Introduction

Navigating the Maryland Comptroller's payment process can often feel like traversing a complex maze. We understand that for many, especially those unfamiliar with state tax obligations, this journey can be overwhelming. This guide is here to help demystify the steps involved, offering valuable insights into the Comptroller's role and the essential documentation needed for a smooth transaction.

It's common to feel uncertain about evolving procedures and the potential pitfalls that may arise. So, how can Maryland residents ensure they are fully equipped to tackle their payment responsibilities without unnecessary stress? We're here to support you every step of the way.

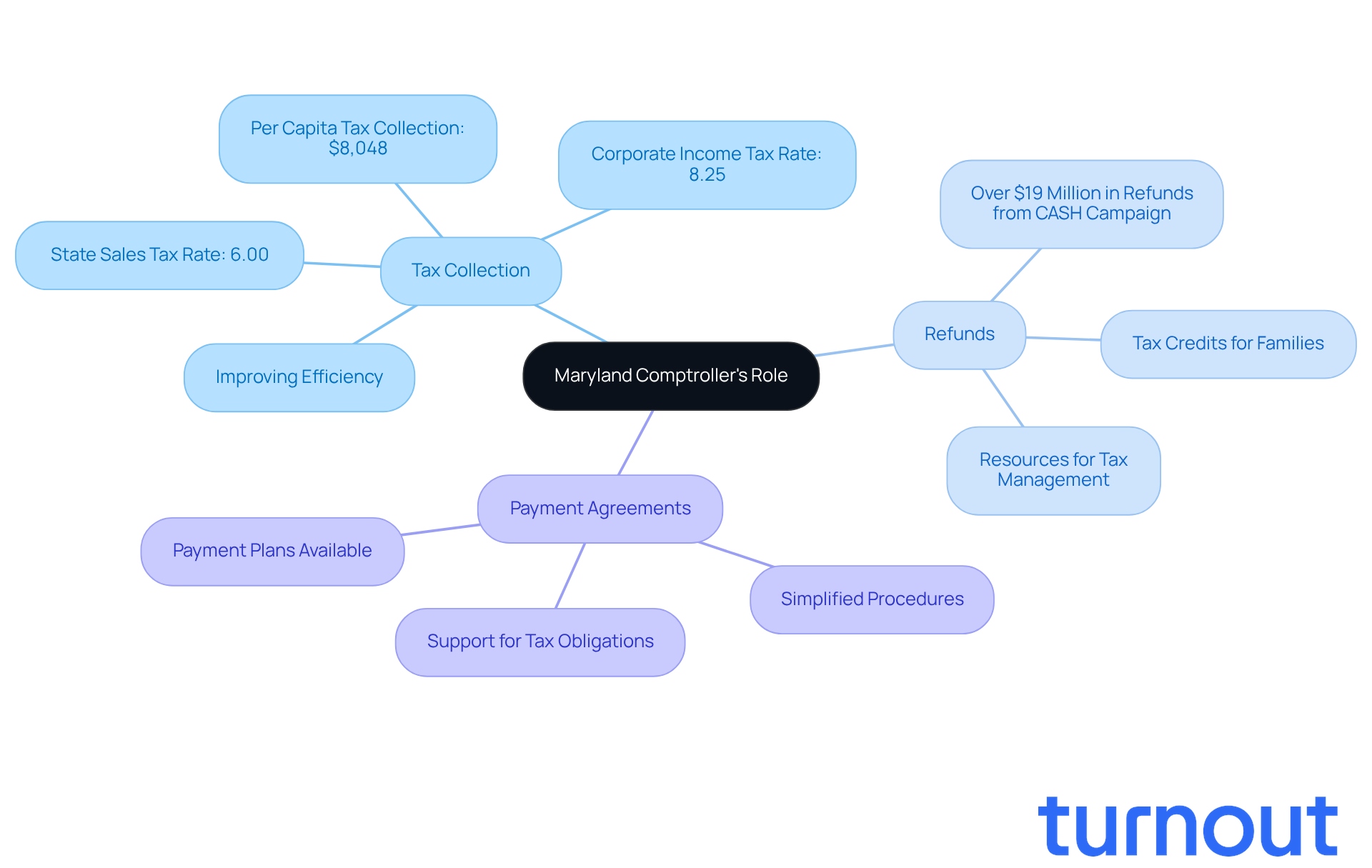

Understand the Maryland Comptroller's Role and Functions

The Maryland financial officer is more than just a title; they are the state's chief financial officer, dedicated to overseeing tax collection and managing state funds. This office plays a crucial role in enforcing tax laws and ensuring that our financial systems run smoothly. We understand that navigating the payment system can be overwhelming, but knowing the official's duties can illuminate the various services available to you, such as:

