Introduction

Navigating the complexities of tax levies can feel overwhelming, especially when they happen without any warning. We understand that the implications of such actions by the IRS can lead to significant financial distress, impacting not just individual taxpayers but entire families.

This article explores essential steps for seeking relief from a tax levy. We aim to provide valuable insights and strategies that empower you to reclaim control over your financial situation. What proactive measures can you take to mitigate the impact of unexpected tax levies and safeguard your assets? Remember, you are not alone in this journey, and we're here to help.

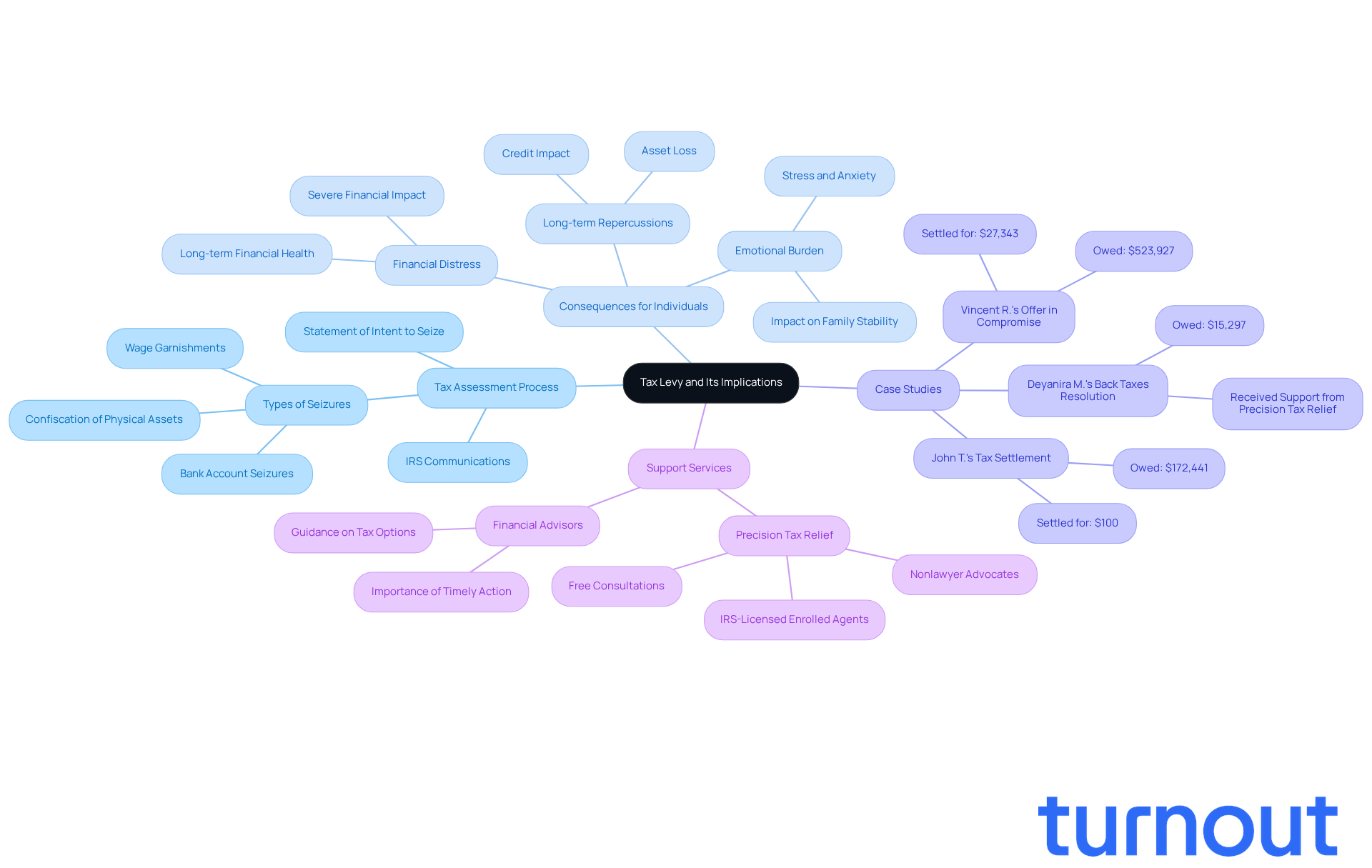

Define a Tax Levy and Its Implications

A tax assessment represents a legal seizure of property by the IRS to satisfy outstanding tax debts. This can manifest in various forms, including wage garnishments, bank account seizures, or the confiscation of physical assets such as vehicles and real estate. Generally, the IRS begins a tax seizure after sending several communications to the taxpayer, culminating in a Statement of Intent to Seize. This notice acts as a final chance for the taxpayer to settle their tax responsibilities before the enforcement occurs.

In 2026, the effect of tax charges on American households remains profound, with many individuals experiencing severe financial distress. For instance, individuals like John T., who owed $172,441, managed to settle for just $100 after navigating a complex tax situation, highlighting the potential for relief despite overwhelming circumstances. On the other hand, the emotional burden of tax impositions can be devastating, as families strive to sustain their livelihoods amid IRS actions.

At Turnout, we provide essential tools and services designed to help individuals navigate these challenges, particularly for those seeking tax debt relief. Our trained nonlawyer advocates work alongside IRS-licensed enrolled agents to assist clients in understanding their options and taking appropriate actions without the need for legal representation. Financial advisors stress the significance of addressing tax charges promptly, as neglecting to do so can result in severe repercussions, including the loss of vital assets. The key consequences of a tax imposed extend beyond immediate financial loss; they can disrupt personal and family stability, leading to long-term repercussions on credit and overall financial health. As the IRS continues to enforce tax impositions, understanding these implications is crucial for consumers seeking to protect their assets and regain control over their financial futures.

