Introduction

Navigating the complexities of Social Security Administration (SSA) benefits can feel overwhelming, especially for those in Las Vegas trying to understand their options. We understand that this journey can be daunting. This guide is here to shed light on the various benefits available, from retirement perks to disability assistance, so you can make informed decisions about your financial future.

With so many programs and eligibility criteria, it’s common to feel lost. How can you effectively maneuver through the application process and avoid common pitfalls? Rest assured, you’re not alone in this. We’re here to help you every step of the way.

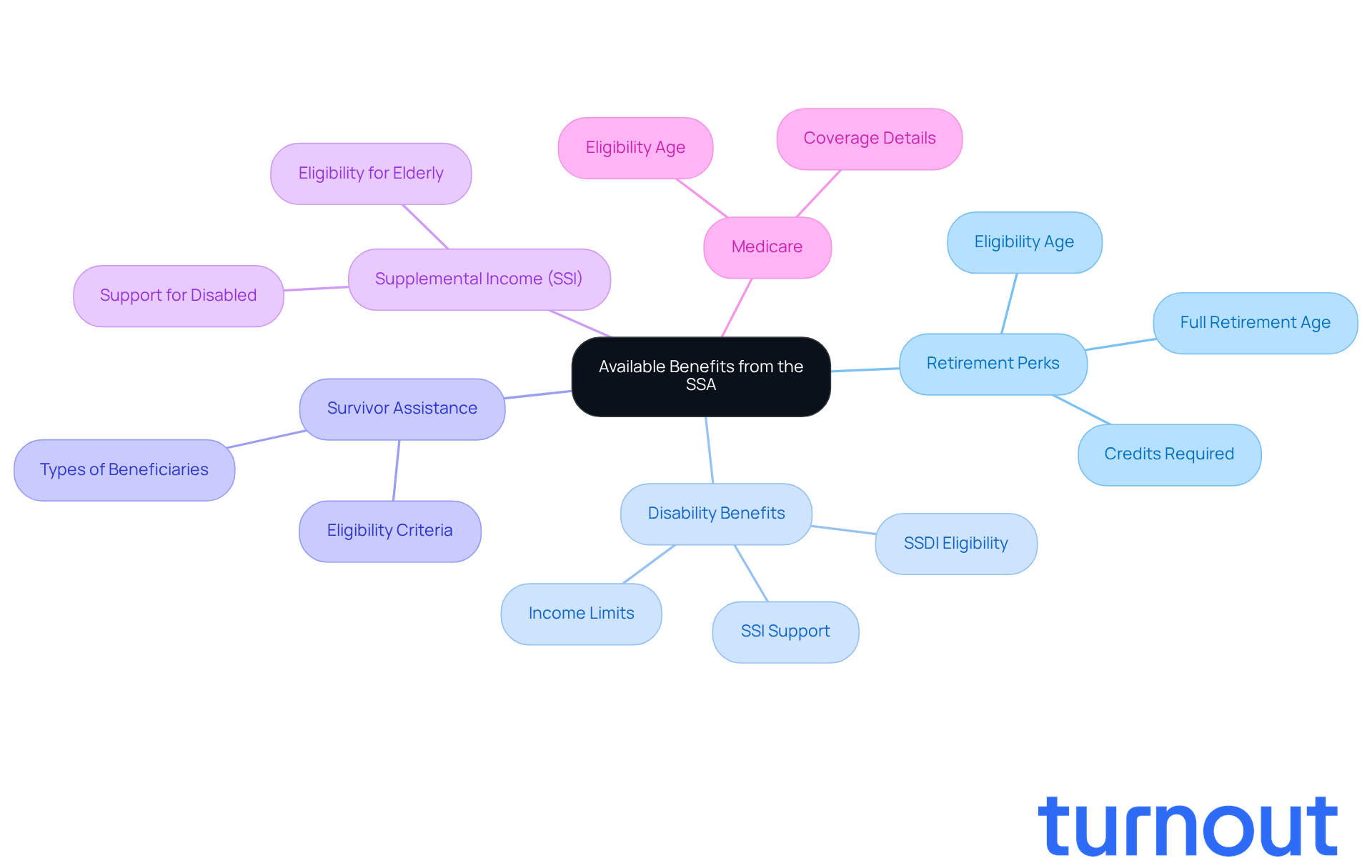

Understand Available Benefits from the Social Security Administration

Navigating the Social Security Administration (SSA) can feel overwhelming, but understanding the benefits available can make a significant difference in your journey. Let’s explore these options together:

-

Retirement Perks: If you’ve worked and contributed to the social program for enough years, you can claim retirement perks as early as age 62. However, full benefits are available at your full retirement age, which varies between 66 and 67 based on your birth year. It’s important to know your options so you can plan accordingly.

-

Disability Benefits: If a medical condition is preventing you from working, you might qualify for Disability Insurance (SSDI) or Supplemental Income (SSI). SSDI is for those who have contributed to Social Insurance, while SSI is designed to support individuals with limited income and resources. Remember, you’re not alone in this; help is available.

-

Survivor Assistance: Losing a loved one is incredibly difficult, and if they earned sufficient credits, you may be eligible for survivor assistance. This support extends to widows, widowers, and dependent children, providing crucial financial help during such challenging times.

-

Supplemental Income (SSI): This program offers financial aid to elderly individuals, those who are visually impaired, or disabled, ensuring a basic level of support for those in need. It’s a lifeline for many, and we’re here to help you understand it.

-

Medicare: While not a direct benefit, Medicare is essential health insurance for individuals aged 65 and older, as well as some younger individuals with disabilities. It helps cover medical expenses, easing some of the financial burdens.

By 2026, around 75 million Americans will rely on assistance programs, including SSDI, which is expected to support millions of disabled individuals. Understanding these benefits is crucial for assessing your eligibility and navigating the application process with confidence. Remember, we’re here to help you every step of the way.

