Introduction

Navigating the complexities of tax relief in Las Vegas can often feel like an uphill battle. We understand that many are grappling with mounting tax debt, and it’s common to feel overwhelmed. This guide aims to illuminate the path toward effective tax relief solutions, offering you insight into essential steps and strategies for managing your financial obligations.

With numerous options available, how can you discern which relief methods are truly beneficial and suited to your unique circumstances? You're not alone in this journey, and we're here to help you find the right path forward.

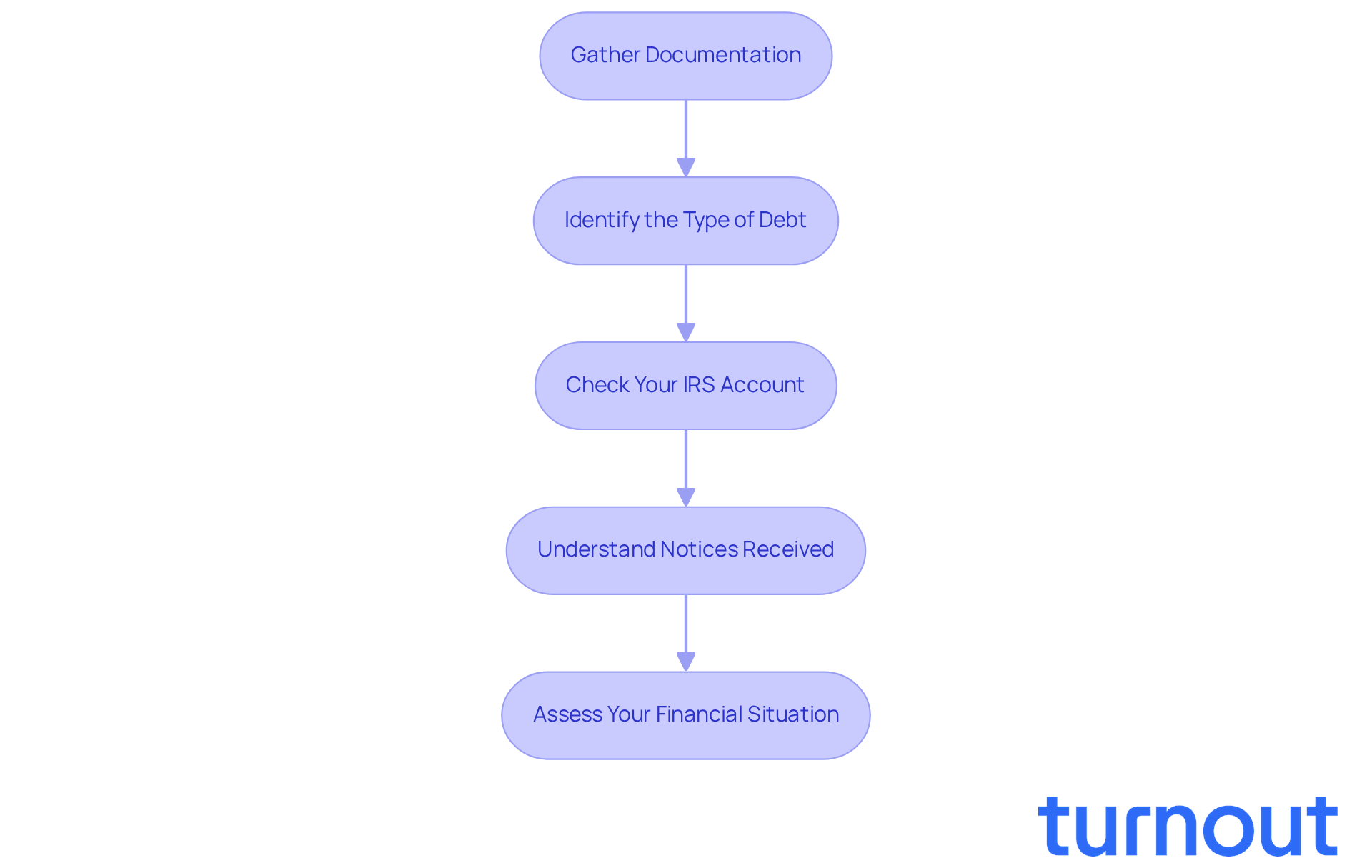

Understand Your Tax Debt Situation

Navigating tax relief help Las Vegas can feel overwhelming, but you’re not alone in this journey. Let’s take a moment to assess your current tax debt situation together. Here are some steps to guide you:

