Introduction

Navigating the complexities of Supplemental Security Income (SSI) can feel overwhelming, especially when it comes to understanding how car ownership impacts your eligibility. We understand that the SSI car value limit is set at $2,000 for individuals and $3,000 for couples, and many beneficiaries worry about losing vital support due to what might seem like harmless vehicle assets.

This article aims to provide essential insights and guidelines surrounding SSI car ownership. We want to offer clarity on how you can maintain your eligibility while still managing your transportation needs. What challenges might arise if you exceed these limits? And how can you safeguard your benefits amidst the intricacies of vehicle ownership? You're not alone in this journey, and we're here to help.

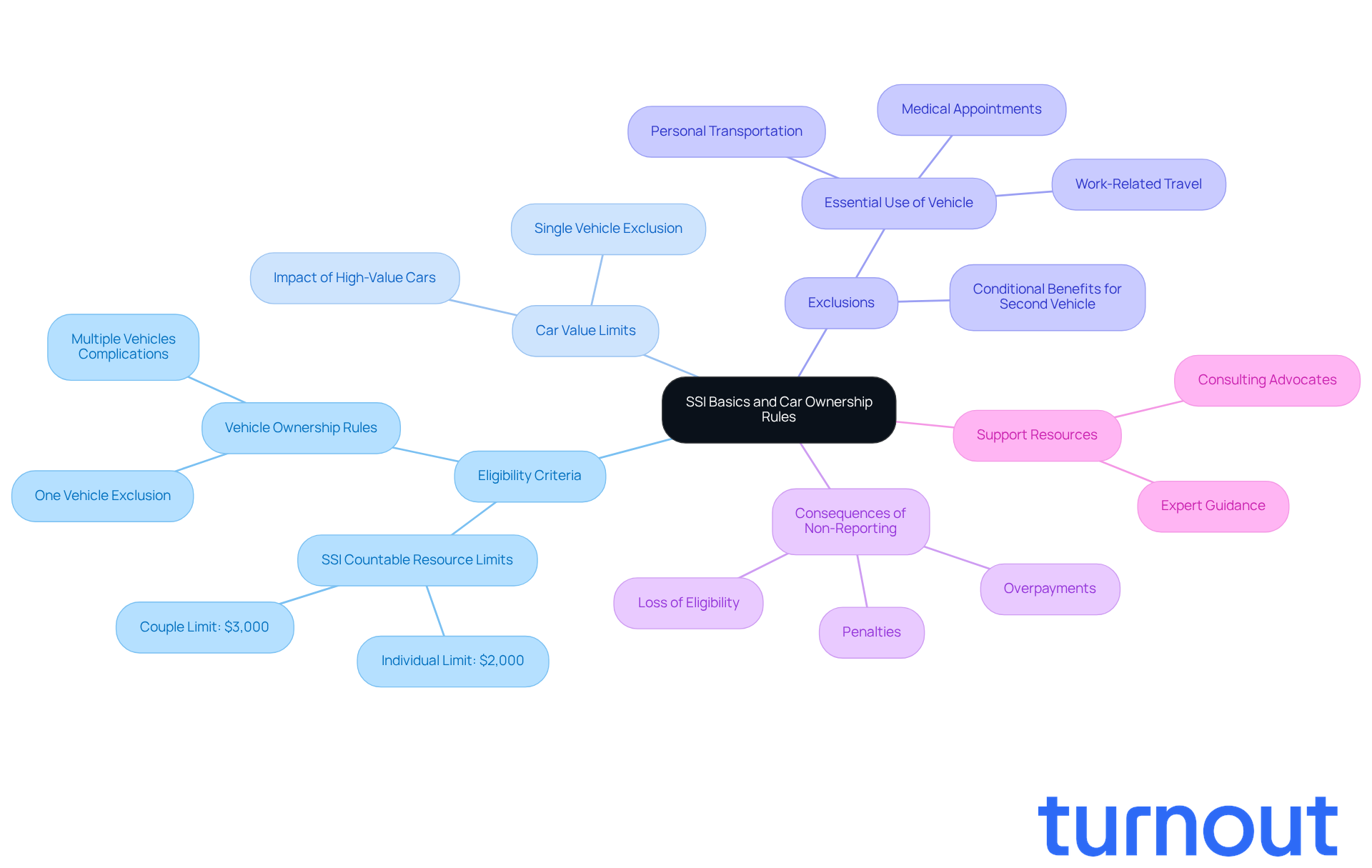

Clarify SSI Basics and Car Ownership Rules

Supplemental Security Income (SSI) is a federal initiative designed to support individuals with limited income and assets, especially those with disabilities. We understand that navigating these regulations can be overwhelming. A crucial aspect of SSI eligibility is the SSI car value limit, which is set at $2,000 for individuals and $3,000 for couples.

It's important to know that the Social Security Administration (SSA) allows certain exclusions, including one mode of transport per household, regardless of its value, as long as it’s used for transportation by the recipient or a household member. This means owning a single car won’t affect your SSI eligibility. However, complications can arise if you have multiple cars, as the second vehicle may be counted as an asset, which could impact your benefits due to the SSI car value limit.

Individuals receiving SSI can have one mode of transportation without it counting against the SSI car value limit, as long as it serves essential purposes like personal transportation, medical appointments, or work-related travel. We understand that changes in car ownership-like buying, selling, or receiving a vehicle-can be tricky. Failing to report these changes can lead to significant repercussions, including overpayments and penalties.

As of 2026, there are approximately 8 million SSI recipients in the United States, many of whom may not realize how car ownership impacts their benefits. We’re here to help simplify access to these complex regulations and offer expert guidance through our tools and services. Our goal is to ensure you can navigate the intricacies of ownership while maintaining your eligibility for benefits. Experts emphasize the importance of understanding these rules, noting that consulting with knowledgeable advocates can help you avoid costly mistakes.

In summary, while having a car doesn’t automatically disqualify you from receiving SSI benefits, it’s essential to navigate the complexities of ownership and reporting requirements to maintain your eligibility. Remember, you are not alone in this journey; we’re here to support you.

