Overview

The article titled "Mastering Schedule R: Your Step-by-Step Tutorial for Success" serves as a comforting guide for taxpayers who are navigating the process of claiming the Credit for the Elderly or Disabled through Schedule R. We understand that this can be a daunting task, so it’s important to clarify the eligibility criteria, necessary documentation, and common challenges you may encounter along the way.

By organizing this information, we aim to empower you with the knowledge that can significantly enhance your chances of successfully obtaining financial relief from tax liabilities. Remember, you are not alone in this journey; we’re here to help you every step of the way.

As you prepare to tackle the filing process, take a moment to reflect on your situation. It’s common to feel overwhelmed, but proper understanding and organization can make a world of difference. We encourage you to approach this process with confidence, knowing that support is available to guide you through.

Introduction

Navigating the complexities of tax forms can feel overwhelming, particularly for those who may be financially vulnerable due to age or disability. We understand that this process can be daunting. Schedule R is designed to assist eligible taxpayers in claiming the Credit for the Elderly or Disabled, offering a crucial opportunity for financial relief by potentially lowering tax liabilities. However, many individuals find themselves feeling lost amid the eligibility criteria and documentation requirements.

How can you ensure that you are maximizing your benefits while avoiding common pitfalls in the filing process? You're not alone in this journey, and we're here to help.

