Introduction

Navigating tax obligations can feel overwhelming, especially for residents in Utah. We understand that the complexities of state requirements can be daunting. Thankfully, Utah's flat income tax rate simplifies calculations, making it easier for you to manage your finances.

This guide is here to support you in mastering the Utah tax payment process. We’ll walk you through recognizing important deadlines and exploring various payment options. However, with multiple methods available, it’s common to feel uncertain about how to meet your obligations efficiently and without stress.

So, how can you ensure that you’re on the right track? Let’s explore this journey together.

Understand Your Tax Obligations in Utah

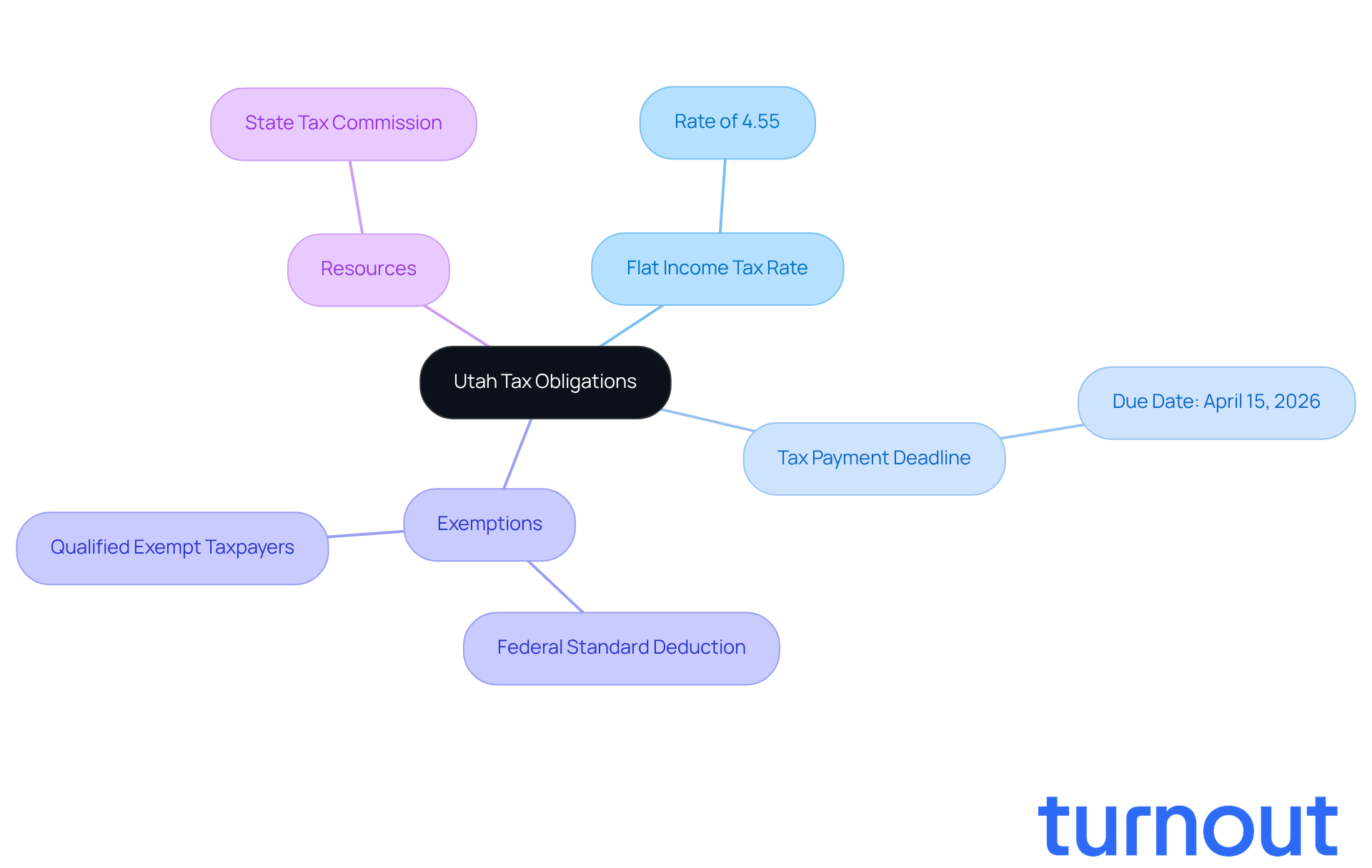

Understanding your tax responsibilities is crucial before you dive into any transactions. In Utah, the state has a flat income tax rate of 4.55% on all taxable earnings, which is relevant for calculating the Utah tax payment. This means everyone pays the same percentage, no matter their income level. It’s a straightforward approach that simplifies the tax process, helping you anticipate your liabilities more easily.

