Introduction

Navigating the complexities of tax liens can feel like wandering through a maze, especially in a vibrant city like Las Vegas. We understand that grappling with the implications of a tax lien is crucial, as it can deeply affect your property ownership and financial stability. This guide is here to illuminate a clear path for you, offering effective strategies and options that can help you regain control over your financial future.

But what happens when the burden of unpaid taxes threatens to derail your personal and financial dreams? You're not alone in this journey, and together, we can explore the solutions that will empower you to move forward.

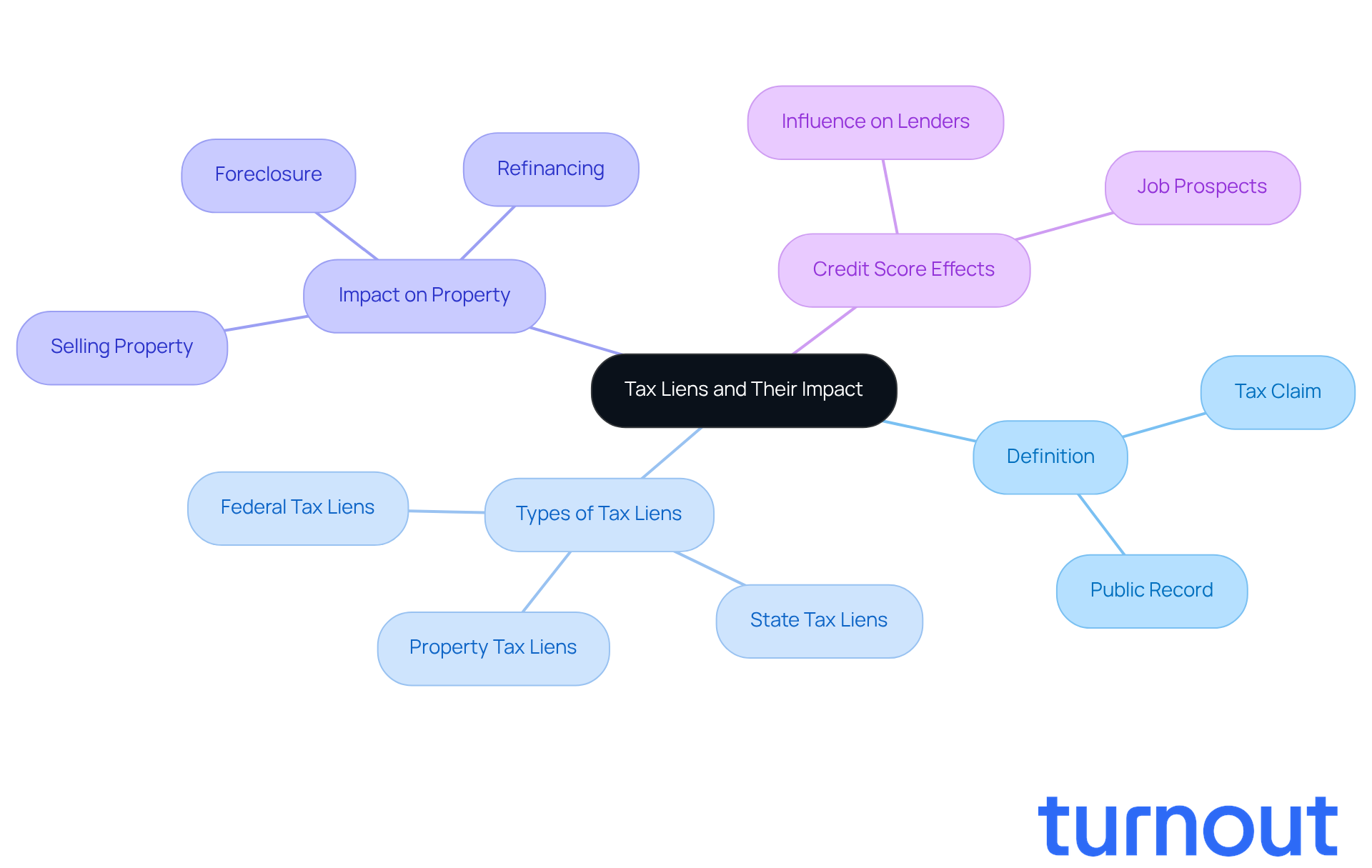

Understand Tax Liens and Their Impact

A tax claim is more than just a legal term; it’s a demand against your property due to unpaid taxes. This claim serves as a public record, letting creditors know about your tax obligations. It’s important to understand how this can affect your ability to secure loans or sell your property. We know this can be overwhelming, but understanding the implications of a tax lien is essential, and seeking tax lien help in Las Vegas can provide valuable assistance.

Types of Tax Liens: There are different types of tax liens - federal, state, and property tax liens. Each comes with its own implications and processes for resolution. Knowing these can help you navigate your situation more effectively.

Impact on Property: A tax obligation can make it difficult to sell or refinance your property until the amount owed is settled. If the debt remains unpaid, it could even lead to foreclosure. Federal tax claims typically stay in public records for ten years, which can have lasting effects on your financial health. It’s common to feel anxious about tax issues, but there are steps you can take, including seeking tax lien help in Las Vegas, to address it.

Credit Score Effects: While tax encumbrances don’t directly impact credit scores anymore, they remain a matter of public record. This can influence lenders' decisions. For instance, auto lenders often view applicants with outstanding claims as high-risk, which might result in higher interest rates or even denial of credit. Additionally, tax claims can affect job prospects, as some employers may check public records during hiring.

By understanding these concepts, including the possibility of withdrawal, you can take proactive steps to seek tax lien help in Las Vegas to resolve your tax situation. Remember, you’re not alone in this journey. We’re here to help you navigate these challenges.