- Tax collection

- Refunds

- Payment agreements

In 2026, the financial oversight office is committed to improving tax collection efficiency. Maryland residents are benefiting from simplified procedures that make it easier to meet state tax obligations. It's heartening to note that the office has returned over $4.2 billion in unclaimed property to individuals nationwide, showcasing its dedication to effective financial management.

Additionally, the Comptroller offers valuable resources designed to help you manage your tax obligations. These tools make it easier for individuals to understand and fulfill their responsibilities. As Albert Einstein wisely pointed out, the complexities of income tax can be daunting. That's why having a knowledgeable financial officer to guide you through these challenges is so important. Remember, you are not alone in this journey; we're here to help.

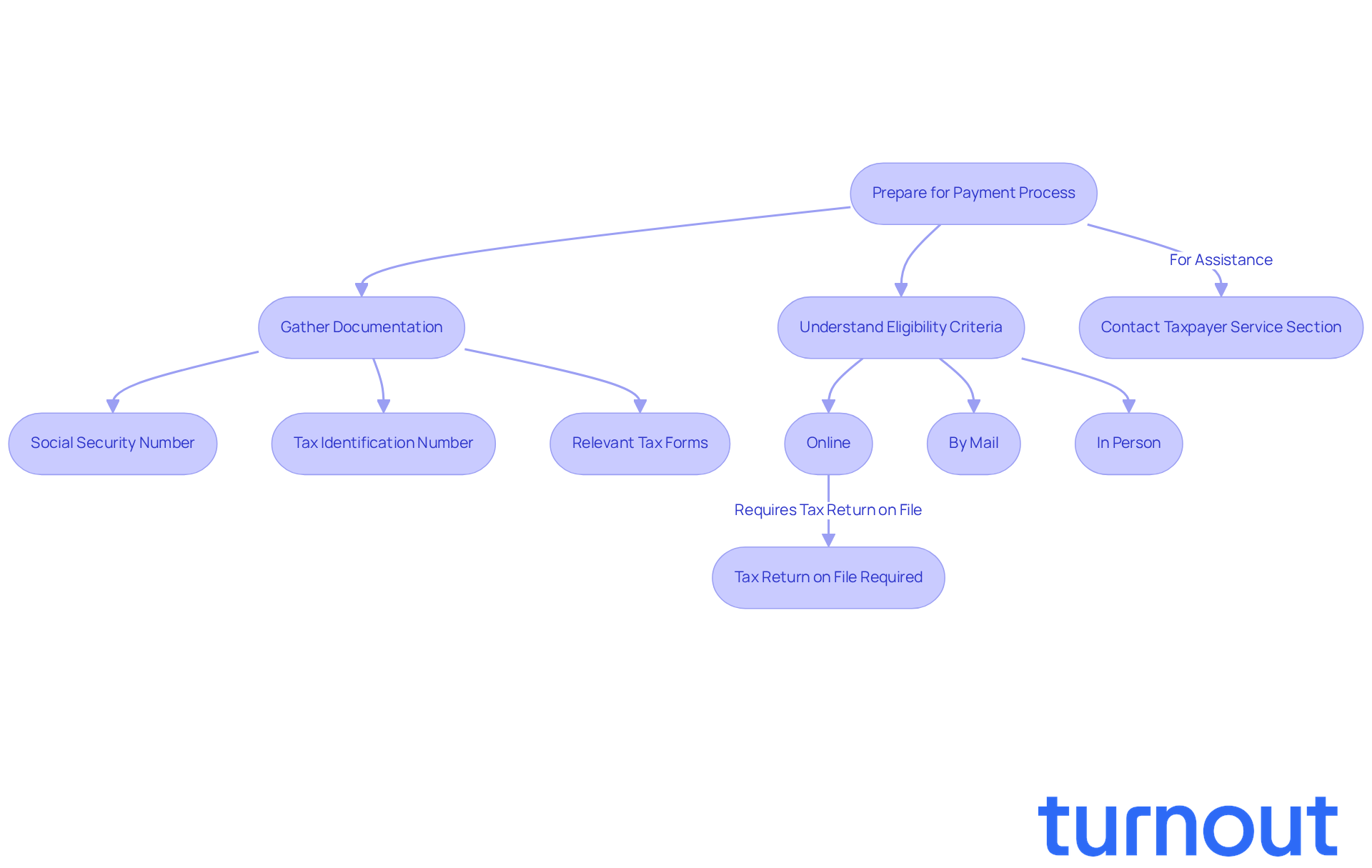

Prepare Required Documentation and Eligibility Criteria

Before you start the payment process, it’s essential to gather the necessary documentation. This usually includes your Social Security number, tax identification number, and any relevant tax forms. We understand that navigating these requirements can feel overwhelming, but knowing what you need can make a big difference.

Make sure you’re clear on the eligibility criteria for the method you plan to use - whether it’s online, by mail, or in person. For instance, if you’re opting for an online transaction, you’ll need to have a tax return on file to process your Maryland Comptroller payment. Tax experts emphasize that being well-prepared can significantly enhance your experience, helping you navigate the financial landscape with ease.

As one tax expert wisely noted, "Comprehending the specific documents needed for your transaction category will simplify the procedure and assist in preventing avoidable hold-ups." Remember, you’re not alone in this journey. If you need further assistance with your Maryland comptroller payment, don’t hesitate to reach out to the Taxpayer Service Section at 410-260-7980 or visit MarylandComptroller.gov/help for helpful online resources. We're here to help!

