Introduction

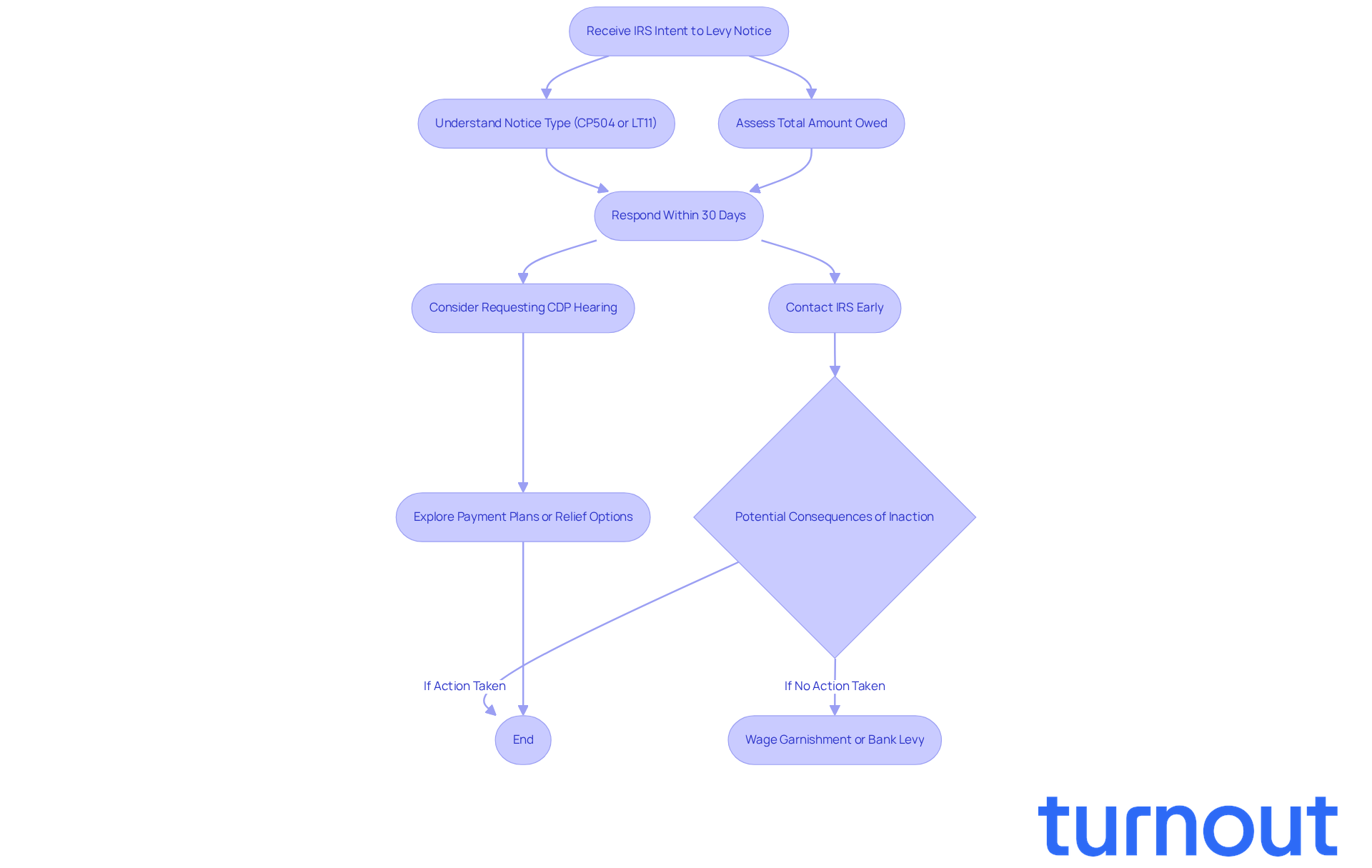

Receiving an IRS intent to levy notice can feel overwhelming. It’s a clear signal that the agency is ready to seize your assets to recover unpaid tax debts. This formal alert often comes after previous communications and marks a critical moment for you. Typically, you have just 30 days to respond before facing serious financial consequences.

We understand that this situation can be incredibly stressful. Knowing the implications of this notice and the options available to you is vital. Taking timely action can not only help you avoid asset confiscation but also open doors to potential resolutions.

So, what steps can you take to navigate this challenging situation? How can you protect your financial interests from the IRS's powerful enforcement measures? Remember, you are not alone in this journey. We're here to help you find the best path forward.

