Introduction

Navigating the complexities of voluntary long-term disability insurance can feel like an uphill battle. We understand that facing the prospect of a qualifying illness or injury is daunting. This type of insurance serves as a crucial safety net, providing financial support when it’s needed most. Yet, many individuals feel unsure about how to effectively apply for these benefits.

What steps can you take to ensure a successful application? How can potential pitfalls be avoided? It’s common to feel overwhelmed, but you’re not alone in this journey. This guide outlines five essential steps to demystify the application process and empower you to secure the support you deserve.

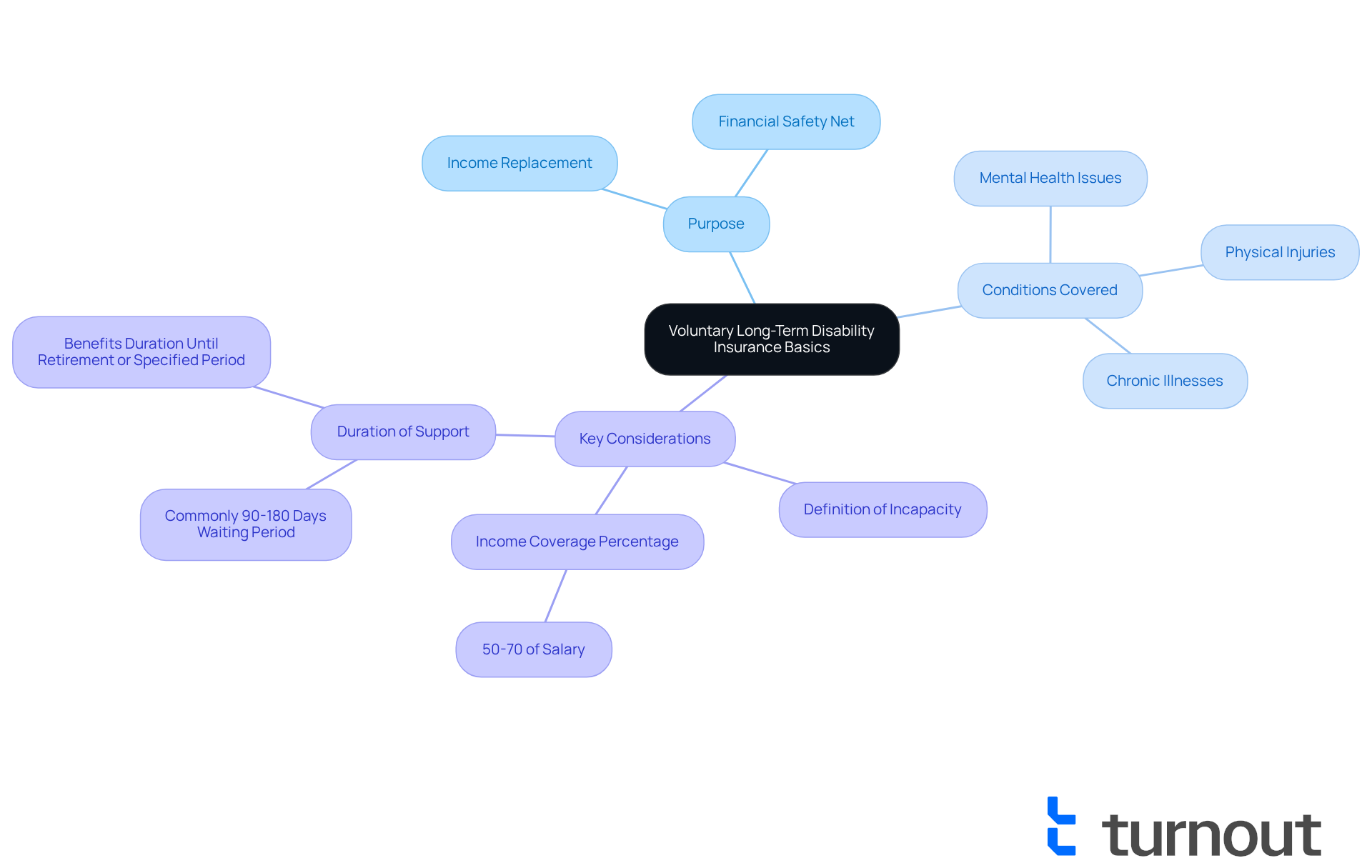

Understand Voluntary Long-Term Disability Insurance Basics

If you're facing the challenge of being unable to work due to a qualifying illness or injury, voluntary long term disability can be a vital lifeline. This insurance is designed to replace your income when you need it most through voluntary long term disability, stepping in after short-term support runs out, typically following a waiting period of 90 to 180 days.

We understand that navigating this process can feel overwhelming. It's important to know that this type of insurance can cover a variety of conditions, from physical injuries to mental health issues. Take the time to familiarize yourself with the specific terms of your policy. Look closely at the following:

- The definition of incapacity

- The percentage of your income that will be covered

- The duration of support available

Knowing these details can empower you as you move through the application process. Remember, you are not alone in this journey. We're here to help you every step of the way.

