Overview

Navigating Illinois payment plan taxes can feel overwhelming, especially when facing tax obligations. We understand that this situation can bring a lot of stress, and we’re here to help you through it. This guide offers a comprehensive, step-by-step approach to understanding eligibility criteria, the necessary documentation, and the application process.

It’s important to maintain proactive communication with the Illinois Department of Revenue. By doing so, you can clarify your options and feel more in control of your situation. Payment plans can provide significant benefits, including flexibility in managing payments and the ability to avoid severe collection measures.

Remember, you are not alone in this journey. Many individuals have successfully navigated similar challenges. We encourage you to take the first step towards managing your financial burdens effectively. Reach out for assistance and explore the options available to you.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when financial hardships weigh heavily on your shoulders. We understand that the stress of lump-sum payments can be daunting. Fortunately, Illinois offers structured payment plans designed to alleviate this burden, allowing individuals like you to manage your tax responsibilities more effectively.

However, it’s common to feel uncertain about the eligibility criteria, necessary documentation, and potential pitfalls associated with these plans. How can you ensure you’re making the most informed decisions while navigating this process?

This guide aims to demystify the journey, providing a clear roadmap for successfully managing Illinois tax payment plans. Remember, you are not alone in this journey; we’re here to help.

Understand Illinois Tax Payment Plans

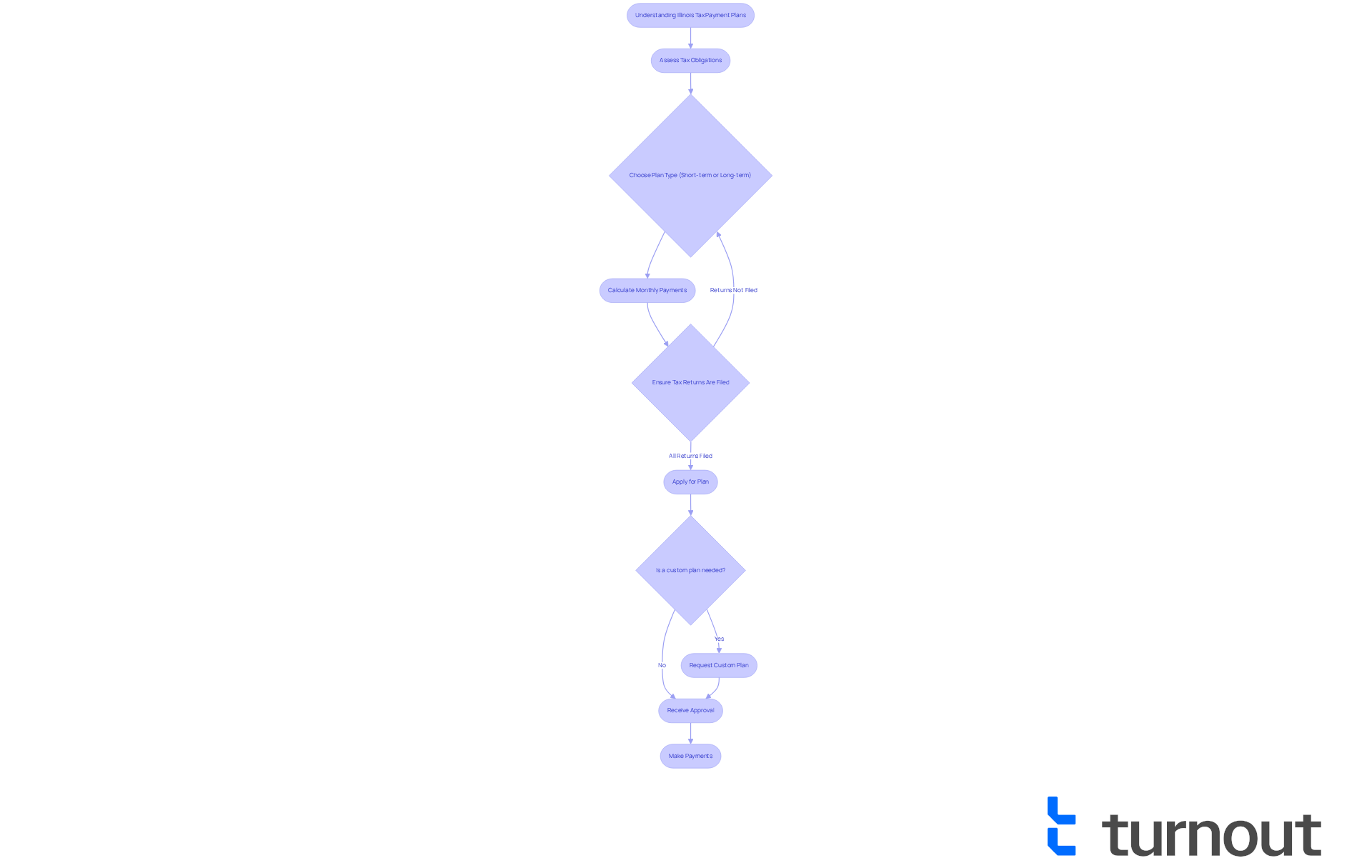

Illinois payment plan taxes are structured arrangements designed to help you gradually resolve your tax obligations. We understand that the financial burden of one-time payments can be overwhelming. These strategies are here for individuals facing difficulties in meeting their tax responsibilities due to various situations. It's essential to comprehend the available choices in the Illinois payment plan taxes:

