Introduction

Navigating the maze of federal tax forgiveness can feel overwhelming. We understand that the many programs available to alleviate tax burdens may leave you feeling lost. This guide aims to provide a clear overview of the options you can explore, from Offers in Compromise to Penalty Abatement. Our goal is to help you find the relief you truly need.

As eligibility criteria evolve and the application process grows more complex, it’s common to wonder how to effectively position yourself for tax relief. Remember, you are not alone in this journey. We're here to help you understand your options and take the necessary steps toward financial peace.

Understand Federal Tax Forgiveness Eligibility and Types

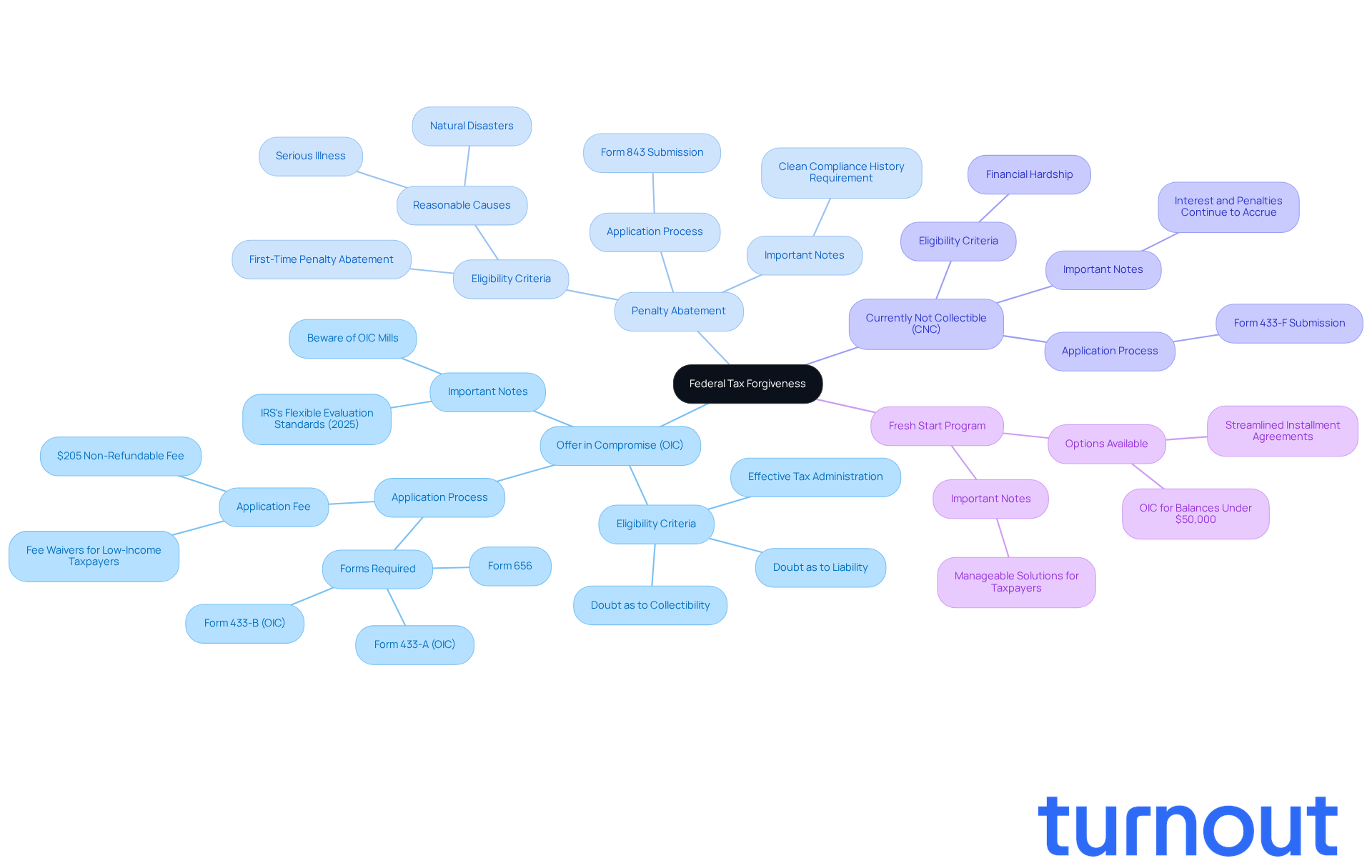

Navigating the process of federal tax forgiveness can feel overwhelming, but you’re not alone in this journey. Understanding the various relief options available can make a significant difference in your financial situation. Here’s a look at some supportive programs that might help you find relief:

-

Offer in Compromise (OIC): This program allows you to settle your tax debt for less than what you owe. If you’re struggling to pay your full tax bill, this could be a viable option for you. In 2025, the IRS expanded eligibility criteria, making it easier for more taxpayers to qualify based on their financial circumstances. To apply, you’ll need to complete Form 433-A (OIC) or Form 433-B (OIC), along with Form 656, and pay a non-refundable processing fee of $205. Many individuals have successfully reduced their tax liabilities through this program. Just be cautious of OIC mills that might mislead you about your qualifications and waste your time and money.

-

Penalty Abatement: If you’ve faced penalties due to circumstances beyond your control - like a serious illness or a natural disaster - you may qualify for penalty relief. This can lead to a significant reduction in your overall tax burden. The IRS’s First-Time Penalty Abatement policy can relieve penalties for a single tax period if you’ve maintained a clean compliance history for the past three years.

-

Currently Not Collectible (CNC): If you’re experiencing financial hardship, you can request the IRS to temporarily halt collection efforts. While in CNC status, collection actions are paused, but keep in mind that interest and penalties will continue to accrue. This status is crucial for those who can’t pay their tax debt without compromising basic living expenses.

-

Fresh Start Program: This initiative offers various options for taxpayers struggling with tax debt, including streamlined installment agreements and OICs for those owing less than $50,000. The program aims to provide manageable solutions for taxpayers seeking relief.

To assess your eligibility for these programs, consider using the IRS's Offer in Compromise Pre-Qualifier tool. It guides you through an initial assessment based on your financial situation. In 2025, more taxpayers are utilizing the OIC program, reflecting its growing importance as a resource for federal tax forgiveness for those in need of tax relief. Remember, we’re here to help you navigate these options and find the support you need.