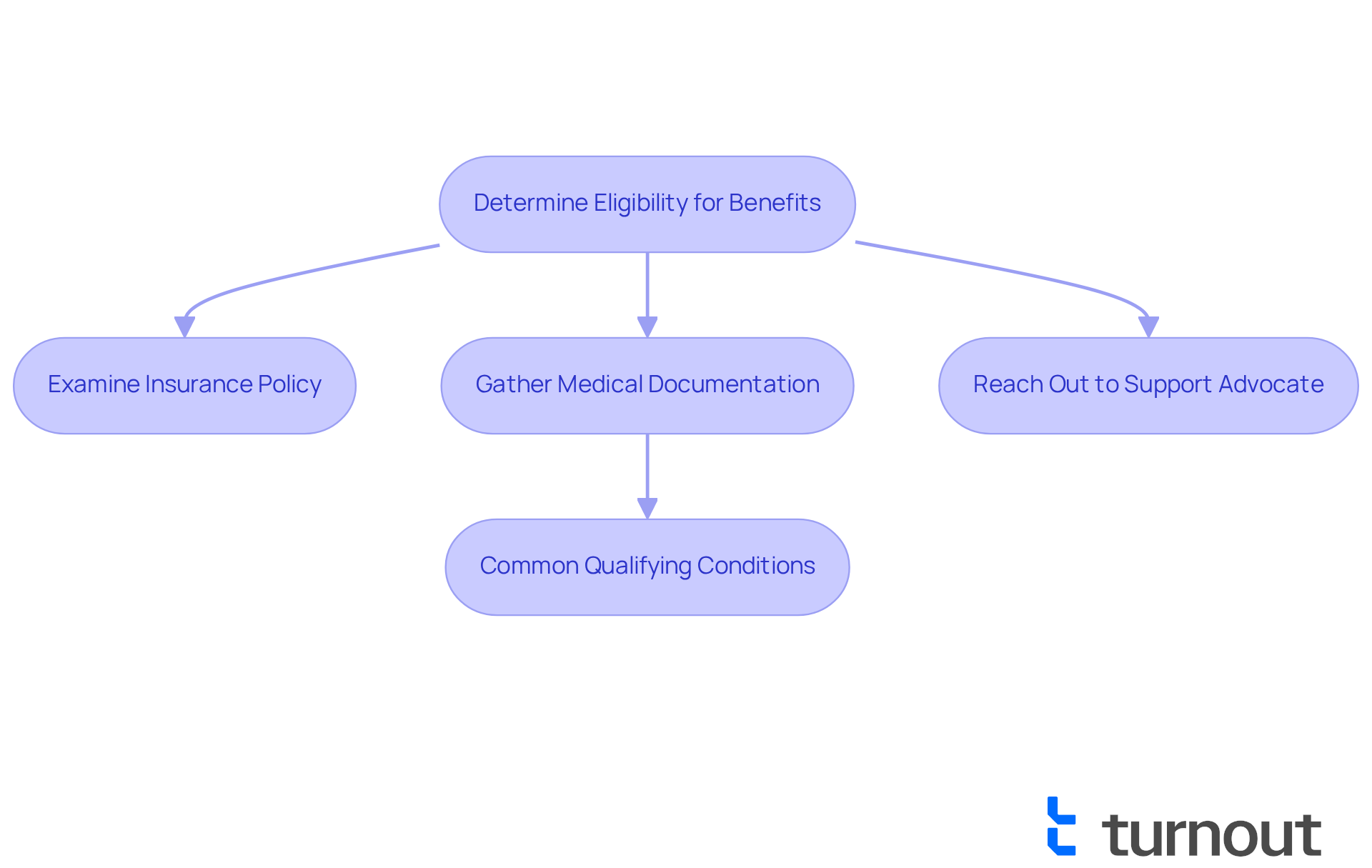

Determine Your Eligibility for Benefits

Are you feeling overwhelmed by the thought of applying for voluntary long term disability benefits? You're not alone. Many people find themselves in similar situations, unsure of where to start. To help you navigate this process, it’s essential to first examine your insurance policy. Most policies require that you’ve worked a specific number of hours or months, and that your condition is expected to last for a prolonged period - typically over 12 months.

You’ll also need to gather medical documentation to support your claim. Common qualifying conditions include:

- Severe injuries

- Chronic illnesses

- Mental health disorders

We understand that this can be a daunting task, and it’s perfectly normal to feel uncertain about your eligibility for voluntary long term disability benefits. If you’re unsure, consider reaching out to a support advocate, like those at Turnout. They can provide personalized guidance tailored to your unique circumstances.

Turnout specializes in helping clients navigate complex financial and governmental systems, including Social Security Disability applications. They ensure you have the support you need, without the pressure of legal representation. Remember, you are not alone in this journey. We're here to help you every step of the way.

