Overview

IRS Notice CP23 brings important news about your tax return, and we understand that it may feel overwhelming. This notice indicates a change that could increase your tax liability, which requires your prompt and careful attention.

It’s crucial to review the notice for accuracy. Take your time to ensure everything is correct. Remember, responding within 60 days is essential to preserve your appeal rights. We want you to feel empowered in this process.

If you find yourself facing a tax obligation, know that there are options available. Explore solutions like:

- installment agreements

- Offers in Compromise

These can help you manage any resulting tax obligations effectively.

You are not alone in this journey. We’re here to help you navigate these changes and find the best path forward.

Introduction

Receiving an IRS Notice CP23 can feel overwhelming. It often signals potential changes to your tax return and an increase in tax liability. We understand that this notice can bring about a wave of anxiety and uncertainty. It’s crucial to grasp the implications of this notice, as it outlines not only the adjustments made but also the actions you need to take to prevent further complications.

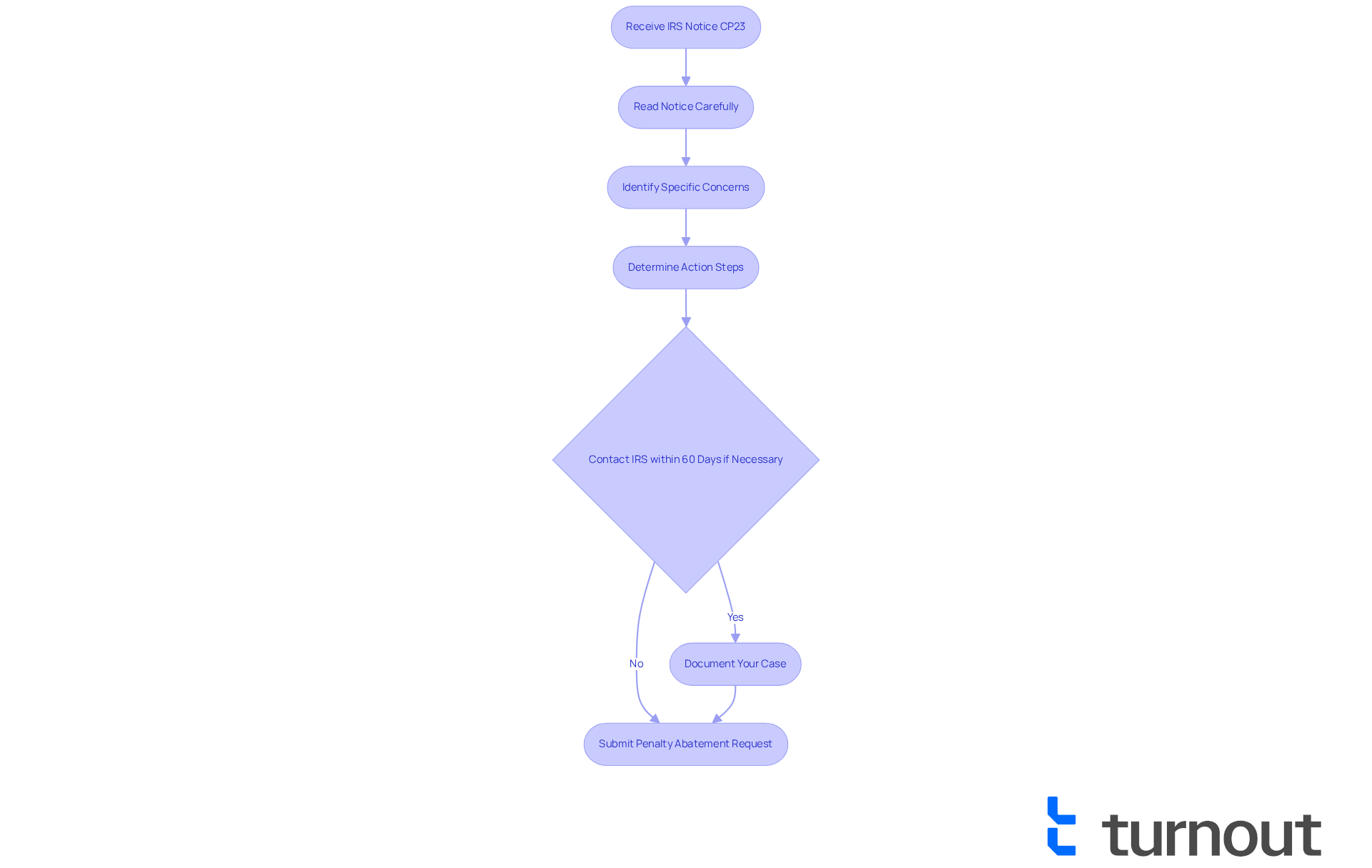

What steps should you consider to navigate this notification effectively? How can you protect yourself from potential penalties and interest? This guide aims to explore essential strategies for responding to IRS Notice CP23. By doing so, we empower you to take control of your tax obligations and safeguard your financial well-being. Remember, you are not alone in this journey; we’re here to help.

Understand IRS Notice CP23: Definition and Importance

IRS Notice cp23 is a notification from the Internal Revenue Service (IRS) that indicates a change to your tax return, which may lead to an increase in your tax liability. We understand that receiving such news can be concerning. This announcement is important as it outlines the modifications made, the reasons for these changes, and the total amount you are required to pay. Comprehending this notice is the first step in ensuring you respond appropriately and avoid further issues with your tax responsibilities. It’s essential to read the notice carefully to identify the specific concerns raised by the IRS, as this will guide your next steps in addressing the situation effectively.

