Overview

Navigating the complexities of SSDI back pay can feel overwhelming, and we understand that many individuals face significant challenges during this process. It’s crucial to grasp the eligibility requirements, gather the right documentation, and apply in a timely manner to secure the maximum benefits available.

By maintaining accurate medical records and consulting with knowledgeable advocates, you can take proactive steps that lead to substantial financial support. These strategies not only help you understand the process better but also empower you to manage your application effectively.

Imagine the relief of knowing you have the support you need. You’re not alone in this journey, and there are resources available to guide you.

Here are some practical steps to consider:

- Keep detailed medical records.

- Seek advice from experienced advocates.

- Apply as soon as you’re eligible.

We’re here to help you through this. Remember, taking these steps can make a significant difference in your financial stability. You deserve the support that SSDI can provide, and with the right approach, you can maximize your benefits.

Introduction

Understanding the complexities of Social Security Disability Insurance (SSDI) back pay is crucial for those facing disabilities. We know that these retroactive payments can provide essential support during tough times. However, many individuals may not realize the maximum benefits available or how to navigate the application process effectively.

As SSDI back pay amounts continue to rise, it’s common to feel overwhelmed. How can you ensure you receive the full benefits you deserve while managing the intricacies of eligibility and documentation? You're not alone in this journey, and we're here to help you through it.

