Introduction

Navigating the complexities of social security benefits can feel overwhelming, especially for widows facing the emotional and financial challenges that come with losing a partner. We understand that this is a difficult time, and knowing about the various benefits available can provide essential support. It’s not just about immediate assistance; it’s about empowering you to secure your financial future.

Many widows often find themselves wondering about their eligibility, the necessary documentation, or how to make the most of their benefits. It’s common to feel uncertain in this situation. That’s why we’re here to help. This guide outlines five essential steps designed to help you confidently navigate the social security system and access the support you rightfully deserve.

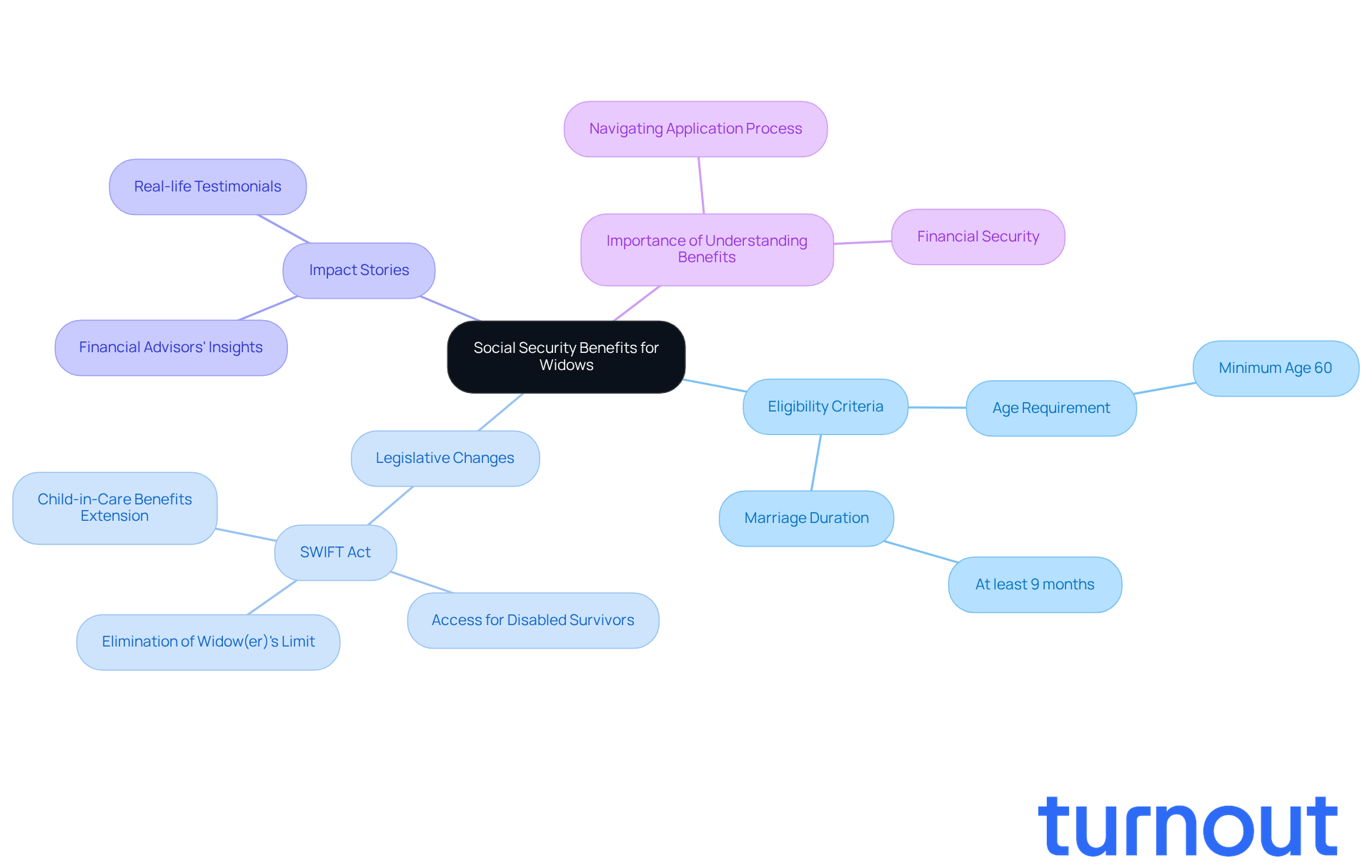

Understand Social Security Benefits for Widows

Survivor assistance from the government offers vital financial support to families who have lost loved ones. If you’re a widow, you might be eligible for social security for widows, particularly if your partner contributed to the public assistance system through their job. These benefits include monthly payments based on your partner's income, which can significantly ease financial burdens during such a difficult time. In 2026, it’s expected that around 2.5 million widows will benefit from social security for widows, highlighting how crucial this program is for providing economic stability.

To qualify for full death benefits, you need to be at least 60 years old and have been married for at least nine months before your spouse passed away. Additionally, the Surviving Widow(er) Income Fair Treatment (SWIFT) Act aims to update these rules, allowing widowed and surviving divorced spouses with disabilities to access full death-related payments at any age. This change is designed to improve access to financial support.

Real-life stories show just how impactful these benefits can be. Many widows have shared that social security for widows has been a lifeline, helping them maintain their households and cover essential expenses. Financial advisors stress the importance of understanding these benefits, as they can provide a crucial safety net for those navigating the challenges of loss and financial uncertainty. Familiarizing yourself with these details can empower you to navigate the application process more effectively and secure the support you deserve. Remember, you’re not alone in this journey; we’re here to help.

