Overview

Navigating the complexities of Social Security Disability Insurance (SSDI) can be overwhelming. Many individuals face significant challenges, including high denial rates and lengthy wait times. We understand that the process can feel daunting, but knowing the eligibility requirements and being well-prepared with the necessary documentation is essential for success.

It's common to feel frustrated and uncertain about what steps to take. By familiarizing yourself with the application process, you can empower yourself to tackle these challenges head-on. Remember, you are not alone in this journey; countless others have walked this path and found their way through.

As you prepare your application, take a moment to gather all required documents. This preparation can make a significant difference in your experience. If you encounter obstacles, don’t hesitate to seek assistance. We're here to help you every step of the way.

Ultimately, understanding the SSDI system is crucial for your success. With the right information and support, you can navigate this process with confidence. Take action today, and remember that help is available for those who need it most.

Introduction

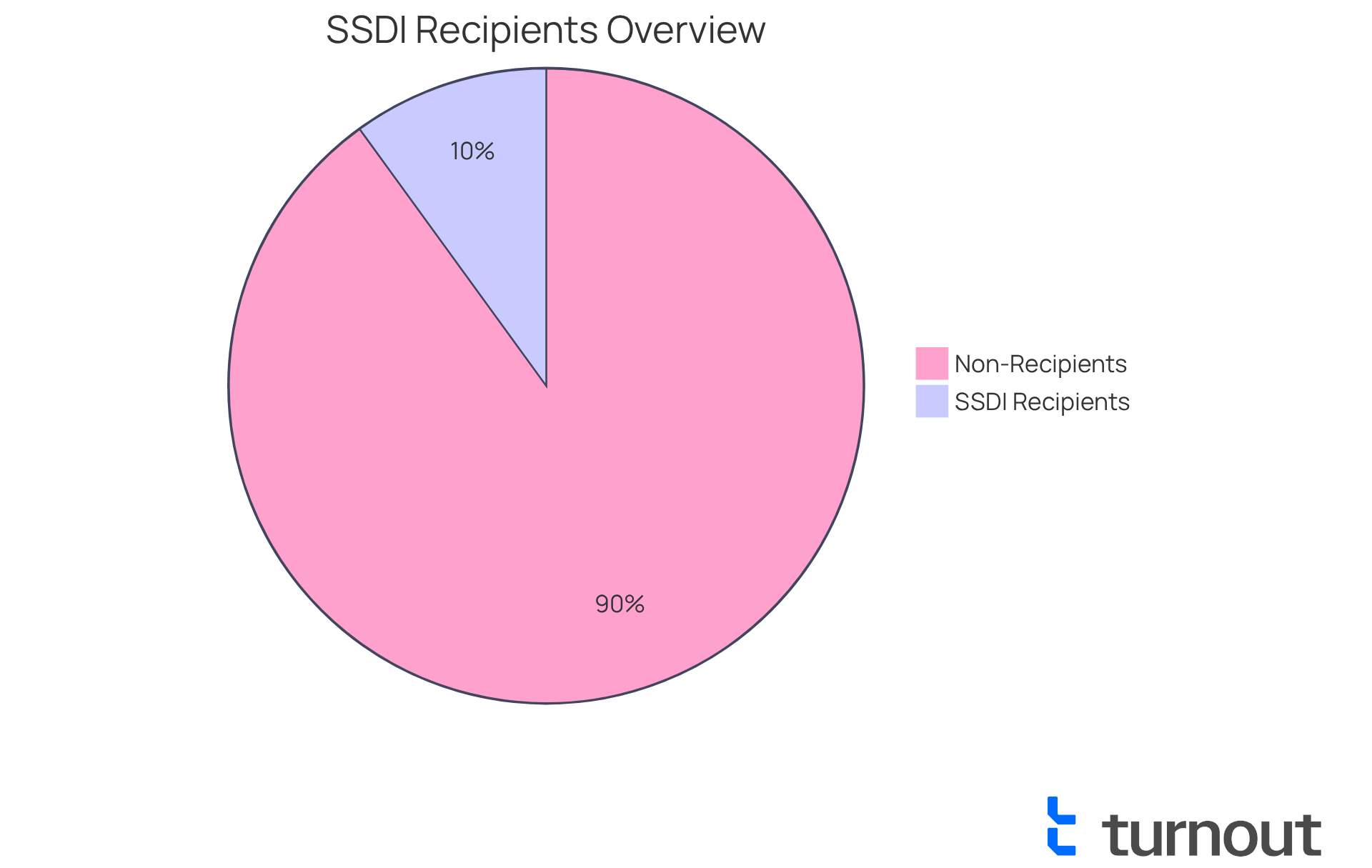

Social Security Disability Insurance (SSDI) serves as a vital safety net for millions of Americans facing disabilities that make work challenging. We understand that navigating this system can feel overwhelming. Projections suggest that nearly 10 million individuals will depend on these benefits by 2025, highlighting the importance of grasping the details of SSDI—from eligibility requirements to the application process.

However, the path to obtaining these benefits is often filled with obstacles, such as high denial rates and complex documentation demands. It's common to feel frustrated and unsure about what steps to take next. What can you do to successfully navigate this complicated landscape and improve your chances of approval?

We're here to help you understand the process and support you every step of the way.

Define Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is more than just a federal program; it's a lifeline for individuals facing the challenges of qualifying disabilities. Funded by payroll taxes, this program is designed to assist those who have contributed to the Social Security system and now find themselves unable to work due to their disabilities. We understand that navigating this process can be overwhelming, but qualifying for these benefits means demonstrating that your disability significantly impairs your ability to engage in any substantial gainful activity.

In 2025, it is expected that around 10 million Americans will receive disability benefits, highlighting the program's essential role in providing financial security during difficult times. These benefits are crucial for managing essential living costs, such as housing, food, and healthcare. For example, the average monthly benefit for disabled workers is projected to increase from $1,483 to $1,520, thanks to a 2.5% cost-of-living adjustment (COLA). This adjustment is vital for keeping pace with inflation-driven price increases.

Financial experts emphasize that Social Security insurance serves as a crucial safety net for disabled individuals, ensuring that they can maintain a basic standard of living despite the challenges they face. The impact of this program on financial stability cannot be overstated; it plays a significant role in preventing poverty and supporting the well-being of millions of Americans with disabilities. Remember, you are not alone in this journey. We’re here to help you find the support you need to navigate these trying times.