-

Gather Documentation: Start by collecting all relevant documents, such as tax returns, IRS notices, and any correspondence regarding your tax debt. Having a comprehensive view of your financial obligations is crucial for understanding your situation.

-

Identify the Type of Debt: It’s important to determine whether your debt is federal, state, or local. Each type may offer different assistance options. For example, the IRS has various programs tailored to specific debts, while state authorities may have their own initiatives.

-

Check Your IRS Account: Take advantage of the IRS online portal to review your account status. This includes the total amount owed, your payment history, and any pending actions. Staying informed can help you feel more proactive.

-

Understand Notices Received: Pay close attention to any notices from the IRS. These documents often contain critical information about your debt, including deadlines and potential penalties. Ignoring these notices can lead to accelerated enforcement actions, so responding in a timely manner is essential.

-

Assess Your Financial Situation: Reflect on your income, expenses, and any assets. Understanding your financial situation will help you assess your capacity to pay and recognize viable assistance options. In 2026, the average tax debt per individual in the U.S. is projected to be significant, making it vital to have a clear picture of your finances.

By following these steps, you can establish a solid foundation for seeking tax relief help in Las Vegas. Remember, we’re here to help you navigate the complexities of your tax obligations.

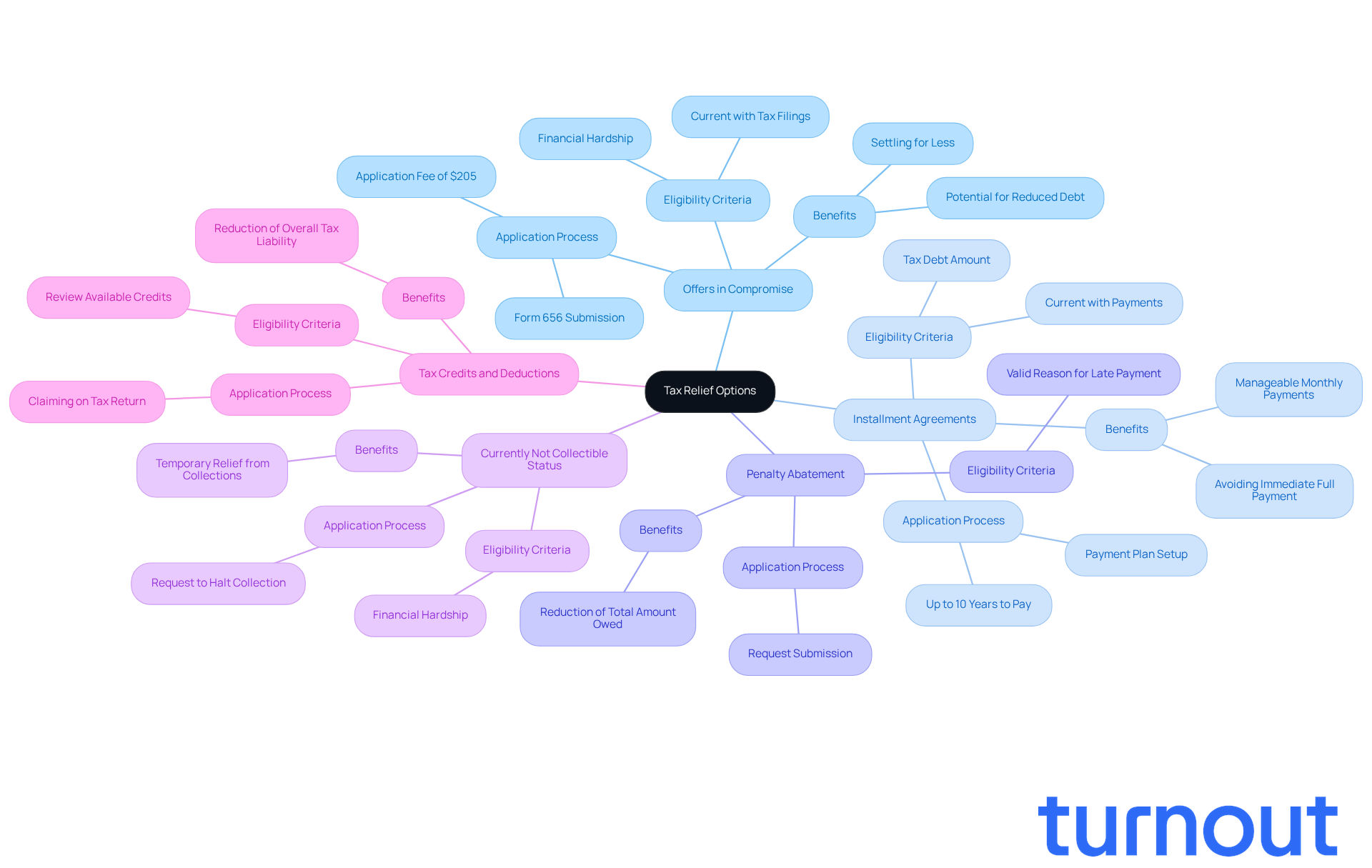

Explore Available Tax Relief Options