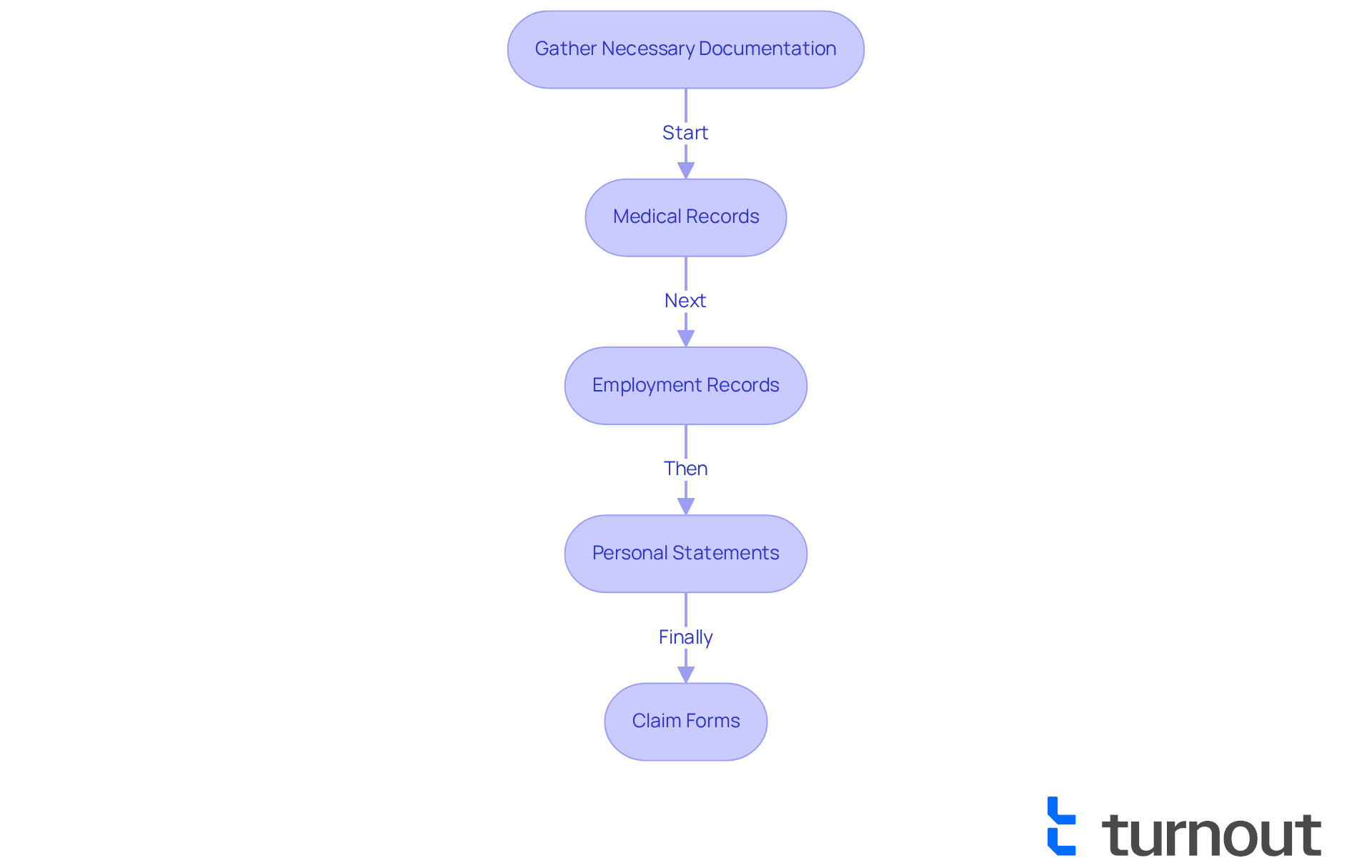

Gather Necessary Documentation for Your Application

Applying for voluntary long term disability benefits can feel overwhelming, but gathering the right documentation is a crucial step toward securing the support you need. Here’s how you can prepare:

- Medical Records: Start by obtaining detailed reports from your healthcare providers. These should clearly outline your diagnosis, treatment history, and prognosis. These records are vital, as they provide the necessary medical evidence to support your claim.

- Employment Records: Compile documentation of your work history. Include job descriptions, hours worked, and any accommodations made due to your condition. This information illustrates how your disability impacts your ability to perform your job.

- Personal Statements: Consider writing a narrative that describes how your condition affects your daily life and work capabilities. This personal insight can significantly enhance your submission by providing context to your medical records.

- Claim Forms: Make sure all required forms from your insurance company are completed accurately and thoroughly. Incomplete or inaccurate forms can lead to delays or refusals of your request.

We understand that organizing these documents in advance can feel daunting. However, it streamlines the application process and minimizes the risk of potential pitfalls. On average, applicants may need to submit several documents, and having everything prepared can enhance your chances of a successful outcome.

Keep in mind that the typical denial rate for claims related to impairments is 68%. This statistic highlights how essential comprehensive documentation is in obtaining the support you deserve. As of February 2025, the average SSDI assistance for disabled workers is $1,581 per month, underscoring the financial implications of inadequate documentation.

You're not alone in this journey. Turnout provides tools and services to assist you in navigating these processes effectively. Our trained nonlawyer advocates can guide you through the documentation requirements without the need for legal representation. Furthermore, the jobless rate for individuals with impairments is reported at 7.5%, reflecting the challenges faced by those pursuing these assistance programs. Remember, we're here to help you every step of the way.