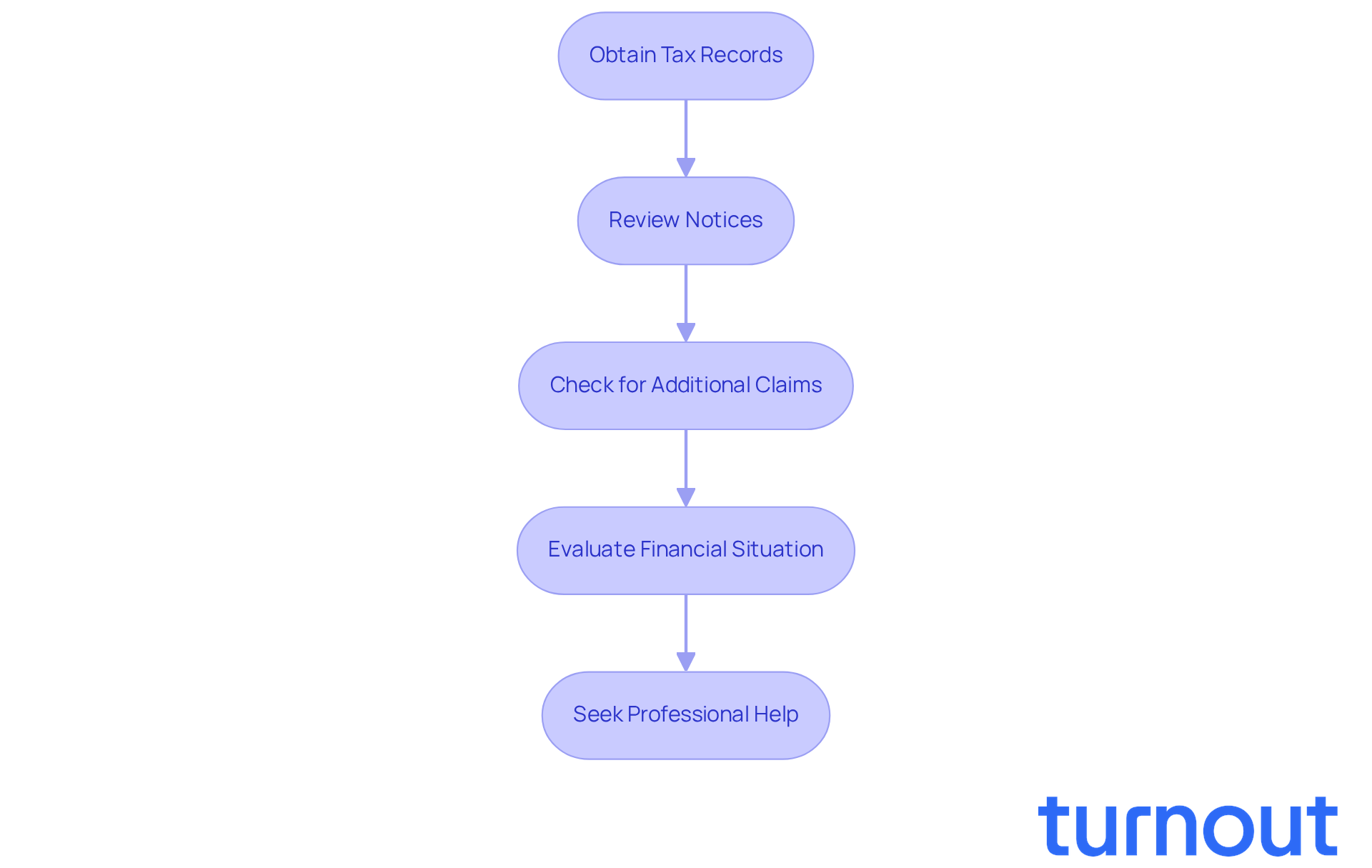

Assess Your Tax Lien Situation

To effectively address your tax lien, begin by gathering all relevant documentation:

- Obtain Tax Records: Request your tax account transcripts from the IRS or your state tax agency to understand the total amount owed, including penalties and interest. In 2026, the average tax debt owed by Americans is approximately $15,000, making it crucial to have accurate records.

- Review Notices: Carefully read any notices received regarding the claim. These documents often contain critical information about deadlines and payment options. Ignoring these notices can lead to missed opportunities for resolution.

- Check for Additional Claims: Verify if there are other claims on your property that may complicate your situation. This can be done through your local tax office or online databases. Comprehending the complete extent of your claims is essential for effective management.

- Evaluate Financial Situation: Assess your current financial status, including income, expenses, and assets. This evaluation will help you determine what payment options you can realistically pursue. Tax advisors stress that obtaining tax lien help Las Vegas and conducting a comprehensive financial assessment is crucial for successfully managing tax obligation resolutions. As noted by tax expert Erin M. Collins, "Working with a qualified tax professional can help taxpayers navigate the complex tax code and effectively resolve their tax issues."

By completing this assessment, you gain a clearer picture of your tax obligation situation, which is essential for determining your next steps. Remember, unresolved tax debt can lead to serious consequences such as wage garnishments and further tax claims, so seeking professional representation is advisable.

