Introduction

Navigating the complexities of unfiled tax returns can feel overwhelming, especially in a bustling city like Las Vegas. Financial obligations can quickly spiral out of control, leaving many feeling anxious and uncertain. We understand that the implications of failing to file taxes can be severe, leading to legal and financial repercussions that catch individuals off guard.

What if there was a clear, step-by-step guide to help ease your stress and confusion? Imagine having the tools and knowledge to tackle this issue head-on. This article will unravel essential processes and strategies for managing unfiled tax returns, ensuring that you are not alone in this journey. Together, we’ll explore how to navigate these challenges with confidence.

Understand Unfiled Tax Returns: Definition and Implications

Unfiled tax documents are more than just forms; they represent missed deadlines that can lead to serious consequences. We understand that dealing with taxes can be overwhelming, but it’s crucial to recognize the potential outcomes of not filing on time.

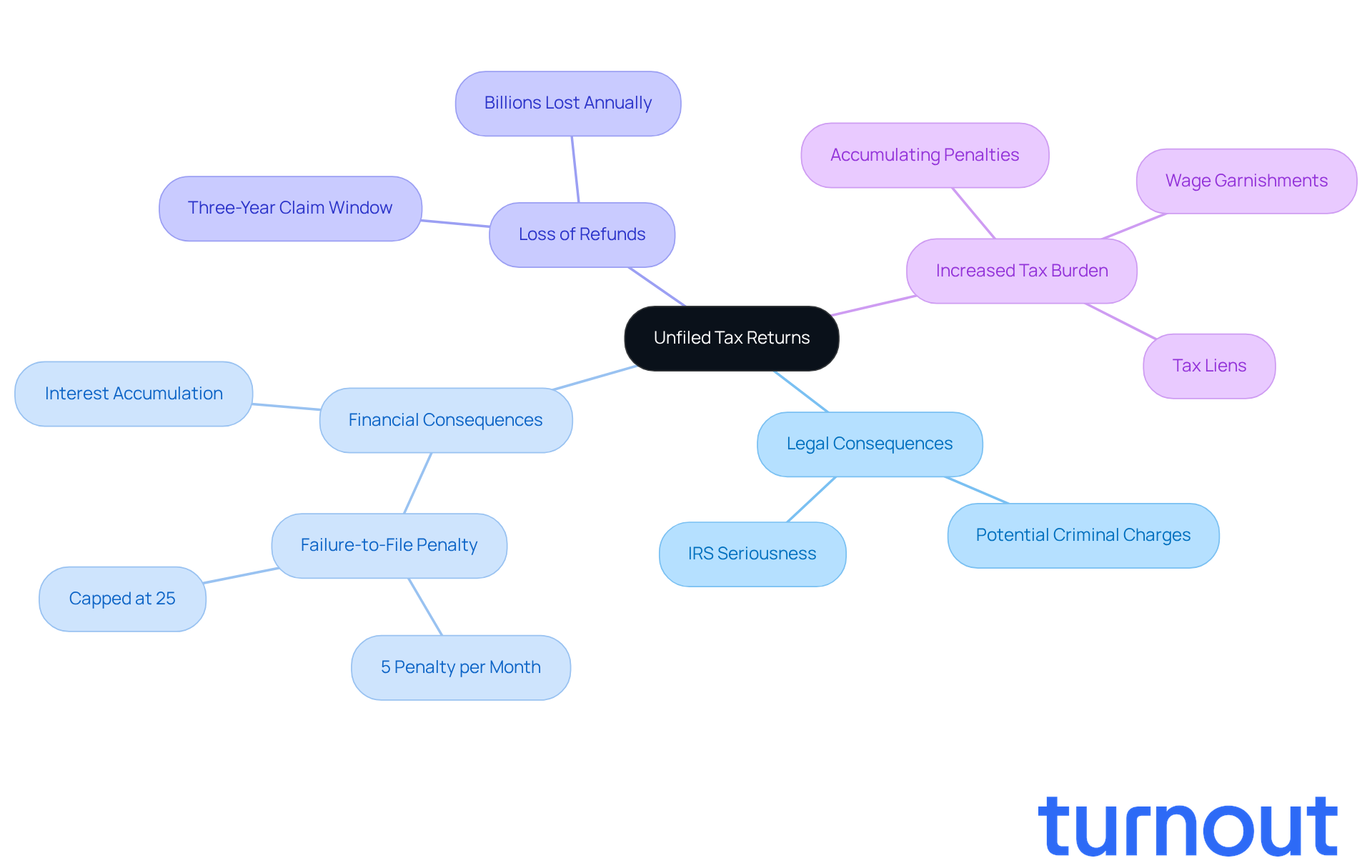

Legal Consequences: Failing to file your taxes can lead to criminal charges, especially if the IRS believes your inaction was intentional. It’s important to know that the IRS considers not submitting a federal tax document a more serious issue than simply not paying. The consequences reflect this seriousness, and it’s something to take to heart.

Financial Consequences: The IRS imposes a failure-to-file fee, typically 5% of the unpaid tax for each month your submission is late, capping at 25%. For example, if you owe $10,000, that amount could balloon to over $14,750 due to penalties and interest if not addressed quickly. It’s easy to see how quickly things can escalate.

Loss of Refunds: If you’re due a refund from a previous year, you need to file within three years to claim it. Missing this window could mean losing out on significant amounts of money. In fact, billions have been lost in refunds because of unfiled returns. It’s a heartbreaking reality for many.

Increased Tax Burden: The longer you wait to file, the more penalties and interest pile up, increasing your overall tax liability. Unresolved tax debt can lead to wage garnishments and tax liens, making financial stability even harder to achieve. Plus, unfiled taxes can affect your future dealings with lenders, employers, and colleges, complicating loan approvals and financial aid.

By understanding these implications, you can see why it’s so important to address unfiled taxes promptly. Remember, you’re not alone in this journey. We’re here to help you navigate your tax obligations effectively.

Gather Required Documentation for Filing

To successfully submit your unfiled tax returns Las Vegas, it’s essential to gather specific documentation for each year you’re filing. We understand that this can feel overwhelming, but here’s a structured approach to help you prepare:

-

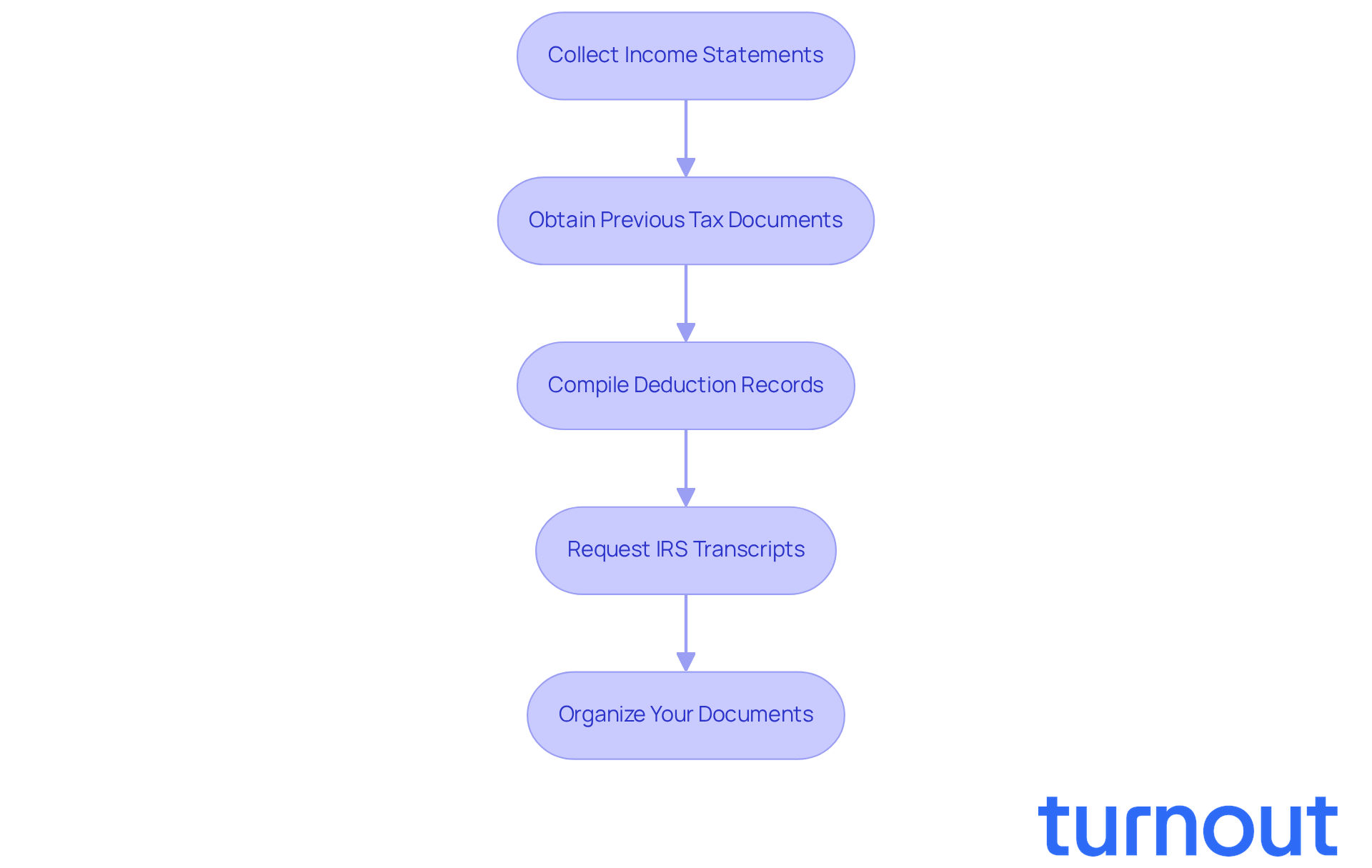

Collect Income Statements: Start by gathering all W-2 forms, 1099 forms, and any other income statements for the years you haven’t filed. These documents are crucial as they report your earnings and ensure accurate filing. It’s common to feel stressed about this step; statistics show that about 30% of taxpayers struggle with gathering these documents, which can lead to delays in the filing process.

-

Obtain Previous Tax Documents: If you’ve filed in the past, locate copies of your previous tax documents. These can serve as a valuable reference for your current filing and help maintain consistency in your reported income.

-

Compile Deduction Records: Collect receipts and documentation for any deductions you plan to claim, such as medical expenses, mortgage interest, or charitable contributions. Accurate records can significantly impact your tax liability and potential refunds. Remember, every little bit helps!

-

Request IRS Transcripts: If you can’t find your income statements, you can request a wage and income transcript from the IRS. This document shows all income reported to them and can be a helpful substitute when original forms are missing.

-

Organize Your Documents: Keep all documents organized by year to streamline the filing process. This organization will help you avoid confusion and ensure that you have everything needed for each tax year. By applying effective methods, like keeping orderly tax records, you can simplify the preparation of precise tax filings and avert future tax problems.

As the IRS emphasizes, the 2026 tax filing season opens on January 26, 2026, making it essential to prepare early. As Mike Habib, an Enrolled Agent, states, "Each client’s situation is unique, and developing a strategy tailored to your specific circumstances is essential for achieving the best possible outcome."

By following these steps, you’ll be well-prepared to accurately submit your unfiled tax returns Las Vegas. We’re here to help you reduce stress and improve your chances of a favorable outcome.

File Your Unfiled Tax Returns: Step-by-Step Process

Submitting your unfiled tax returns Las Vegas can feel overwhelming, but breaking it down into manageable steps can truly make a difference. We understand that this process can be stressful, so here’s how to navigate it effectively:

-

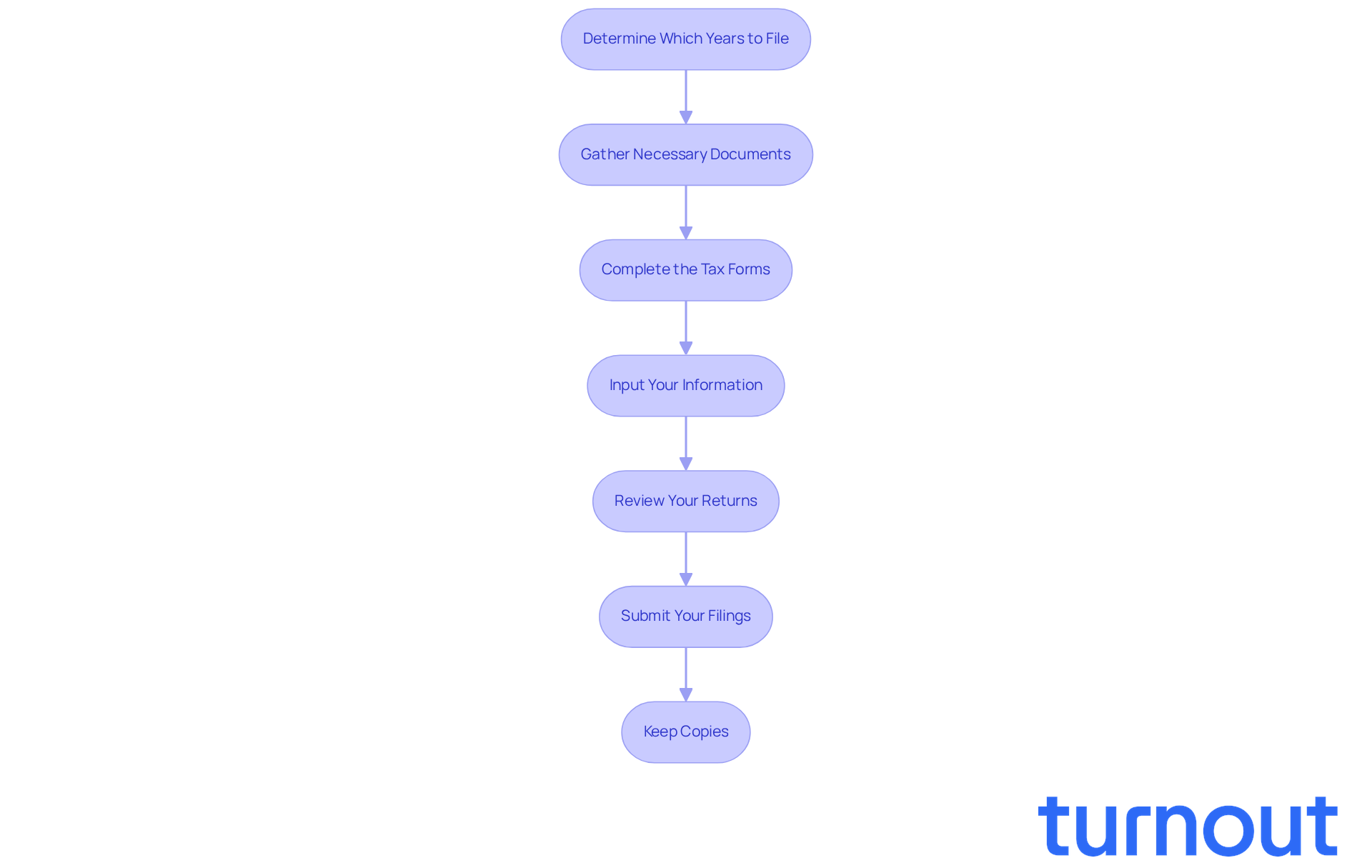

Determine Which Years to File: Start by identifying all the years you haven’t filed. The IRS usually requires the last six years of returns, but if you have significant unreported income, you might need to file for additional years.

-

Gather Necessary Documents: Collect all relevant documents, like W-2s, 1099s, and expense receipts. Keeping these organized in one folder will help you maintain order and accessibility, making it easier to complete your forms accurately.

-

Complete the Tax Forms: Use the appropriate tax forms for each year, which you can find on the IRS website or through tax preparation software. It’s crucial to use the correct forms to avoid complications down the line.

-

Input Your Information: Carefully fill out the forms with your income, deductions, and credits. Precision is key; common errors include misreporting income or overlooking deductions, which can lead to delays or consequences. As tax attorney Darrin T. Mish notes, "Clients appreciate the confidential consultations and the relief of no longer dealing directly with IRS agents."

-

Review Your Returns: Double-check all entries for accuracy. Tax experts emphasize that even small mistakes can lead to major problems with the IRS, including extra charges. Mish also states, "This guide is designed to help you break free from the anxiety, avoid costly penalties, and take back control of your financial future."

-

Submit Your Filings: You can file electronically or by mail. If you choose to mail, make sure you send them to the correct IRS address for your state. Keep in mind that the IRS is currently working to recover from pandemic-related challenges, which may affect processing times. Ignoring your filing obligations can lead to severe consequences, including criminal prosecution in extreme cases of tax evasion.