Gather Required Documentation for Application

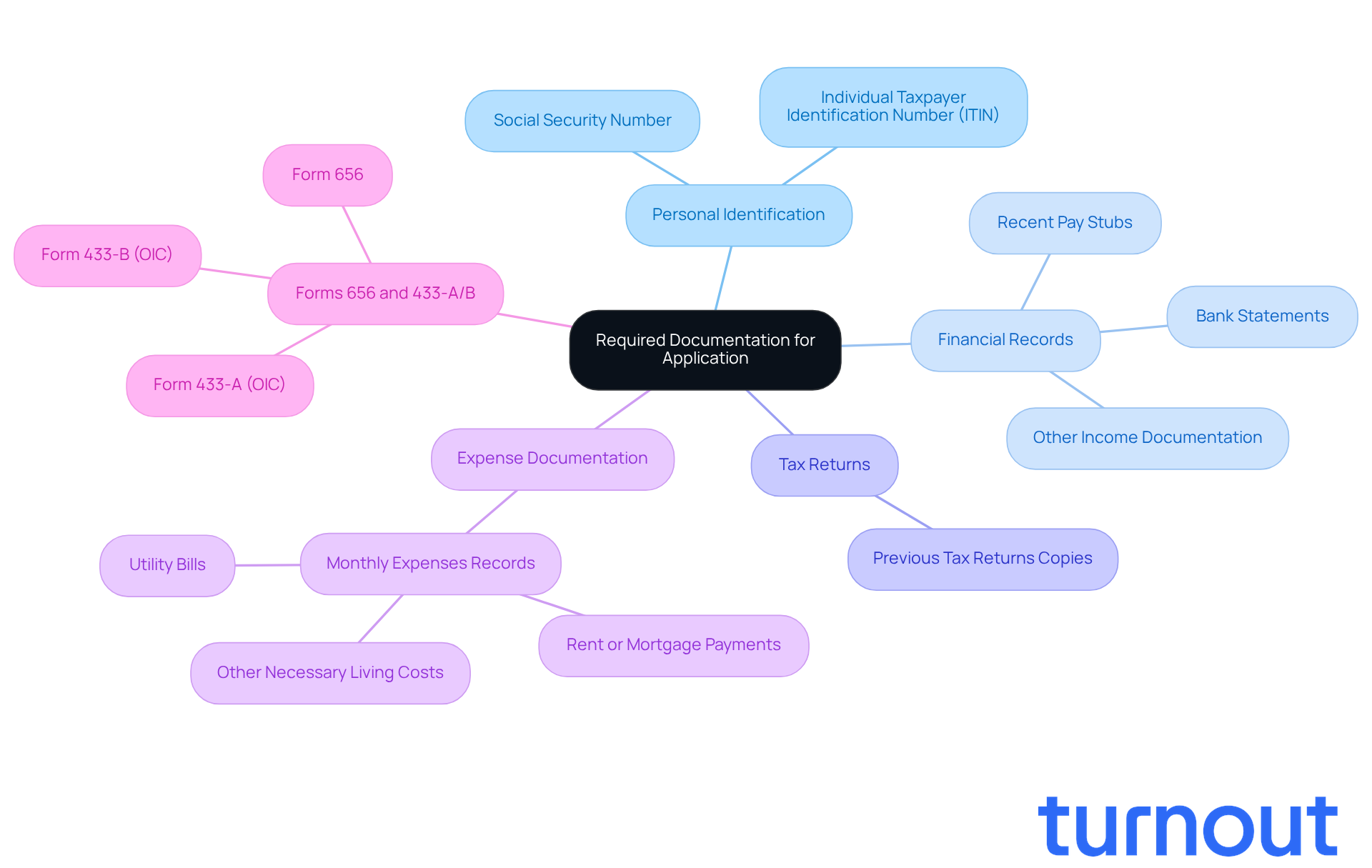

It’s important to gather a few essential documents before you submit your application for federal tax forgiveness. We understand that this process can feel overwhelming, but having everything in order can make a significant difference.

- Personal Identification: Make sure to include your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Financial Records: Prepare your recent pay stubs, bank statements, and any other income documentation. This will help clearly demonstrate your financial situation.

- Tax Returns: Collect copies of your previous tax returns. These documents provide the IRS with a comprehensive view of your financial history.

- Expense Documentation: Compile records of your monthly expenses, including rent or mortgage payments, utility bills, and other necessary living costs.

- Forms 656 and 433-A/B: These forms are crucial for the Offer in Compromise submission. Ensure they are filled out accurately and completely.

Arranging these documents clearly will help streamline the process. Using a checklist can ensure you have everything needed before submission, reducing the likelihood of common documentation errors that can delay your application.

We know that applying for federal tax forgiveness can be complex and tedious. But remember, you’re not alone in this journey. Turnout is here to help you navigate these challenges. Our trained nonlawyer advocates and IRS-licensed enrolled agents are ready to support you throughout the process. While we’re not a law office and don’t offer legal representation, our experts are qualified to assist you with the necessary documentation and procedures. This support can significantly enhance your chances of success.

