Introduction

Navigating the complexities of the Social Security system can feel overwhelming, especially for those seeking assistance in Greensboro, NC. We understand that this journey can be filled with uncertainty and questions. This guide is here to help you every step of the way, offering a clear, step-by-step approach to:

- Understanding your benefits

- Gathering the necessary documentation

- Submitting applications efficiently

But what happens when unexpected challenges arise? It’s common to feel frustrated or confused when things don’t go as planned. Don’t worry; we’re here to support you in troubleshooting these issues, ensuring you have a smooth experience as you navigate this important process.

Understand Social Security Benefits and Eligibility Criteria

Navigating the Greensboro NC social security office can feel overwhelming, but understanding the types of assistance available and the eligibility criteria can significantly improve your journey.

-

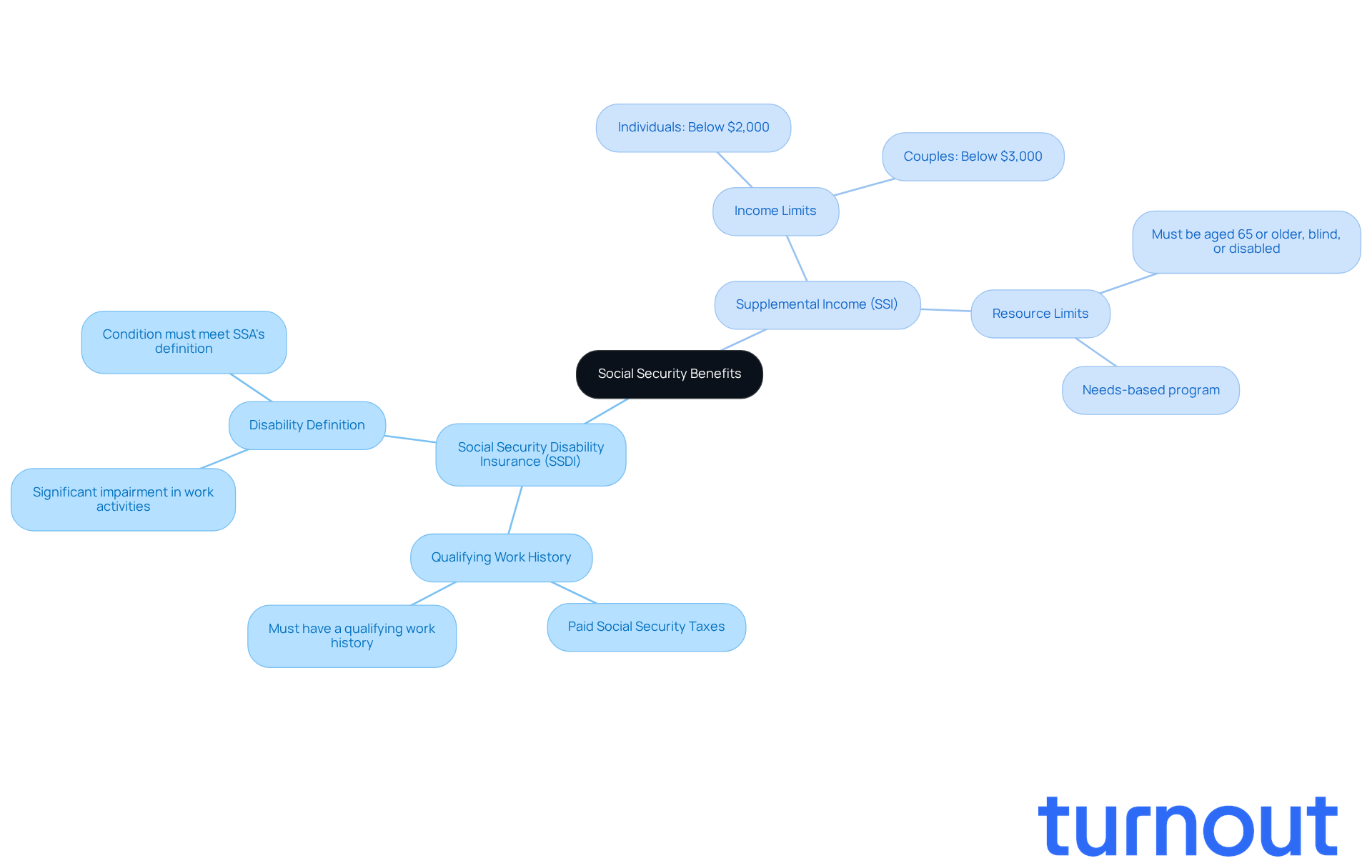

Types of Benefits: Let’s explore the two primary types of benefits that might be available to you:

- Social Security Disability Insurance (SSDI): This program is designed for individuals who have a qualifying work history and have paid Social Security taxes but can no longer work due to a disability. As of February 2026, around 10 million Americans are receiving SSDI benefits. This highlights how vital this support is for those in need.

- Supplemental Income (SSI): This needs-based program helps individuals with limited income and resources, regardless of their work history. To qualify for SSI, applicants must be aged 65 or older, blind, or disabled.

-

Eligibility Criteria: Each program has specific requirements that you should be aware of:

- For SSDI, you need a qualifying work history and must meet the Social Security Administration's (SSA) definition of disability. This means having a condition that significantly impairs your ability to perform basic work activities.

- For SSI, strict income and resource limits apply. In 2026, individuals must have resources below $2,000 for individuals or $3,000 for couples to qualify.

-

Resources: We encourage you to visit the Social Security Administration's website. It’s a valuable resource for checking your eligibility and learning more about the benefits available to you. The site offers extensive information, including updates on SSDI and SSI programs, ensuring you are well-informed as you navigate your application process. Remember, you are not alone in this journey; we’re here to help guide you every step of the way.

Gather Required Documentation for Your Application

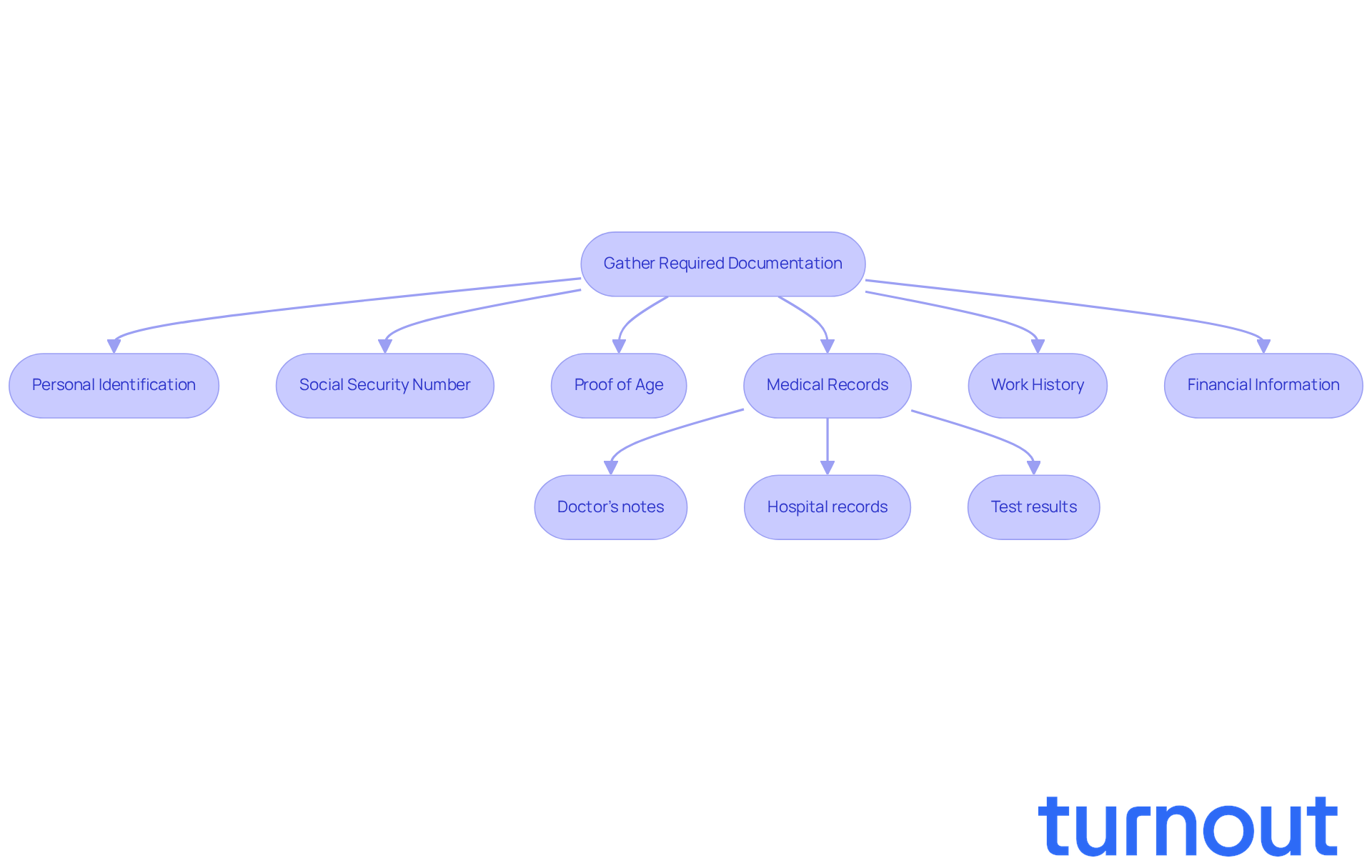

Before you head to the Greensboro NC Social Security Office, it’s important to have all your required documentation ready. We understand that this process can feel overwhelming, so here’s a helpful checklist to guide you:

- Personal Identification: Make sure to bring a government-issued photo ID, like your driver’s license or passport.

