Introduction

Navigating the complexities of Short-Term (STD) and Long-Term Disability (LTD) benefits can feel overwhelming. We understand that facing unforeseen medical challenges can be daunting. These benefits are crucial financial lifelines, yet many individuals are unaware of their eligibility criteria and the application process.

Understanding the nuances of these benefits is essential. They can significantly impact your financial stability during difficult times. What happens when an unexpected illness or injury threatens not only your health but also your economic security?

This guide aims to demystify STD and LTD benefits. We want to equip you with the knowledge needed to make informed decisions and secure the support you deserve. Remember, you are not alone in this journey. We're here to help.

Define Short-Term and Long-Term Disability Benefits

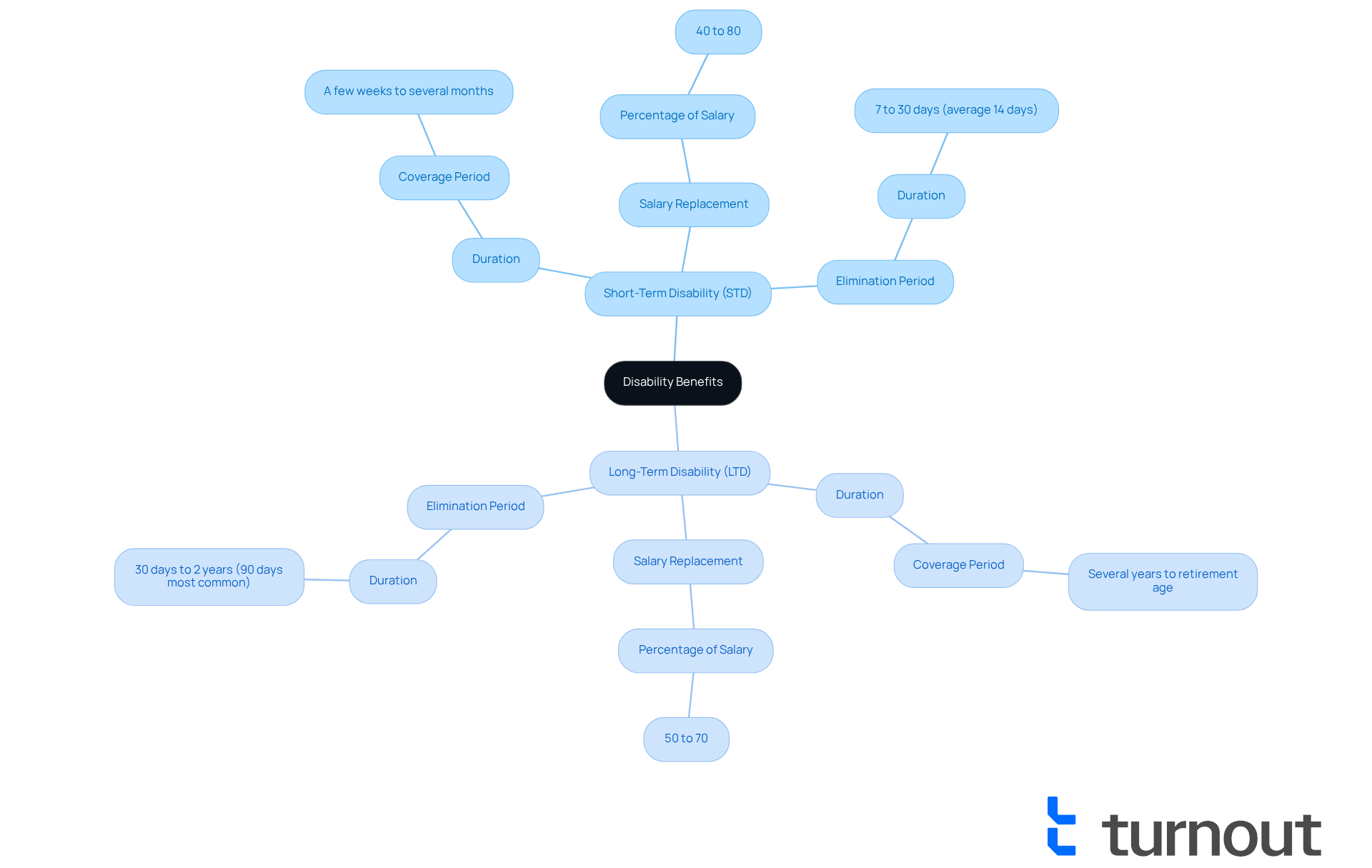

Short-Term Disability (STD) payments can be a lifeline for employees facing medical challenges. If you find yourself unable to work, these payments offer temporary financial support, typically lasting from a few weeks to several months. They usually replace a portion of your salary, often between 40% and 70%, depending on your employer's policy.

On the other hand, support under Long-Term Disability (LTD) is designed for those who may be out of work for an extended period, often beyond six months, in accordance with ltd std. LTD std benefits can provide income replacement for several years or until you reach retirement age, covering approximately 60% of your gross monthly earnings based on the specific policy conditions.

Understanding these benefits is crucial as you navigate the application process. We know that this can be overwhelming, but having a clear grasp of your options can significantly impact your financial stability during tough times. Remember, STD benefits typically kick in after an elimination period of 7 to 30 days, with an average of 14 days. In contrast, LTD elimination periods can range from 30 days to two years.

At Turnout, we’re here to help you through these processes. We provide tools and services to ensure you understand your options for SSD claims and financial support, all without needing legal representation.