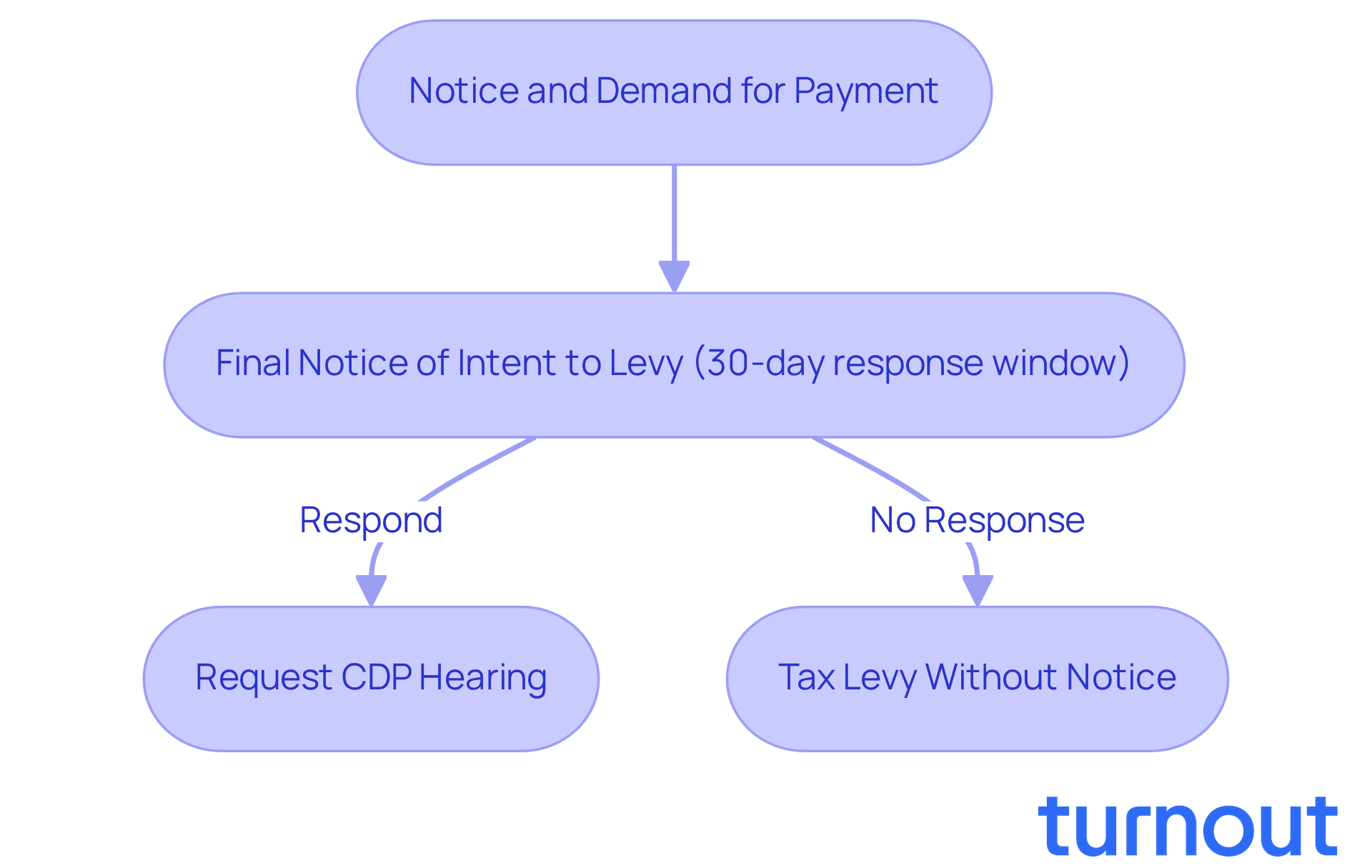

Understand IRS Procedures Before a Levy Is Issued

Navigating the IRS collection process can feel overwhelming, but understanding the steps involved can empower you. Initially, you’ll receive a Notice and Demand for Payment, which clearly outlines the amount you owe. Following this, a Final Notice of Intent to Levy is issued, giving you a crucial 30-day window to respond or resolve your tax debt before a tax levy without notice may occur.

We understand that ignoring the IRS might seem like an option, but as J. David Tax Law emphasizes, "Ignoring the IRS is the worst choice; proactive engagement is essential." During this time, you have the right to request a Collection Due Process (CDP) hearing. This is your opportunity to contest the seizure and present your case, a vital chance to defend your rights and potentially prevent a tax levy without notice.

It's important to note that these notices are sent approximately five weeks apart, giving you at least four to five months to prepare for the final alert. Understanding these procedures is essential, as they provide a framework for you to navigate your obligations and seek relief effectively. Remember, you are not alone in this journey; we’re here to help.

