Introduction

Navigating the complexities of tax resolution can feel overwhelming, especially in a vibrant city like Las Vegas, where financial stakes are often high. We understand that facing tax debts or disputes can be stressful and confusing. It’s crucial to grasp the intricacies of tax liabilities and the resolution options available to you.

How can you effectively tackle these challenges and secure your financial future amidst the pressures of potential penalties and collection actions? This guide is here to help. We’ll explore essential steps and strategies for successfully navigating tax resolution in Las Vegas, empowering you to take control of your financial situation. Remember, you are not alone in this journey.

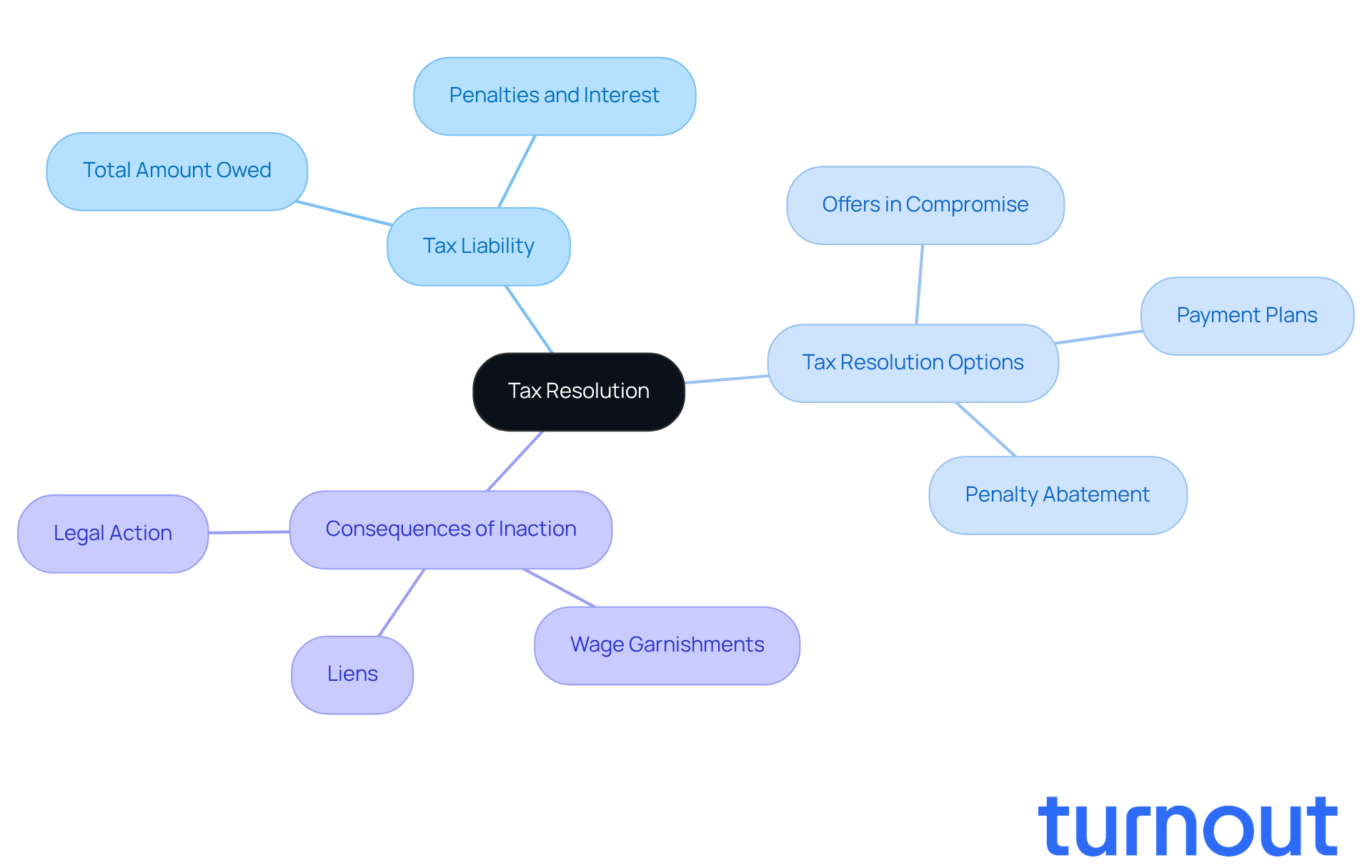

Understand Tax Resolution: Key Concepts and Importance

Tax settlement is a form of tax resolution in Las Vegas that focuses on addressing and resolving tax debts or disputes with the IRS or state tax authorities. We understand that navigating this process can be overwhelming, especially when it impacts your financial well-being and peace of mind. Let’s explore some key concepts together:

- Tax Liability: This is the total amount of tax you owe to the government. If not addressed promptly, it can lead to penalties and interest that only add to your stress.

- Tax Resolution Las Vegas Options: Various strategies are available to help you, including payment plans, offers in compromise, and penalty abatement. Knowing your options can empower you to take control of your situation.

- Consequences of Inaction: Ignoring tax issues can lead to serious consequences, including wage garnishments, liens, and even legal action. It’s common to feel anxious about these possibilities, but you don’t have to face them alone.

Recognizing the importance of tax resolution Las Vegas allows you to take proactive steps toward financial stability. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and avoid the pitfalls of unresolved tax problems.