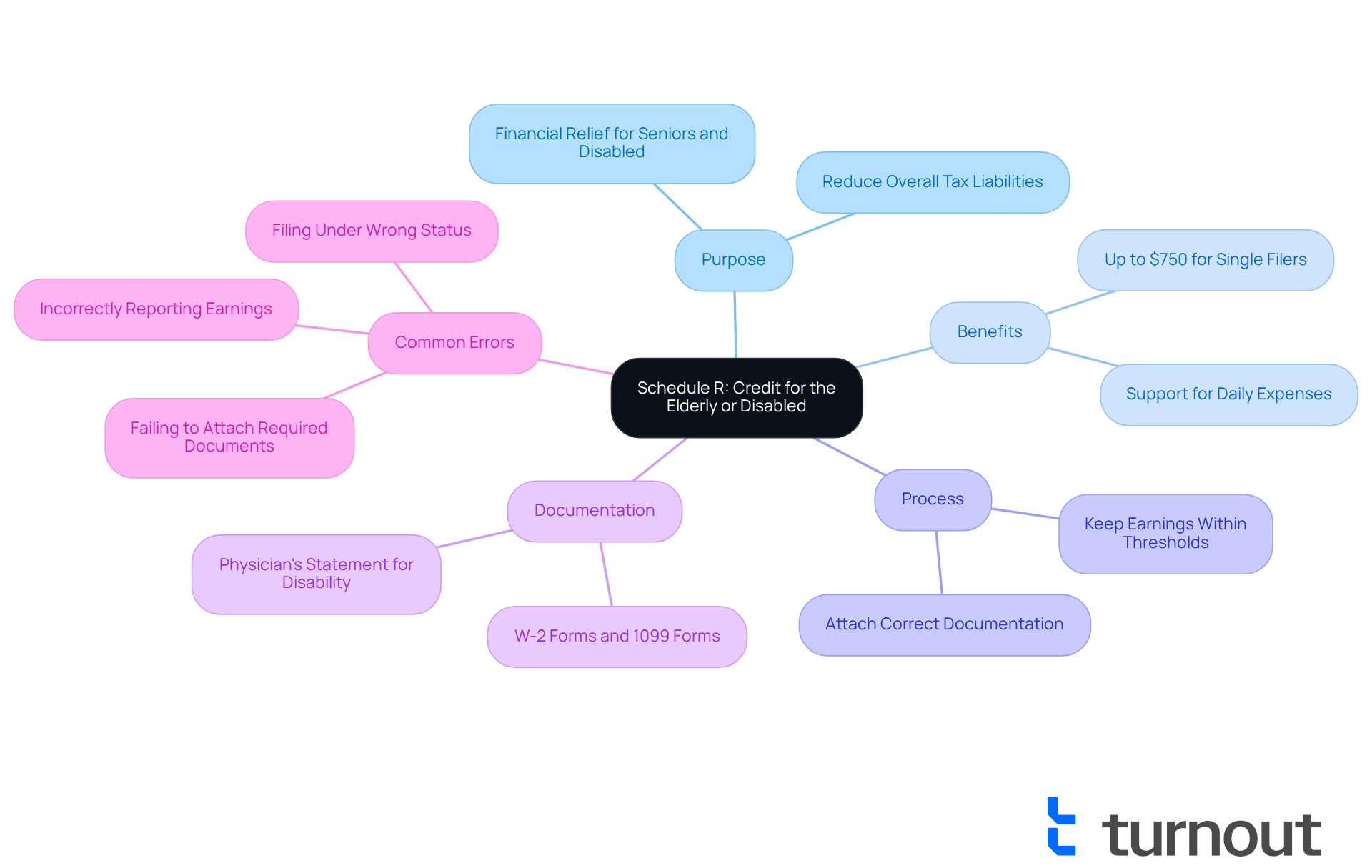

Overview of Schedule R: Purpose and Importance

is an essential form for eligible taxpayers who are looking to claim the . This credit is specifically designed to ease financial burdens by reducing overall . We understand that can be challenging, especially for seniors and individuals with disabilities. This assistance can significantly improve your , enabling you to handle your expenses more effectively.

For instance, if you are a single filer earning $20,000 per year, you could potentially receive a benefit of up to $750. This amount can provide vital support for daily expenses. The importance of sch r lies in its ability to offer , particularly for those grappling with the costs associated with aging or disability. By claiming this credit, you can experience a meaningful reduction in your tax bills, which can be transformative for your financial stability.

It's common to feel overwhelmed by the complexities of government benefits, but to this process. They provide tools and , ensuring that disabled individuals can navigate these challenges effectively. Remember to keep your earnings within the specified thresholds and attach the correct documentation to .

To accurately complete the sch r, collect documents that indicate your earnings, such as W-2 forms and various 1099 forms. Be mindful of typical errors to avoid, such as incorrectly reporting earnings or failing to attach a physician's statement for disability requests. We recommend maintaining records for at least three years to ensure proper tax documentation. You are not alone in this journey; we’re here to help you every step of the way.