Understand the IRS Intent to Levy

The IRS intent to levy serves as a formal alert that the IRS plans to seize your assets to settle an unpaid tax debt, rather than being merely a notice. This message usually comes after previous communications about your tax obligations and acts as a final warning. We understand that receiving such news can be overwhelming, but it’s crucial to know that you have a limited timeframe - typically 30 days - to respond before the IRS can take action against your wages, bank accounts, or other assets.

Understanding the specific notice you received, like the CP504 or LT11, is essential. Each of these carries unique implications and requirements. For instance, the CP504 indicates the IRS intent to levy your assets, while the LT11 provides information about your rights to request a Collection Due Process (CDP) hearing.

Statistics show that many taxpayers don’t respond to these alerts, which can lead to serious consequences, such as wage garnishment or bank levies. It’s common to feel uncertain about what to do next, but remember, timely responses can make a significant difference. For example, one taxpayer successfully arranged a payment plan after quickly responding to an LT11 alert, avoiding a potential levy.

Here are some key details to keep in mind about IRS Intent to Levy notices:

- The total amount owed

- The specified deadlines

- Your rights to appeal or request a hearing

Reaching out to the IRS early can help you maintain your options and possibly lessen the impact of enforcement measures. Ignoring or delaying action can lead to mounting penalties and interest, making it vital to act swiftly. Remember, you’re not alone in this journey; we’re here to help you navigate these challenges.