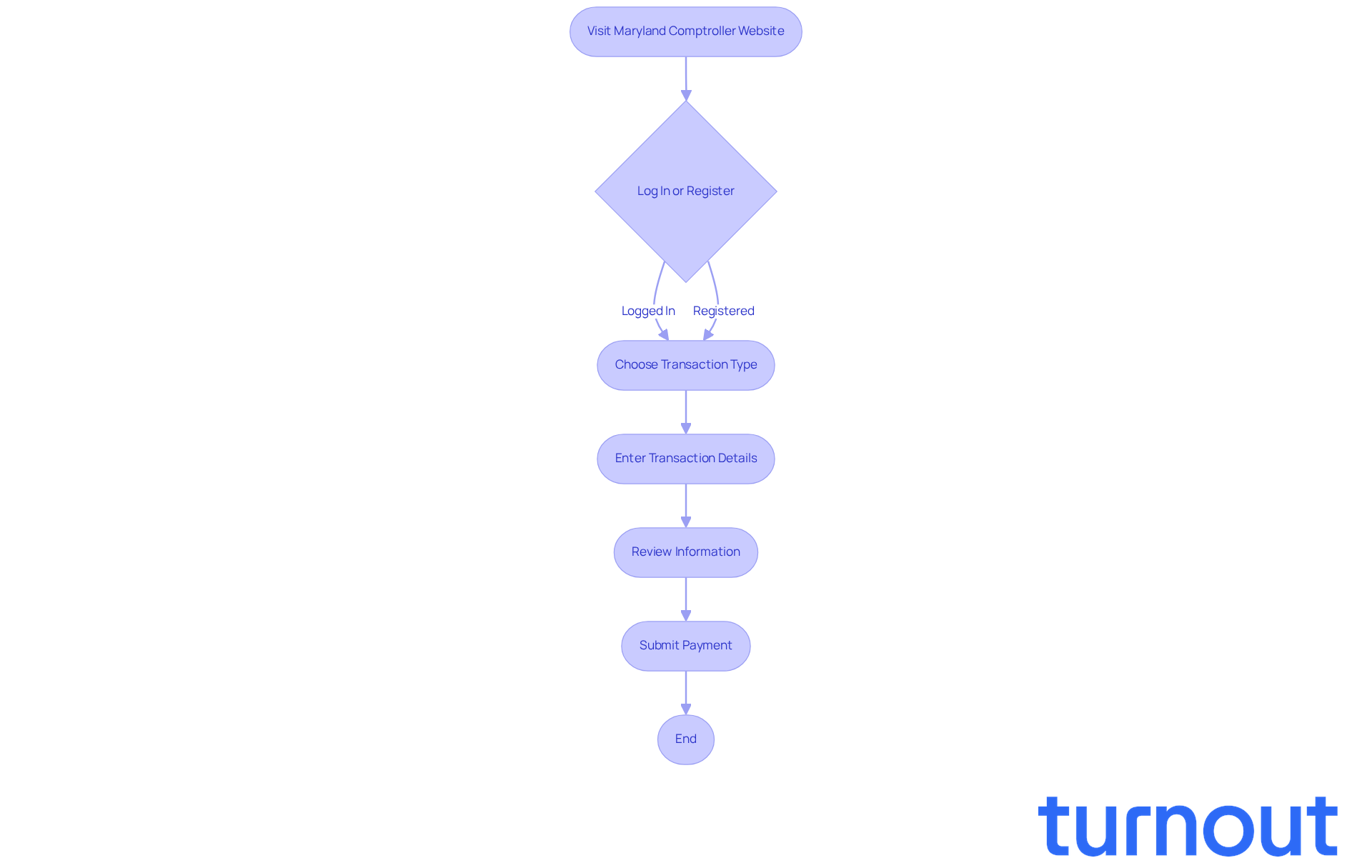

Initiate and Complete the Payment Process

Starting the transaction process can feel overwhelming, but we're here to help. To get started, visit the official website of the Maryland Comptroller payment and locate the section for transactions. If you already have an account, simply log in. If not, don’t worry-you’ll need to register first. During registration, you’ll be asked to provide essential information like your Social Security Number, name, and address. Once you’re registered or logged in, you can choose the type of transaction you wish to make, whether it’s income tax or estimated contributions.

Next, follow the prompts to enter your transaction details, including the amount and your preferred method of payment, either through a bank account or credit card. Just a heads up: credit card transactions come with a 2.45% service fee. After entering your information, take a moment to review it carefully. It’s common to feel anxious about making mistakes, so double-checking can help you avoid issues like incorrect amounts or methods that could lead to delays.

Once you provide your funds, a confirmation will be generated. It’s crucial to keep this confirmation for your records, as it may be needed for future reference. Did you know that the Maryland comptroller payment for taxes online has significantly increased? In 2025, about 70% of taxpayers opted for digital transactions. This shift not only simplifies the financial process but also enhances efficiency and accuracy in managing tax obligations.

Stay informed about Maryland Comptroller payment updates from the office. They’re continuously working to improve the online transaction experience for taxpayers in 2026, including introducing new features designed to make the process even easier. Remember, you’re not alone in this journey, and we’re here to support you every step of the way.

