Introduction

Navigating the complexities of tax amendments can feel overwhelming. We understand that the stakes are high, especially when it comes to potential refunds and correcting past errors. It’s essential to grasp the significance of amending tax filings, as these adjustments can greatly influence your financial outcomes.

But what happens when the status of your amended return is unclear or unresolved? It’s common to feel anxious in such situations. This article will guide you through the steps for checking your tax amendment status, troubleshooting common issues, and exploring valuable resources. We’re here to help you confidently manage your amendments and reclaim what is rightfully yours.

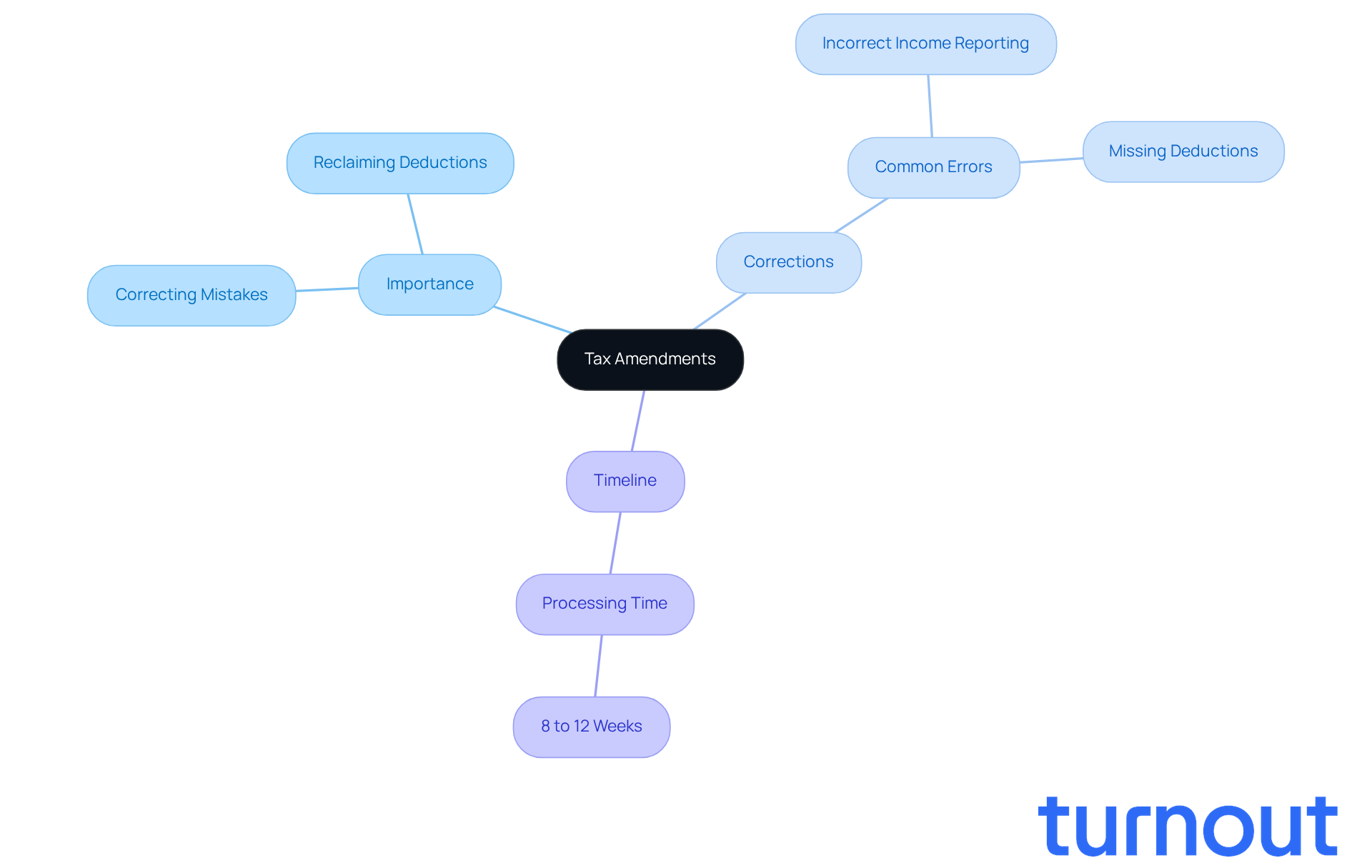

Understand Tax Amendments and Their Importance

Tax adjustments are important changes you can make to your previously submitted tax filings to reflect your tax amend status. They give you the chance to correct mistakes, like reporting incorrect income or missing out on deductions. Understanding the significance of these adjustments is crucial, as they can greatly affect your tax obligations and potential refunds.

