amended tax return refund check. However, it is crucial to include a detailed description of the adjustments made, as this will facilitate a smoother processing experience. If extra tax is owed, you must submit a revised form and pay the tax by the April deadline to avoid penalties and interest. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

Identify Reasons to Amend Your Tax Return

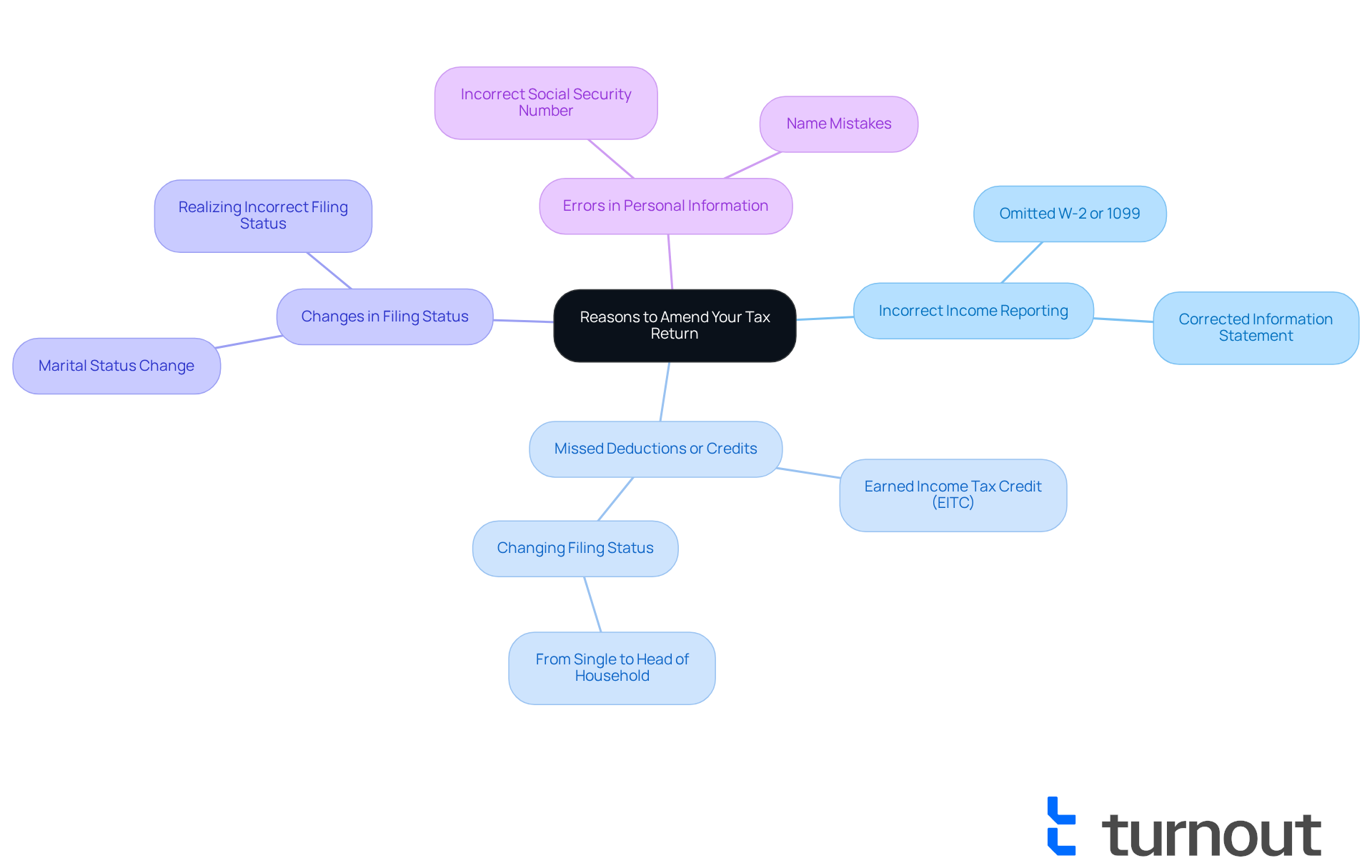

There are several common reasons you might consider amending your tax return.

- Incorrect Income Reporting: It's easy to overlook income from a W-2 or 1099 form, which can lead to significant penalties. Many taxpayers find themselves in this situation, resulting in underpayment of taxes.

- Missed Deductions or Credits: A substantial number of taxpayers miss out on valuable deductions or credits, like the Earned Income Tax Credit (EITC), simply due to oversight. For example, changing your filing status from Single to Head of Household can increase your standard deduction by $3,000, which might lead to a larger refund.