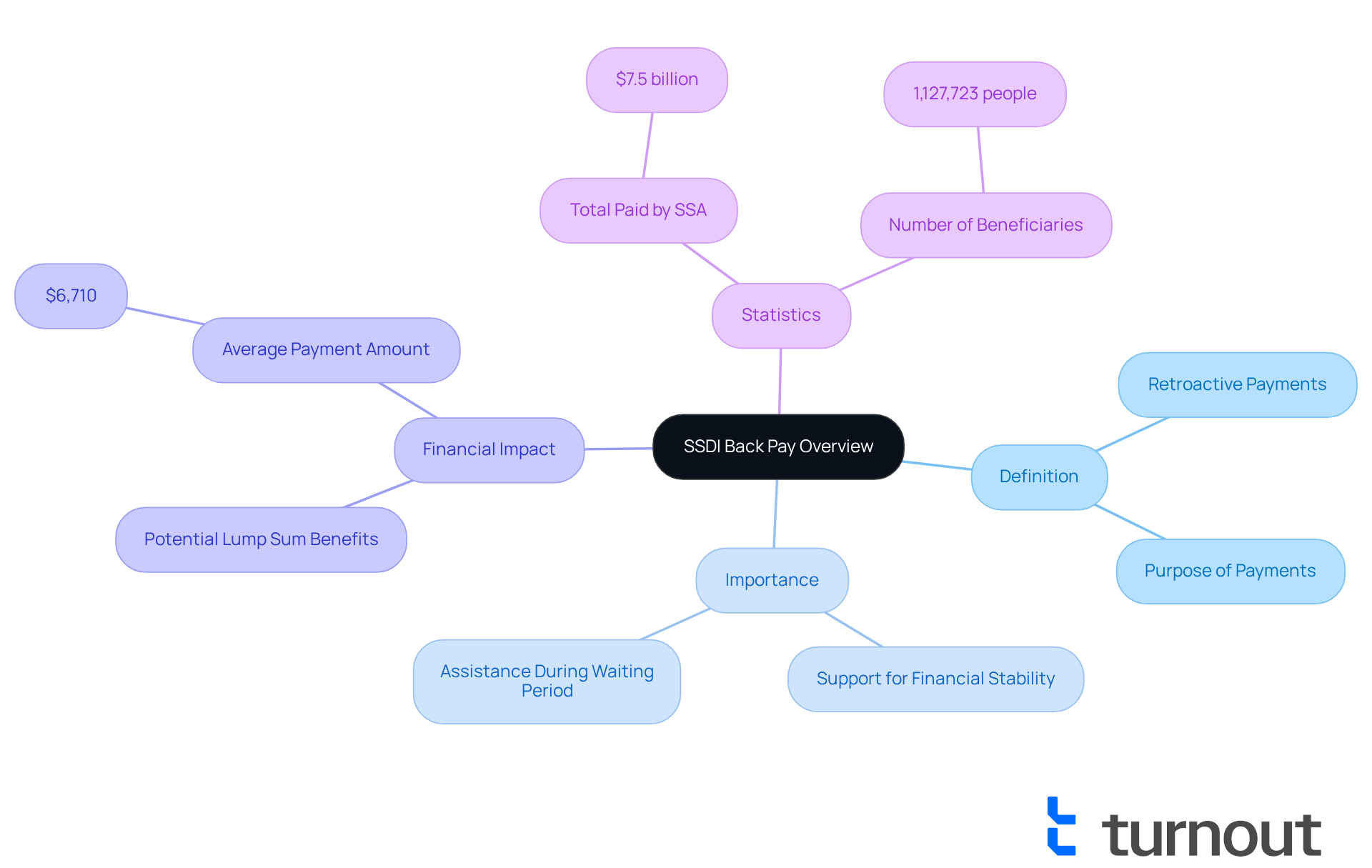

Define SSDI Back Pay: Importance and Overview

Retroactive payments can be a lifeline for individuals navigating the challenges of disability. These payments from the Social Security Administration (SSA) are designed to support those who qualified for benefits but hadn’t yet received authorization. They reimburse applicants for the time between their disability onset date and the acceptance of their Social Security Disability Insurance claim, reflecting the ssdi back pay maximum.

Understanding these retroactive payments is crucial. They can significantly impact the financial security of those unable to work due to disabilities. Typically, these payments can cover up to 12 months before the application date, which does not exceed the ssdi back pay maximum, excluding any waiting periods. Imagine having been disabled for a while before applying; you could receive a substantial lump sum to help with your expenses during that time.

Recent statistics show that the average retroactive payment is around $6,710. This amount can provide essential support for individuals facing financial hardships. We understand that managing medical costs and everyday expenses can be overwhelming. Real-life stories illustrate how these payments have helped families cope, highlighting the importance of disability compensation in achieving financial stability.

If you find yourself in this situation, remember: you are not alone in this journey. We're here to help you navigate these benefits and ensure you receive the support you deserve.

