Introduction

Navigating the complexities of back taxes can feel like an uphill battle. We understand that the weight of unpaid dues can loom heavily over many individuals. It's crucial to grasp the implications of these financial obligations, as the consequences can extend beyond mere penalties to severe actions like asset seizures or wage garnishments.

This guide offers a step-by-step approach to accessing relief services for back taxes. We're here to empower you to reclaim control over your financial future. But what happens when the path to relief seems unclear? It’s common to feel overwhelmed when the eligibility criteria appear daunting.

Remember, you are not alone in this journey. Together, we can explore the options available to you.

Understand Back Taxes and Their Implications

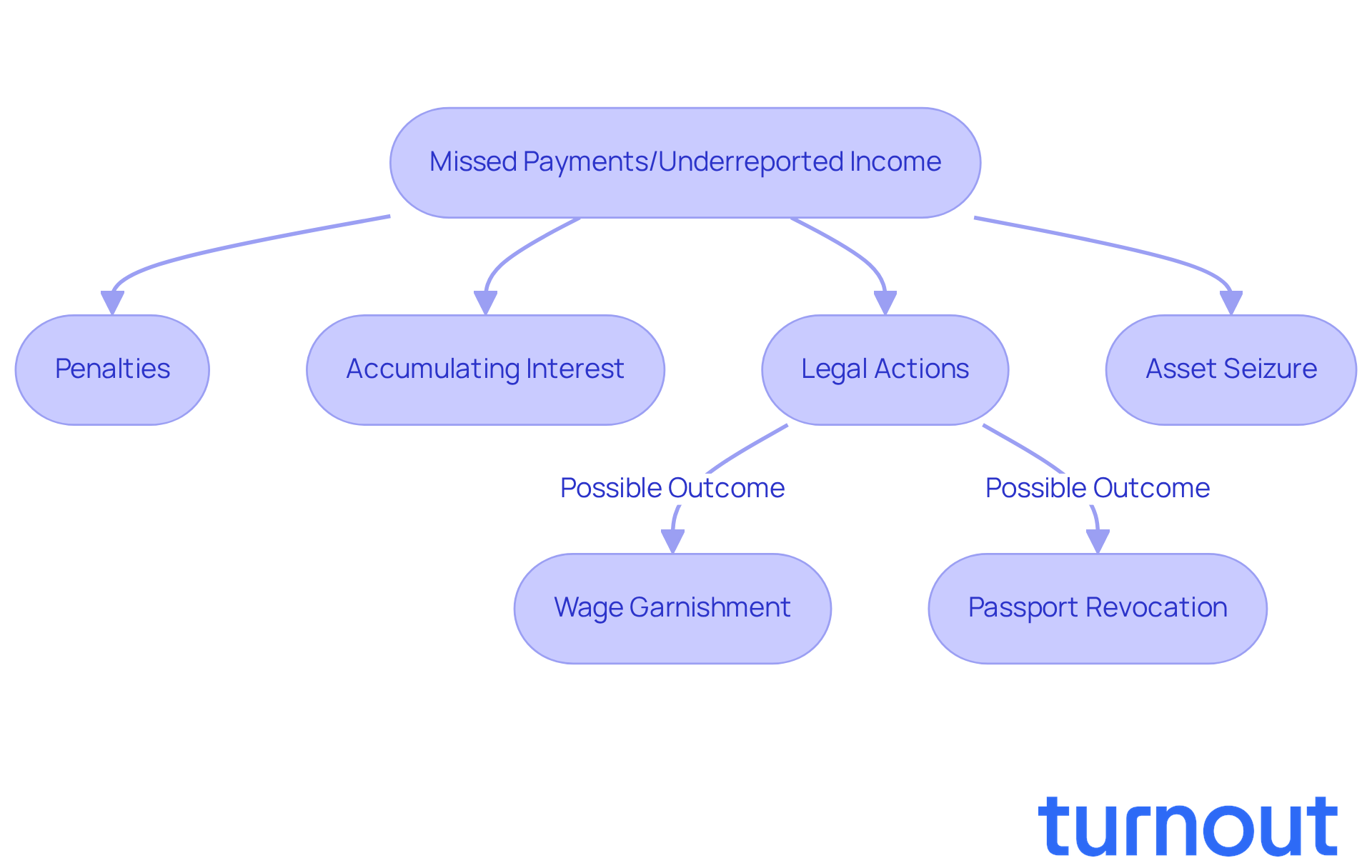

Back dues are those unpaid levies from previous years that can weigh heavily on your mind. If you've missed payments, underreported income, or haven't filed returns, you might find yourself facing back dues. We understand that the consequences of overdue payments can be daunting. Penalties, accumulating interest, and even legal actions like wage garnishment or liens can follow. It's crucial to grasp these implications, as they can motivate you to take action toward resolution.

For instance, did you know that the IRS can seize your assets or even revoke your passport if debts remain unpaid? Acknowledging the urgency of addressing back taxes is the first step in navigating the relief services back taxes available. At Turnout, we're here to help. We offer access to tools and relief services back taxes designed to guide you through these complex financial systems, including tax debt assistance.

Our trained nonlawyer advocates and IRS-licensed enrolled agents are ready to support you through the process. You can receive the assistance you need without the necessity of legal representation. Please remember, Turnout is not a law firm and is not affiliated with any law firm or government agency. The information we provide does not constitute legal advice. You are not alone in this journey; we’re here to help you find your way.

