Introduction

Navigating the complexities of short-term disability (STD) benefits can feel like an uphill battle. We understand that unexpected medical challenges can arise, leaving you feeling overwhelmed. These benefits serve as a crucial financial lifeline, providing essential support during times of temporary incapacity due to non-work-related illnesses or injuries.

However, it’s common to feel uncertain when only a fraction of workers have access to these benefits. Understanding the application process, eligibility requirements, and necessary documentation becomes paramount. What happens when the application process seems daunting, or when claims are denied?

This guide aims to demystify the steps involved in securing STD benefits. We’re here to help you confidently tackle potential hurdles and ensure you receive the support you need. Remember, you are not alone in this journey.

Understand Short-Term Disability (STD) Benefits

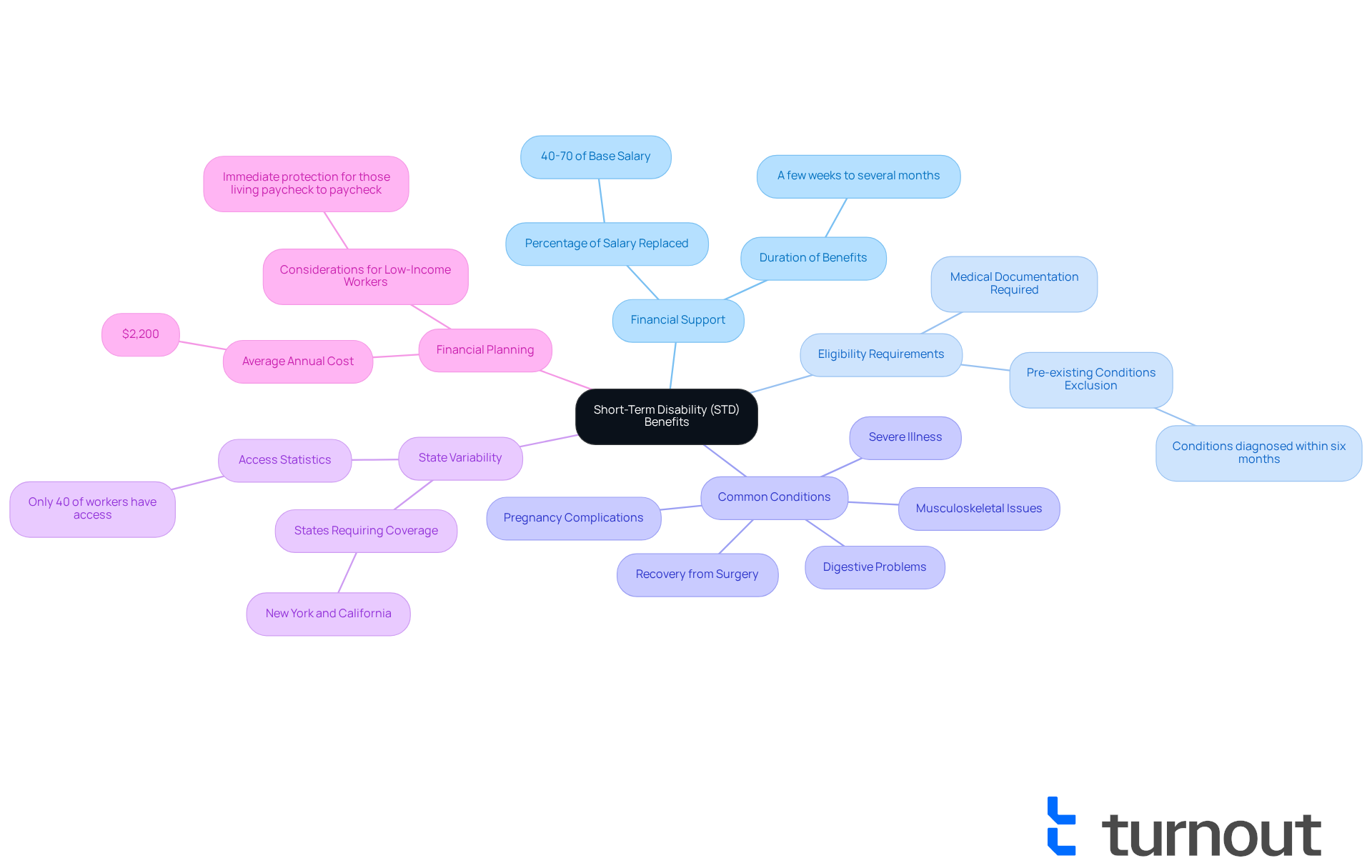

Short-term disability (std limited) payments provide essential financial support for those facing temporary challenges due to a non-work-related illness or injury. These benefits typically replace 40-70% of your base salary for a period that can range from a few weeks to several months, depending on your specific policy. Understanding the nuances of std limited benefits, including how they differ from long-term disability and the types of conditions that qualify, is vital for anyone considering this option. For instance, STD assistance can cover situations like recovery from surgery, severe illness, or complications from pregnancy. Familiarizing yourself with these details can make the application process smoother and less daunting.

