Introduction

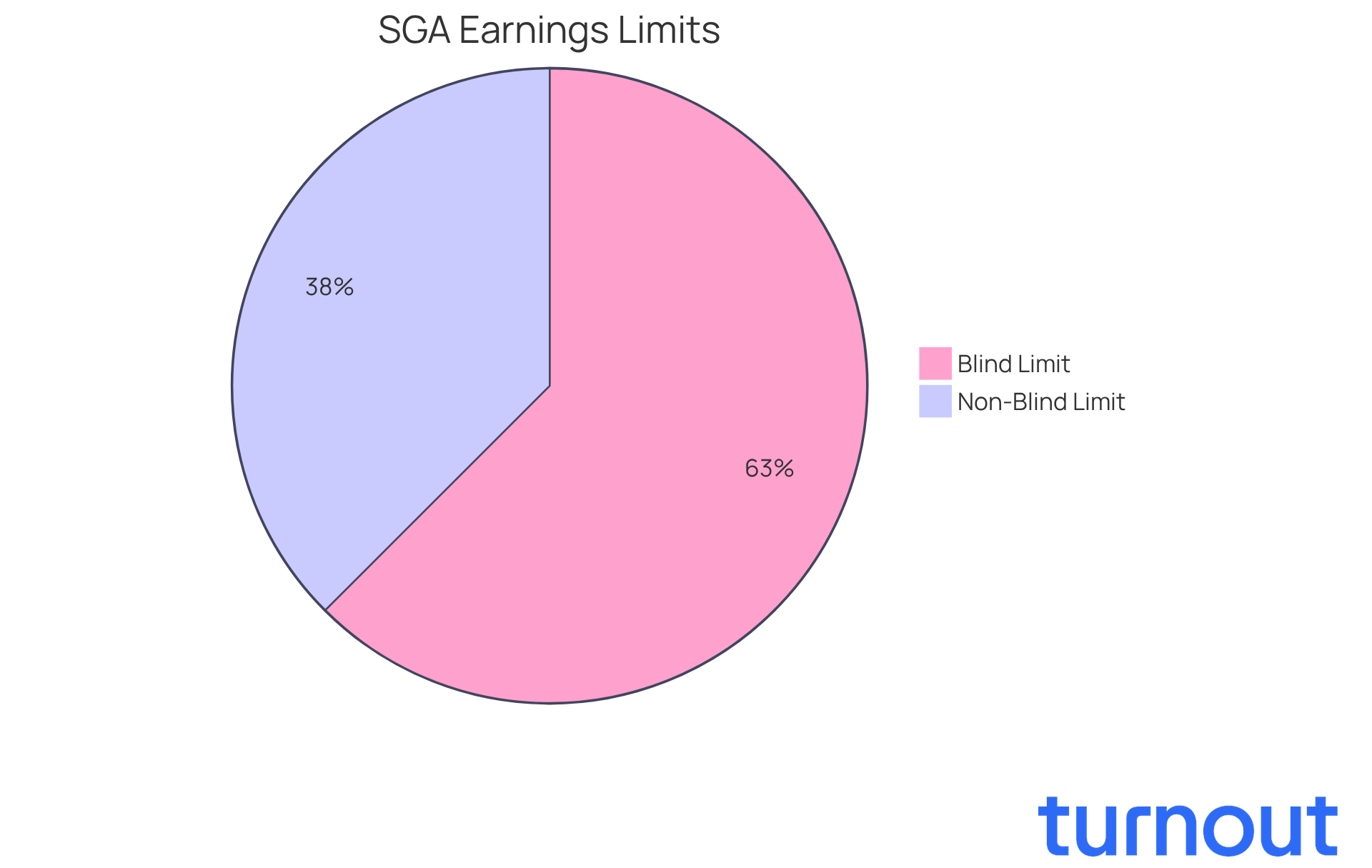

Navigating the world of disability benefits can feel overwhelming, especially when it comes to understanding Substantial Gainful Activity (SGA). We know that the SGA threshold for 2025 is set at $1,620 for non-blind individuals and $2,700 for those who are blind. This can create a challenging situation where your earnings might affect your eligibility for crucial assistance.

This article aims to guide you through these thresholds, offering strategies to help you manage your income effectively while ensuring you keep access to essential benefits. It’s common to wonder: how can you balance the need to work with the risk of exceeding these limits? What steps can you take to secure the support you deserve?

You are not alone in this journey. Together, we can explore the options available to you.

