Introduction

Dealing with an IRS wage levy can feel like navigating a financial minefield. This powerful tool allows the government to directly seize a portion of your earnings to recover unpaid taxes. We understand that this can significantly disrupt your financial stability and living standards.

Many individuals remain unaware of their rights and options in these challenging situations. It's common to feel overwhelmed and uncertain about what to do next. What steps can you take to regain control and protect your financial well-being amidst the looming threat of garnishment?

You're not alone in this journey. There are ways to address this issue and find relief. Let's explore your options together.

Define IRS Wage Levy: Understanding the Basics

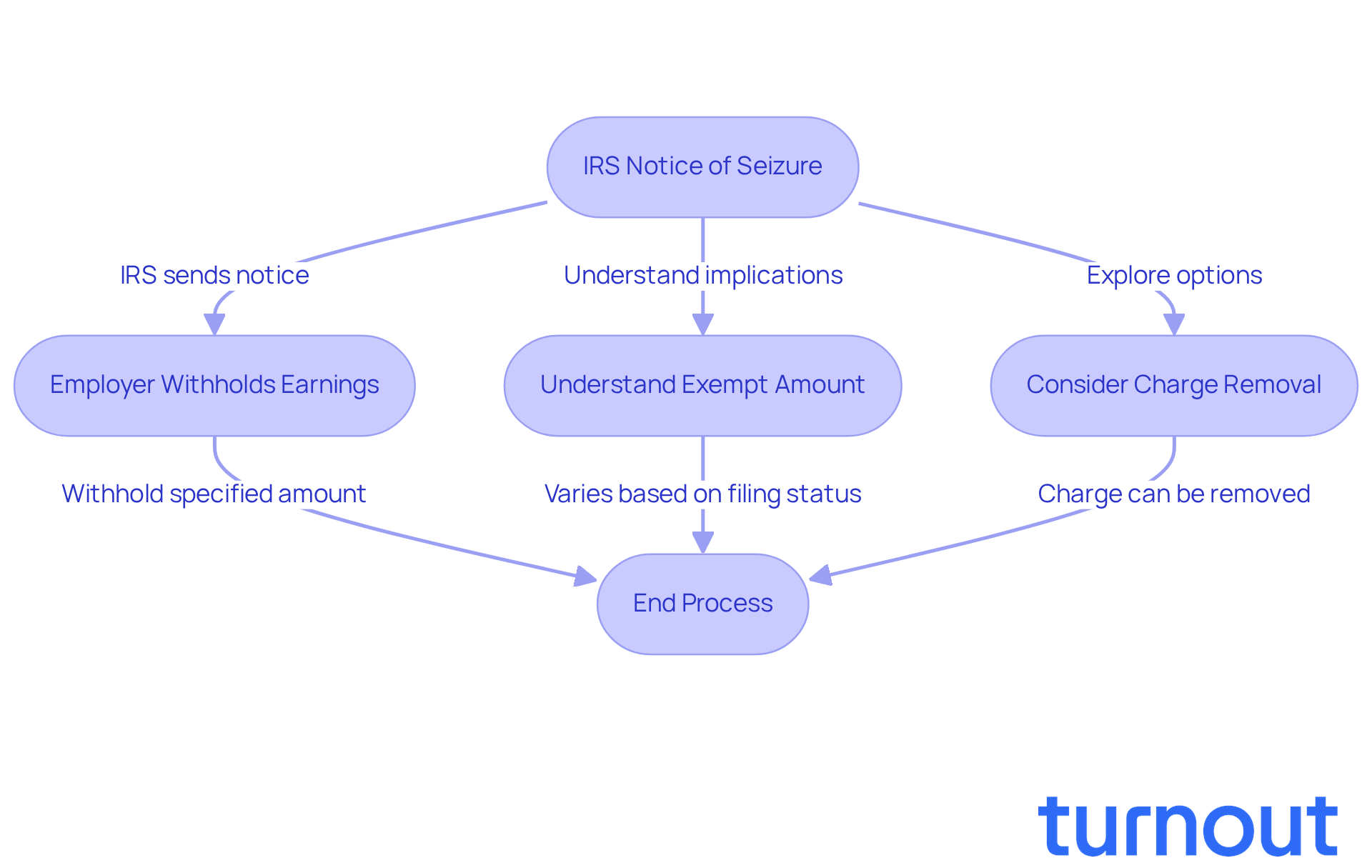

Dealing with an IRS levy wage, which is often referred to as earnings garnishment, can be overwhelming. This legal method allows the Internal Revenue Service to recover unpaid taxes by implementing an IRS levy wage, directly seizing a portion of your earnings from your employer. It all starts when the IRS sends a notice of seizure, which requires your employer to withhold a specified amount from your paycheck until your tax obligation is met.

It's important to know that the IRS can impose an IRS levy wage without needing a court order. This underscores how powerful this tool can be for tax collection. Unfortunately, this action can have serious implications for your financial stability. It reduces your take-home pay and can make it difficult to cover essential living expenses.

The IRS garnishes income above a certain exempt amount, which varies based on factors like your filing status and number of dependents. If you find yourself in this situation, remember that you can often have a charge removed in as little as 24-72 hours after the IRS receives the proper documentation. Most charge releases happen within 1-7 days after the IRS approves a payment plan or hardship request.

Understanding the intricacies of this process is crucial for anyone grappling with tax debt. It can significantly impact your financial well-being. We understand that navigating this can be daunting, but you're not alone in this journey. As experts suggest, "Understanding the process early can make a significant difference in outcomes." We're here to help you through it.

