Introduction

Navigating the world of self-employment can be overwhelming, especially when it comes to understanding the Anexo C Formulario 1040. This essential tax document is not just a form; it’s a key tool that helps you report your business income and losses. It also plays a crucial role in determining your overall tax liability and potential deductions.

We understand that completing this form can feel daunting, particularly with recent updates and evolving IRS regulations. How can you ensure that you’re accurately reporting your earnings while maximizing your tax benefits?

This guide is here to help you master Schedule C, offering clarity and confidence as you face your tax responsibilities. You are not alone in this journey, and together, we can simplify the process.

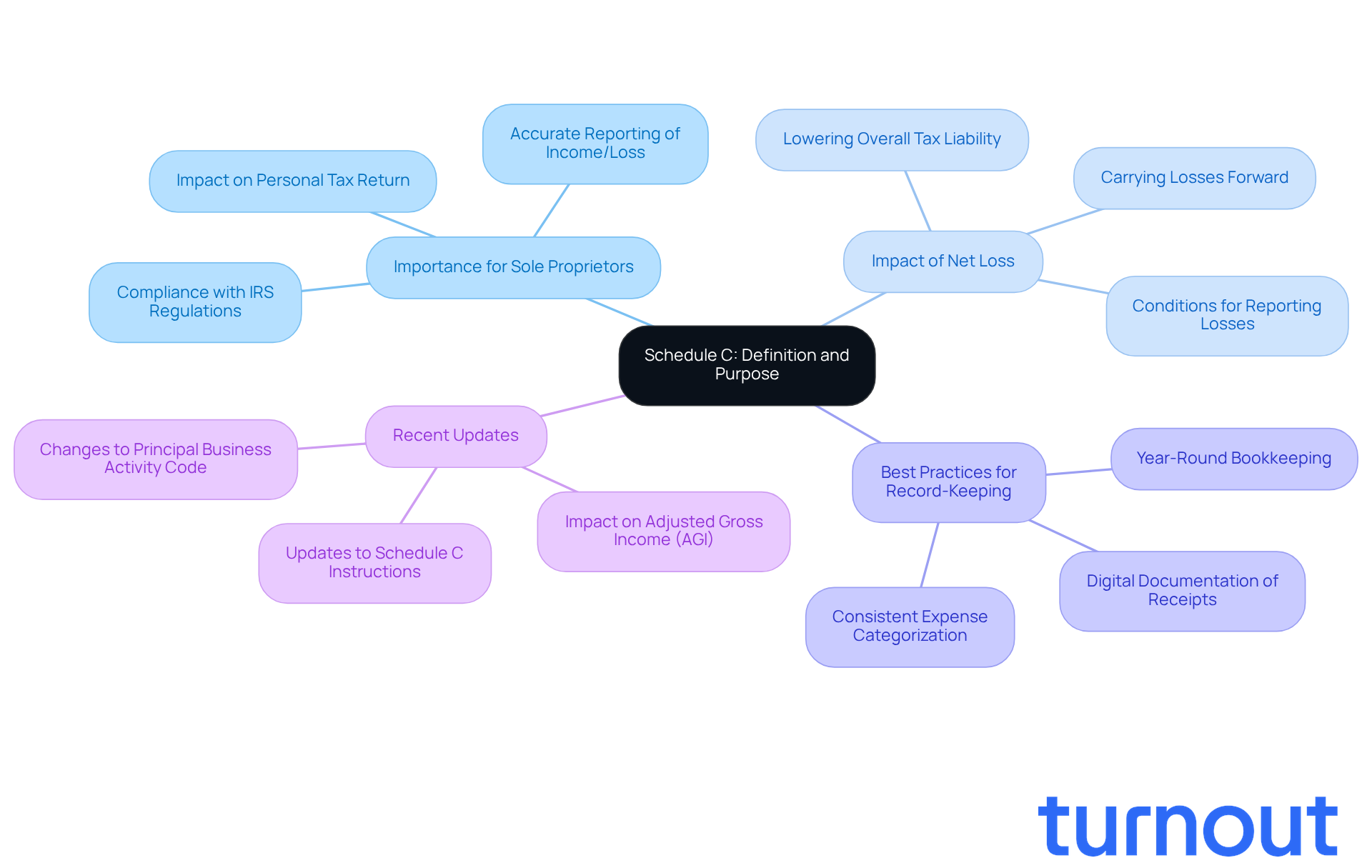

Understand Schedule C: Definition and Purpose

Form C (Form 1040) is more than just a tax document for sole proprietors and single-member LLCs; it’s a vital tool that helps you accurately report your business income or losses. We understand that for self-employed individuals, this form can feel overwhelming. However, it plays a crucial role in determining your net profit or loss, which directly impacts your personal tax return. Completing Form C accurately is essential for staying compliant with IRS regulations, and it can significantly affect your tax responsibilities and potential deductions.

Consider this: if you report a net loss on Schedule C, you might be able to lower your overall tax liability. This is especially beneficial if you meet certain conditions, like actively participating in your business and following the passive activity loss rules. If you’re facing financial challenges, this can be a lifeline, allowing you to carry losses forward to offset future earnings.

Keeping organized records throughout the year is also key. Regular bookkeeping can help you spot discrepancies, such as missing income or miscategorized expenses, which could lead to IRS audits if overlooked. By adopting best practices - like consistently categorizing expenses and digitally documenting receipts - you can simplify your tax preparation and reduce the risk of errors.

With recent updates, including changes to the Principal Business Activity Code on 23-JAN-2024 and 03-FEB-2023, understanding Form C is more important than ever. These updates highlight the evolving nature of tax compliance and remind us that staying informed about your reporting obligations is essential. Remember, the results from the anexo c formulario 1040 flow into Line 3 of Form 1040, affecting your Adjusted Gross Income (AGI) and tax category. Mastering this form not only ensures compliance but also empowers you to maximize your tax benefits.

We’re here to help you navigate this process. You’re not alone in this journey.