-

Keep Copies: After filing, retain copies of your submitted documents and any correspondence with the IRS. This documentation is essential for your records and can help in case of future inquiries.

By following these steps, you can efficiently submit your unsubmitted taxes and make significant progress toward resolving your tax issues. Remember, the IRS imposes fines for unfiled tax returns Las Vegas, including a failure-to-file charge of up to 5% per month, so acting promptly is crucial. Additionally, the IRS has been mailing notices to individuals who have not filed, highlighting the importance of addressing your tax responsibilities. You are not alone in this journey; we're here to help.

Manage Post-Filing Outcomes: Penalties and Payment Options

After filing your unfiled tax returns Las Vegas, it’s essential to manage potential outcomes effectively. We understand that this can be a stressful time, so here’s what you need to know:

-

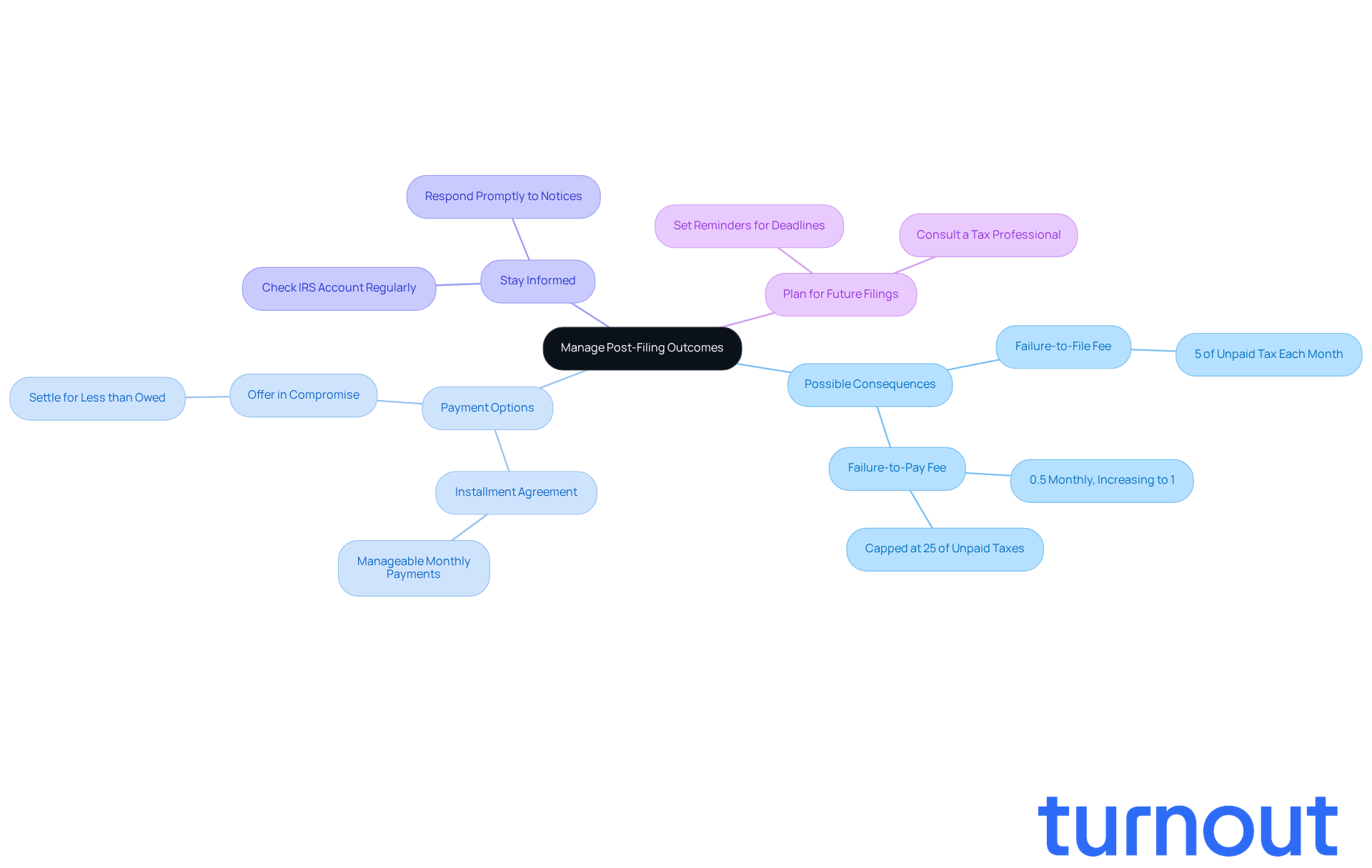

Understand Possible Consequences: It’s important to be aware that the IRS imposes fines for late filing and late payment. The failure-to-file fee is typically 5% of the unpaid tax each month, while the failure-to-pay fee starts at 0.5% monthly, increasing to 1% if payment isn’t received within 10 days of a notice of intent to levy. Thankfully, the failure-to-pay charge won’t exceed 25% of unpaid taxes, and you may qualify for a reduction under specific conditions.

-

Explore Payment Options: If paying your tax bill in full feels overwhelming, know that the IRS offers several options:

- Installment Agreement: This allows you to pay your tax debt in manageable monthly installments. Many taxpayers find relief through this option, easing their financial burden.

- Offer in Compromise: If you qualify, you might settle your tax debt for less than the total amount owed, providing significant relief for those facing tough financial situations.

-

Stay Informed: Regularly check your IRS account for any notices or updates regarding your tax situation. Responding promptly to IRS correspondence is crucial to avoid harsher penalties or collection actions. Remember, proactive communication can open up more options for settling your debt.

-

Plan for Future Filings: To prevent falling behind again, consider setting reminders for future tax deadlines. Consulting a tax professional can offer ongoing support and help you navigate complex tax regulations effectively.

By managing these post-filing outcomes, you can ensure compliance with tax regulations and minimize further complications. Remember, you’re not alone in this journey, and we’re here to help.

Conclusion

Navigating unfiled tax returns in Las Vegas can feel overwhelming, and we understand the serious implications of not filing on time. The potential legal and financial consequences are daunting, but recognizing these challenges is the first step toward resolution. Addressing unfiled taxes isn’t just about compliance; it’s about reclaiming your financial stability and peace of mind.