Understanding your tax debt situation can be overwhelming, but tax relief help Las Vegas provides options available to assist you. Let’s explore some tax relief solutions that might ease your burden:

-

Offers in Compromise (OIC): This program allows you to settle your tax debt for less than what you owe. If paying the full amount would cause you financial hardship, you may qualify. The application requires a fee of $205, and historically, the IRS accepts about 30-40% of OIC applications. Thorough preparation is key to success. You can use the IRS's pre-qualifier tool to assess your eligibility before applying.

-

Installment Agreements: If paying your tax debt in full isn’t possible, consider setting up a payment plan with the IRS. This option lets you pay off your debt in manageable monthly installments. Typically, you can have up to 10 years to pay off your balance, but shorter terms can help minimize additional interest and penalties.

-

Penalty Abatement: If you have a valid reason for not paying your taxes on time, you might qualify for penalty forgiveness. This can significantly reduce the total amount you owe, offering you prompt tax relief help Las Vegas.

-

Currently Not Collectible Status: If you’re facing financial hardship, you can request that the IRS temporarily halt collection efforts. This status gives you breathing room to focus on regaining your financial stability.

-

Tax Credits and Deductions: Don’t forget to investigate any tax credits or deductions you may qualify for. These can reduce your overall tax liability, leading to substantial savings and further easing your financial burden.

We understand that navigating tax debt can be challenging, but with tax relief help Las Vegas, you are not alone in this journey. Take the first step towards relief today.