Prompt action on related communications is crucial. We recognize that procrastination can result in significant financial repercussions, as unresolved discrepancies may escalate into larger liabilities. For example, last month, three cases were resolved, revealing incorrect balance due alerts totaling over $45,000. Such instances highlight the necessity of understanding IRS communications and responding promptly. Additionally, success rates for penalty abatement requests submitted with proper documentation exceed 50%, reinforcing the importance of maintaining meticulous records.

It’s important to note that IRS Notice cp23 often signifies a discrepancy between the estimated tax payments reported on your return and what the IRS has on record. We encourage taxpayers to keep detailed records to prevent such issues. If you disagree with the amount owed or are unsure about the content of the notice, it’s vital to reach out to the IRS within 60 days to preserve your appeal rights.

The impact of CP23 from the IRS on taxpayers can be significant, potentially leading to penalties and interest charges on unpaid taxes. However, proactive resolution strategies can help mitigate these consequences. Taxpayers who successfully document their cases have seen success rates above 50% in penalty abatement requests. Understanding the importance of IRS communications is essential; as one specialist noted, 'The most effective prevention is automating your estimated tax payments through EFTPS.'

Moreover, it’s comforting to know that taxpayers can request IRS notices or letters in Braille or large print, ensuring accessibility for everyone. In summary, the cp23 notice from the IRS is not just a notification but a prompt for action. By understanding its implications and responding appropriately, you can navigate your tax obligations more effectively and avoid unnecessary complications. Remember, you are not alone in this journey; we’re here to help.

