Introduction

Navigating the complexities of tax debt can feel overwhelming. We understand that the burden of back taxes weighs heavily on many individuals. The IRS Fresh Start Program shines as a beacon of hope, offering various pathways for taxpayers to regain control of their financial futures. Yet, understanding the eligibility criteria and application process can be challenging.

How can you effectively maneuver through the intricacies of this program to secure the relief you need? It's common to feel lost in the details, but know that you're not alone in this journey. We're here to help you explore your options and find the support you deserve.

Understand the IRS Fresh Start Program

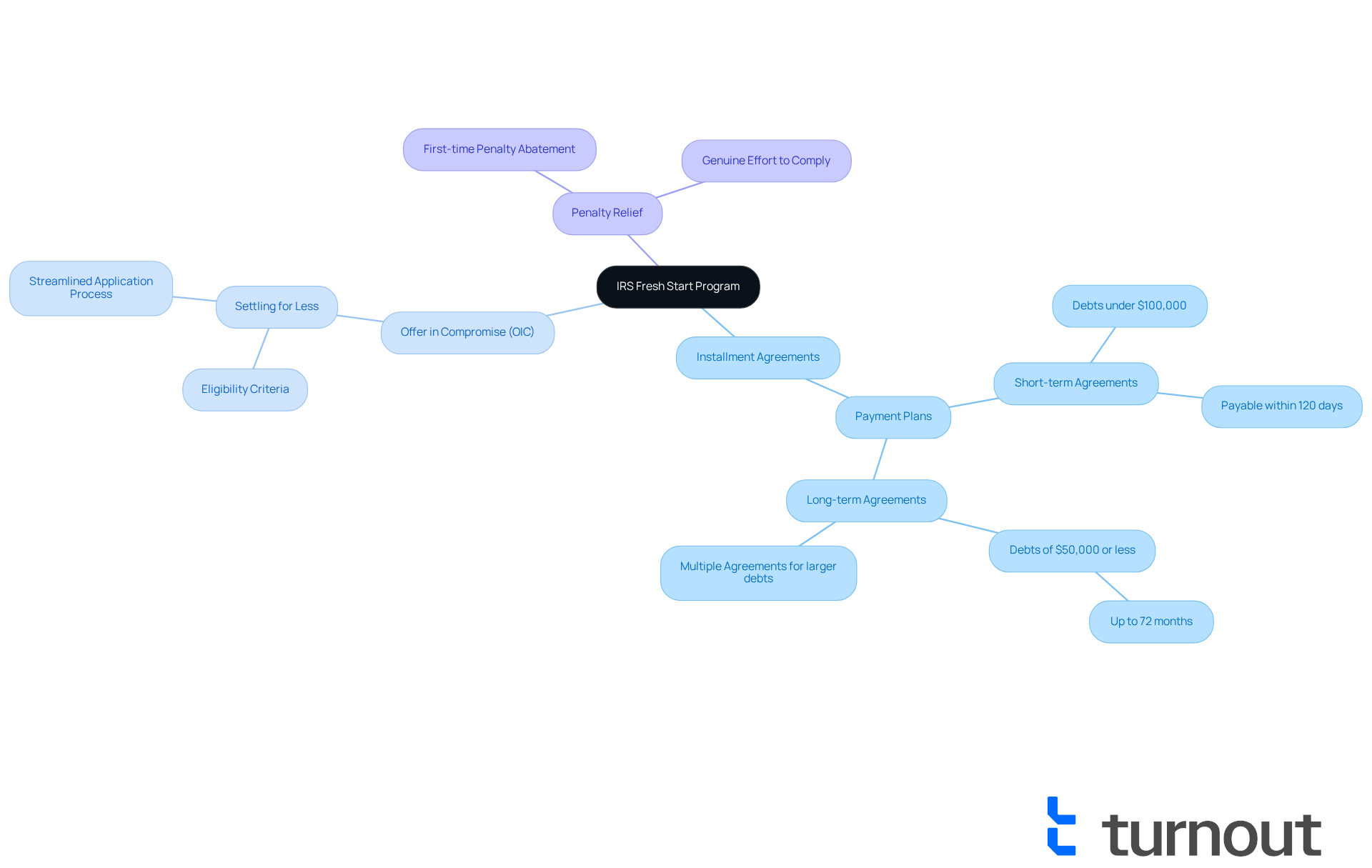

The IRS New Start Program is designed with you in mind, specifically created to offer IRS back tax relief to taxpayers who are feeling the weight of back taxes. It offers several initiatives that simplify the process of settling tax debts, making it easier for you to regain control of your financial situation. Here are some key components of the program:

-

Installment Agreements: You can set up a payment plan that allows you to pay off your tax debt over time. This makes repayment more manageable, especially if you're facing financial challenges. For debts of $50,000 or less, these agreements can extend up to 72 months, giving you the flexibility you need.

-

Offer in Compromise (OIC): If you're struggling financially, this option might be for you. It allows eligible taxpayers to settle their tax debt for less than the total amount owed. The OIC process has been streamlined, making it easier for you to apply with the help of tax professionals, significantly improving your chances of a favorable outcome.

-

Penalty Relief: You may qualify for penalty relief if you can show that you made a genuine effort to comply with tax laws but faced circumstances beyond your control. This includes first-time penalty abatement, which can remove penalties for late filing or payment.

Recent updates to the New Start Program have broadened its benefits, and more taxpayers are taking advantage of IRS back tax relief options than ever before. In 2025, the IRS reported a significant rise in applications for the Start Program, highlighting its growing importance in helping individuals restore financial stability. For instance, a taxpayer named M. Johnson shared how navigating the Start process gave him newfound confidence in managing his tax liabilities.

We understand that seeking help can be daunting, but consulting with a tax expert can provide you with customized advice tailored to your unique circumstances. This proactive approach can lead to considerable support and a clearer path toward financial recovery. Remember, you are not alone in this journey; we're here to help.