Have you ever realized you left out a significant deduction after filing? Checking your tax amend status after amending your tax submission can help you reclaim money that’s rightfully yours. It’s common to feel overwhelmed by these processes, but knowing how to navigate them can empower you.

Additionally, it’s essential to be aware of the timeline for these adjustments. Typically, the IRS takes about 8 to 12 weeks to process a revised submission. This knowledge can help you manage your tax obligations more effectively. Remember, you’re not alone in this journey; we’re here to help you take proactive steps.

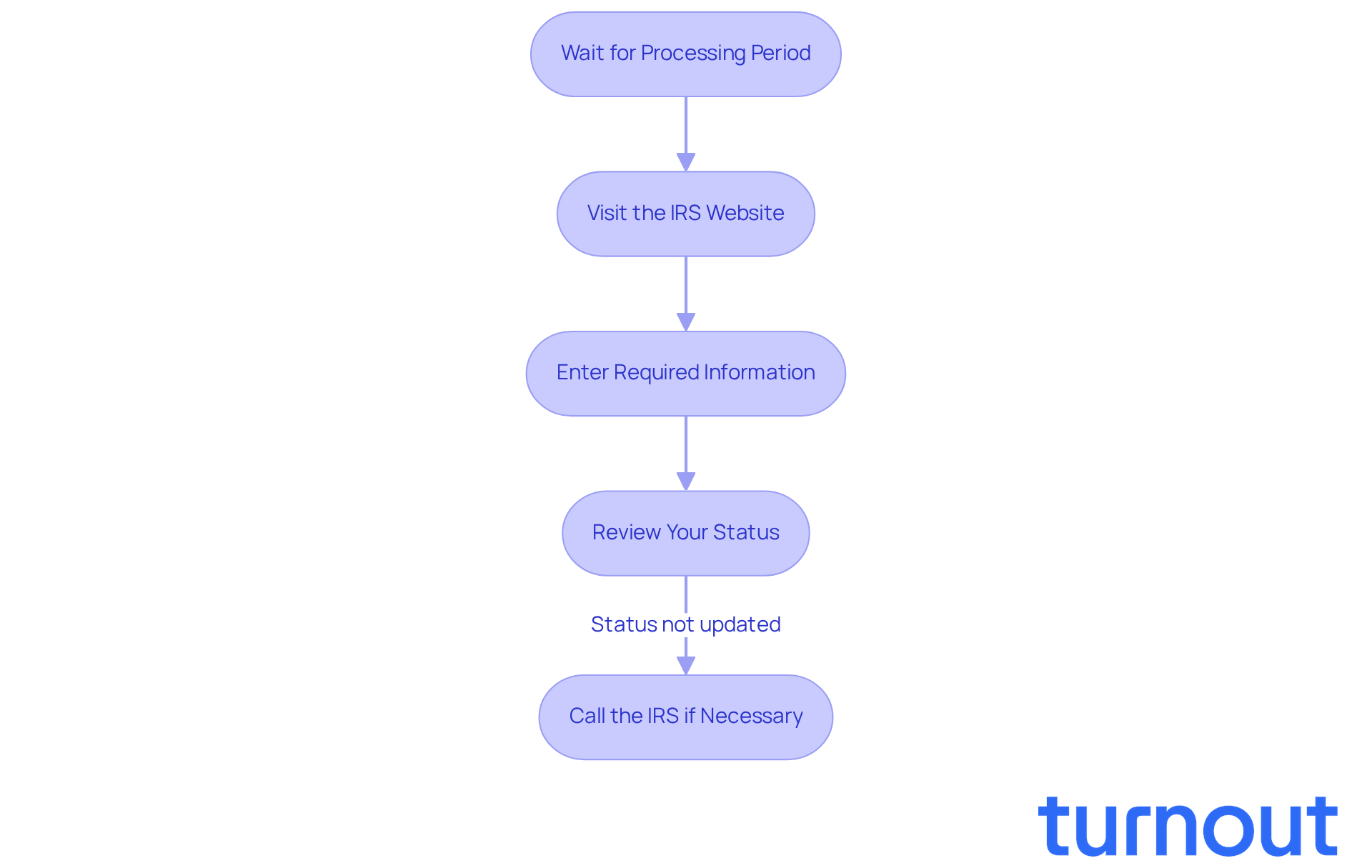

Follow Steps to Check Your Tax Amendment Status

To check your tax amendment status, follow these caring steps:

-

Wait for the Processing Period: After submitting your revised document (Form 1040-X), it’s important to allow at least three weeks for the IRS to process your changes. We understand that waiting can be tough, but patience is key during this time.