- Short-term arrangements typically last a few months.

- Long-term agreements can extend up to 60 months, enabling you to make manageable monthly installments.

For instance, if you have a $2,000 balance, you could opt for a minimum monthly contribution of just $34 over 60 months. Keep in mind that the maximum amount owed for an installment agreement is $75,000, and interest on unpaid balances is charged yearly at approximately 5%. When seeking these options, a fair initial deposit of at least 5% is usually required.

Before applying for the Illinois payment plan taxes, it's crucial to ensure that all necessary tax returns for the state are submitted. As stated by the Department of Revenue, 'You must have all of your required tax returns filed.' This step is vital for maintaining good standing with the Department of Revenue (DOR). Once you receive authorization, this Illinois payment plan taxes arrangement can assist you in avoiding severe collection measures, such as wage garnishments or bank levies, thereby providing you with peace of mind during a challenging economic time.

If the pre-approved conditions don't quite fit your needs, you can request a custom arrangement through your MyTax Illinois account, which allows for more flexibility regarding Illinois payment plan taxes. We encourage you to reach out to the DOR proactively if you're unable to pay in full; this can help you avoid collection actions.

Real-world examples highlight the effectiveness of these strategies. Many individuals have successfully signed up for financial arrangements, enabling them to manage their tax obligations without excessive strain. By taking the initiative to contact the DOR and understanding the details of their financial arrangements, you can approach your responsibilities with increased confidence. Remember, you are not alone in this journey; we're here to help.