- Social Security Number: Have your Social Security card or a document that includes your SSN handy.

- Proof of Age: You’ll need a birth certificate or other legal documents that verify your age. If you don’t have a birth certificate, don’t worry! You can apply for SSDI by providing alternative documentation, such as a certified copy of your birth certificate or a U.S. passport.

- Medical Records: Gather detailed medical documentation that supports your disability claim. This includes:

- Doctor’s notes

- Hospital records

- Test results

- Work History: Prepare a list of your jobs from the past 15 years, including employer names, addresses, and dates of employment.

- Financial Information: If you’re applying for SSI, collect information about your income and resources, such as bank statements and tax returns.

Arranging these documents is crucial. Missing information can lead to significant delays in your submission. In fact, statistics show that incomplete submissions can extend processing times by weeks or even months. This highlights just how important thorough preparation is. Successful cases often emphasize the role of well-organized documentation in speeding up approvals.

Remember, you’re not alone in this journey. Turnout's trained nonlawyer advocates are here to help you prepare the right documentation for your SSD claims. We’re committed to ensuring you have the support you need to navigate this complex process. So, please follow this checklist closely and aim to apply at least three months before you want your payments to start.

Submit Your Application at the Greensboro NC Social Security Office

Once you’ve gathered all the necessary documentation, it’s time to submit your application at the Greensboro NC Social Security Office. We understand that this process can feel overwhelming, but following these steps can help you navigate it with ease:

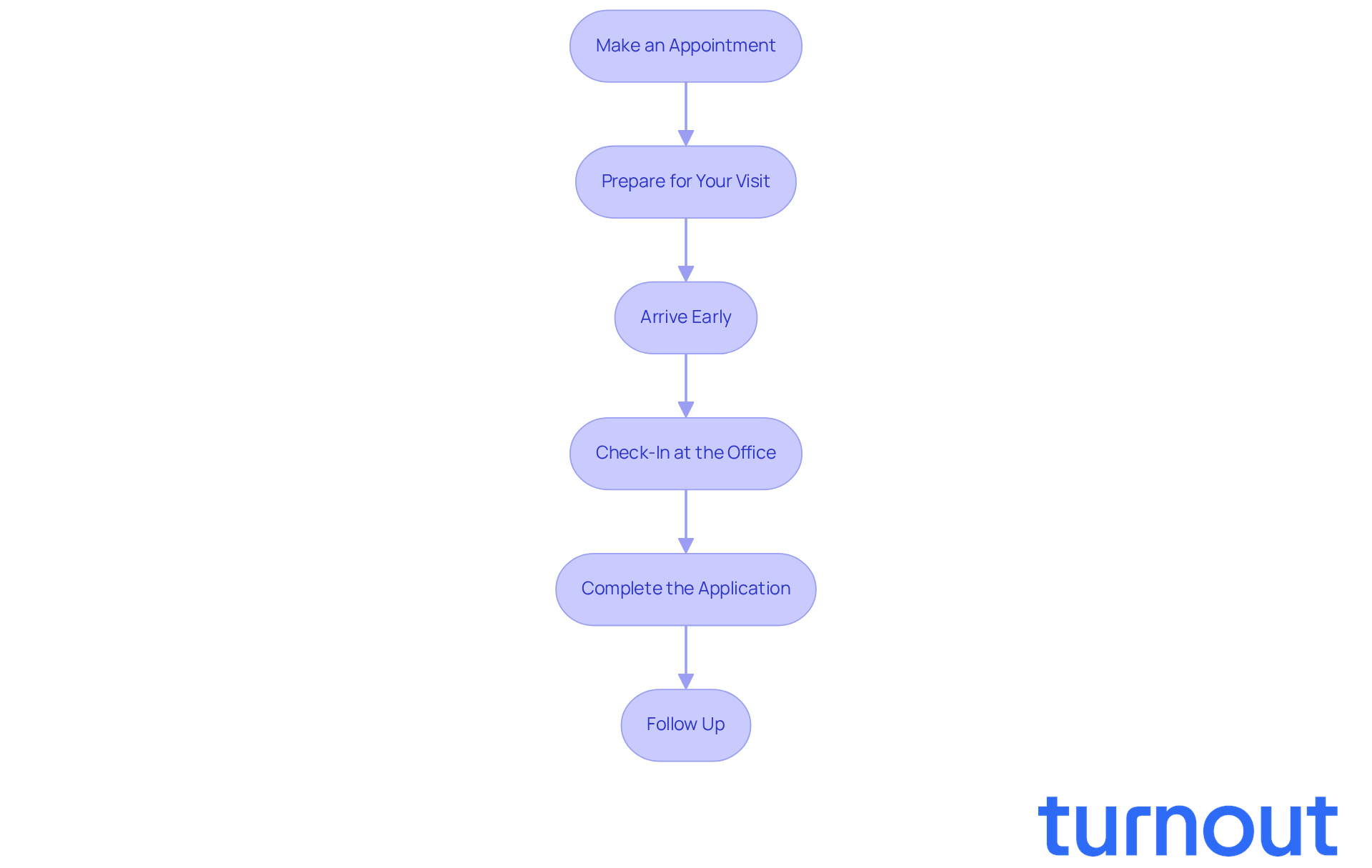

- Make an Appointment: To minimize wait times, call the Social Security Administration at 1-800-772-1213 to schedule your appointment. Starting March 7, 2026, you’ll be able to self-schedule your appointment online through the new National Appointment Scheduling Center, making things even simpler.

- Prepare for Your Visit: On the day of your appointment, ensure all your documents are organized and ready to present. This preparation is crucial, as it can significantly impact how smoothly your submission goes.

- Arrive Early: Plan to arrive at least 15 minutes before your scheduled appointment. This extra time allows for check-in and any unexpected delays, helping you feel more at ease.

- Check-In at the Office: When you arrive at the Greensboro office, located at 6005 Landmark Center Blvd, check in with the receptionist. They’re there to guide you through the next steps of the process, so don’t hesitate to ask questions.

- Complete the Application: You may need to fill out additional forms during your visit. Make sure to provide accurate information, and remember, it’s perfectly okay to ask for help if you need it.

- Follow Up: After submitting your request, keep track of any follow-up appointments or inquiries from the SSA. Staying proactive can help ensure your request is processed smoothly.

