Introduction

Navigating the complexities of tax debt can feel like an uphill battle. We understand that the weight of financial obligations can become overwhelming. But there’s hope. The IRS Fresh Start Program offers a chance for relief, providing taxpayers with various options to alleviate their burdens.

However, we know that understanding the eligibility criteria and application process can be daunting. What steps must you take to successfully qualify for this program? How can you ensure you don’t fall victim to common pitfalls along the way?

You are not alone in this journey. Let’s explore how you can navigate this process with confidence and support.

Understand the IRS Fresh Start Program

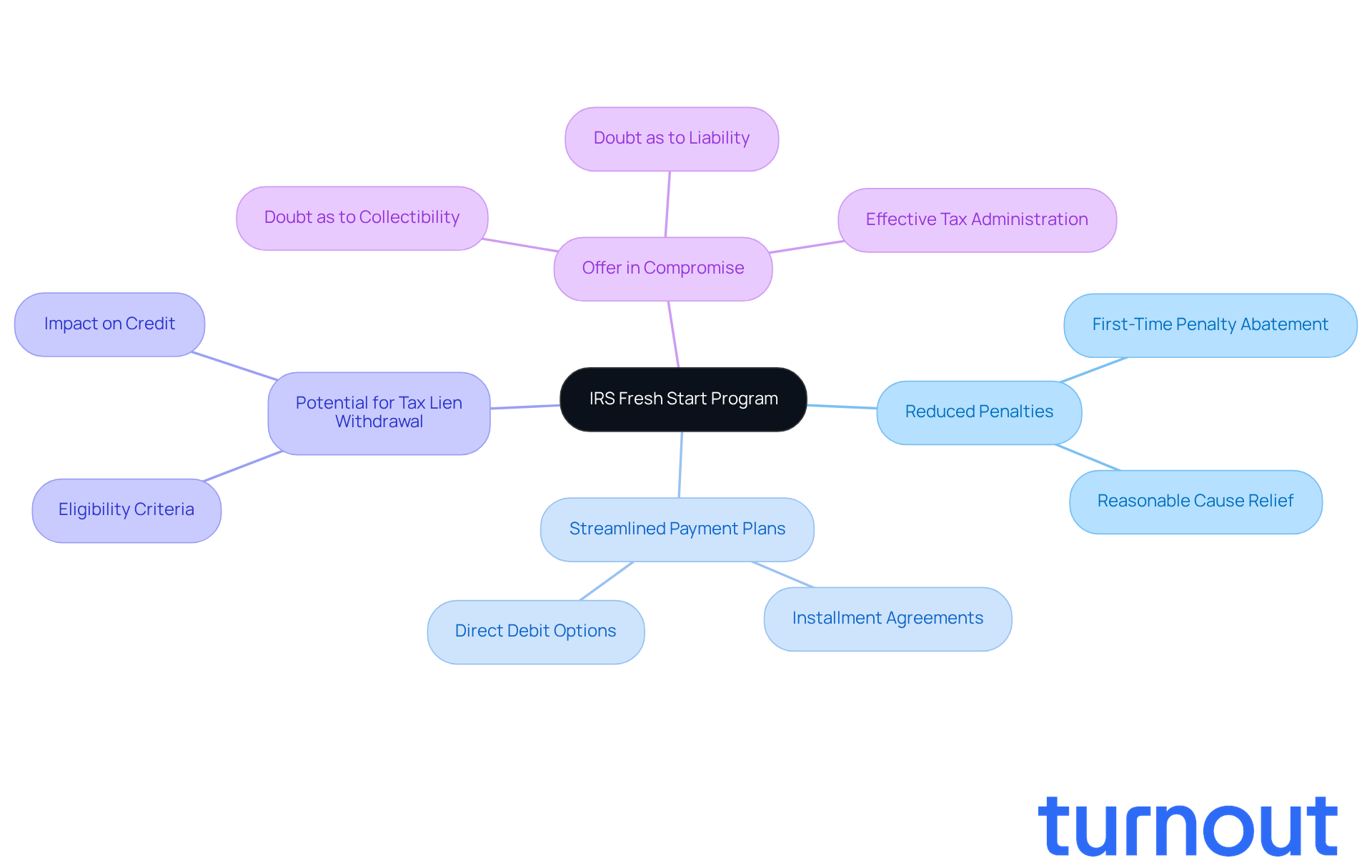

The IRS offers fresh start tax relief to help taxpayers who are facing the heavy burden of tax debt. We understand that navigating these challenges can be overwhelming, but there are options available for relief. One such option is the Offer in Compromise (OIC), which allows you to settle your tax debts for less than what you owe.

Turnout provides valuable tools and services to guide you through this program, ensuring you can manage your tax obligations effectively, even without legal representation. This program is designed to create a manageable path for you to regain economic stability while addressing your tax responsibilities.

If you're considering applying for fresh start tax relief, it's essential to understand the specifics of this program, including its benefits and limitations. Key features of the fresh start tax relief program include:

- Reduced penalties

- Streamlined payment plans

- The potential for tax lien withdrawal

These aspects make it a valuable resource for those experiencing economic distress.

At Turnout, we utilize trained nonlawyer advocates and collaborate with IRS-licensed enrolled agents to support you through these processes. Remember, you are not alone in this journey; we're here to help you every step of the way.