Consider the story of someone who successfully obtained LTD assistance after a severe back injury. This support allowed them to maintain financial stability while focusing on their recovery. It’s a powerful reminder of how these benefits can make a difference. In fact, did you know that 48% of all home foreclosures are linked to disability?

You are not alone in this journey. We encourage you to explore your options and reach out for assistance. Your well-being matters, and we’re here to support you.

Outline Eligibility Requirements for STD and LTD Benefits

To qualify for Short-Term Disability (STD) assistance, we understand that you may need to show that a medical condition prevents you from performing your job duties. Most policies have a waiting period, known as an elimination period, which can last from a few days to several weeks. Additionally, you’ll likely need medical documentation from a healthcare provider confirming your condition.

For LTD STD assistance, eligibility usually requires that you have been unable to work for a specified duration, typically six months or longer. It’s important to meet specific criteria outlined in your employer's policy, which may include a minimum number of hours worked or a certain length of service. Recent changes in 2025 have raised the Substantial Gainful Activity (SGA) limit to $1,620 per month for non-blind individuals. This change offers more flexibility for those trying to return to work while still receiving support.

Understanding these criteria is essential for a successful application, especially as assistance programs evolve. We recognize the importance of thorough documentation and following policy specifics to improve your chances of approval. For example, individuals with conditions like PTSD may find it easier to qualify under new guidelines that lessen the burden of proof. Our trained nonlawyer advocates are here to assist you in navigating these processes, ensuring you have the support needed to understand and meet eligibility criteria.

Overall, staying informed about eligibility standards and recent changes can significantly impact the success of your disability claims. Remember, you are not alone in this journey, and we’re here to help.