Determine Your Eligibility for Relief Services

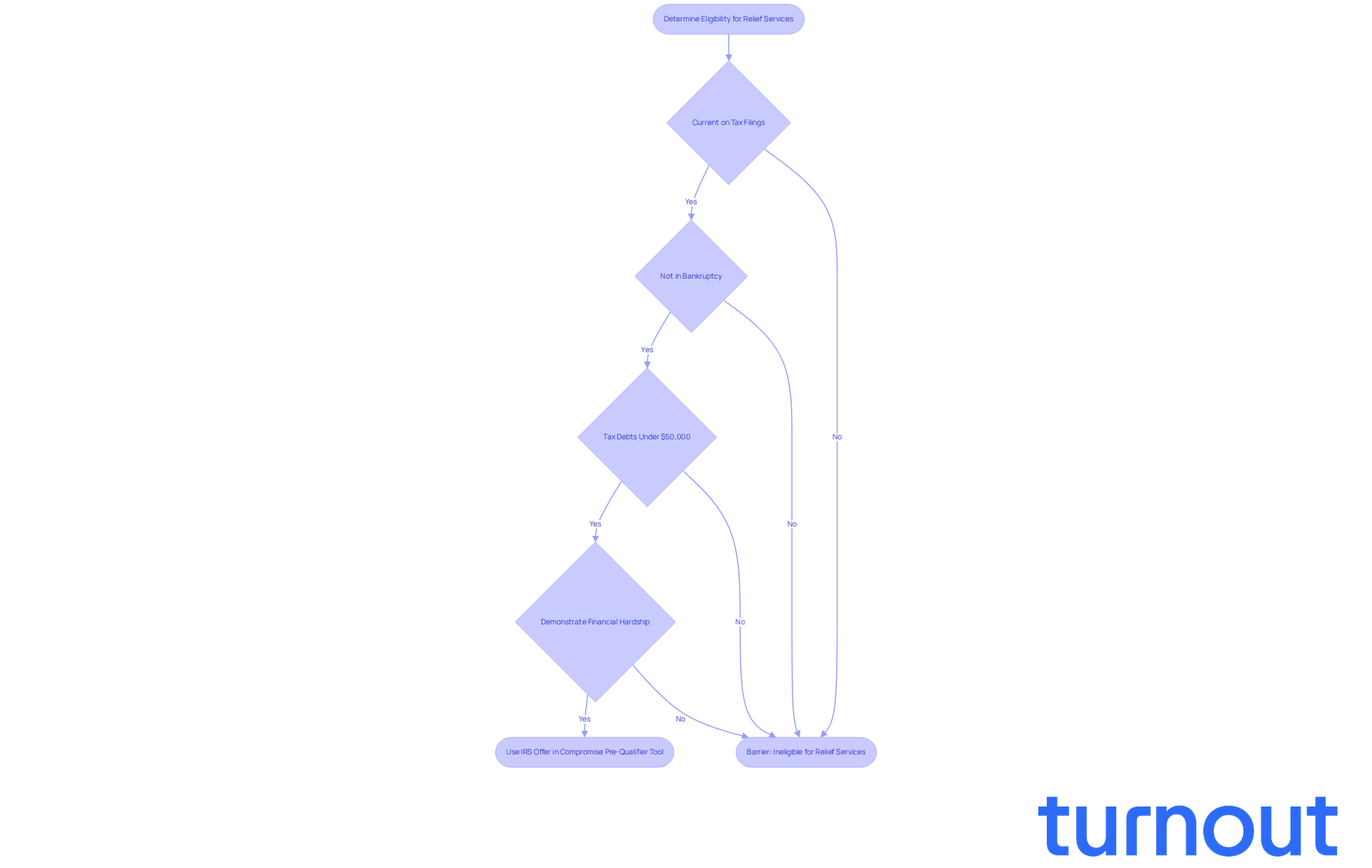

Navigating relief services back taxes can feel overwhelming, but you’re not alone in this journey. To qualify for help, it’s important to meet certain eligibility criteria. First and foremost, you need to be current on all your tax filings and not involved in an open bankruptcy case.

If you have tax debts under $50,000, the IRS Fresh Start Program could be a lifeline for you. This program offers various options to help manage your obligations, making it easier to regain control of your finances.

We understand that demonstrating financial hardship can be daunting. You may need to provide documentation that outlines your income, expenses, and assets. This step is crucial in showing your situation and opening doors to assistance.

For a more personalized evaluation, consider using the IRS Offer in Compromise Pre-Qualifier tool. This resource can guide you in assessing your eligibility for different assistance options. Remember, understanding these requirements is key to finding the right relief services back taxes that are tailored to your needs.

You deserve support, and we’re here to help you through this process.