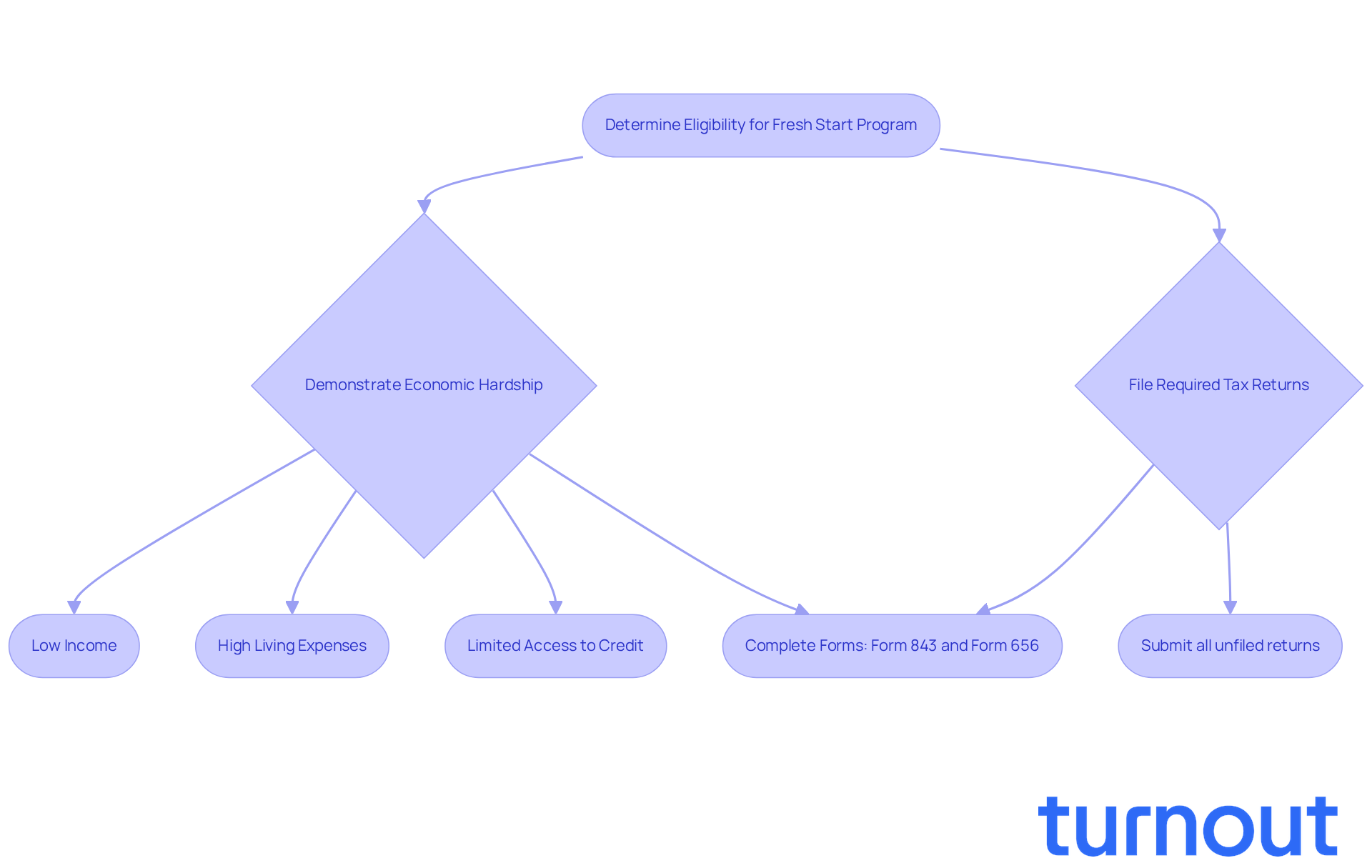

Identify Eligibility Requirements for the Fresh Start Program

Are you feeling overwhelmed by tax debt? You're not alone. Many individuals find themselves in a tough spot, owing $50,000 or less in total tax debt while trying to stay current on their tax filings. The IRS Fresh Start Program could be a lifeline for you, but it’s essential to understand the eligibility criteria.

To qualify, you need to demonstrate economic hardship. This can be shown through income statements and other financial documents. Common signs of economic hardship include low income, high living expenses, and limited access to credit. Remember, it’s crucial to have filed all required tax returns and made any necessary estimated payments. If you have any unfiled returns, they must be submitted before you apply.

Tax professionals emphasize that understanding these requirements is vital for successfully navigating the application process. Did you know that about 40% of individuals with back taxes are classified as Currently Not Collectible? This highlights just how common economic hardship is among taxpayers.

The fresh start tax relief program offers a chance to reduce your total tax debt, remove or lower penalties, and avoid aggressive collections. Here are some specific forms you’ll need:

- Form 843 for the First Time Abate program

- Form 656 for Offer in Compromise

Consulting with a tax professional can significantly improve your chances of obtaining relief through the Fresh Start Program. Remember, you are not alone in this journey, and we're here to help you find the support you need.