Explore SSI Car Value Limits and Eligibility Impact

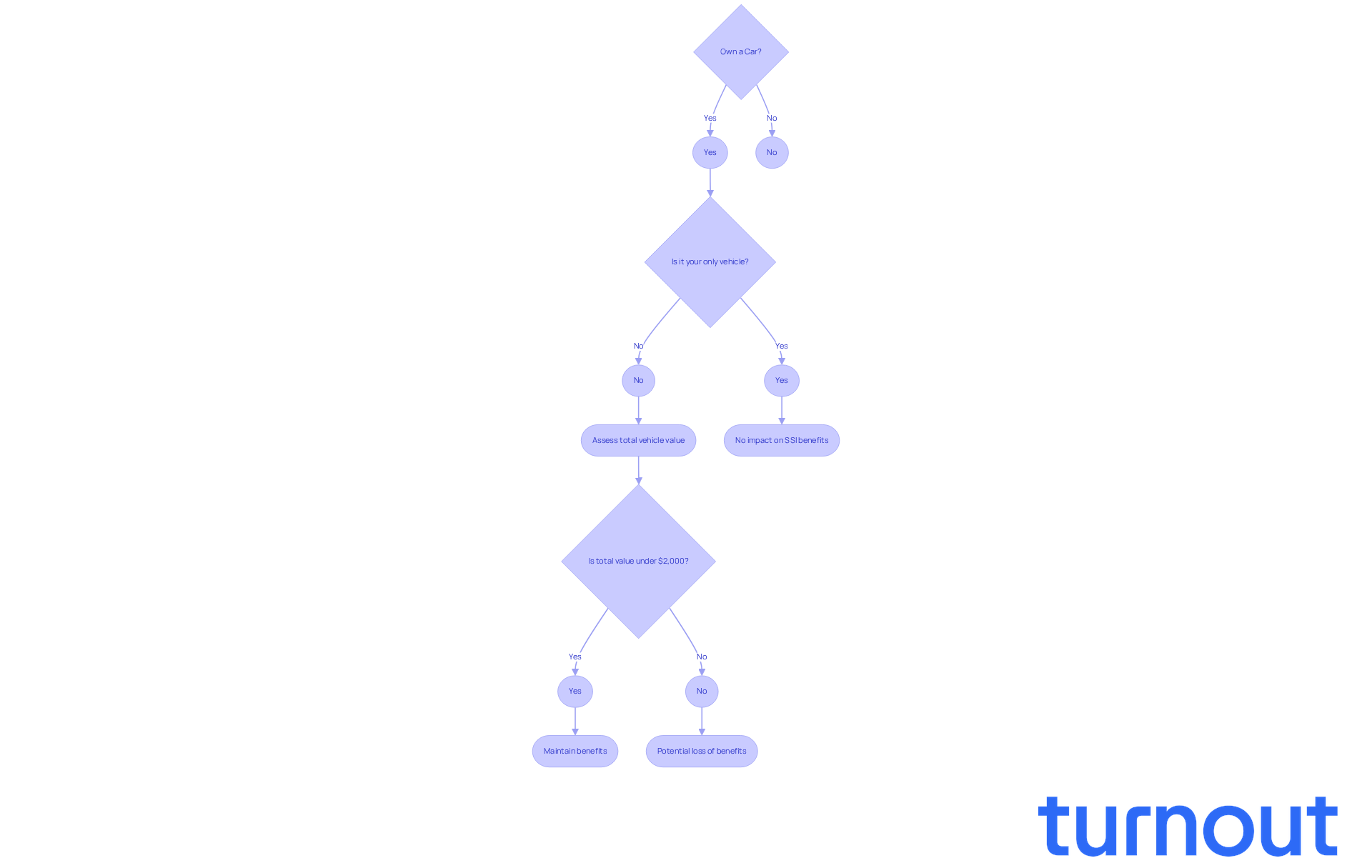

Navigating the world of Social Security benefits can be challenging, especially when it comes to managing assets like automobiles. The Social Security Administration (SSA) allows SSI beneficiaries to own one car without it affecting their SSI car value limit. This means that your primary vehicle holds no value restriction, which is a relief for many. If you receive your first car as a gift, it won’t count against your assets either. However, the SSI car value limit can complicate your eligibility when owning multiple vehicles. For instance, if you have a car valued at $25,000, you may still qualify for SSI benefits. However, if you also own a second vehicle worth $5,000, your total countable assets would exceed the SSI car value limit of $2,000 for individuals, putting your benefits at risk. This situation underscores the importance of managing car ownership wisely.

It’s important to understand that while one mode of transport can be excluded from calculations, any additional vehicles will impact your SSI car value limit. If you find yourself with a second vehicle, the SSA will assess its value, and if it surpasses the SSI car value limit, it could lead to a loss of benefits. Thankfully, the SSA provides conditional payments for up to three months while you sell an excess asset, which can be a helpful option if you need to part with a car to maintain your eligibility. Financial advisors often emphasize the importance of understanding these regulations, as mismanaging your vehicle ownership can lead to unexpected consequences, including interruptions in your benefits.

Real-life experiences show that SSI beneficiaries who navigate the complexities of owning multiple cars often realize they need to sell one to keep their benefits intact. The SSA's guidelines are straightforward: only one vehicle can be excluded under the SSI car value limit, and any additional vehicles must be reported and evaluated. Knowing the current market value (CMV) of your cars is crucial, as it helps you understand how your assets are appraised. Therefore, it’s vital for beneficiaries to stay informed and proactive about managing their assets. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

