Introduction

Navigating the complexities of unfiled tax returns can evoke a sense of dread for many. We understand that facing the IRS can feel overwhelming. However, unfiled tax return assistance in Las Vegas offers a pathway to reclaim control over your financial situation.

By understanding the potential consequences of non-filing, you can alleviate your anxiety. It’s common to feel uncertain about the steps required to rectify this issue. But know that you’re not alone in this journey. There are effective strategies to tackle unfiled returns and ensure compliance with your tax obligations.

What steps can you take to regain peace of mind? Let’s explore the options available to you.

Understand Unfiled Tax Returns

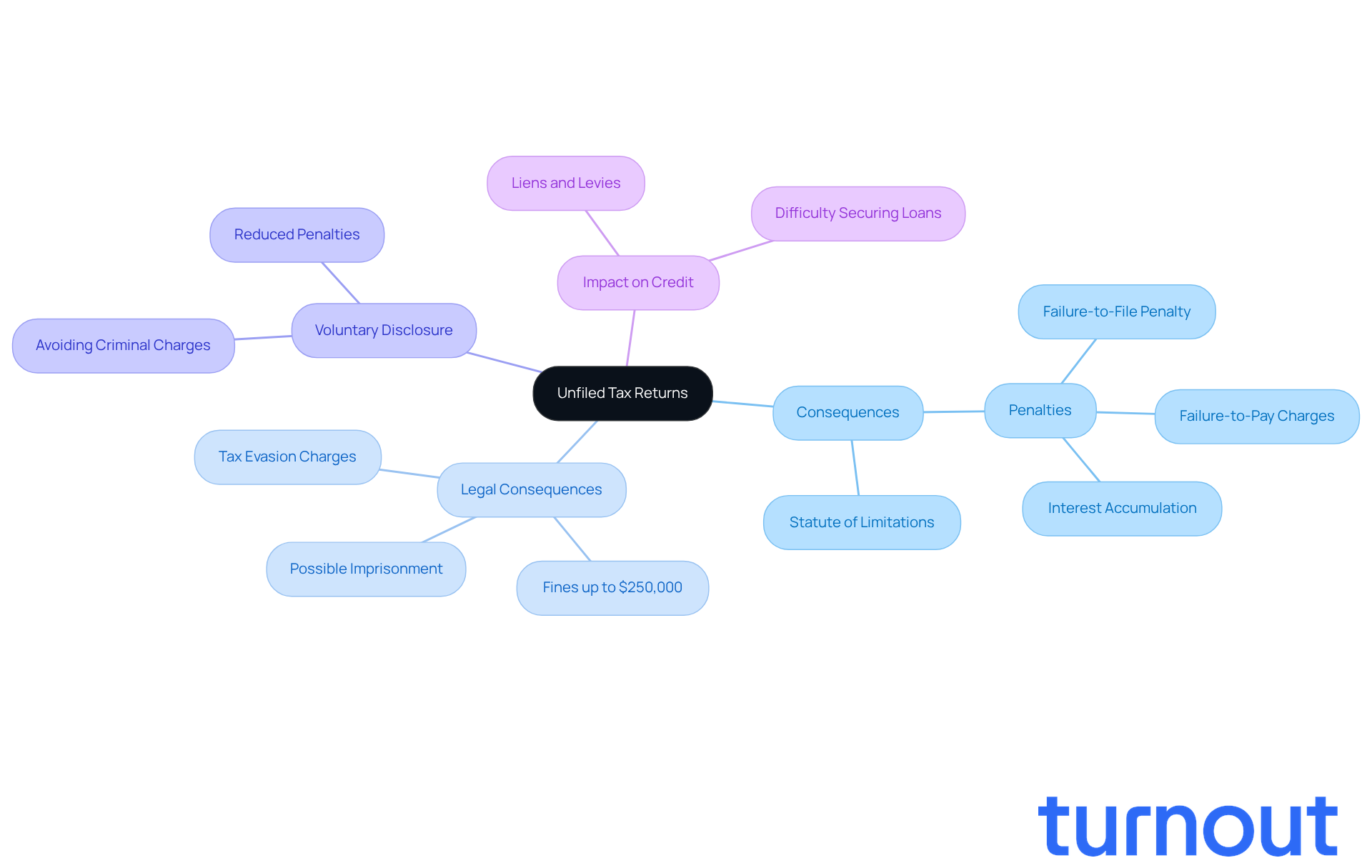

Many people find unfiled tax returns to be a source of worry, but unfiled tax return assistance in Las Vegas can help. These are federal income tax returns that haven’t been submitted by their due date, even if you’ve requested an extension. If you find yourself in this situation, it’s important to understand the implications of seeking unfiled tax return assistance Las Vegas. The IRS can impose fines, interest, and even take enforcement actions against you. Plus, not filing could mean missing out on potential refunds and tax credits. Understanding your situation is the first step toward seeking unfiled tax return assistance Las Vegas to address these unsubmitted filings and avoid further complications with the IRS.

