Introduction

Navigating the complexities of back tax relief in Las Vegas can often feel like an uphill battle. We understand that countless individuals find themselves in similar situations, seeking a way out from under their tax burdens. This guide offers a comprehensive roadmap to understanding and accessing various relief programs. It’s designed to empower you to take control of your financial future.

However, with numerous eligibility criteria and potential pitfalls, it’s common to feel overwhelmed. How can you ensure you successfully secure the relief you need? We’re here to help you through this journey.

Understand Back Tax Relief: Definition and Importance

If you're facing back tax relief in Las Vegas, know that you're not alone. Back tax relief Las Vegas provides a variety of programs designed to help you manage your debts to the IRS or state tax authorities. These initiatives can ease your burden, minimize penalties, and prevent aggressive collection actions. Understanding your options is crucial; it empowers you to take control of your financial situation. You can explore avenues like:

- Offers in Compromise

- Installment agreements

- Penalty abatement

Many taxpayers have found relief through these programs. For instance, the IRS Fresh Start program has expanded eligibility, allowing more individuals to qualify based on their income and financial challenges. It's important to remember that if you owe taxes and miss the filing deadline, you may face a failure-to-file penalty. This penalty can add up to five percent of the tax owed for each month your return is late, reaching a maximum of 25 percent.

Consider this: taxpayers who work with professional tax advocates often see better outcomes. These specialists navigate the complexities of tax assistance options effectively. By demonstrating financial hardship, you can significantly improve your chances of qualifying for help. It's common to feel overwhelmed, but taking prompt action can greatly reduce the anxiety associated with tax debt.

By recognizing the value of back tax relief Las Vegas, you can discover solutions that align with your financial situation. Remember, we're here to help you pave the way toward a more secure financial future.

