Overview

Navigating taxes while living in one state and working in another can be overwhelming. We understand that figuring out residency status, tax incentives, and filing requirements is crucial to avoid double taxation.

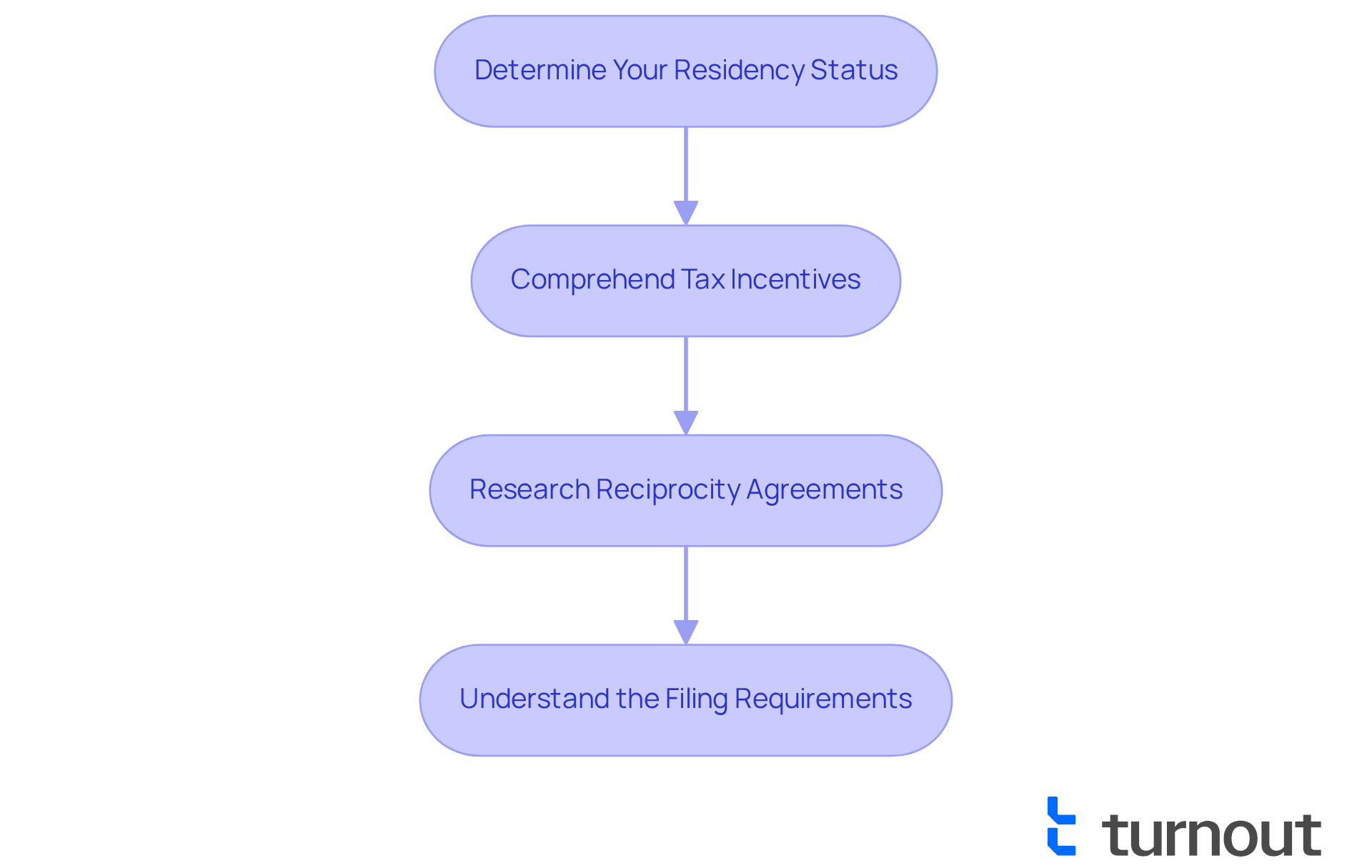

To help you through this journey, we outline essential steps to ease your concerns:

- Start by gathering your documents and determining your filing status.

- Completing tax returns for both locations is vital, and it’s common to feel uncertain about the process.

- Consulting a tax professional can provide you with the guidance you need to ensure compliance and reduce the complexities involved in multi-state taxation.

Remember, you are not alone in this journey; we’re here to help.

Introduction

Navigating the complexities of state taxes can be daunting, especially for those who live in one state and work in another. We understand that this situation often leads to confusion over residency definitions, tax credits, and filing requirements, leaving many feeling overwhelmed.

Understanding the intricacies of multi-state taxation is crucial. It not only helps in avoiding double taxation but also empowers you to make informed decisions. It's common to feel stressed when different states impose conflicting tax laws. How can you effectively manage your obligations to ensure compliance and minimize stress?