Outline Eligibility Requirements for SSDI Benefits

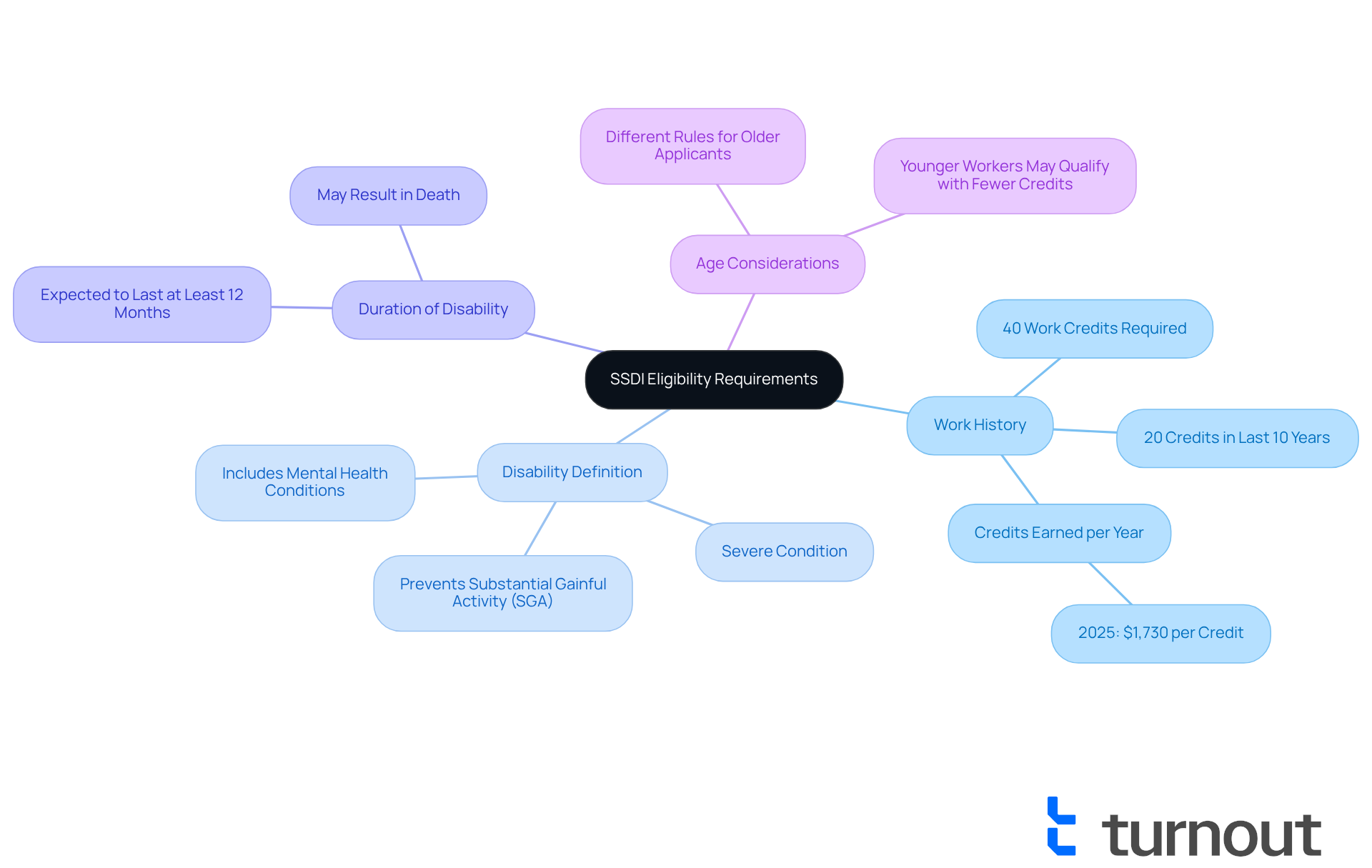

To qualify for SSDI benefits, it's important to understand the key eligibility requirements that can often feel overwhelming. We know that navigating this process can be challenging, but being informed is the first step toward securing the support you need.

-

Work History: A sufficient work history is essential. Typically, candidates must have paid Social Security taxes for at least five out of the last ten years. In 2025, most applicants will need a total of 40 work credits, with at least 20 acquired in the last decade before their disability began.

-

Disability Definition: You must have a medical condition that aligns with the Social Security Administration's (SSA) definition of disability. This means your condition should be severe enough to prevent you from engaging in any substantial gainful activity (SGA).

-

Duration of Disability: It's crucial that your disability is expected to last at least 12 months or result in death. This ensures that only those with long-term impairments qualify for benefits.

-

Age Considerations: Different rules may apply based on your age, especially if you're nearing retirement. This can influence the number of required work credits.

Understanding these criteria is essential for evaluating your suitability and preparing for the submission process. It's common to feel disheartened, especially since about two-thirds of early disability claims are rejected. This highlights the importance of fulfilling these requirements and providing comprehensive documentation.

Remember, even if your condition isn’t explicitly listed, you might still qualify based on your functional limitations and medical evidence. You're not alone in this journey; we're here to help you explore your options and ensure you have the best chance at receiving the support you deserve.