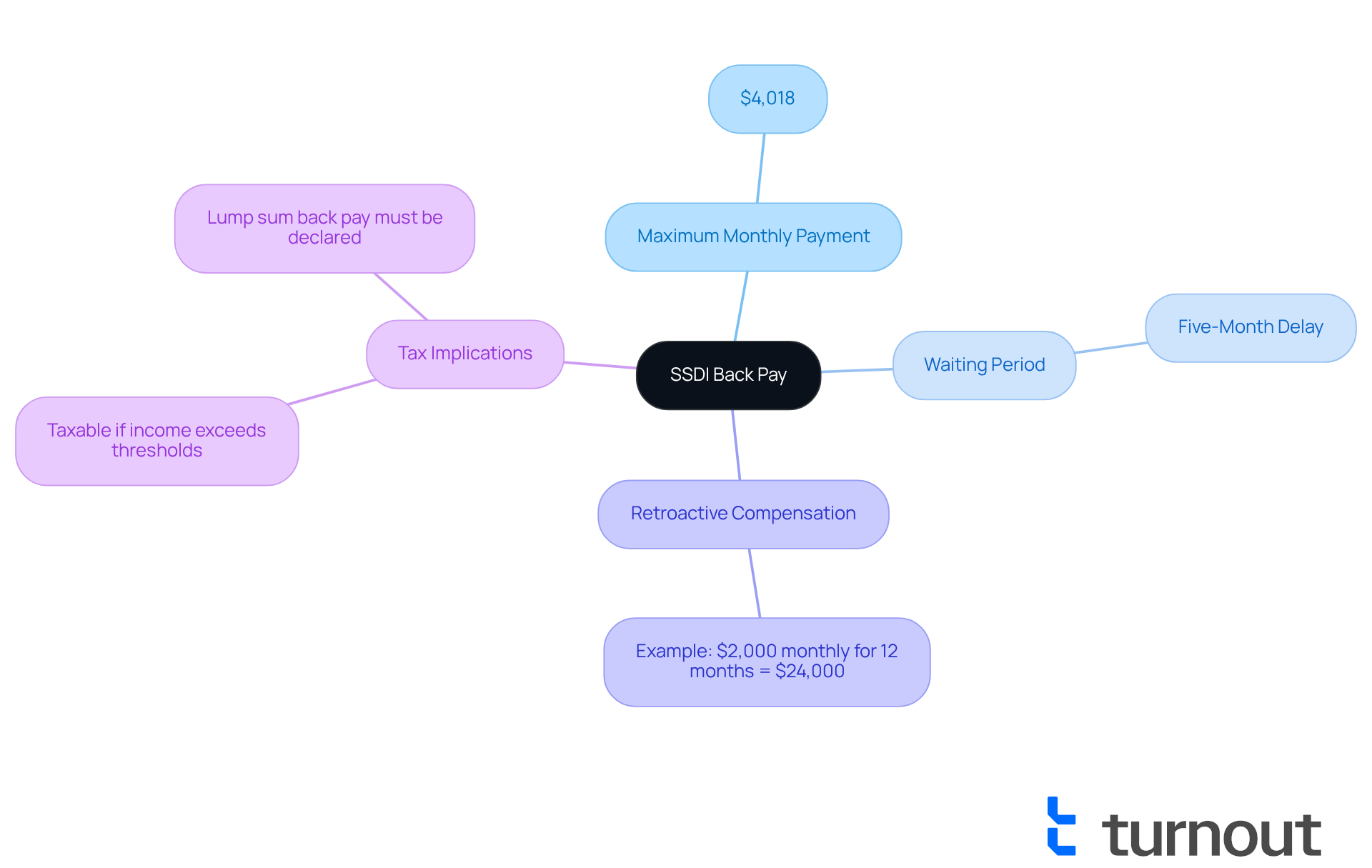

Determine Maximum SSDI Back Pay: Key Figures and Limits

In 2025, the SSDI back pay maximum has risen to $4,018 for the monthly payment, representing a significant increase from previous years. We understand that navigating the complexities of disability benefits can be overwhelming. When determining retroactive compensation, recipients may qualify for the SSDI back pay maximum of up to 12 months of payments, starting from the onset date of their disability. However, it's important to note that there is a five-month waiting period after the start of disability during which no payments are made. This can impact the total compensation you receive.

The actual payment amount, which can reach the SSDI back pay maximum, is influenced by your work history and contributions to the Social Security system. For instance, if your monthly payment is $2,000 and you qualify for the full 12 months of retroactive compensation, you could receive a lump sum of $24,000. It's common to feel uncertain about how these figures work, but understanding the income limits for disability support taxation is essential, as it may affect the taxable portion of your retroactive payment.

We’re here to help you navigate these calculations and the intricacies of the disability system. Turnout offers valuable support, utilizing trained non-professional advocates who can assist you in maximizing your benefits and effectively managing your claims. Remember, you are not alone in this journey.