- Changes in Filing Status: If your marital status changes or you realize you need to adjust your filing status, it’s essential to amend your return to accurately reflect these changes.

- Errors in Personal Information: Mistakes such as incorrect Social Security numbers or names can also necessitate a correction.

Understanding these reasons can help you decide if a modification is needed, ensuring you submit your return correctly. By addressing these common issues, you can avoid future complications, such as IRS notices or audits. We encourage you to file amendments as soon as possible and keep copies of all documentation related to your amended tax return refund check. Remember, if you owe more taxes and do not correct your filing, you may receive a CP2000 notice, which could lead to significant penalties. You're not alone in this journey; we're here to help you navigate these challenges.

Follow Steps to File Your Amended Tax Return

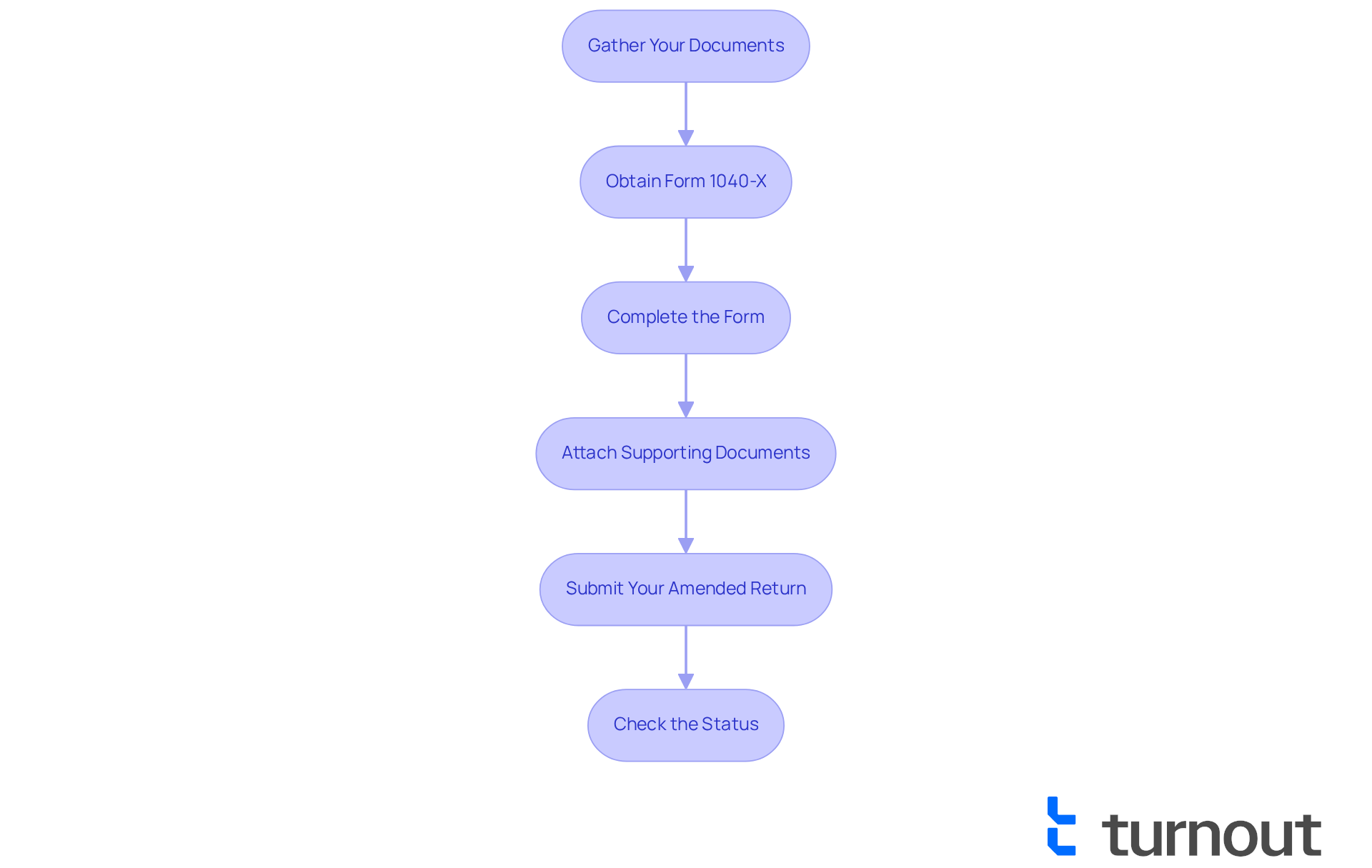

Filing an amended tax return can feel overwhelming, but we're here to guide you through it. Follow these steps to make the process smoother:

-

Gather Your Documents: Start by assembling your original tax filing along with any new paperwork that supports your revision. This may include W-2s, 1099s, or other relevant financial records that you have.