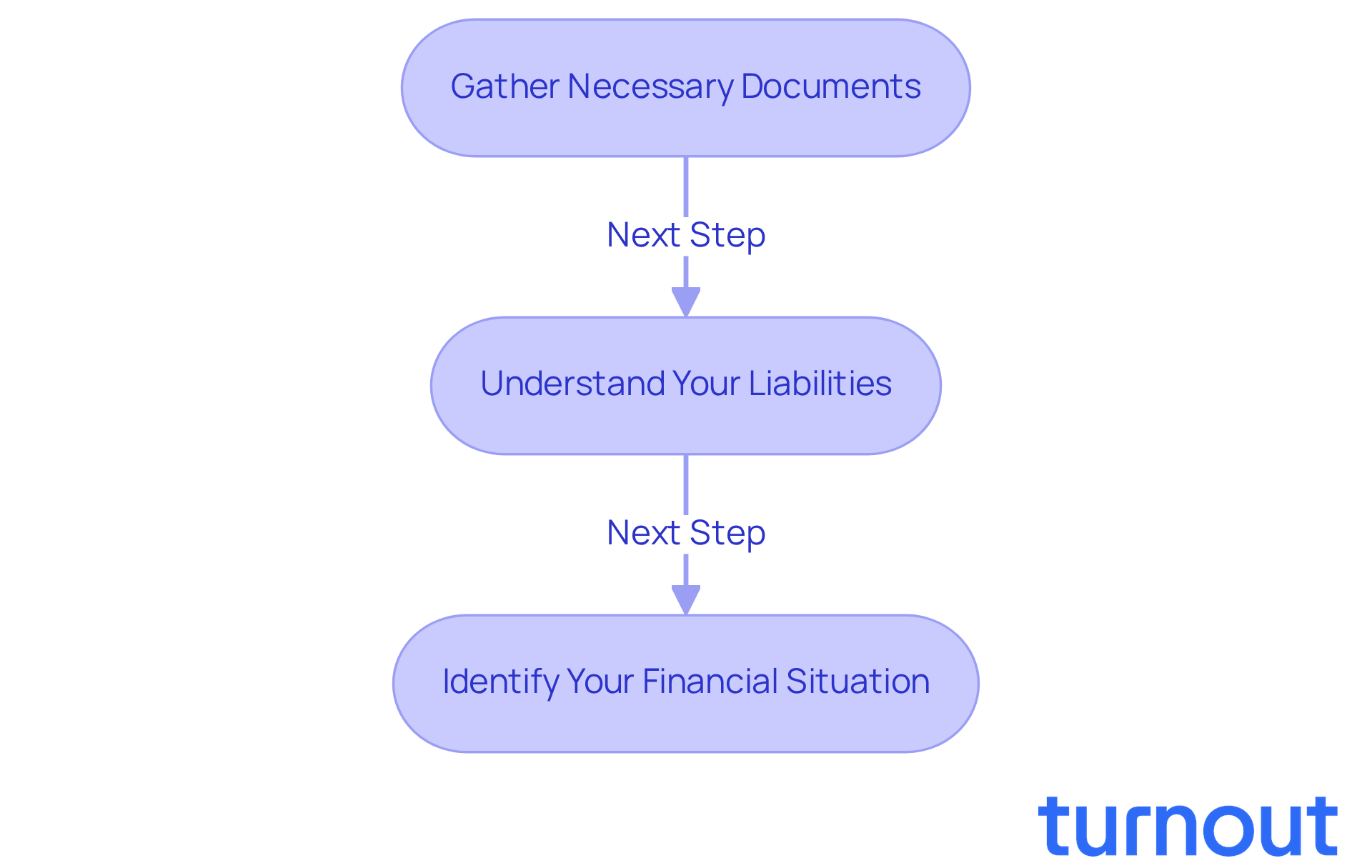

Assess Your Tax Situation: Gather Documents and Understand Liabilities

Navigating tax resolution in Las Vegas can feel overwhelming, but you’re not alone in this journey. Let’s take it step by step to ensure you find the best path forward.

- Gather Necessary Documents: Start by collecting all relevant tax documents. This includes:

- Recent tax returns

- IRS notices or letters

- Bank statements

- Pay stubs or income statements

- Understand Your Liabilities: It’s crucial to review your tax documents to determine:

- The total amount owed, which averages around $10,000 for many Americans in 2026 (source: IRS data).

- Any penalties or interest accrued, as 17% of federal taxes go unpaid each year (source: IRS report).

- The specific tax years involved in your liabilities.

- Identify Your Financial Situation: Take a moment to assess your current financial status, including income, expenses, and assets. This information is vital when exploring your options. Life changes, like divorce or job loss, can unexpectedly affect your tax responsibilities. Recent studies show these shifts can significantly impact what you owe.

Additionally, consider using IRS Individual Online Accounts, available 24/7. This resource allows you to view account information, make payments, and manage communication preferences, helping to streamline your tax settlement process.

By thoroughly evaluating your tax circumstances, you’ll feel more empowered to engage with effective tax resolution Las Vegas options. Remember, we’re here to help you find a clearer path toward economic relief.