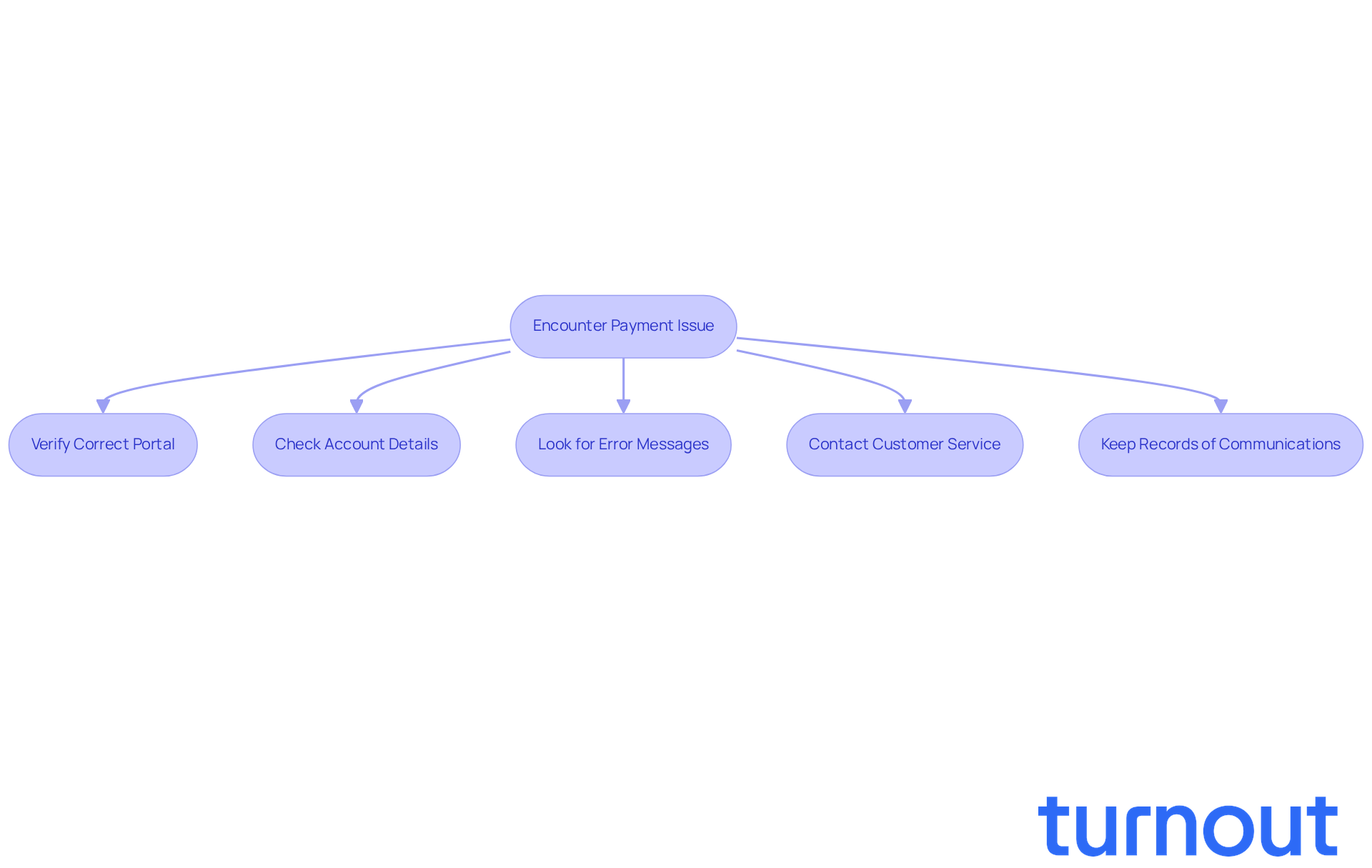

Troubleshoot Common Issues in Payment Processing

If you encounter issues during the transaction process, first verify that you are using the correct portal for your tax type. Frequent issues consist of inaccurate account details or transaction method errors. If your transaction does not go through, check for any error messages and follow the instructions provided. For persistent issues, contact the financial officer's customer service for assistance. They can assist you in resolving financial issues and ensure that your tax obligations are met. Additionally, keep records of any communications for future reference.

In 2025, the Maryland financial officer's customer service was recognized for its efficiency, with 93 percent of customers indicating satisfaction with their service experience. This high level of responsiveness greatly assisted many consumers in overcoming transaction challenges by quickly reaching out to customer service, which proved effective in addressing their concerns. By following these steps and utilizing available resources, such as the Maryland Comptroller's website, you can troubleshoot payment problems with confidence.

Conclusion

Navigating the Maryland Comptroller payment process can feel overwhelming at first. We understand that many residents may have concerns about fulfilling their tax obligations. However, by grasping the structure and functions of the Comptroller's office, you can simplify this journey. As the chief financial officer of the state, the Comptroller is dedicated to efficient financial management and tax collection, ensuring that you have the support you need.