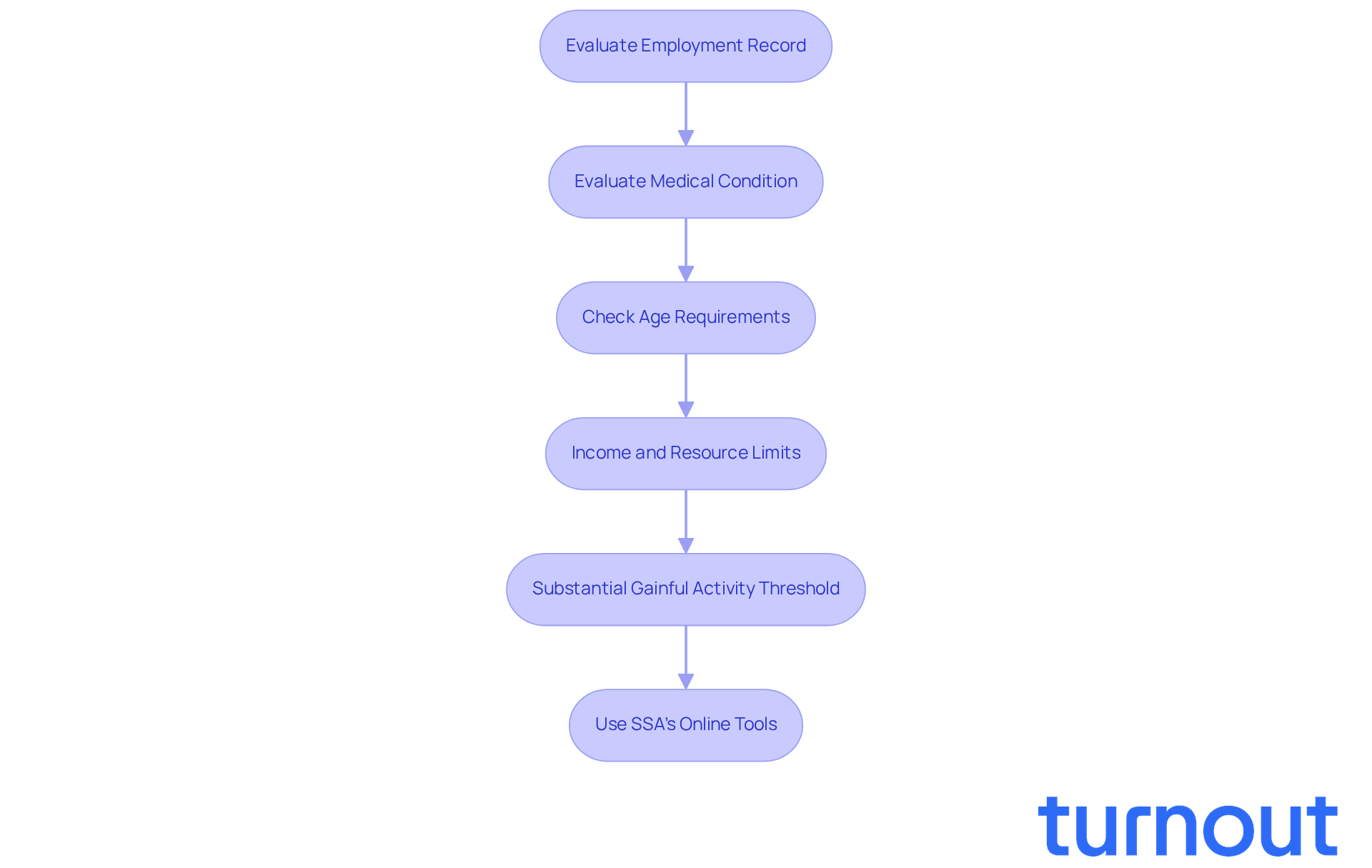

Determine Your Eligibility for Benefits

Determining your eligibility for Social Security benefits can feel overwhelming, but we're here to help you navigate this journey. Follow these steps to gain clarity:

-

Evaluate Your Employment Record: If you're looking into Disability Insurance (SSDI), it's important to know that you typically need to have worked for at least 40 credits, with 20 of those earned in the last 10 years. This work history is essential for establishing your eligibility.

-

Evaluate Your Medical Condition: Your medical condition must align with the Social Security Administration's (SSA) definition of disability. This means it should significantly limit your ability to perform basic work activities. Many claims are denied due to insufficient medical evidence, so this evaluation is crucial.

-

Check Age Requirements: You can start receiving retirement payments at age 62, but the age for full entitlements varies based on your birth year. Understanding these age limits is vital for organizing your benefits effectively.

-

Income and Resource Limits: For Supplemental Security Income (SSI), your income and resources must fall below specific limits. As of 2026, individuals should have less than $2,000 in resources, while couples must have under $3,000. Additionally, the maximum federal SSI payment for individuals will rise from $967 to $994, and couples will see their payment increase from $1,450 to $1,491. These limits ensure that assistance reaches those who truly need it.

-

Substantial Gainful Activity (SGA) Threshold: In 2026, the SGA cut-off for non-blind individuals will increase to $1,690 per month. This change allows for more income before risking the loss of benefits, providing greater financial flexibility for those considering employment while receiving disability assistance.

-

Use the SSA's Online Tools: The SSA offers helpful online tools to assess your eligibility. By visiting their website and answering a few questions, you can quickly determine if you qualify for assistance.

By carefully evaluating these factors, you can better understand your eligibility and focus on the benefits available to you. Remember, as Diane Bross emphasizes, "Monitor your earnings and work activity carefully" to stay compliant with SSA requirements. Turnout is here to simplify your access to government assistance and financial support, guiding you through the complexities of SSD claims and tax relief without needing legal representation.