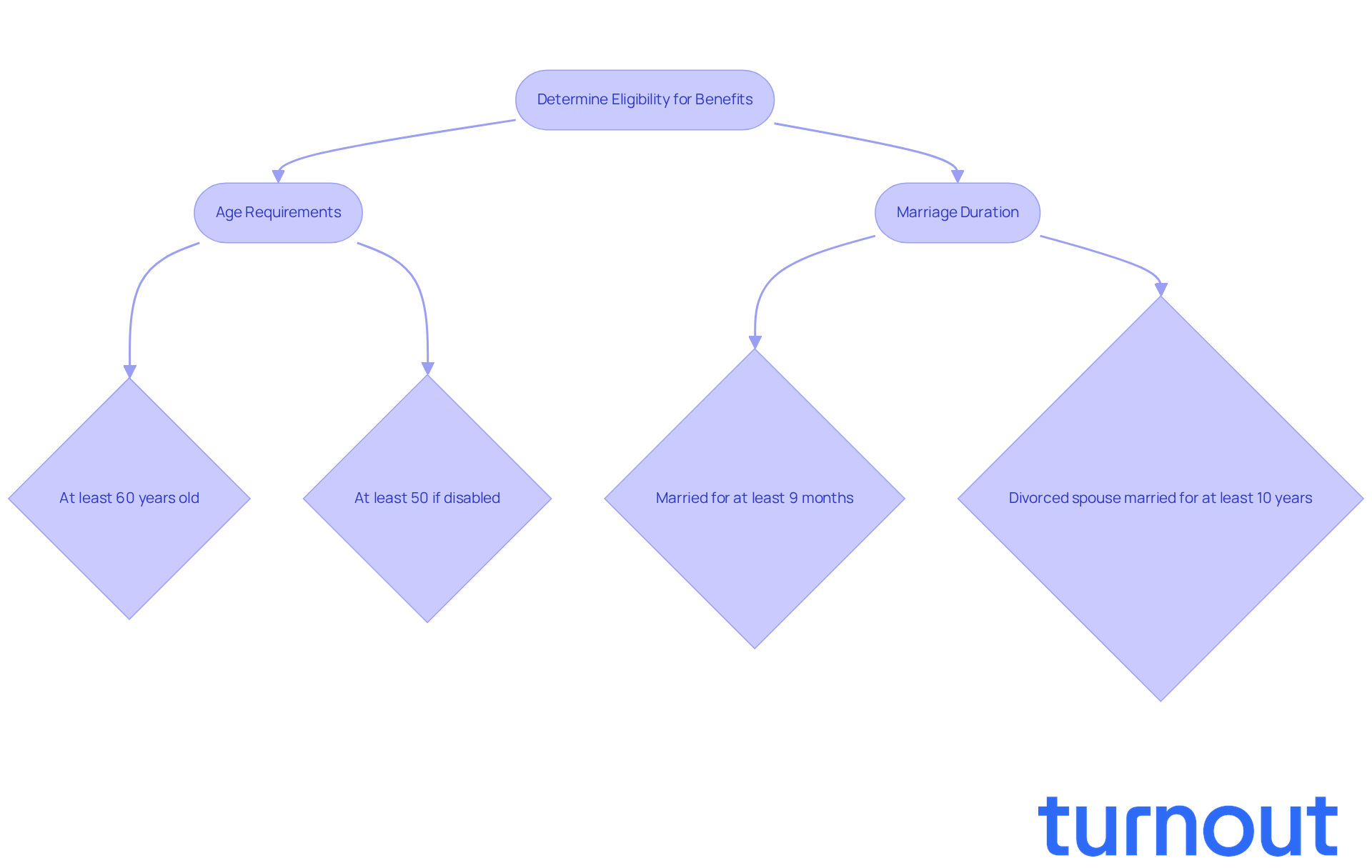

Determine Eligibility Requirements for Benefits

Losing a loved one is incredibly challenging, and navigating the assistance process can feel overwhelming. To qualify for support after such a loss, there are specific eligibility criteria you need to meet. Generally, you must be at least 60 years old, or 50 if you are disabled. Additionally, you should have been married to the deceased for at least nine months. If your spouse was a divorced worker, you may still qualify if your marriage lasted at least ten years.

It's essential to verify these requirements against your unique circumstances. For instance, if your partner had a substantial employment history with the Administration, you might be eligible for a larger payment amount. We understand that this can be a lot to process, and that’s where Turnout can help. They provide access to trained nonlawyer advocates who can guide you through these complex eligibility criteria, ensuring you understand your options without needing legal representation.

Please remember, Turnout is not a law firm and does not provide legal advice. Alongside government death assistance, they also offer help with tax debt relief, ensuring a comprehensive approach to your financial needs. By reviewing the eligibility criteria thoroughly, you can take the next steps with confidence. You're not alone in this journey; we're here to help.