Know Your Rights: Legal Protections Against Wage Levies

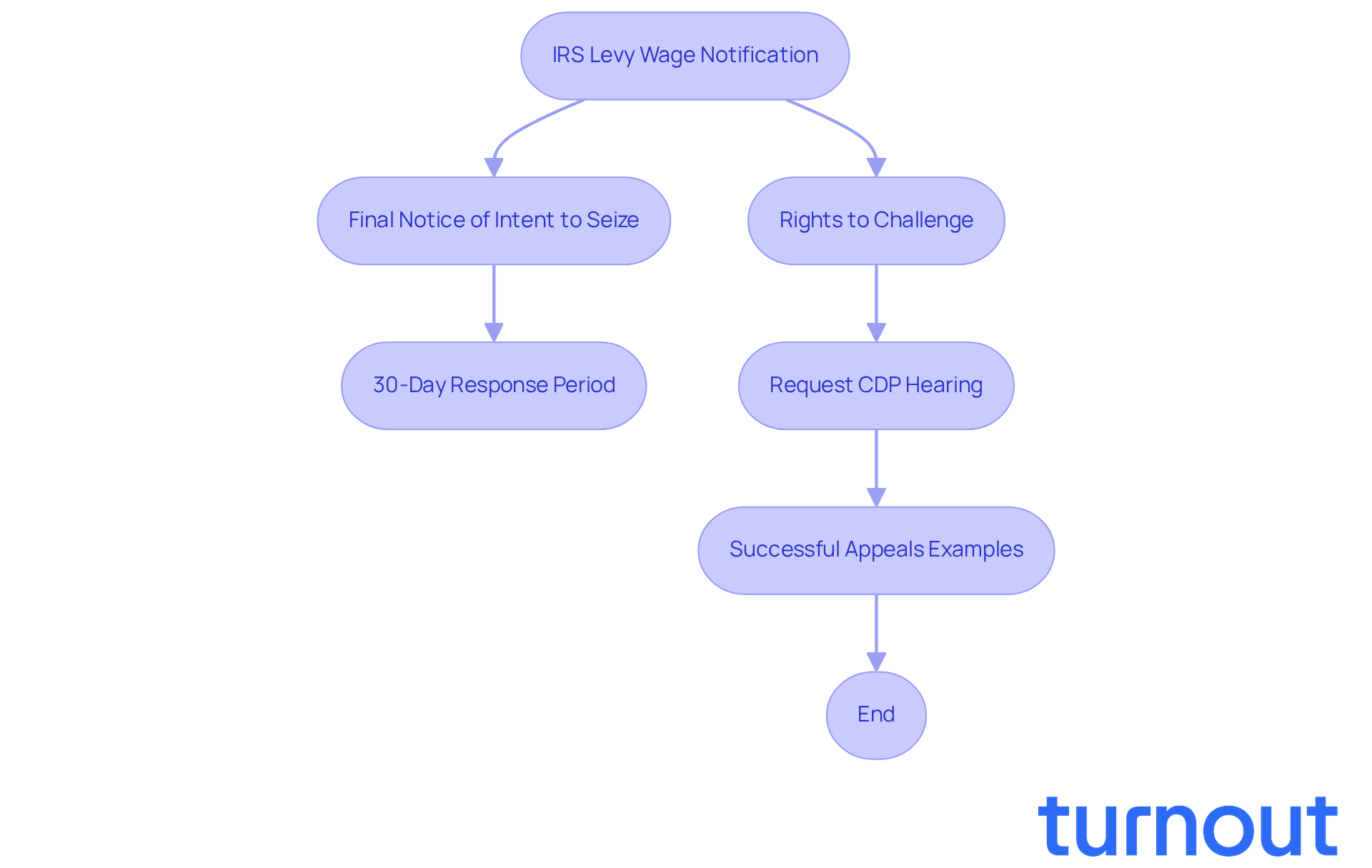

If you're dealing with an IRS levy wage, it’s important to know that you have rights designed to protect your financial well-being. First and foremost, the IRS is required to send several notices before any IRS levy wage action takes place. This includes a Final Notice of Intent to Seize related to the IRS levy wage, which must be sent at least 30 days before the garnishment begins. This notice is your chance to respond and address the situation before any action is taken. Remember, a portion of your earnings is protected from deduction based on your filing status and the standard allowance. This means that not all of your income can be taken, allowing you to maintain a basic standard of living.

You also have the right to challenge the IRS levy wage garnishment and request a Collection Due Process (CDP) hearing if you believe the charge is unfair. This appeal process is crucial, as it gives you a formal way to contest the IRS's actions. For example, there have been cases where taxpayers successfully reduced their tax liabilities significantly-one case saw a debt of $41,251 reduced to just $2,196 through an Offer in Compromise, resulting in a remarkable 95% savings.

Despite these protections, many taxpayers remain unaware of their rights. Research indicates that a significant number of individuals do not know they can contest income garnishments. In fact, around 1,312 taxpayers may have been affected because the IRS did not send a copy of the CDP garnishment notification to their authorized representative. This highlights the urgent need for better education and resources. Understanding your rights is essential for effectively managing this process and safeguarding your financial future.

We’re here to help you navigate these challenges. You are not alone in this journey, and knowing your rights can empower you to take action.

Explore Your Options: Steps to Address an IRS Wage Levy

Receiving a notice of an IRS levy wage can be overwhelming. We understand that this situation can bring a lot of stress, but there are effective steps you can take to regain control:

-

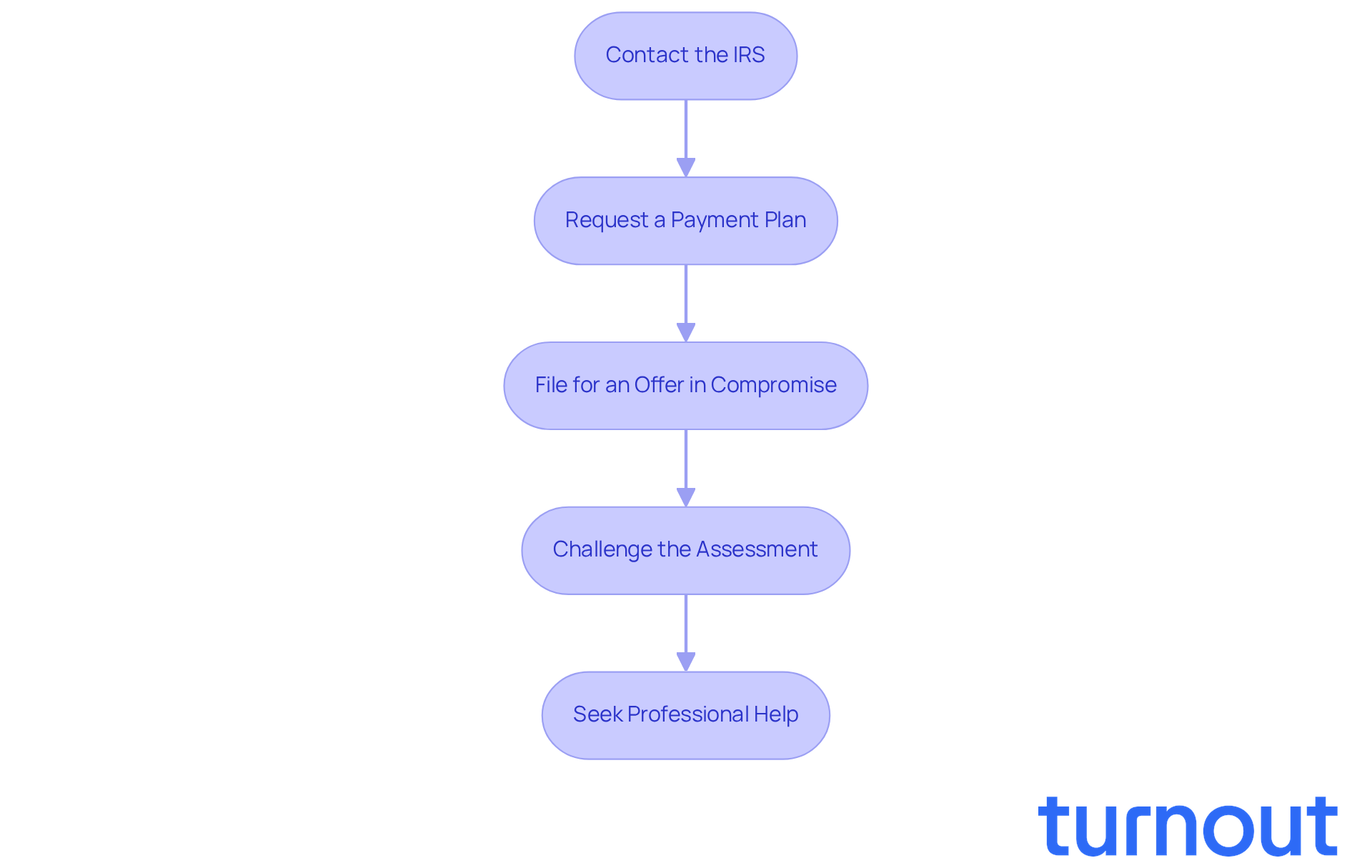

Contact the IRS: Reach out to the IRS right away to discuss your tax liability. Engaging early can help you maintain control over the resolution process and ease some of your worries.

-

Request a Payment Plan: If paying the full amount isn’t feasible, consider setting up an installment agreement. In FY 2024, over 70% of taxpayers who couldn’t pay their IRS tax bill opted for a payment plan. This option allows you to manage your debts over time without facing immediate enforcement actions. The IRS collected $120.2 billion in unpaid assessments on returns filed in FY 2024, highlighting the importance of addressing tax liabilities promptly.

-

File for an Offer in Compromise: If you can show financial hardship, you might qualify to settle your tax debt for less than what you owe. In FY 2024, the IRS accepted 7,199 offers in compromise, totaling $163.4 million. This increase in acceptance rates provides a viable path for many taxpayers seeking relief.