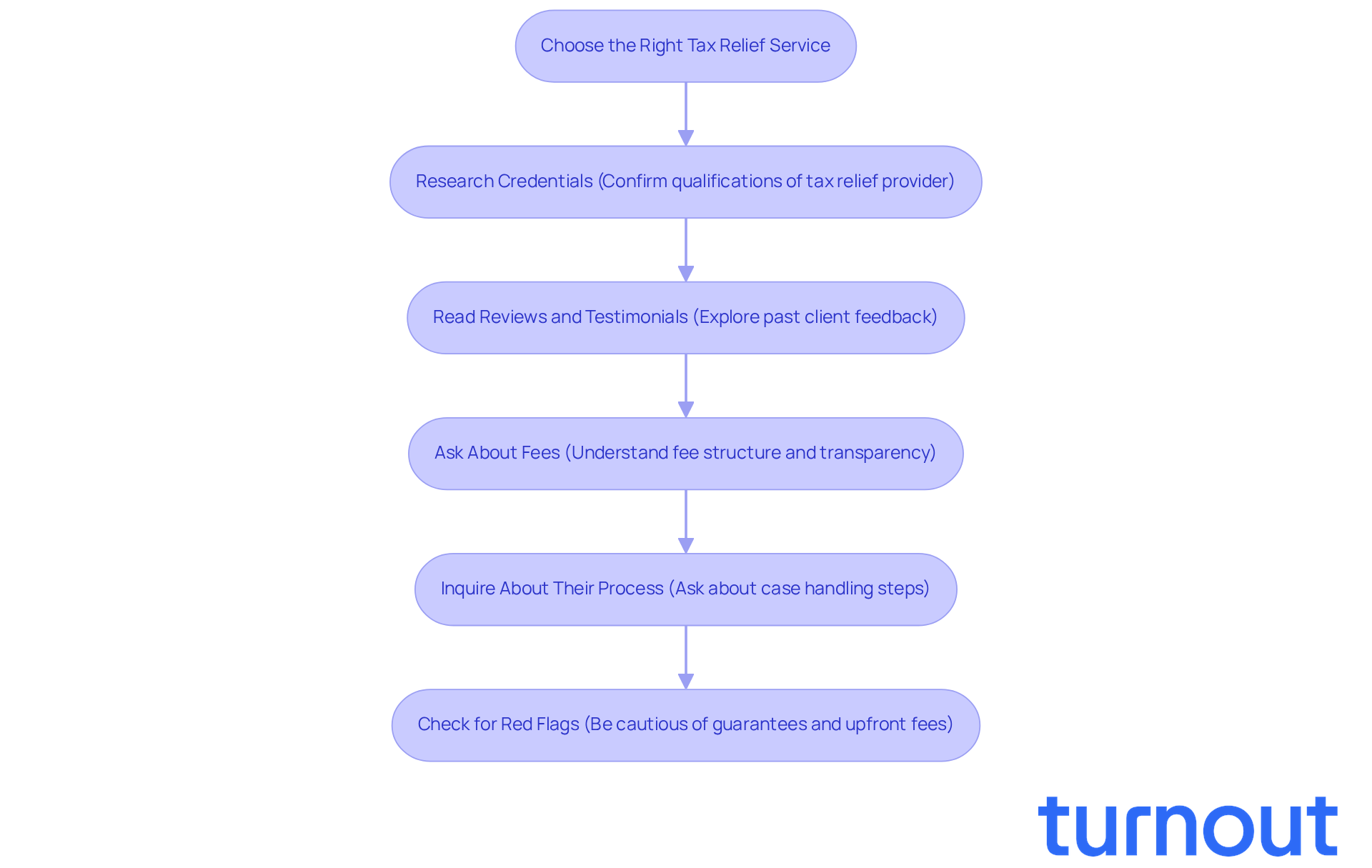

Choose the Right Tax Relief Service

Choosing the right tax relief help Las Vegas can feel overwhelming, but it’s a crucial step toward achieving a positive outcome. Here’s how you can make an informed decision that feels right for you:

-

Research Credentials: It’s important to confirm the qualifications of your tax relief provider. Look for licensed professionals, like CPAs or tax attorneys, who have a solid track record in tax resolution. This way, you’ll be working with experts who truly understand the complexities of tax law and can navigate the IRS on your behalf.

-

Read Reviews and Testimonials: Take a moment to explore online evaluations and endorsements from past clients. This can give you a sense of the provider’s reputation and effectiveness. High client retention rates and positive feedback are often signs of a firm’s reliability and success in resolving tax issues.

-

Ask About Fees: Understanding the fee structure before you commit is essential. Trustworthy providers should be transparent about their charges, which can vary widely. Leading tax assistance providers often offer flat-rate engagement fees, promoting clarity and preventing hidden costs. For instance, typical charges for tax assistance in 2026 range from flat-rate agreements to hourly fees, depending on the complexity of your case. Make sure you’re aware of any additional costs that might arise during the process.

-

Inquire About Their Process: Don’t hesitate to ask how they handle cases and what steps they take to resolve tax issues. A transparent process is a good indicator of professionalism and reliability. Firms that use thorough checklists to ensure compliance with IRS standards often achieve better outcomes, minimizing delays caused by incomplete documentation.