For the 2025 tax year, remember that the Utah tax payment was due by April 15, 2026. Being aware of these deadlines is essential to avoid any penalties. If your federal adjusted gross income is below the federal standard deduction, you might qualify for exemptions. It’s important to assess your specific situation to see what applies to you.

Tax experts suggest that this flat rate can be beneficial, offering predictability in your tax planning. We understand that navigating taxes can be overwhelming, but you’re not alone in this journey. To ensure you’re on the right track and to gain deeper insight into your tax responsibilities, we encourage you to refer to the State Tax Commission's resources. They provide extensive information tailored to various individual scenarios, including details on exemptions and credits available to you.

Explore Payment Options for Utah Taxes

Paying taxes can feel overwhelming, but there are several convenient options for Utah tax payment that residents can utilize to ease the process. The Taxpayer Access Point (TAP) allows you to handle Utah tax payment transactions online using credit cards, debit cards, or electronic checks (ACH debit). Many taxpayers are choosing this method because it’s efficient and user-friendly.

If you prefer traditional methods, you can still mail your Utah tax payment via check or money order using Form TC-547, which should be addressed to the Utah State Tax Commission. You can also visit designated locations in person. Just a heads up: online transactions may come with a 3% convenience fee, so it’s wise to check the fee structure on the TAP website.

You can even plan your contributions up to 130 days in advance, giving you flexibility in managing your tax responsibilities. However, remember that there’s no grace period for overdue fees. If you haven’t requested an extension, your Utah tax payment must be made on or before April 15th. The effective date of your transaction is the day you submit it, regardless of how long processing takes.

Many taxpayers have successfully navigated the TAP system for their Utah tax payment, enjoying its user-friendly interface and timely processing, which typically takes 3-10 business days to post, depending on your financial institution. Financial advisors often recommend online transaction methods for their speed and security, making them a popular choice for those managing their Utah tax payment obligations.

If you owe taxes but can’t pay in full by the due date, don’t worry. You can request an arrangement through your TAP account. Remember, you’re not alone in this journey, and we’re here to help you find the best way to meet your tax responsibilities.