Eligibility Criteria for Filing Schedule R

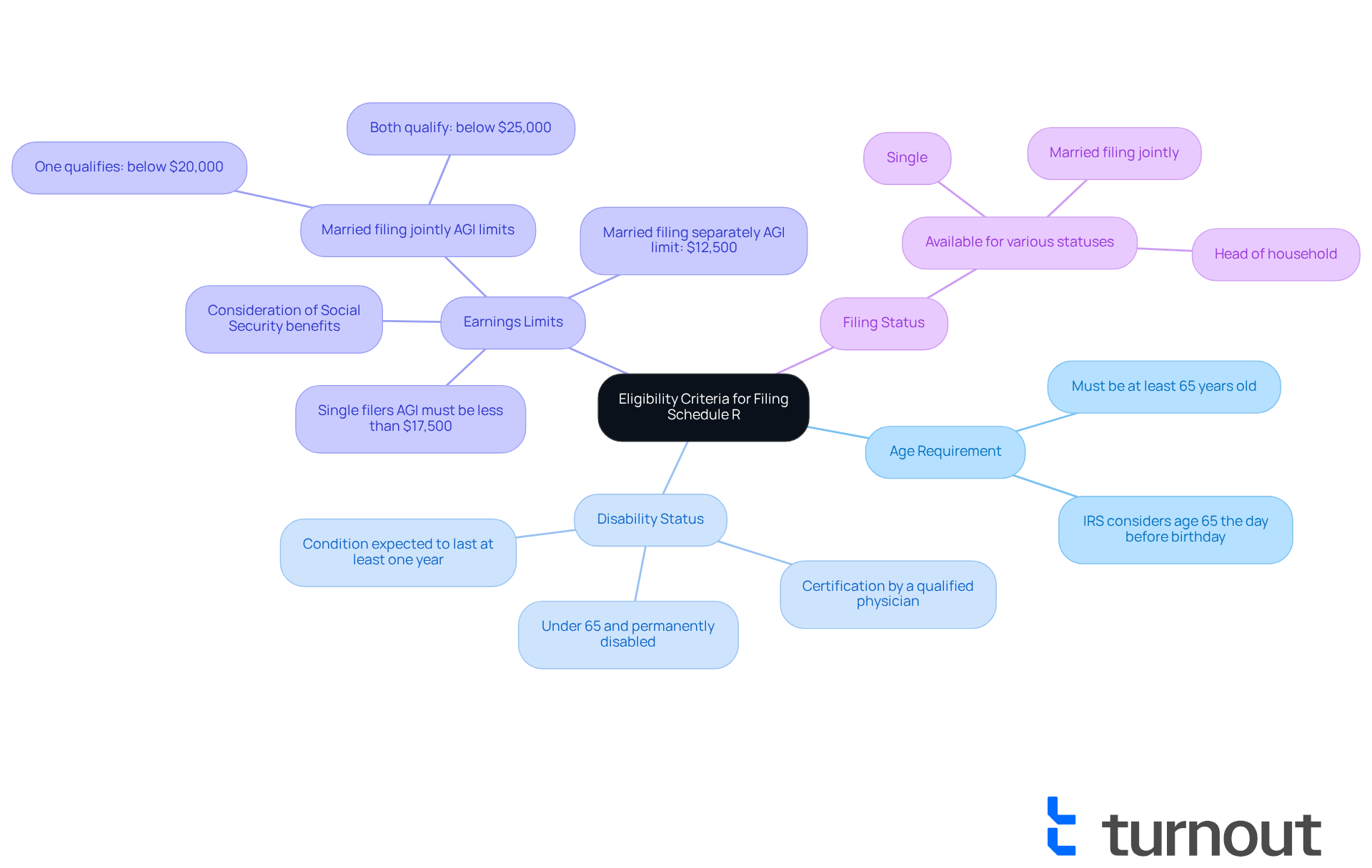

To qualify for Schedule R, it's important to understand the specific criteria that can help you benefit from this program:

- Age Requirement: You must be at least 65 years old by the end of the tax year. The IRS considers you to reach age 65 the day before your 65th birthday, so it's good to keep this in mind.

- Disability Status: If you're under 65, you may still qualify if you are and receive taxable disability payments. Remember, this condition needs to be certified by a qualified physician and is expected to last for at least one year.

- Earnings Limits: There are that you should not exceed to claim the credit. For single filers, your adjusted gross earnings (AGI) must be less than $17,500. If you're married and filing jointly, the AGI must be below $25,000 if both qualify, or $20,000 if only one does. For married individuals filing separately and living apart, the AGI limit is set at $12,500. It's also essential to note that only a portion of is considered in the earnings calculation for .

- Filing Status: The benefit is available for various filing statuses, including single, married filing jointly, and head of household.

We understand that can feel overwhelming. To support your , you’ll need a physician’s certification for , evidence of earnings, [Social Security benefits](https://myturnout.com/service/social-security-disability), and other relevant tax documents. Knowing these criteria is crucial for determining your eligibility and ensuring that your filing process is smooth and accurate.

For example, if you are a single filer earning $20,000 each year and receiving $5,000 in Social Security benefits, you might be eligible for a benefit of up to $750. This illustrates the financial advantages of precise reporting. Furthermore, if you meet the age or disability qualifications, you can claim the on your Schedule R, provided you also meet specific income restrictions based on your tax-filing status.

It's vital to accurately complete and file Schedule R on time to avoid any penalties or denial of credits. Remember, the credit is nonrefundable, meaning any excess credit over the tax owed will not result in a refund. You're not alone in this journey; we’re here to help you navigate the process and ensure you receive the benefits you deserve.