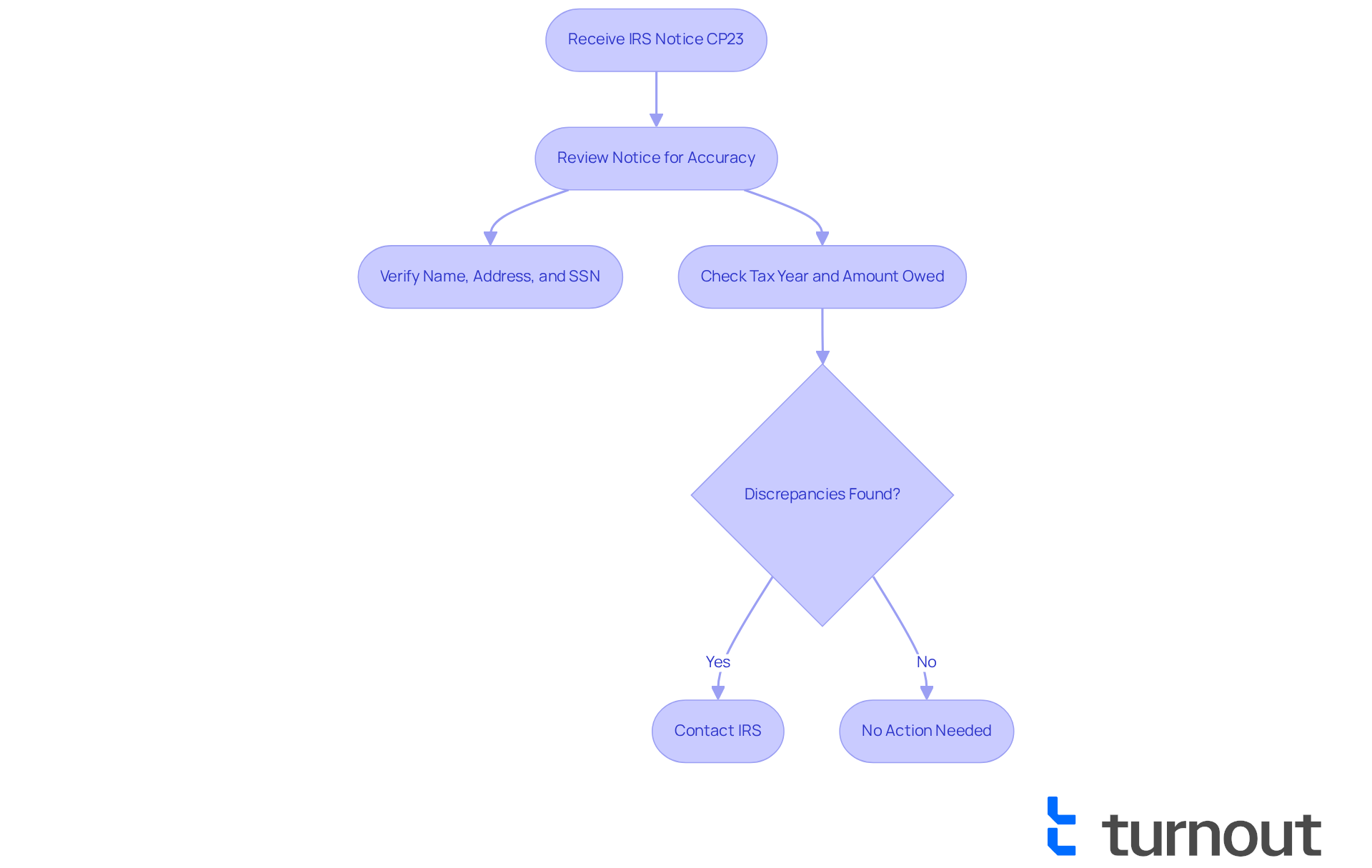

Verify Your IRS Notice CP23: Initial Steps to Take

Begin by carefully reviewing the IRS notice cp23 for accuracy. We understand that receiving such notices can be stressful. Ensure your name, address, and Social Security number are correct. Next, verify the tax year mentioned in the communication and the amount owed. It’s common to feel confused, so we recommend contrasting the announcement with your tax return to identify any discrepancies.

Common causes for receiving a cp23 notification include incorrect entries on the estimated tax line. If you have concerns regarding the legitimacy of the announcement, please reach out to the IRS directly using the number included on the document. This verification step is crucial; ignoring inaccuracies can lead to escalating penalties and interest, which accumulate during the first 60 days of inaction. As one tax expert mentioned, 'If you’re uncertain whether the communication is accurate, it might be beneficial to consult a tax specialist for clarification.'