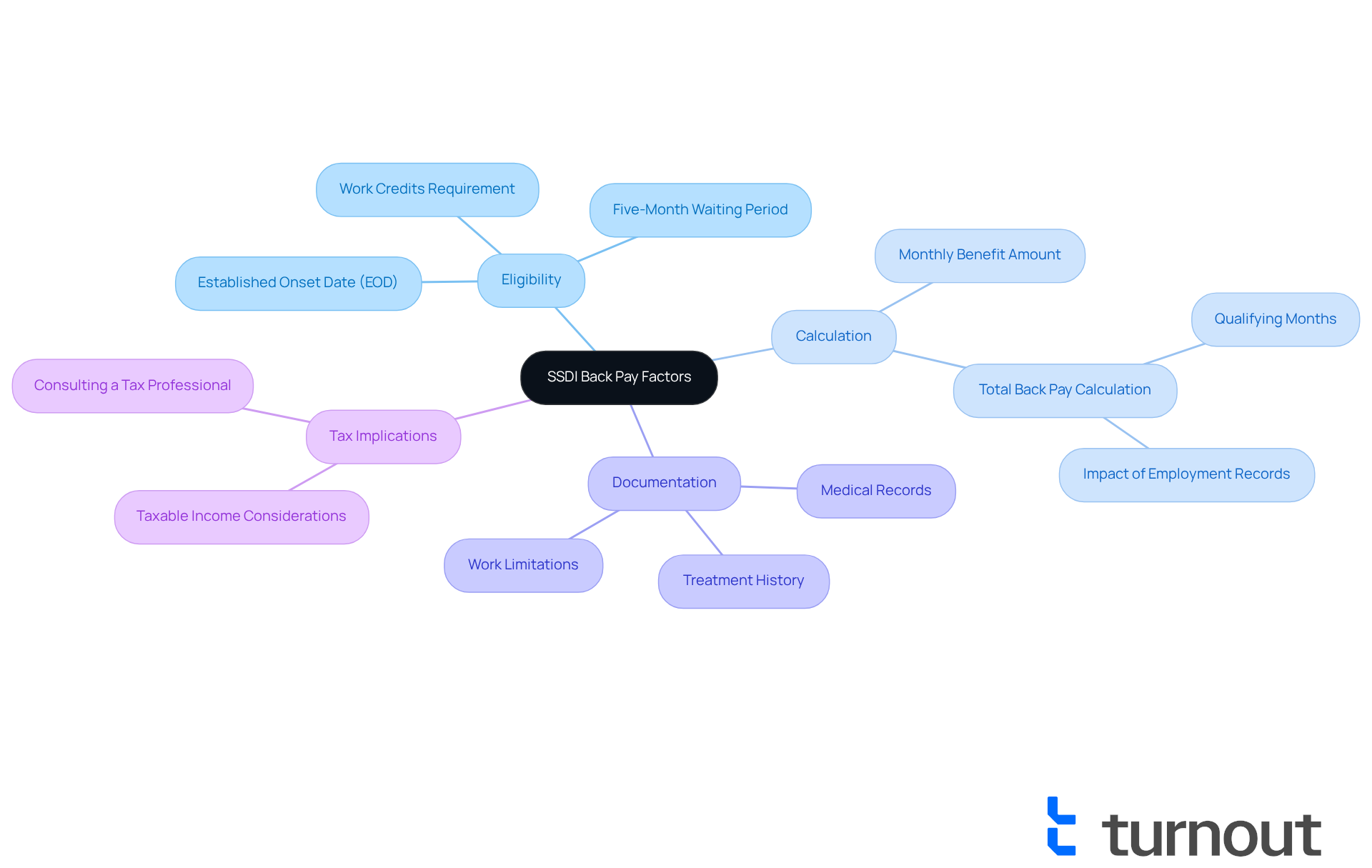

Identify Factors Affecting SSDI Back Pay: Eligibility and Calculation

Navigating the world of disability compensation can feel overwhelming, and we understand that many factors influence the amount you might receive. One crucial element is the established onset date (EOD), which marks when you became unable to work due to your condition. The Social Security Administration (SSA) relies on this date to determine your eligibility for the SSDI back pay maximum.

Did you know that the SSDI back pay maximum allows for retroactive payments up to 12 months before your application date, provided your EOD is at least 17 months earlier? This means that if your EOD is January 2, for example, your benefits wouldn’t start until July if approved in January of the following year. It’s important to remember that there’s also a five-month waiting period during which no assistance is provided.

Your employment record and contributions to Social Security will directly impact your monthly payment amount, which in turn affects your total compensation. For instance, if you qualify for a monthly benefit of $1,200, you could potentially receive around $9,600 in SSDI back pay maximum for eight qualifying months.

Keeping thorough documentation of your medical conditions, treatment history, and work limitations is essential to support your disability claim. We’re here to help you navigate this intricate process. Turnout offers access to skilled non-legal advocates who can guide you through understanding your eligibility and how retroactive payments are calculated. Remember, Turnout is not a law firm and does not provide legal advice.