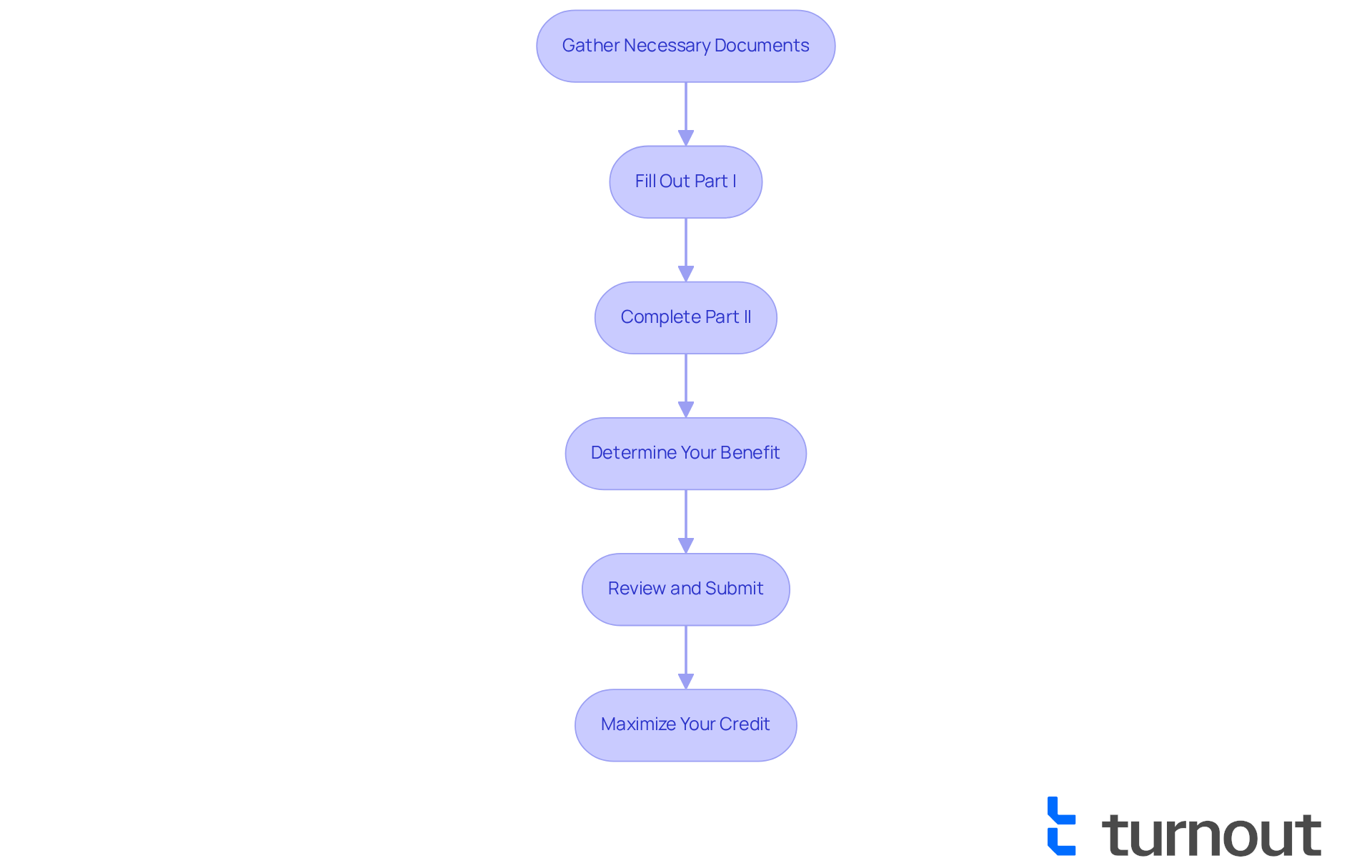

Step-by-Step Guide to Completing Schedule R

Completing the sch r involves several key steps, and we understand that this process can feel overwhelming. Our team is here to help you navigate it effectively. Please remember that , and the information provided does not constitute legal advice.

- Gather Necessary Documents: Start by collecting all relevant documents, including proof of age or disability and income statements. This may include Social Security records, disability benefit letters, and tax returns from previous years. It’s important to have documentation to support your assertion, such as medical records or letters from disability agencies. Our trained nonlegal advocates are ready to assist you in for your SSD applications, including sch r.

- Fill Out Part I: Indicate your age or disability status. If you are requesting disability, please supply documentation to back your request. Remember to check the 'Type of filer' box to indicate your filing status. Our representatives can help you understand what sch r documentation is necessary to support your request effectively.

- Complete Part II: Report your earnings and any adjustments. This section is vital for determining the amount of credit you can claim. Be thorough in listing all sources of revenue, including nontaxable benefits, as these can influence your eligibility. Keep in mind the adjusted gross income (AGI) limits for the : for single filers, the AGI must be less than $17,500; for married filing jointly, if only one spouse qualifies, the limit is $20,000, and if both qualify, the limit is $25,000. Our resources can help clarify these limits and ensure you report accurately.

- Determine Your Benefit: Use the provided tables in the instructions to determine your benefit based on the information entered. Pay attention to your AGI and ensure it remains within the specified limits for financial support. Our IRS-licensed enrolled agents can offer guidance on optimizing your financial benefits using sch r based on your unique circumstances.