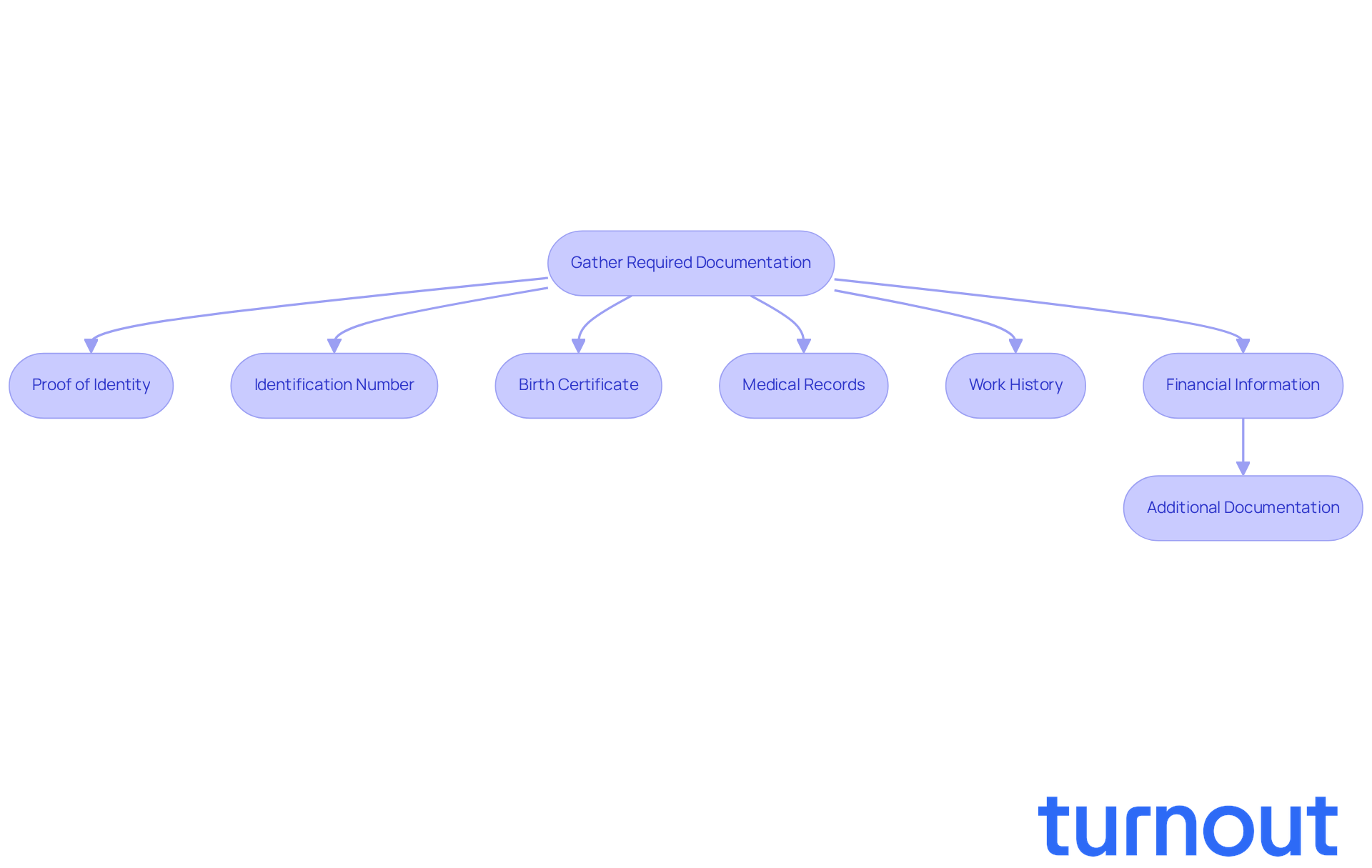

Gather Required Documentation for Your Application

Before you apply for Social Security benefits, it’s important to gather the right documentation. This preparation can make your application process smoother and less stressful. Here’s what you’ll need:

-

Proof of Identity: A government-issued photo ID, like a driver’s license or passport, is essential to establish who you are.