-

Obtain Form 1040-X: You can download Form 1040-X from the IRS website or use tax software that supports amended returns. This form is essential for correcting any errors or omissions in your original filing, so it’s important to have it ready.

-

Complete the Form: Take your time filling out Form 1040-X with your personal information, the changes you’re making, and the reasons for those changes. Ensuring accuracy here can help avoid delays in processing, which is something we all want to avoid.

-

Attach Supporting Documents: Don’t forget to include any necessary documentation that supports your change. This could be new income statements or other relevant financial documents that justify the changes you’re making.

-

Submit Your Amended Return: Once everything is complete, mail your Form 1040-X and any attachments to the address specified in the form instructions. If you’re using tax software, you may have the option to e-file your amendment, which can speed up the process by one or two weeks.

-

Check the Status: After about three weeks, you can use the IRS 'Where's My Amended Return?' tool to verify the status of your revised submission. This tool is available 24/7, but keep in mind there may be specific downtime on Mondays and occasional Sundays.

It’s important to understand that submitting an amended tax return refund check can take between eight to twelve weeks for processing by the IRS. In some cases, it may extend up to sixteen weeks due to various reasons such as errors, incompleteness, or requests for more information. Knowing this timeline can help manage your expectations regarding any potential refunds or adjustments related to the amended tax return refund check. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Troubleshoot Common Issues When Amending Your Return