Determine Your Eligibility for a Payment Plan

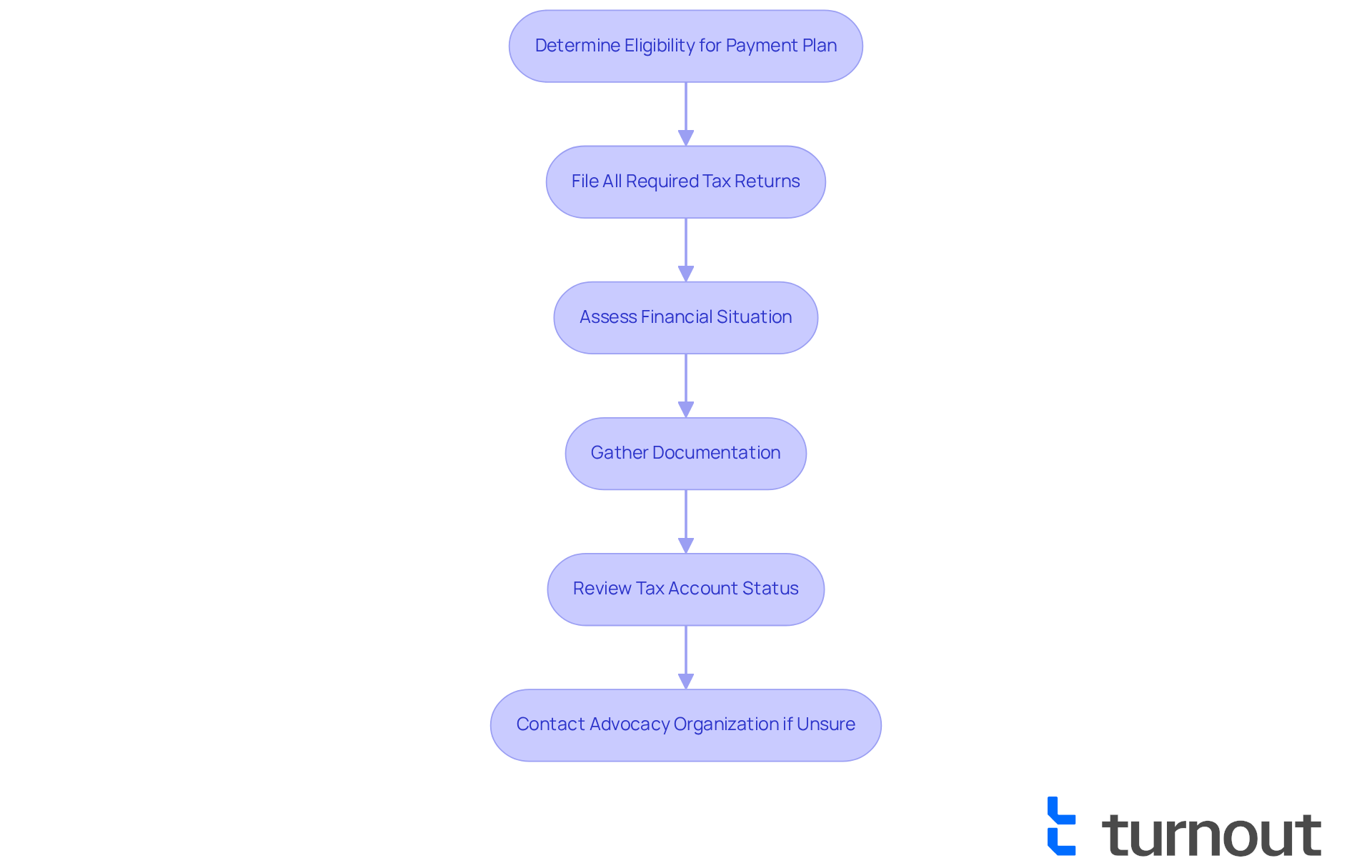

If you find yourself in a challenging financial situation, qualifying for an Illinois payment plan taxes could be a helpful step forward. To get started, it's essential to meet specific criteria set by the Illinois Department of Revenue. First and foremost, ensure that you have filed all required tax returns and that you have a balance you cannot pay in full.

We understand that this process can feel overwhelming. Your financial situation will undergo a thorough assessment, including a review of your income, expenses, and existing debts. You may need to provide documentation such as recent tax returns, pay stubs, and bank statements to support this assessment. Remember, it’s important to be current with all your tax return filings before applying for an Installment Payment Plan using the CPP-1 form.

Before proceeding, take a moment to review your tax account status. This will help ensure there are no outstanding issues that could hinder your eligibility. It’s common to feel uncertain, but around 60% of taxpayers experiencing financial difficulties may qualify for these assistance options. If you’re unsure about your eligibility, consider reaching out to a consumer advocacy organization for expert guidance. They can help you navigate the application process and clarify the necessary documentation for a successful request.

Please keep in mind that failing to meet a financial obligation on a tax arrangement can lead to alerts and potentially terminate your contract. Therefore, maintaining open communication with the department is crucial. You have options for making payments, including MyTax, phone, mail, or credit card. Remember, you are not alone in this journey; we’re here to help.

