Introduction

Navigating the tax landscape can feel overwhelming for small business owners. With so many obligations and potential benefits, it’s easy to get lost in the details. We understand that this complexity can lead to confusion and frustration. But here’s the good news: understanding tax services isn’t just a necessity; it’s an opportunity.

By grasping the intricacies of tax services, small enterprises can maximize their savings and ensure compliance. However, many business owners are unaware of the deductions available to them. Have you ever wondered how you can effectively leverage tax services to minimize your liabilities and optimize your financial health?

You’re not alone in this journey. Many small businesses face similar challenges, but there are solutions out there. We’re here to help you navigate this landscape with confidence.

Understand Your Tax Obligations and Benefits

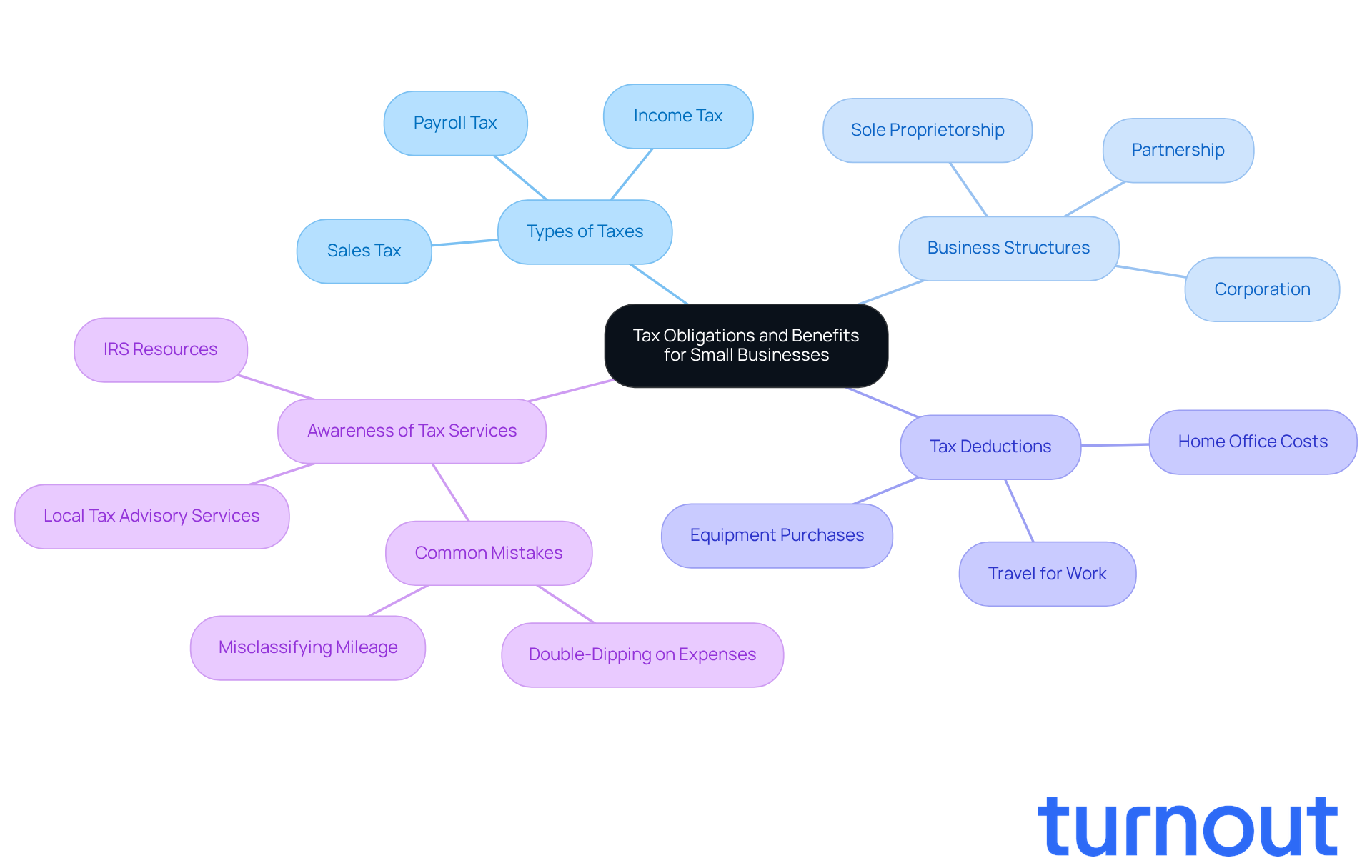

Navigating tax services for small businesses can feel overwhelming for small enterprises. You’re not alone in this journey. From income tax to payroll tax and sales tax, understanding these responsibilities is the first step toward effective tax management.

For instance, depending on your business structure - whether it’s a sole proprietorship, partnership, or corporation - you’ll need to submit federal income tax returns that come with different requirements. It’s common to feel confused about what applies to you.

But there’s good news! Small enterprises can benefit from various tax deductions. These include home office costs, travel for work, and equipment purchases. Did you know that the IRS standard mileage rate for business use will rise to 72.5 cents per mile in 2026? This change offers significant potential savings for businesses that rely on travel.

However, to truly optimize these tax benefits, proper tracking of mileage is essential. Many small businesses face issues like misclassifying commuting mileage or double-dipping on vehicle expenses. Familiarizing yourself with these obligations and benefits can lead to substantial savings and ensure compliance with tax services for small businesses.

A recent survey revealed that only 40% of small enterprises are aware of the tax deductions available to them in 2026. This highlights the importance of seeking help, particularly from tax services for small businesses. Utilizing resources like the IRS website and local tax advisory services can provide essential guidance. Remember, we’re here to help you navigate your tax landscape effectively.