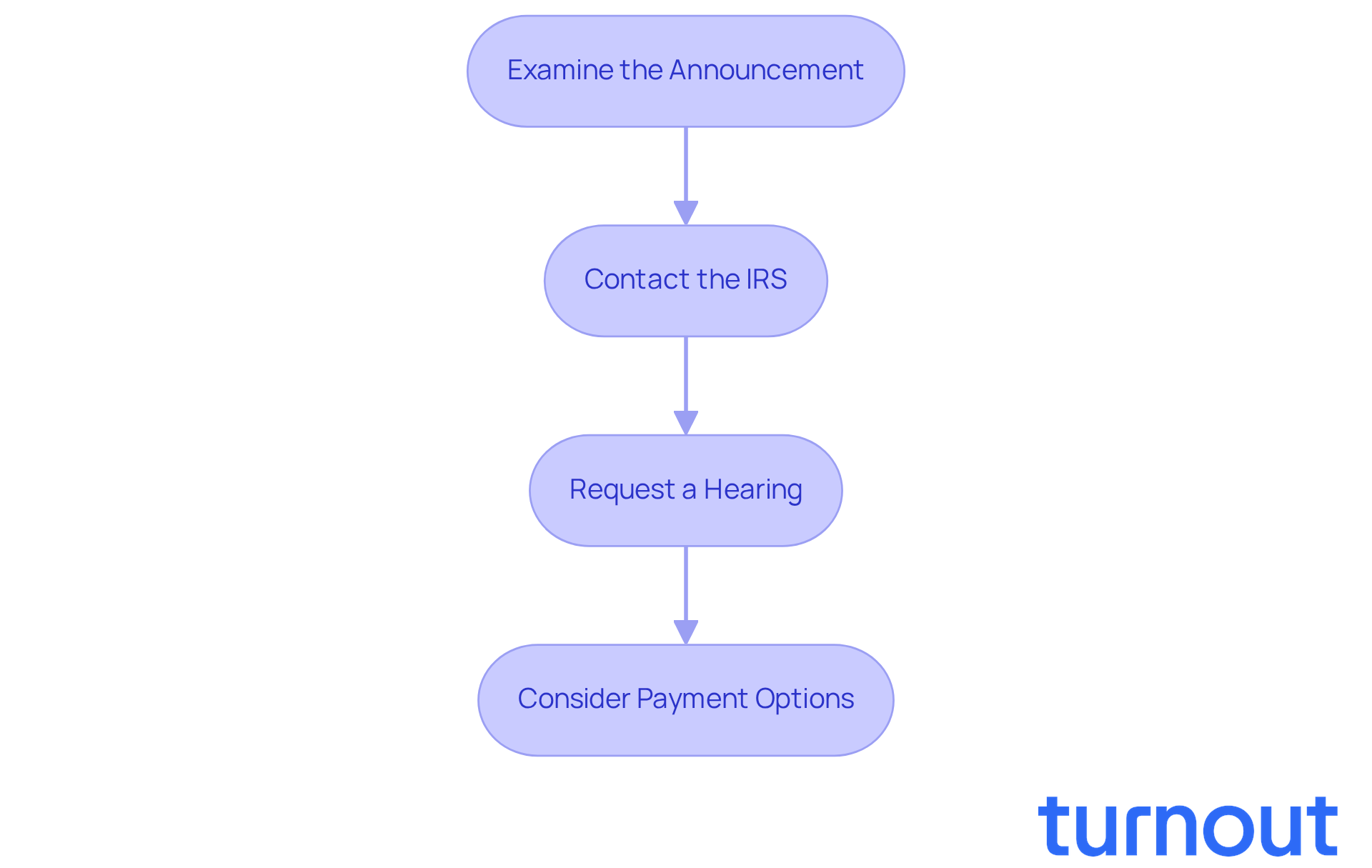

Take Action: Steps to Respond to a Tax Levy

If you receive a notification of a tax seizure, it’s important to take action. Here’s how you can navigate this challenging situation:

-

Examine the Announcement: Take a moment to thoroughly read the announcement. Understanding the amount due and the type of charge being applied is crucial. We understand that this can be overwhelming, but knowing the details is the first step.

-

Contact the IRS: Don’t hesitate to call the number on the letter. Discussing your situation with them can provide clarity. Be prepared to share your financial circumstances and explore options for resolution. Remember, you’re not alone in this.

-

Request a Hearing: If you feel the charge is unjust, you have the right to request a Collection Due Process hearing within 30 days of receiving the notice. This is your opportunity to contest the charge and present your case. It’s common to feel anxious about this, but standing up for yourself is important.

-

Consider Payment Options: Explore various options available to you, such as setting up an installment agreement, proposing an Offer in Compromise, or demonstrating economic hardship to lift the restriction. Taking prompt action can significantly reduce the impact of the charge and lead to a resolution.

We’re here to help you through this process. Remember, taking these steps can make a difference.