Gather Required Documentation for Application

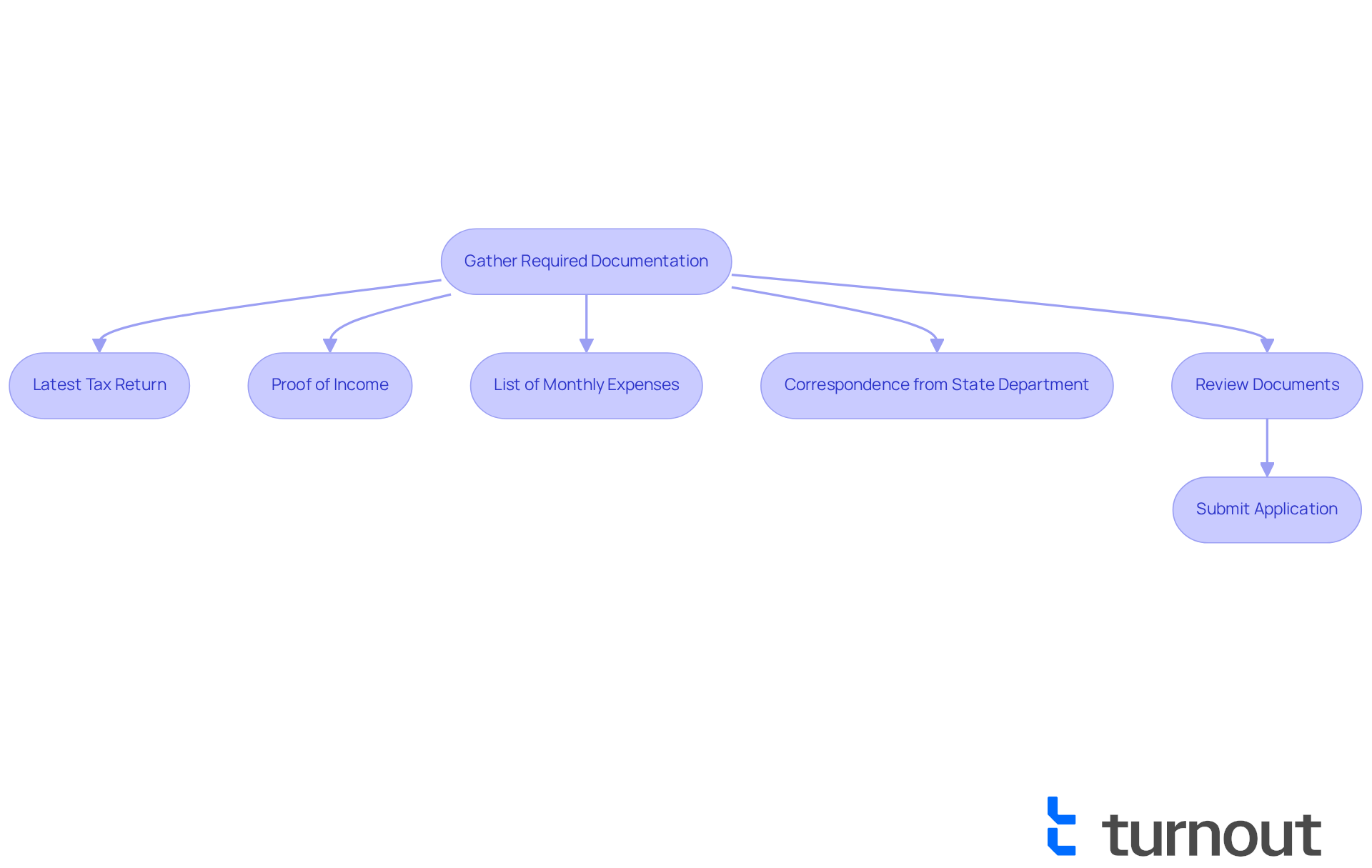

Before applying for a payment plan, we understand that it’s essential to gather all required documentation to support your application. This typically includes:

- Your latest tax return

- Proof of income (like pay stubs or bank statements)

- A detailed list of monthly expenses

- Any correspondence from the state Department of Revenue regarding your tax account

Having these documents ready not only streamlines the application process but also shows your commitment to resolving your tax obligations. Please ensure that all documents are current and accurately reflect your financial situation, as this will help facilitate a smoother review by tax authorities.

Applications submitted through MyTax Illinois are generally processed within a few weeks. By taking the initiative to gather your documentation, you can significantly reduce delays. We recommend setting aside a few days to compile and thoroughly review your financial records. Remember, precise and thorough documentation is vital for a successful application, as it helps demonstrate your financial ability to comply with the proposed arrangement.

As specialists often emphasize, "Our dedication to openness and customized approaches assists you in attaining feasible financial arrangements designed to suit your unique situation, aiding you in restoring economic confidence." By preparing diligently, you can enhance your chances of approval and pave the way for effective tax resolution. Additionally, it's important to recognize that financing arrangements are not disclosed to credit agencies and typically do not affect your credit score, alleviating concerns about entering a financing agreement. However, neglecting obligations can lead to enforcement measures, so ensuring timely contributions is crucial.