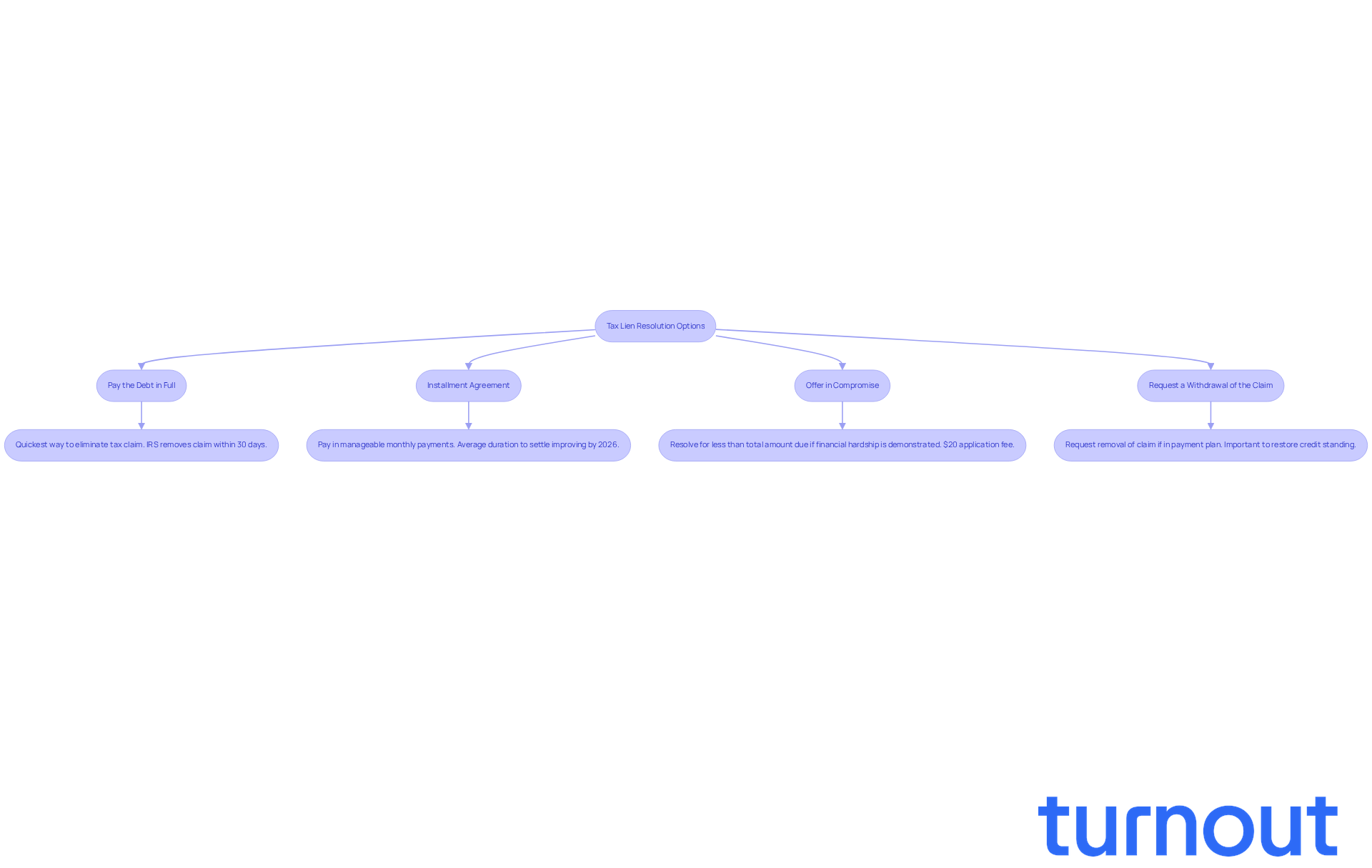

Explore Options for Tax Lien Resolution

Once you’ve assessed your tax lien situation, it’s important to explore your options for tax lien help Las Vegas to find a resolution. We understand that dealing with tax issues can be overwhelming, but tax lien help Las Vegas provides paths forward that can help you regain control.

-

Pay the Debt in Full: If you can, settling the total amount owed is the quickest way to eliminate a tax claim. The IRS typically removes the claim within 30 days of payment, allowing you to regain your financial stability swiftly.

-

Installment Agreement: If paying the full amount isn’t feasible, you might qualify for an installment agreement. This option allows you to pay your tax obligation in manageable monthly payments. In 2026, the average duration to settle tax obligations through installment agreements is expected to be more efficient, making this choice more attainable.

-

Offer in Compromise: This option lets you resolve your tax obligation for less than the total amount due if you can demonstrate financial hardship. Just keep in mind that the IRS has specific fees associated with filing an Offer in Compromise, including a non-refundable application fee of $20. If you need assistance with tax liens, you can find tax lien help in Las Vegas, which can be waived for those who meet low-income certification guidelines.