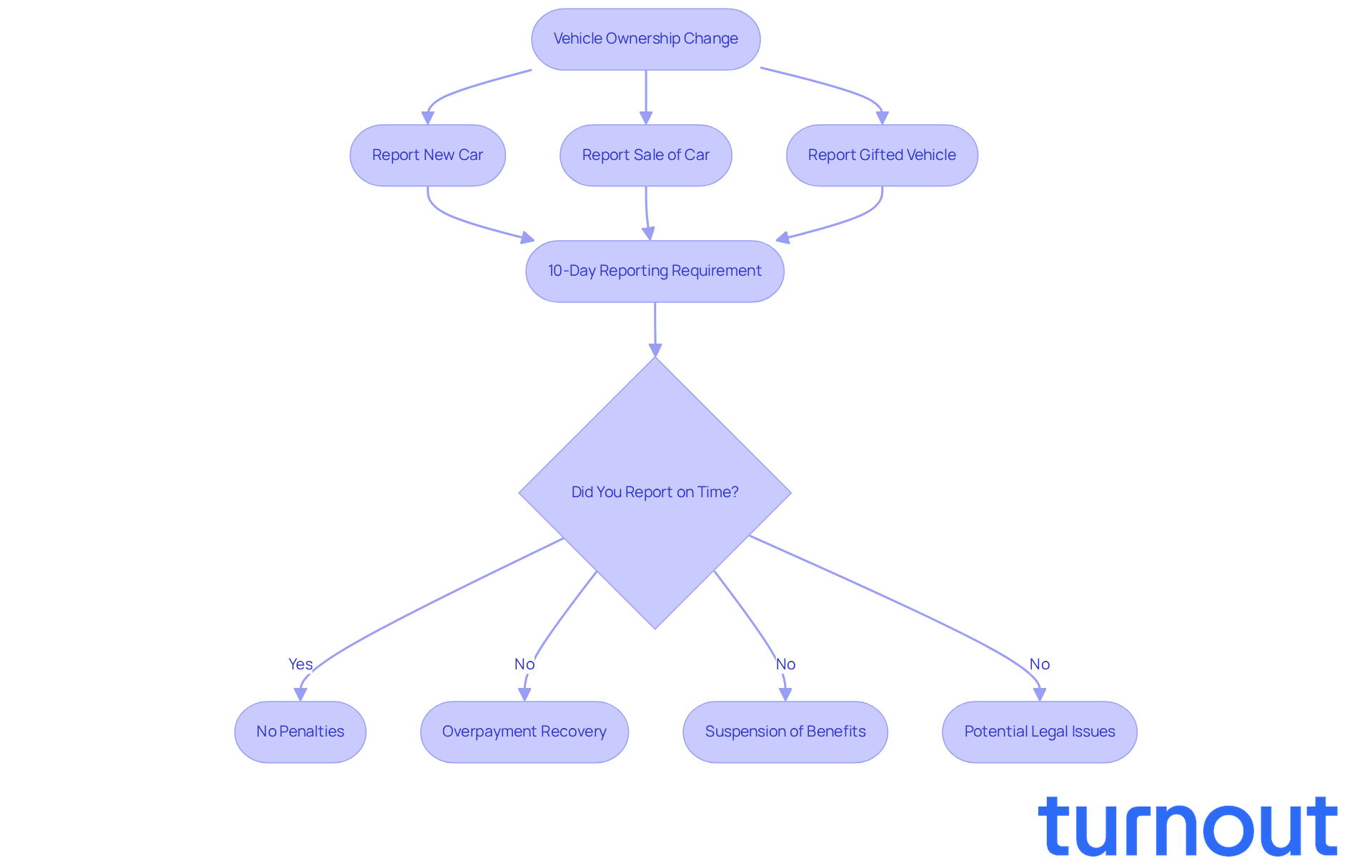

Understand Reporting Requirements for Vehicle Ownership

If you're receiving SSI, it's really important to let the Social Security Administration (SSA) know about any changes regarding your car ownership. This includes things like getting a new car, selling your current one, or even receiving a vehicle as a gift. The SSA asks that you report these changes within 10 days. Not doing so can lead to serious issues, such as overpayments that the SSA might try to recover or even a suspension of your benefits.

We understand that navigating these requirements can feel overwhelming. As Daniel A. Bridgman points out, "Failure to report changes can result in fines, sanctions including up to six months loss of benefits, and potentially prison time, with repeat violations leading to longer benefit denials." Keeping accurate records of your car transactions and communicating promptly with the SSA is crucial for staying compliant.