Explain the Application Process for Disability Benefits

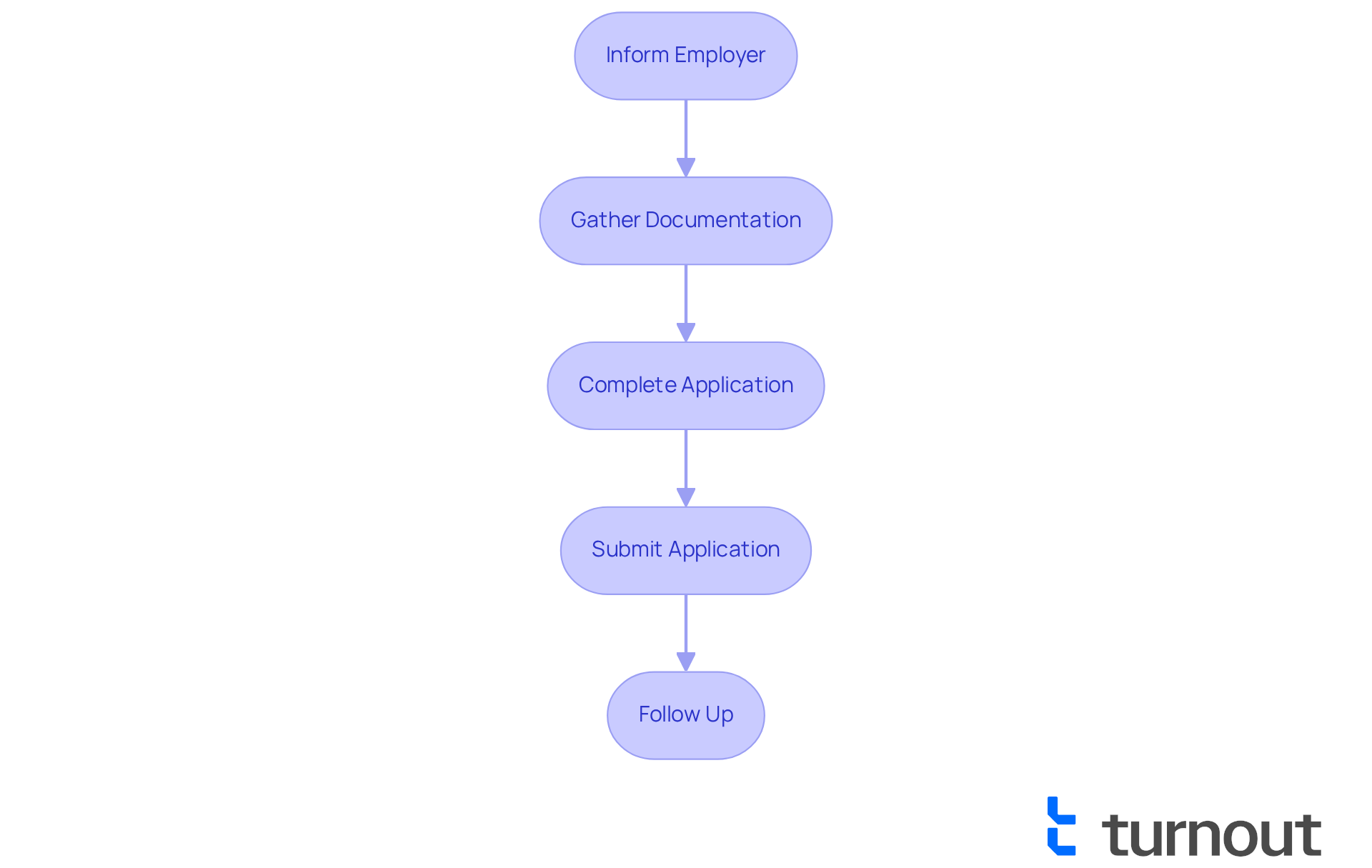

We understand that seeking assistance can feel overwhelming. The first step in the application procedure is to inform your employer about your situation and your intention to request support. Next, gather all necessary documentation, such as medical records, proof of employment, and any required forms from your employer or insurance provider.

It's crucial to complete the application accurately and thoroughly. Incomplete applications can lead to delays or denials, which can be frustrating. If relevant, be sure to provide details about any workplace injuries, list the positions you've held in the five years before your inability to work, and include the names and addresses of two non-medical professionals who can endorse your claim.

To help you organize this information, consider using the Adult Disability Starter Kit. This kit includes a checklist, worksheet, and fact sheet that can improve your chances of a successful application. After submitting your application, follow up with your employer or the insurance company to ensure it’s being processed.

It's common to feel anxious about the outcome, especially since many initial applications for disability assistance are denied. But remember, you’re not alone in this journey. Turnout offers support through trained nonlawyer advocates who can guide you through the SSD claims process, ensuring you have the necessary resources and assistance.

Grasping this procedure can greatly improve your likelihood of obtaining the assistance you require. We're here to help you every step of the way.