Submit Your Application for Federal Tax Forgiveness

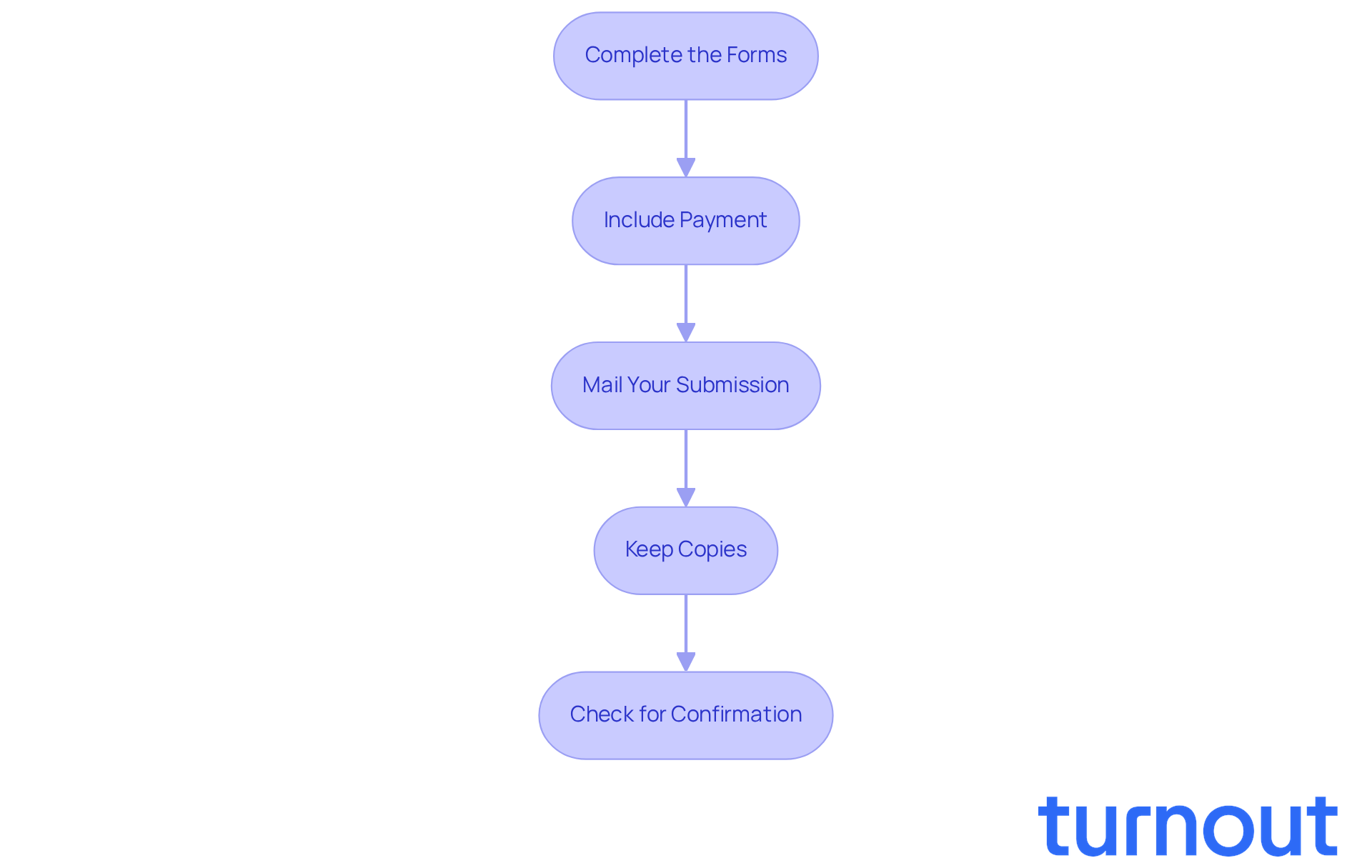

To successfully submit your application for federal tax forgiveness, follow these essential steps:

-

Complete the Forms: We understand that filling out forms can be daunting. Accurately complete Form 656 and Form 433-A/B, ensuring all information is correct and complete. Common mistakes include missing signatures or failing to provide necessary financial details, which can lead to rejection. Remember, as tax professionals often say, "Missing documents or miscalculations can result in your offer being denied or returned without review."

-

Include Payment: If you’re not eligible for a fee waiver, don’t forget to include the $205 charge for the Offer in Compromise. However, if you’re a low-income applicant, you can have this fee waived, making it easier to access the program. This waiver is significant for those who may struggle with upfront costs.

-

Mail Your Submission: Once your forms are complete, send them to the designated IRS address, which you can find on the IRS website. We recommend using a secure mailing method, like certified mail, so you can track your submission.

-

Keep Copies: It’s important to retain copies of all documents submitted. This is vital for your records and can be beneficial if you need to refer to them later during the evaluation.

-

Check for Confirmation: After sending your submission, keep an eye out for confirmation from the IRS regarding its receipt. The IRS review process can take up to 24 months, so staying informed is key. Historically, the IRS accepts about one in three Offer in Compromise submissions, so thorough preparation is essential.