-

Request a Withdrawal of the Claim: If you enter into a payment plan, you can request a removal of the claim. This can help restore your credit standing. It’s crucial to take this step, as ignoring tax debt can lead to serious repercussions, including wage garnishments and property claims.

If you need assistance with tax liens, you can find tax lien help in Las Vegas. Seek professional tax lien help in Las Vegas by considering reaching out to a tax professional or advocate who can provide personalized guidance and negotiate on your behalf. As tax relief author Eva Hanson emphasizes, understanding your options and staying up to date on filings will empower you more than waiting for the next notification.

By examining these alternatives, you can find the best way to address your tax obligation efficiently. Remember, you’re not alone in this journey, and taking action now can help you reclaim authority over your financial future.

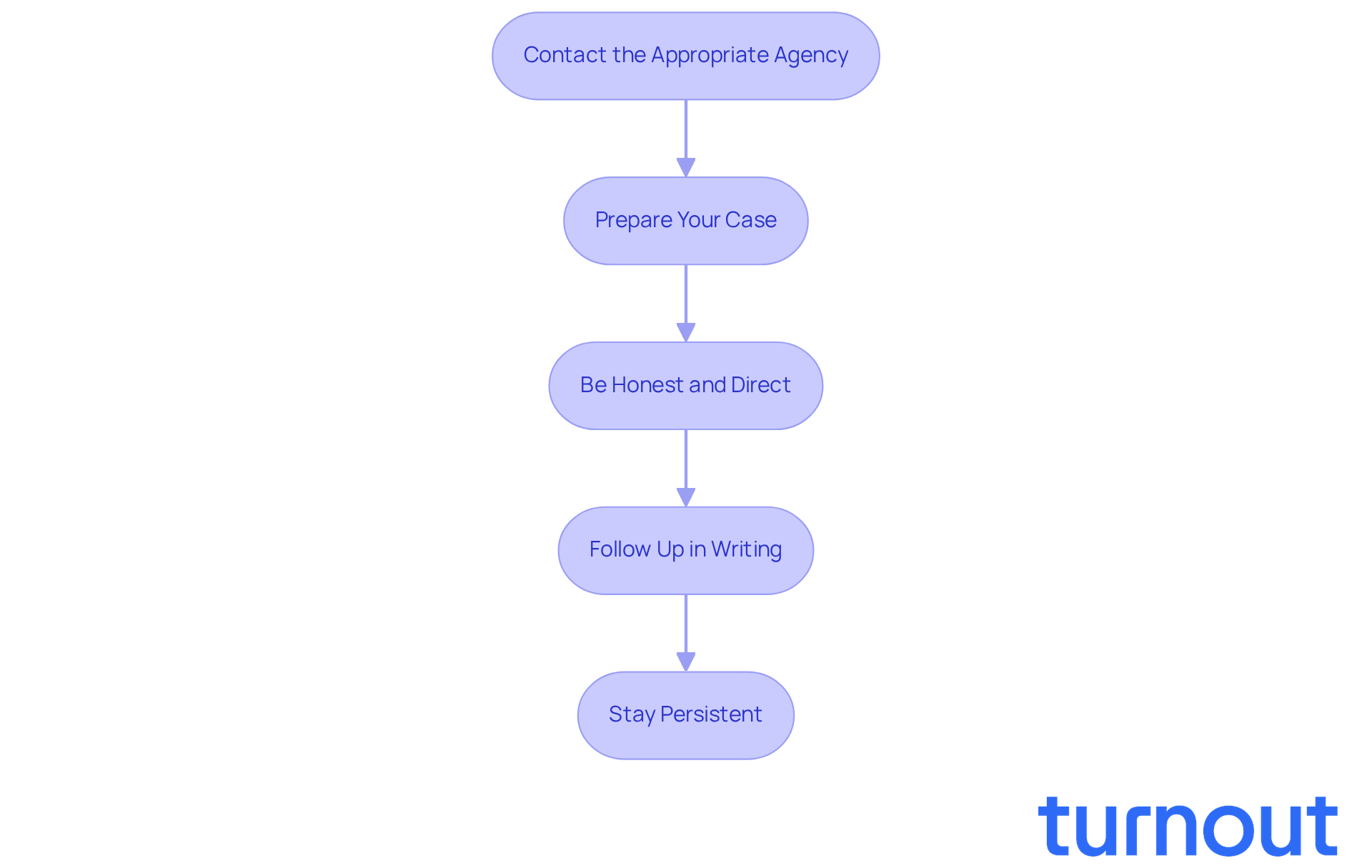

Engage with Tax Authorities for Relief

Effective communication with tax authorities is crucial for easing your tax burden. We understand that navigating this process can be overwhelming, but following these steps can help you find your way:

- Contact the Appropriate Agency: First, identify whether your issue lies with the IRS or a state tax agency. Reach out to the correct office using official contact numbers to steer clear of scams.

- Prepare Your Case: Before making contact, gather all relevant documents - your tax records, notices, and any correspondence. Being ready to explain your situation clearly can make a significant difference.

- Be Honest and Direct: When you speak with a representative, honesty about your financial situation is key. Clearly express your intention to resolve the claim and ask about available options. Remember, they’re there to help you.

- Follow Up in Writing: After your initial conversation, send a written summary of what was discussed, including any agreements made. This creates a helpful record of your communication.

- Stay Persistent: If you don’t receive a timely response, don’t hesitate to follow up. Persistence often leads to quicker resolutions.

By engaging effectively with tax authorities, you can receive tax lien help Las Vegas to navigate this process more smoothly. Remember, you’re not alone in this journey, and taking these steps can increase your chances of obtaining tax lien help in Las Vegas.

Conclusion