Consequences of Non-Filing: It’s crucial to know that the IRS can assess penalties of 5% of the unpaid tax for each month your return is late, up to a maximum of 25%. There’s also a failure-to-pay charge of 0.5% per month, which can add to your financial burden.

Statute of Limitations: Unfortunately, there’s no statute of limitations on unfiled documents. This means the IRS can pursue you indefinitely until those documents are submitted.

Legal Consequences: Ignoring tax filings can lead to serious legal repercussions. This includes tax evasion charges, fines up to $250,000, and even the possibility of imprisonment for up to 5 years.

Voluntary Disclosure: If you come forward voluntarily to submit your unfiled documents, you might be able to reduce penalties and avoid criminal charges. The IRS encourages individuals to submit filings for tax years prior to 2019 to reclaim any owed refunds.

Impact on Credit: Failing to file can also lead to liens or levies that negatively affect your credit score, making it harder to secure loans or mortgages.

By understanding these aspects, you can better prepare for the steps ahead in seeking unfiled tax return assistance Las Vegas. Remember, you’re not alone in this journey, and we’re here to help.

Gather Necessary Tax Documents

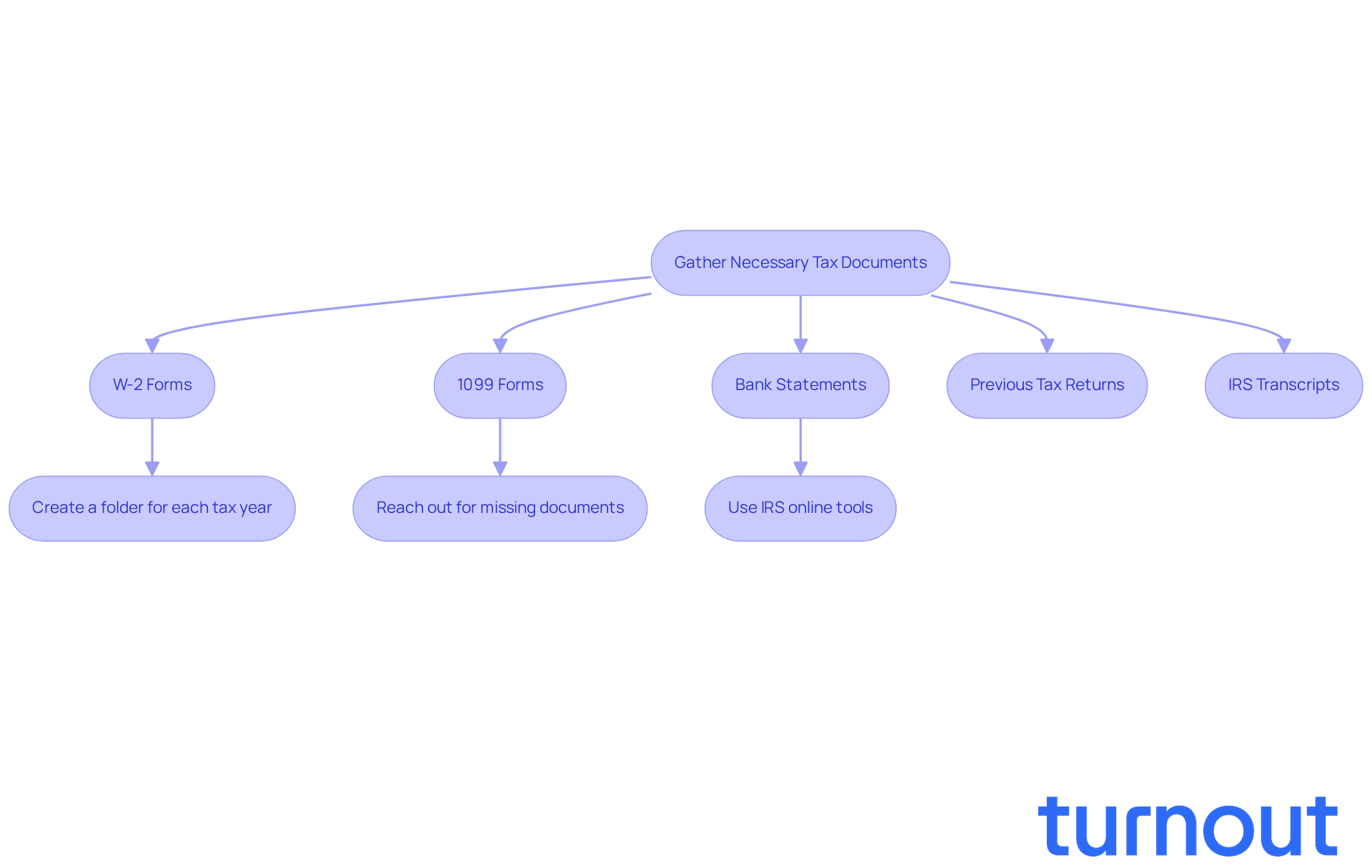

Before you can submit your outstanding tax filings, it’s important to gather all the necessary tax documents for each year you haven’t submitted. We understand that this can feel overwhelming, but taking it step by step can make the process smoother. Here’s what you’ll need:

- W-2 Forms: Provided by your employer, these forms show your earnings and the taxes withheld. They’re essential for accurate filing.

- 1099 Forms: If you’re self-employed or received income from other sources, these forms are crucial for reporting your earnings.

- Bank Statements: These can help verify your income and expenses, providing a clearer picture of your financial situation.

- Previous Tax Returns: If you’ve filed in the past, these can serve as a helpful reference for your current filings.

- IRS Transcripts: If you’re missing any documents, don’t worry! You can request wage and income transcripts from the IRS to help reconstruct your financial history.

Tips for Gathering Documents:

- Create a folder for each tax year to keep your documents organized. This simple step can save you time and stress.

- If you’re missing any documents, reach out to your employer or financial institutions to request copies. They’re usually happy to help.

- Use the IRS's online tools to access your tax records if needed. It’s a great resource!

Having all your documents ready will not only streamline the filing process but also reduce the likelihood of errors. Remember, you’re not alone in this journey; we’re here to help!

File Your Unfiled Tax Returns

Navigating the process of filing your unfiled tax returns can feel overwhelming, but with unfiled tax return assistance Las Vegas, you’re not alone in this journey. Here are some essential steps to help you navigate the process with confidence:

-

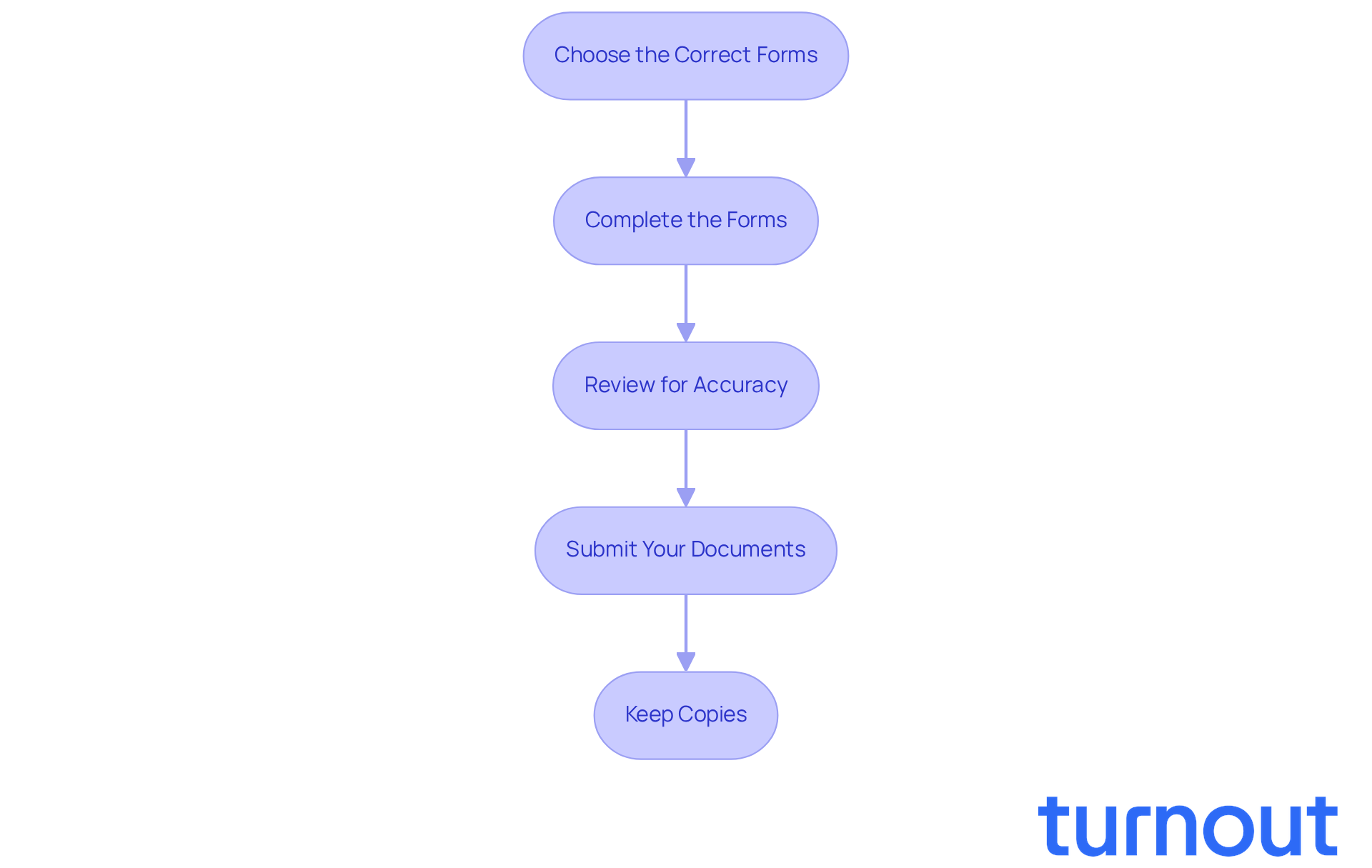

Choose the Correct Forms: Start by identifying the right tax forms for your situation. If you’re filing individual income tax, you’ll want to use Form 1040. It’s important to understand the specific filing requirements based on your income level and status. We understand that this can be confusing, but taking the time to get it right is crucial.

-

Complete the Forms: As you fill out the forms, use the information from your gathered documents, including all income sources and deductions. Remember, missing or incorrect information can lead to significant delays and consequences. As Denson Pepper, CPA, wisely notes, "Mistakes in your tax filing can lead to a variety of issues, including delays." Take a deep breath and double-check your entries.

-

Review for Accuracy: Carefully review all your entries. Mistakes can lead to complications, including extra penalties that accumulate at 5% of unpaid taxes for each month your submission is delayed, up to a maximum of 25%. This highlights just how important accuracy is in your filings. We’re here to provide you with unfiled tax return assistance Las Vegas to help you avoid those pitfalls.

-

Submit Your Documents: You have the option to file your documents electronically or by mail. If you choose to mail them, make sure you send them to the correct IRS address for your state. Filing electronically is often faster and can help expedite processing. Just a reminder: the IRS won’t discuss any payment plan until your last six years of tax filings are submitted.

-

Keep Copies: Don’t forget to retain copies of your submitted documents and any correspondence with the IRS. This documentation is vital for future reference and to confirm your compliance. Keeping organized records can ease your mind.

Additional Considerations:

- If you owe taxes, consider establishing a payment plan with the IRS to manage your debt effectively. Submitting your filings on time can greatly decrease fines and charges, which can build up monthly if not addressed. It’s common to feel overwhelmed, but unfiled tax return assistance Las Vegas often leads to more favorable treatment from the IRS, especially for those who voluntarily disclose their tax issues. The IRS has programs for tax relief that you can explore, offering additional options for managing your tax obligations. Remember, we’re here to help you every step of the way.