For instance, one taxpayer received a cp23 communication due to a software error that misreported estimated payments. After confirming the announcement and supplying documentation, the IRS adjusted the balance, removing the amount due. Remember, responding to the alert swiftly can avert significant repercussions, such as liens and wage garnishments.

Additionally, keeping accurate records of all communications with the IRS is essential for managing your tax obligations effectively. You are not alone in this journey; we’re here to help you navigate through it.

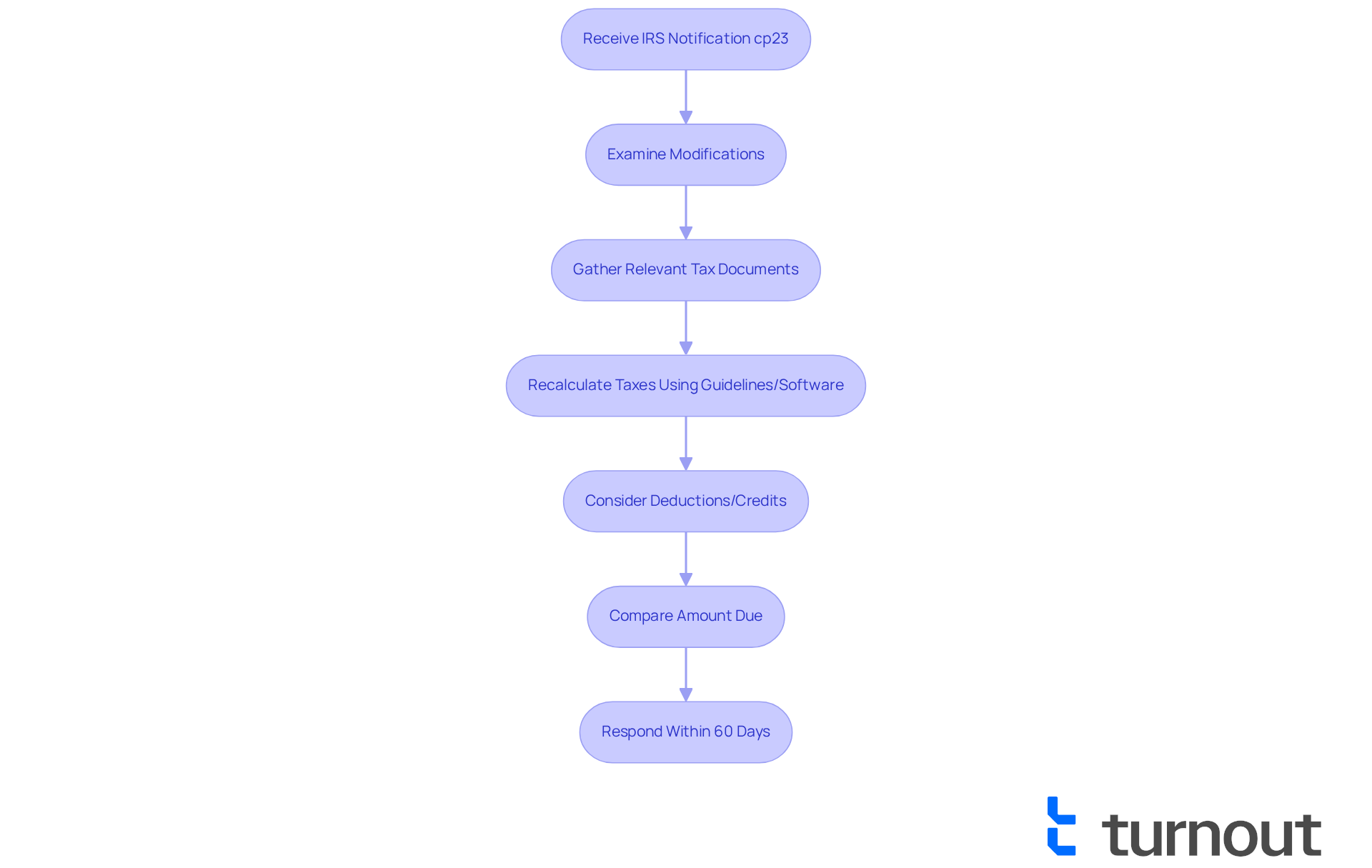

Calculate Your Tax Liability: Determine What You Owe

To determine your tax obligation after receiving IRS Notification cp23, it’s important to take a deep breath and approach the situation step by step. Start by carefully examining the modifications outlined in the document. Gather all relevant tax documents, including your original return and any supporting materials. We understand that this can feel overwhelming, but using IRS guidelines or reliable tax software to recalculate your tax based on the corrected figures can help clarify things. Remember to consider any applicable deductions or credits that may affect your total. Once you have determined the accurate sum due, compare it with the amount stated in the notification to identify any discrepancies. This thorough calculation will not only clarify your financial obligations but also prepare you for the necessary next steps.

It's essential to know that the IRS allows for first-time penalty abatement for those with clean compliance histories. This can significantly reduce your financial burdens. Additionally, be aware that interest charges apply on the amount owed unless paid by the due date, making timely responses crucial. You have 60 days from the date of the alert to reply to the correspondence to maintain your appeal rights, highlighting the importance of addressing these alerts swiftly. By automating estimated tax payments through EFTPS and keeping meticulous records, you can further mitigate the risk of future discrepancies. Disregarding collection alerts can lead to increasing recovery measures, such as further communications and possible garnishments on bank accounts or salaries. As one tax advisor noted, "The most effective prevention is automating your estimated tax payments through EFTPS." Remember, you are not alone in this journey; we’re here to help.