-

Identification Number: Your identification card or number is necessary for the application.

-

Birth Certificate: A certified copy of your birth certificate helps verify your age.

-

Medical Records: If you’re applying for disability benefits, collect comprehensive medical records that document your condition. This includes diagnoses, treatment history, and relevant test results. Don’t forget to include names and contact information for your medical providers, along with approximate treatment dates.

-

Work History: Prepare a detailed work history, listing employer names, dates of employment, and job titles. This information is crucial for determining your eligibility for Social Security Disability Insurance (SSDI).

-

Financial Information: If you’re requesting Supplemental Security Income (SSI), gather details about your income and resources. This includes bank statements, pay stubs, and tax returns. Recent changes in documentation requirements highlight the importance of accurate financial records, as the SSA may ask for proof of income from the previous tax year.

-

Additional Documentation: Depending on your situation, you might need other documents, like marriage certificates or divorce decrees if you’re applying for spousal assistance. Noncitizens who served in the U.S. Armed Forces may also need military discharge papers.

Having these documents ready not only simplifies your submission process but also significantly reduces the chances of delays. We understand that this can feel overwhelming, but advocates emphasize that prompt and organized documentation can lead to successful claims. Many applicants who prepared diligently have received their entitlements without issues. Remember, the sooner you apply after suspecting eligibility, the better your chances of receiving assistance promptly.

Additionally, consider using the Disability Starter Kits available on the SSA website. They can help you organize your documentation effectively. You’re not alone in this journey, and we’re here to help.