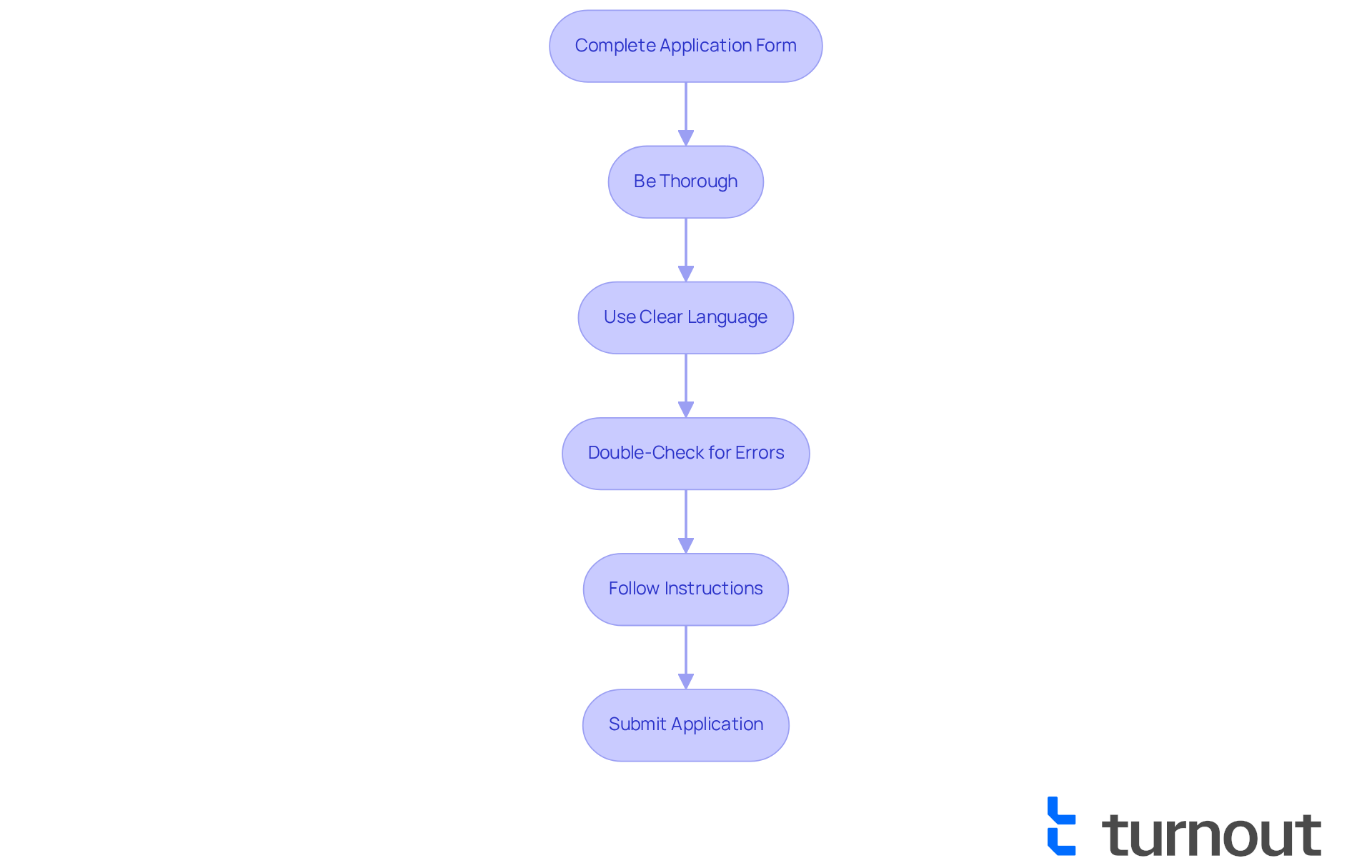

Complete the Application Form Accurately

When completing your request form for voluntary long term disability benefits, it’s essential to pay close attention to detail. We understand that this process can feel overwhelming, but we’re here to help. Here are some key tips to guide you:

-

Be Thorough: Answer all questions completely, providing as much detail as possible about your condition and its impact on your work. Advocates emphasize that thorough medical documentation is crucial for approval. This is especially important for younger applicants, who faced an approval rate of only 6.3% for males and 5.9% for females in 2023.