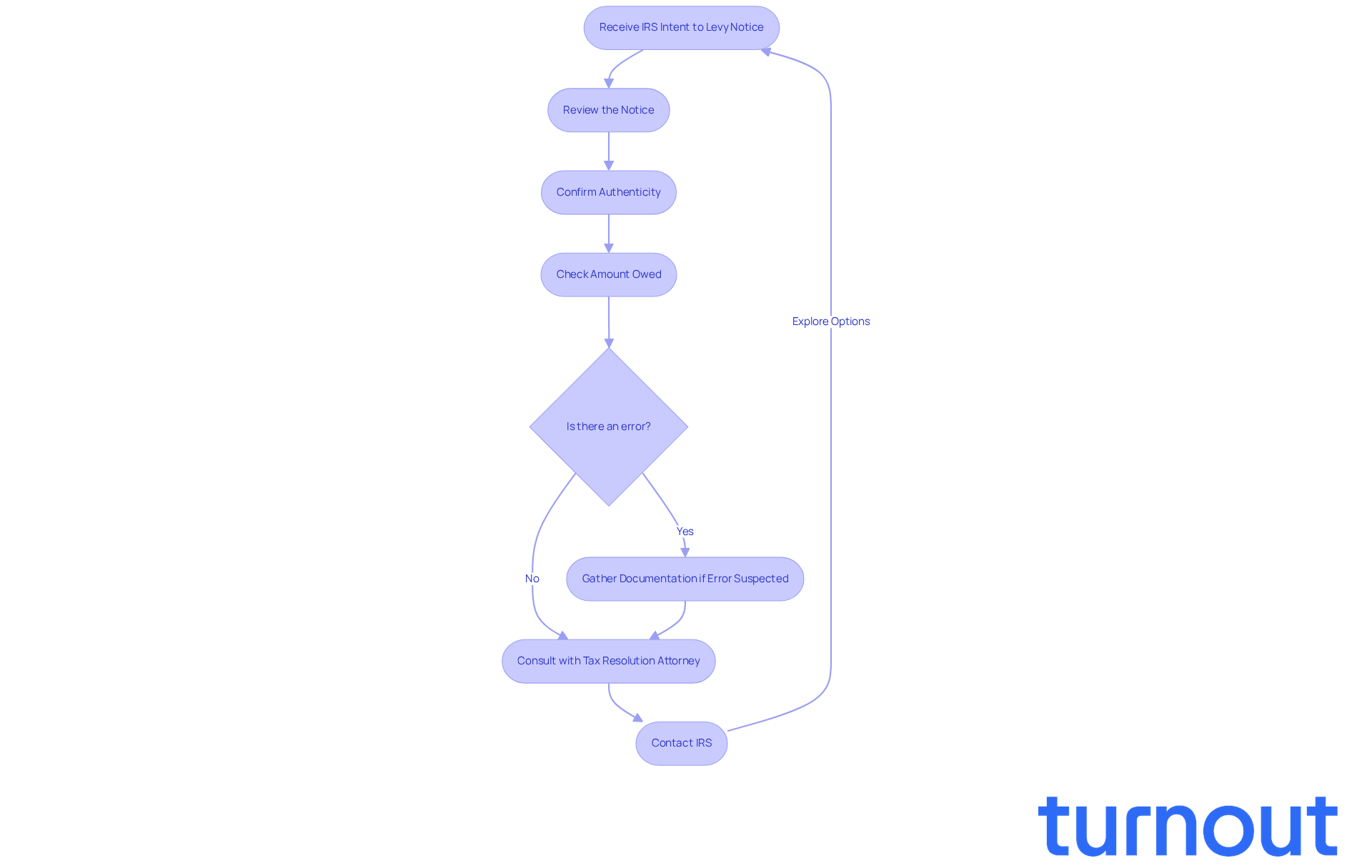

Take Immediate Action Upon Receiving the Notice

Receiving an IRS intent to levy communication can be overwhelming, and it's crucial to act swiftly. First, take a moment to thoroughly review the announcement and confirm its authenticity. Look for official IRS markings, like the IRS logo and contact information, to ensure it’s legitimate. It’s important to confirm the amount owed by cross-referencing it with your records. The average amount owed by taxpayers receiving an Intent to Levy can be significant, often exceeding several thousand dollars, so accuracy is vital.

If you suspect an error, gather all pertinent documentation, including tax returns and payment records, to support your claims. As attorney Tony Ramos wisely advises, "By consulting with an experienced IRS tax resolution attorney, you can usually resolve your tax liability in your best interest." Don’t hesitate to contact the IRS immediately to discuss your situation and explore resolution options. You might consider:

- Setting up a payment plan

- Requesting a hearing to contest the levy

Remember, you usually have 30 days to reply to the alert, so taking swift measures is crucial to avoid asset confiscation.

Engaging with the IRS early can provide you with the necessary time to navigate your options effectively and protect your financial interests. It’s also helpful to recognize that the IRS typically issues a sequence of alerts prior to a levy, which includes the essential 'IRS intent to levy' notification. This knowledge can empower you to prepare and respond appropriately. You are not alone in this journey; we’re here to help you through it.