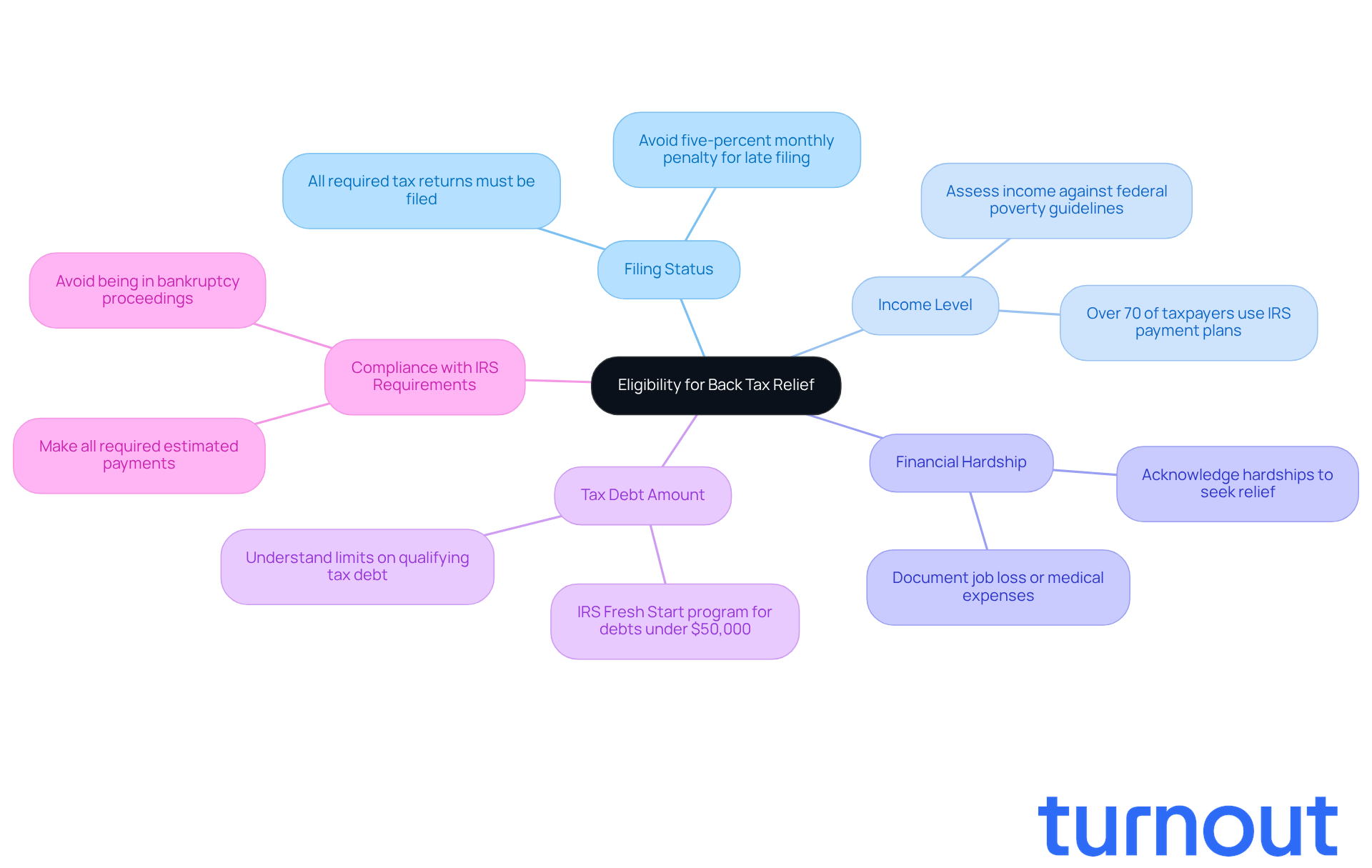

Determine Eligibility for Back Tax Relief in Las Vegas

If you're feeling overwhelmed by back tax relief Las Vegas issues, you're not alone. Understanding your eligibility for relief can be a daunting task, but we're here to help you navigate this journey. Here are some key criteria to consider:

-

Filing Status: It's essential to ensure that all your required tax returns are filed. The IRS typically requires that any overdue returns be submitted before you can apply for assistance. Timely filing is crucial; it helps you avoid a five-percent monthly penalty for failing to file.

-

Income Level: Take a moment to assess your income against the federal poverty guidelines. Many assistance programs, like the Offer in Compromise, look at your ability to pay based on your income. Did you know that over 70% of taxpayers utilize one of the IRS payment plans? This shows just how common it is to seek help.

-

Financial Hardship: If you're facing financial difficulties, it's important to document them. Job loss, medical expenses, or other significant burdens can impact your ability to pay your tax debt. Remember, acknowledging these hardships is a vital step toward finding relief.

-

Tax Debt Amount: Be aware that some programs have limits on the tax debt that qualifies for assistance. For instance, the IRS Fresh Start program is available for individuals with tax debts under $50,000. Understanding these limits can make a big difference in your options.

-

Compliance with IRS Requirements: Make sure you've made all required estimated payments and that you're not currently in bankruptcy proceedings. Staying compliant is key to accessing relief.

By reflecting on these factors, you can gain a clearer understanding of your eligibility for back tax relief Las Vegas assistance options. Many taxpayers who have successfully navigated the IRS Fresh Start program often share that meeting these criteria made their process smoother. It's a reminder of how important thorough preparation and compliance can be.

And remember, understanding your tax obligations is crucial. The risk of wage garnishments for unpaid debts can be daunting, but taking proactive steps can help you regain control. You're not alone in this journey, and there are resources available to support you.