In this guide, we’ve outlined essential steps to help you manage unfiled tax returns effectively. From understanding the implications of unfiled taxes to gathering necessary documentation, filing the returns, and managing post-filing outcomes, each phase is crucial. Remember, prompt action is vital to avoid escalating penalties and the potential loss of refunds. Staying organized with your documentation can streamline the filing process.

Taking control of unfiled tax returns is not merely an obligation; it’s an opportunity to reshape your financial future. By following the structured steps provided and seeking assistance when needed, you can navigate this challenging landscape with confidence. It’s common to feel overwhelmed, but you’re not alone in this journey. Stay proactive, keep informed, and plan for future tax responsibilities to prevent falling into the same situation again.

Embrace the journey toward compliance and financial health. The path may seem daunting, but the rewards are invaluable. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What are unfiled tax returns?

Unfiled tax returns refer to tax documents that have not been submitted by the deadline, representing missed deadlines that can lead to serious legal and financial consequences.

What are the legal consequences of failing to file taxes?

Failing to file taxes can lead to criminal charges, particularly if the IRS believes the inaction was intentional. The IRS considers not submitting a federal tax document to be a more serious issue than simply not paying taxes.

What financial penalties are associated with unfiled tax returns?

The IRS imposes a failure-to-file fee of typically 5% of the unpaid tax for each month the submission is late, capping at 25%. For instance, if you owe $10,000, the total amount could increase to over $14,750 due to penalties and interest if not addressed quickly.

What happens to tax refunds if returns are not filed on time?

If you are due a refund from a previous year, you must file within three years to claim it. Missing this window can result in losing significant amounts of money, as billions have been lost in refunds due to unfiled returns.

How does waiting to file taxes affect overall tax liability?

The longer you wait to file, the more penalties and interest accumulate, increasing your overall tax liability. Unresolved tax debt can lead to wage garnishments and tax liens, making financial stability more difficult.

Can unfiled tax returns affect future financial dealings?

Yes, unfiled taxes can complicate future dealings with lenders, employers, and colleges, potentially affecting loan approvals and financial aid opportunities.

Why is it important to address unfiled taxes promptly?

Addressing unfiled taxes promptly is crucial to avoid escalating penalties, loss of refunds, and complications in financial dealings, which can have long-term implications on financial stability.