Determine Your Eligibility for Relief

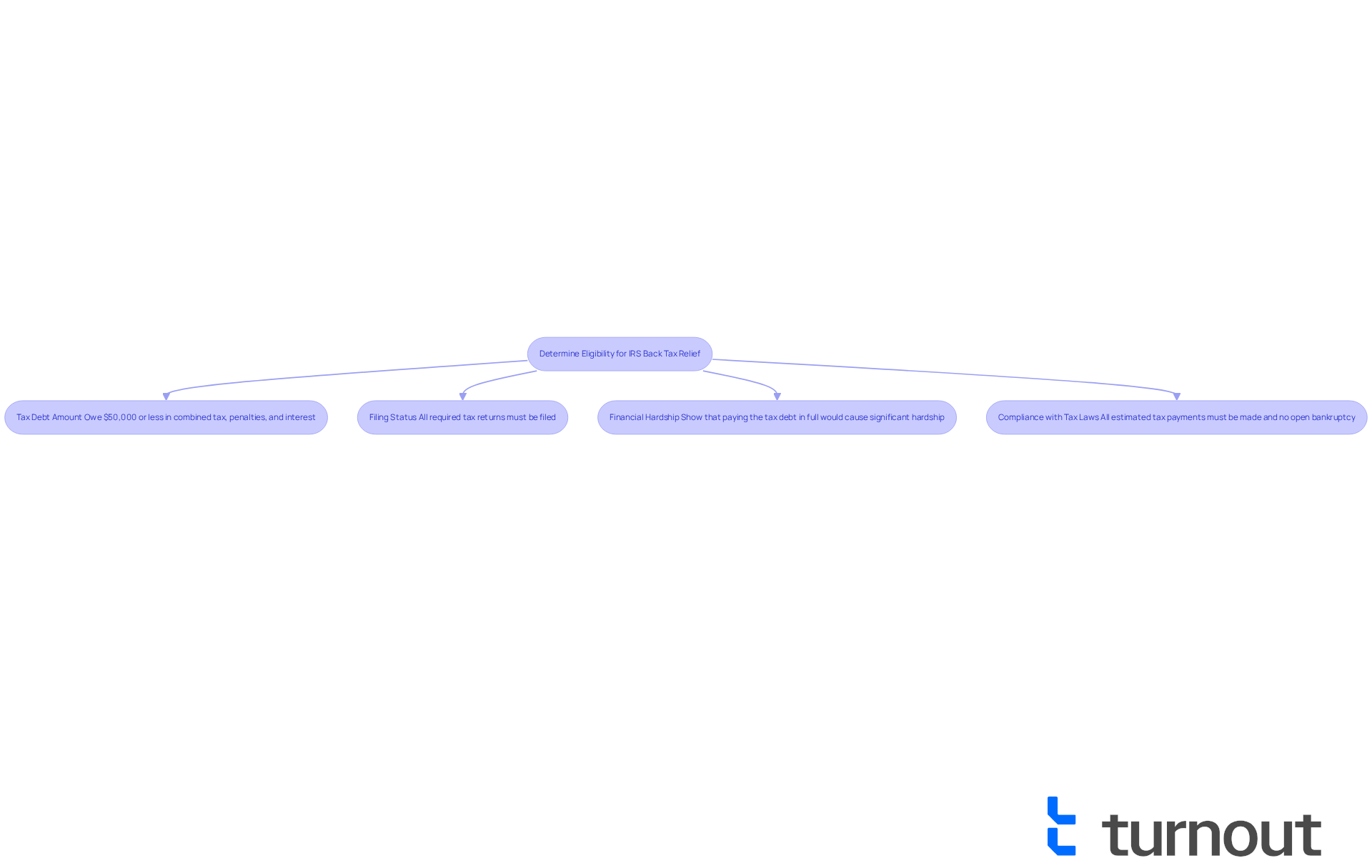

If you're feeling overwhelmed by tax debt, you may want to explore IRS back tax relief options, as you're not alone. The IRS Fresh Start Program could offer you IRS back tax relief. To see if you qualify, consider these important criteria:

-

Tax Debt Amount: Generally, you need to owe $50,000 or less in combined tax, penalties, and interest to qualify for the Offer in Compromise (OIC). This threshold opens the door for many taxpayers seeking assistance. In 2025, the IRS noted that a significant number of applicants typically owe around this amount, making it a common benchmark for eligibility.

-

Filing Status: It's crucial to ensure that all required tax returns are filed. To apply for IRS back tax relief, you must be current on your tax filings as required by the IRS. Missing returns can block access to OIC and installment agreements, so it's a critical point to keep in mind.

-

Financial Hardship: You must show that paying your tax debt in full would cause significant financial hardship. This may involve providing documentation of your income, expenses, and assets. The IRS emphasizes that adequate evidence is essential for requests regarding IRS back tax relief, and many applicants overlook this requirement.

-

Compliance with Tax Laws: You should have made all required estimated tax payments for the current year and not be in an open bankruptcy proceeding. Non-compliance can lead to delays or denials in your assistance requests for IRS back tax relief, highlighting the importance of following these requirements.

To assess your eligibility, we encourage you to use the IRS Offer in Compromise Pre-Qualifier tool available on the IRS website. This tool can help you determine if you meet the necessary criteria. Remember, understanding these requirements is vital. Many applicants neglect the importance of precise documentation and compliance, which can lead to delays or refusals in their assistance requests. As the IRS states, "The IRS will not accept a request for tax assistance through any of the programs in the Start Initiative without sufficient evidence."

We're here to help you navigate this process, and you are not alone in this journey.

