Overview

Navigating tax preparation can be particularly challenging for disabled individuals. We understand that managing financial documents while dealing with unique expenses can feel overwhelming. However, utilizing a tax organizer can be a game-changer. It not only helps keep your financial documents organized but also significantly reduces stress and errors during this crucial time.

By staying organized, you can maximize your deductions and credits, ensuring that you receive the benefits you deserve. Imagine the relief of having everything in one place, ready for your tax preparer. It’s common to feel anxious about missing out on potential savings, but a tax organizer can help alleviate those worries.

Here are some benefits of using a tax organizer:

- Reduced Stress: Keeping your documents organized can ease the burden during tax season.

- Minimized Errors: An organized approach helps prevent mistakes that could cost you.

- Maximized Deductions: You’ll be better equipped to identify all eligible expenses related to your disability.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges. Take the first step towards a smoother tax preparation experience by considering a tax organizer. You deserve peace of mind during this process.

Introduction

Navigating the complexities of tax preparation can feel particularly overwhelming for individuals with disabilities. We understand that the stakes often seem higher, and the process can be daunting. That’s where a tax organizer comes in as a vital tool. It offers a structured way to manage essential financial documents and streamline the filing process.

But how can you maximize the benefits of this tool? How can you ensure that no deduction or credit goes unclaimed? This article delves into best practices for utilizing tax organizers effectively. We’re here to empower you to take control of your financial obligations with confidence and clarity. You are not alone in this journey.