Address Tax Debt and Penalties

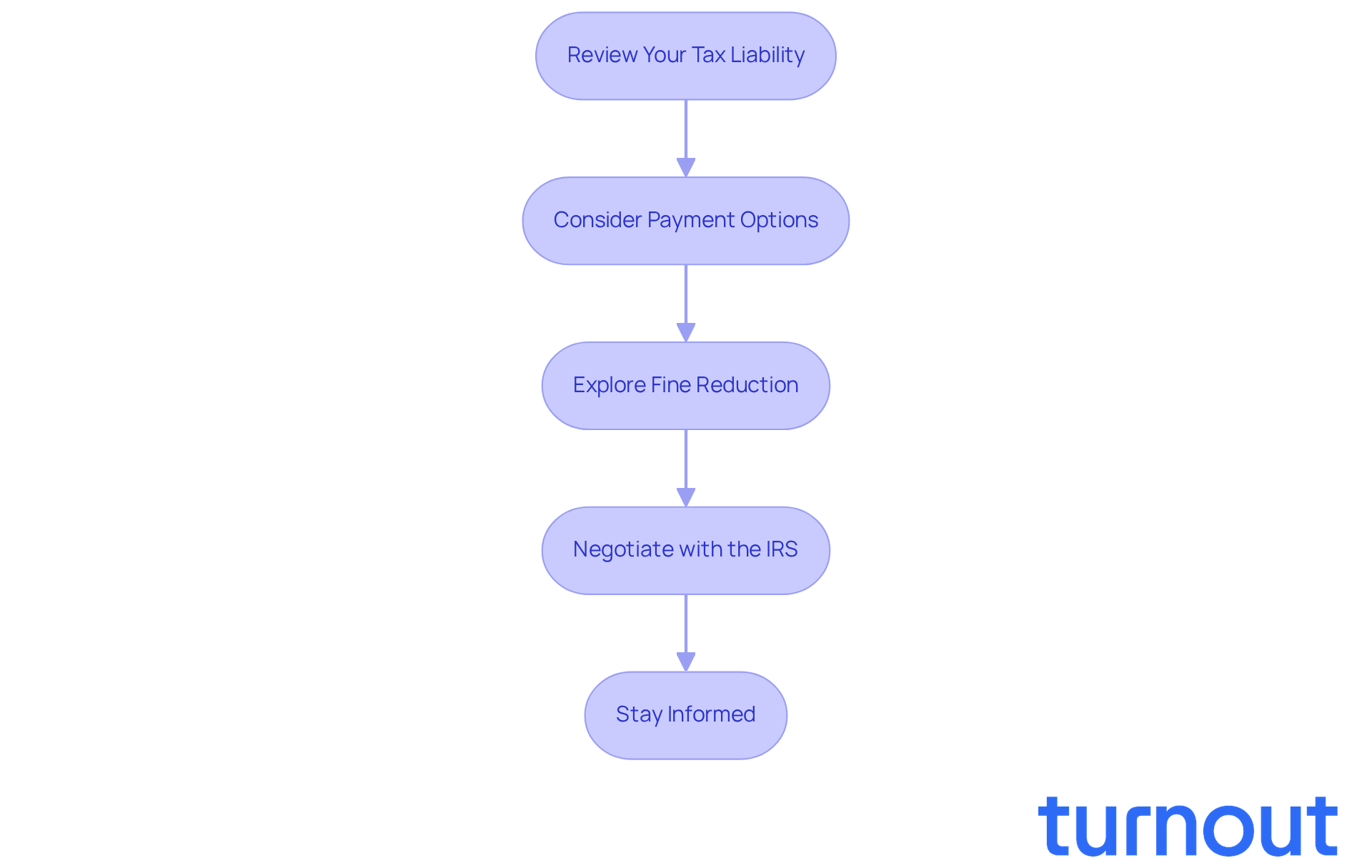

After submitting your financial filings, you might find yourself facing dues, fines, or interest. We understand that this can be overwhelming. Here’s how to navigate these challenges:

-

Review Your Tax Liability: Once you file, the IRS will process your returns and let you know if you owe anything. Take a moment to review this information carefully.

-

Consider Payment Options: If you owe taxes, you have choices. You can pay in full or set up a payment plan with the IRS. This can help you manage your debt over time, making it less daunting.

-

Explore Fine Reduction: If this is your first encounter with fines, you may qualify for a first-time fine reduction. This could reduce or even eliminate penalties for late filing, giving you some relief.

-

Negotiate with the IRS: If paying your tax debt feels impossible, consider negotiating an Offer in Compromise (OIC). This allows you to settle your tax debt for less than the full amount owed, which can be a lifeline.