Troubleshoot Common Application Issues

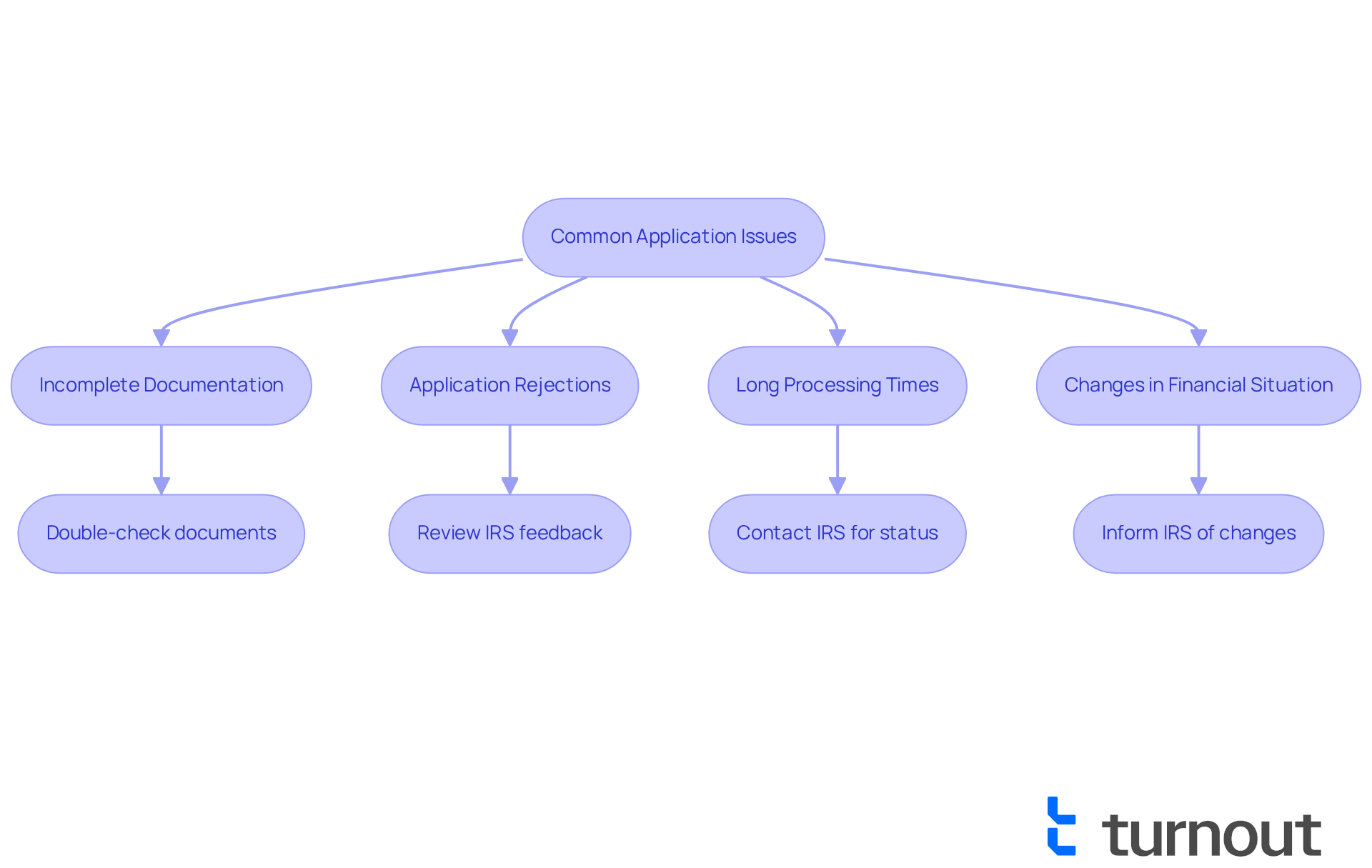

Navigating the IRS New Start Program for tax assistance can be daunting, especially when seeking IRS back tax relief, and it's common to encounter a few challenges along the way. But don’t worry; we’re here to help you troubleshoot them:

-

Incomplete Documentation: It’s crucial to ensure that all required forms and supporting documents are submitted. Take a moment to double-check that you’ve included your financial statements, tax returns, and any other necessary paperwork. Missing documentation is a frequent cause of application delays, and we understand how frustrating that can be.