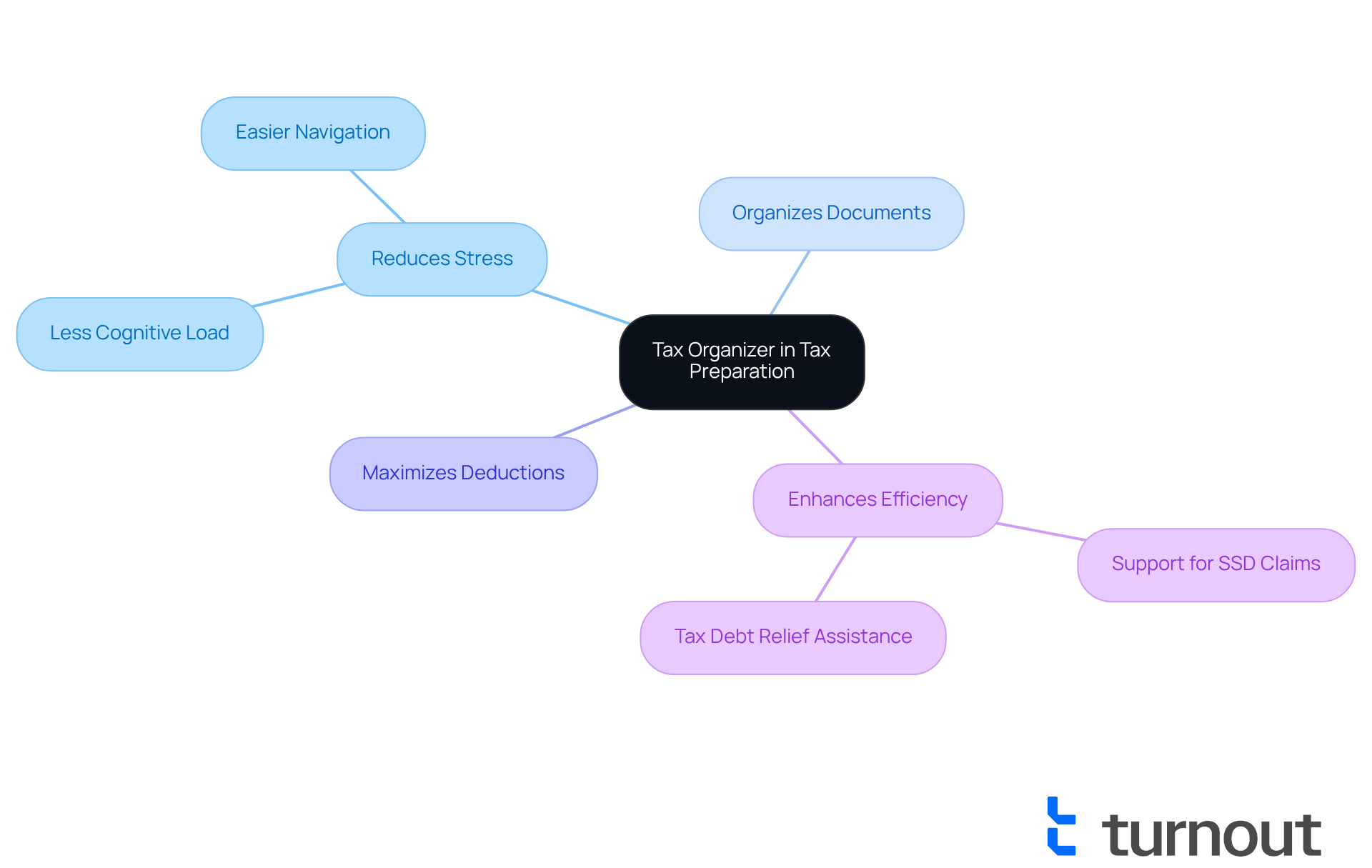

Understand the Role of a Tax Organizer in Tax Preparation

Navigating tax preparation can feel overwhelming, especially when you rely on a tax organizer to manage multiple documents and deadlines. A tax management tool is here to help. The tax organizer gathers and organizes all your essential financial documents in one place, making the process smoother and less stressful.

For individuals with disabilities, this tool can be a game-changer. It significantly reduces the cognitive load associated with managing various paperwork. Imagine having all your pertinent information readily available—this is crucial for maximizing the deductions and credits you deserve.

By using a tax organizer, you not only save time but also reduce the risk of errors that could lead to delays or audits. We understand that taking charge of your financial situation can feel daunting, but understanding how a tax organizer works can empower you. It transforms the tax process into something more manageable and achievable with the help of a tax organizer.

If you're navigating complex financial systems, like SSD claims or tax debt relief, organized documentation can greatly enhance your efficiency. Turnout's approach, which includes skilled non-legal advocates and IRS-licensed enrolled agents, ensures that you receive the necessary support without the complexities of legal representation.

Remember, you are not alone in this journey. We're here to help you streamline your economic management and make tax season a little less intimidating.

Leverage Key Features of Tax Organizers for Efficiency

We understand that managing taxes can be overwhelming, especially for disabled individuals. To ease this process, consider utilizing a tax organizer that provides key features designed to support you. Document categorization is one such feature that allows you to sort receipts, income statements, and other financial documents into specific categories. This makes it much easier to find the information you need when tax season arrives.

It's common to feel anxious about missing important deadlines. That's where deadline reminders come in handy. They help ensure that you don’t overlook crucial dates, which is vital for avoiding penalties. Additionally, many tax planners offer integration with popular tax software. This means you can transfer your data seamlessly, reducing the chances of errors and making the whole process smoother.

By taking advantage of these features, you can streamline your tax preparation process using a tax organizer. Imagine how much more efficient and less stressful it could be! Remember, you’re not alone in this journey. We’re here to help you navigate through it.