-

Stay Informed: Keep track of your payments and any correspondence with the IRS. Staying organized can help you ensure compliance and avoid future issues.

Ignoring tax debt can lead to serious consequences, like wage garnishments and tax liens. If you’re unsure about your options or need help with negotiations regarding your tax situation, don’t hesitate to seek unfiled tax return assistance las vegas. Remember, you’re not alone in this journey; we’re here to help.

Seek Professional Assistance

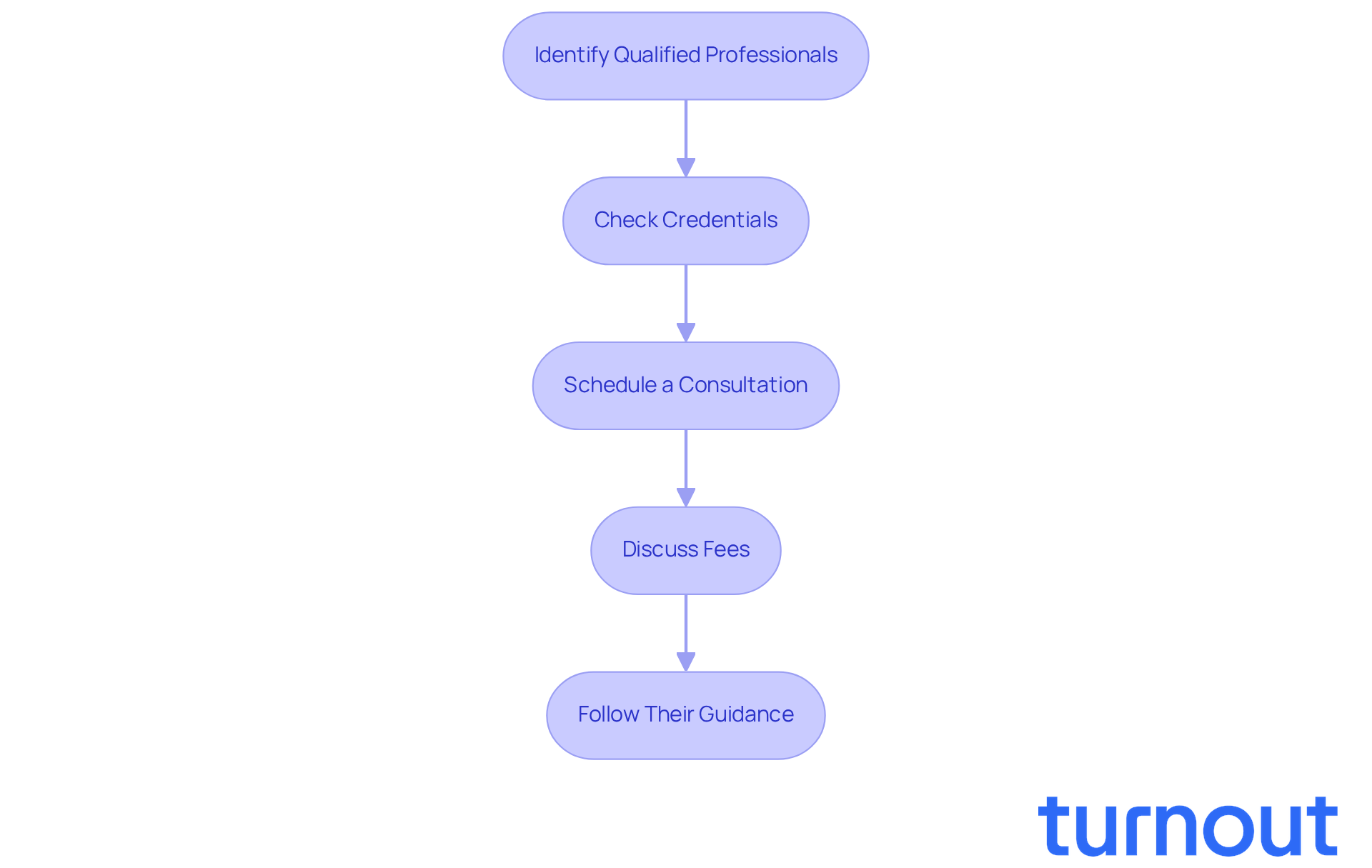

Navigating the process of unfiled tax return assistance Las Vegas and the associated tax debt can feel overwhelming. But remember, you’re not alone in this journey. Professional assistance, such as unfiled tax return assistance in Las Vegas, can make a world of difference. Here’s how to find the right help:

-

Identify Qualified Professionals: Look for tax professionals like Certified Public Accountants (CPAs), tax attorneys, or enrolled agents who specialize in tax resolution. Their expertise is essential for effectively managing IRS negotiations and ensuring unfiled tax return assistance Las Vegas.