These steps are designed to assist you in navigating the submission process efficiently, especially with the upcoming changes in appointment scheduling and protocols in 2026. Remember, you’re not alone in this journey, and we’re here to help.

Troubleshoot Common Issues During the Application Process

Even with careful preparation, we understand that applicants may face challenges during the Social Security enrollment process. Here are some common issues and effective troubleshooting strategies to help you navigate this journey:

-

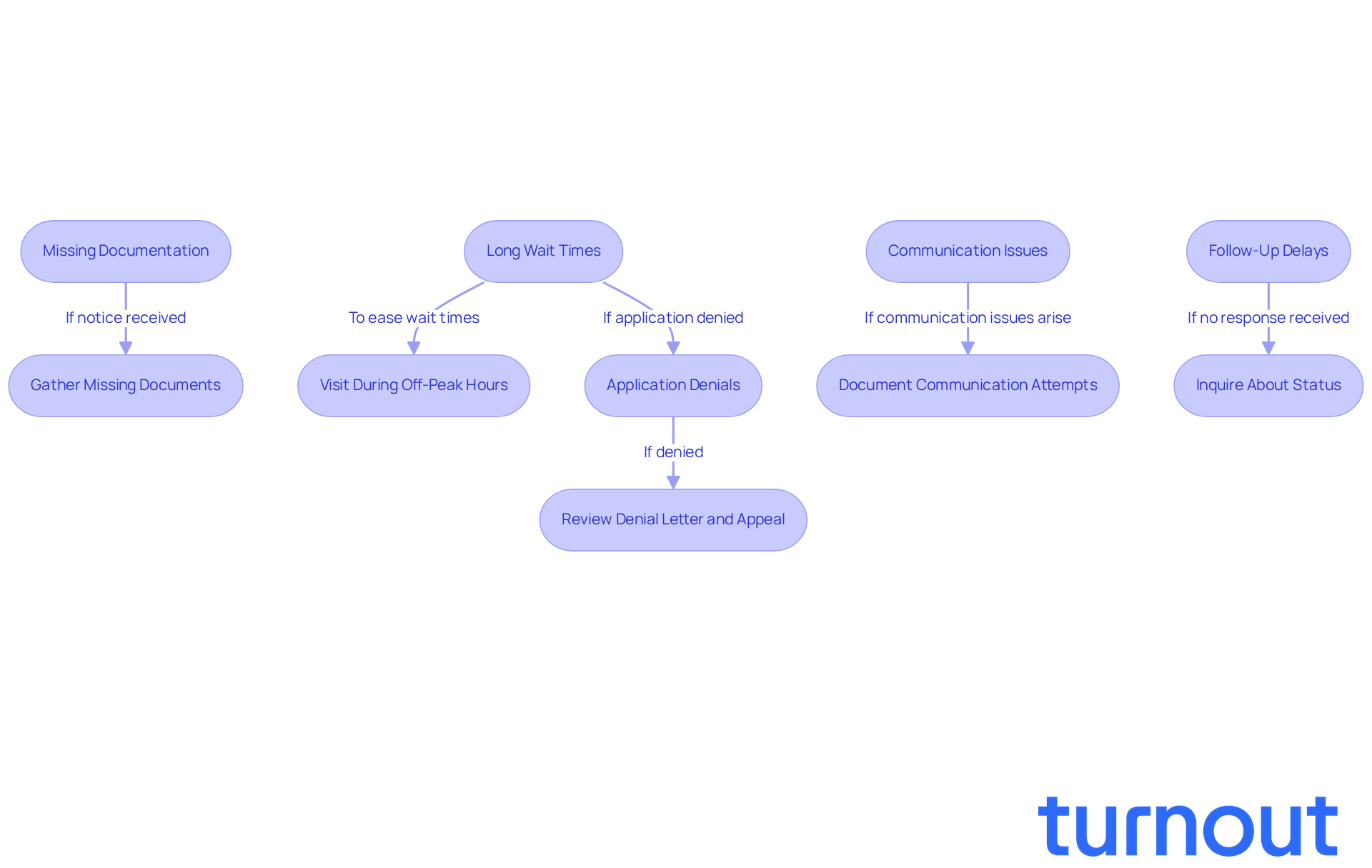

Missing Documentation: If you receive a notice indicating that your submission is incomplete, take a moment to review the checklist provided and gather any missing documents. It’s crucial to include detailed work history and explanations of functional limitations, as these are essential for approval. If you’re unsure about specific requirements, don’t hesitate to contact the SSA for clarification. We’re here to help you submit the correct information.