Integrate Bookkeeping with Tax Preparation Services

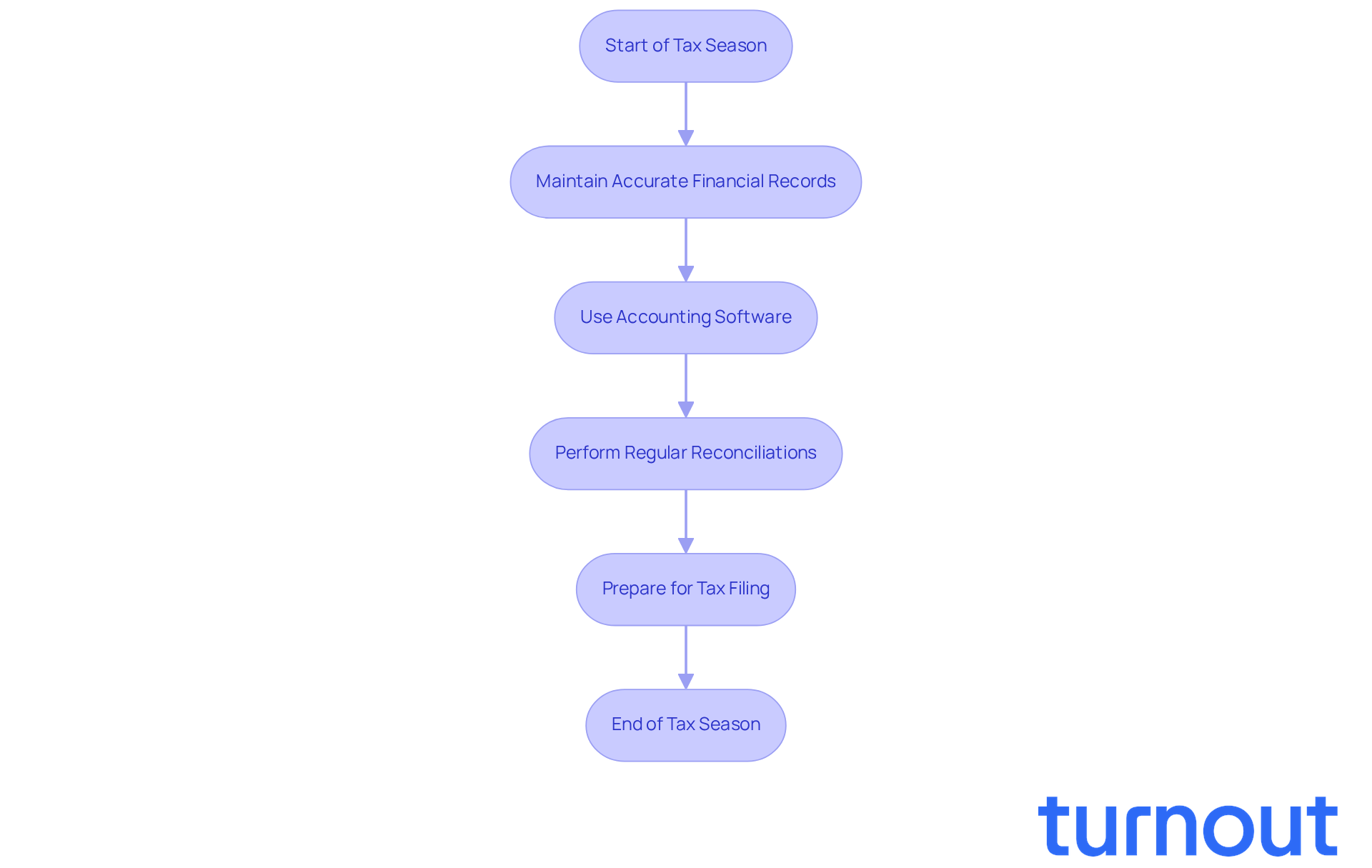

We understand that navigating tax season can be overwhelming for small business owners, making tax services for small businesses essential. Integrating bookkeeping with tax services for small businesses can truly simplify this process. By keeping precise and up-to-date financial records throughout the year, you can ensure that all necessary documentation is ready when tax time arrives. This includes tracking income, managing expenses, and identifying potential deductions.

Imagine using accounting software that combines bookkeeping and tax preparation functionalities, like QuickBooks or Xero. These tools can automate many routine tasks, significantly reducing errors and saving you valuable time. Regular account reconciliations and financial statement reviews are essential practices that help catch discrepancies early, leading to a smoother and more efficient tax preparation experience.

Did you know that companies with organized records are three times more likely to experience growth? Block Advisors highlights this, stating that "companies with updated records are 3x more likely to experience growth." This statistic is a testament to the importance of maintaining good financial practices. In fact, over two million owners turn to Block Advisors for tax services for small businesses each year, emphasizing how crucial professional bookkeeping can be.

Moreover, utilizing these services can lead to substantial cost savings. Block Advisors offers bookkeeping services for up to 50% less than the cost of a typical accountant. Remember, you are not alone in this journey; we're here to help you thrive.

Implement Tax Reduction Strategies and Deductions

Running a small business can be challenging, especially when managing taxes and utilizing tax services for small businesses. We understand that navigating tax liabilities can feel overwhelming. But don’t worry; there are effective strategies you can implement to minimize your tax burden and keep more of your hard-earned money.