- Review and Submit: Before submitting Schedule R with your tax return, double-check all entries for accuracy and completeness. Common errors include not satisfying eligibility requirements, miscalculating the allowance, or forgetting to include necessary documentation. Specific errors to avoid include not reporting all relevant income and overlooking state-specific rules. Taking the time to review can help prevent delays or denials of your claim for funds. Consider using for electronic filing, as it can simplify the process and guide you through the necessary steps. We are here to support you in this process, ensuring you have the assistance you need to navigate these complexities confidently.

By following these steps carefully and utilizing the available resources, you can maximize your potential credit and navigate the filing process with confidence. Remember, you are not alone in this journey; we are here to help every step of the way.

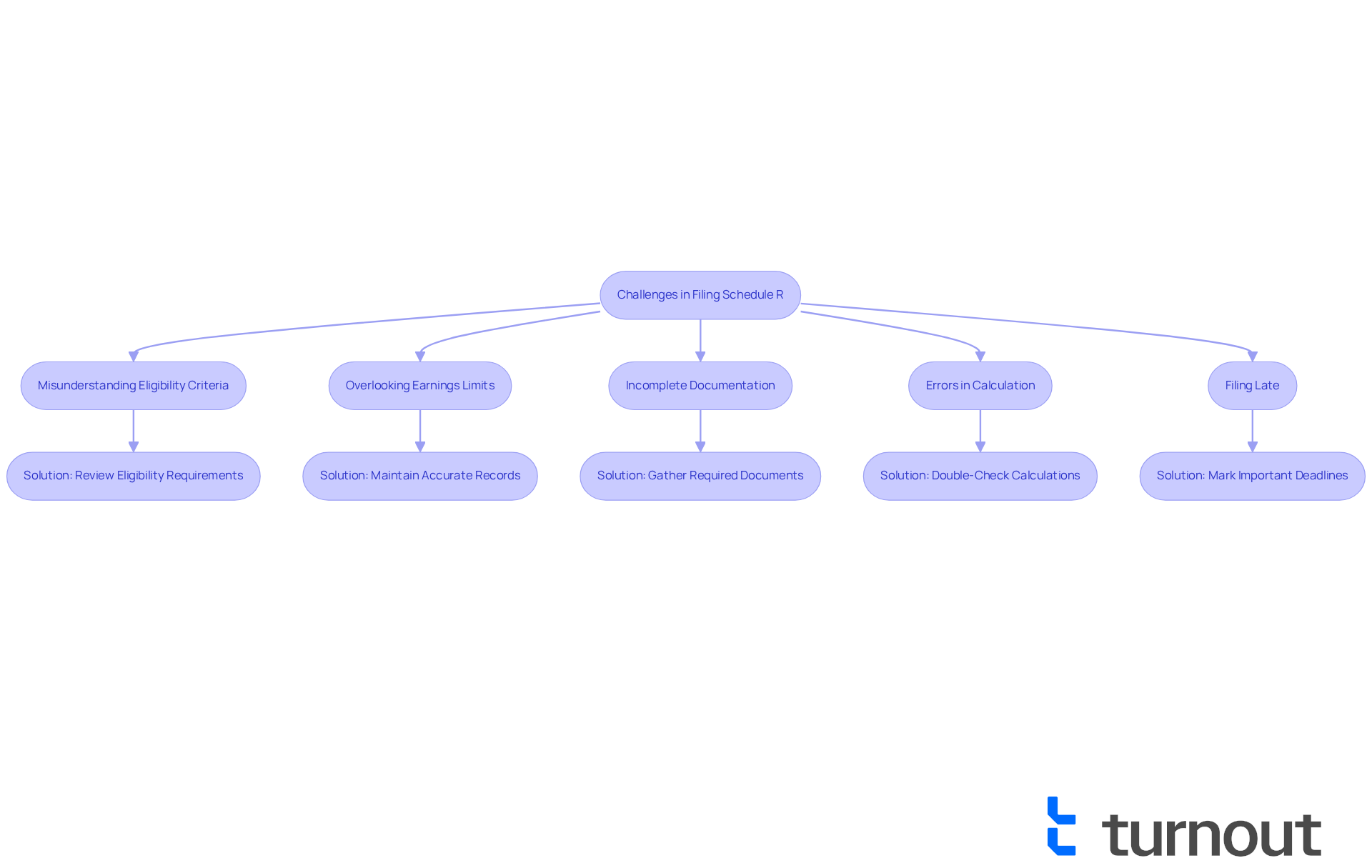

Common Challenges and Solutions in Filing Schedule R

Filing , and we understand that being aware of them can help you navigate the process more effectively:

- : It's common to feel unsure about whether you qualify. To avoid this, take a moment to carefully review the eligibility requirements. Individuals must be 65 years or older or permanently disabled, as certified by a physician. in and how they apply to your situation, though it’s important to note that Turnout is not a law firm and does not provide legal advice.