-

Challenge the Assessment: If you believe the assessment is unfair, you can submit Form 12153 to request a Collection Due Process hearing. This step is crucial for protecting your rights and may help stop the charge.

-

Seek Professional Help: Consulting with a tax professional or advocate can offer you tailored advice and support throughout this process. Experienced professionals understand IRS negotiation tactics and can help you navigate your options effectively.

Ignoring the IRS levy wage notifications is the worst choice you can make. By implementing these proactive measures, you can regain control over your financial situation and work towards a solution that lessens the impact of the charge on your income. Remember, you are not alone in this journey, and we’re here to help.

Understand the Consequences: Risks of Ignoring a Wage Levy

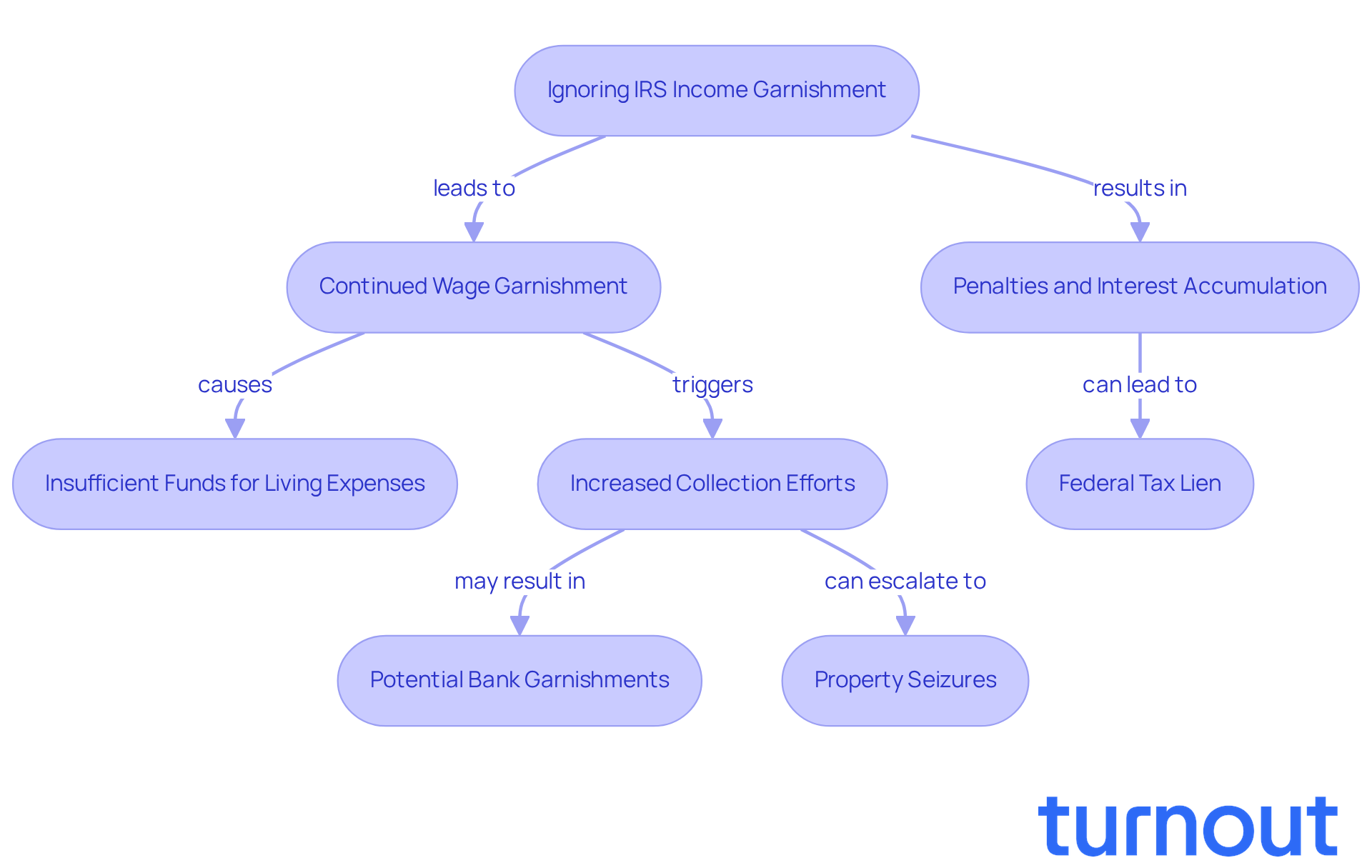

Ignoring an IRS income garnishment can lead to serious financial challenges. We understand that receiving such notices can be overwhelming, but not responding allows the IRS to continue garnishing your wages. This often leaves you with insufficient funds to cover essential living expenses.

As time goes on, the IRS may ramp up their collection efforts, which could include bank garnishments or even property seizures. It’s common to feel anxious about these possibilities. Moreover, penalties and interest on your unpaid tax debt can add 25-30% or more to your original balance within a year. For example, a $10,000 tax bill could balloon by 30% or more if left unaddressed, leading to thousands of dollars in additional debt.

Neglecting these notices can also result in a federal tax lien against your property, which can negatively impact your credit score and complicate future loan or credit applications. It’s vital to take any notice of an IRS levy wage seriously. Acting promptly can help you resolve the underlying tax issues and preserve your financial well-being.

We’re here to help you navigate these challenges. Consider reaching out to a tax professional for a penalty review. They can provide valuable guidance and support as you work through this situation. Remember, you are not alone in this journey.

Conclusion

Navigating the complexities of an IRS wage levy can feel overwhelming. We understand that this situation can bring about anxiety and uncertainty. However, knowing your rights and options is crucial for regaining control over your financial future.

This article highlights key aspects of IRS wage levies, including the legal protections available to you and proactive steps you can take to address these garnishments effectively. By familiarizing yourself with the processes involved, you can better manage your tax liabilities and lessen the impact of wage garnishments on your livelihood.