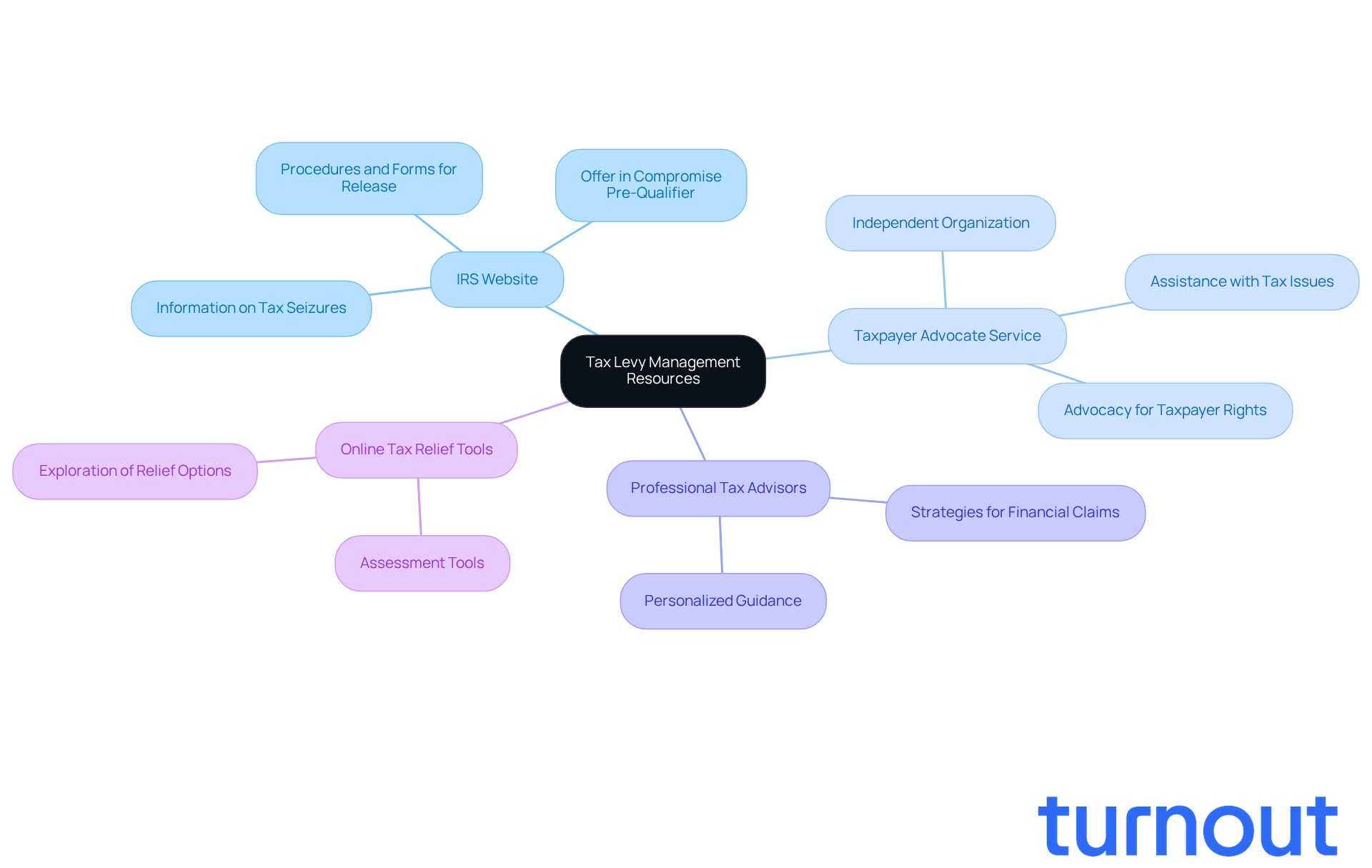

Explore Resources and Tools for Tax Levy Management

Managing a tax assessment can feel overwhelming, but you’re not alone in this journey. Here are some resources that can help you navigate through it:

-

IRS Website: The IRS provides a wealth of information on tax seizures, including the necessary procedures and forms to request a release. You can find more details at IRS.gov.