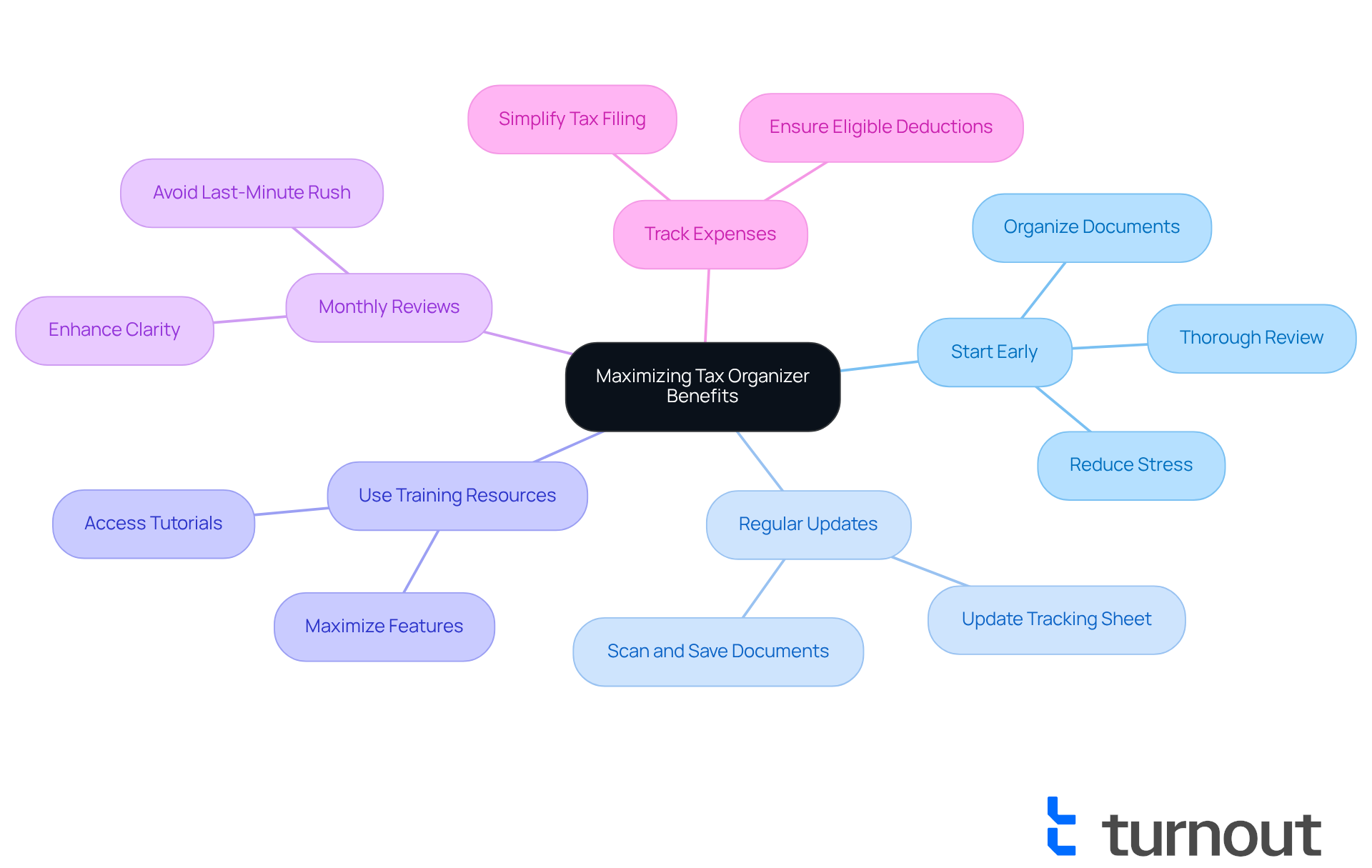

Implement Best Practices for Maximizing Tax Organizer Benefits

To truly benefit from a tax management tool, it’s important to adopt some thoughtful practices. We understand that tax season can be overwhelming, so starting early by organizing your documents can make a world of difference. This approach not only eases stress but also gives you a chance to thoroughly review your financial information. Remember to keep your tax collection updated with new documents as they arrive; this way, nothing slips through the cracks.

Have you considered taking advantage of any training or tutorials offered by your tax organizer? These resources can help you maximize its features and functionalities. Setting aside specific time each month to review and organize your financial documents can greatly enhance clarity and help you avoid that last-minute rush that often accompanies tax season.