Gather Required Documentation for Your Application

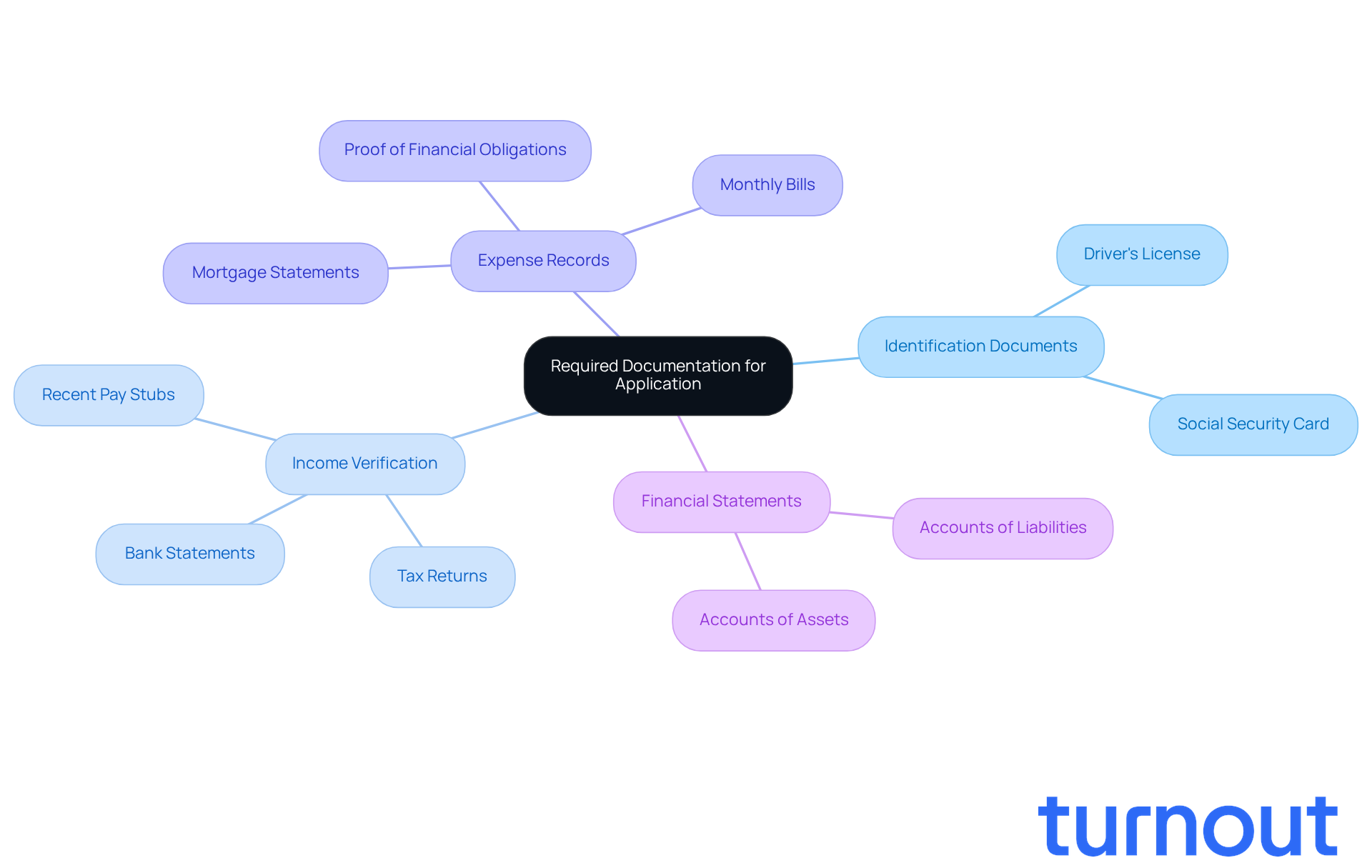

When applying for relief services back taxes, we understand that gathering the right documents can feel overwhelming. To make this process easier for you, here are some key documents you’ll need:

- Identification Documents: This includes items like your driver's license or Social Security card.

- Income Verification: Recent pay stubs, tax returns, or bank statements will help verify your income.

- Expense Records: Monthly bills, mortgage statements, and proof of any other financial obligations are essential.

- Financial Statements: Detailed accounts of your assets and liabilities will provide a complete picture.

It's important to ensure that all documents are accurate and current. Discrepancies can slow down your process, and we want to help you avoid that. By preparing these documents in advance, you’ll simplify your submission and increase your chances of approval.

At Turnout, we know that navigating relief services back taxes can be daunting, especially for individuals with disabilities seeking benefits. You're not alone in this journey. Our trained nonlawyer advocates and IRS-licensed enrolled agents are here to support you every step of the way. We’ll ensure that the documentation you provide aligns with the assistance you need, all without the necessity of legal representation. Remember, we’re here to help!