-

Use Clear Language: Avoid jargon and be straightforward in your descriptions. If you find it necessary, don’t hesitate to attach additional pages to elaborate on your situation. Clear communication can make a significant difference.

-

Double-Check for Errors: Before sending your submission, take a moment to review it for any mistakes or missing information. It might also be helpful to have someone else look it over. Common mistakes in the approval process for voluntary long term disability often stem from incomplete information or unclear descriptions.

-

Follow Instructions: Make sure to adhere to any specific guidelines provided by your insurance company regarding format, required signatures, and submission methods. Non-compliance can lead to delays or denials, which can be frustrating.

On average, processing durations for long-term benefits requests can differ significantly, often requiring several months. Understanding this timeline can help you manage your expectations and prepare accordingly. By being diligent and precise, you can navigate the complexities of the submission process more effectively. Remember, you are not alone in this journey.

Follow Up on Your Application Status

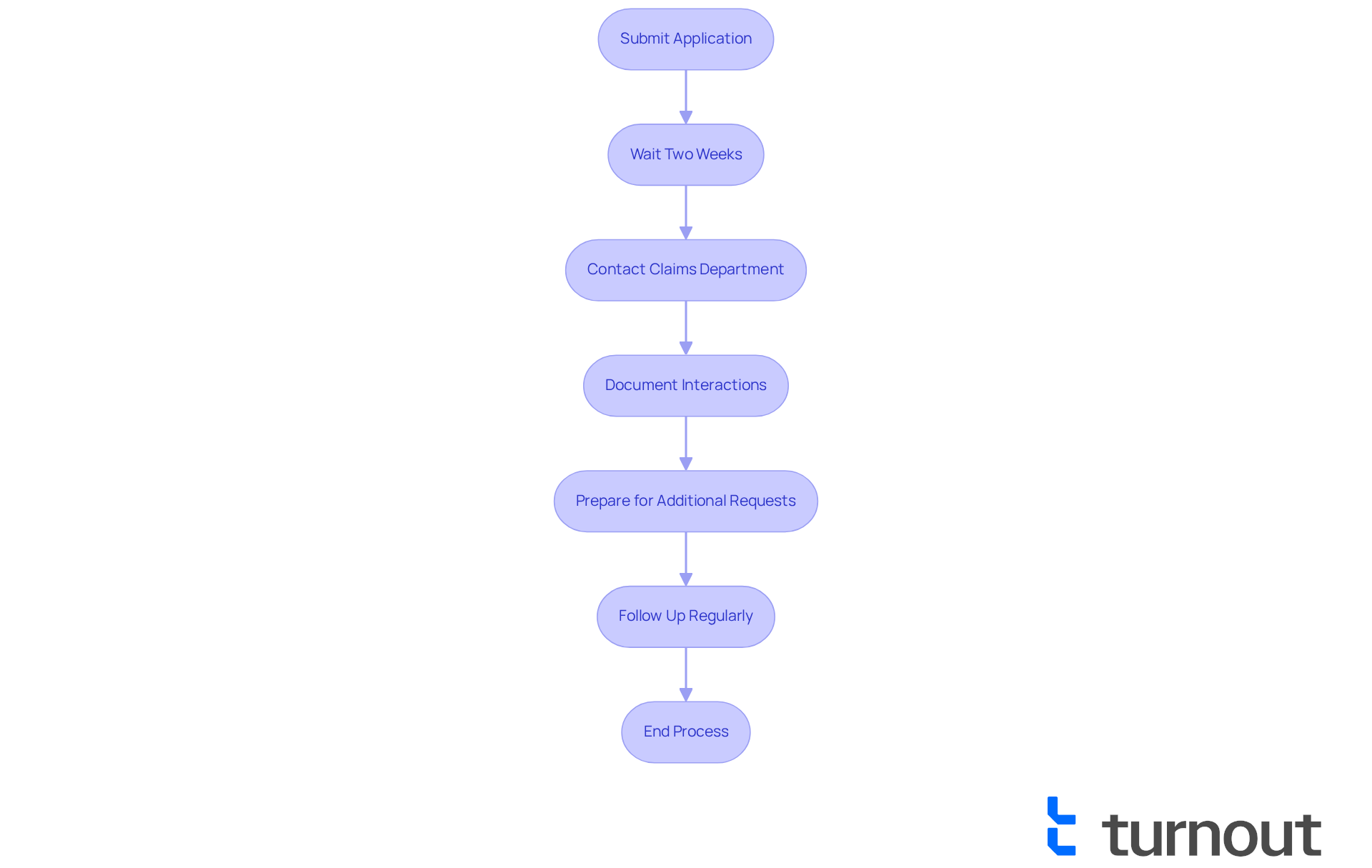

After submitting your request for voluntary long term disability benefits, it’s crucial to follow up regularly to ensure that everything is processed promptly. We understand that this can be a stressful time, and we’re here to help you navigate it effectively.

- Set a Timeline: Allow at least two weeks after submission before checking in. This gives the insurance company enough time to handle your request.

- Contact the Claims Department: Use the contact information provided in your application materials to reach out. Approach your inquiries with politeness and assertiveness; effective communication can significantly influence your case's progress.

- Document Your Interactions: Keep a detailed record of all communications, including dates, times, and the names of representatives you speak with. This documentation can be invaluable if issues related to voluntary long term disability arise later in the process.

- Be Prepared for Additional Requests: Insurers may occasionally require further documentation or clarification. Responding promptly to these requests is essential to avoid unnecessary delays in your application.

- Follow Up Regularly: Consistent follow-ups can keep your request on track. It’s common to feel anxious during this process, but statistics show that applicants who actively monitor their status are more likely to receive timely updates and resolutions. For instance, about half of applicants who appeal an initial denial of their voluntary long term disability claim ultimately receive benefits, highlighting the importance of persistence in the claims process.

Remember, you are not alone in this journey. By staying proactive and engaged, you can help ensure that your application is handled smoothly.