Apply for the Illinois Tax Payment Plan

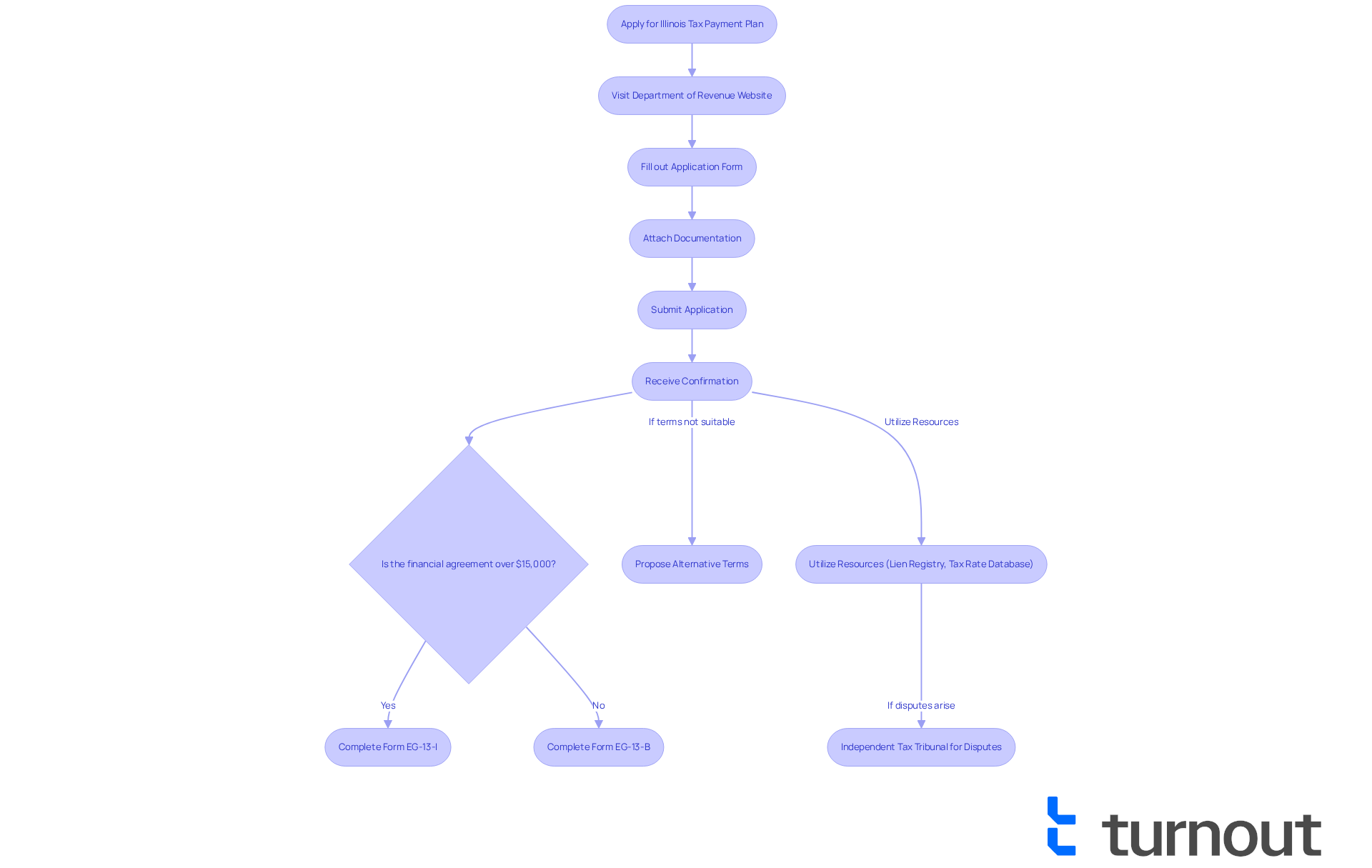

If you're looking to request a tax installment arrangement, we understand that taking this step can feel overwhelming. Start by visiting the Department of Revenue's website or reaching out to their office directly. The online application through MyTax is often the most efficient method. When filling out the application form, please ensure that you provide accurate information and attach any necessary documentation to support your request. After submission, you will receive a confirmation message, and your application will be reviewed by the department. It's important to be prepared to respond promptly to any follow-up questions or requests for additional information. Remember to keep a record of your application and all correspondence for your records.

For those who are experiencing financial difficulties, it's comforting to know that the Illinois payment plan taxes can be addressed through an installment arrangement offered by the Illinois Department of Revenue via MyTax Illinois. Many successful applicants have shared that after submitting their application, they received confirmation and were able to propose alternative terms if the pre-approved ones didn’t fit their situation. This flexibility can be vital for managing tight budgets. If your financial agreement exceeds $15,000, please ensure you complete Form EG-13-I or Form EG-13-B, depending on whether you are applying as an individual or a business.