Submit Your Application for Relief Services

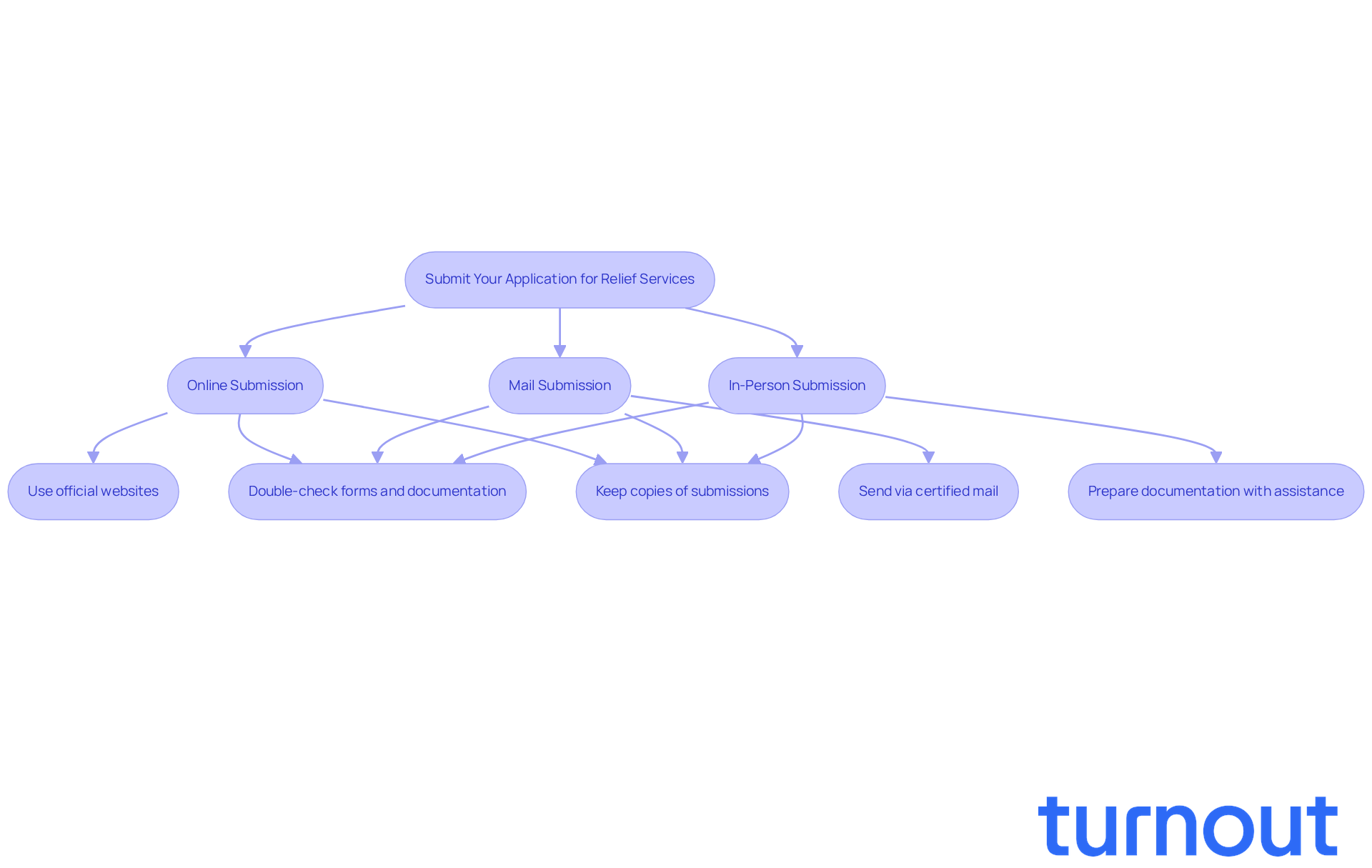

Once you’ve gathered all the necessary paperwork, the next step is to submit your request for assistance services. We understand that this can feel overwhelming, but you’re not alone in this journey. Depending on the program, you have several options for submission:

- Online Submission: Many relief programs, like the IRS Fresh Start Program, allow you to apply online through their official websites. Turnout simplifies this process by guiding you through each step, ensuring your submission is complete and accurate.

- Mail Submission: If you prefer a more traditional approach, you can send your request via postal mail. We recommend using certified mail so you can track your submission. It’s also a good idea to keep a record of everything you send for your future reference.

- In-Person Submission: Some taxpayers choose to present their requests in person at local IRS offices or taxpayer assistance centers. Turnout’s trained nonlawyer advocates are here to help you prepare for this step, making sure you have all the required documentation ready.