Explain the SSDI Application Process and Required Documentation

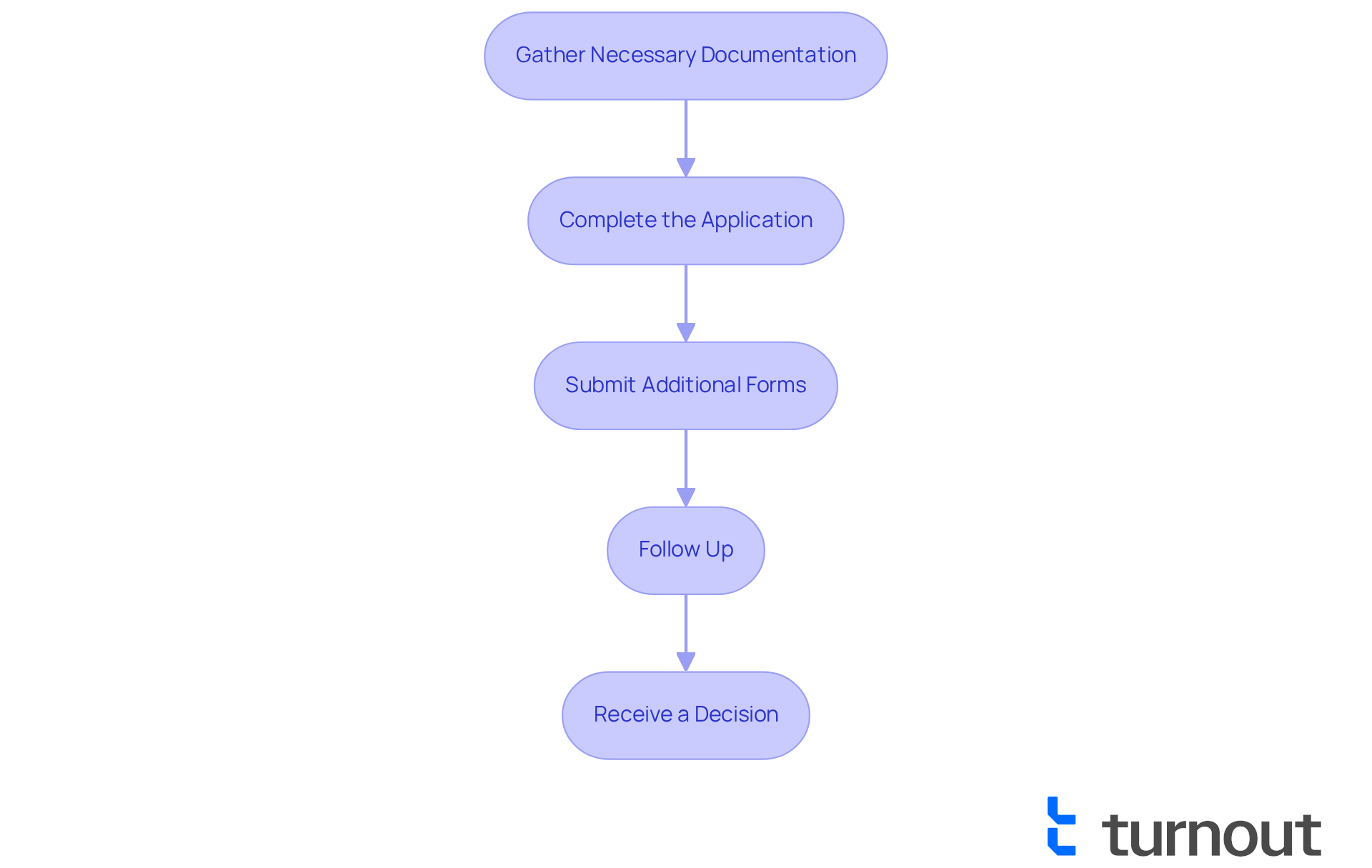

Navigating the SSDI application process can feel overwhelming, but we are here to help you through each step. Here’s a gentle guide to assist you:

-

Gather Necessary Documentation: Before you begin, take a moment to collect essential documents. This includes medical records that detail your condition and treatment history, work history information such as W-2 forms and tax returns, and personal identification documents like your birth certificate and Social Security card. We understand that gathering these can be challenging, but having everything ready can ease the process.

-

Complete the Application: You can submit your application online, by phone, or in person at your local Social Security office. The application requires detailed information about your medical condition, work history, and daily activities. It's common to feel anxious about the initial review process, which can take 3-5 months, depending on your case's complexity and the availability of medical records.

-

Submit Additional Forms: After your initial submission, you may need to fill out extra forms, like the Function Report. This report outlines how your disability affects your daily life. Remember, precision and completeness are crucial for a successful submission. Take your time with these reports; they are vital to your case.