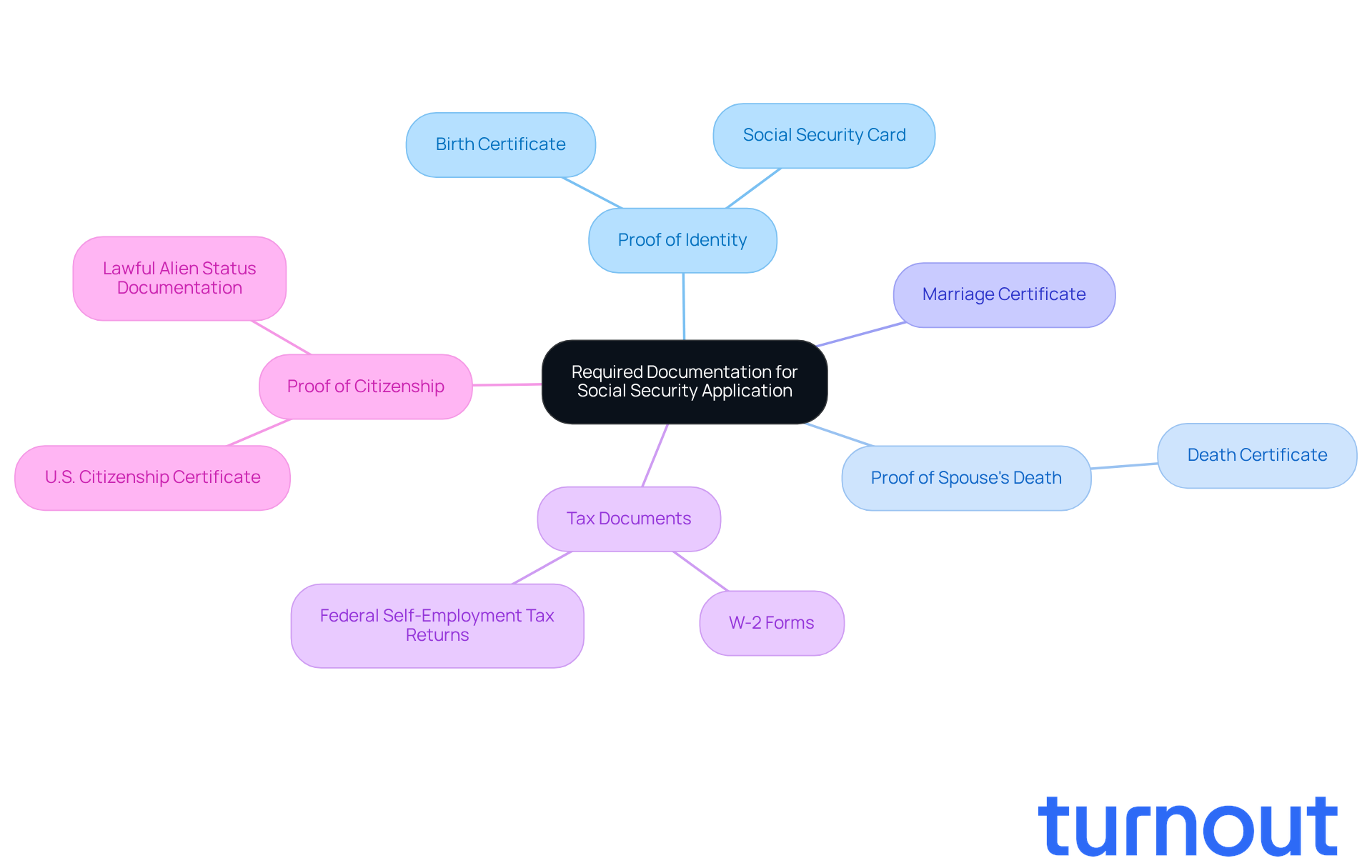

Gather Required Documentation for Application

When applying for social security for widows, we understand that gathering the necessary documents can feel overwhelming. Here’s a helpful list to guide you:

- Proof of identity, such as a birth certificate or Social Security card.

- Proof of your spouse's death, typically a death certificate.

- Marriage certificate to confirm your relationship.

- Relevant tax documents, including W-2 forms or federal self-employment tax returns for the most recent year.

- Proof of U.S. citizenship or lawful alien status, if applicable.

It’s important to note that original documents are required for most items. Having these documents organized in advance can significantly streamline your application process and help avoid potential delays. Statistics show that missing documentation can lead to extended processing times, with claims potentially taking weeks longer to process.

We want you to know that having the required documents not only speeds up your application but also ensures you can obtain your entitlements without unnecessary difficulties. If you’re unsure about which advantages to pursue first, consulting the Administration of Services (SSA) can provide valuable advice, helping you make informed choices. Remember, you are not alone in this journey; we’re here to help.