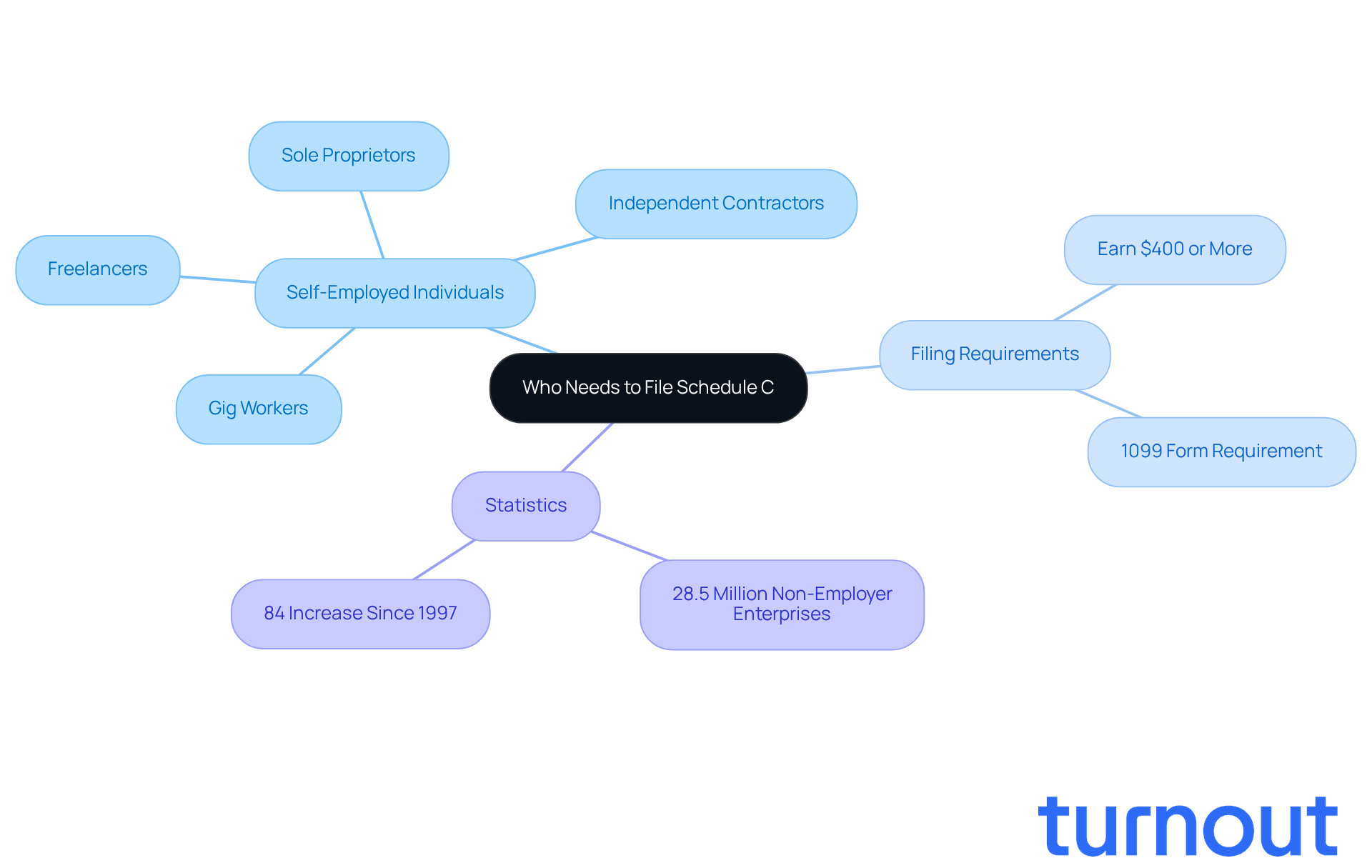

Identify Who Needs to File Schedule C

If you're self-employed - whether as a sole proprietor, independent contractor, freelancer, or gig worker - it's important to know that you need to submit Form C if you earn income from your activities. This requirement applies to anyone receiving a 1099 form for their services. Specifically, if your net earnings from self-employment hit $400 or more, filing Schedule C becomes a must.

In 2023, there were about 28.5 million non-employer enterprises in the U.S., marking an impressive 84% increase since 1997. This growth highlights the increasing number of individuals navigating these tax requirements. We understand that keeping up with these obligations can feel overwhelming, but it's crucial to comply. Failing to do so can lead to significant penalties, including fines and interest on unpaid taxes. With IRS scrutiny and compliance enforcement ramping up in 2025, staying informed is more important than ever.

Understanding your filing obligations is essential to avoid penalties and ensure you adhere to IRS regulations. Additionally, remember that self-employed individuals must also make estimated tax payments throughout the year. You're not alone in this journey; we're here to help you navigate your tax responsibilities with confidence.