-

Application Rejections: If your application is rejected, carefully review the IRS's feedback. Common reasons for rejection include not meeting eligibility criteria, such as having no open bankruptcy cases or failing to file all required tax returns. Insufficient documentation can also lead to denial, so make sure your application is thorough. Remember, you’re not alone in this; many face similar hurdles.

-

Long Processing Times: If you experience delays, consider reaching out to the IRS directly or checking the status of your application through your online account. In FY 2024, the IRS processed 266 million returns, which can lead to longer wait times. Patience is key here, as processing times can vary significantly. It’s perfectly normal to feel anxious during this waiting period.

-

Changes in Financial Situation: If your financial situation changes after submitting your application, it’s important to inform the IRS immediately. Changes in income or expenses can affect your eligibility for IRS back tax relief, and timely communication can help you adjust your application accordingly. We understand that life can be unpredictable, and we’re here to support you through these changes.

By being proactive and addressing these issues promptly, you can enhance your chances of successfully navigating the application process. Consulting a tax professional can also provide valuable guidance, as they can help you understand the nuances of the Fresh Start Initiative and improve your application’s chances of approval. Remember, you are not alone in this journey; support is available.

Conclusion

Navigating the complexities of IRS back tax relief can feel overwhelming. We understand that facing tax debts can be a heavy burden. However, the IRS Fresh Start Program is here to help you regain financial control. This initiative offers options like installment agreements, offers in compromise, and penalty relief, providing a pathway to settle your debts and restore your financial stability.

Let’s explore the essential components of the Fresh Start Program together. Eligibility criteria include tax debt limits and the necessity of filing all required tax returns. It’s common to encounter challenges during this process, such as incomplete documentation and long processing times. By addressing these issues proactively and seeking professional guidance, you can enhance your chances of successfully navigating the application process.

The importance of the IRS Fresh Start Program cannot be overstated. It serves as a vital resource for those seeking relief from back taxes, offering hope and support in difficult financial times. Taking the initiative to explore these options empowers you to tackle your tax liabilities and fosters a greater sense of financial security. Remember, seeking help is a sign of strength; you are not alone in this journey. Assistance is available, and taking action today can lead to a brighter financial future.

Frequently Asked Questions

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is designed to provide back tax relief to taxpayers struggling with tax debts, offering initiatives that simplify the process of settling those debts.

What are the key components of the Fresh Start Program?

The key components include Installment Agreements, Offer in Compromise (OIC), and Penalty Relief.

How do Installment Agreements work?

Installment Agreements allow taxpayers to set up a payment plan to pay off their tax debt over time. For debts of $50,000 or less, these agreements can extend up to 72 months.

What is the Offer in Compromise (OIC)?

The Offer in Compromise (OIC) is an option for eligible taxpayers to settle their tax debt for less than the total amount owed. The process has been streamlined to improve the likelihood of a favorable outcome.

What is Penalty Relief and who qualifies for it?

Penalty Relief may be available to taxpayers who demonstrate a genuine effort to comply with tax laws but faced uncontrollable circumstances. This includes first-time penalty abatement for late filing or payment.

How has the Fresh Start Program evolved recently?

Recent updates to the Fresh Start Program have broadened its benefits, leading to a significant rise in applications for tax relief options, indicating its growing importance in helping individuals restore financial stability.

Can consulting a tax expert help with the Fresh Start Program?

Yes, consulting with a tax expert can provide customized advice tailored to individual circumstances, offering considerable support and a clearer path toward financial recovery.