Research shows that 90% of households choose the standard deduction, which underscores the importance of tracking your expenses throughout the year. By keeping organized records, you can simplify processes like applying for benefits or negotiating salaries, leading to better financial outcomes. For those who are disabled, proactive document organization can be especially helpful, making the complexities of tax filing feel more manageable and less daunting.

You’re not alone in this journey, and with a little planning and organization, you can navigate tax season with confidence.

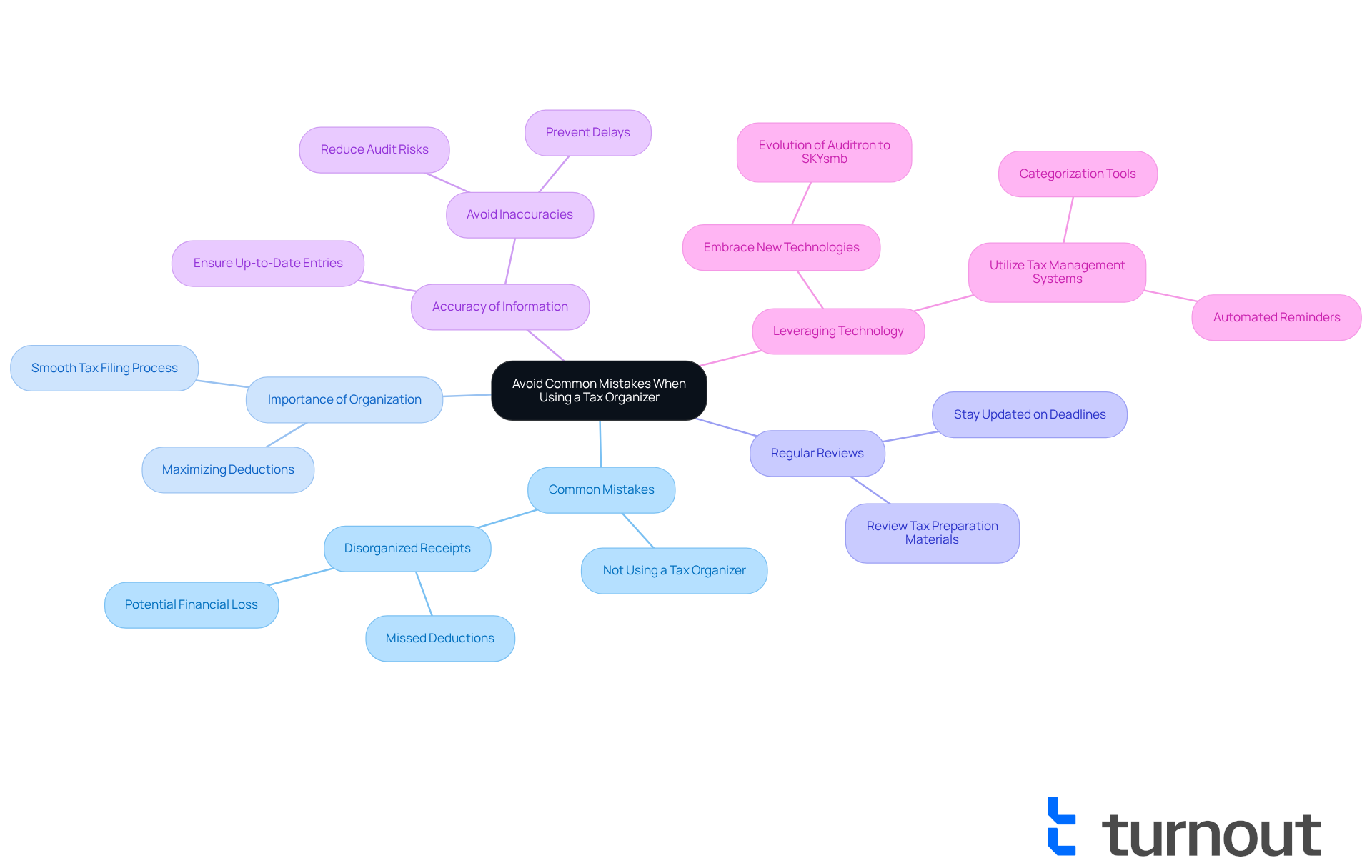

Avoid Common Mistakes When Using a Tax Organizer

Navigating tax season can feel overwhelming, and we understand that many people face common pitfalls. One significant mistake is not using a tax organizer to keep receipts and documentation organized throughout the year. This can lead to missed deductions, which can be frustrating. Scott Sloan, a CPA with 36 years of experience, points out that disorganized receipts can cost individuals hundreds to thousands of dollars in potential tax savings. This is especially true for disabled taxpayers who may have unique expenses related to their condition. He emphasizes, "A tax organizer is crucial for keeping your receipts organized, maximizing your deductions, and ensuring a smooth tax filing process."

It's also easy to overlook the importance of regularly reviewing your tax preparation materials. This oversight can cause you to miss important updates or deadlines, which might mean losing out on valuable deductions or credits. Many users don’t fully utilize the features in their tax management systems, like automated reminders or categorization tools, which can simplify the process and improve accuracy. The evolution of Auditron to SKYsmb shows how embracing technology can significantly enhance tax organization and outcomes.

Moreover, it is vital to ensure that all information entered into your tax organizer is accurate and up-to-date. Inaccuracies can complicate the tax filing process, leading to delays or even audits. By being mindful of these common mistakes and leveraging technology, you can greatly improve your tax preparation experience and achieve better financial outcomes. Remember, you’re not alone in this journey; we’re here to help you navigate it.

Conclusion

Using a tax organizer can truly make the often overwhelming process of tax preparation feel more manageable and efficient, especially for individuals with disabilities. By bringing together essential financial documents and simplifying the organization of paperwork, a tax organizer not only eases stress but also helps users maximize their eligible deductions and credits.