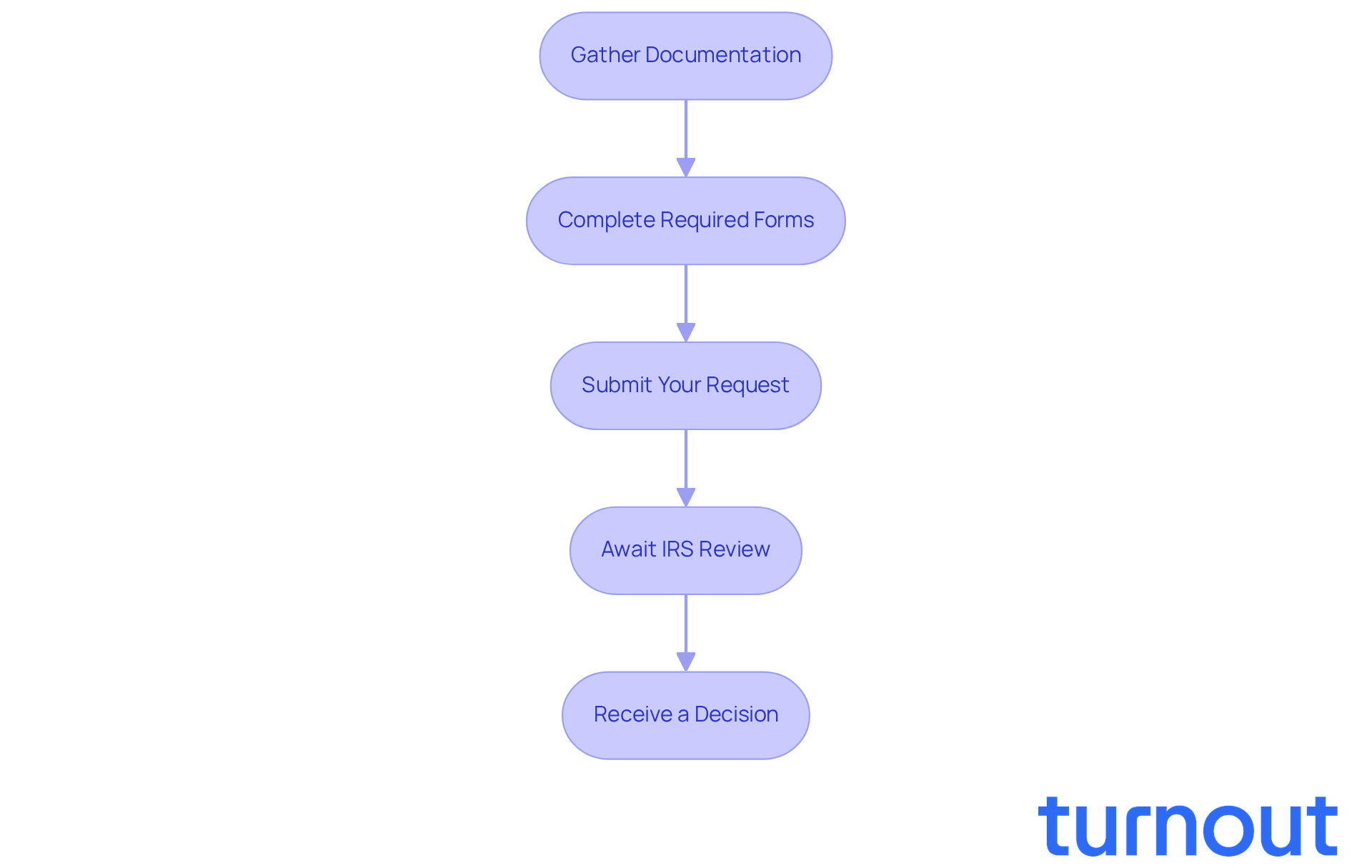

Apply for the IRS Fresh Start Program

Applying for the IRS Fresh Start Program can feel overwhelming, but we're here to help you navigate this process. By following a few essential steps, you can set yourself up for a successful outcome:

-

Gather Documentation: Start by collecting all necessary financial records. This includes recent tax returns, pay stubs, bank statements, and evidence of any economic hardships. We understand that incomplete submissions can lead to denials, so thorough documentation is crucial. Detailed financial records, like income statements and expense reports, are vital in demonstrating your financial hardship.

-

Complete Required Forms: Next, fill out IRS Form 656 (Offer in Compromise) and Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses. Accuracy is key here; common mistakes often stem from misunderstanding eligibility requirements or submitting incomplete information.

-

Submit Your Request: Once your forms are complete, send them along with the necessary documentation and the processing fee (currently $205) to the IRS. If you're a low-income taxpayer, you might qualify for a fee waiver, so be sure to check your eligibility.

-

Await IRS Review: After submission, the IRS will review your request and may ask for additional information. Responding promptly to their inquiries can significantly impact your application’s outcome. Remember, staying compliant with future tax filings and payments is essential to avoid disqualification from program benefits.

-

Receive a Decision: Finally, the IRS will notify you of their decision. If approved, you'll receive instructions on how to proceed with your payment plan or settlement. Many successful applicants find that maintaining open communication with the IRS throughout the process is incredibly beneficial.

In 2025, the IRS Fresh Start Program offers fresh start tax relief options for taxpayers facing financial difficulties. Real-world examples show just how effective this program can be. For instance, Dana, a nurse practitioner, managed to reduce her nearly $50,000 tax debt to $41,800 through a streamlined Fresh Start agreement and a First-Time Penalty Abatement. Similarly, Tyrell, who faced over $70,000 in unpaid taxes, negotiated a Partial Payment Installment Agreement, allowing him to pay only $365 per month while avoiding liens or levies. These stories highlight the potential for substantial fresh start tax relief, allowing eligible taxpayers to decrease their tax liability by as much as 90 percent when the process is handled properly. Remember, you are not alone in this journey; support is available.