Conclusion

Navigating the complexities of voluntary long-term disability insurance can feel overwhelming. We understand that securing the benefits you need during tough times is essential. This guide has highlighted the critical steps involved, from grasping the basics of your policy to following up on your application status. With this knowledge, you can approach each stage with confidence.

Key insights include:

- Understanding your eligibility

- Gathering necessary documentation

- Completing the application form with care

By paying attention to detail and maintaining clear communication with your insurance provider, you can significantly enhance your chances of a successful outcome. Remember, support advocates can be invaluable, guiding you through the nuances of the application process and helping to alleviate some of the stress.

Ultimately, being proactive and informed is crucial in your pursuit of voluntary long-term disability benefits. This journey may be challenging, but it’s important to remember: you are not alone. By taking these steps and remaining persistent, you can navigate the system effectively and secure the financial support you need during uncertain times. We're here to help you every step of the way.

Frequently Asked Questions

What is voluntary long-term disability insurance?

Voluntary long-term disability insurance is designed to replace your income when you are unable to work due to a qualifying illness or injury, typically stepping in after short-term support runs out, following a waiting period of 90 to 180 days.

What conditions does voluntary long-term disability insurance cover?

This insurance can cover a variety of conditions, including physical injuries, chronic illnesses, and mental health disorders.

What should I know about my policy before applying?

It's important to understand the definition of incapacity, the percentage of your income that will be covered, and the duration of support available under your policy.

How do I determine my eligibility for benefits?

To determine your eligibility, you should review your insurance policy, which typically requires you to have worked a specific number of hours or months and have a condition expected to last over 12 months.

What documentation do I need to gather for my claim?

You will need to gather medical documentation to support your claim for voluntary long-term disability benefits.

What are some common qualifying conditions for voluntary long-term disability benefits?

Common qualifying conditions include severe injuries, chronic illnesses, and mental health disorders.

Where can I find support if I feel overwhelmed by the application process?

You can reach out to support advocates, such as those at Turnout, who specialize in helping clients navigate complex financial and governmental systems, including Social Security Disability applications.