To make this process easier, it’s crucial to prepare the necessary documentation and understand the eligibility criteria. Following a clear, step-by-step process can help you initiate and complete your payments smoothly. By being well-prepared and informed, you can avoid common pitfalls and take full advantage of the resources available to you. The shift towards digital transactions is a significant step toward efficiency, allowing you to manage your tax responsibilities with greater ease.

Ultimately, the Maryland Comptroller's office is here to support you every step of the way. Engaging with the available resources and staying updated can greatly enhance your payment experience. Remember, you are not alone in this journey. Embrace the tools and guidance provided to navigate the payment process confidently, ensuring that your tax obligations are met without unnecessary stress.

Frequently Asked Questions

What is the role of the Maryland Comptroller?

The Maryland Comptroller serves as the state's chief financial officer, overseeing tax collection and managing state funds, while enforcing tax laws to ensure smooth financial operations.

What services does the Maryland Comptroller's office provide?

The office provides services such as tax collection, refunds, and payment agreements to assist residents with their financial obligations.

What improvements are planned for tax collection in Maryland by 2026?

By 2026, the financial oversight office aims to enhance tax collection efficiency, making it easier for residents to meet their state tax obligations.

How much unclaimed property has the Maryland Comptroller's office returned to individuals?

The office has returned over $4.2 billion in unclaimed property to individuals nationwide, demonstrating its commitment to effective financial management.

What resources does the Maryland Comptroller offer to help individuals manage their tax obligations?

The Comptroller offers valuable resources and tools designed to help individuals understand and fulfill their tax responsibilities.