No matter which method you choose, it’s important to double-check that all forms are filled out accurately and that you’ve included all necessary documentation. Remember to keep copies of everything you submit for your records. Turnout is here to support you through this process, helping you navigate the complexities of financial assistance, government benefits, and relief services back taxes. You’re taking a brave step, and we’re here to help every step of the way.

Follow Up on Your Application Status

After submitting your request, following up is crucial to ensure it’s being processed efficiently. We understand that this can be a stressful time, and our relief services back taxes are here to help. Here are some effective steps to track your application:

-

Utilize Online Tools: Many tax relief programs, including the IRS, offer online portals for tracking application statuses. For instance, the IRS provides a dedicated tool called 'Where’s My Refund?' for monitoring the status of your Offer in Compromise. This way, you can stay updated on your case and feel more in control.

-

Contact Customer Support: If online updates aren’t enough, don’t hesitate to call the customer service number provided on your form. Having your submission details handy will help you get quicker assistance and clarify any uncertainties you might have.

-

Maintain Documentation: Keeping a detailed record of all communications, including any reference numbers provided during your follow-up, is invaluable. This documentation can be a great asset if you need to escalate your inquiry or address any discrepancies.

Regular follow-ups are essential for staying informed and ensuring your request for relief services back taxes progresses toward approval. It’s common to feel anxious about the timeline, especially with the average processing time for tax relief requests anticipated to differ in 2026. Many cases may require several weeks to months, depending on the complexity and volume of submissions. According to the IRS, e-file and direct deposit refunds typically arrive in about three weeks, while mail-in returns may take four to nine weeks. By utilizing available tools and maintaining proactive communication, you can significantly enhance your experience and outcomes. As tax professional Kate Schubel notes, "Staying informed about your application status can alleviate anxiety and help you plan your finances better." Remember, you are not alone in this journey.

Conclusion

Navigating the complexities of back taxes and relief services can feel overwhelming. We understand that the weight of unpaid taxes can lead to anxiety and uncertainty. But recognizing this challenge is the first step toward regaining control of your financial situation. With the right support and resources, you can effectively address your tax obligations and find a path toward resolution.

Key insights from this guide highlight the importance of:

- Determining your eligibility for relief services.

- Gathering the necessary documentation.

- Submitting applications accurately.

Programs like the IRS Fresh Start Program and other tailored assistance options are within your reach. By following the outlined processes and utilizing online tools to track your application status, you can alleviate anxiety and stay informed throughout your journey.

Taking proactive steps to address back taxes is vital. The support available through relief services is not just about resolving financial burdens; it’s about empowering you to regain your peace of mind and financial stability. Embracing this process can lead to a brighter future, free from the shadows of unpaid taxes. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are back taxes?

Back taxes are unpaid taxes from previous years, which may arise from missed payments, underreported income, or not filing returns.

What are the consequences of not paying back taxes?

Consequences can include penalties, accumulating interest, legal actions such as wage garnishment or liens, and the IRS may seize your assets or revoke your passport if debts remain unpaid.

How can I address back taxes?

It’s important to acknowledge the urgency of addressing back taxes. Seeking assistance through relief services and understanding the implications can motivate you to take action toward resolution.

What services does Turnout provide for back tax issues?

Turnout offers access to tools and relief services designed to help individuals navigate back taxes, including tax debt assistance from trained nonlawyer advocates and IRS-licensed enrolled agents.

Is Turnout a law firm?

No, Turnout is not a law firm and is not affiliated with any law firm or government agency. The information provided does not constitute legal advice.

What are the eligibility criteria for relief services?

To qualify for relief services, you must be current on all tax filings and not involved in an open bankruptcy case.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program offers options to help manage tax debts under $50,000, making it easier for individuals to regain control of their finances.

How can I demonstrate financial hardship?

You may need to provide documentation outlining your income, expenses, and assets to demonstrate financial hardship and open doors to assistance.

What is the IRS Offer in Compromise Pre-Qualifier tool?

The IRS Offer in Compromise Pre-Qualifier tool helps individuals assess their eligibility for different assistance options regarding their tax debts.