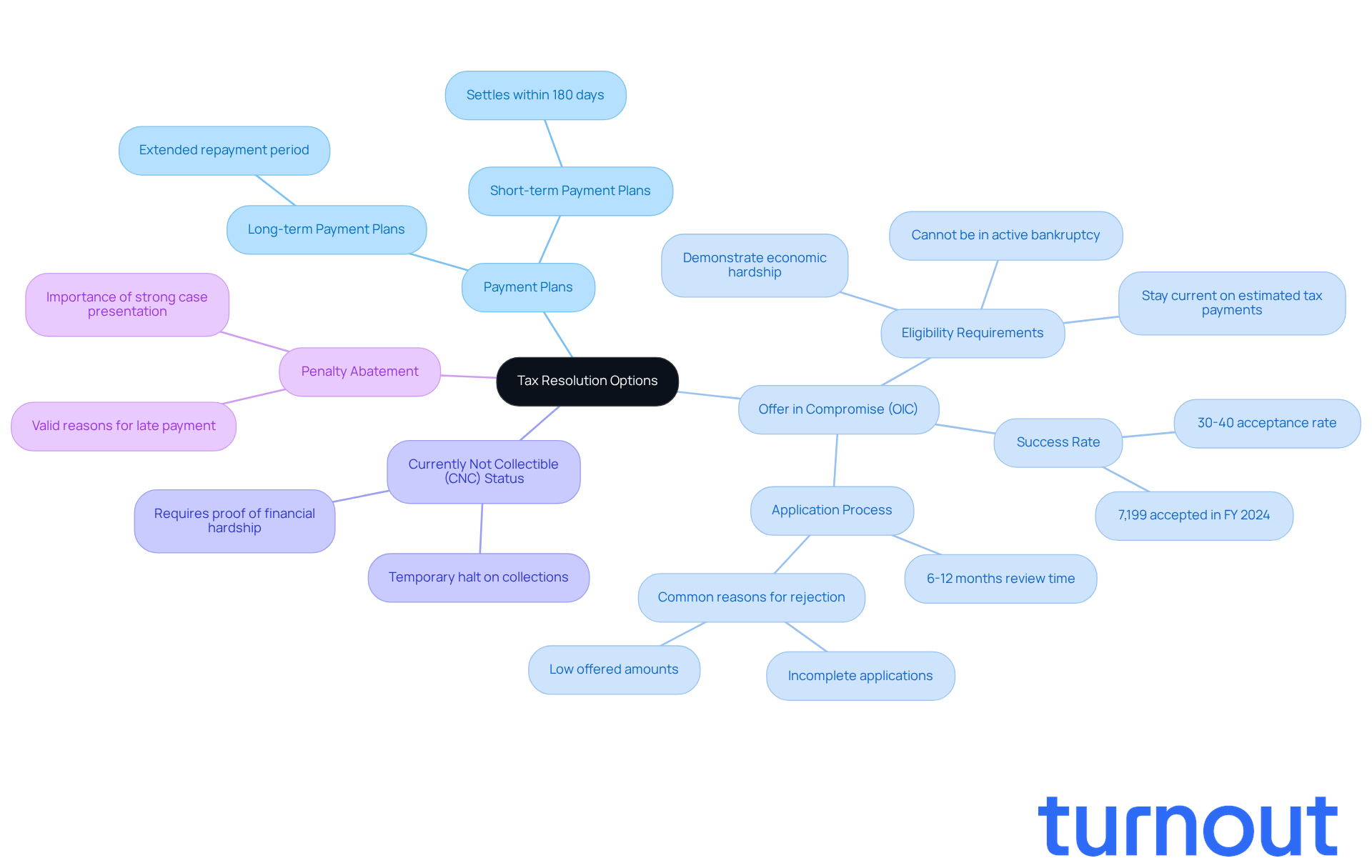

Explore Resolution Options: Payment Plans and Relief Strategies

Once you've assessed your tax situation, it’s time to explore your options for tax resolution Las Vegas. We understand that dealing with tax issues can be overwhelming, but tax resolution Las Vegas strategies are available to help you find relief. Here are some common paths you might consider:

-

Payment Plans: The IRS offers installment agreements that allow you to pay your tax debt over time. You can apply for:

- Short-term Payment Plans: For debts that can be settled within 180 days.

- Long-term Payment Plans: For debts that require more time to pay off.

-

Offer in Compromise (OIC): This option lets you settle your tax debt for less than what you owe. To qualify, you’ll need to demonstrate that paying the full amount would cause you economic hardship. In FY 2024, the IRS accepted 7,199 OIC applications, totaling $163.4 million, with a success rate of about 30% to 40%. This acceptance rate suggests a more favorable environment for OIC approvals, meaning you might have a better chance of success now than in the past. However, keep in mind that the IRS usually takes 6 to 12 months to review and decide on an OIC application. Also, you cannot be in an active bankruptcy case to qualify, and if you’re self-employed or running a business, you must stay current on estimated tax payments. Real-world examples show the potential of this option; for instance, a self-employed freelancer managed to reduce a $53,325 tax obligation to just $100 through an OIC, relieving significant financial stress.