By following these steps meticulously, you can enhance your chances of achieving federal tax forgiveness. Consulting with a tax expert can further improve your success rate by ensuring that your submission is complete and compliant with IRS guidelines. Additionally, consider using the IRS’s OIC Pre-Qualifier tool to assess your eligibility before applying, as this can significantly impact your chances of approval. Remember, you are not alone in this journey; we’re here to help.

Follow Up on Your Application Status

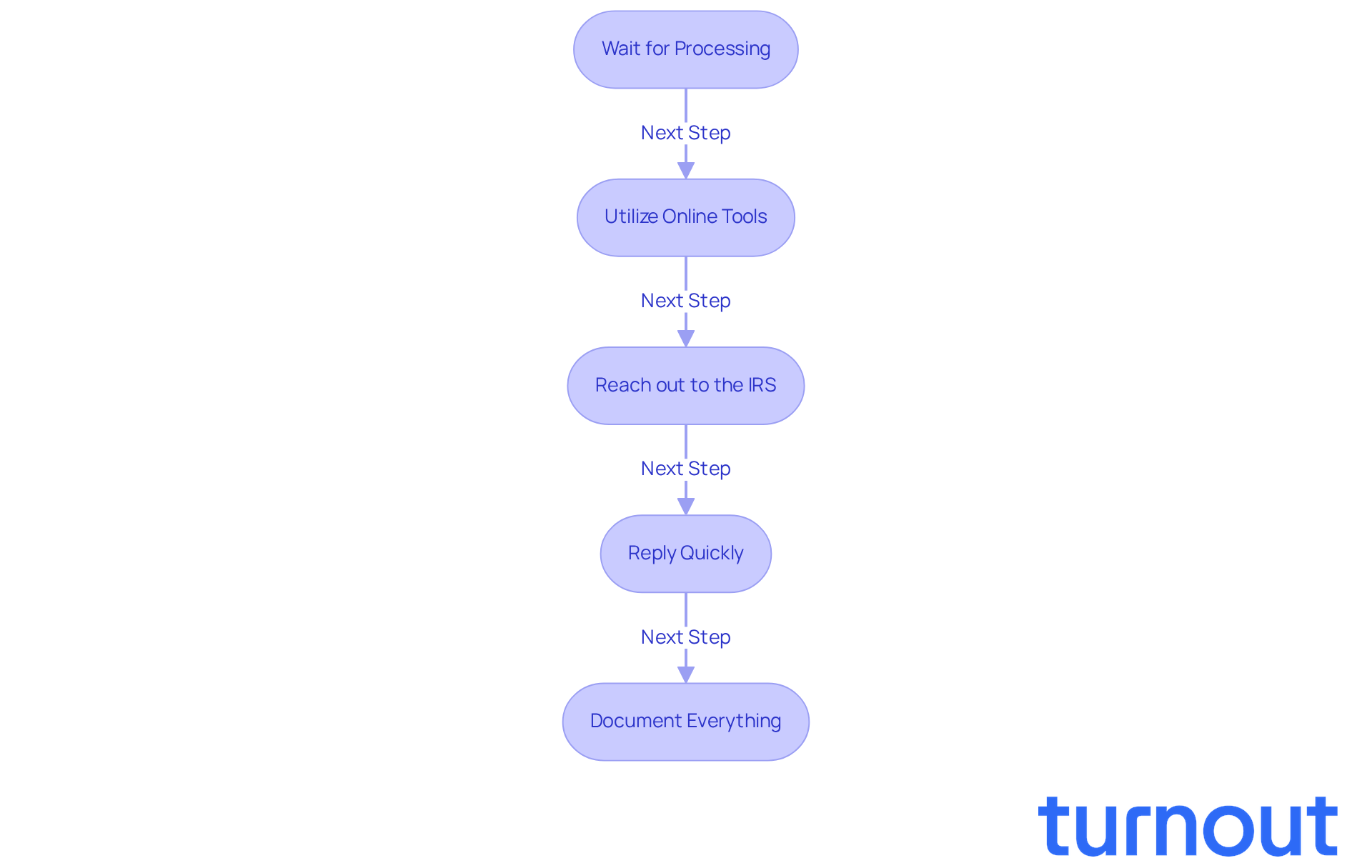

After submitting your application, following up is crucial to ensure timely processing. We understand that this can be a stressful time, and we’re here to help you navigate it:

-

Wait for Processing: The IRS typically requires between 30 to 90 days to process an Offer in Compromise request. While patience is key, staying vigilant is equally important. It’s common to feel anxious during this wait. Remember, roughly 25% of submissions may require additional information from the IRS, which can extend processing times.