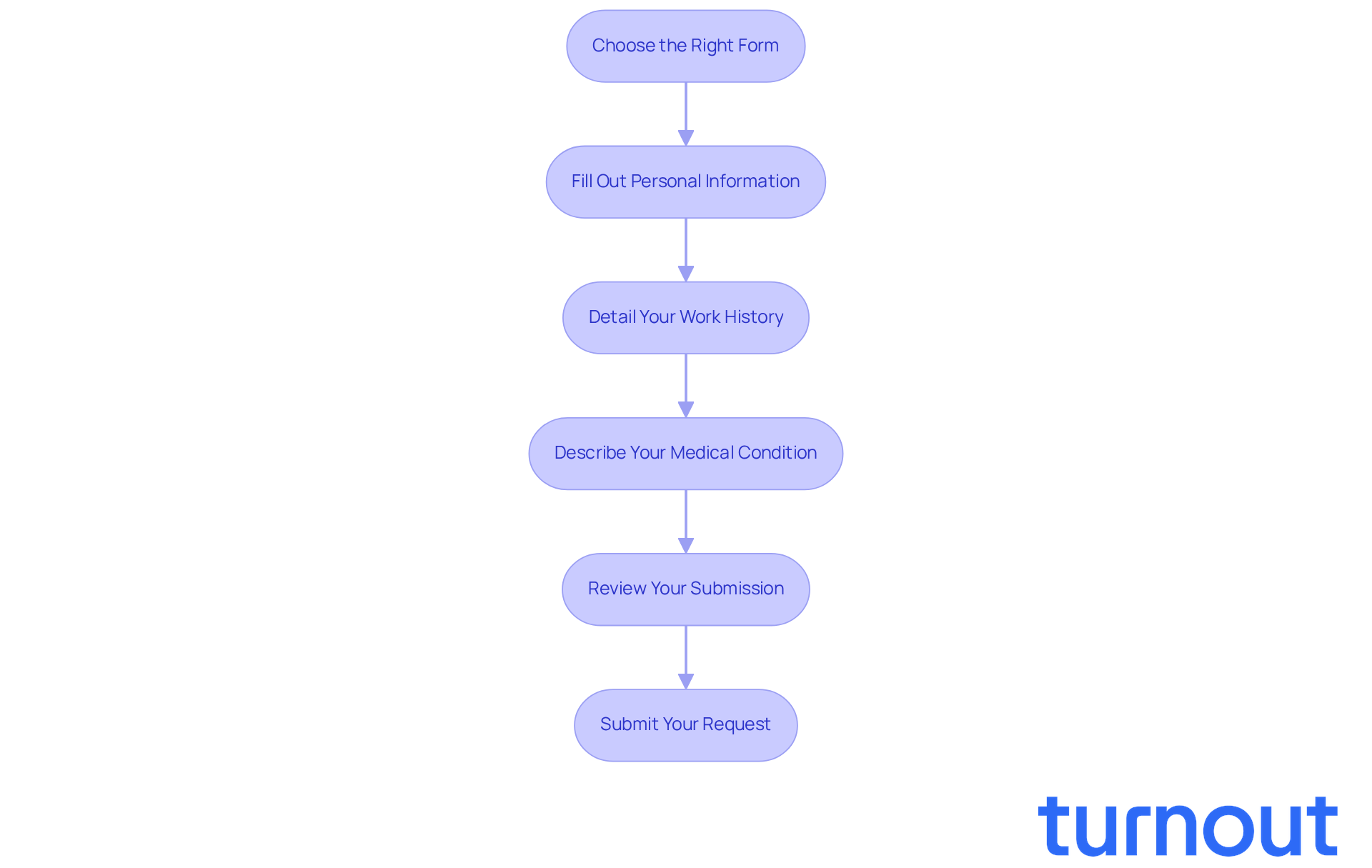

Complete the Application Form Accurately

To accurately complete your Social Security application form, let’s walk through these essential steps together:

-

Choose the Right Form: It’s important to select the right form based on the benefits you’re applying for. For Disability Insurance (SSDI), use Form SSA-16, and for retirement benefits, go with Form SSA-1.

-

Fill Out Personal Information: Provide your full name, Social Security number, date of birth, and contact information. Make sure all details are accurate and match your identification documents. This helps avoid any delays that can be frustrating.

-

Detail Your Work History: Include comprehensive employment information, like job titles, dates of employment, and descriptions of your duties. Being thorough here is key to preventing gaps in your work history, which can lead to issues with your submission.

-

Describe Your Medical Condition: If you’re applying for disability, clearly explain your medical condition and how it affects your daily life and work capabilities. Attaching supporting medical documentation can really strengthen your case.

-

Review Your Submission: Before sending it off, take a moment to carefully check your document for any errors or missing information. Having a trusted friend or family member review it can provide you with extra peace of mind.

-

Submit Your Request: You can submit your request online through the social security admin las vegas website, by mail, or in person at the social security admin las vegas office. Remember to keep copies of all submitted documents for your records.

Completing the form accurately is vital for a smooth process and timely approval. We understand that waiting can be tough; recent statistics show that the average time for an initial decision on SSDI claims is about 7 to 8 months. This highlights how important it is to get it right the first time. Real-life examples, like that of a 49-year-old single mother who successfully appealed her denied claim, remind us of the significance of thorough documentation and accurate submissions in navigating the complexities of Social Security benefits. Remember, you’re not alone in this journey, and we’re here to help!