Troubleshoot Common Issues in the Application Process

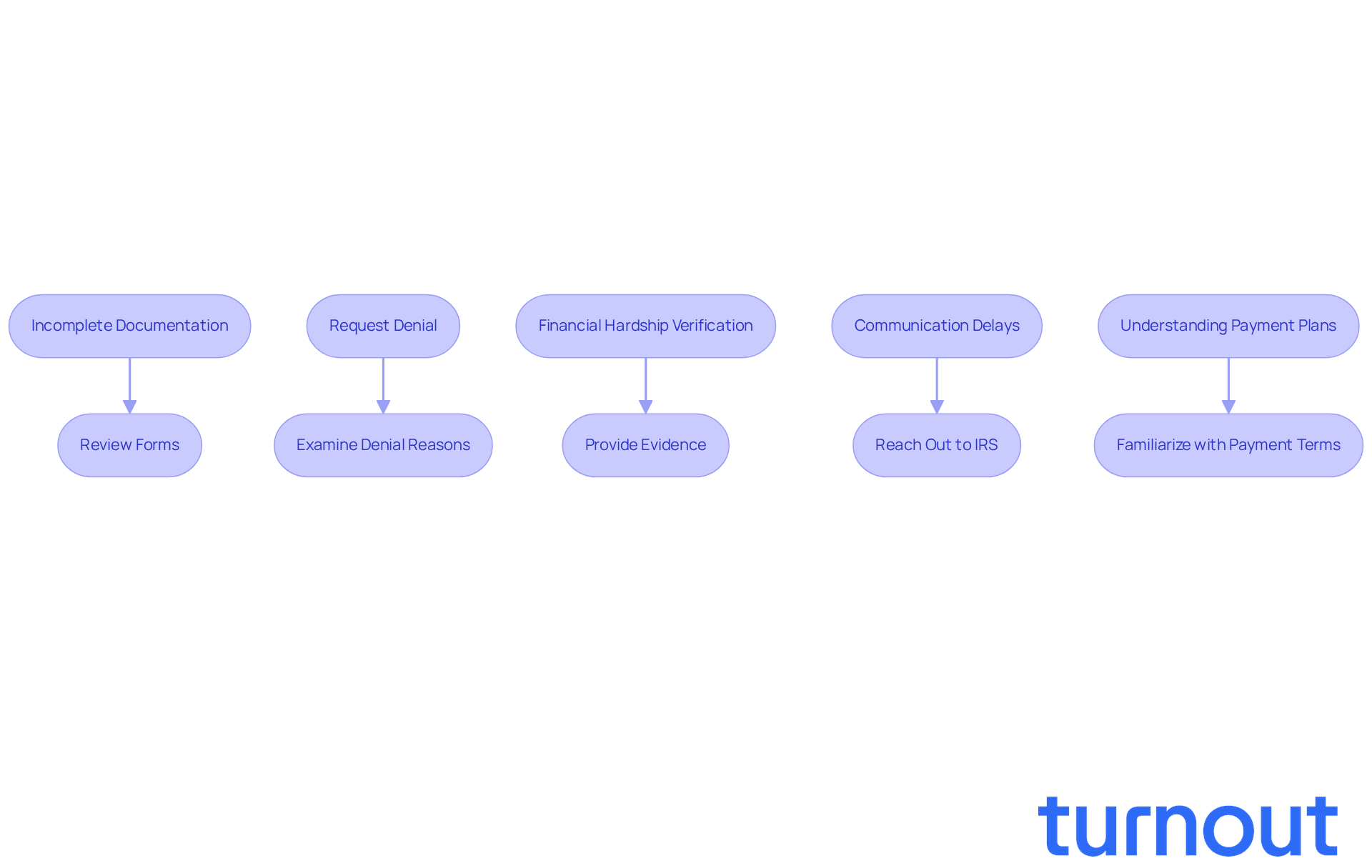

Navigating the fresh start tax relief program from the IRS can be daunting, and we understand that you may encounter several common challenges. Here’s what you should keep in mind:

-

Incomplete Documentation: It’s crucial to submit all required documents. Did you know that around 21.4% of requests for fresh start tax relief by the IRS are denied due to missing information? To avoid this, take a moment to meticulously review your forms before submission. Every detail counts!

-

Request Denial: If your request is denied, don’t lose hope. Carefully examine the reasons provided by the IRS. In 2024, only 7,199 out of 33,591 offers in compromise were accepted, which shows how tough it can be. Remember, you have the right to appeal or submit additional documentation. Understanding the specific reasons for denial can guide your next steps effectively.

-

Financial Hardship Verification: Be prepared to provide comprehensive financial details to support your claim of hardship. If the IRS requests more evidence, respond quickly to prevent delays. Tax professionals often emphasize that thorough documentation can significantly improve your chances of approval.

-

Communication Delays: If you find yourself waiting longer than expected for a response, don’t hesitate to reach out to the IRS. Keeping detailed records of all communications can help clarify misunderstandings and facilitate smoother interactions. You’re not alone in this process.

-

Understanding Payment Plans: Once approved, take the time to familiarize yourself with the terms of your payment plan. If you encounter challenges meeting your obligations, reach out to the IRS immediately. Early communication can prevent further complications. Also, consider the First-Time Penalty Abatement option if you face penalties; it can provide relief for those with a clean compliance record.

By addressing these common issues with diligence and preparation, you can enhance your chances of successfully navigating the fresh start tax relief program offered by the IRS. Remember, we’re here to help, and you are not alone in this journey.

Conclusion

Navigating the IRS Fresh Start Program can be a lifeline for those grappling with tax debt. We understand that financial difficulties can feel overwhelming, but this program is here to help you find relief. With options like reduced penalties, streamlined payment plans, and potential tax lien withdrawals, you can take meaningful steps toward regaining control of your financial future.

Throughout this article, we’ve outlined key steps for qualifying and applying for the Fresh Start Program. It’s crucial to gather thorough documentation and complete the necessary forms accurately. Remember, being prepared to respond to IRS inquiries can make a significant difference. Real-life examples show how many have successfully reduced their debt, highlighting the program's effectiveness when approached with care and diligence.

Ultimately, the Fresh Start Program represents a vital opportunity for you to alleviate your burdens and achieve economic stability. Engaging with this program not only provides immediate relief but also fosters a path toward long-term financial health. If you’re facing tax challenges, know that taking proactive steps today can pave the way for a brighter, more secure financial future. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is a tax relief initiative designed to help taxpayers facing significant tax debt by providing options for relief, such as settling tax debts for less than what is owed through an Offer in Compromise (OIC).

What is an Offer in Compromise (OIC)?

An Offer in Compromise (OIC) is a program that allows taxpayers to settle their tax debts for less than the full amount owed, providing a more manageable way to address tax obligations.

What are the key features of the Fresh Start tax relief program?

Key features of the Fresh Start tax relief program include reduced penalties, streamlined payment plans, and the potential for tax lien withdrawal.

How can Turnout assist with the Fresh Start Program?

Turnout provides valuable tools and services, utilizing trained nonlawyer advocates and collaborating with IRS-licensed enrolled agents to guide taxpayers through the Fresh Start Program, ensuring effective management of tax obligations.

Who can benefit from the Fresh Start tax relief program?

The Fresh Start tax relief program is beneficial for taxpayers experiencing economic distress and struggling with tax debt, offering them a path to regain economic stability while addressing their tax responsibilities.

Do I need legal representation to apply for the Fresh Start Program?

No, you do not need legal representation to apply for the Fresh Start Program, as Turnout offers support and guidance through the process.