Introduction

Navigating the complexities of tax laws can feel overwhelming, especially when trying to understand the services offered by the IRS in Orange County. We understand that this journey can be daunting, and that’s why this guide is here to help. It aims to demystify the process, equipping you with essential knowledge about available resources, from Taxpayer Assistance Centers to valuable tax benefits.

However, it’s common to face challenges like long wait times and document requirements. So, how can you ensure a smooth and successful visit to an IRS office? Let’s explore the options together, so you feel prepared and supported every step of the way.

Understand the Role of the IRS and Available Services in Orange County

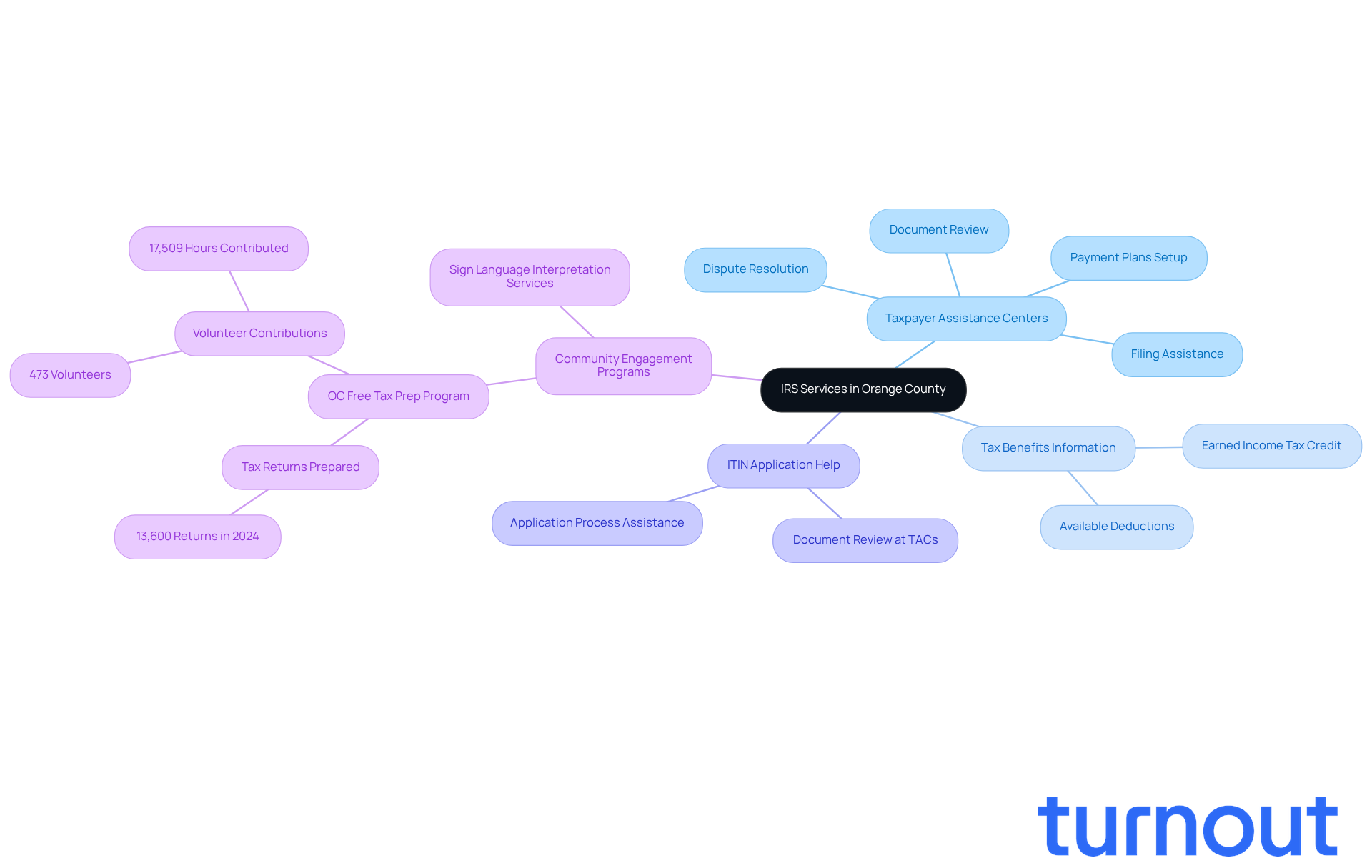

The IRS offices in Orange County are here to help you navigate the complexities of tax laws across the United States. We understand that dealing with taxes can be overwhelming, but the IRS offers a variety of services designed to assist you effectively:

- Taxpayer Assistance Centers (TACs): These centers provide in-person support for various tax-related issues, such as filing assistance, setting up payment plans, and resolving disputes. With several IRS offices in Orange County, you can easily access the resources you need. Remember, appointments are necessary at these centers, ensuring you receive personalized support for document review and assistance.