Follow Up on Your Application Status

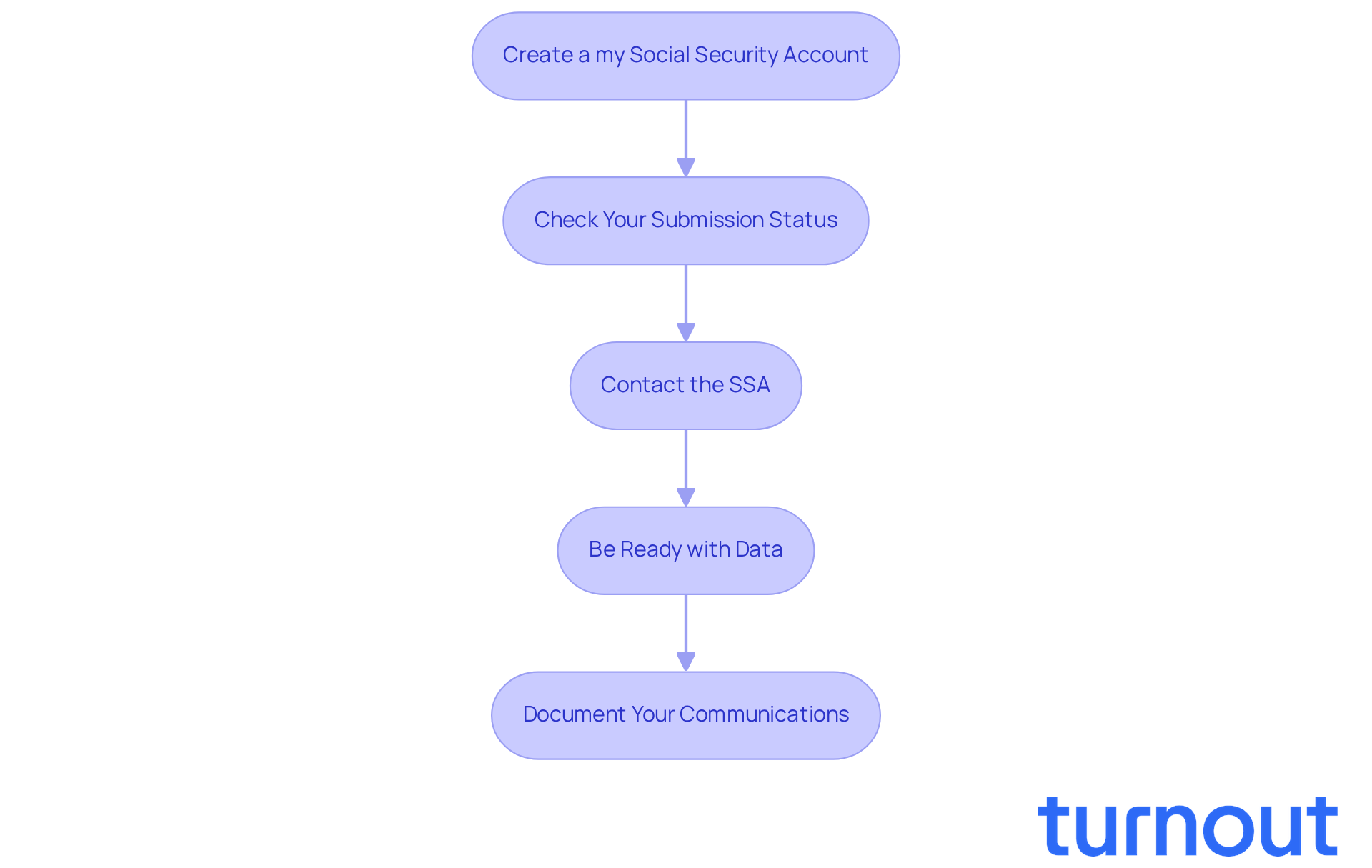

After submitting your request, following up is crucial to ensure timely processing. We understand that waiting can be stressful, but here’s how you can effectively track your application status:

-

Create a my Social Security Account: If you haven’t done so already, setting up an account on the SSA website is a great first step. This account allows you to verify your status online, giving you a convenient way to stay informed.

-

Check Your Submission Status: Log in to your account and head to the submission status section. Here, you can see whether your request is pending, approved, or if additional information is needed. It’s common to feel anxious about this process; as of early 2026, around 30% of submissions require follow-up inquiries. This highlights the importance of staying proactive, especially with the SSA's current backlog of 12 million cases and the impact of recent employee layoffs on processing times.