Define Substantial Gainful Activity

Understanding Substantial Gainful Activity (SGA) is crucial for anyone navigating the world of disability benefits. The Social Security Administration (SSA) defines SGA as the level of work activity and earnings that can affect your eligibility for assistance. For the 2025 SGA, the threshold is set at $1,620 per month for non-blind individuals and $2,700 for those who are blind.

It's common to feel overwhelmed by these numbers. Exceeding these earnings limits can lead to the conclusion that you might be capable of engaging in SGA, which directly impacts your eligibility for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI). For instance, if a visually impaired person earns $2,800 each month, they may face challenges in keeping their benefits. On the other hand, someone with a monthly income of $1,500 would still qualify.

We understand that these thresholds can be confusing and stressful. Comprehending the SGA definition and its implications is essential for managing the intricacies of disability assistance. Remember, you are not alone in this journey. We're here to help you navigate these challenges and ensure you receive the support you need.

Understand the 2025 SGA Thresholds

The thresholds for the 2025 sga are set at $1,620 monthly for non-blind individuals and $2,700 monthly for those who are statutorily blind. These limits are adjusted each year based on the national average wage index, ensuring they reflect current economic conditions. If you exceed these limits, the Social Security Administration (SSA) may classify your earnings as 2025 sga, which could result in disqualification from receiving disability assistance. We understand how important it is to keep a close eye on your earnings.

Many people find it helpful to organize their work hours or consider part-time positions to stay below these thresholds. This way, they can maintain their eligibility for benefits. Additionally, any month where you earn $1,160 or more counts as one of your trial employment months. This allows you to test your ability to work without losing your benefits. Remember, work attempts lasting less than six months due to disability are not considered substantial gainful activity, which is an important detail to keep in mind.

The SSA evaluates employment activity based on various factors, including your earnings, hours worked, type of job, and any accommodations you may need. Understanding and adhering to these thresholds is crucial for anyone navigating the complexities of disability support, especially under the 2025 sga.

At Turnout, we’re here to help. Our trained nonlawyer advocates can guide you through understanding these thresholds and navigating the SSD claims process effectively. You deserve the support you need without the added stress of legal complexities. Please remember, Turnout is not a law firm and does not provide legal advice, but we’re committed to assisting you on this journey.