-

Long Wait Times: Experiencing long wait times at the office can be frustrating. To ease this, consider visiting during off-peak hours, typically mid-week or mid-month. Additionally, check if you can complete your application online or via phone to save time. Remember, disability claims currently take 12-18 months to complete, so patience is key.

-

Application Denials: A denial can feel disheartening, but it’s important to stay proactive. Carefully review the denial letter to understand the reasons behind the decision. You have the right to appeal; follow the instructions in the letter to begin this process. Appeal hearings have significantly higher approval rates, with the national average being 54%. Pursuing this option can enhance your chances of success. Turnout can assist you in navigating this procedure, utilizing trained nonlawyer advocates to help you understand your options and IRS-licensed enrolled agents for financial assistance.

-

Communication Issues: If you’re having trouble reaching the SSA by phone, try calling during non-peak hours or utilize their online services for inquiries. Document all your communication attempts, including dates and times, to maintain a record of your efforts. This can be helpful in case you need to follow up.

-

Follow-Up Delays: If you haven’t received a response within the expected timeframe, don’t hesitate to reach out to the SSA to inquire about the status of your request. Keeping a record of your reference number and any communication will make this process smoother and help you stay updated.

By preparing for these common issues and leveraging the support of Turnout's expert guidance, including trained nonlawyer advocates and IRS-licensed enrolled agents, you can navigate the application process more effectively. Remember, you are not alone in this journey, and we’re here to support you every step of the way.

Conclusion

Navigating the Greensboro NC Social Security Office can feel overwhelming, but with the right knowledge and preparation, it doesn’t have to be. We understand that understanding the types of benefits available, like SSDI and SSI, along with their eligibility criteria, is crucial for ensuring you receive the support you need. By gathering the necessary documentation and following a structured application process, you can significantly improve your chances of a successful outcome.

Key insights include the importance of thorough preparation. From understanding the benefits to organizing required documents, each step - from making an appointment to submitting your application - plays a vital role in ensuring a smooth experience. It’s common to feel uncertain, but being aware of potential issues and having strategies in place can help streamline the process. Utilizing resources like the Social Security Administration's website and support from trained advocates can provide invaluable assistance.

Ultimately, the journey to securing Social Security benefits is critical and can profoundly impact your life. Taking proactive steps, staying informed, and seeking help when needed can empower you to navigate this complex system effectively. Remember, perseverance and thoroughness in this process are essential; every effort you make today contributes to a more secure tomorrow. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are the two primary types of Social Security benefits available?

The two primary types of Social Security benefits are Social Security Disability Insurance (SSDI) and Supplemental Income (SSI).

Who qualifies for Social Security Disability Insurance (SSDI)?

SSDI is designed for individuals who have a qualifying work history, have paid Social Security taxes, and can no longer work due to a disability.

How many Americans are receiving SSDI benefits as of February 2026?

As of February 2026, around 10 million Americans are receiving SSDI benefits.

What is Supplemental Income (SSI) and who is eligible for it?

SSI is a needs-based program that helps individuals with limited income and resources. To qualify, applicants must be aged 65 or older, blind, or disabled, regardless of their work history.

What are the eligibility criteria for SSDI?

To qualify for SSDI, you need a qualifying work history and must meet the Social Security Administration's (SSA) definition of disability, which means having a condition that significantly impairs your ability to perform basic work activities.

What are the resource limits for qualifying for SSI in 2026?

In 2026, individuals must have resources below $2,000 for individuals or $3,000 for couples to qualify for SSI.

Where can I find more information about Social Security benefits and eligibility?

You can visit the Social Security Administration's website, which offers extensive information about checking your eligibility and learning more about SSDI and SSI programs.