-

Visit the IRS Website: You can access the IRS 'Where's My Amended Return?' tool at IRS.gov. This tool is available 24 hours a day, except on Mondays from midnight to 3 a.m. Eastern time and on some Sundays from 1 to 7 a.m. Eastern time. Knowing when you can check can ease some of your worries.

-

Enter Required Information: To retrieve your status, simply provide your Social Security number, date of birth, and ZIP code. It’s a straightforward process, and we’re here to help you through it.

-

Review Your Status: The tool will show whether your amended submission is pending, processing, or completed. Remember, processing can take up to 16 weeks in some cases. In 2026, the average wait time for e-filers is about 7 weeks, while paper filers may wait up to 14 weeks. Understanding these timelines can help manage your expectations as you navigate this modification process.

-

Call the IRS if Necessary: If your status hasn’t updated after the expected time, don’t hesitate to contact the IRS at 866-464-2050 for assistance. This hotline is specifically for checking the tax amend status of amended returns. You’re not alone in this journey. Also, keep in mind that the average refund amount was $3,167, and approximately 104 million taxpayers (63%) received refunds in 2025. Knowing this can provide some comfort as you await your own outcome.

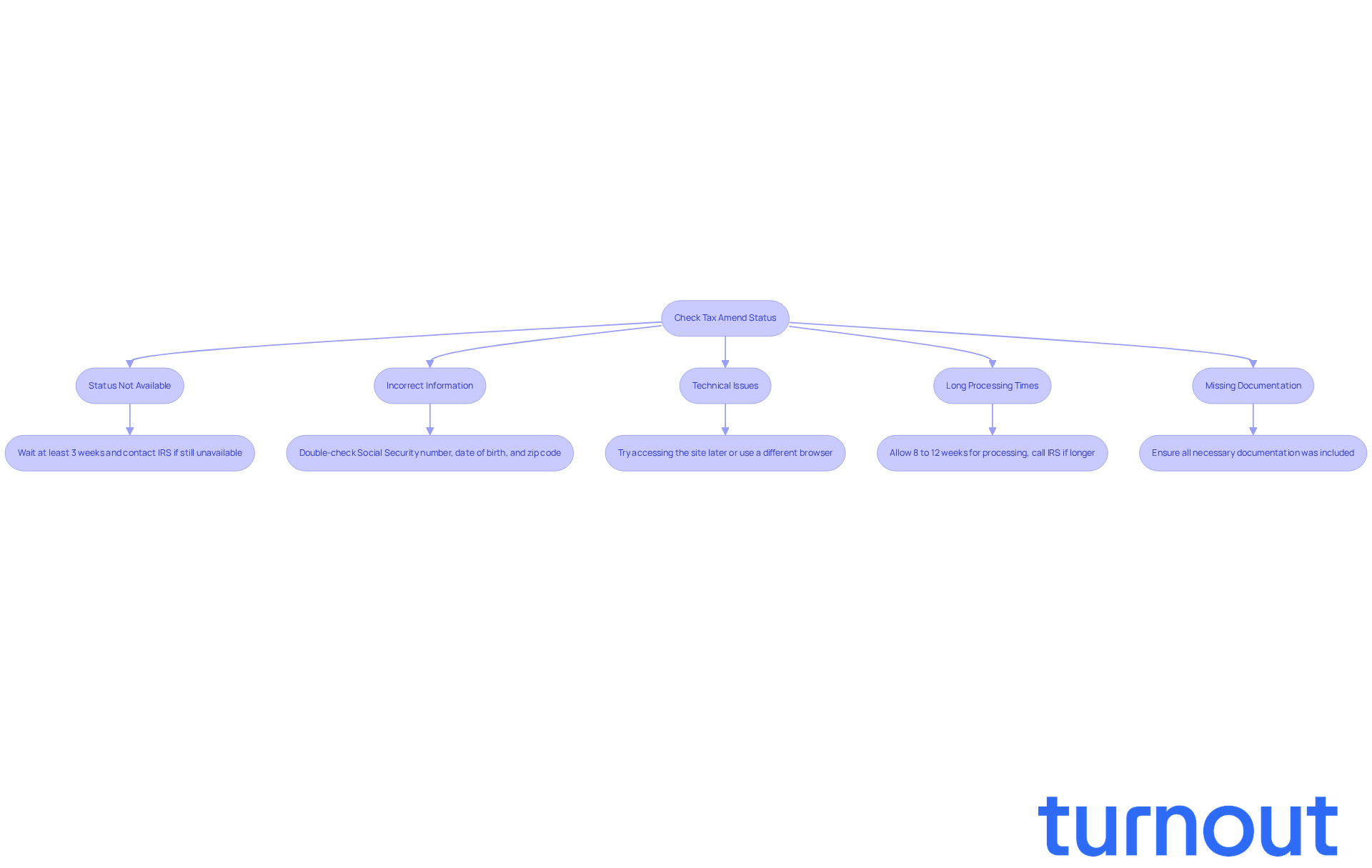

Troubleshoot Common Issues When Checking Status

When checking your tax amend status, it’s common to run into a few bumps along the way. We understand that navigating this process can be stressful, so let’s address some common issues you might face:

-

Status Not Available: If you see that your status isn’t available, don’t worry just yet. Make sure you’ve waited at least three weeks after submitting your change. If it’s been longer, it might be a good idea to reach out to the IRS for assistance.

-

Incorrect Information: Double-check the details you entered. Is your Social Security number, date of birth, and zip code accurate? Any discrepancies can keep you from accessing your status, so it’s worth taking a moment to verify.

-

Technical Issues: If the IRS website is down or you’re facing technical difficulties, try accessing the site at a different time or using another browser. It’s frustrating, but these things happen!

-

Long Processing Times: Generally, you should allow 8 to 12 weeks for processing your Form 1040-X. However, some cases may take up to 16 weeks. If your adjustment has been pending longer than this, it’s perfectly reasonable to call the IRS for clarification. Just be ready with your amended return details for reference.

-

Missing Documentation: If your revision was rejected or not processed, check to ensure that all necessary documentation was included when you submitted your modification. Missing forms can significantly delay processing; in fact, nearly 25% of refund delays in previous cycles were linked to clerical errors.

By following these troubleshooting steps, you can effectively navigate the complexities of checking your tax amend status. Remember, you’re not alone in this journey, and we’re here to help you resolve any issues that arise.

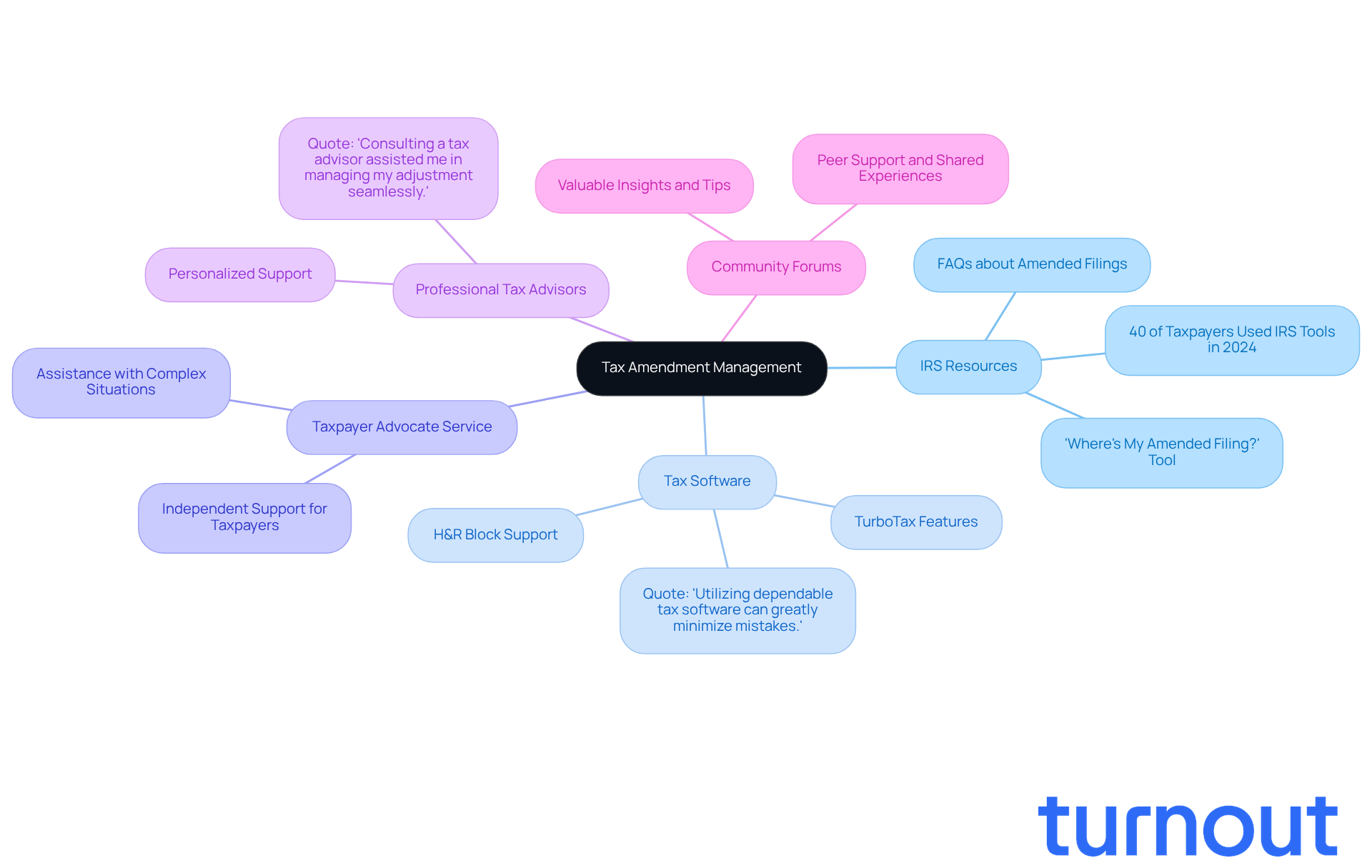

Access Resources and Tools for Tax Amendment Management

Managing your tax amend status can feel overwhelming, but you are not alone in this journey. Here are some resources and tools that can help you navigate the process with confidence:

-

IRS Resources: The IRS website is a vital resource, offering a wealth of information, including FAQs about amended filings and the 'Where's My Amended Filing?' tool. This handy feature allows you to track the status of your revised submission, providing updates on its processing. Did you know that nearly 40% of taxpayers turned to IRS tools for amended filings in 2024? This highlights just how important these resources can be.

-

Tax Software: Consider using leading tax preparation software like TurboTax or H&R Block. These platforms come equipped with features specifically designed to assist you in filing and tracking amended returns. With step-by-step guidance, they make the process more manageable and help ensure accuracy. As one tax expert wisely noted, "Utilizing dependable tax software can greatly minimize mistakes and simplify the correction process."

-

Taxpayer Advocate Service: If you find yourself facing significant challenges with your correction, the Taxpayer Advocate Service is here to help. This independent organization within the IRS is dedicated to supporting taxpayers like you in resolving issues and navigating complex situations.

-