- Information on Tax Benefits: The IRS is committed to guiding you through available tax credits and deductions that can significantly ease your tax burden. For instance, the Earned Income Tax Credit can provide substantial financial relief, and we’re here to help you understand how to take advantage of it.

- Help with ITIN Applications: If you need an Individual Taxpayer Identification Number (ITIN), the IRS is ready to assist you with the application process, including document review at TACs.

For our deaf or hard of hearing friends, we can arrange appointments for sign language interpretation by calling TTY/TDD 800-829-4059.

We’re pleased to share that all Taxpayer Advocate Service offices are now operational following the government shutdown, allowing for enhanced assistance delivery. The IRS has also resumed normal operations, including the reopening of TACs, which are available by appointment only. This ensures you receive tailored support for your document review and assistance needs.

Successful taxpayer assistance programs in Orange County, including those at IRS offices in Orange County like the OC Free Tax Prep program, showcase the power of community engagement in tax preparation. In 2024 alone, this program prepared over 13,600 tax returns with the help of 473 volunteers who dedicated 17,509 hours to tax preparation work, positively impacting our local economy by $21.2 million.

Understanding these services and recent changes will empower you to navigate the IRS system more efficiently. We encourage you to identify the support you might need before visiting an IRS location. Remember, you are not alone in this journey; we’re here to help.