-

Contact the SSA: If your request has been pending for an unusually long time or if you have specific concerns, don’t hesitate to reach out to the SSA directly. You can call their toll-free number at 1-800-772-1213 or visit your local office for assistance. Remember, you are not alone in this journey.

-

Be Ready with Data: When following up, it’s helpful to have your identification number and any pertinent information about your request ready. This preparation will enable the representative to assist you more efficiently.

-

Document Your Communications: Keeping a detailed record of all communications with the SSA, including dates, times, and the names of representatives you speak with, can be invaluable if you need to escalate any issues.

Regular follow-ups can significantly enhance the likelihood of your application being processed promptly, ensuring you receive the benefits you are entitled to. Additionally, the social security admin las vegas has emphasized its commitment to improving customer service through operational efficiencies, making the my Social Security account a vital tool for applicants. Remember, we’re here to help you every step of the way.

Conclusion

Navigating the complexities of Social Security Administration (SSA) benefits in Las Vegas can feel overwhelming. We understand that securing the support you need is crucial. This guide has shed light on various benefits, including:

- Retirement perks

- Disability assistance

- Survivor support

- Medicare

It also outlines essential steps to determine eligibility and gather necessary documentation.

Key insights emphasize the importance of evaluating your work history, medical condition, and financial resources. By preparing your documentation carefully and completing application forms accurately, you can significantly reduce processing delays. It's common to feel anxious about the application status, but following up through the SSA's online tools and maintaining clear communication with representatives can enhance your chances of timely approvals.

Ultimately, being informed and proactive in navigating the SSA benefits landscape is vital for receiving the assistance you deserve. As more individuals rely on these programs, understanding how to access Social Security benefits is more important than ever. Remember, you're not alone in this journey. Engaging with local resources and support systems can empower you to take charge of your financial future, ensuring you receive the benefits you need.

Frequently Asked Questions

What benefits are available from the Social Security Administration (SSA)?

The SSA offers several benefits including retirement perks, disability benefits, survivor assistance, Supplemental Income (SSI), and Medicare.

At what age can I start claiming retirement benefits?

You can claim retirement benefits as early as age 62, but full benefits are available at your full retirement age, which ranges from 66 to 67 depending on your birth year.

What are the differences between Disability Insurance (SSDI) and Supplemental Income (SSI)?

SSDI is for individuals who have worked and contributed to Social Insurance, while SSI provides financial support to individuals with limited income and resources, including the elderly and disabled.

Who is eligible for survivor assistance?

Survivor assistance is available to widows, widowers, and dependent children of individuals who earned sufficient credits in the Social Security system.

What is Supplemental Income (SSI) and who qualifies for it?

SSI offers financial aid to elderly individuals, those who are visually impaired, or disabled, ensuring they receive a basic level of support. Eligibility requires meeting specific income and resource limits.

What is Medicare and who is eligible for it?

Medicare is a health insurance program for individuals aged 65 and older, as well as some younger individuals with disabilities, helping to cover medical expenses.

How can I determine my eligibility for Social Security benefits?

To determine eligibility, evaluate your employment record, medical condition, age requirements, income and resource limits, and the Substantial Gainful Activity (SGA) threshold. The SSA also provides online tools for assessment.

What are the income and resource limits for Supplemental Security Income (SSI)?

As of 2026, individuals must have less than $2,000 in resources, while couples must have under $3,000.

What is the SGA threshold for non-blind individuals in 2026?

The SGA cut-off for non-blind individuals will increase to $1,690 per month in 2026, allowing more income before risking the loss of benefits.

How can I navigate the application process for Social Security benefits?

By evaluating your eligibility factors and using the SSA's online tools, you can simplify your access to government assistance and financial support.