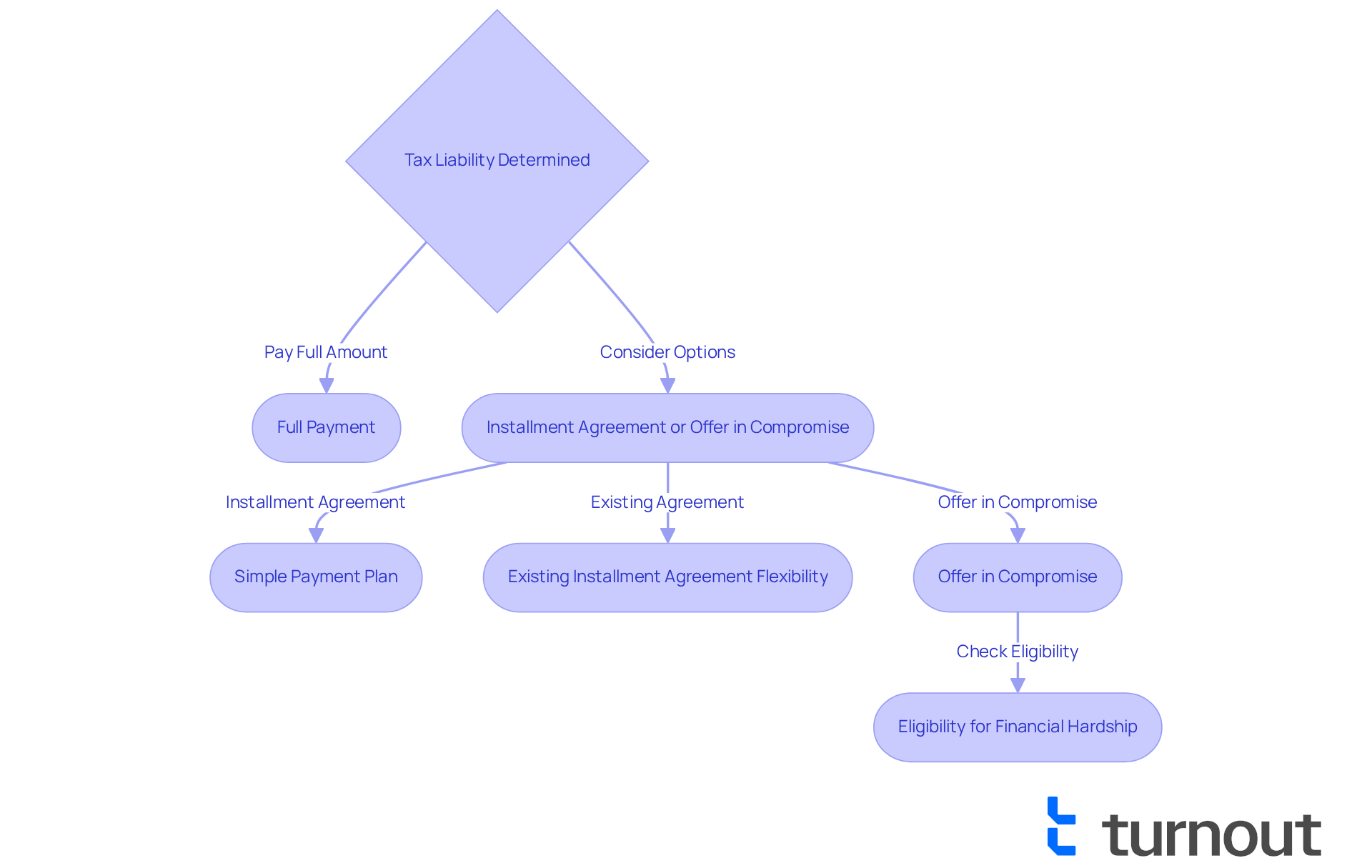

Explore Payment Options: Full Payment, Installments, or Compromise

After determining your tax liability, we understand that evaluating your payment options can feel overwhelming. If you're able to pay the full amount, you can do so directly through the IRS website or by mail. However, if full payment isn't feasible, consider an installment agreement. This option allows you to pay your tax liability in smaller, manageable amounts over time. Currently, over 90% of individual taxpayers with a balance due qualify for a Simple Payment Plan, making this a viable option for many.

It's also comforting to know that the IRS has introduced more flexibility for existing Installment Agreements as part of its COVID-19 tax debt relief options. This can be particularly beneficial for those already enrolled in a plan. Alternatively, you might be eligible for an Offer in Compromise (OIC), which enables you to settle your tax debt for less than the total amount owed. This option is especially advantageous for those facing financial hardship, as it can significantly reduce the burden of tax debt.

It's important to note that if you've tried to comply with tax laws but faced circumstances beyond your control, you may qualify for penalty relief. This provides additional reassurance during a challenging time. To set up an installment agreement, visit the IRS website for detailed instructions and eligibility requirements. Taking action promptly is crucial; delaying payments or overlooking IRS communications can lead to higher penalties and interest.

For instance, a taxpayer with a $200,000 IRS debt could opt for a time-based payment plan, resulting in monthly payments of approximately $2,300 over 84 months. However, remember that penalties and interest continue to accrue during repayment, emphasizing the importance of timely action.

Many taxpayers have successfully utilized installment agreements or Offers in Compromise, highlighting the effectiveness of these options. They have found relief through structured payment plans, allowing them to manage their tax obligations without overwhelming financial strain. As financial experts often remind us, choosing the right payment method is essential to avoid costly penalties and interest, ensuring a smoother path to financial stability. You are not alone in this journey; we're here to help you navigate these options.