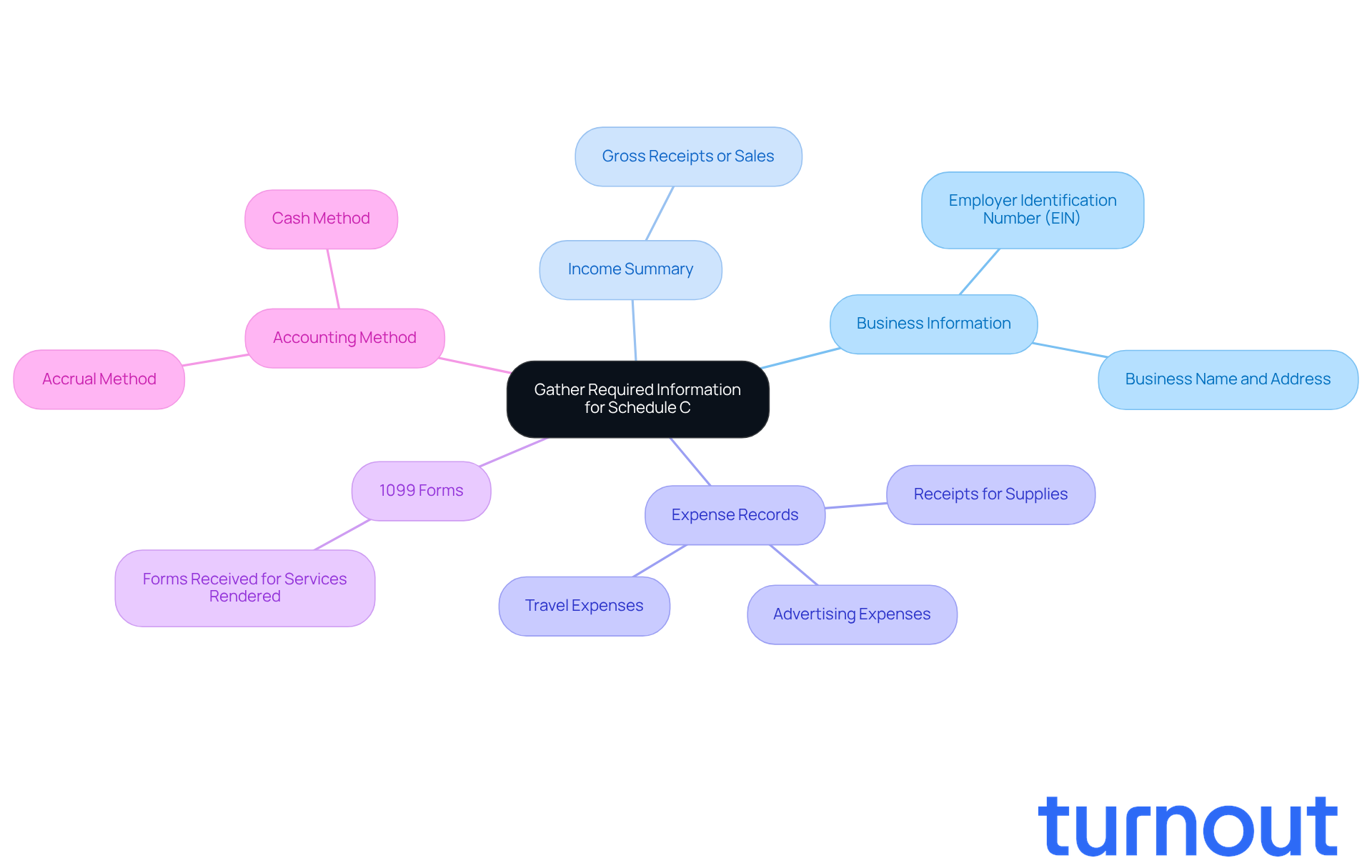

Gather Required Information and Documentation

To successfully complete Schedule C, it’s important to gather a few key pieces of information. We understand that this process can feel overwhelming, but having everything organized can make a world of difference.

Here’s what you’ll need:

- Your business name and address.

- Your Employer Identification Number (EIN), if applicable.

- A summary of your income, including gross receipts or sales.

- Detailed records of all company expenses, like receipts for supplies, advertising, and travel.

- Any relevant 1099 forms received for services rendered.

- Information regarding your accounting method (cash or accrual).

Having this information ready will streamline the filing process and significantly enhance accuracy. It’s common to feel anxious about tax season, but remember, meticulous record-keeping is crucial for self-employed individuals. As Olivia Chen, a former Senior Writer at Bankrate, wisely states, "Accurate documentation not only simplifies tax preparation but also ensures compliance and maximizes potential deductions."

Think about it: companies that have organized their information for Schedule C often report smoother filing experiences and fewer issues with the IRS. Statistics show that self-employed individuals can deduct various expenses related to their work, which can significantly lower their taxable earnings. In fact, research indicates that you can deduct up to 20% of your qualified business earnings. This makes thorough documentation even more essential.

You’re not alone in this journey. We’re here to help you navigate through it!