Professional Tax Advisors: Engaging a tax professional can be especially beneficial for more complicated cases. They provide personalized support, ensuring your modification is submitted accurately and that you receive any refunds you’re entitled to. One taxpayer shared, "Consulting a tax advisor assisted me in managing my adjustment seamlessly and retrieving my refund promptly."

-

Community Forums: Don’t underestimate the power of community! Online forums and groups, such as Reddit or specialized tax communities, can offer peer support and shared experiences. Connecting with others who have faced similar challenges can provide valuable insights and tips that may aid in your amendment process.

Remember, you’re not alone in this. We’re here to help you every step of the way.

Conclusion

Understanding and managing your tax amend status is crucial for ensuring your tax filings are accurate and reflect any necessary corrections. We know that navigating the amendment process can feel overwhelming, but taking the time to do so can help you reclaim potential refunds and address any discrepancies from your initial submissions.

In this guide, we’ve outlined key steps to assist you. You’ll learn how to check your tax amendment status, troubleshoot common issues, and access valuable resources. From waiting for the IRS processing period to utilizing online tools and seeking professional assistance, each aspect plays a vital role in successfully managing tax amendments. Remember, these adjustments are significant; they directly impact your financial outcomes.

Ultimately, taking proactive steps in managing tax amendments empowers you and fosters confidence in navigating the complexities of tax obligations. By leveraging available resources and understanding the processes involved, you can feel well-equipped to handle your tax affairs effectively. Embracing this knowledge can lead to a smoother experience and the potential for financial recovery.

You are not alone in this journey. We’re here to help you every step of the way.

Frequently Asked Questions

What are tax amendments?

Tax amendments are changes you can make to your previously submitted tax filings to reflect your tax amend status, allowing you to correct mistakes such as reporting incorrect income or missing deductions.

Why are tax amendments important?

Tax amendments are important because they can significantly affect your tax obligations and potential refunds, giving you the chance to reclaim money that you may have missed.

What should I do if I realize I left out a significant deduction after filing?

If you realize you left out a significant deduction after filing, you should check your tax amend status and consider amending your tax submission to reclaim any money that is rightfully yours.

How long does it take for the IRS to process a revised tax submission?

The IRS typically takes about 8 to 12 weeks to process a revised tax submission.

How can understanding tax amendments help me?

Understanding tax amendments can empower you to navigate the process more effectively, allowing you to manage your tax obligations and maximize your potential refunds.