Locate IRS Offices Using Online Resources and Local Directories

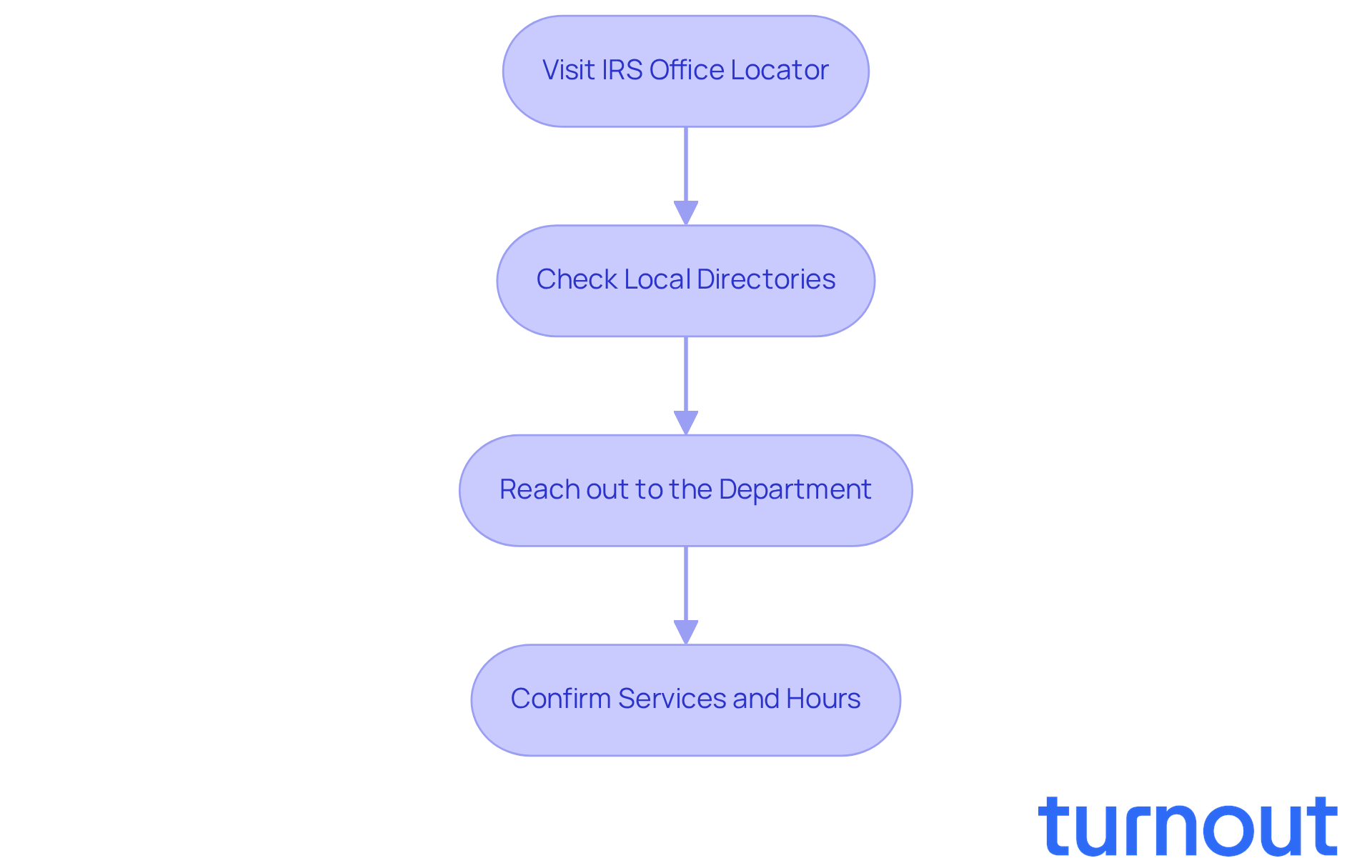

Finding the nearest IRS offices in Orange County can feel overwhelming, but we’re here to help you through it. Just follow these simple steps:

-

Visit the IRS Office Locator: Start by heading to the IRS Local Office Locator. Enter your address, city, or ZIP code to discover the closest Taxpayer Assistance Center. It’s a straightforward way to get the information you need.

-

Check Local Directories: Websites like Yelp or Google Maps can be incredibly helpful. They provide additional insights about IRS site locations, including user reviews and photos. This can give you a better sense of what to expect.

-

Reach out to the Department: Once you’ve found a suitable location, don’t hesitate to call them. Confirm their services and hours of operation. This step ensures you have the most current information before your visit, making your experience smoother.

We understand that navigating these processes can be challenging, but remember, you’re not alone in this journey. If you have any questions or need further assistance, feel free to reach out. We're here to support you!