It’s also worth noting that disability benefits retroactive payments may be considered taxable income. Seeking advice from a tax expert can provide you with the assistance you need. Understanding these components is crucial for optimizing your disability compensation arrears. You are not alone in this journey, and we’re here to support you every step of the way.

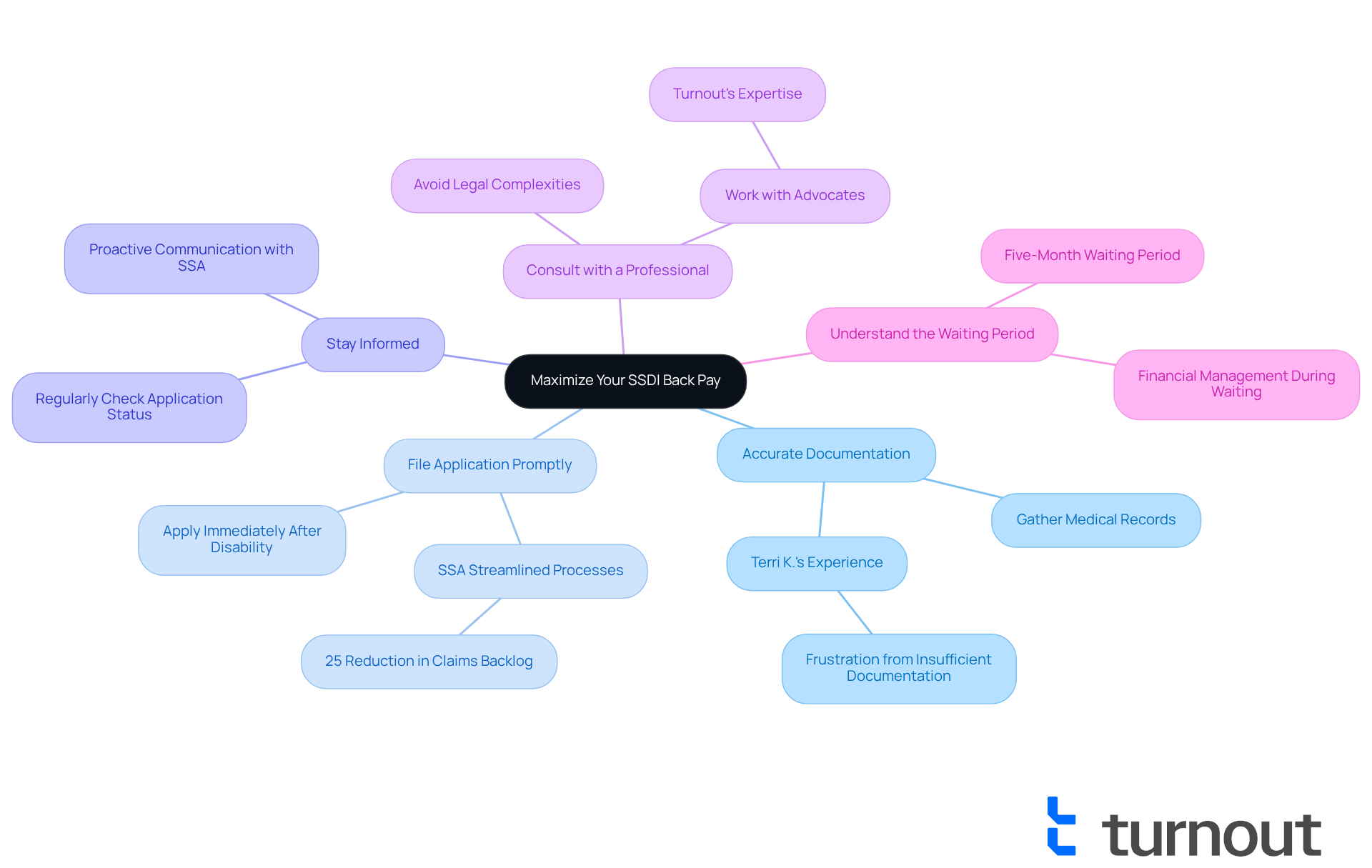

Maximize Your SSDI Back Pay: Strategies and Tips

To maximize your SSDI back pay, consider these supportive strategies:

-

Ensure Accurate Documentation: Gather all necessary medical records that clearly establish your disability onset date. This helps the SSA determine your owed payments accurately. For instance, Terri K.'s experience highlights the importance of careful record-keeping; her frustration stemmed from insufficient documentation.