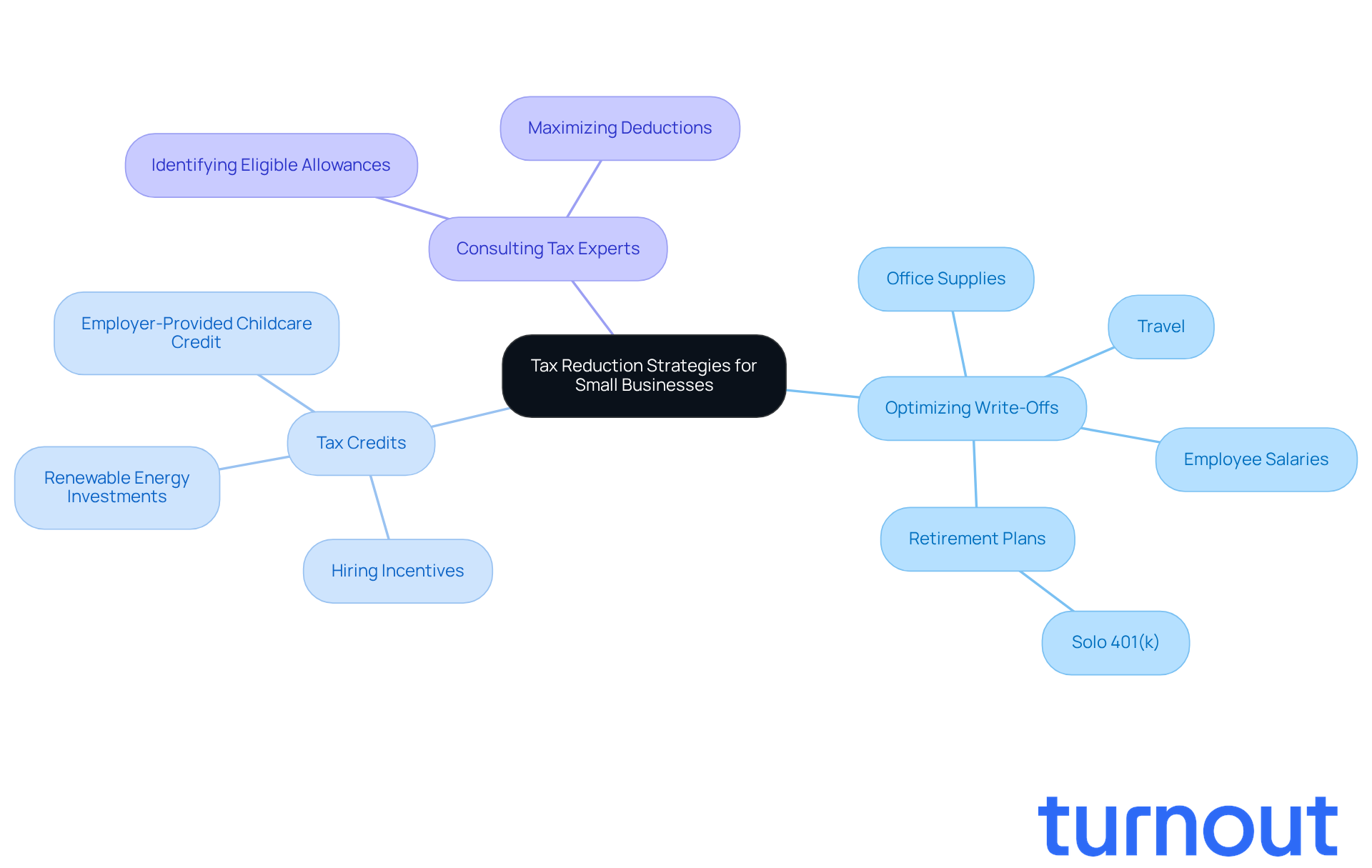

One of the best ways to start is by optimizing your write-offs. Keeping thorough records of all your business-related costs is essential. Proper documentation not only helps you adhere to regulations but also enhances your tax advantages. Common deductions include expenses for office supplies, travel, and employee salaries. Additionally, consider contributing to retirement plans like a Solo 401(k). In 2024, you can contribute and deduct up to $69,000, which can significantly lower your taxable income while planning for your future.

Have you thought about tax credits? They can make a big difference in reducing your tax bills. For instance, hiring employees from certain demographics or investing in renewable energy can qualify you for credits. Plus, starting in 2026, the OBBBA raises the employer-provided childcare credit from 25% to 40% of eligible expenses. This change encourages small businesses to invest in their employees' welfare, which is a win-win.