-

Check Credentials: It’s important to verify that the professional has the right qualifications and a solid track record in offering unfiled tax return assistance Las Vegas. Reading reviews and testimonials can give you insight into their effectiveness in similar situations.

-

Schedule a Consultation: Many tax professionals offer free initial consultations. Take advantage of this opportunity to discuss your specific situation and see how they can provide unfiled tax return assistance Las Vegas to help you navigate your tax issues.

-

Discuss Fees: Be open about the fees associated with their services. Understanding the cost structure-whether it’s hourly rates, flat fees, or contingency arrangements-will help you make informed decisions. In 2026, average fees for tax professionals in tax resolution can vary significantly based on experience and the complexity of the case, so clarity is key.

-

Follow Their Guidance: Once you hire a professional, it’s crucial to adhere closely to their advice. Their expertise can greatly influence the outcome of your tax situation, particularly when seeking unfiled tax return assistance Las Vegas or negotiating with the IRS.

Resources for Finding Help:

- IRS Resources: The IRS maintains a list of Low Income Taxpayer Clinics (LITCs) that provide free or low-cost assistance to eligible individuals.

- Local Tax Assistance Programs: Many community organizations offer tax assistance programs, especially during tax season, which can be invaluable for those in need.

Conclusion

Navigating the complexities of unfiled tax returns can feel overwhelming, and we understand that. But remember, seeking assistance in Las Vegas can significantly ease the stress involved. Addressing unfiled tax returns is crucial - not just to avoid penalties and interest, but also to reclaim potential refunds and credits that may be owed to you. By taking proactive steps, you can reduce the risks associated with non-filing and work towards a resolution.

Key insights from this guide highlight the importance of:

- Gathering necessary documentation

- Accurately completing tax forms

- Addressing any outstanding tax debts

It’s common to feel anxious about the consequences of non-filing - legal repercussions, financial penalties, and impacts on credit can weigh heavily on your mind. This urgency underscores the need to take action. Seeking professional assistance can provide essential support in navigating the intricacies of tax resolution and negotiating with the IRS.

Ultimately, you don’t have to face the journey towards filing unfiled tax returns and managing tax debt alone. With the right resources and professional guidance, you can take control of your tax situation, ensuring compliance and paving the way for a more secure financial future. Taking the first step today can lead to significant long-term benefits. So, don’t hesitate - seek unfiled tax return assistance in Las Vegas without delay. We're here to help you every step of the way.

Frequently Asked Questions

What are unfiled tax returns?

Unfiled tax returns are federal income tax returns that have not been submitted by their due date, even if an extension has been requested.

What are the consequences of not filing tax returns?

The IRS can impose penalties of 5% of the unpaid tax for each month the return is late, up to a maximum of 25%. Additionally, there is a failure-to-pay charge of 0.5% per month. Ignoring tax filings can also lead to serious legal repercussions, including tax evasion charges, fines up to $250,000, and potential imprisonment for up to 5 years.

Is there a statute of limitations on unfiled tax returns?

No, there is no statute of limitations on unfiled tax returns, meaning the IRS can pursue individuals indefinitely until the returns are submitted.

What is voluntary disclosure regarding unfiled tax returns?

Voluntary disclosure is when an individual comes forward to submit their unfiled tax documents. This can potentially reduce penalties and avoid criminal charges, especially for tax years prior to 2019, allowing individuals to reclaim any owed refunds.

How can unfiled tax returns impact my credit?

Failing to file tax returns can lead to liens or levies, which can negatively affect your credit score, making it harder to secure loans or mortgages.

What documents do I need to gather for submitting unfiled tax returns?

You will need W-2 forms, 1099 forms, bank statements, previous tax returns, and IRS transcripts if any documents are missing.

How can I organize my tax documents?

Create a folder for each tax year to keep your documents organized, which can save time and reduce stress during the filing process.

What should I do if I'm missing tax documents?

Reach out to your employer or financial institutions to request copies of missing documents. You can also use the IRS's online tools to access your tax records if needed.