Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when financial hardships arise. We understand that facing tax debts can be daunting, but there is hope. Currently Not Collectible (CNC) status offers a crucial lifeline for those unable to meet their tax obligations without suffering significant hardship.

This article explores the eligibility criteria, application process, and benefits of achieving CNC status. It sheds light on how taxpayers can find relief amidst overwhelming financial pressures. However, it’s common to feel concerned about what happens when the very relief sought comes with its own set of challenges, such as accruing interest and penalties. Understanding these nuances is essential for anyone considering this option.

You are not alone in this journey. We’re here to help you navigate these challenges and find the support you need.

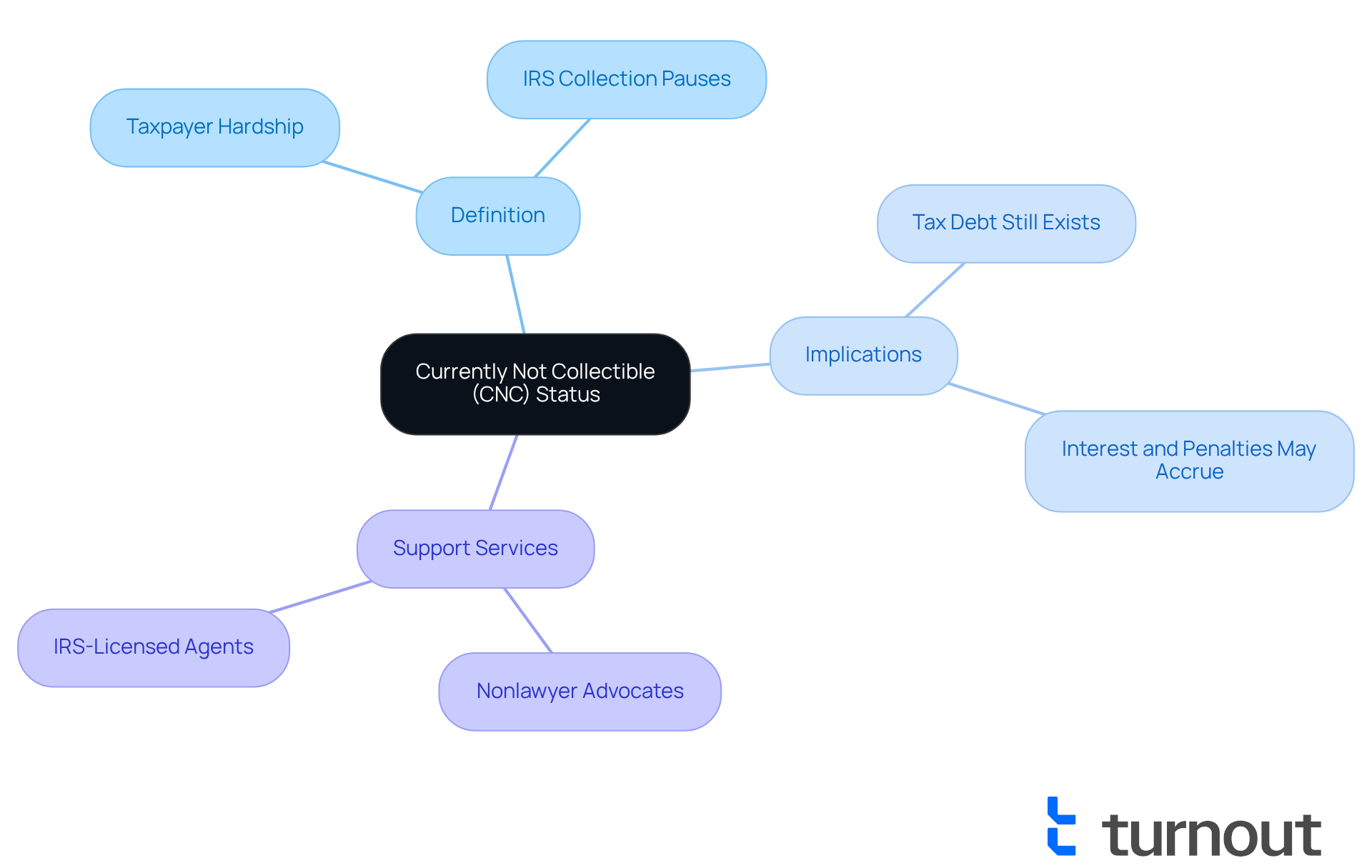

Define Currently Not Collectible (CNC) Status

The designation of Currently Not Collectible (CNC) is a crucial classification by the IRS. It indicates that a taxpayer is unable to pay their tax debt without facing significant hardship. When the IRS places an account in IRS CNC status, it pauses its collection efforts. This means the IRS won’t pursue payment through wage garnishments, bank levies, or other collection actions.

However, it’s important to understand that while collection efforts are on hold, the underlying tax debt still exists. Interest and penalties may continue to accrue during this time. The IRS CNC designation is typically granted when a taxpayer's income is not sufficient to cover essential living costs. It serves as a temporary lifeline for individuals in challenging economic situations.

At Turnout, we recognize how overwhelming this process can feel. We’re here to help you navigate the complexities of attaining the IRS CNC designation. Our trained nonlawyer advocates and IRS-licensed enrolled agents provide support without the need for legal representation. You are not alone in this journey; we’re committed to guiding you every step of the way.