Consider the importance of timely communication with the IRS. Setting up payment plans can be a viable option, and you have the right to challenge unfair assessments through formal hearings. Remember, neglecting IRS notices can lead to serious consequences, such as increased debt and damage to your credit score. Staying informed and assertive in addressing any IRS actions is essential for protecting your financial stability.

Ultimately, understanding the implications of an IRS wage levy and recognizing the available avenues for resolution can empower you to take decisive action. Seeking professional advice and being proactive in managing your tax obligations can significantly influence your outcomes. By prioritizing awareness and education on IRS wage levies, you can navigate this challenging landscape with confidence and resilience. You're not alone in this journey, and we're here to help.

Frequently Asked Questions

What is an IRS wage levy?

An IRS wage levy, also known as earnings garnishment, is a legal method used by the Internal Revenue Service to recover unpaid taxes by seizing a portion of your earnings directly from your employer.

How does the IRS initiate a wage levy?

The IRS initiates a wage levy by sending a notice of seizure to your employer, which requires them to withhold a specified amount from your paycheck until your tax obligation is fulfilled.

Does the IRS need a court order to impose a wage levy?

No, the IRS can impose a wage levy without needing a court order, making it a powerful tool for tax collection.

What are the financial implications of an IRS wage levy?

An IRS wage levy reduces your take-home pay, which can make it difficult to cover essential living expenses and negatively impact your financial stability.

How does the IRS determine the amount that can be garnished from my wages?

The IRS garnishes income above a certain exempt amount, which varies based on factors such as your filing status and number of dependents.

Can I have an IRS wage levy removed?

Yes, you can often have a charge removed in as little as 24-72 hours after the IRS receives the proper documentation. Most charge releases occur within 1-7 days after the IRS approves a payment plan or hardship request.

Why is it important to understand the IRS wage levy process?

Understanding the intricacies of the IRS wage levy process is crucial for anyone dealing with tax debt, as it can significantly impact your financial well-being. Early understanding can lead to better outcomes.