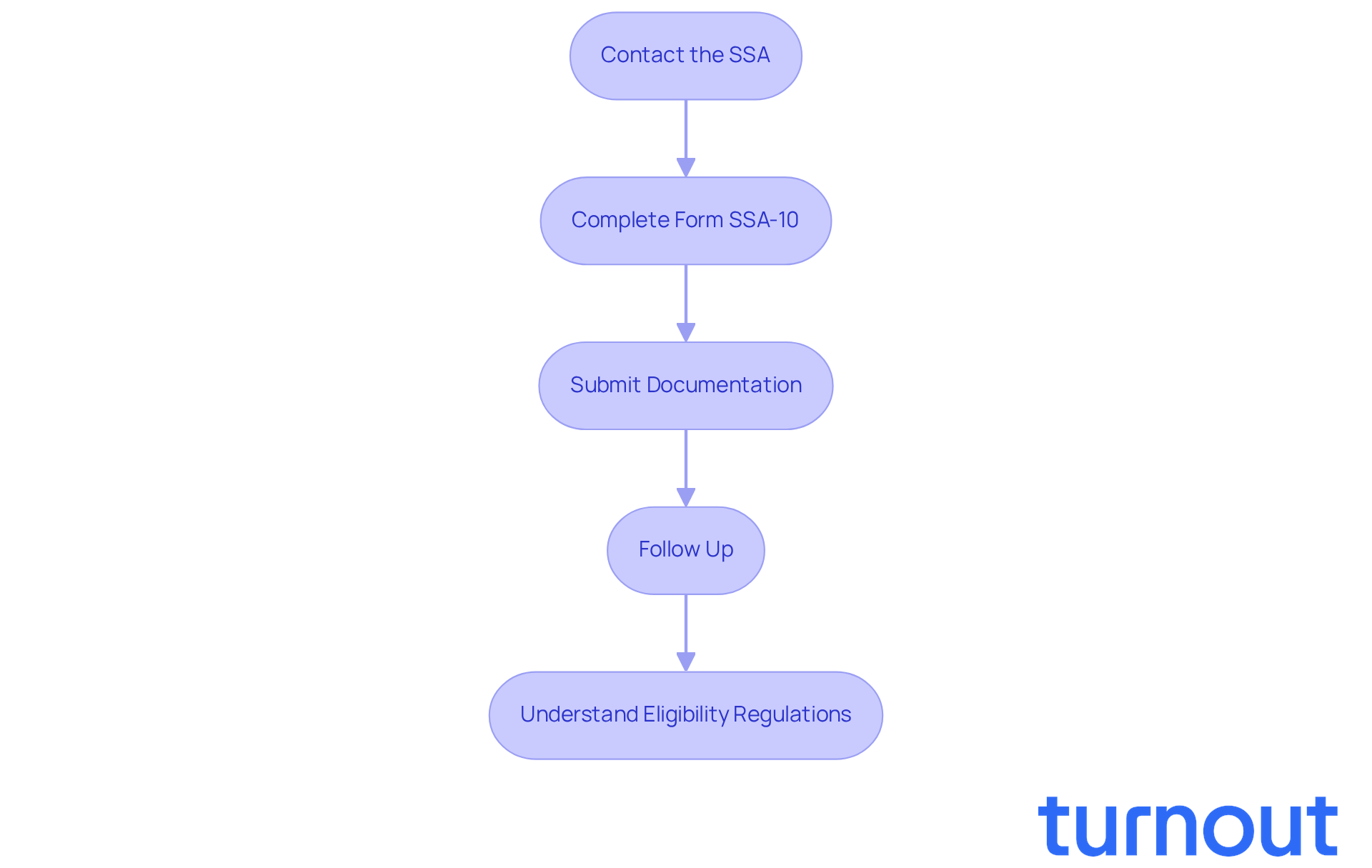

Complete the Application Process for Benefits

Navigating the application for Social Security survivor benefits can feel overwhelming, but you’re not alone in this journey. Here are some essential steps to guide you through the process:

-

Contact the Social Security Administration (SSA): Start by reaching out to the SSA at 1-800-772-1213 or visiting your local office. Remember, applications for survivor assistance can’t be submitted online, so it’s important to connect with them directly.

-

Complete Form SSA-10: This form is specifically for social security for widows or widowers' insurance payments. Make sure all your information is accurate and complete to avoid any delays in processing your application.

-

Submit your documentation: Gather the necessary documents, including your deceased partner's identification number, marriage certificate, and death certificate. It’s a good idea to bring both the original documents and copies, as the SSA may need to verify them.

-

Follow up: After you’ve submitted your application, keep a close eye on your case status. The SSA might reach out for additional information, so be ready to respond promptly. By diligently completing these steps, you can help ensure your application is processed efficiently.