-

Taxpayer Advocate Service: This independent organization within the IRS is dedicated to helping taxpayers like you resolve issues and navigate the tax system. If you’re facing a tax seizure, they can offer valuable assistance. As the National Taxpayer Advocate points out, "Refund delays and unclear and confusing disallowance notices harm taxpayers and jeopardize their rights to administrative and judicial review."

-

Professional Tax Advisors: Consulting with a tax expert or attorney who specializes in tax law can provide you with personalized guidance and strategies to address your financial claim effectively.

-

Online Tax Relief Tools: There are various online platforms that offer tools to assess your tax situation and explore relief options. For instance, the Offer in Compromise Pre-Qualifier on the IRS website can help you determine if you’re eligible to settle your tax debt for less than the full amount owed.

Additionally, the IRS awarded over $22.5 million in matching grants to Low Income Taxpayer Clinics for the 2026 grant year, which can provide further support.

Utilizing these resources empowers you to take informed steps toward resolving your tax levy without notice and regaining control over your financial situation. Remember, we’re here to help you every step of the way.

Conclusion

Facing a tax levy without any prior notice can feel overwhelming. We understand that this situation can bring about a whirlwind of emotions, but there’s hope. By grasping the implications and knowing the steps to take, you can find effective relief. Engaging proactively with the IRS is crucial, and remember, resolution is possible even when things seem daunting. With the right knowledge and resources, you can regain control over your financial future and lessen the impact of a tax levy.

Key insights from this article shed light on the essential stages of the IRS collection process. It’s important to recognize the various notices that come before a levy, understand your right to contest the seizure through a Collection Due Process hearing, and act promptly. Resources like the IRS website, the Taxpayer Advocate Service, and professional tax advisors are here to support you in navigating your unique circumstances. Each step you take can significantly influence the outcome, leading to a more favorable resolution.

You don’t have to face this journey alone. By utilizing available resources and understanding the necessary actions, you can effectively manage your tax situation. Taking charge of your financial health is vital, and seeking assistance can open doors to relief. Remember, empowerment through knowledge and action is key to overcoming the challenges posed by tax levies. Together, we can work towards ensuring a more stable financial future.

Frequently Asked Questions

What is a tax levy?

A tax levy is a legal seizure of property by the IRS to satisfy outstanding tax debts, which can include wage garnishments, bank account seizures, or confiscation of physical assets like vehicles and real estate.

How does the IRS initiate a tax levy?

The IRS typically initiates a tax levy after sending several communications to the taxpayer, culminating in a Statement of Intent to Seize, which serves as a final chance for the taxpayer to settle their tax responsibilities.

What are the potential outcomes for individuals facing tax levies?

Individuals may experience severe financial distress due to tax levies, but there is potential for relief, as illustrated by cases where individuals managed to settle significant debts for much less after navigating complex tax situations.

What emotional impacts can tax levies have on families?

The emotional burden of tax impositions can be devastating, as families strive to maintain their livelihoods while dealing with IRS actions.

How can Turnout assist individuals dealing with tax levies?

Turnout provides tools and services to help individuals navigate tax challenges, offering support from trained nonlawyer advocates and IRS-licensed enrolled agents to assist clients in understanding their options without requiring legal representation.

Why is it important to address tax charges promptly?

Addressing tax charges promptly is crucial because neglecting them can lead to severe repercussions, including the loss of vital assets and long-term disruptions to personal and family stability, affecting credit and overall financial health.

What are the long-term implications of tax levies on financial health?

The consequences of tax levies extend beyond immediate financial loss; they can disrupt personal and family stability and lead to long-term repercussions on credit and overall financial well-being.