For instance, SSI beneficiaries who have reported changes in their automobile ownership have successfully avoided penalties by following these guidelines. Remember, while the main vehicle you own is not counted towards the SSI car value limit, any additional vehicles must be reported to prevent complications with your benefits. The SSA does not impose a value limit on your primary automobile, so you can rest easy knowing that your main mode of transport is safe.

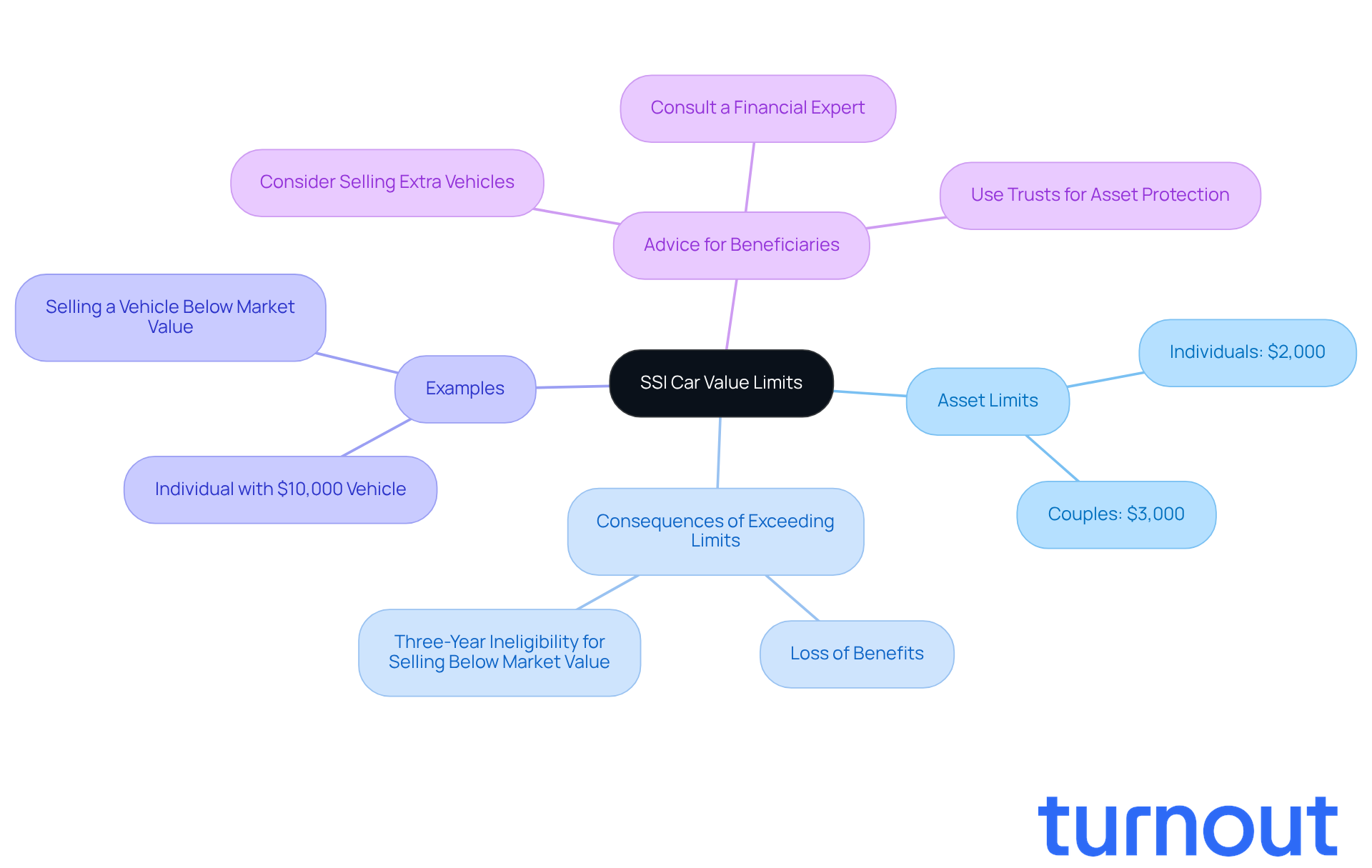

Assess Risks of Exceeding SSI Car Value Limits

Exceeding the ssi car value limit can lead to serious challenges for beneficiaries. We understand that navigating these rules can be overwhelming. Currently, the asset limit for Supplemental Security Income (SSI) stands at $2,000 for individuals and $3,000 for couples - a figure that hasn’t budged since 1989. If you own more than one vehicle or if the total value of your vehicles exceeds the ssi car value limit, you risk losing your benefits.

For example, imagine an individual with a vehicle valued at $10,000 and a second car worth $3,000. That totals $13,000 in countable assets, which is above the ssi car value limit. This situation could lead to a suspension of benefits until the individual reduces their assets to comply with SSI regulations. To avoid such risks, consider selling any extra automobiles or placing them in a trust. This can help protect your SSI eligibility.

It’s also crucial to know that the Social Security Administration (SSA) allows one mode of transport to be excluded from resource calculations, as long as it’s used for transportation. This means that having one car won’t affect your SSI eligibility, but any additional vehicles must be managed carefully to avoid disqualification.

Real-world examples highlight the importance of this knowledge. Some beneficiaries have lost their benefits simply because the value of their second automobile exceeded the ssi car value limit. Additionally, selling a vehicle below market value can result in ineligibility for SSI for up to three years. Consulting with a financial expert can provide valuable insights into the implications of exceeding SSI resource limits and help you navigate the complexities of car ownership while receiving benefits.

As attorney Sarah Aitchison wisely notes, "If you sell a vehicle for less than its market value, you could end up being deemed ineligible for SSI for up to three years." Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding the complexities of Supplemental Security Income (SSI) and its car ownership rules is essential for beneficiaries who want to keep their benefits. We know that navigating these regulations can be overwhelming. The good news is that you can own one vehicle without it affecting your SSI eligibility. However, if you have additional vehicles, it’s important to manage them carefully to avoid exceeding asset limits that could put your financial support at risk.