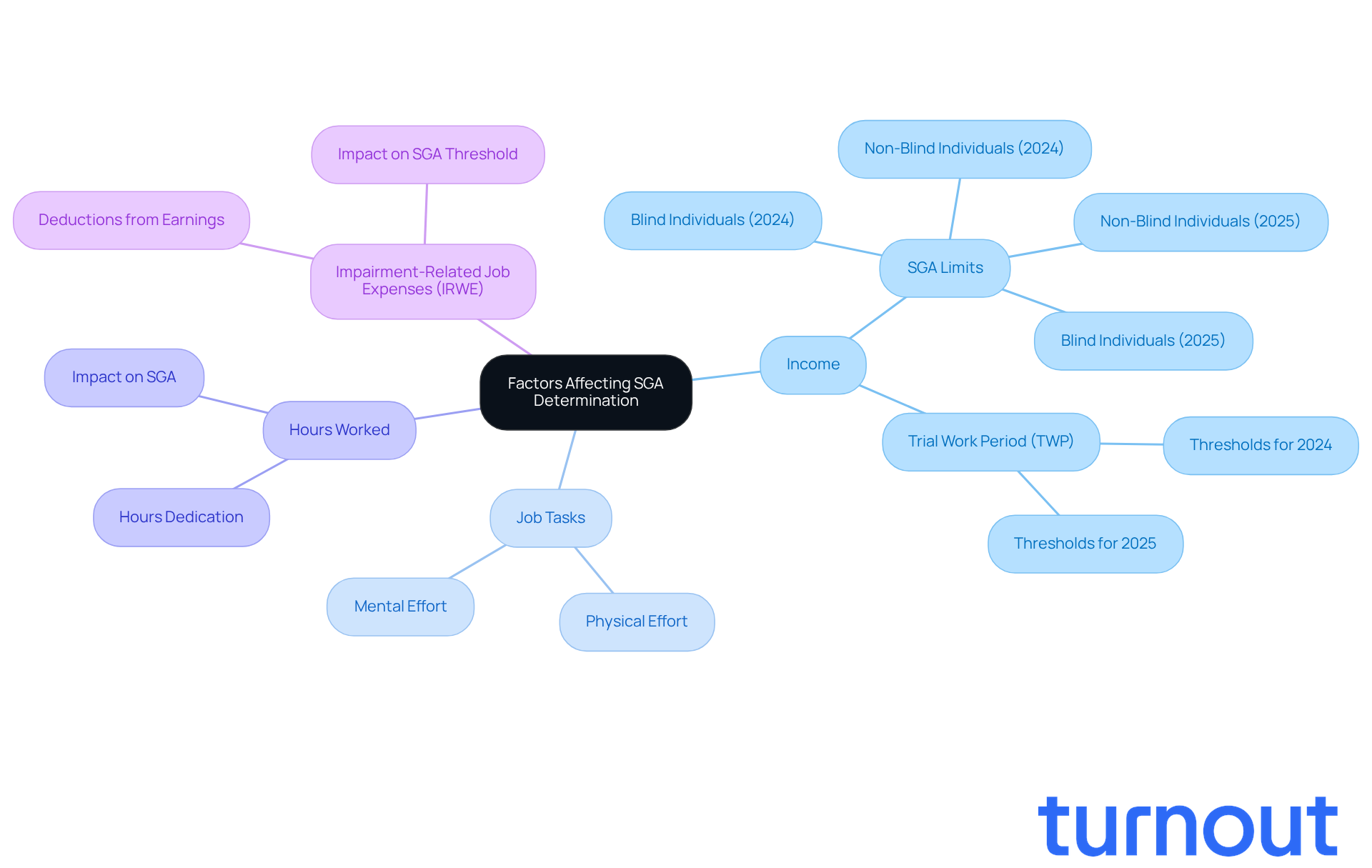

Identify Factors Affecting SGA Determination

Understanding whether you're engaging in Substantial Gainful Activity (SGA) can feel overwhelming. We recognize that navigating this process is challenging, and it’s important to know what factors come into play. The Social Security Administration (SSA) looks at not just your income, but also the tasks you perform and the hours you dedicate to work. Jobs that require significant physical or mental effort may be examined more closely, as they can suggest a greater capacity for labor.

You might be relieved to know that impairment-related job expenses (IRWE) can be deducted from your total earnings. This can be a helpful way to stay below the SGA threshold while still participating in the workforce. It’s common to feel uncertain about how to manage these responsibilities, but understanding these nuances is crucial for preserving your eligibility for disability benefits.

Remember, you’re not alone in this journey. We’re here to help you navigate these complexities and ensure you have the support you need.

