Introduction

Navigating tax debt can feel overwhelming, especially in a vibrant city like Las Vegas. We understand that the weight of financial burdens can be heavy, and it’s common to feel lost in the maze of options available. Fortunately, there are various IRS programs designed to help lighten that load. Understanding these options is crucial for anyone seeking relief.

Imagine having a clear, step-by-step guide to navigate the complexities of tax debt relief. This guide could empower you to reclaim your financial stability and take control of your situation. You are not alone in this journey; many have walked this path and found their way to brighter days.

Let’s explore how you can find the support you need. With the right information and guidance, you can take the first steps toward a more secure financial future.

Understand IRS Tax Debt Relief Options

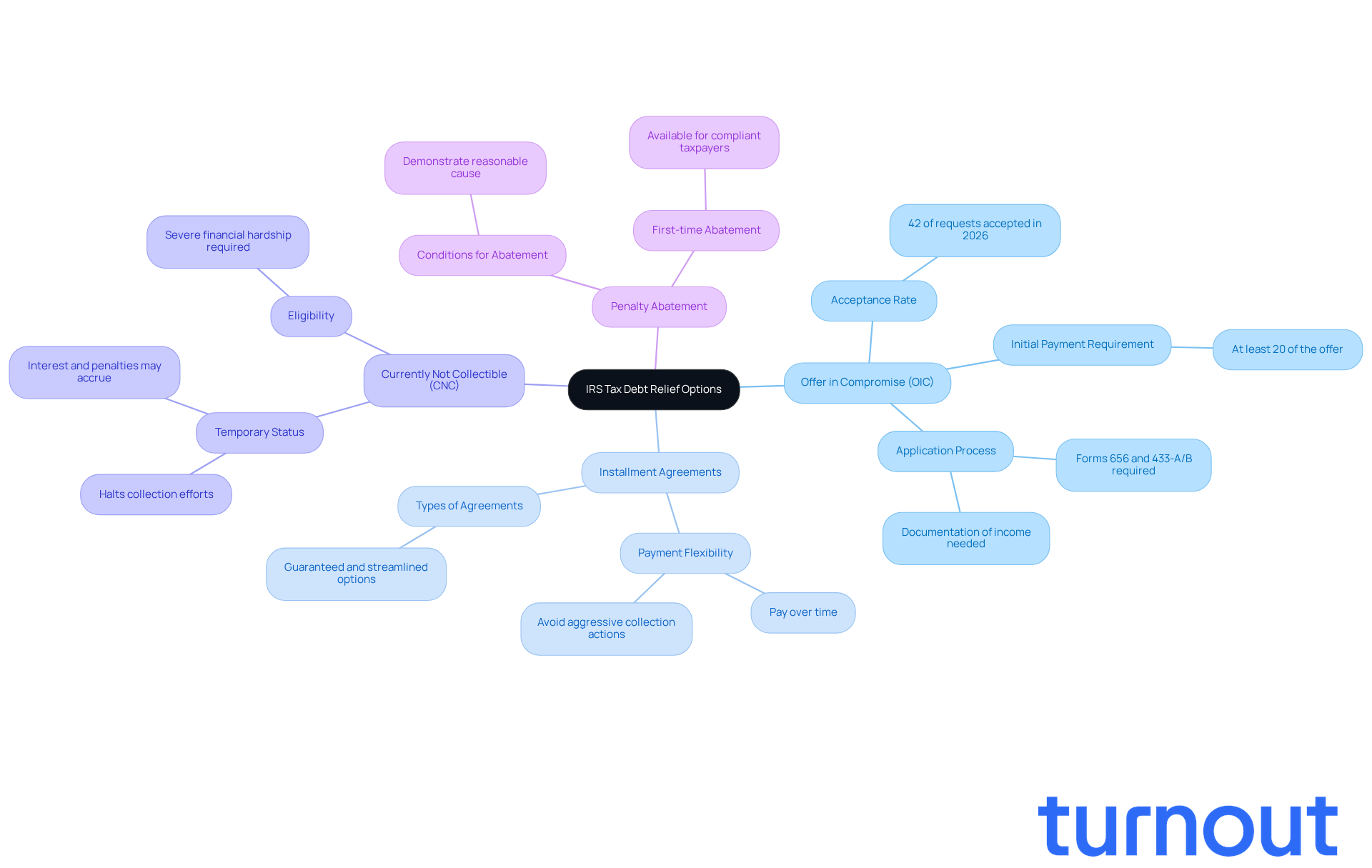

Navigating las vegas tax debt relief can feel overwhelming, and we understand that. But knowing your options is the first step toward las vegas tax debt relief. The IRS offers several programs designed to assist taxpayers in financial distress:

-

Offer in Compromise (OIC): This program allows you to settle your tax debt for less than the full amount owed. In 2026, approximately 42% of OIC requests were accepted, making it a viable option for those unable to pay their tax obligations in full due to financial difficulties. Tax professionals emphasize that las vegas tax debt relief through an Offer in Compromise (OIC) can significantly reduce the stress of overwhelming debt. Mike Habib, EA, reminds us, "Remember that you have rights as a taxpayer, and there are legitimate pathways to resolve even significant tax problems."

-

Installment Agreements: If immediate payment isn’t feasible, you may qualify for a payment plan that allows you to pay your debt over time. This option provides flexibility and can help you manage your financial obligations without facing aggressive collection actions.

-

Currently Not Collectible (CNC): For those experiencing severe financial hardship, requesting CNC status can temporarily halt collection efforts. This status allows you to focus on regaining financial stability without the pressure of ongoing IRS collections.

-

Penalty Abatement: In certain circumstances, you may be able to have penalties removed if you can demonstrate reasonable cause for your failure to pay on time. This option can alleviate some of the financial burden associated with tax debt.

Additionally, it’s crucial to voluntarily file any past-due tax returns in order to obtain las vegas tax debt relief. This is viewed favorably by the IRS and is a vital step in resolving tax situations. Be cautious of tax relief calls, as some may be scams targeting vulnerable taxpayers. Familiarizing yourself with these options will empower you to make informed decisions about your tax situation. With the right approach and guidance, you can navigate these challenges and work towards a resolution that suits your financial circumstances. Remember, you are not alone in this journey; we're here to help.