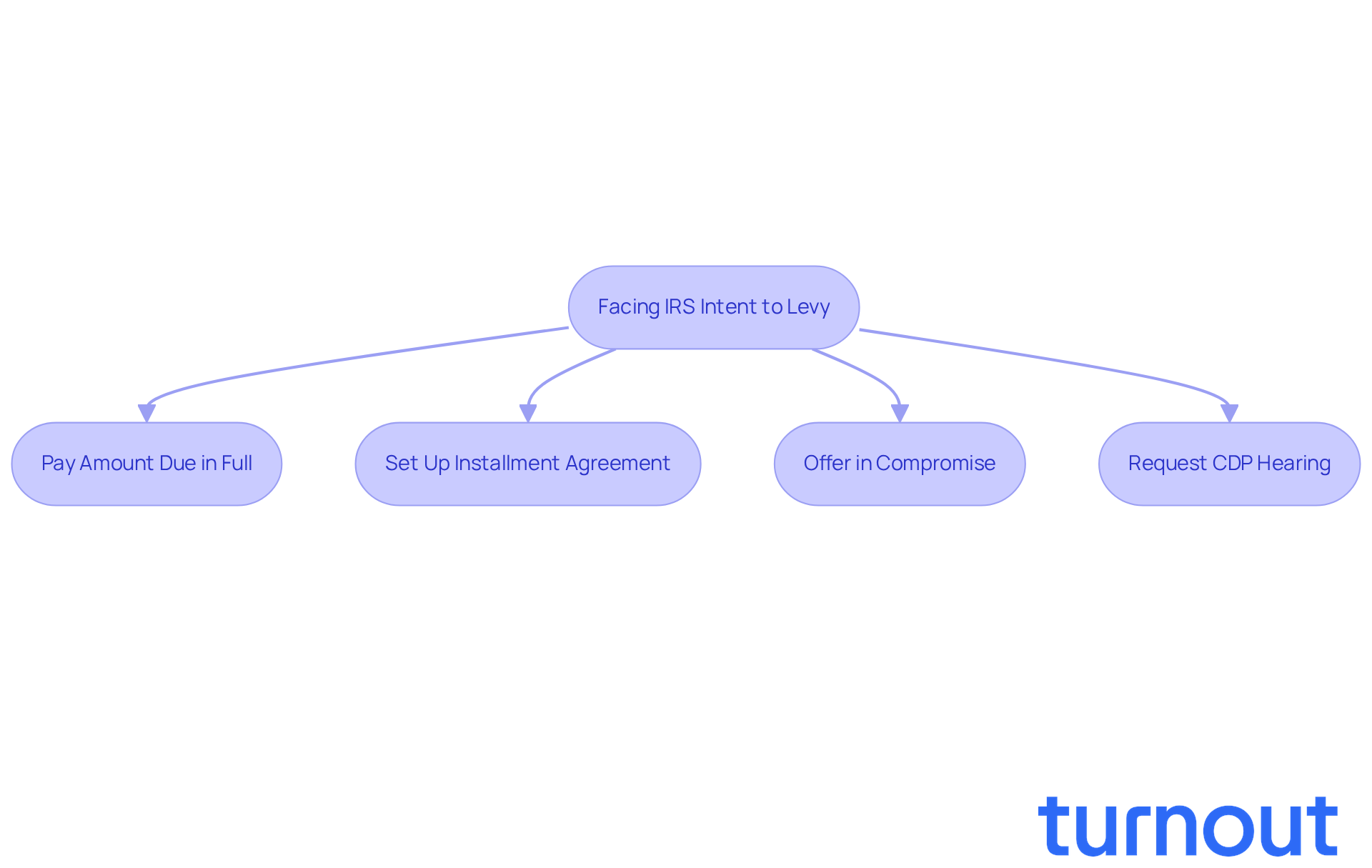

Explore Your Response Options

Facing an IRS intent to levy can be overwhelming, and it’s completely normal to feel anxious about this situation. But don’t worry; you have several options to consider that can help you navigate this situation.

One of the most straightforward methods is to pay the amount due in full. This action will stop any further collection efforts and give you peace of mind. If immediate payment isn’t feasible, you might want to explore setting up an installment agreement. This option allows you to pay off your debt over time, making it more manageable.

Alternatively, you may qualify for an Offer in Compromise. This program lets you settle your tax debt for less than the full amount owed, especially if you can demonstrate financial hardship. It’s a chance to find relief when you need it most.

If you disagree with the levy, remember that you can request a Collection Due Process (CDP) hearing. By filing Form 12153 within the 30-day window, you can present your case and potentially negotiate a more favorable outcome. We understand that this process can feel daunting, but you’re not alone in this journey. We’re here to help you every step of the way.