-

Follow Up: Once you've submitted your application, it's important to check on your status regularly. The SSA may request further information or clarification, so staying proactive is key. With a backlog of around 575,000 submissions, prompt follow-up can help ensure your case is handled effectively.

-

Receive a Decision: The SSA will review your application and notify you of their decision. If approved, you will begin receiving benefits; if denied, remember that you have the right to appeal. Understanding the appeals procedure is essential, especially if your claim is rejected, as it involves a structured system that can seem intricate.

Many applicants face challenges in gathering the required documentation, which can lead to delays. For instance, some individuals struggle to obtain comprehensive medical records from healthcare providers, which are essential for substantiating their claims. Additionally, frequent errors during submission, such as incomplete forms or missing details about daily tasks, can obstruct approval opportunities. Therefore, preparation is vital for a seamless submission process. Remember, you are not alone in this journey, and with the right support, you can navigate the SSDI application process successfully.

Identify Common Challenges in the SSDI Application Process

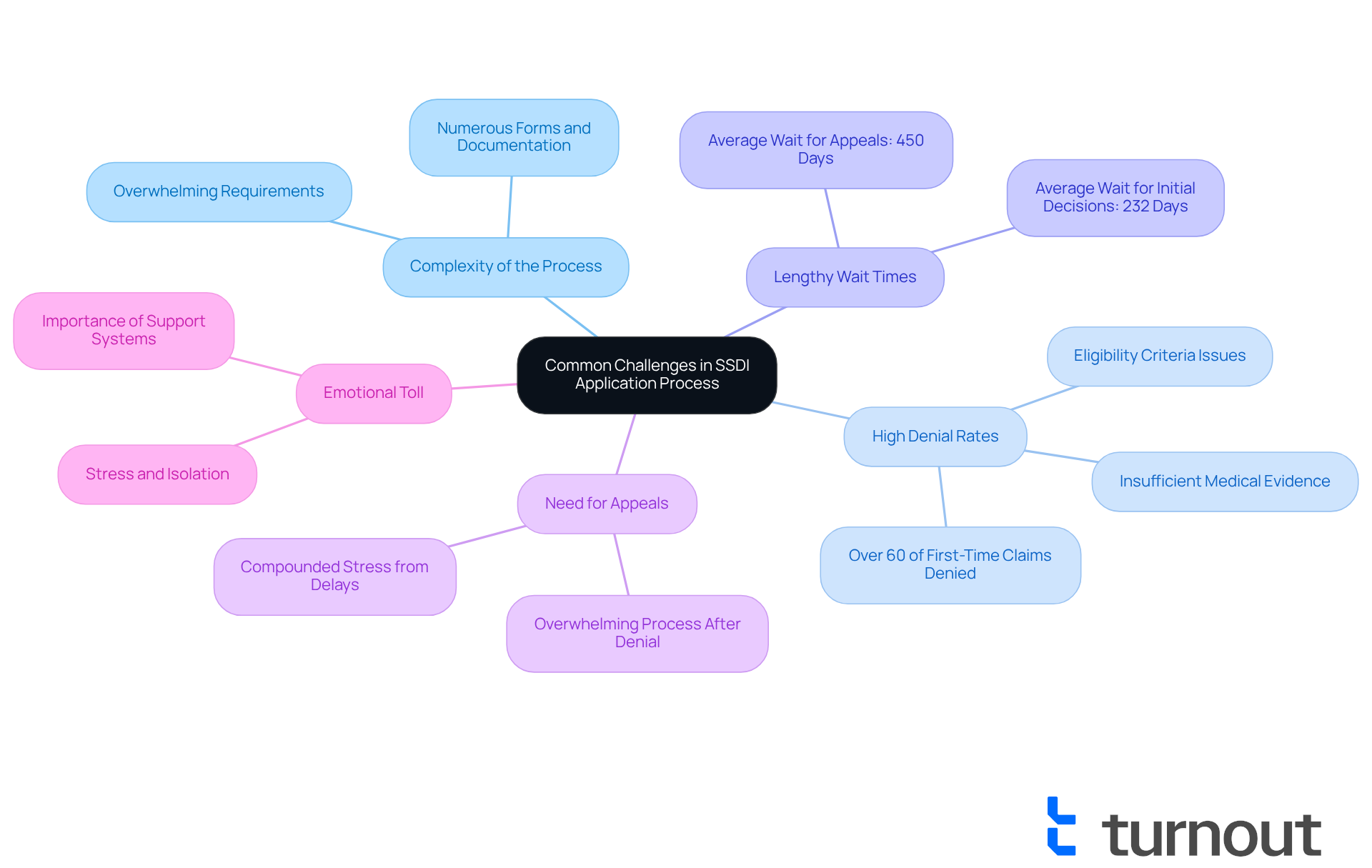

Navigating the SSDI application process can be daunting, and many applicants face common challenges along the way.

-

Complexity of the Process: We understand that the SSDI request can be intricate. With numerous forms and documentation requirements, it’s easy to feel overwhelmed.

-

High Denial Rates: It’s disheartening to know that many initial applications are denied. Statistics show that over 60% of first-time claims are rejected, often due to insufficient medical evidence or not meeting eligibility criteria. Understanding these elements can empower you to strengthen your case.

-

Lengthy Wait Times: The wait for an evaluation can feel endless, often extending up to 232 days for initial decisions. This delay can create significant financial strain as you await your benefits.

-

Need for Appeals: If your application is denied, you may find yourself navigating the appeals process. This can be overwhelming, especially without proper support. The average wait for a hearing can add an additional 450 days to your journey, compounding the stress.

-

Emotional Toll: Managing a disability while dealing with the application process can take an emotional toll. It's common to feel stressed and isolated. Remember, support systems, including advocacy groups and community resources, are essential in helping you cope with these challenges.

Recognizing these hurdles is the first step toward seeking assistance and preparing effectively. You are not alone in this journey, and with the right support, your chances of success can significantly increase.