Determine Eligibility for an Offer in Compromise

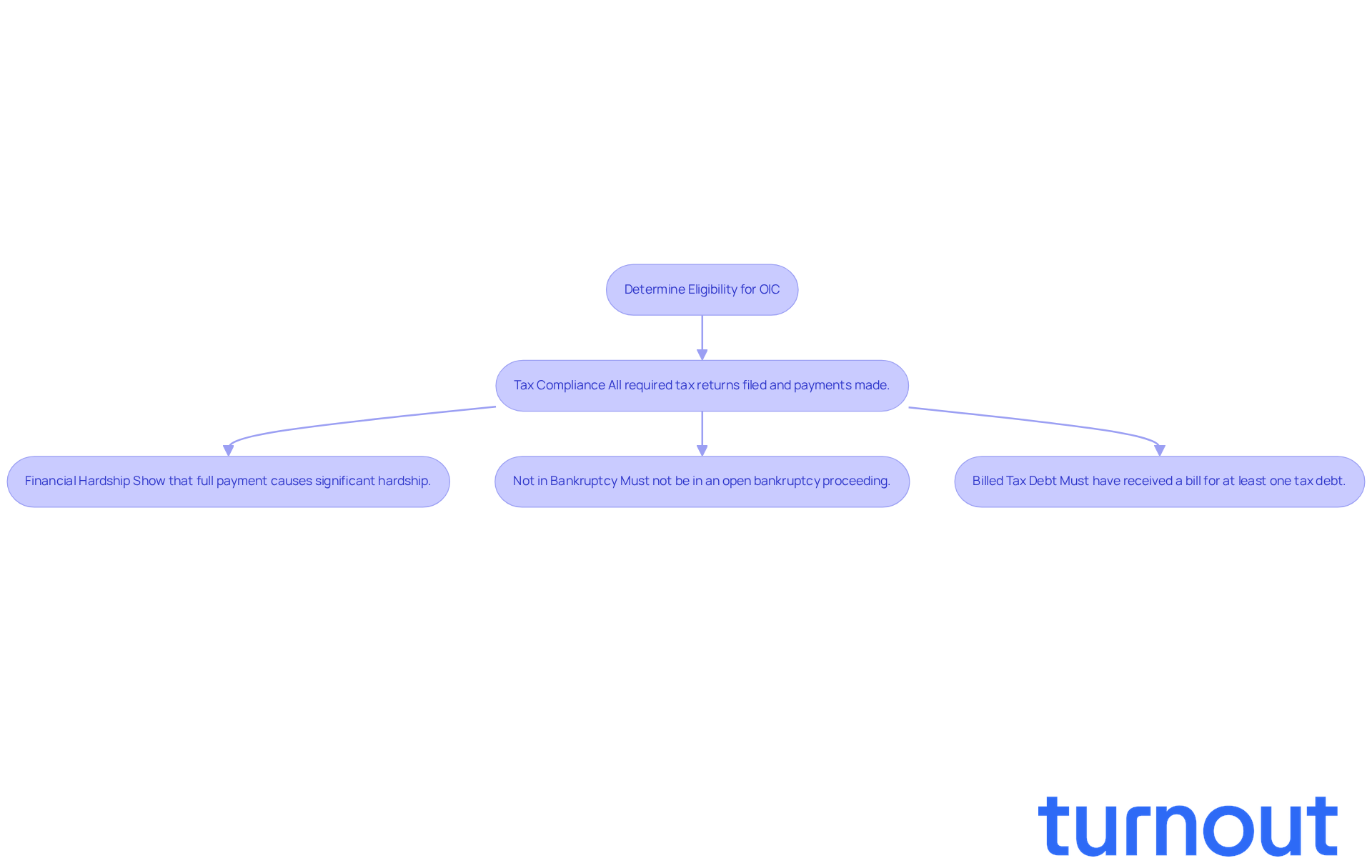

Applying for an Offer in Compromise (OIC) can feel overwhelming, but we’re here to help you navigate this process. First, it’s crucial to ensure you meet the IRS eligibility requirements. Let’s take a look at the key criteria you should consider:

- Tax Compliance: It’s essential to have all required tax returns filed and any necessary estimated payments made. The IRS expects full compliance before they’ll even consider an OIC, so this step is fundamental.

- Financial Hardship: You need to show that paying your full tax debt would cause significant financial hardship. This might mean your income isn’t enough to cover basic living expenses, making it clear that the tax burden is simply unmanageable.

- Not in Bankruptcy: If you’re currently in an open bankruptcy proceeding, you won’t be able to apply for an OIC. This is an important requirement, as the IRS can’t process an OIC while bankruptcy is active.

- Billed Tax Debt: You must have received a bill for at least one tax debt you want to include in your offer. This ensures the IRS knows about your outstanding obligations.

To help you assess your eligibility, consider using the IRS Offer in Compromise Pre-Qualifier tool available on their website. This tool can quickly help you determine if you meet the necessary criteria, making your submission process smoother. Remember, while approximately 40% of OIC requests are accepted, this rate dropped to just 21.4% in 2024. This highlights the importance of thorough preparation and understanding what the IRS expects from you. Also, keep in mind that there’s a non-refundable processing fee of $205 when you submit your offer. Consulting with a tax professional can significantly improve your chances of acceptance, and you don’t have to face this journey alone.