-

Currently Not Collectible (CNC) Status: If you’re unable to pay your tax obligation due to economic hardship, you can request CNC status, which temporarily halts collection efforts. This status can provide you with some breathing room while you work on your financial situation.

-

Penalty Abatement: If you have a valid reason for not paying your taxes on time, you may request a reduction or elimination of penalties. Tax professionals emphasize the importance of presenting a strong case for abatement, as it can significantly lessen your overall tax burden. Consulting with a tax professional can greatly improve your chances of success in these negotiations.

By understanding these options, you can choose the best path forward for tax resolution in Las Vegas to effectively resolve your tax issues. Remember, you’re not alone in this journey, and we’re here to help.

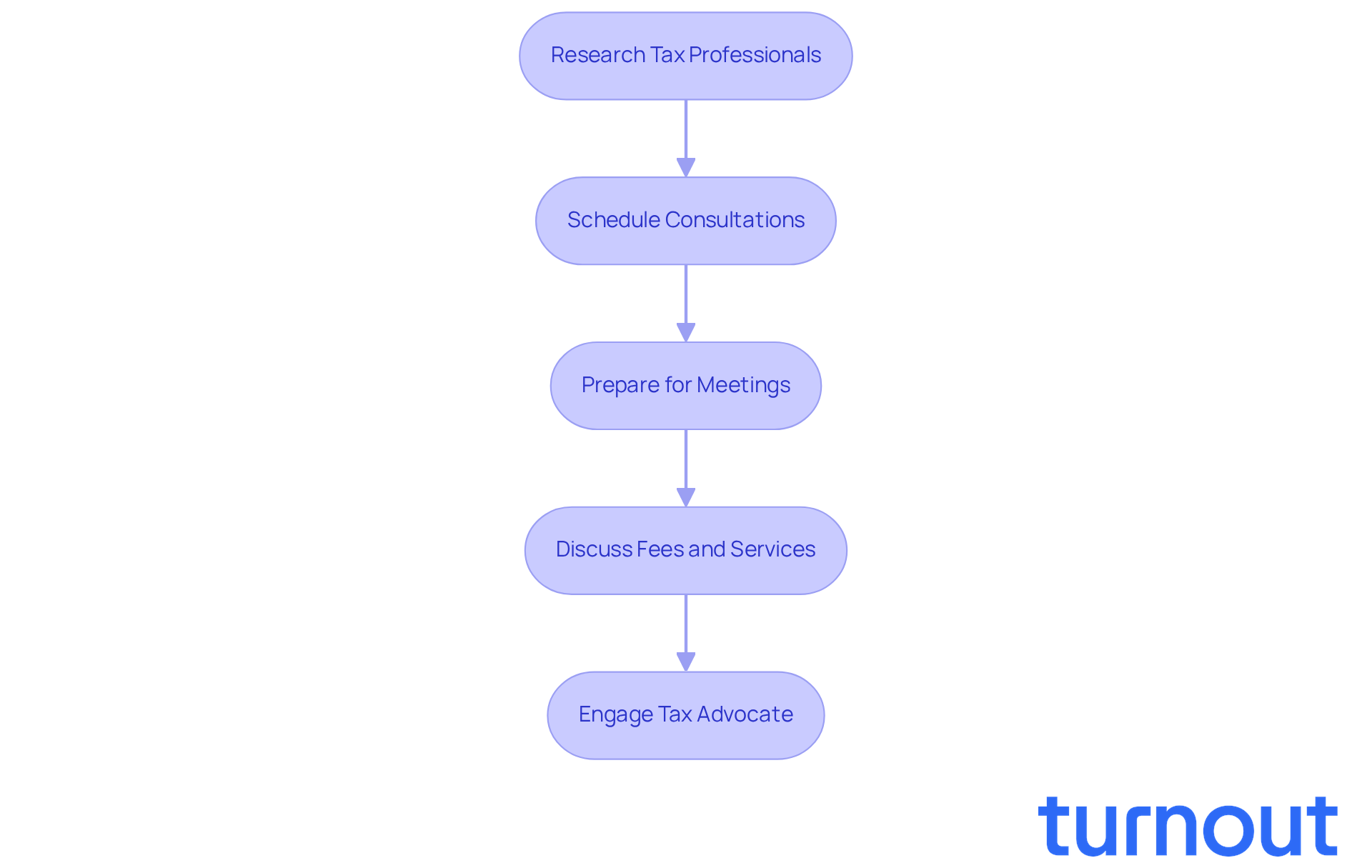

Seek Professional Assistance: Engage Tax Advocates for Support

Navigating tax issues can feel overwhelming, and we understand that seeking professional assistance can significantly enhance your chances of success. Here’s how to effectively engage tax advocates:

-

Research Tax Professionals: Start by identifying qualified tax advocates or firms that specialize in tax solutions. Check reviews and credentials to ensure they have a proven track record. Resources like Yelp or local directories can help you find reputable professionals for tax resolution in Las Vegas.

-

Schedule Consultations: Many tax professionals offer free consultations. Take advantage of this opportunity to discuss your situation and assess their expertise and approach. Collaborating with a specialist can lead to more advantageous settlements and faster outcomes, especially for intricate cases.

-

Prepare for Meetings: Bring all relevant documents and a summary of your tax situation to your meetings. This preparation will enable the advocate to understand your case thoroughly and provide tailored advice. A well-prepared client can significantly enhance the effectiveness of the consultation.

-

Discuss Fees and Services: Be open about the costs involved and the services that will be provided. Understanding the fee structure upfront can prevent misunderstandings later. Resolution fees for tax relief services typically range from $1,000 to $10,000 or more for complex cases, so clarity is essential.