Conclusion

Social Security Disability Insurance (SSDI) is a vital support system for individuals with disabilities, offering essential financial assistance to those unable to work due to their conditions. We understand that navigating the complexities of SSDI eligibility, the application process, and the challenges faced by applicants can be overwhelming. Recognizing these factors is crucial for securing benefits that help maintain a basic standard of living.

The key eligibility requirements for SSDI include:

- Work history

- The definition of disability

- The expected duration of the condition

- Age considerations

The step-by-step application process is also important, highlighting the necessity of thorough documentation and proactive follow-ups. Many applicants face common challenges, such as:

- High denial rates

- Lengthy wait times

- The emotional toll of the process

It’s common to feel discouraged, but support and preparation can make a significant difference.

Ultimately, while navigating the SSDI landscape can feel daunting, awareness and understanding empower individuals to overcome obstacles and advocate for their rights. Remember, you are not alone in this journey. Engaging with available resources and seeking guidance can significantly enhance your chances of a successful application, ensuring that you receive the support you deserve. We're here to help you every step of the way.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

Social Security Disability Insurance (SSDI) is a federal program that provides financial assistance to individuals who are unable to work due to qualifying disabilities. It is funded by payroll taxes and aims to support those who have contributed to the Social Security system.

Who qualifies for SSDI benefits?

To qualify for SSDI benefits, individuals must demonstrate that their disability significantly impairs their ability to engage in any substantial gainful activity.

How many Americans are expected to receive SSDI benefits in 2025?

In 2025, it is expected that around 10 million Americans will receive disability benefits from the SSDI program.

What are the average monthly benefits for disabled workers?

The average monthly benefit for disabled workers is projected to increase from $1,483 to $1,520 in 2025, due to a 2.5% cost-of-living adjustment (COLA).

Why is the cost-of-living adjustment (COLA) important for SSDI benefits?

The cost-of-living adjustment (COLA) is important because it helps ensure that SSDI benefits keep pace with inflation-driven price increases, allowing beneficiaries to manage essential living costs.

How does SSDI impact financial stability for disabled individuals?

SSDI serves as a crucial safety net for disabled individuals, helping to prevent poverty and supporting their well-being by providing financial security during challenging times.