Apply for an Offer in Compromise: Step-by-Step Process

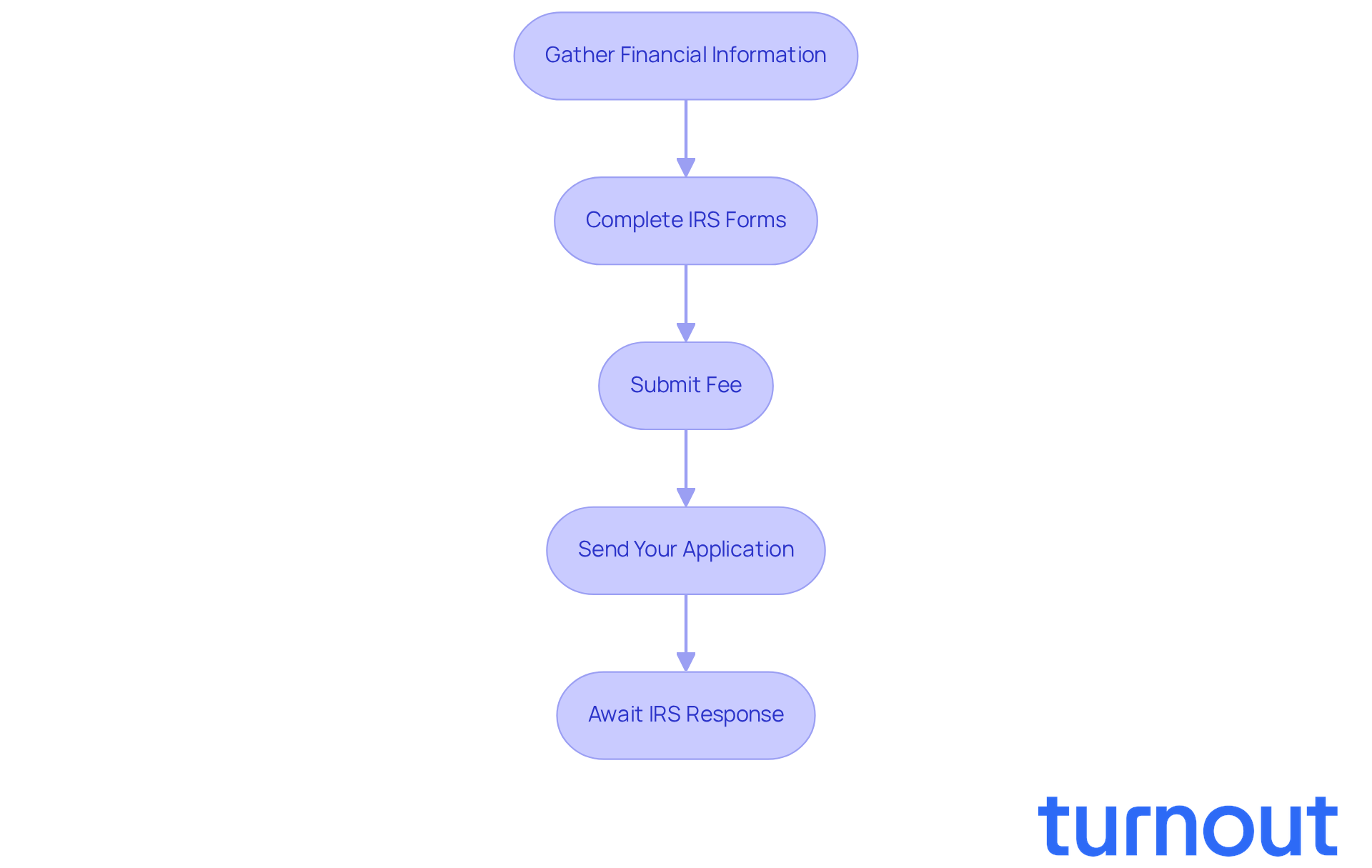

Applying for an Offer in Compromise (OIC) can feel overwhelming, but we're here to help you through it. Follow these essential steps to navigate the process with confidence:

-

Gather Financial Information: Start by collecting all necessary financial documents, like income statements, expenses, and assets. This information is crucial for your submission and will help us understand your situation better.

-

Complete IRS Forms: Next, accurately fill out Form 656 (Offer in Compromise) and either Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses. Make sure all details are complete to avoid any delays in your application.

-

Submit Fee: Don’t forget to include the non-refundable fee of $205 with your submission, unless you qualify for a fee waiver based on low-income certification. We understand that every dollar counts.