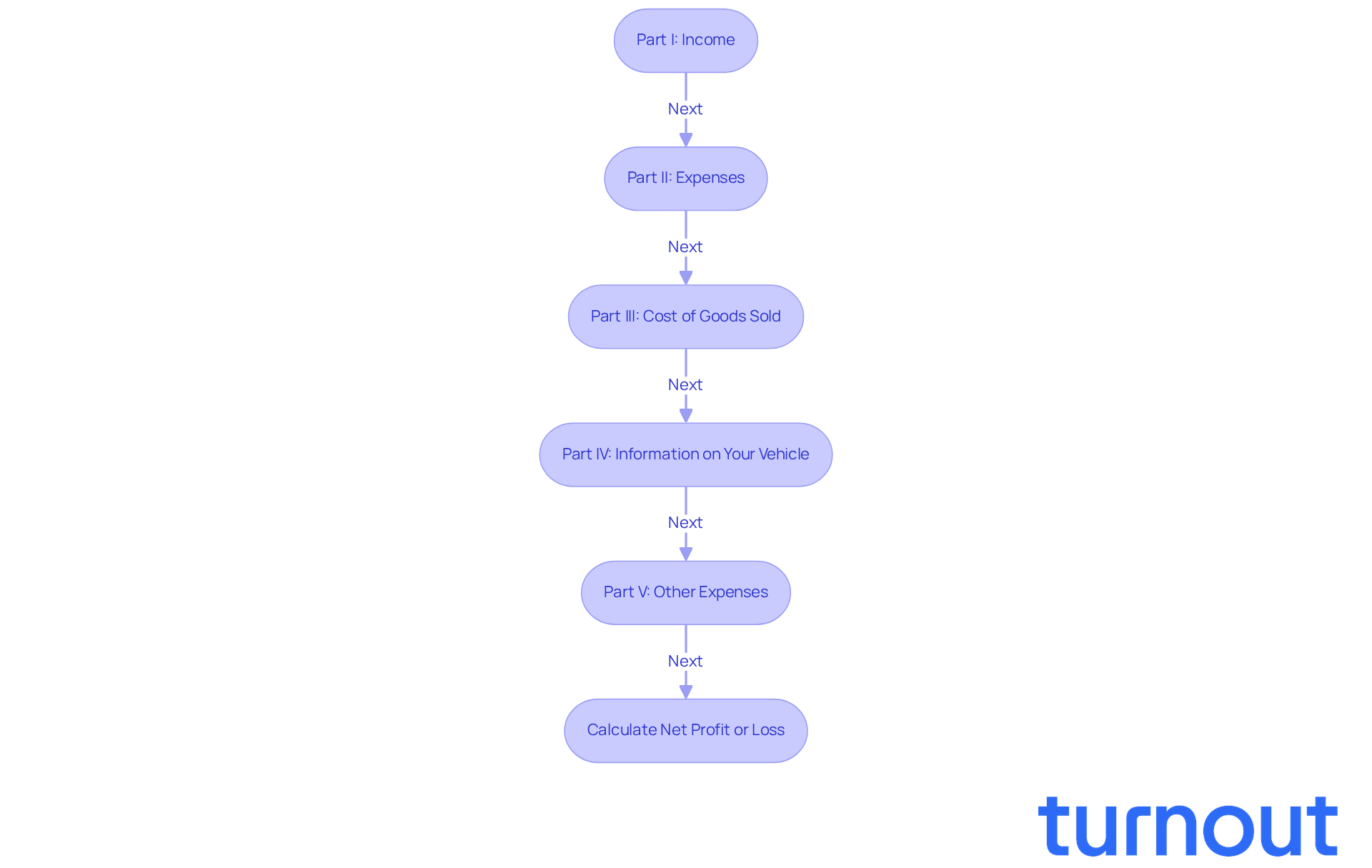

Complete the Schedule C Form: Step-by-Step Instructions

Completing Schedule C can feel overwhelming, but we're here to help you through it. Let’s break it down step by step:

-

Part I: Income - Start by reporting your gross receipts or sales. Don’t forget to subtract any returns and allowances to find your total income.

-

Part II: Expenses - Next, list all your operational expenses. It’s helpful to categorize them by type, like advertising, car and truck expenses, or contract labor.

-

Part III: Cost of Goods Sold - If this applies to you, calculate your cost of goods sold. Detail your inventory at the beginning and end of the year to get an accurate picture.

-

Part IV: Information on Your Vehicle - If you use a vehicle for business, provide the necessary details about how it’s used.

-

Part V: Other Expenses - Don’t forget to include any additional expenses that haven’t been covered in the previous sections.

-

Calculate Net Profit or Loss - Finally, subtract your total expenses from your total earnings. This will help you determine your net profit or loss, which you’ll report on your anexo c formulario 1040.

Remember, it’s common to feel a bit lost in this process, but taking it step by step can make it manageable. You’re not alone in this journey, and with each completed section, you’re one step closer to finishing your taxes.