It’s crucial to consult with a tax expert who offers tax services for small businesses to help you identify all eligible allowances and credits. This way, you can optimize your savings and avoid missing out on potential opportunities. Many small business owners overlook deductions due to confusion about eligibility regulations, especially regarding the home office deduction. Remember, as tax regulations evolve, staying informed and proactive can greatly impact your business's financial health.

You are not alone in this journey. We’re here to help you navigate these complexities and ensure you’re making the most of your tax situation.

Stay Informed About Filing Deadlines and Compliance

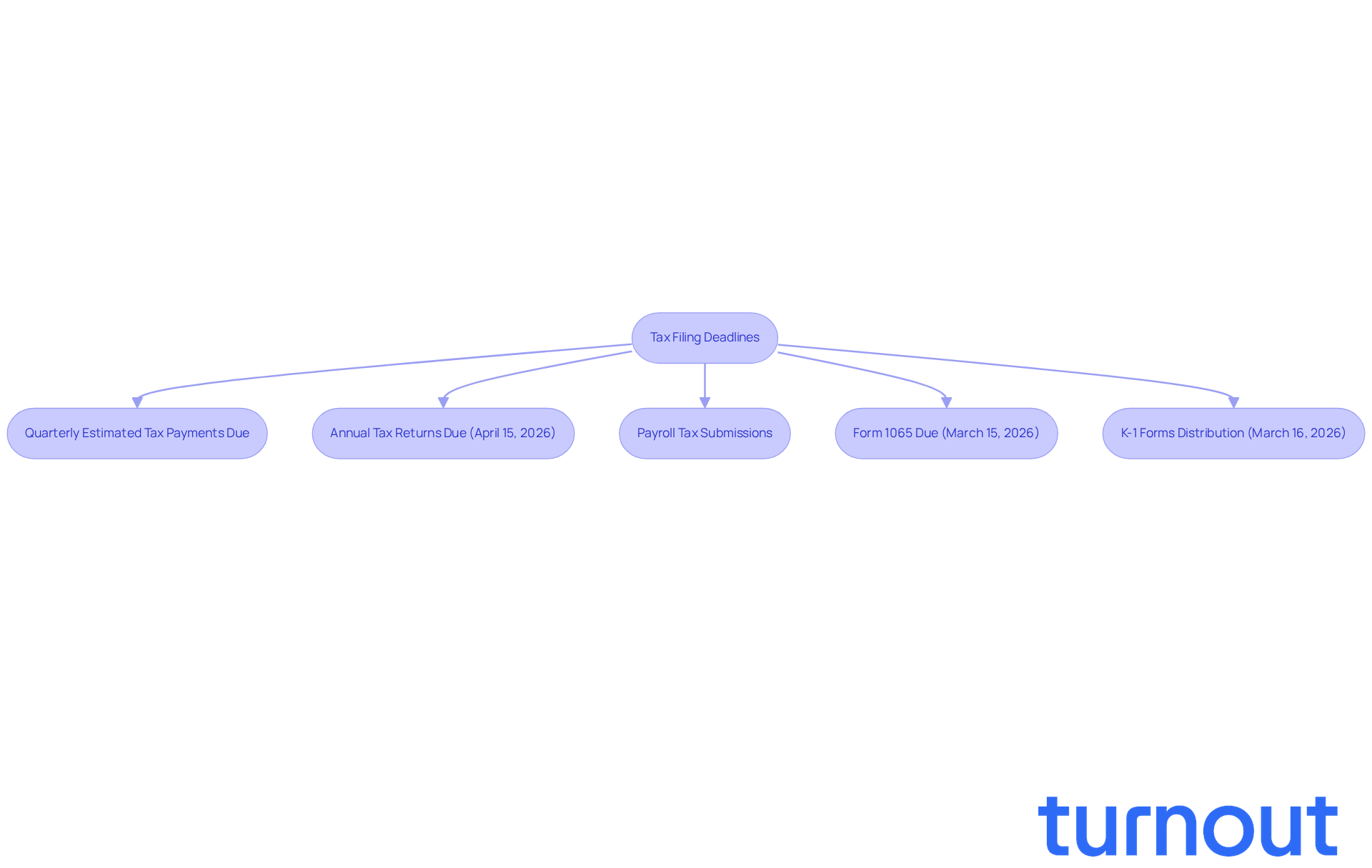

To avoid penalties and ensure compliance, small enterprises must stay alert about critical tax filing deadlines. We understand that keeping track of these dates can be overwhelming, but knowing them is essential. Key dates include:

- The due dates for quarterly estimated tax payments

- Annual tax returns

- Payroll tax submissions

For example, the deadline for filing individual income tax returns is April 15, 2026. Remember, while an extension gives you more time to file, it doesn’t extend the payment deadline. Businesses must also submit Form 1065 by March 15, 2026. Using a tax calendar can help you track these deadlines and plan accordingly.

Regularly reviewing compliance with tax regulations is crucial, especially when it comes to properly classifying employees and accurately reporting income. We know that failure to comply can lead to significant penalties, such as $220 per partner or shareholder for late filings, incurred monthly. Engaging with a qualified tax professional can provide you with the reassurance that all requirements are met and deadlines adhered to when utilizing tax services for small businesses. As IRS Chief Executive Officer Frank Bisignano noted, the IRS is committed to assisting taxpayers during the filing season. It’s important for businesses to leverage available resources for a smoother tax experience. Additionally, partnerships and LLCs must ensure that K-1 forms are distributed by March 16, 2026, to comply with reporting requirements.

Conclusion