You're not alone in this journey. We're here to help you navigate these challenges with confidence.

Understand Your Tax Obligations Across State Lines

Navigating tax regulations can feel overwhelming, especially when living in one state and working in another. We understand that this situation can lead to confusion and stress, but we're here to help. Here are some key points to consider:

-

Determine Your Residency Status: Every region has its own way of defining residency. Generally, if you spend more than half the year in a region, you may be regarded as a resident there. It's essential to understand where you stand.

-

Comprehend Tax Incentives: Many regions offer credits for taxes paid to different jurisdictions, which can help you avoid double taxation. Check if your home region provides a credit for payments made to your workplace. This could be a relief for you.

-

Research Reciprocity Agreements: Some regions have agreements that allow residents to pay taxes only in their home region, even if they work across borders. Familiarizing yourself with these agreements can significantly simplify your tax obligations.

-

Understand the Filing Requirements: Each region has different filing requirements for residents and non-residents. Make sure you know which forms you need to submit in both regions. This knowledge can empower you to take control of your situation.

Follow the Steps to File Taxes in Two States

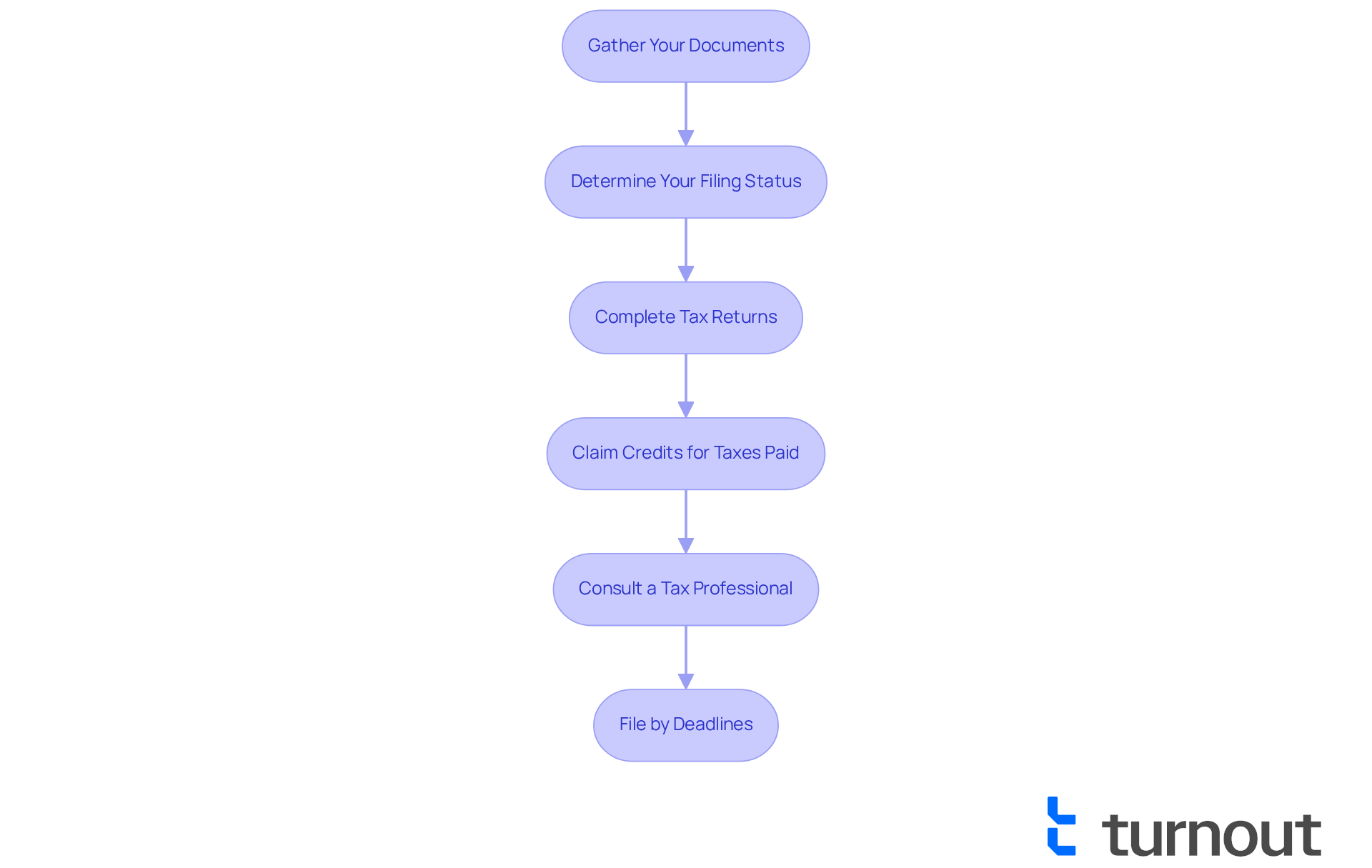

Filing taxes can feel overwhelming when living in one state and working in another, but it doesn’t have to be. By following these supportive steps, you can navigate this process with confidence:

-

Gather Your Documents: Start by compiling all the necessary documents, including W-2s, 1099s, and any other earnings statements from both regions. Don’t forget to include documentation of any extra income sources, like freelance projects or rental properties. We understand that organizing these can be a challenge, but taking this first step is crucial.