Utilizing resources like the Lien Registry and Tax Rate Database can provide valuable information throughout this process. The Lien Registry can assist you in understanding any current liens on your property, while the Tax Rate Database offers insights into relevant tax rates that may influence your financial plan. Furthermore, if you encounter disagreements related to your tax circumstances, the Independent Tax Tribunal of your state is available to help settle these matters. By utilizing these resources, you can navigate the application process more efficiently and work towards a feasible tax resolution. Remember, you are not alone in this journey; we’re here to help.

Troubleshoot Common Issues with Your Payment Plan

Once your financial arrangement is set up, it’s essential to stay alert regarding your contributions and any communication about the Illinois payment plan taxes from the Illinois Department of Revenue. We understand that frequent problems can arise, such as overlooked dues, changes in financial situations, and miscommunications about the terms of the agreement. If you find yourself unable to meet a financial obligation, it’s crucial to reach out to the department promptly to explore your options. They may allow adjustments based on your current financial circumstances.

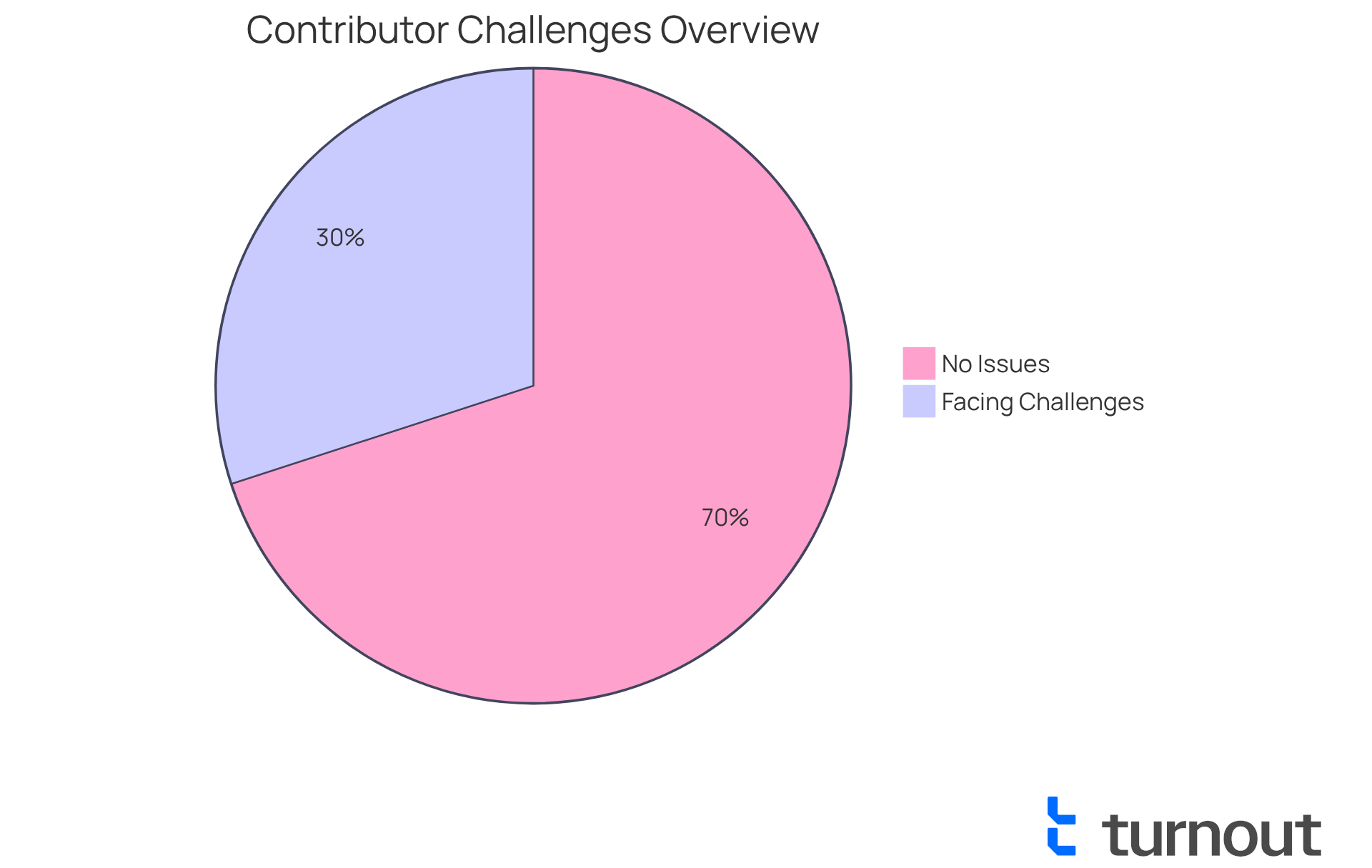

Data suggests that roughly 30% of contributors in the state encounter challenges with overdue contributions related to their Illinois payment plan taxes. This highlights the importance of proactive communication. Keeping a detailed record of all payments made and any communications with the department is vital for clarity and accountability.

In cases of ongoing issues, seeking support from a consumer advocacy organization that specializes in tax matters can be invaluable. Jamie C. Yesnowitz, a partner at SALT Solutions, emphasizes, "Businesses and individuals that are subject to Illinois tax but have not timely paid and/or filed tax returns should strongly consider participation in the Department’s upcoming amnesty program." This program can offer relief for those facing difficulties with their Illinois payment plan taxes, ensuring you have the resources to manage your tax responsibilities effectively.

Conclusion

Navigating the Illinois payment plan taxes can be a vital lifeline for individuals grappling with tax obligations. We understand that facing these responsibilities can be overwhelming. By understanding the structured arrangements available, such as short- and long-term payment plans, you can alleviate the stress of one-time payments and regain control over your financial responsibilities.

This article outlines essential steps to help you on this journey:

- Determine your eligibility and gather the necessary documentation.

- Applying for the payment plan is a significant step forward.

- Remember, submitting all required tax returns and maintaining open communication with the Department of Revenue is crucial.

- Proactively addressing any issues that may arise during the payment process can make a difference.