Maximizing savings through essential tax services is vital for small businesses striving to thrive in today’s competitive landscape. We understand that navigating tax obligations can be overwhelming. By integrating bookkeeping with tax preparation, implementing effective tax reduction strategies, and staying informed about filing deadlines, you can build a robust tax management strategy. These practices not only help you manage the complexities of tax regulations but also open the door to significant savings and growth potential.

Many small business owners are unaware of the deductions and credits available to them, leading to missed opportunities for savings. By leveraging tax services and consulting with tax professionals, you can ensure compliance while optimizing your financial outcomes. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Engaging with the right tax services and maintaining organized financial records empowers you to make informed decisions. This can significantly reduce your tax burdens, allowing you to focus on what truly matters: growing your business. Embrace these strategies today, and take the necessary steps to secure a financially sound future for your small enterprise. You deserve to thrive!

Frequently Asked Questions

What are the main tax obligations for small businesses?

Small businesses must understand their responsibilities regarding income tax, payroll tax, and sales tax. These obligations vary depending on the business structure, such as sole proprietorship, partnership, or corporation, which dictate the federal income tax return requirements.

What tax deductions can small businesses take advantage of?

Small businesses can benefit from various tax deductions, including home office costs, travel expenses for work, and equipment purchases.

What is the IRS standard mileage rate for business use in 2026?

The IRS standard mileage rate for business use will rise to 72.5 cents per mile in 2026, providing significant potential savings for businesses that rely on travel.

Why is proper tracking of mileage important for small businesses?

Proper tracking of mileage is essential to optimize tax benefits and avoid issues such as misclassifying commuting mileage or double-dipping on vehicle expenses.

How aware are small businesses of available tax deductions?

A recent survey revealed that only 40% of small enterprises are aware of the tax deductions available to them in 2026, highlighting the need for better awareness and understanding of tax benefits.

Where can small businesses seek help with their tax obligations?

Small businesses can utilize resources such as the IRS website and local tax advisory services to gain essential guidance on navigating their tax landscape effectively.