-

Check for Red Flags: Be cautious of providers that guarantee results or require large upfront payments. Legitimate firms will conduct a thorough assessment of your situation before making any promises. For example, effective tax assistance for disabled individuals often emphasizes customized solutions rather than one-size-fits-all promises. Also, be wary of firms that promise specific reduction percentages without reviewing your details, as this can raise concerns about their reliability. Ensure that the firm provides a clear engagement letter detailing their offerings and fees to protect yourself from unexpected expenses.

By following these guidelines, you can confidently choose a tax relief help Las Vegas option that meets your needs. Remember, you’re not alone in this journey, and with the right support, you can enhance your chances of a successful resolution.

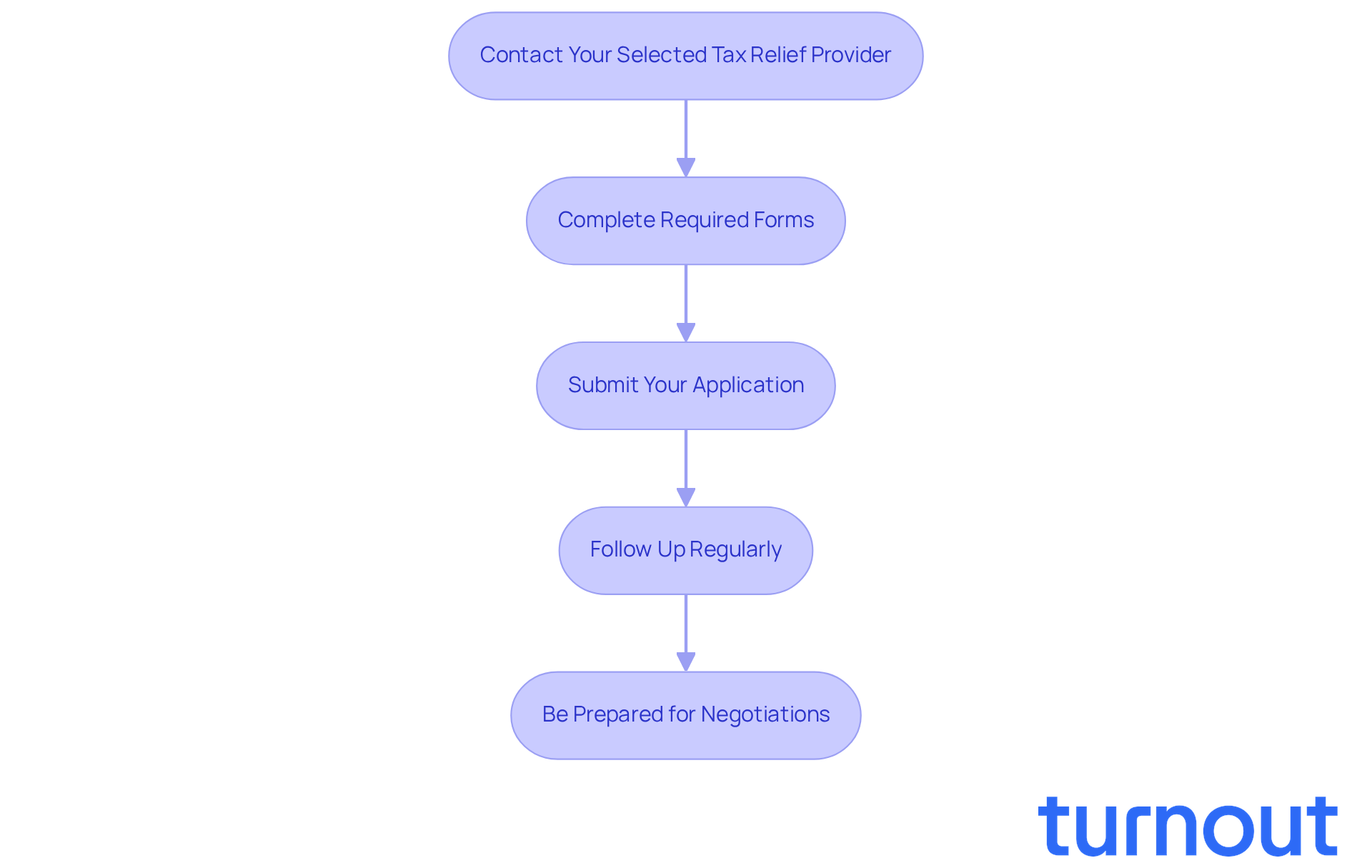

Initiate the Tax Relief Process

Now that you have a better understanding of your tax situation and have explored your options, it’s time to embark on the tax assistance process. We’re here to help you every step of the way. Follow these steps:

-

Contact Your Selected Tax Relief Provider: Reach out to your chosen provider. Be prepared to share detailed financial information and documentation about your tax debt. This initial contact is crucial for setting the stage for your assistance application.

-

Complete Required Forms: Fill out any necessary forms required by the IRS or your tax assistance organization. This may include financial statements and applications for assistance programs. Remember, accurate and thorough completion of these forms is essential for a smooth process.

-

Submit Your Application: Make sure all forms are submitted correctly and on time. Keeping copies of everything for your records is vital. It helps maintain a clear trail of your application, which can be reassuring during this process.

-

Follow Up Regularly: Maintain regular contact with your tax assistance provider and the IRS. Frequent follow-ups can help ensure your case is progressing and that you’re informed of any updates. It’s common to feel anxious during this time, but statistics show that timely communication can significantly reduce response times, which are expected to improve in 2026.

-

Be Prepared for Negotiations: If relevant, be ready to discuss your tax assistance options with the IRS. Your tax relief help Las Vegas should provide guidance throughout this process, helping you navigate any complexities that arise. Remember, you are not alone in this journey.

Conclusion