Prepare for Your Visit: Essential Documents and Information Needed

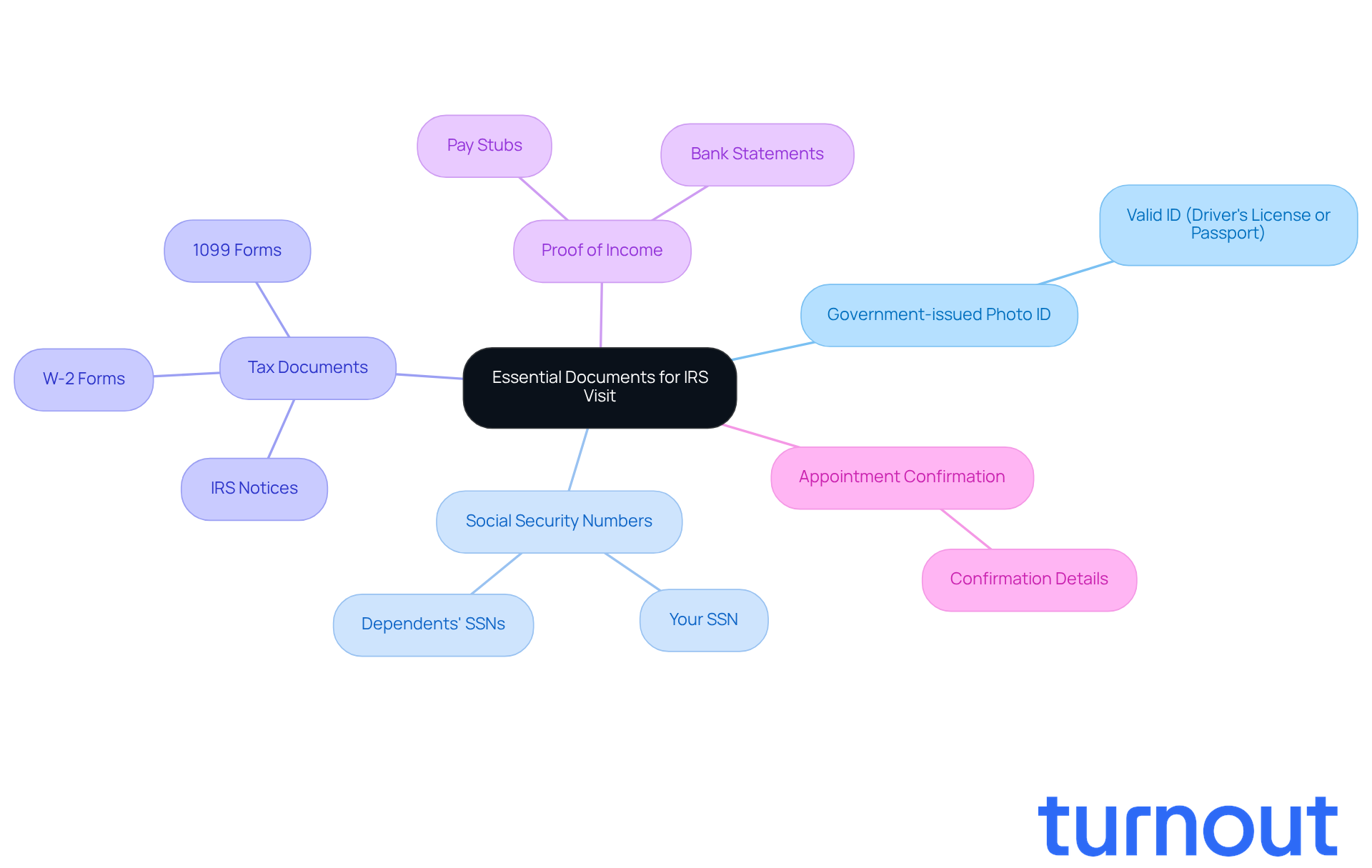

Before you visit the IRS offices in Orange County, it’s important to feel prepared and confident. We understand that navigating tax matters can be stressful, so having the right documents can make a big difference. Here’s what you’ll need:

- Government-issued Photo ID: Please bring a valid ID, like your driver’s license or passport. This helps verify your identity and ensures a smoother process.

- Social Security Numbers: Make sure you have your Social Security number handy, along with those of any dependents. This is crucial for your records.

- Tax Documents: Gather any relevant tax forms, such as W-2s, 1099s, and any IRS notices you’ve received. Having these on hand will help address your questions more effectively.

- Proof of Income: If applicable, bring documentation that verifies your income, like pay stubs or bank statements. This can be helpful for any discussions about your financial situation.

- Appointment Confirmation: If you’ve scheduled an appointment, don’t forget to bring any confirmation details. This will help expedite your check-in process and reduce wait times.