-

Send Your Application: Mail your completed forms and supporting documentation to the appropriate IRS address specified in the instructions. Double-check that all documents are included to prevent any processing delays.

-

Await IRS Response: After submission, the IRS will review your request, which can take up to 24 months. It’s common to feel anxious during this waiting period, but be ready to respond quickly to any inquiries for additional details to keep your submission moving forward.

Historically, the IRS accepts about one in three OIC submissions, highlighting the importance of thorough preparation. By carefully following these steps and considering the advice of a tax expert, you can significantly improve your chances of a successful OIC submission for las vegas tax debt relief. Many clients have successfully navigated this process and achieved remarkable debt reductions. For instance, one client managed to lower their IRS payment from $1,988 to just $61 per month. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Handle Rejections and Explore Alternative Solutions

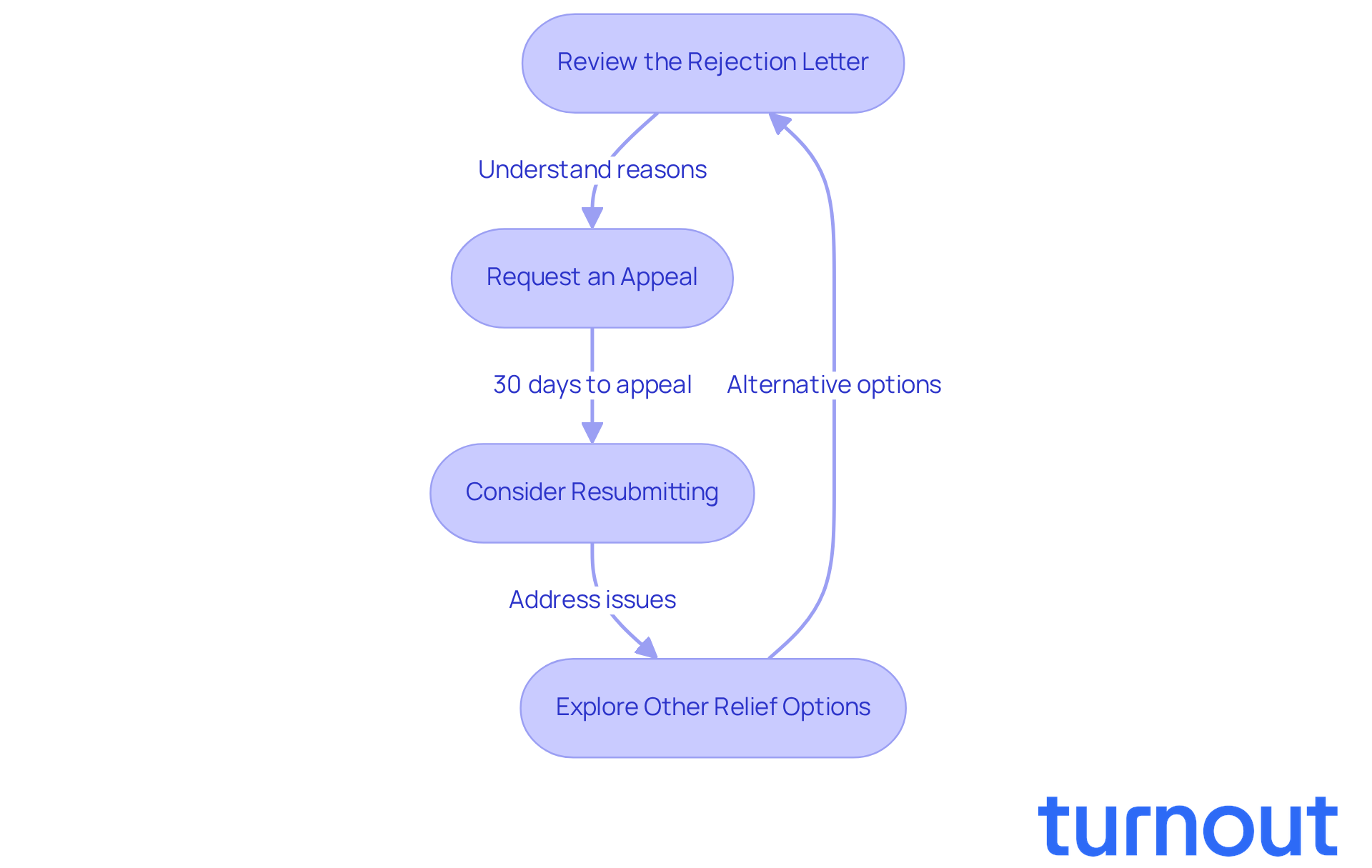

If your Offer in Compromise is rejected, don’t lose hope. We understand that this can be disheartening, but there are steps you can take to move forward:

- Review the Rejection Letter: Take a moment to understand the reasons for the rejection. Common issues include insufficient financial documentation or not meeting eligibility criteria.

- Request an Appeal: Remember, you have 30 days from the date of the rejection letter to request an appeal. Use Form 13711 to formally appeal the decision.

- Consider Resubmitting: If you believe you can address the issues raised in the rejection, consider resubmitting your application with additional documentation or corrections.

- Explore Other Relief Options: If an OIC isn’t feasible, don’t worry. There are other options available, such as installment agreements or Currently Not Collectible status.

By taking these steps, you can continue to seek Las Vegas tax debt relief, even after experiencing an initial setback. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of Las Vegas tax debt relief can feel overwhelming, especially when financial challenges weigh heavily on your mind. We understand that facing tax issues is stressful, but knowing about the various IRS programs - like Offer in Compromise, Installment Agreements, and Currently Not Collectible status - can empower you to take control of your situation. These options offer legitimate pathways to ease the burden of tax debt, allowing you to focus on rebuilding your financial future.

In this guide, we've shared essential insights, including:

- The importance of staying compliant with tax obligations

- A step-by-step process for applying for an Offer in Compromise

- What to do if your application is rejected

Each of these elements is crucial for effectively navigating the tax relief landscape. By familiarizing yourself with these options and seeking professional guidance, you can significantly improve your chances of achieving a positive outcome.

Ultimately, seeking tax debt relief is about more than just settling financial obligations; it’s about reclaiming your peace of mind and paving the way toward a more secure financial future. Whether you choose to pursue the IRS's various programs or explore alternative solutions, remember that the journey toward relief is within reach. Taking that first step today can lead to brighter days ahead, reinforcing the idea that you are not alone in this journey.

Frequently Asked Questions

What are the main IRS tax debt relief options available for taxpayers?

The main IRS tax debt relief options include Offer in Compromise (OIC), Installment Agreements, Currently Not Collectible (CNC) status, and Penalty Abatement.

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) allows taxpayers to settle their tax debt for less than the full amount owed. In 2026, approximately 42% of OIC requests were accepted, making it a viable option for those unable to pay their tax obligations in full.

How does an Installment Agreement work?

An Installment Agreement is a payment plan that allows taxpayers to pay their tax debt over time. This option provides flexibility and helps manage financial obligations without facing aggressive collection actions.

What does Currently Not Collectible (CNC) status mean?

Currently Not Collectible (CNC) status is for individuals experiencing severe financial hardship. It temporarily halts IRS collection efforts, allowing taxpayers to focus on regaining financial stability without the pressure of ongoing collections.

What is Penalty Abatement, and how can it help?

Penalty Abatement is the removal of penalties under certain circumstances if a taxpayer can demonstrate reasonable cause for failing to pay on time. This option can alleviate some financial burdens associated with tax debt.

Why is it important to file past-due tax returns?

Voluntarily filing any past-due tax returns is crucial for obtaining tax debt relief, as it is viewed favorably by the IRS and is a vital step in resolving tax situations.

What should taxpayers be cautious about when seeking tax relief?

Taxpayers should be cautious of tax relief calls, as some may be scams targeting vulnerable individuals. It is essential to familiarize oneself with legitimate options for tax relief.