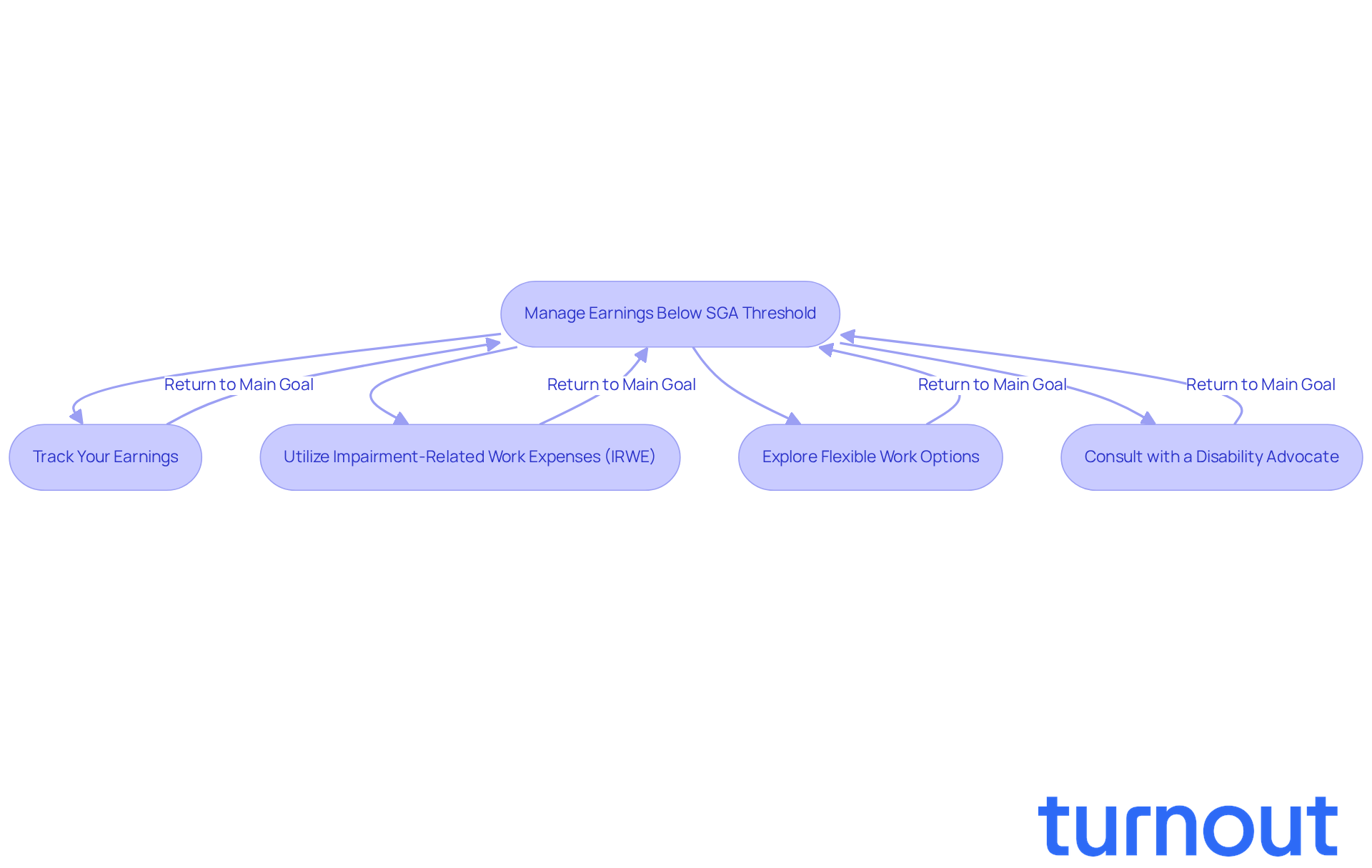

Implement Strategies for Managing SGA

Managing your earnings while staying below the SGA threshold can feel overwhelming, but you’re not alone in this journey. Here are some caring strategies to help you navigate this process:

-

Track Your Earnings: Keeping detailed records of your monthly income is essential. This way, you can ensure you don’t exceed the 2025 SGA limits, which are set at $1,620 for non-blind individuals.

-

Utilize Impairment-Related Work Expenses (IRWE): Don’t forget to deduct any necessary expenses related to your disability from your earnings. These costs can significantly lower your countable income, helping you stay compliant with SGA requirements.

-

Explore Flexible Work Options: Consider part-time or flexible job opportunities. These can allow you to work while keeping your earnings within the SGA limits, helping you gain valuable experience without jeopardizing your benefits.

-

Consult with a Disability Advocate: Engaging with professionals who specialize in disability assistance can be incredibly beneficial. They can provide personalized advice to help you manage the challenges of working while receiving support.

Remember, if you’re receiving SSDI, you have a nine-month trial employment period. During this time, you can earn at or above the SGA level without losing your assistance. By implementing these strategies, you can maintain your eligibility for disability benefits while still engaging in meaningful work. We’re here to help you every step of the way.

Conclusion

Navigating the complexities of disability benefits in 2025 can feel overwhelming. We understand that understanding Substantial Gainful Activity (SGA) and its implications for eligibility is crucial. By recognizing the SGA thresholds - $1,620 for non-blind individuals and $2,700 for those who are blind - you can manage your earnings while ensuring access to essential support. This knowledge is vital for anyone seeking to secure their disability benefits without unnecessary stress.

Key insights to consider include:

- The importance of tracking your earnings

- Understanding impairment-related work expenses

- Exploring flexible job options

These strategies empower you to stay within SGA limits, preserving your eligibility for benefits. Additionally, consulting with a disability advocate can provide tailored guidance, making the process of managing SGA feel less daunting.

Remember, you don’t have to face this journey alone. By implementing effective strategies and seeking support, you can navigate the challenges of SGA with confidence. Staying informed and proactive is crucial in ensuring that financial stability and necessary assistance go hand in hand. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is Substantial Gainful Activity (SGA)?

Substantial Gainful Activity (SGA) refers to the level of work activity and earnings that can affect eligibility for disability benefits as defined by the Social Security Administration (SSA).

What are the SGA thresholds for 2025?

For 2025, the SGA threshold is $1,620 per month for non-blind individuals and $2,700 per month for those who are blind.

How does exceeding the SGA threshold impact disability benefits?

Exceeding the SGA earnings limits can lead to the conclusion that an individual may be capable of engaging in SGA, which directly impacts their eligibility for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI).

Can you provide an example of how SGA affects eligibility?

For example, if a visually impaired person earns $2,800 per month, they may face challenges in keeping their benefits. Conversely, someone with a monthly income of $1,500 would still qualify for assistance.

Why is understanding SGA important for individuals seeking disability assistance?

Understanding the SGA definition and its implications is essential for managing the complexities of disability assistance and ensuring that individuals receive the support they need.