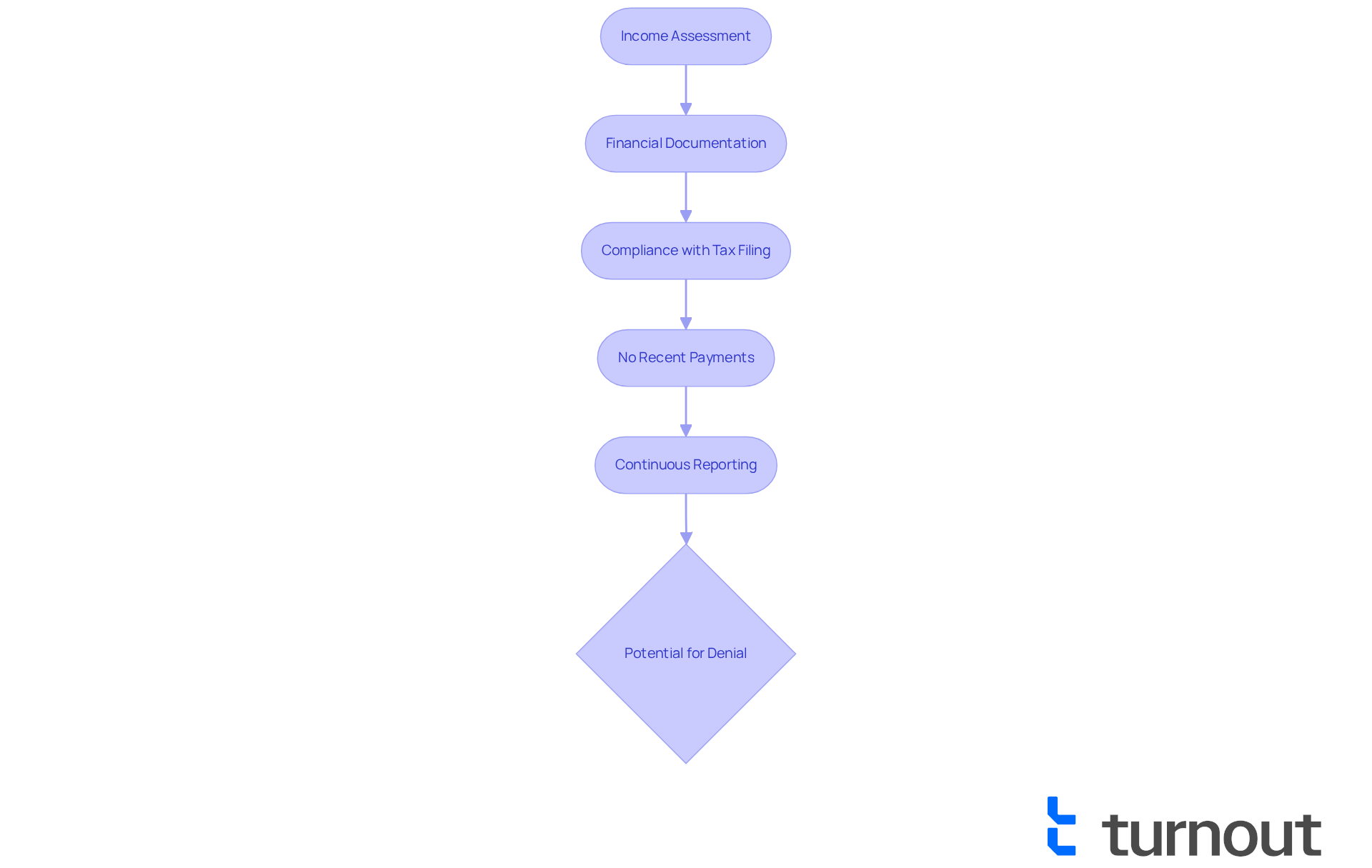

Identify Eligibility Requirements for CNC Status

If you're facing financial difficulties, you might be wondering about the IRS CNC designation, which stands for Currently Not Collectible. This option is available for taxpayers who can demonstrate that paying their tax obligations to the IRS CNC would cause significant hardship. Here’s what you need to know:

- Income Assessment: You’ll need to show that your monthly income isn’t enough to cover essential living expenses like housing, food, and healthcare.

- Financial Documentation: It’s important to gather comprehensive financial information. This includes details about your income, expenses, and assets. You might need to submit documents like pay stubs, bank statements, and utility bills, typically using IRS Form 433-F (Collection Information Statement).

- Compliance with Tax Filing: Make sure all required tax returns are submitted. Following IRS CNC regulations is crucial for eligibility.

- No Recent Payments: Generally, you shouldn’t have made any recent payments towards your tax debt to qualify for CNC designation.

- Continuous Reporting: Keep the IRS informed about any changes in your financial situation. They regularly evaluate CNC status, so staying updated is key.

- Potential for Denial: Be aware that the IRS CNC may deny designation if your financial information indicates you can pay, such as having income that exceeds necessary living expenses or available assets.

While you’re in CNC status, it’s important to remember that interest and penalties on your tax debt will continue to accrue. Meeting these criteria is essential for successfully applying for the IRS CNC designation and obtaining the relief it offers.

You’re not alone in this journey. Nearly 70% of CNC cases undergo yearly evaluations, which highlights the importance of keeping accurate and current records. If you’re feeling overwhelmed, the Taxpayer Advocate Service is here to help you navigate these challenges. Remember, we’re here to support you every step of the way.