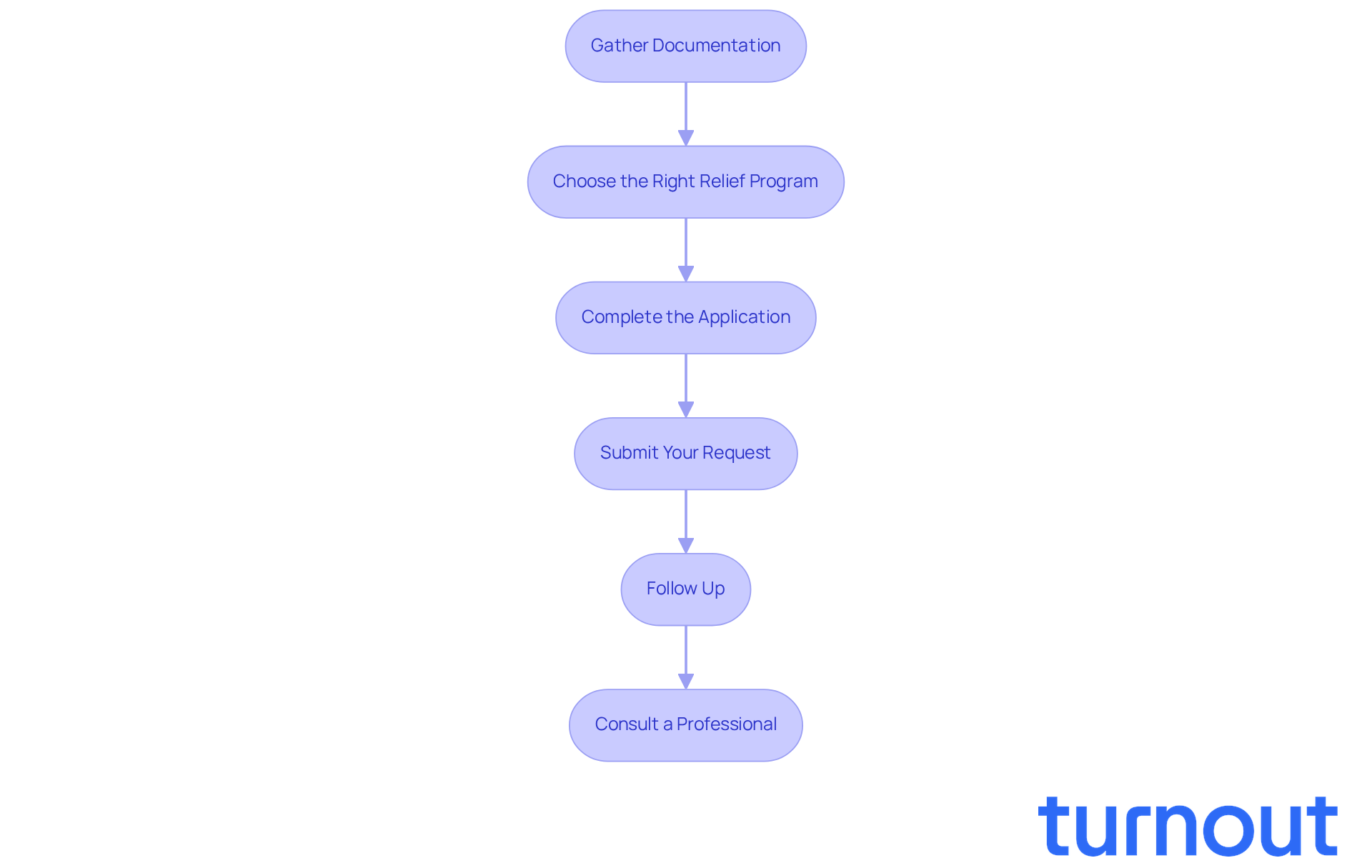

Apply for Back Tax Relief: Step-by-Step Process

Navigating back tax relief Las Vegas can feel overwhelming, but you’re not alone in this journey. Here are some essential steps to guide you through the process:

-

Gather Documentation: Start by collecting all necessary documents, such as tax returns, income statements, and any correspondence from the IRS. This documentation is crucial as it supports your request and illustrates your financial situation.

-

Choose the Right Relief Program: We understand that each situation is unique. Based on your eligibility, determine which relief program suits your needs best. Options like Offers in Compromise, installment agreements, or penalty abatement are designed to address different financial circumstances. The IRS Fresh Start Initiative offers structured options for managing federal tax debt, making it an important consideration.

-

Complete the Application: If you’re applying for an Offer in Compromise, accurately fill out Form 656 and Form 433-A (OIC). These forms require detailed financial information, so ensure everything is accurate and thorough to avoid delays. Historically, the IRS approves only about one in three submissions, as noted by TaxRise, so it’s vital to get it right.

-

Submit Your Request: Once your forms are complete, send them to the appropriate IRS address. If you’re applying for state relief, check the Nevada Department of Taxation website for specific submission guidelines to ensure compliance. Remember, submitting an Offer in Compromise requires a non-refundable processing fee of $205, but this fee can be waived for those who qualify for low-income certification.