Navigating tax relief help in Las Vegas can feel overwhelming, but it’s a journey that can truly lighten your financial burden. We understand that dealing with tax debt is stressful, and knowing your options is crucial. By gathering your documentation, assessing your financial situation, and pinpointing the type of debt you owe, you’re already taking important steps toward finding the help you need.

This guide highlights various tax relief options available to you, including:

- Offers in Compromise

- Installment agreements

- Penalty abatements

Choosing a reputable tax relief provider is essential. Take the time to research their credentials, read reviews, and ensure they communicate clearly about fees and processes. Each of these steps is designed to empower you, making your path to resolution feel more achievable.

Remember, taking proactive steps is vital. Engaging with the right resources and professionals can lead to meaningful tax relief and a more stable financial future. If you’re seeking assistance in Las Vegas, the tools and strategies outlined here serve as your roadmap to navigate the complexities of tax relief effectively. Taking action today can truly pave the way for a brighter tomorrow.

Frequently Asked Questions

What is the first step in understanding my tax debt situation?

The first step is to gather all relevant documentation, such as tax returns, IRS notices, and any correspondence regarding your tax debt. This will give you a comprehensive view of your financial obligations.

Why is it important to identify the type of tax debt I have?

Identifying whether your debt is federal, state, or local is important because each type may offer different assistance options. For example, the IRS has various programs tailored to specific debts, while state authorities may have their own initiatives.

How can I check my IRS account status?

You can check your IRS account status by using the IRS online portal, which allows you to review your total amount owed, payment history, and any pending actions.

What should I do if I receive notices from the IRS?

It is essential to pay close attention to any notices from the IRS, as they contain critical information about your debt, including deadlines and potential penalties. Responding in a timely manner is crucial to avoid accelerated enforcement actions.

How can I assess my financial situation regarding tax debt?

To assess your financial situation, reflect on your income, expenses, and any assets. Understanding your financial capacity will help you recognize viable assistance options for paying your tax debt.

Why is it important to have a clear picture of my finances?

Having a clear picture of your finances is vital, especially as the average tax debt per individual in the U.S. is projected to be significant by 2026. This understanding will help you assess your capacity to pay and explore assistance options.