Dispute the Notice: Steps to Challenge IRS Errors

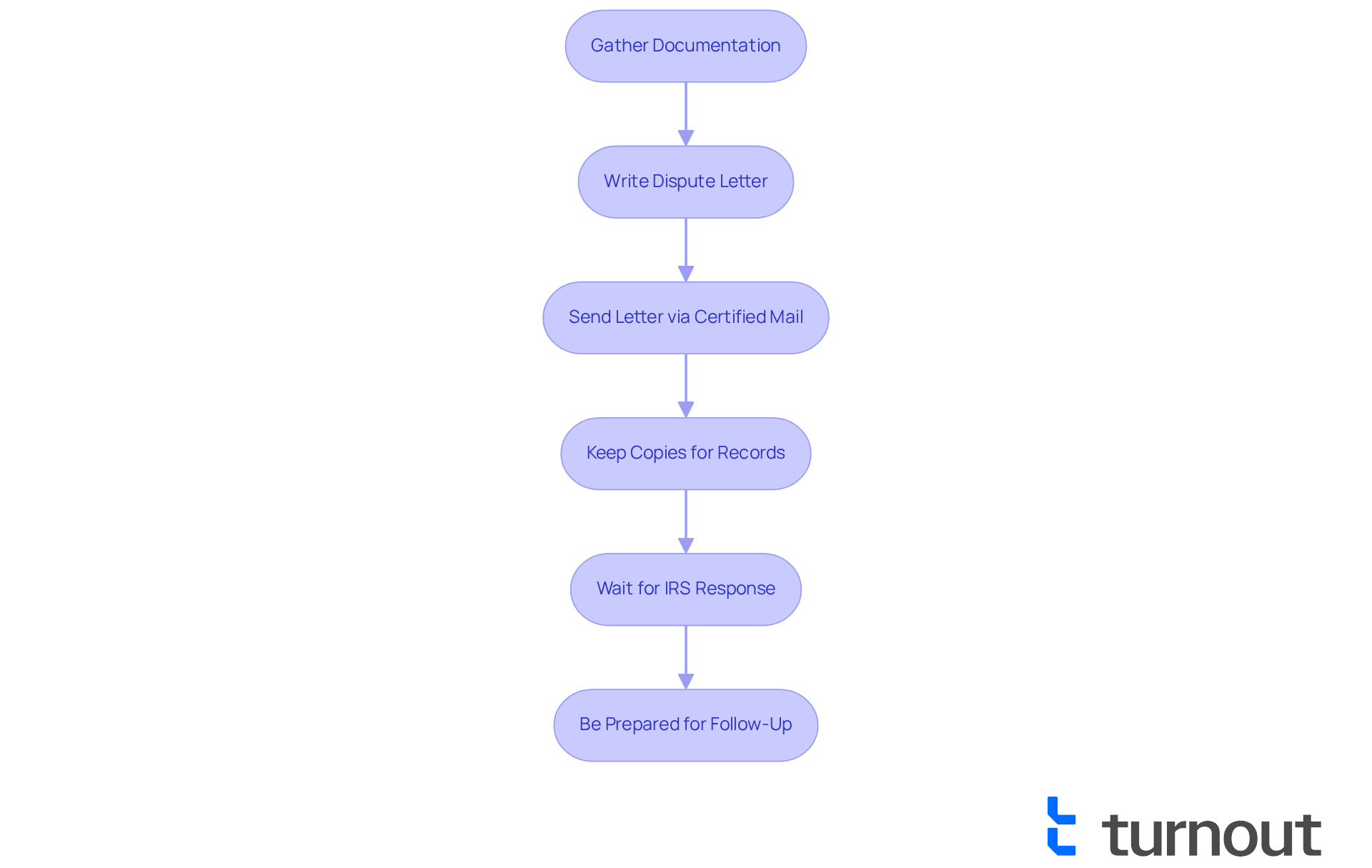

If you think that the IRS Notice contains errors, we understand how concerning that can be. You have the right to contest it, and we’re here to help you through this process. Start by gathering all relevant documentation that supports your claim, such as your original tax return and any correspondence with the IRS.