With a significant percentage of taxpayers successfully managing their obligations through these plans, it's clear that help is available for those who seek it.

Ultimately, taking action to engage with the Illinois payment plan taxes not only fosters financial relief but also empowers you to navigate your tax responsibilities with confidence. It’s important to remember that support is accessible. Reaching out to the Department of Revenue or consumer advocacy organizations can truly make a significant difference. By utilizing the resources and guidance available, you can transform your financial burdens into manageable steps toward resolution and peace of mind. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What are Illinois payment plan taxes?

Illinois payment plan taxes are structured arrangements that help individuals gradually resolve their tax obligations, making it easier to manage payments over time.

What are the durations available for payment plans in Illinois?

There are short-term arrangements that typically last a few months and long-term agreements that can extend up to 60 months.

How much would I need to pay monthly for a $2,000 tax balance under a 60-month plan?

For a $2,000 balance, the minimum monthly contribution would be approximately $34 over 60 months.

What is the maximum amount I can owe to qualify for an installment agreement?

The maximum amount owed for an installment agreement is $75,000.

Is there interest charged on unpaid balances?

Yes, interest on unpaid balances is charged yearly at approximately 5%.

What is the initial deposit required when applying for an Illinois payment plan?

A fair initial deposit of at least 5% is usually required when applying for a payment plan.

What must I do before applying for an Illinois payment plan?

You must ensure that all necessary tax returns for the state are submitted before applying for the payment plan.

What can happen if I do not maintain good standing with the Department of Revenue?

Failing to maintain good standing can lead to severe collection measures such as wage garnishments or bank levies.

Can I request a custom payment arrangement if the pre-approved conditions do not fit my needs?

Yes, you can request a custom arrangement through your MyTax Illinois account for more flexibility.

What criteria do I need to meet to qualify for an Illinois payment plan?

You must have filed all required tax returns and have a balance that you cannot pay in full.

What documentation might I need to provide when applying for a payment plan?

You may need to provide documentation such as recent tax returns, pay stubs, and bank statements to support your financial assessment.

What should I do if I'm unsure about my eligibility for a payment plan?

If you're unsure about your eligibility, consider reaching out to a consumer advocacy organization for guidance.

What happens if I fail to meet my financial obligations under a tax arrangement?

Failing to meet your obligations can lead to alerts and potentially terminate your payment plan contract.

How can I make payments under the Illinois payment plan?

Payments can be made through MyTax, phone, mail, or credit card.