We’re here to help you through this journey, and being prepared can ease some of the stress. Remember, you’re not alone in this process.

Troubleshoot Common Issues When Accessing IRS Services

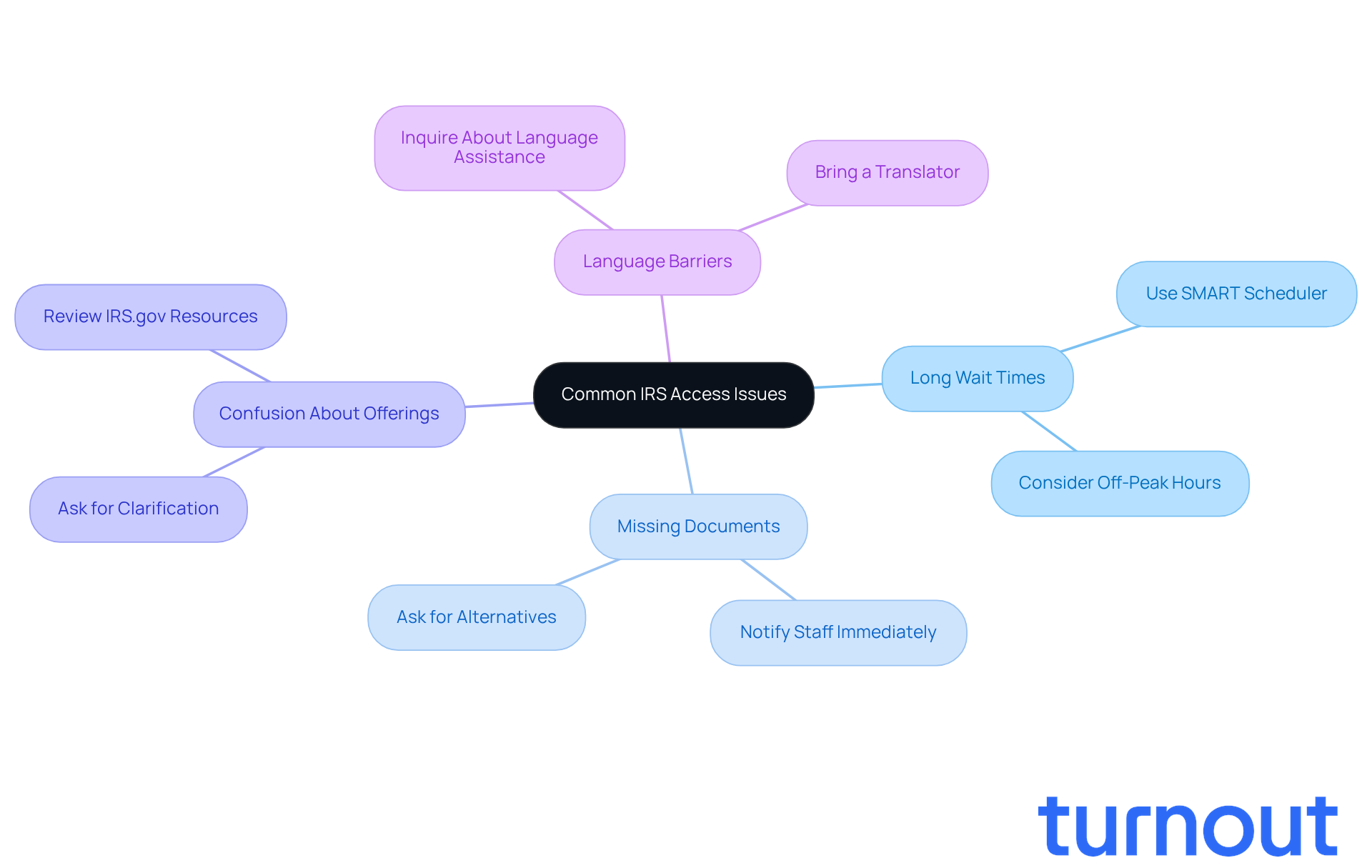

Visiting an IRS location can be daunting, and it’s common to face a few challenges. But don’t worry; we’re here to help you navigate through them effectively.