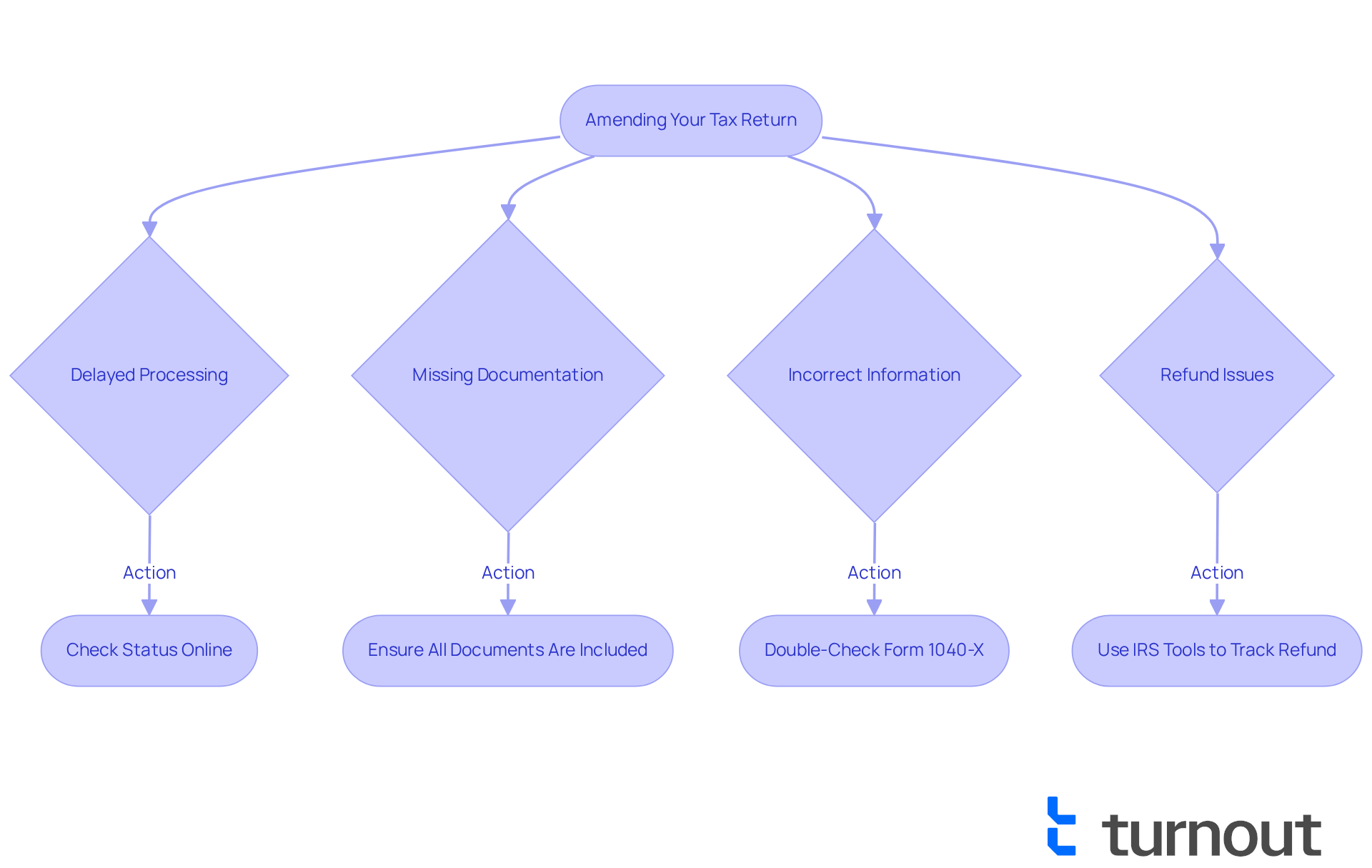

When amending your tax return, it's common to face several challenges that can complicate the process. We understand that this can be overwhelming, but knowing what to expect can ease your journey.

- Delayed Processing: Amended returns often take longer to process than original returns—typically around 8 to 12 weeks. It's important to be patient during this time. According to the IRS, about 20% of revised submissions may experience delays due to missing documentation or incorrect information. You can check your status online to stay informed.

- Missing Documentation: To avoid processing delays, ensure all necessary documents accompany your modification. If you receive a notice from the IRS, respond promptly to any requests for additional information. Charles Dean Smith, Jr., a tax compliance expert, reminds us, "Small business owners will want to review the status of ERC claims and determine if additional reporting is required."

- Incorrect Information: It's essential to double-check all entries on Form 1040-X for accuracy. Errors can lead to further complications. In fact, statistics show that nearly 30% of amended returns are flagged for review due to inaccuracies.

- Refund Issues: If your modification results in an amended tax return refund check, it may take some additional time to receive it. Use IRS tools to track your refund status and stay informed about your situation.

Understanding these potential issues and knowing how to address them can help you navigate the amendment process more effectively. Remember, you're not alone in this journey, and we're here to help you through it.

Conclusion

Understanding the amended tax return process is essential for ensuring that any mistakes in your original filing are corrected. We recognize that navigating this process can feel overwhelming. By utilizing Form 1040-X, you can rectify errors and potentially secure a refund you are rightfully owed. This process not only allows for the correction of income reporting and missed deductions but also serves as a safeguard against future complications with the IRS.

Throughout this guide, we've shared key insights to simplify the amendment process. From identifying common reasons to amend, such as incorrect income reporting and missed deductions, to following a clear step-by-step approach for filing, the information provided aims to empower you. It's common to feel anxious about challenges like delayed processing and missing documentation, but addressing these can significantly enhance your likelihood of a smooth amendment experience.

Ultimately, taking proactive steps to amend your tax return is crucial for safeguarding your financial interests. We encourage you to act swiftly and ensure accuracy in your filings. By remaining informed and utilizing available resources, you can navigate the amended tax return refund check process with confidence and ease. Remember, the journey may seem daunting, but with the right knowledge and support, achieving a successful resolution is entirely attainable. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is an amended tax return?

An amended tax return is a form submitted to the IRS to correct mistakes on a previously filed tax document, such as errors in income reporting, deductions, or credits.

Which form do I need to file to amend my tax return?

You need to use Form 1040-X, Amended U.S. Individual Income Tax Return, to make corrections to your tax filings.

Why is it important to understand the process of amending a tax return?

Understanding the process is vital as it allows you to rectify mistakes and potentially receive an amended tax return refund check that you are entitled to.

How common is it for taxpayers to amend their returns?

Statistics show that around 3% of taxpayers adjust their filings each year, highlighting the significance of recognizing frequent errors.

What are some common mistakes that lead to an amended tax return?

Common mistakes include errors in income reporting and missed deductions. For example, a taxpayer may overlook a significant deduction after receiving a revised W-2.

Can I electronically file an amended tax return?

Yes, for 2025, the IRS has updated Form 1040-X to allow taxpayers to electronically file amended documents and receive refunds via direct deposit.

How long does it take for the IRS to process an amended tax return?

The IRS processes all amended filings manually, which usually takes around 20 weeks.

When can I check the status of my amended tax return?

You can start verifying the status of your amended documents approximately three weeks after submission using the IRS 'Where's My Amended Document?' tool.

What is the deadline for submitting an amended tax return?

You must submit Form 1040-X within three years of the original document or two years after the tax was paid, whichever is later.

What should I include when submitting an amended tax return?

It is crucial to include a detailed description of the adjustments made to facilitate a smoother processing experience.

What happens if I owe extra tax when amending my return?

If extra tax is owed, you must submit a revised form and pay the tax by the April deadline to avoid penalties and interest.