Troubleshoot Common Issues When Completing Schedule C

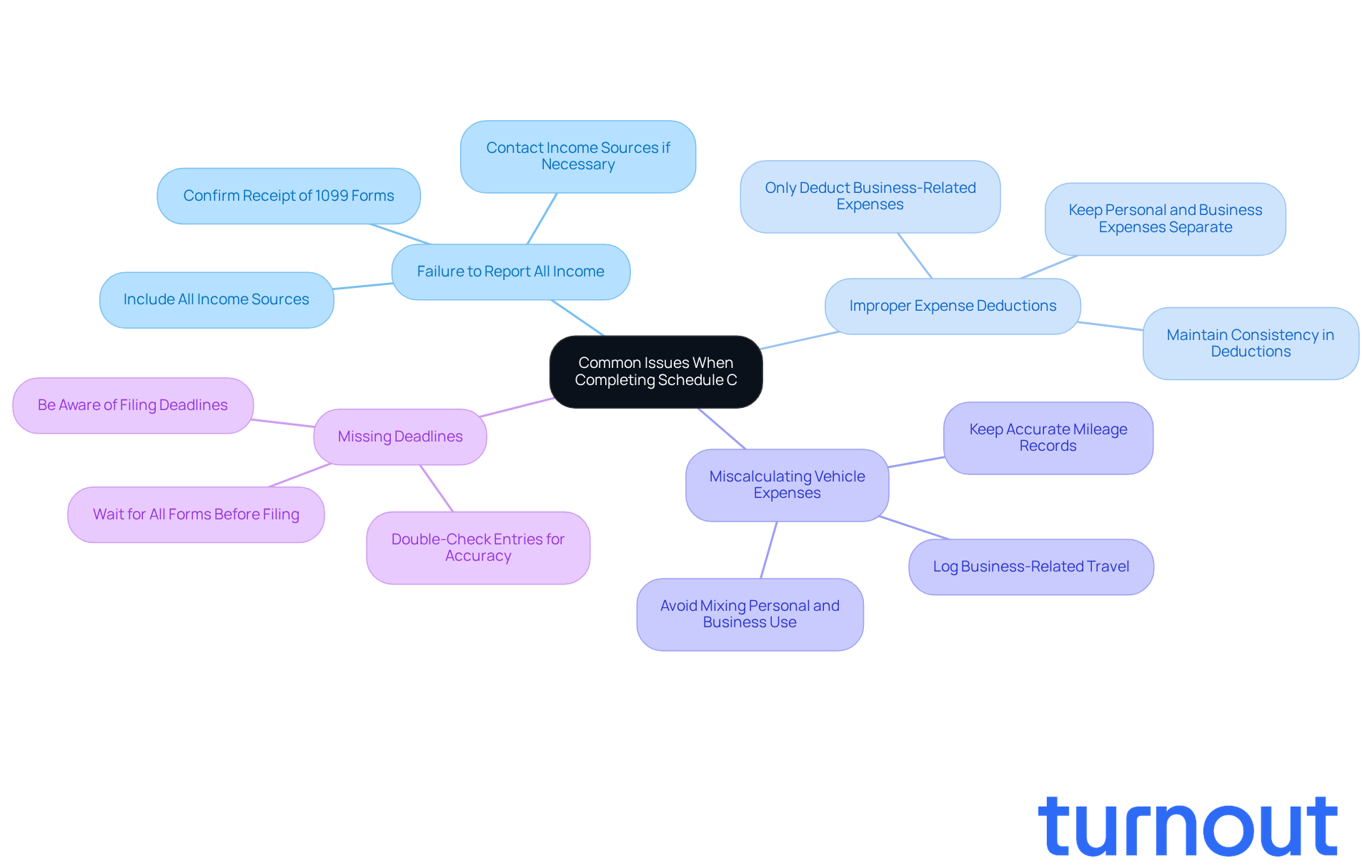

Common issues when completing Schedule C can feel overwhelming, but you’re not alone in this journey. Let’s explore some common pitfalls and how to navigate them with confidence.