It’s crucial to report any changes in vehicle ownership to the Social Security Administration (SSA). Not doing so can lead to serious consequences. Remember, the SSI car value limit is $2,000 for individuals and $3,000 for couples. Consulting with knowledgeable advocates can help you understand these regulations better and steer clear of costly mistakes.

Ultimately, navigating SSI and car ownership is vital for maintaining your eligibility for benefits. We encourage you to stay informed about your rights and responsibilities. Timely reporting of any changes in vehicle ownership is key. By taking these steps, you can protect your benefits and enjoy the freedom that comes with owning a vehicle. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a federal initiative designed to support individuals with limited income and assets, particularly those with disabilities.

What is the SSI car value limit?

The SSI car value limit is set at $2,000 for individuals and $3,000 for couples.

Can I own a car and still be eligible for SSI benefits?

Yes, you can own one mode of transportation without it affecting your SSI eligibility, as long as it is used for essential purposes like personal transportation, medical appointments, or work-related travel.

What happens if I own multiple cars?

If you own multiple cars, the second vehicle may be counted as an asset, which could impact your benefits due to the SSI car value limit.

Are there any exclusions regarding vehicle ownership for SSI recipients?

Yes, the Social Security Administration (SSA) allows one mode of transport per household, regardless of its value, as long as it is used for transportation by the recipient or a household member.

What should I do if I buy, sell, or receive a vehicle while on SSI?

It is important to report any changes in car ownership, as failing to do so can lead to significant repercussions, including overpayments and penalties.

How many SSI recipients are there in the United States as of 2026?

As of 2026, there are approximately 8 million SSI recipients in the United States.

Why is it important to understand the car ownership rules related to SSI?

Understanding these rules is crucial to avoid costly mistakes and maintain eligibility for benefits, and consulting knowledgeable advocates can provide valuable guidance.