Next, write a letter to the IRS explaining the discrepancies. Include copies of your supporting documents, and don’t forget to mention the announcement number and your tax identification number in your correspondence. Sending your dispute letter via certified mail is a wise choice to ensure it is received. Remember to keep copies of everything for your records.

The IRS will review your dispute and respond, so be prepared for potential follow-up communication. It's important to note that penalty removal rates can exceed 50% when properly presented to the IRS, highlighting the effectiveness of a well-prepared dispute. Disregarding cp23 activates increasing collection measures, which can result in further alerts, Notification of Intent to Levy, and even actual levies on bank accounts or wages.

You have 60 days from the notice date to respond, making it crucial to act promptly. Understanding this process is vital for protecting your rights and correcting errors. Remember, you are not alone in this journey—taking these steps can lead to a positive outcome.

Conclusion

Receiving IRS Notice CP23 can feel overwhelming. We understand that navigating tax responsibilities is challenging, and it’s vital to comprehend what this notice means for you. This notice serves as an important alert about changes to your tax return that may affect your liability. By taking the time to understand the notice and following the outlined steps, you can approach this situation with greater confidence and avoid potential complications.

The article outlines essential steps for responding to IRS Notice CP23:

- Start by verifying the accuracy of the notice.

- Next, calculate your correct tax liability.

- Explore payment options and, if necessary, dispute any errors.

Each step is designed to empower you, highlighting the importance of prompt action to prevent escalating penalties and interest. Keeping meticulous records and considering options like installment agreements or Offers in Compromise can provide relief during financial challenges.

Ultimately, the key takeaway is that engaging proactively with IRS communications can significantly reduce tax-related stress and financial burdens. You are encouraged to act swiftly and seek assistance when needed; remember, you are not alone in this journey. Taking these critical steps can lead to a more manageable resolution, reinforcing the importance of understanding and responding to IRS Notice CP23 with diligence and care.

Frequently Asked Questions

What is IRS Notice CP23?

IRS Notice CP23 is a notification from the Internal Revenue Service (IRS) indicating a change to your tax return, which may result in an increase in your tax liability. It outlines the modifications made, the reasons for these changes, and the total amount you are required to pay.

Why is it important to understand IRS Notice CP23?

Understanding IRS Notice CP23 is crucial as it helps you identify specific concerns raised by the IRS, guiding your next steps in addressing the situation effectively and avoiding further issues with your tax responsibilities.

What should I do upon receiving IRS Notice CP23?

You should read the notice carefully, verify its accuracy, and respond promptly to any discrepancies. It is essential to reach out to the IRS within 60 days if you disagree with the amount owed or are unsure about the notice's content.

What are the potential consequences of ignoring IRS Notice CP23?

Ignoring IRS Notice CP23 can lead to significant financial repercussions, including escalating penalties and interest charges on unpaid taxes. Procrastination may also result in larger liabilities.

How can I verify the accuracy of IRS Notice CP23?

Begin by reviewing the notice for accuracy, including your name, address, Social Security number, the tax year mentioned, and the amount owed. Compare the notice with your tax return to identify any discrepancies.

What are common causes for receiving IRS Notice CP23?

Common causes include incorrect entries on the estimated tax line or discrepancies between your reported estimated tax payments and what the IRS has on record.

What should I do if I suspect the notice is not legitimate?

If you have concerns regarding the legitimacy of the notice, contact the IRS directly using the number included in the document to verify its authenticity.

What are the success rates for penalty abatement requests related to IRS Notice CP23?

Success rates for penalty abatement requests submitted with proper documentation exceed 50%, highlighting the importance of maintaining meticulous records.

Can taxpayers request IRS notices in different formats?

Yes, taxpayers can request IRS notices or letters in Braille or large print to ensure accessibility for everyone.

What is a proactive strategy to prevent issues related to IRS Notice CP23?

Automating your estimated tax payments through EFTPS (Electronic Federal Tax Payment System) is an effective prevention strategy against discrepancies and related issues.