-

Utilize Online Tools: Leverage the IRS's online resources, like the 'Where's My Refund?' tool, to check the status of your request. This tool provides real-time updates and can help you stay informed. Additionally, the IRS offers a specialized online portal for monitoring your status, which can be quite advantageous.

-

Reach out to the IRS: If you haven’t received any communication after 90 days, don’t hesitate to get in touch with the IRS using the contact number included in your confirmation. Be prepared to provide your submission details for efficient assistance. Tax experts often suggest reaching out directly if you face delays, as they can offer insights into usual processing times for Offer in Compromise submissions.

-

Reply Quickly: If the IRS asks for further information or documentation, react promptly to avoid any hold-ups in handling your request. Delays in response can significantly impact your application timeline, and we want to ensure you’re on track.

-

Document Everything: Maintain a detailed record of all interactions with the IRS, including dates, times, and the names of representatives you speak with. This documentation can be invaluable if any issues arise during the process. Keeping thorough records is a best practice recommended by tax professionals to ensure a smooth follow-up.

By being proactive and organized, you can greatly enhance your chances of a successful outcome. Remember, you are not alone in this journey, and taking these steps can make a significant difference.

Conclusion

Navigating the complexities of federal tax forgiveness can feel overwhelming, and we understand that. It's essential to know the options available for those seeking relief. This article highlights several key programs designed to assist you in overcoming financial burdens:

- Offer in Compromise

- Penalty Abatement

- Currently Not Collectible status

- Fresh Start Program

By familiarizing yourself with these options, you can take meaningful steps toward alleviating your tax liabilities.

Gathering necessary documentation is crucial. Personal identification, financial records, and tax returns are all important to support your application for forgiveness. Remember, completing forms accurately and submitting them correctly is vital. Following up diligently ensures timely processing. Utilizing resources like the IRS's OIC Pre-Qualifier tool can significantly enhance your chances of approval.

You don’t have to face the journey toward federal tax forgiveness alone. By being proactive, organized, and informed, you can successfully navigate the application process and secure the relief you need. Engaging with qualified professionals for assistance can further improve your success rates. It’s imperative to take action and explore the available options for federal tax relief. Remember, we're here to help you every step of the way.

Frequently Asked Questions

What is the Offer in Compromise (OIC) program?

The Offer in Compromise (OIC) program allows taxpayers to settle their tax debt for less than the total amount owed. It was expanded in 2025 to make it easier for more taxpayers to qualify based on their financial circumstances.

How can I apply for the Offer in Compromise program?

To apply for the OIC program, you need to complete Form 433-A (OIC) or Form 433-B (OIC), along with Form 656, and pay a non-refundable processing fee of $205.

What is Penalty Abatement and who qualifies for it?

Penalty Abatement is a relief option for taxpayers who have incurred penalties due to circumstances beyond their control, such as serious illness or natural disasters. The IRS’s First-Time Penalty Abatement policy can relieve penalties for a single tax period if the taxpayer has maintained a clean compliance history for the past three years.

What does Currently Not Collectible (CNC) status mean?

Currently Not Collectible (CNC) status allows taxpayers experiencing financial hardship to request the IRS to temporarily halt collection efforts. While in this status, collection actions are paused, but interest and penalties will continue to accrue.

What is the Fresh Start Program?

The Fresh Start Program offers various options for taxpayers struggling with tax debt, including streamlined installment agreements and OICs for those owing less than $50,000. It aims to provide manageable solutions for taxpayers seeking relief.

How can I assess my eligibility for federal tax forgiveness programs?

You can assess your eligibility for federal tax forgiveness programs by using the IRS's Offer in Compromise Pre-Qualifier tool, which guides you through an initial assessment based on your financial situation.