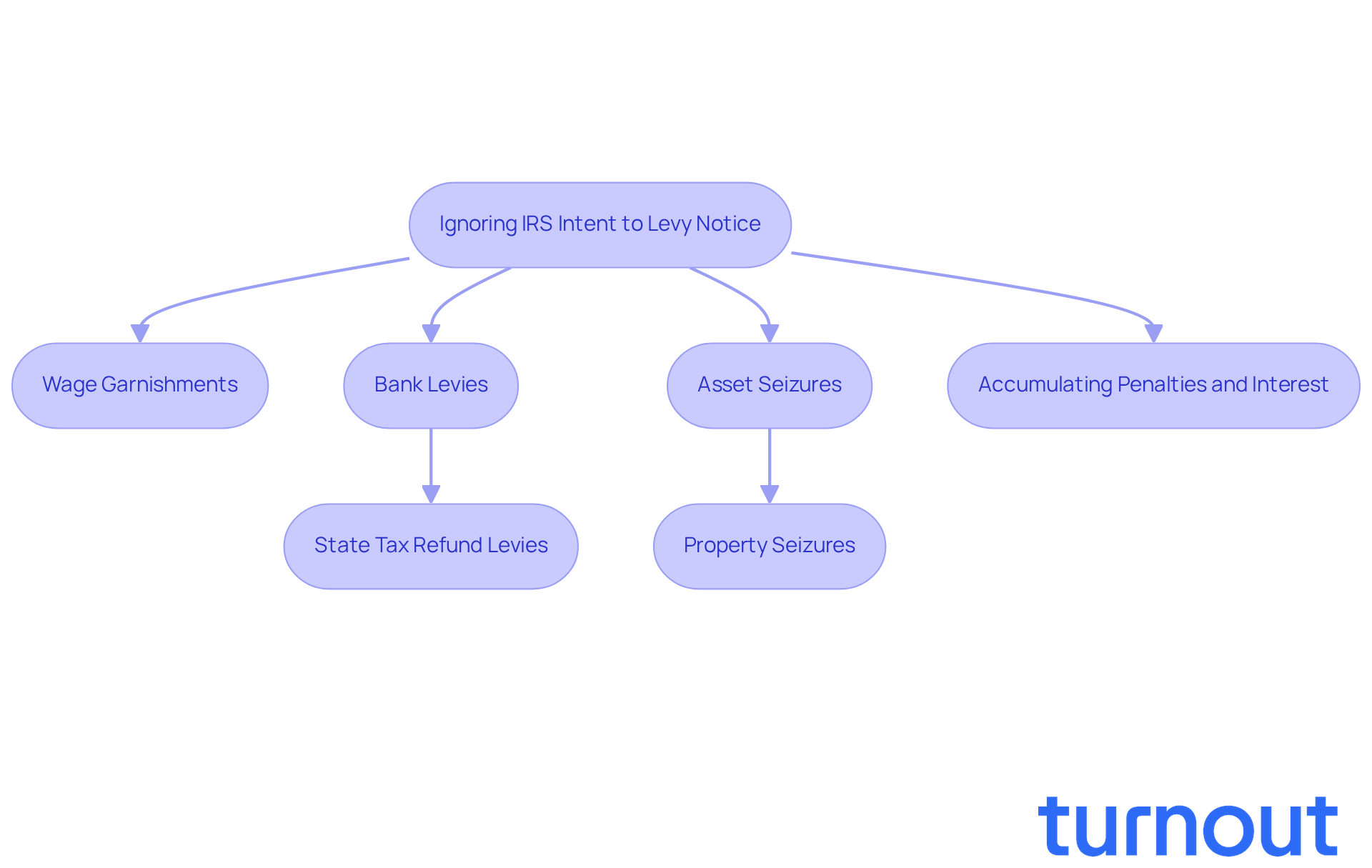

Recognize the Consequences of Inaction

Ignoring an IRS intent to levy notice can lead to serious financial consequences, such as wage garnishments, bank levies, and asset seizures. We understand that receiving such a notice can be overwhelming. Once the 30-day response period ends, the IRS can take enforcement actions without further notice. This might include levying state tax refunds and seizing property, which can result in a portion of your wages being withheld directly from your paycheck or your bank accounts being frozen.

It's common to feel anxious about these possibilities. Disregarding the notice not only increases the risk of the IRS intent to levy but also allows penalties and interest to accumulate daily, making your financial situation even more challenging. For example, a $10,000 tax bill can grow by over 30% within a year if left unaddressed, significantly affecting your financial stability.

As Stephen D. Ralph wisely points out, "Ignoring IRS letters is one of the biggest mistakes you can make, and it's far more common than you might think." The IRS has substantial authority in these matters, and neglecting to act can have long-lasting effects on your financial health.

So, what can you do? It's essential to take this notice seriously and respond promptly. Remember, you are not alone in this journey. We're here to help you safeguard your rights and assets.

Conclusion

Receiving an IRS intent to levy notice can feel overwhelming. We understand that this is a serious situation, and it’s crucial to act quickly to protect your financial well-being. This notice isn’t just a formality; it’s a significant alert that requires your attention. Engaging with the IRS early can make a real difference, opening up options like payment plans or hearings that can ease your burden.

First, it’s essential to verify that the notice is legitimate. Understanding the specific type of notice you’ve received is key. From there, consider your response strategies. You might think about:

- Paying the owed amount

- Setting up an installment agreement

- Exploring an Offer in Compromise

These options can help you manage your tax liabilities effectively.

Ignoring this notice can lead to severe consequences, such as wage garnishment or asset seizure. We know that these outcomes can escalate financial difficulties, and that’s why taking action is so important.

The message is clear: responding promptly and knowledgeably to an IRS intent to levy can protect your financial interests. Instead of feeling anxious or paralyzed, we encourage you to take proactive steps. Seek professional guidance and explore your options. Remember, you’re not alone in this journey. By taking these steps, you can navigate these challenges more effectively and regain control over your financial future.

Frequently Asked Questions

What does the IRS intent to levy mean?

The IRS intent to levy is a formal alert indicating that the IRS plans to seize your assets to settle an unpaid tax debt, following previous communications about your tax obligations.

How much time do I have to respond to an IRS intent to levy?

You typically have a limited timeframe of 30 days to respond before the IRS can take action against your wages, bank accounts, or other assets.

What are the specific notices related to IRS intent to levy that I should be aware of?

Key notices include the CP504, which indicates the IRS intent to levy your assets, and the LT11, which provides information about your rights to request a Collection Due Process (CDP) hearing.

What can happen if I do not respond to an IRS intent to levy notice?

Many taxpayers do not respond, which can lead to serious consequences such as wage garnishment or bank levies.

What should I keep in mind when receiving an IRS intent to levy notice?

Important details to remember include the total amount owed, specified deadlines, and your rights to appeal or request a hearing.

How can I lessen the impact of an IRS intent to levy?

Reaching out to the IRS early can help you maintain your options and potentially lessen the impact of enforcement measures.

What are the consequences of ignoring or delaying action on an IRS intent to levy?

Ignoring or delaying action can lead to mounting penalties and interest, making it vital to act swiftly.