- : We want to ensure that your earnings do not exceed the thresholds set by the IRS. Different income limits apply for single filers, heads of household, and married couples filing jointly. Keeping accurate records can help prevent this issue. Our trained can offer assistance in maintaining these records effectively, ensuring you stay within the limits.

- Incomplete Documentation: We understand that failing to provide can lead to delays or denials. Frequent errors include neglecting to add a physician’s statement for disability requests and omitting other pertinent tax documents that support eligibility. Always ensure that you include all required supporting documents when filing. The platform can assist you in to back your assertions, making use of their tools and resources.

- Errors in Calculation: Mistakes in determining the credit can lead to inaccurate requests, and we want to help you avoid this. The IRS error rate for paper returns is notably high, at 21%, compared to less than 1% for e-filed returns. The IRS reported nearly 2.5 million math errors on tax returns filed for the 2017 tax year. Use IRS tables and double-check your math to ensure accuracy, as even minor errors can lead to significant delays or penalties. Our organization’s resources can assist you in verifying your calculations to avoid these pitfalls.

- Filing Late: Be mindful of deadlines to avoid penalties. The IRS recommends filing by the April deadline to claim Schedule R without incurring late fees. Mark your calendar with important dates to ensure timely submission. This system can assist you in maintaining your filing schedule, offering reminders and support during the process.

By anticipating these challenges and implementing the suggested solutions, you can enhance your chances of a successful filing experience. Understanding the immediate benefits of Schedule R can provide , especially for seniors on fixed incomes or individuals with high medical expenses. Recognizing these situations can help eligible taxpayers take advantage of available credits, and Turnout is here to support you in navigating these processes effectively.

Conclusion

Mastering Schedule R is more than just completing a form; it’s an important opportunity for eligible taxpayers, especially seniors and individuals with disabilities, to ease financial burdens. By understanding the nuances of this credit, you can achieve significant tax relief, which can provide essential support for daily expenses and enhance your overall financial stability.

Throughout this guide, we have highlighted key points such as:

- Eligibility criteria

- Necessary documentation

- A step-by-step approach to accurately completing Schedule R

It’s crucial to adhere to income limits and ensure thorough documentation, as these factors directly impact your ability to claim the Credit for the Elderly or Disabled. We understand that navigating these requirements can be challenging, but being aware of common obstacles and their solutions can empower you to approach the filing process with confidence and clarity.

Ultimately, the significance of Schedule R goes beyond tax benefits; it offers a pathway to greater financial security for those who need it most. We encourage you to take action, gather the necessary documents, and utilize available resources to maximize your potential credits. Remember, with the right support and knowledge, navigating the complexities of Schedule R can lead to transformative financial relief, making a meaningful difference in your life.

Frequently Asked Questions

What is Schedule R and its purpose?

Schedule R is a form for eligible taxpayers to claim the Credit for the Elderly or Disabled, aimed at reducing overall tax liabilities and easing financial burdens for seniors and individuals with disabilities.

How does the Credit for the Elderly or Disabled benefit taxpayers?

This credit provides financial relief by potentially reducing tax bills, which can help improve the financial well-being of those with limited incomes, particularly seniors and individuals with disabilities.

What is an example of the benefit amount one might receive?

For instance, a single filer earning $20,000 per year could potentially receive a benefit of up to $750, which can assist with daily expenses.

Why is it important to claim Schedule R?

Claiming Schedule R is important because it can significantly reduce tax liabilities, providing crucial financial support for those facing costs associated with aging or disability.

How can individuals get assistance with claiming Schedule R?

Turnout offers tools and expert guidance to help disabled individuals navigate the complexities of claiming Schedule R and accessing government benefits.

What documents are needed to complete Schedule R?

To complete Schedule R, collect documents that indicate your earnings, such as W-2 forms and various 1099 forms.

What are common errors to avoid when completing Schedule R?

Common errors include incorrectly reporting earnings and failing to attach a physician's statement for disability requests.

How long should records be maintained for tax documentation?

It is recommended to maintain records for at least three years to ensure proper tax documentation.