Every year, thousands of requests for survivor assistance are submitted, highlighting the importance of understanding this process. It’s common to feel uncertain about eligibility regulations, especially if you have varied employment histories or complex marital situations. If you plan to work while receiving social security for widows, be aware of the earnings test that could affect your assistance.

By following these steps and utilizing SSA resources, you can navigate the complexities of the SSA with greater confidence and clarity. Remember, we’re here to help you every step of the way.

Maximize Your Social Security Benefits

Maximizing your social security for widows benefits is crucial for your financial well-being. Here are some caring strategies to consider:

- Delay your claim: If you can, wait until you reach your full retirement age to claim benefits. This decision can significantly increase your monthly payment, as advantages accumulate for each year you postpone, up to age 70. We understand that delaying your claim might feel challenging, but it can lead to a more secure financial future, particularly regarding social security for widows.

- Coordinate with your own advantages: If you qualify for your own retirement entitlements, take a moment to evaluate which option offers the highest payout. You might find it beneficial to take your own advantages first and switch to survivor payments later, particularly if your own advantages are lower. This choice can provide you with more financial flexibility.

- Stay informed about changes: Regulations regarding social insurance can change, and it’s essential to stay updated on any modifications that may affect your entitlements. For instance, understanding how the anticipated 2.6% cost-of-living adjustment (COLA) for 2026 impacts your advantages can help you plan better. While this adjustment may seem modest, it can accumulate significantly over time, influencing your overall retirement income.

- Consider tax implications: It’s important to be aware that up to 85% of your Social Security benefits may be taxed, depending on your other income. This could push you into a higher tax bracket, so factoring this into your financial planning is essential.

By implementing these strategies, you can ensure that you receive the maximum financial support available to you. Remember, enhancing your economic security during retirement is within your reach, and we're here to help you every step of the way.

Conclusion

Navigating the complexities of Social Security benefits for widows can feel overwhelming, especially after the loss of a spouse. We understand that this is a crucial step toward securing financial stability during such a challenging time. By familiarizing yourself with eligibility requirements, gathering necessary documentation, and completing the application process, you can significantly impact the support available to you. Empowering yourself with this knowledge is essential to accessing the benefits you deserve.

Throughout this guide, we've shared key insights that can help you on this journey. Knowing the eligibility criteria, understanding the types of documents required, and exploring strategies for maximizing your benefits are all vital steps. Real-life stories highlight the profound impact these benefits can have on individuals facing financial uncertainty. Engaging with resources like the Social Security Administration and organizations that offer guidance can further enhance your application experience.

Remember, you don’t have to face this journey alone. By taking proactive steps and staying informed, you can navigate this process with confidence. The financial support available can provide a much-needed safety net, allowing you to focus on healing and rebuilding your life. We're here to help you every step of the way.

Frequently Asked Questions

What is social security for widows?

Social security for widows provides financial support to families who have lost loved ones, offering monthly payments based on the deceased partner's income, which can help ease financial burdens during difficult times.

Who is eligible for social security benefits for widows?

To qualify for full death benefits, you must be at least 60 years old and have been married for at least nine months before your spouse's passing. If you are disabled, you can qualify at age 50. Additionally, if your spouse was a divorced worker, you may still qualify if your marriage lasted at least ten years.

What is the Surviving Widow(er) Income Fair Treatment (SWIFT) Act?

The SWIFT Act aims to update eligibility rules, allowing widowed and surviving divorced spouses with disabilities to access full death-related payments at any age, improving access to financial support.

How many widows are expected to benefit from social security by 2026?

It is expected that around 2.5 million widows will benefit from social security for widows in 2026, highlighting the program's importance in providing economic stability.

How can Turnout assist with the application process for social security benefits?

Turnout provides access to trained nonlawyer advocates who can guide individuals through the complex eligibility criteria for social security benefits, helping them understand their options without needing legal representation.

What additional support does Turnout offer?

In addition to assistance with government death benefits, Turnout also offers help with tax debt relief, ensuring a comprehensive approach to financial needs.

Why is it important to understand social security benefits for widows?

Understanding these benefits can empower widows to navigate the application process effectively and secure the financial support they deserve during a challenging time.