Compare Short-Term and Long-Term Disability Benefits

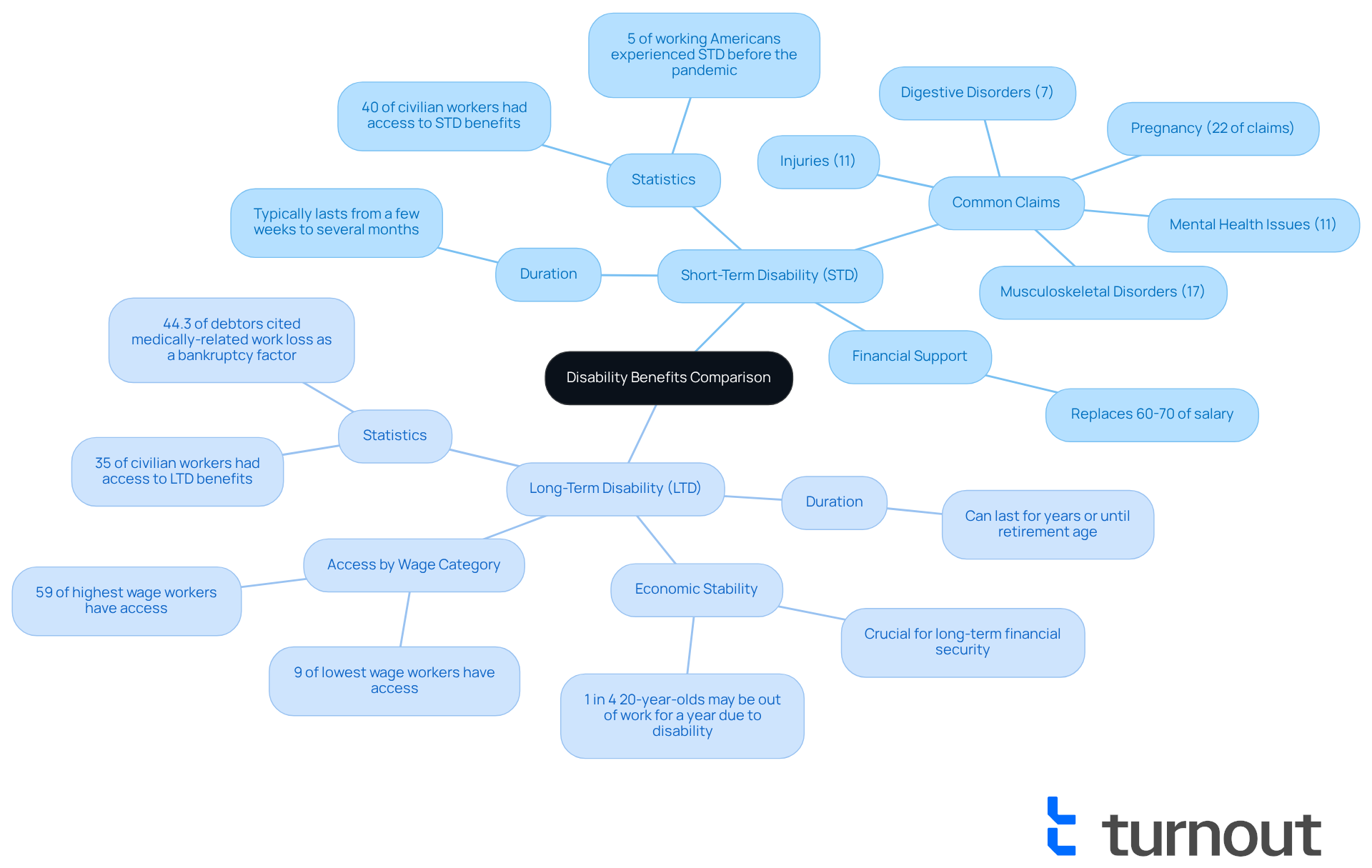

Short-Term Disability (STD) payments are designed to provide quick financial support during challenging times, typically lasting from a few weeks to several months. These benefits can be a lifeline for those recovering from surgery, injury, or temporary illness. Did you know that pregnancies account for 22% of STD claims? This statistic highlights how relevant these plans are for individuals facing short-term health challenges. Before the pandemic, around 5% of working Americans experienced a short-term disability due to illness, injury, or pregnancy, showing just how common these situations can be.