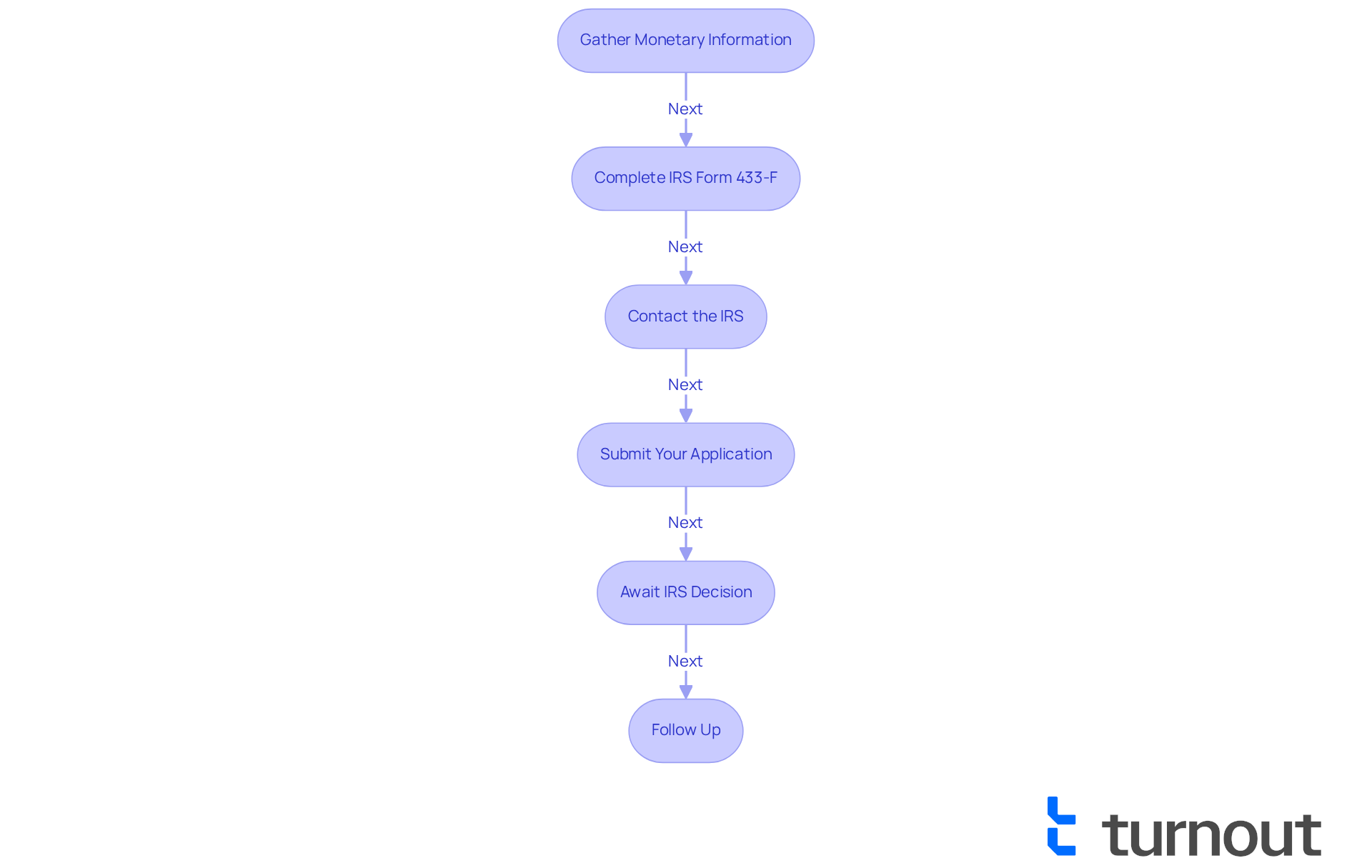

Outline the Steps to Apply for CNC Status

Applying for IRS CNC status can feel overwhelming, but we're here to help you through it. By following these essential steps, you can navigate this process with greater ease:

-

Gather Monetary Information: Start by collecting all necessary monetary documents, such as income statements, expense reports, and relevant tax returns. This documentation is crucial for demonstrating your economic hardship to the IRS. Remember, it’s important to file all outstanding tax returns before applying; otherwise, the IRS CNC will not process your application.

-

Complete IRS Form 433-F: Next, fill out the Collection Information Statement (Form 433-F). This form gives the IRS a comprehensive overview of your financial situation. Make sure every section is filled out accurately to reflect your current monetary condition as required by irs cnc.

-

Contact the IRS: Reach out to the IRS by calling 800-829-1040 or using the contact information from any IRS notices you’ve received. Applying over the phone can often speed up the process, which can be a relief.

-

Submit Your Application: Once you’ve completed Form 433-F, send it along with any supporting documentation to the IRS. You can do this via mail or fax, depending on the instructions provided by the IRS representative.

-

Await IRS Decision: After you submit your application, the IRS will review your financial information. They may reach out for additional details, so be ready to respond promptly. Typically, the processing time for applications related to IRS CNC is between 60 to 90 days, but it can vary based on the IRS's workload.

-

Follow Up: If you haven’t heard back within a reasonable timeframe, don’t hesitate to follow up with the IRS to check on your application’s progress. Keep in mind that CNC designation is a temporary relief measure; it doesn’t eliminate tax debt, and interest and penalties will continue to accrue during this time.