Follow Steps to Make Your Payment Online

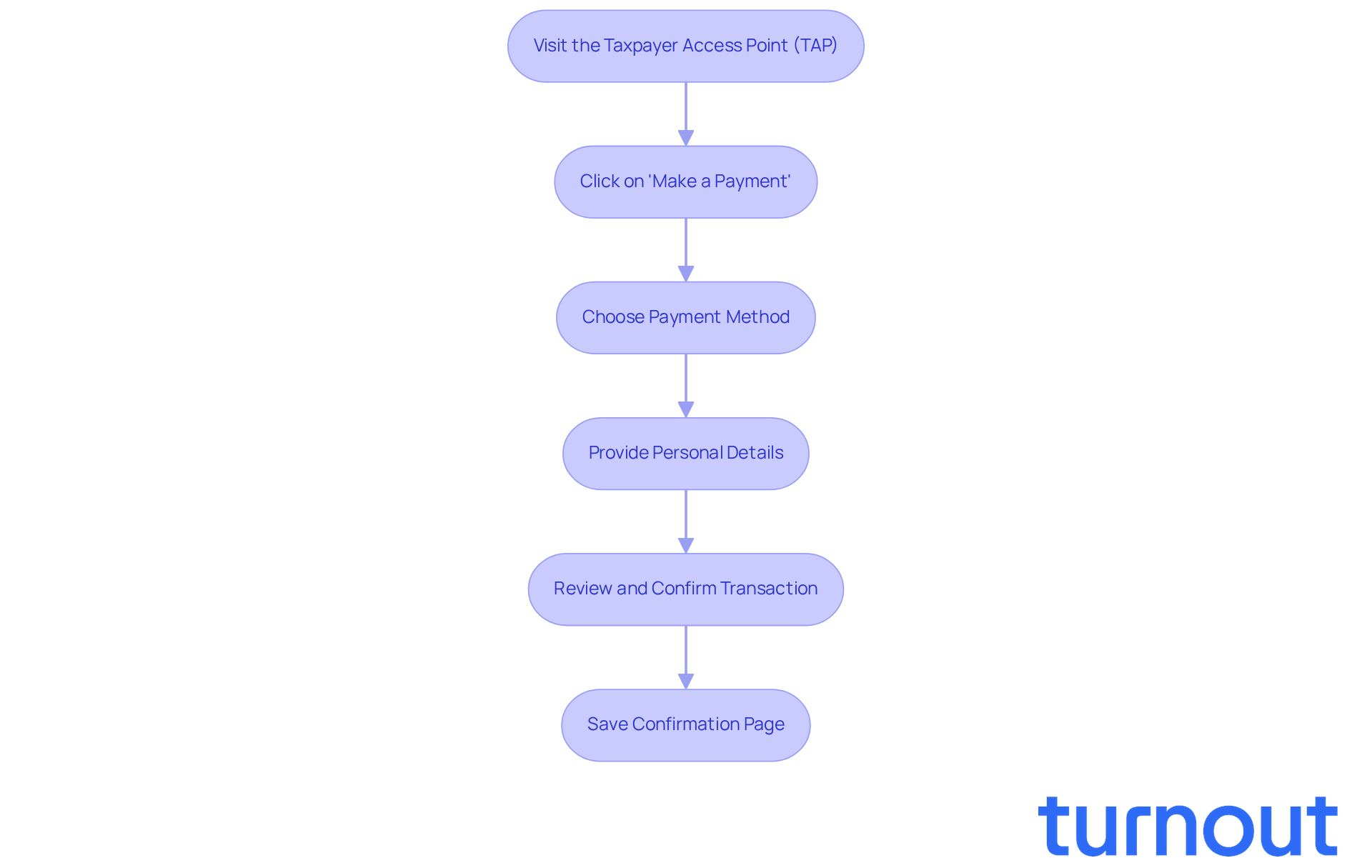

Making your Utah tax payment online can feel overwhelming, but we're here to help you through it. Just follow these simple steps:

- Visit the Taxpayer Access Point (TAP).

- Click on 'Make a Payment' from the main menu.

- Choose your preferred method of transaction: credit card, debit card, or electronic check.

- Provide your personal details, including your Social Security number and the amount due.

- Review your financial details carefully and confirm the transaction.

- Save or print the confirmation page for your records. This confirmation is essential; it serves as evidence of your transaction and can help prevent any disagreements in the future.

We understand that meeting deadlines can be stressful. Ensure that your fee is submitted before the deadline to avoid any penalties. Recent updates show that the success rate of online tax transactions for Utah tax payment has improved significantly, making this method both efficient and dependable.

Tax experts emphasize the importance of keeping your confirmation receipts. They can be crucial for future reference and provide reassurance. Remember, you are not alone in this journey; we’re here to support you every step of the way.

Troubleshoot Common Payment Issues

When you’re facing issues with your Utah tax payment, it’s completely understandable to feel a bit overwhelmed. Here are some helpful tips to guide you through common problems:

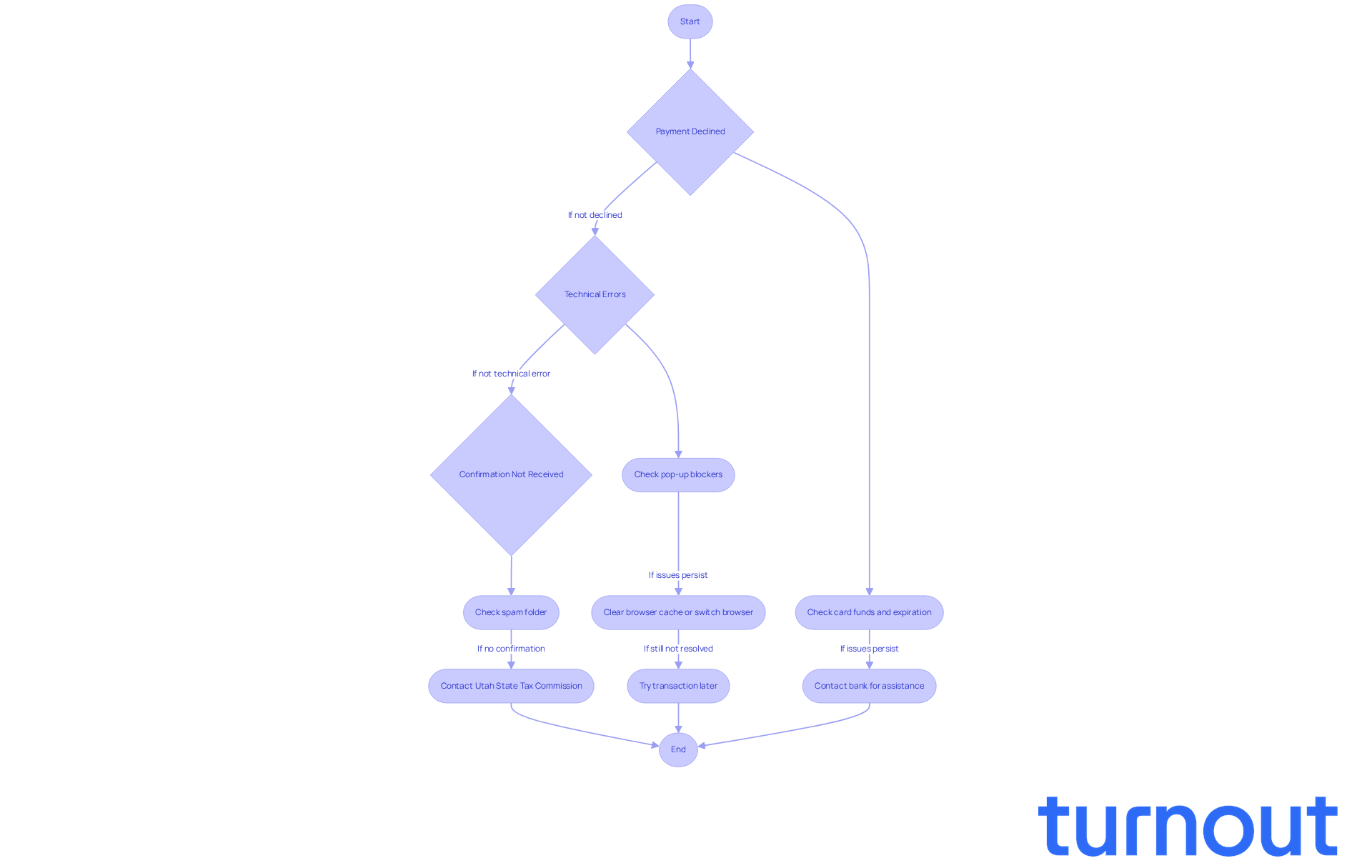

- Payment Declined: First, check if your credit or debit card has enough funds and isn’t expired. If you’re still having trouble, don’t hesitate to reach out to your bank for assistance. They’re there to help you.

- Technical Errors: If you’re having trouble accessing the TAP website, it’s common for pop-up blockers to interfere with viewing documents. Try clearing your browser cache or switching to a different browser. If the issues persist, consider making your transaction later when things might be running smoother.

- Confirmation Not Received: Not receiving a confirmation email after your payment can be frustrating. Start by checking your spam folder; sometimes, emails can get lost there. If it’s not there, please contact the Utah State Tax Commission at 801-297-2200 or email taxmaster@utah.gov for assistance with your Utah tax payment. They’re ready to support you through this.

Remember, you’re not alone in this journey. We’re here to help!

Conclusion

Understanding your tax obligations in Utah is essential for successfully navigating the state's tax system. We know that managing taxes can feel overwhelming, but with a flat income tax rate of 4.55% and clear deadlines, you can handle your responsibilities more effectively. This straightforward approach simplifies the process, making it easier for you to anticipate your liabilities and avoid penalties.

Key insights from this guide highlight the various payment options available for Utah taxes. You can use the user-friendly Taxpayer Access Point (TAP) for online transactions or stick to traditional methods like mailing checks. We’ve included detailed step-by-step instructions for making online payments, ensuring you can complete your transactions efficiently while keeping essential confirmation receipts for future reference. If you encounter any common payment issues, our troubleshooting tips provide reassurance, emphasizing the support available through the Utah State Tax Commission.

Ultimately, mastering your Utah tax payment process not only alleviates stress but also empowers you to take control of your financial obligations. By leveraging the resources and options available, you can confidently navigate your responsibilities and ensure compliance with state regulations. Embrace this knowledge and take action today to secure your financial well-being and avoid any unnecessary complications in the future. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is the income tax rate in Utah?

Utah has a flat income tax rate of 4.55% on all taxable earnings.

How does the flat income tax rate in Utah work?

The flat income tax rate means that everyone pays the same percentage (4.55%) regardless of their income level, simplifying the tax process.

When is the tax payment due for the 2025 tax year in Utah?

The tax payment for the 2025 tax year was due by April 15, 2026.

What should I be aware of to avoid penalties regarding tax deadlines in Utah?

It is essential to be aware of tax deadlines to avoid any penalties, such as the due date for tax payments.

Can I qualify for exemptions on my Utah taxes?

If your federal adjusted gross income is below the federal standard deduction, you might qualify for exemptions. It’s important to assess your specific situation to see what applies to you.

What resources are available for understanding tax responsibilities in Utah?

The State Tax Commission provides extensive resources tailored to various individual scenarios, including details on exemptions and credits available to you.