We understand that navigating the world of temporary disability can be overwhelming. It's important to note that only five states require employers to provide coverage for temporary incapacity, highlighting the variability in access to these benefits across the country. In fact, only 40% of workers have access to temporary coverage through their employers, making individual policies a viable option for many. Common conditions associated with temporary disabilities include musculoskeletal issues, digestive problems, and pregnancy complications, broadening the perspective on what qualifies.

Eligibility for assistance under STD limited usually requires medical documentation that proves your inability to perform job duties. While not federally mandated, some states, like New York and California, do require employers to offer temporary injury insurance, which can be a valuable resource for workers facing unexpected medical situations. Financial advisors often recommend considering temporary income protection as a safety net, especially for those living paycheck to paycheck, as it provides timely financial assistance during critical times.

Moreover, it’s crucial to be aware that most policies exclude pre-existing conditions diagnosed within six months before coverage begins. This detail is significant for potential applicants. The average annual cost of income protection insurance is around $2,200, which should be factored into your financial planning. In conclusion, temporary disability assistance plays a vital role in ensuring financial stability during brief periods of inability to work. By understanding the coverage details and eligibility requirements, you can navigate the application process more effectively and secure the support you need during challenging times. Remember, you are not alone in this journey; we're here to help.

Identify Eligibility Requirements for STD Benefits

To qualify for short-term disability (STD) assistance, we understand that navigating the requirements can feel overwhelming. Applicants typically need to meet several criteria, which can vary by employer or insurance provider. Here are some key requirements to keep in mind:

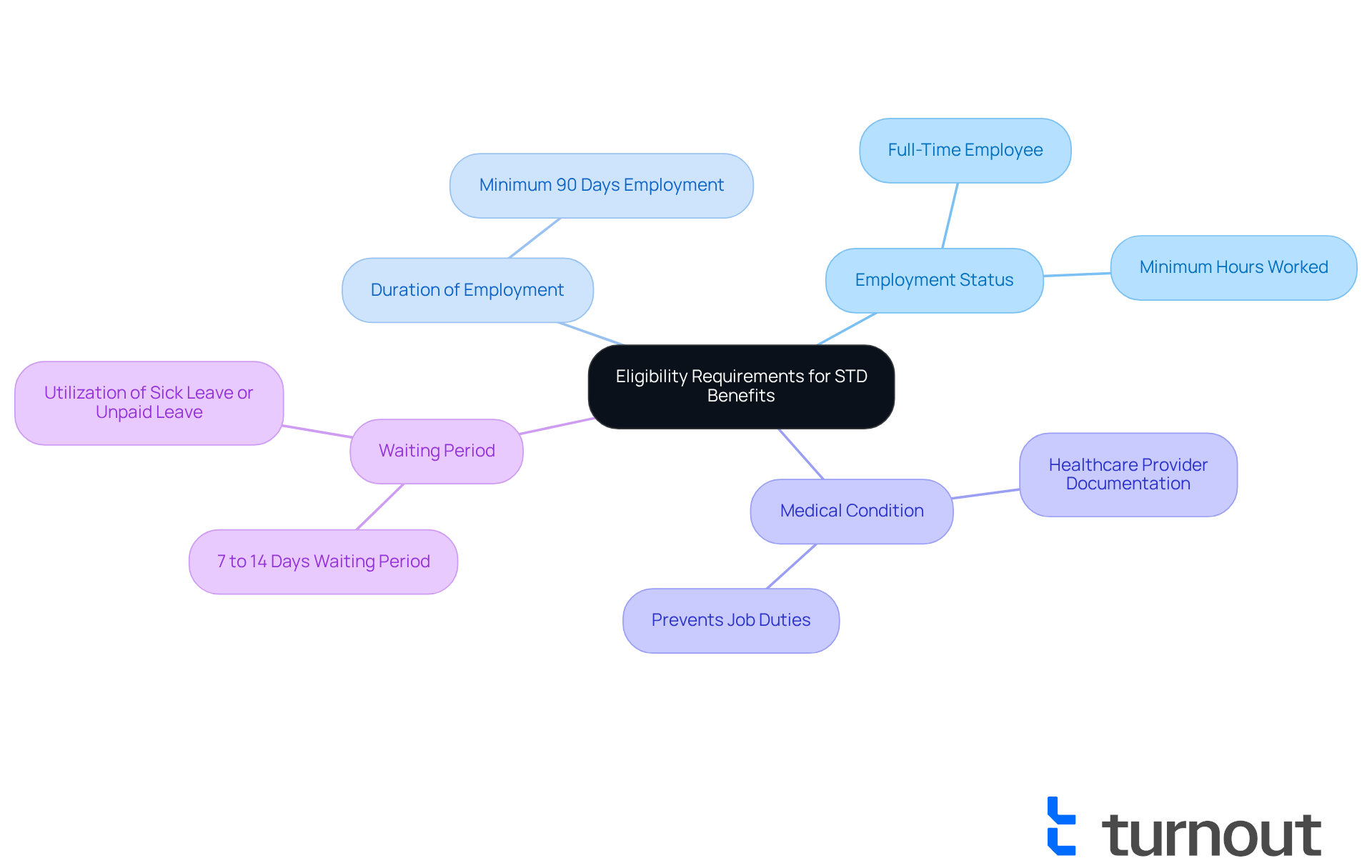

- Employment Status: Generally, you need to be a full-time employee or meet the minimum hours worked as defined by your employer's policy.

- Duration of Employment: Many policies specify that staff must have been employed for a certain duration, often around 90 days, before they can request assistance.

- Medical Condition: A healthcare provider must document your condition, showing that it prevents you from performing your job duties.

- Waiting Period: Most policies impose a waiting duration of 7 to 14 days before benefits begin, during which you may need to utilize sick leave or unpaid leave.

In 2025, approximately 43% of working Americans have access to STD benefits. This highlights the importance of understanding these eligibility criteria. HR experts frequently emphasize that clear documentation and compliance with these requirements are essential for a successful request. By thoroughly examining these standards, you can better evaluate your eligibility and prepare for the next steps in the process.

Remember, you are not alone in this journey. Turnout's trained nonlawyer advocates are here to assist you in navigating the process. They can help you comprehend the requirements and prepare the necessary documentation for a successful application. We're here to help!

Gather Required Documentation for Your Application

When applying for temporary disability assistance, we understand that gathering the right documents can feel overwhelming. At Turnout, we’re dedicated to simplifying access to government benefits and financial support, providing expert guidance every step of the way. Here are the key documents you’ll typically need:

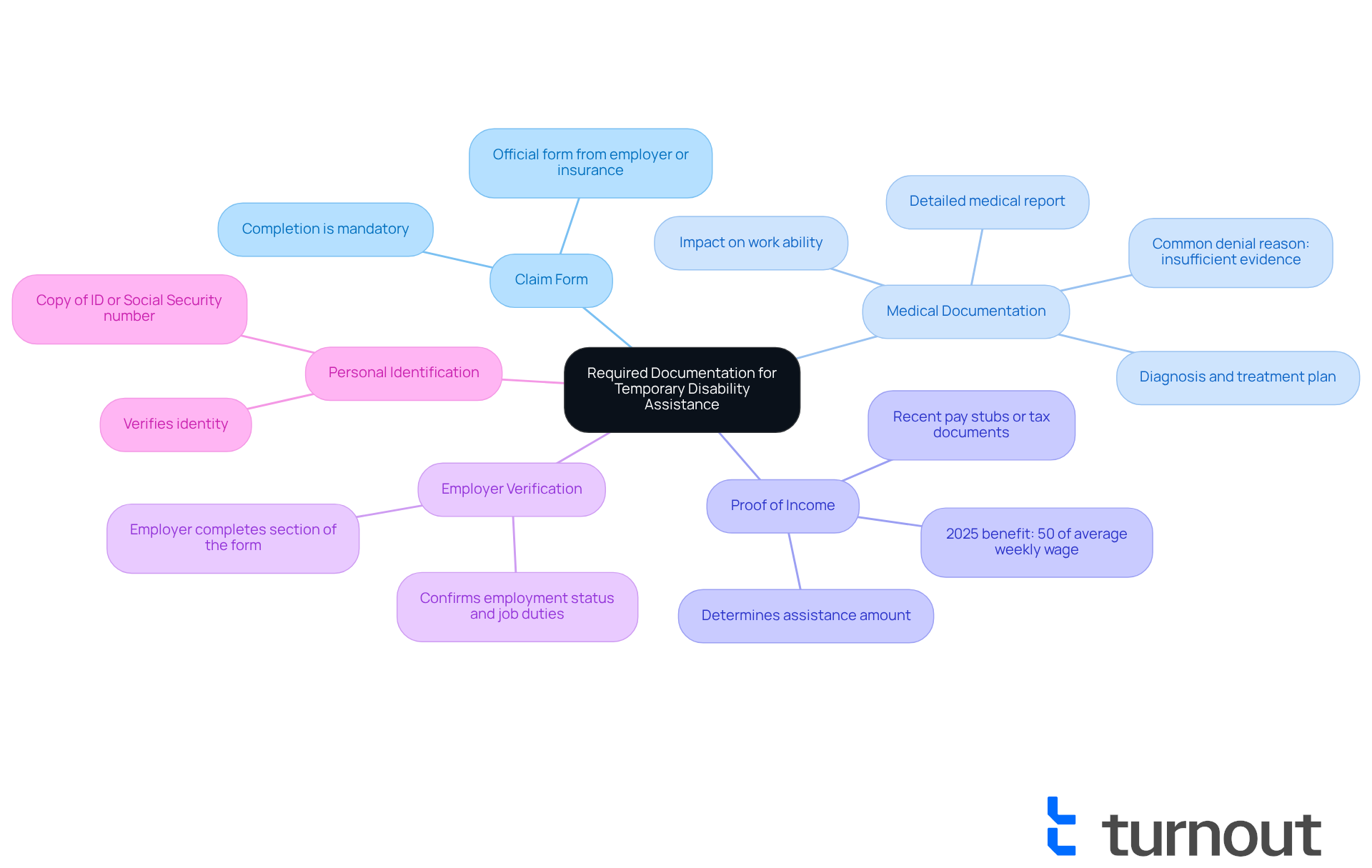

- Claim Form: Make sure to complete the official claim form provided by your employer or insurance company.

- Medical Documentation: It’s crucial to secure a detailed medical report from your healthcare provider. This report should outline your diagnosis, treatment plan, and how your condition affects your ability to work. Comprehensive medical evidence significantly boosts your chances of approval. In fact, industry statistics show that the most common reason for denial of a short-term disability claim is the insurance company’s finding that the applicant does not meet the definition of 'disability'.

- Proof of Income: Include recent pay stubs or tax documents to verify your earnings. This information helps determine the assistance amount. For 2025, covered workers are entitled to 50% of their average weekly wage for the last eight weeks worked, with a maximum benefit of $170 per week.

- Employer Verification: Your employer may need to complete a section of the form to confirm your employment status and job duties. This ensures that all information aligns with your submission.

- Personal Identification: Don’t forget to provide a copy of your ID or Social Security number to verify your identity.

Having these documents organized and ready can really streamline the application process and significantly increase your chances of approval. Remember, submitting all necessary forms is essential to avoid denial, as claims with complete documentation are more likely to be approved. Also, keep in mind that benefits start on the eighth consecutive day of incapacity, so understanding this waiting period is important.

At Turnout, our trained nonlawyer advocates are here to assist you in navigating these requirements effectively. You are not alone in this journey.

Submit Your Application for STD Benefits

To successfully submit your application for short-term disability (STD) benefits, we’re here to guide you through these essential steps:

-

Review Your Application: We understand that this process can be overwhelming. Ensure all forms and documents are accurate and complete. Mistakes can lead to delays or denials, and we want to help you avoid that.

-

Choose Your Submission Method: Starting July 1, 2025, employees must apply directly to The Hartford for std limited short-term disability requests. Depending on your employer or insurance provider, you may submit your application online, by mail, or in person. Please adhere to the specific instructions provided to avoid complications.