Understanding tax liens and their implications is crucial for maintaining your financial stability and property ownership. We know that the journey through tax lien resolution can feel overwhelming. But with the right knowledge and support, you can navigate this complex landscape. By seeking tax lien help in Las Vegas, you can find the guidance you need to regain control of your financial future.

In this guide, we’ve outlined key steps to help you. From assessing your tax lien situation to exploring resolution options and engaging effectively with tax authorities, each action you take can significantly impact your outcome. Whether it’s paying off the debt, negotiating an installment agreement, or seeking professional assistance, understanding the types of tax liens and their effects on your credit score and property is vital. These factors play a crucial role in the resolution process.

Taking proactive steps toward resolving tax liens is essential for anyone facing these challenges. We understand that it can be tough, but by staying informed and seeking help when needed, you can reclaim your financial standing and work toward a brighter future. Embrace this opportunity to take control, and remember, support is available in Las Vegas to help you navigate this intricate process.

Frequently Asked Questions

What is a tax lien?

A tax lien is a legal claim against your property due to unpaid taxes, serving as a public record that informs creditors of your tax obligations.

What types of tax liens exist?

There are three main types of tax liens: federal tax liens, state tax liens, and property tax liens, each with its own implications and resolution processes.

How does a tax lien impact property sales or refinancing?

A tax lien can make it difficult to sell or refinance your property until the owed amount is settled. Unpaid debts may even lead to foreclosure.

How long do federal tax claims remain in public records?

Federal tax claims typically stay in public records for ten years, which can have lasting effects on your financial health.

Do tax liens affect credit scores?

While tax liens do not directly impact credit scores anymore, they remain public records that can influence lenders' decisions and may result in higher interest rates or denial of credit.

Can tax liens affect job prospects?

Yes, tax claims can affect job prospects since some employers may check public records during the hiring process.

What steps can I take if I have a tax lien?

Seeking tax lien help in Las Vegas can provide valuable assistance in addressing and resolving your tax situation.