-

Follow Up: After submission, actively monitor the status of your request. The IRS may ask for additional information, so be prepared to respond promptly to any inquiries. Staying engaged during the review period is essential for preserving your eligibility for assistance options.

-

Consult a Professional: If you encounter challenges, consider seeking help from a tax professional or advocate. Their expertise can provide valuable guidance and support, increasing your chances of a successful outcome. For instance, Tyrell, who faced over $70,000 in unpaid taxes, now pays just $365 a month under a Partial Payment Installment Agreement, showing that positive outcomes are possible.

By following these steps, you can effectively navigate the process for back tax relief Las Vegas. Remember, you’re not alone, and there are real-life examples of successful submissions to inspire confidence in your journey.

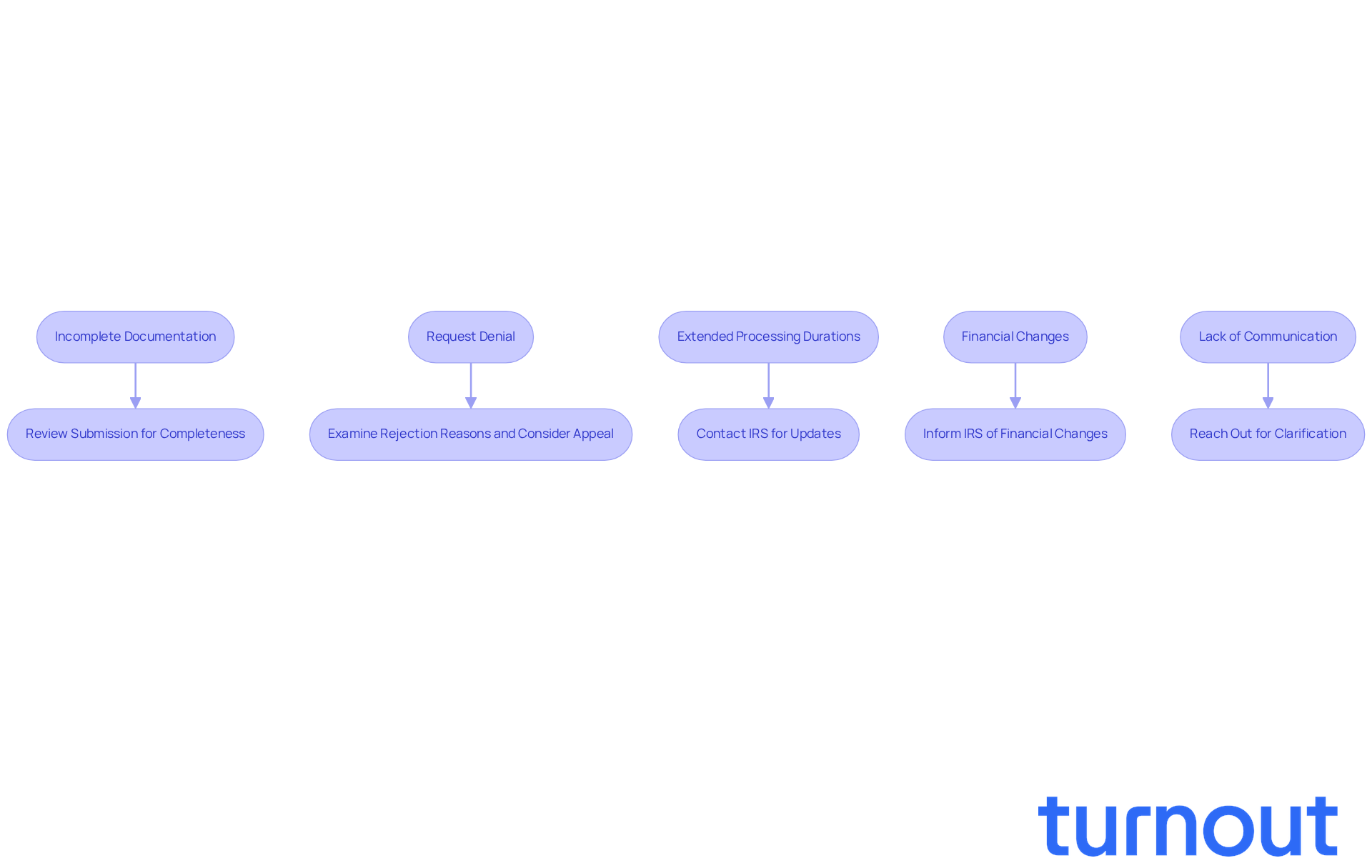

Troubleshoot Common Challenges in Securing Tax Relief

When applying for back tax relief Las Vegas, we understand that you may encounter several common challenges. Here’s how to effectively troubleshoot them:

-

Incomplete Documentation: It’s crucial to ensure that all required documents are submitted. Missing information can lead to delays or denials. Take a moment to carefully review your submission against the requirements set by the IRS or your state tax authority to confirm completeness.

-

Request Denial: If your request is denied, don’t lose hope. Thoroughly examine the reasons provided in the rejection notice. You might have the option to appeal the decision or reapply with additional documentation that directly addresses the concerns raised. Understanding the specific reasons for denial can significantly enhance your chances of a successful appeal.

-

Extended Processing Durations: We know that tax assistance requests can take time to handle, which can be frustrating. If you experience delays, proactively reach out to the IRS or your state tax office for updates. Keeping detailed records of your communications, including dates and names of representatives, can be invaluable for follow-ups.

-

Financial Changes: If your financial situation changes after sending your request, it’s important to inform the IRS immediately. Variations in income or expenditures can influence your eligibility for assistance, and prompt updates can help modify your request accordingly.

-

Lack of Communication: If you haven’t received updates regarding your submission, don’t hesitate to reach out to the IRS or consult a tax professional for assistance. They can help clarify your application status and advise on the next steps to take.

By being aware of these challenges and knowing how to address them, you can significantly improve your chances of successfully securing back tax relief Las Vegas. Many taxpayers have successfully overturned initial denials by gathering additional documentation and presenting a well-organized appeal. Remember, persistence and thoroughness are key in this process, and you are not alone in this journey.

Conclusion

Facing back tax relief in Las Vegas can feel overwhelming, but you’re not alone. Understanding the options and processes available can truly empower you to take control of your financial future. This guide has shed light on the importance of back tax relief, showcasing various programs and steps that can help ease the burden of tax debt. By recognizing the need for timely action and informed decision-making, you can navigate your tax challenges with greater confidence.

We understand that eligibility criteria for relief programs can be confusing. It’s essential to file all required tax returns and demonstrate financial hardship. This article has laid out a step-by-step process for applying for back tax relief, highlighting the importance of thorough documentation and proactive communication with tax authorities. Common challenges, like incomplete submissions and request denials, were also addressed, offering practical solutions to enhance your chances of success.

Ultimately, the journey toward back tax relief doesn’t have to be faced alone. With the right knowledge, resources, and support, you can effectively manage your tax obligations and work towards a more secure financial future. Taking the initiative to seek assistance and understanding the steps involved can lead to significant relief and peace of mind. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is back tax relief?

Back tax relief refers to various programs designed to help individuals manage their debts to the IRS or state tax authorities, easing their financial burden, minimizing penalties, and preventing aggressive collection actions.

Why is understanding back tax relief important?

Understanding back tax relief is crucial because it empowers taxpayers to take control of their financial situation by exploring available options to alleviate their tax debts.

What options are available for back tax relief?

Options for back tax relief include Offers in Compromise, installment agreements, and penalty abatement.

What is the IRS Fresh Start program?

The IRS Fresh Start program is an initiative that has expanded eligibility, allowing more individuals to qualify for tax relief based on their income and financial challenges.

What happens if I miss the tax filing deadline?

If you miss the tax filing deadline, you may face a failure-to-file penalty, which can add up to five percent of the tax owed for each month your return is late, with a maximum penalty of 25 percent.

How can professional tax advocates help with back tax relief?

Professional tax advocates can help taxpayers navigate the complexities of tax assistance options, often leading to better outcomes, especially when demonstrating financial hardship.

What should I do if I feel overwhelmed by tax debt?

If you feel overwhelmed by tax debt, taking prompt action can significantly reduce anxiety. Exploring back tax relief options can help you find solutions that align with your financial situation.