-

Long Wait Times: If you arrive and see a long line, it’s understandable to feel frustrated. Consider using the SMART Scheduler feature on IRS.gov to self-schedule an appointment for a later date. Many taxpayers prefer this option, with 65 percent indicating they’d rather schedule than wait in line. This simple step can significantly reduce your wait time.

-

Missing Documents: Forgetting a necessary document can happen to anyone. If this occurs, let the staff know right away. They may offer alternatives or assist you in rescheduling your appointment, ensuring you have everything you need for your case.

-

Confusion About Offerings: It’s perfectly normal to feel uncertain about the options available to you. Don’t hesitate to ask the staff for clarification. They’re there to assist you and can provide valuable guidance on what to expect during your visit.

-

Language Barriers: If you need assistance in a language other than English, just ask about available language options at the office. Bringing a translator can also help ensure clear communication.

By following these strategies, you can navigate the IRS experience more smoothly. Many taxpayers have reported issues like long wait times and confusion about services, but by being proactive and prepared, you can enhance your chances of a successful visit. Remember, you’re not alone in this journey, and we’re here to support you.

Conclusion

Navigating the IRS offices in Orange County can feel overwhelming, but it doesn’t have to be. With the right knowledge and resources, you can approach this process with confidence. We understand that tax-related concerns can be stressful, but knowing about the services available - from taxpayer assistance to ITIN applications - can empower you to tackle these challenges head-on. The IRS is dedicated to making their services accessible, ensuring that every taxpayer finds the support they need.

Preparation is key. Gathering essential documents and utilizing online resources to locate your nearest IRS office can make a world of difference. By understanding the services offered and the steps to take before your visit, you can significantly reduce stress and enhance your experience. It’s common to face challenges like long wait times or missing documents, but being aware of these potential issues allows you to proactively address them.

Remember, the journey through tax season doesn’t have to be daunting. By leveraging the resources and support available at IRS offices in Orange County, you can navigate this process more effectively. Take charge of your tax experience: prepare thoroughly, reach out for assistance when needed, and know that help is available every step of the way. You are not alone in this journey.

Frequently Asked Questions

What services does the IRS offer in Orange County?

The IRS offers various services in Orange County, including in-person support at Taxpayer Assistance Centers (TACs) for filing assistance, payment plans, and dispute resolution, as well as information on tax benefits and help with Individual Taxpayer Identification Number (ITIN) applications.

What are Taxpayer Assistance Centers (TACs)?

TACs are IRS offices that provide in-person support for various tax-related issues. Appointments are necessary to receive personalized assistance for document review and other tax matters.

How can the IRS assist with tax benefits?

The IRS provides guidance on available tax credits and deductions, such as the Earned Income Tax Credit, which can help reduce your tax burden.

What support does the IRS offer for ITIN applications?

The IRS assists individuals with the application process for Individual Taxpayer Identification Numbers (ITINs), including document review at Taxpayer Assistance Centers.

Is there assistance available for deaf or hard of hearing individuals?

Yes, the IRS can arrange appointments for sign language interpretation for deaf or hard of hearing individuals by calling TTY/TDD 800-829-4059.

Are the Taxpayer Advocate Service offices operational?

Yes, all Taxpayer Advocate Service offices are now operational following the government shutdown, allowing for enhanced assistance delivery.

How does the OC Free Tax Prep program contribute to the community?

The OC Free Tax Prep program prepared over 13,600 tax returns in 2024 with the help of 473 volunteers, positively impacting the local economy by $21.2 million.

What should I do before visiting an IRS location?

It is encouraged to identify the support you might need before visiting an IRS location to ensure you receive the appropriate assistance.