By engaging a tax advocate, you can leverage their expertise to navigate the intricacies of tax resolution Las Vegas. Remember, you are not alone in this journey, and with the right support, you can achieve better outcomes in your financial journey.

Conclusion

Navigating the complexities of tax resolution in Las Vegas can feel overwhelming, especially for those facing tax debts or disputes. We understand that this journey may seem daunting, but taking proactive steps can lead to financial stability and peace of mind. With the right knowledge and support, resolving tax issues becomes a manageable process.

Start by assessing your tax situation. Gather the necessary documents and understand your liabilities. There are various resolution strategies available, such as:

- Payment plans

- Offers in compromise

- Penalty abatement

These options provide pathways to alleviate your tax burdens. Remember, seeking professional assistance from qualified tax advocates can significantly enhance your chances of a favorable outcome. You don’t have to navigate these challenges alone.

Addressing tax issues promptly and effectively is vital for your financial health. By taking the necessary steps and leveraging available resources, you can regain control over your financial future. Engaging with tax professionals and understanding your options not only empowers you but also paves the way for a more secure financial landscape.

We’re here to help you every step of the way. You are not alone in this journey.

Frequently Asked Questions

What is tax resolution in Las Vegas?

Tax resolution in Las Vegas refers to the process of addressing and resolving tax debts or disputes with the IRS or state tax authorities.

What is tax liability?

Tax liability is the total amount of tax you owe to the government. If not addressed promptly, it can lead to penalties and interest.

What are some options for tax resolution in Las Vegas?

Options for tax resolution include payment plans, offers in compromise, and penalty abatement.

What are the consequences of ignoring tax issues?

Ignoring tax issues can lead to serious consequences such as wage garnishments, liens, and legal action.

Why is tax resolution important?

Tax resolution is important because it allows individuals to take proactive steps toward financial stability and avoid the negative impacts of unresolved tax problems.