By diligently following these steps, you can enhance your chances of successfully obtaining CNC designation. This status offers temporary relief from IRS CNC collection actions, allowing you to stabilize your financial situation. Remember, you are not alone in this journey, and taking these steps is a positive move toward regaining control.

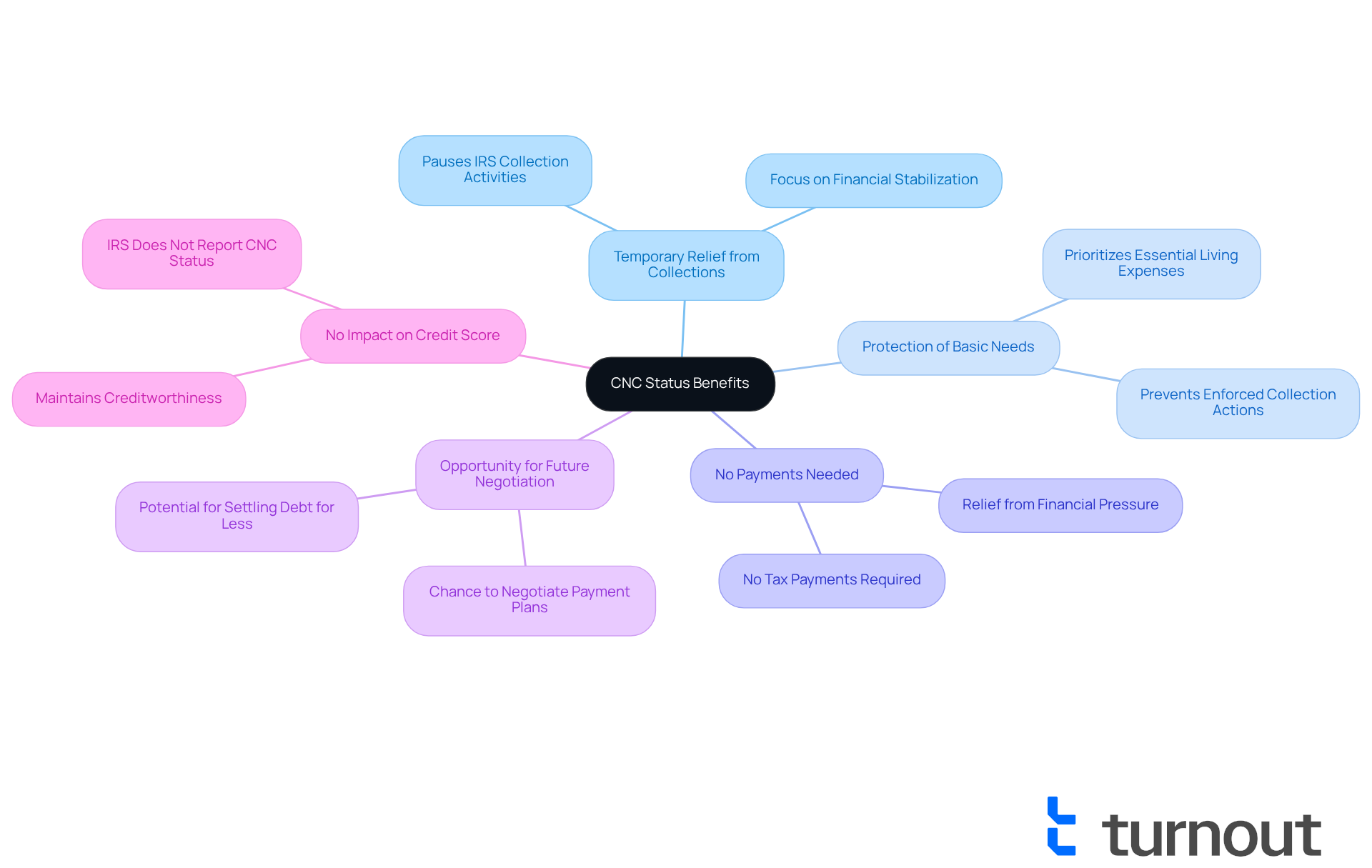

Explain the Implications and Benefits of CNC Status

Obtaining Currently Not Collectible (CNC) status can bring significant relief and benefits for taxpayers facing financial challenges.