On the other hand, the LTD STD provisions offer extended financial assistance for those unable to work for a longer duration, often due to chronic conditions or serious injuries. While STD coverage may replace a higher percentage of your salary-often around 60-70%-LTD support is crucial for long-term economic stability, as it can last for years or until retirement age. It's concerning to note that just under one in four of today’s 20-year-olds can expect to be out of work for at least a year due to a disabling condition before reaching retirement age. Additionally, 44.3% of debtors have cited medically-related work loss as a factor in their bankruptcy, illustrating the economic strain that can accompany disability.

Understanding the differences between LTD STD benefits is essential for making informed decisions about your financial future. As one specialist wisely noted, "Comprehending your choices can significantly influence your economic stability during difficult periods." Hoogensen also emphasizes the importance of tailored communication in sales strategies, reinforcing the need for informed decision-making regarding assistance programs. The economic implications are significant; nearly 4 out of 10 American adults struggle to cover an unexpected $400 expense without borrowing, highlighting the potential pressure on resources without adequate disability coverage.

Moreover, access to disability insurance varies greatly by wage category. Only 9% of employees in the lowest wage category have access to long-term disability insurance, compared to 59% in the highest wage category. Choosing the right coverage based on your health needs and financial situation is crucial. While STD benefits offer immediate relief, benefits from LTD STD provide ongoing support. It’s important to evaluate both options carefully, ensuring you have the protection you need. Remember, you’re not alone in this journey; we’re here to help you navigate these choices.

Conclusion

Navigating the complexities of Short-Term and Long-Term Disability (STD and LTD) benefits can feel overwhelming, especially for those facing medical challenges that may affect their ability to work. We understand that knowing the differences between these benefits, along with their eligibility requirements and application processes, is crucial. This knowledge empowers you to make informed decisions that can significantly impact your financial security during difficult times.

This guide has highlighted the key features of STD and LTD benefits, emphasizing when each type of support is applicable. Short-Term Disability offers immediate financial relief for temporary conditions, while Long-Term Disability provides sustained support for more serious, long-lasting health issues. The eligibility criteria and application processes for both benefits can seem daunting, but being aware of recent changes and having thorough documentation can enhance your chances of approval. Real-life examples illustrate the profound difference these benefits can make, reinforcing the necessity of understanding your options.

Ultimately, being well-informed about disability benefits is essential. With nearly 4 out of 10 American adults struggling to cover unexpected expenses, having the right coverage is crucial. For those facing health challenges, exploring available support options is not just a safety net; it’s a vital step toward maintaining financial stability and peace of mind. Remember, you are not alone in this journey. Engaging with resources and advocates can ensure that you are well-prepared to navigate the complexities of your disability claims.

Frequently Asked Questions

What are Short-Term Disability (STD) benefits?

Short-Term Disability (STD) benefits provide temporary financial support for employees who are unable to work due to medical challenges. These payments typically last from a few weeks to several months and usually replace a portion of the employee's salary, often between 40% and 70%, depending on the employer's policy.

How do Long-Term Disability (LTD) benefits differ from STD benefits?

Long-Term Disability (LTD) benefits are designed for individuals who may be out of work for an extended period, often beyond six months. LTD benefits can provide income replacement for several years or until retirement age, covering approximately 60% of gross monthly earnings based on the specific policy conditions.

What is the elimination period for STD and LTD benefits?

The elimination period for Short-Term Disability benefits typically ranges from 7 to 30 days, with an average of 14 days. In contrast, Long-Term Disability elimination periods can range from 30 days to two years.

Why is understanding these benefits important?

Understanding Short-Term and Long-Term Disability benefits is crucial as it helps individuals navigate the application process and can significantly impact their financial stability during challenging times.

How can Turnout assist with disability claims?

Turnout provides tools and services to help individuals understand their options for Social Security Disability (SSD) claims and financial support, all without the need for legal representation.

Can you give an example of how LTD benefits can help?

An example is someone who obtained Long-Term Disability assistance after a severe back injury. This support allowed them to maintain financial stability while focusing on their recovery, highlighting the importance of these benefits.

What statistic highlights the impact of disability on home ownership?

It is noted that 48% of all home foreclosures are linked to disability, emphasizing the critical role of disability benefits in maintaining financial security.