-

File Your Application Promptly: Apply for SSDI as soon as you become disabled. The sooner you submit your application, the quicker you can start receiving assistance, and the greater compensation you might qualify for. In 2025, the SSA has streamlined processes to help expedite applications. Notably, the SSA reported a 25% reduction in the initial disability claims backlog as of July 2025, making timely applications even more crucial.

-

Stay Informed About Your Claim: Regularly check the status of your application and keep in touch with the SSA. This proactive approach can help you address any issues that may arise during the processing of your claim.

-

Consult with a Professional: Consider working with a knowledgeable advocate, like those at Turnout, who can guide you through the application process and help you understand your rights. Their expertise ensures your application is complete and accurate, preventing delays and maximizing your back pay. Turnout employs trained nonlawyer advocates specializing in SSD claims, providing the support you need without the complexities of legal representation. Remember, Turnout is not a law firm and does not offer legal advice.

-

Understand the Waiting Period: Be aware of the five-month waiting period before assistance begins. Knowing when your benefits will start can help you manage your finances during this time. For example, if you were incapacitated for 17 months before applying, you might receive compensation for the entire duration your application was under review, excluding the waiting period. Also, keep in mind that disability payments may be subject to tax based on your income level, so strategizing is important.

By following these strategies and considering help from advocates like those at Turnout, you can enhance your chances of receiving the SSDI back pay maximum that is available to you. Real-world examples show that individuals who meticulously document their cases and seek assistance often achieve better outcomes, ensuring they receive the benefits they deserve. Remember, you're not alone in this journey; we're here to help.

Conclusion

Understanding SSDI back pay is crucial for those facing the challenges of disability. These retroactive payments from the Social Security Administration not only provide financial support for those who qualify but also serve as a vital lifeline during tough times. By grasping the intricacies of SSDI back pay—like the maximum benefits available and the factors influencing these payments—you can better navigate your financial future.

We understand that applying for benefits can feel overwhelming. Key insights shared throughout this article highlight the importance of:

- Timely application

- Accurate documentation

- Understanding the waiting period

The maximum SSDI back pay for 2025 has been discussed, along with strategies to maximize your potential benefits. Real-life examples underscore the significance of meticulous record-keeping and the positive impact knowledgeable advocates can have on the claims process.

It's common to feel daunted by the journey to securing SSDI back pay, but staying informed and proactive is essential. Seeking assistance from professionals and understanding eligibility requirements can significantly enhance your chances of receiving the maximum benefits available. Remember, empowerment through knowledge is key; take charge of your claims to ensure you receive the support you rightfully deserve. We're here to help you every step of the way.

Frequently Asked Questions

What is SSDI back pay?

SSDI back pay refers to retroactive payments from the Social Security Administration (SSA) for individuals who qualified for Social Security Disability Insurance benefits but had not yet received authorization. These payments reimburse applicants for the time between their disability onset date and the acceptance of their claim.

Why is SSDI back pay important?

SSDI back pay is important because it provides financial support to individuals who are unable to work due to disabilities. It can significantly impact their financial security by covering expenses incurred during the period before their benefits were approved.

How far back can SSDI back pay cover?

SSDI back pay can typically cover up to 12 months prior to the application date, not exceeding the SSDI back pay maximum, and does not include any waiting periods.

What is the average amount of SSDI back pay?

The average retroactive payment for SSDI back pay is around $6,710, which can provide essential support for individuals facing financial hardships.

How can SSDI back pay assist individuals financially?

SSDI back pay can assist individuals by providing a substantial lump sum to help cover medical costs and everyday expenses during the time they were disabled but had not yet received benefits.

What support is available for individuals navigating SSDI back pay?

Individuals navigating SSDI back pay can find support and guidance to ensure they receive the benefits they deserve, helping them through the challenges of managing their disability and finances.