We understand that navigating tax season can be challenging. This article has shared several key strategies for effectively using a tax organizer. From recognizing its role in simplifying tax preparation to adopting helpful practices like early organization and regular document updates, these insights aim to enhance your overall experience. Additionally, being aware of common pitfalls—such as not keeping receipts organized or overlooking available features—can lead to significant financial benefits and a smoother filing process.

It's important to remember that a tax organizer is invaluable for disabled individuals. By taking proactive steps to organize your financial documents and utilizing the tools at your disposal, you can approach tax season with greater confidence and ease. Embracing these practices not only simplifies the tax preparation process but also ensures that you fully realize all potential benefits, paving the way for a more secure financial future.

You are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the role of a tax organizer in tax preparation?

A tax organizer gathers and organizes all essential financial documents in one place, making the tax preparation process smoother and less stressful.

How does a tax organizer benefit individuals with disabilities?

For individuals with disabilities, a tax organizer significantly reduces the cognitive load associated with managing various paperwork, making it easier to have all pertinent information readily available.

What advantages does using a tax organizer offer?

Using a tax organizer saves time and reduces the risk of errors that could lead to delays or audits during tax preparation.

How can a tax organizer help maximize deductions and credits?

By having all relevant information organized and accessible, a tax organizer helps ensure that you can maximize the deductions and credits you deserve.

Who can benefit from using a tax organizer when dealing with complex financial systems?

Individuals navigating complex financial systems, such as SSD claims or tax debt relief, can greatly enhance their efficiency with organized documentation.

What support does Turnout provide in relation to tax preparation?

Turnout offers support through skilled non-legal advocates and IRS-licensed enrolled agents, helping you manage your financial situation without the complexities of legal representation.

How does a tax organizer change the perception of tax preparation?

A tax organizer empowers individuals by transforming the tax process into something more manageable and achievable, making tax season less intimidating.