-

Keep Copies: It’s always a good idea to make copies of all submitted documents for your records. This will be invaluable if you need to reference your submission later.

-

Follow Up: After submission, confirm receipt of your application with your employer or insurance company. This can generally be accomplished via a phone call or email, ensuring that your request is in process.

Prompt and precise submission is essential. Research indicates that requests submitted correctly on the first attempt can greatly decrease processing durations, which are typically std limited to several weeks. As one insurance expert observes, 'A well-prepared application can significantly impact the speed of your request.' Moreover, expedited applications and simplified procedures may further improve the effectiveness of requests for individuals with significant impairments. By adhering to these steps, you can improve your likelihood of a seamless and effective reimbursement process. Remember, you are not alone in this journey; we’re here to help.

Troubleshoot Common Application Issues

Even with thorough preparation, we understand that applicants may encounter difficulties during the std limited application process. Here are some common issues and effective troubleshooting strategies to help you navigate this journey:

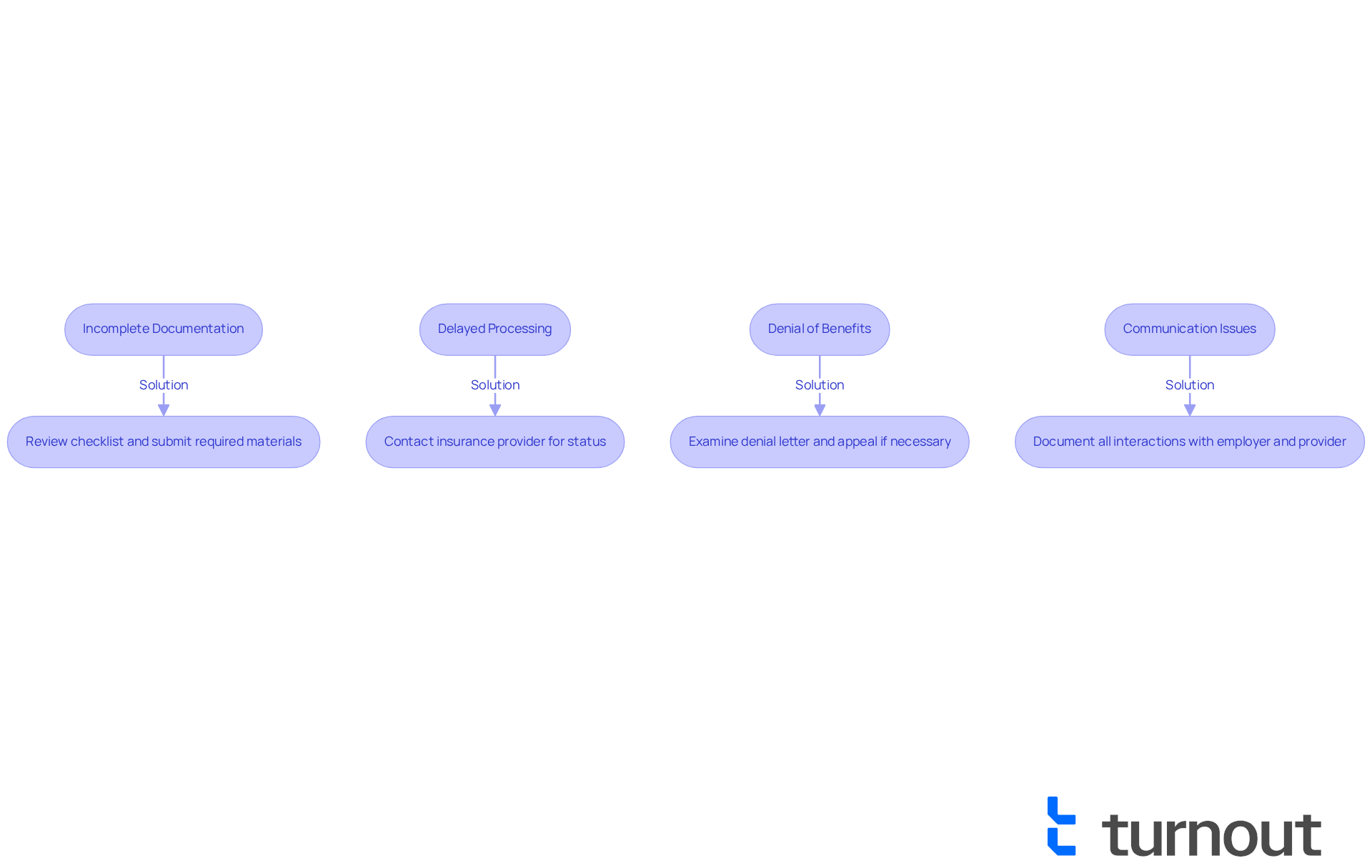

- Incomplete Documentation: If your application is returned due to missing documents, promptly review the checklist provided by your insurance provider and submit the required materials. Ensuring all necessary documentation is included can significantly reduce delays. Remember, we’re here to help you through this.

- Delayed Processing: It’s common to feel anxious if you haven’t received a response within the expected timeframe. In such cases, it’s crucial to contact your insurance provider to ask about the status of your request. Many claims can take longer than expected, so proactive follow-up is essential.

- Denial of Benefits: If your request is denied, carefully examine the denial letter for specific reasons. Common reasons for denial include insufficient medical evidence or failure to meet non-medical requirements. You may have the option to appeal the decision by submitting additional documentation or clarifying your situation. Remember, you are not alone in this process.

- Communication Issues: Maintaining open lines of communication with both your employer and insurance provider is vital. Document all interactions, including dates and details, to create a clear record that can assist in resolving any misunderstandings. We understand that clear communication can make a significant difference.

By being proactive and informed, you can navigate these challenges more effectively and improve your chances of a successful claim. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the complexities surrounding short-term disability (STD) benefits can feel overwhelming, especially when facing temporary health challenges. We’re here to help you navigate this journey. This guide has illuminated the path to accessing these essential financial resources, highlighting the importance of knowing eligibility requirements, required documentation, and common troubleshooting strategies. By grasping these elements, you can approach the process with confidence and clarity.

Key insights discussed include:

- The varying availability of STD benefits across states

- The critical role of medical documentation

- The necessity of meticulous application preparation

It’s common to feel uncertain about what’s needed. The guide also highlighted common pitfalls, such as incomplete documentation and delayed processing, while providing actionable steps to mitigate these issues. This comprehensive approach ensures that you are well-equipped to navigate the application process effectively.

The significance of short-term disability benefits cannot be overstated. They serve as a vital safety net during unforeseen medical situations. By taking the time to understand the intricacies of STD coverage and preparing adequately, you can secure the support you need to maintain financial stability during challenging times. Remember, empowerment through knowledge is key. Seize the opportunity to safeguard your financial future by exploring your options and taking proactive steps in your application journey. You are not alone in this process.

Frequently Asked Questions

What are short-term disability (STD) benefits?

Short-term disability benefits provide financial support for individuals facing temporary challenges due to non-work-related illnesses or injuries, typically replacing 40-70% of their base salary for a duration that can range from a few weeks to several months.

What conditions qualify for STD benefits?

Conditions that may qualify for STD benefits include recovery from surgery, severe illness, complications from pregnancy, musculoskeletal issues, and digestive problems.

How does short-term disability differ from long-term disability?

Short-term disability benefits are designed for temporary situations, while long-term disability benefits provide support for extended periods of inability to work, often due to more serious or chronic conditions.

What are the eligibility requirements for STD benefits?

To qualify for STD benefits, applicants generally need to be full-time employees, have been employed for a minimum duration (often around 90 days), provide medical documentation of their condition, and may need to wait 7 to 14 days before benefits begin.

Do all employers provide STD benefits?

No, only five states require employers to provide coverage for temporary incapacity, and about 40% of workers have access to temporary coverage through their employers.

What documentation is needed to apply for STD benefits?

Applicants typically need medical documentation from a healthcare provider that proves their inability to perform job duties due to their condition.

Are there any exclusions in STD policies?

Yes, most policies exclude pre-existing conditions that were diagnosed within six months before coverage begins.

How much does income protection insurance cost on average?

The average annual cost of income protection insurance is around $2,200.

Is temporary disability assistance federally mandated?

No, temporary disability assistance is not federally mandated, but some states, like New York and California, require employers to offer temporary injury insurance.

Who can assist with the application process for STD benefits?

Trained nonlawyer advocates, such as those from Turnout, can help applicants navigate the process, understand the requirements, and prepare the necessary documentation for a successful application.