-

Temporary Relief from Collections: We understand that dealing with tax debt can be overwhelming. While in IRS CNC status, the IRS pauses all collection activities, offering immediate relief from the pressures of tax obligations. This pause allows you to focus on stabilizing your finances without the constant worry of wage garnishments or bank levies.

-

Protection of Basic Needs: It's common to feel anxious about meeting essential living expenses. With IRS CNC designation, you can prioritize your basic needs, ensuring that you have what you need to get by without the risk of enforced collection actions. This protection is crucial for those experiencing economic hardship, allowing you to maintain your standard of living during tough times.

-

No Payments Needed: You won’t be required to make payments towards your tax debt while in CNC status. This can be a huge relief, helping you stabilize your economic situation. Think of it as a crucial pressure release valve, allowing you to manage your immediate financial concerns without the added burden of tax payments.

-

Opportunity for Future Negotiation: As your financial situation improves, you may find the chance to negotiate a payment plan or settle your tax debt for less than what you owe. This flexibility can lead to more manageable solutions tailored to your improved circumstances.

-

No Impact on Credit Score: Importantly, CNC designation does not directly affect your credit score. The IRS does not report this classification to credit bureaus, meaning you can maintain your creditworthiness while addressing your tax obligations.

However, it’s essential to remember that the IRS CNC status doesn’t eliminate your tax debt; it merely pauses collection efforts. While in CNC condition, penalties and interest continue to accumulate, which can impact your overall financial situation. You must also continue to file tax returns and make federal tax deposits on time to keep your CNC designation. Additionally, the IRS CNC status may allow the IRS to submit a Notice of Federal Tax Lien, which could affect your economic position.

The IRS CNC evaluates standing each year, so it’s important to stay aware of your financial situation and be prepared to address your tax responsibilities when your circumstances change. Approximately 1 in 4 taxpayer accounts in CNC status are due to low income, highlighting the demographic most affected by this status. Remember, you are not alone in this journey, and there are resources available to help you navigate these challenges.

Conclusion

If you're facing financial hardships, obtaining Currently Not Collectible (CNC) status from the IRS can be a vital lifeline. This designation not only stops collection actions like wage garnishments and bank levies but also gives you the breathing room to focus on your immediate living expenses without the constant worry of tax debt.

We understand that navigating this process can feel overwhelming. Throughout this article, we’ve outlined the eligibility requirements for CNC status, emphasizing the importance of comprehensive financial documentation and compliance with IRS regulations. Key steps for applying - such as gathering necessary information, completing IRS Form 433-F, and following up on your application - were discussed to guide you through this often daunting journey.

The implications and benefits of CNC status are significant. It protects your essential living needs and opens the door to potential future negotiations regarding your tax obligations. By understanding the eligibility criteria and application steps, you can take proactive measures to secure this relief.

Ultimately, navigating the IRS CNC status isn’t just about managing tax debt; it’s a crucial opportunity for you to regain stability. If you’re struggling with tax debt, exploring CNC status could be a pivotal step toward financial recovery and peace of mind. Remember, you are not alone in this journey - we're here to help.

Frequently Asked Questions

What does Currently Not Collectible (CNC) status mean?

Currently Not Collectible (CNC) status is a classification by the IRS indicating that a taxpayer cannot pay their tax debt without experiencing significant hardship.

What happens when an account is placed in CNC status?

When an account is in CNC status, the IRS pauses its collection efforts, meaning they will not pursue payment through wage garnishments, bank levies, or other collection actions.

Does the tax debt disappear when in CNC status?

No, the underlying tax debt still exists while in CNC status, and interest and penalties may continue to accrue during this time.

Who qualifies for CNC status?

CNC status is typically granted to taxpayers whose income is insufficient to cover essential living costs.

How can I get help with the CNC designation process?

Organizations like Turnout offer support through trained nonlawyer advocates and IRS-licensed enrolled agents to help navigate the complexities of attaining the IRS CNC designation.