-

Failure to Report All Income: It’s crucial to include every source of income, even those not reported on a 1099 form. Remember, the IRS receives copies of all earnings documents, and discrepancies can lead to audits. Neglecting to report earnings is a common reason for IRS scrutiny. To ensure you’re covering all bases, confirm receipt of all 1099 forms before submitting your tax return. This might mean reaching out to your income sources directly, but it’s worth it for peace of mind.

-

Improper Expense Deductions: Only expenses directly tied to your business can be deducted. Personal expenses? They don’t qualify and claiming them can raise red flags with the IRS. Tax experts emphasize the importance of keeping a clear separation between personal and professional expenses to avoid complications. Also, be mindful of consistency in your claims; significant changes in deductions from year to year can prompt an audit.

-

Miscalculating Vehicle Expenses: Keeping accurate records of mileage and costs for your vehicle’s professional use is vital. Mixing personal and business use can lead to IRS scrutiny, so maintaining a detailed log of your business-related travel is highly recommended.

-

Missing Deadlines: It’s easy to overlook filing deadlines, but being mindful can save you from penalties. Employers and payers must send tax forms by January 31, and it’s wise to wait until all forms are in hand before filing your taxes. Discrepancies between reported earnings and IRS records can lead to automatic audits, so accuracy is key.

To resolve these issues, take a moment to double-check your entries and maintain thorough records. Consulting IRS guidelines or a tax professional can also be a great step if you’re feeling uncertain. Regularly verifying your income and transactions can help prevent errors and ensure compliance. Remember, we’re here to help you through this process.

Conclusion

Mastering the Anexo C Formulario 1040 is crucial for self-employed individuals like you who want to accurately report their business income and expenses. We understand that navigating tax forms can feel overwhelming. This guide has shed light on the importance of Schedule C, showing how it helps determine your net profit or loss and impacts your personal tax returns. By understanding this form, you not only comply with IRS regulations but also empower yourself to take advantage of potential tax benefits.

Key insights shared throughout this article emphasize the need for organized record-keeping and the specific requirements for filing Schedule C. We’ve provided step-by-step instructions to help you complete the form with confidence. From gathering essential documentation to troubleshooting common issues, we know the process may seem daunting, but with the right approach, it’s entirely manageable. Each aspect discussed is vital for avoiding penalties and ensuring a smooth filing experience.

As the landscape of self-employment continues to grow, staying informed about your tax obligations is more important than ever. Embracing the knowledge shared in this guide can lead to more confident and efficient tax preparation. Taking proactive steps today not only ensures compliance but also sets the stage for maximizing deductions and minimizing tax liabilities in the future. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is Schedule C and its purpose?

Schedule C (Form 1040) is a tax document for sole proprietors and single-member LLCs that helps report business income or losses. It is crucial for determining net profit or loss, which impacts personal tax returns.

Why is it important to complete Schedule C accurately?

Completing Schedule C accurately is essential for compliance with IRS regulations and can significantly affect tax responsibilities and potential deductions. An accurate report can also help lower overall tax liability if a net loss is reported.

What are the implications of reporting a net loss on Schedule C?

Reporting a net loss on Schedule C may allow you to lower your overall tax liability, especially if you actively participate in your business and follow passive activity loss rules. It can also enable you to carry losses forward to offset future earnings.

What best practices should be followed for maintaining records related to Schedule C?

Keeping organized records, regular bookkeeping, consistently categorizing expenses, and digitally documenting receipts are key practices. This helps spot discrepancies and reduces the risk of errors or IRS audits.

What recent updates have been made to Schedule C?

Recent updates include changes to the Principal Business Activity Code on January 23, 2024, and February 3, 2023. These updates emphasize the importance of staying informed about reporting obligations.

Who is required to file Schedule C?

Individuals who are self-employed, including sole proprietors, independent contractors, freelancers, or gig workers, need to submit Schedule C if they earn income from their activities, particularly if their net earnings hit $400 or more.

What are the consequences of failing to file Schedule C?

Failing to file Schedule C can lead to significant penalties, including fines and interest on unpaid taxes. Increased IRS scrutiny and compliance enforcement are expected in 2025, making it crucial to stay informed and compliant.

What additional tax responsibilities do self-employed individuals have?

Self-employed individuals must also make estimated tax payments throughout the year in addition to filing Schedule C.