-

Determine Your Filing Status: Next, think about whether you will file as a resident in your home location and a non-resident in your work location, or if you qualify for part-year residency in either area. Understanding your residency status is important, particularly when living in one state and working in another, as it dictates your tax obligations. Remember, many regions apply a physical presence test, meaning you need to spend 183 days or more in the area to establish residency.

-

Complete Tax Returns for Your Location: Begin with the area where you live. Complete the resident tax return, disclosing all your earnings. After that, finalize the non-resident return for the region where you work, documenting only the income generated there. Each region has unique forms and requirements, so it’s essential to be mindful of these differences.

-

Claim Credits for Taxes Paid: If your home jurisdiction allows it, remember to claim a credit for taxes paid to your work location on your resident return. This can help you avoid double taxation, which many find burdensome. Knowing the regulations in both areas can ease the strain of living in one state and working in another, which can result in being taxed in two places.

-

Consult a Tax Professional: Given the complexities of multi-state taxation, consider reaching out to a tax professional who specializes in this area. They can offer personalized guidance and help ensure you comply with all regulations. You are not alone in this journey, and expert assistance can make a significant difference.

-

File by Deadlines: Lastly, make sure to submit both local returns by their respective deadlines to avoid penalties. Keep track of any extensions you may need to request. Consulting with a tax professional can also help you stay compliant.

We’re here to help you through this process, and we hope these steps provide clarity and support as you navigate your multi-state tax obligations.

Avoid Common Mistakes When Filing State Taxes

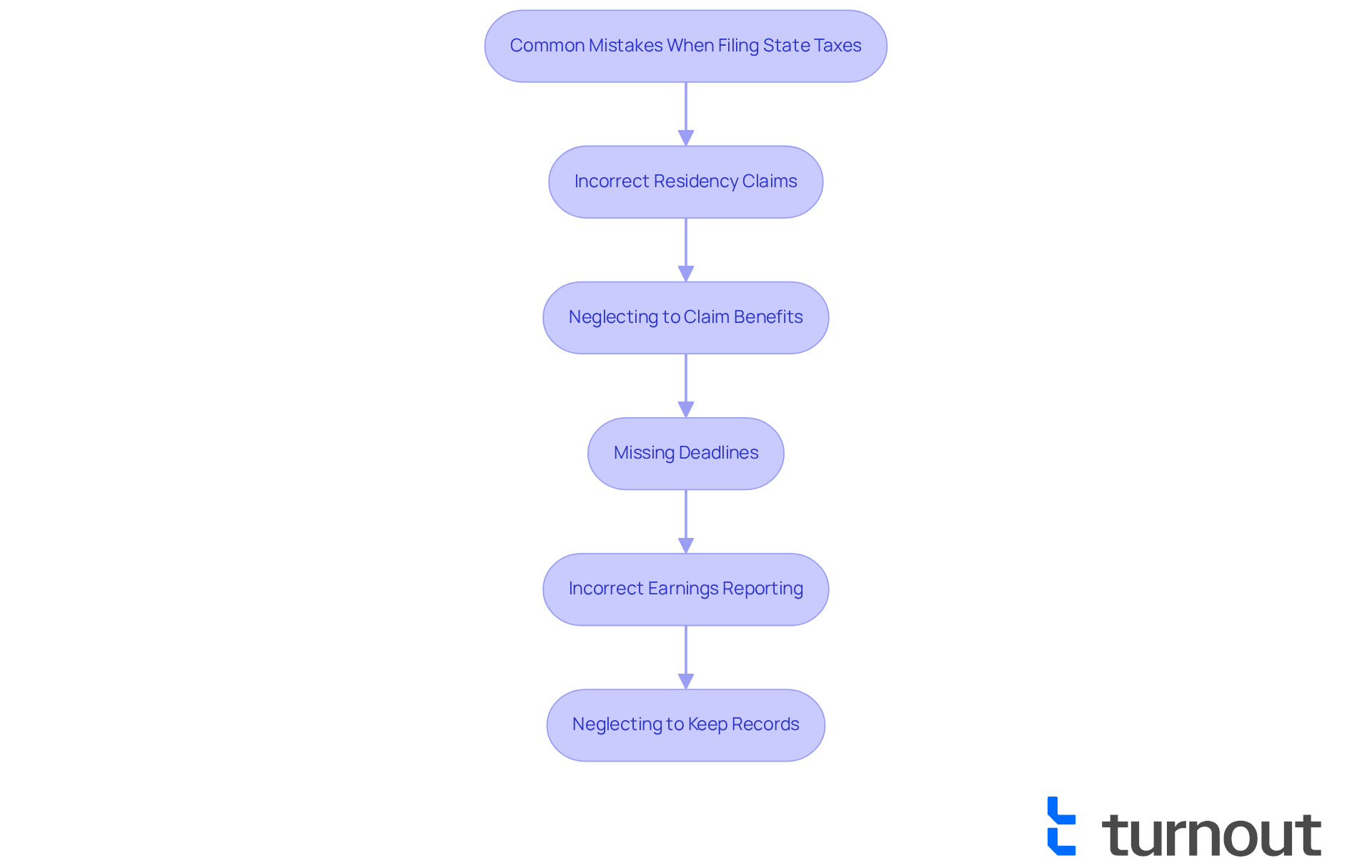

To ensure a smooth tax filing experience, it’s important to be mindful of some common mistakes that many people encounter:

-

Incorrect Residency Claims: We understand that misunderstanding your residency status can lead to significant filing errors. To prevent complications, it’s essential to verify the residency regulations for both regions, particularly for those living in one state and working in another.

-

Neglecting to claim benefits is common for taxpayers living in one state and working in another, as they often overlook credits for payments made to another jurisdiction. Be sure to claim these credits to effectively reduce your overall tax liability.

-

Missing Deadlines: Keeping track of filing due dates for both regions can be overwhelming. As Kemberley Washington, a CPA, observes, 'April 15 is the deadline to submit your taxes, unless you are living in one state and working in another, in which case the IRS permits individuals to request an extension due to natural disasters.' Missing these deadlines can lead to penalties and accruing interest, adding to your financial burden.

-

Incorrect Earnings Reporting: It’s crucial to precisely disclose all earnings acquired when living in one state and working in another. Neglecting to report earnings can lead to audits or penalties, complicating your tax situation. Remember, the error rate for e-filed returns is less than 1%, compared to 21% for paper returns, so consider filing electronically to minimize mistakes.

-

Neglecting to Keep Records: Maintaining thorough records of your earnings and tax documents is essential. This practice is invaluable if you need to amend your return or respond to inquiries from tax authorities. Many individuals forget essential tax forms, particularly 1099 forms for reporting various income types and W2 forms for reporting wages from multiple jobs.

By being vigilant about these common pitfalls, you can navigate the complexities of state tax obligations more effectively. Remember, you are not alone in this journey; we’re here to help you avoid unnecessary complications.

Conclusion

Navigating the complexities of living in one state while working in another can feel overwhelming. We understand that this situation presents unique tax challenges that require careful consideration and understanding. It’s essential to grasp your residency status, recognize tax incentives, and be aware of any reciprocity agreements that may ease your financial obligations. By taking these steps, you can effectively manage your tax responsibilities and minimize the stress associated with multi-state taxation.

Key insights to consider include:

- Gathering necessary documents

- Understanding filing requirements

- Claiming credits for taxes paid to avoid double taxation

Consulting a tax professional can provide personalized guidance, ensuring compliance with local regulations and helping to avoid common pitfalls such as incorrect residency claims and missed deadlines. Remember, you are not alone in this journey; being proactive and informed can help you navigate the intricacies of state taxes with confidence.

Ultimately, understanding the tax implications of living in one state and working in another is crucial for your financial well-being. By following the outlined steps and remaining vigilant against common mistakes, you can take control of your tax situation. Embracing these practices not only simplifies the filing process but also empowers you to make informed decisions about your financial future. We’re here to help you every step of the way.

Frequently Asked Questions

What should I determine regarding my residency status?

You should determine where you are considered a resident, as each region defines residency differently. Generally, if you spend more than half the year in a region, you may be regarded as a resident there.

How can tax incentives help me?

Many regions offer credits for taxes paid to different jurisdictions, which can help you avoid double taxation. It's important to check if your home region provides a credit for taxes paid to your workplace.

What are reciprocity agreements?

Reciprocity agreements are arrangements between some regions that allow residents to pay taxes only in their home region, even if they work in another region. Familiarizing yourself with these agreements can simplify your tax obligations.

Why is it important to understand filing requirements?

Each region has different filing requirements for residents and non-residents. Knowing which forms you need to submit in both regions can empower you to manage your tax situation effectively.