Introduction

Navigating the complexities of state taxes can often feel like an uphill battle. We understand that in North Carolina, where tax regulations are constantly evolving, this can be particularly challenging. It's crucial for residents to grasp the fundamentals of the state's tax system to manage their financial responsibilities effectively.

This guide offers a clear pathway through the intricacies of North Carolina's tax payment process. From choosing the right payment method to completing the transaction seamlessly, we’re here to help you every step of the way. However, with various options available and potential pitfalls lurking at every turn, it’s common to feel overwhelmed. How can you ensure you’re making the best choices to avoid penalties and stress? You are not alone in this journey.

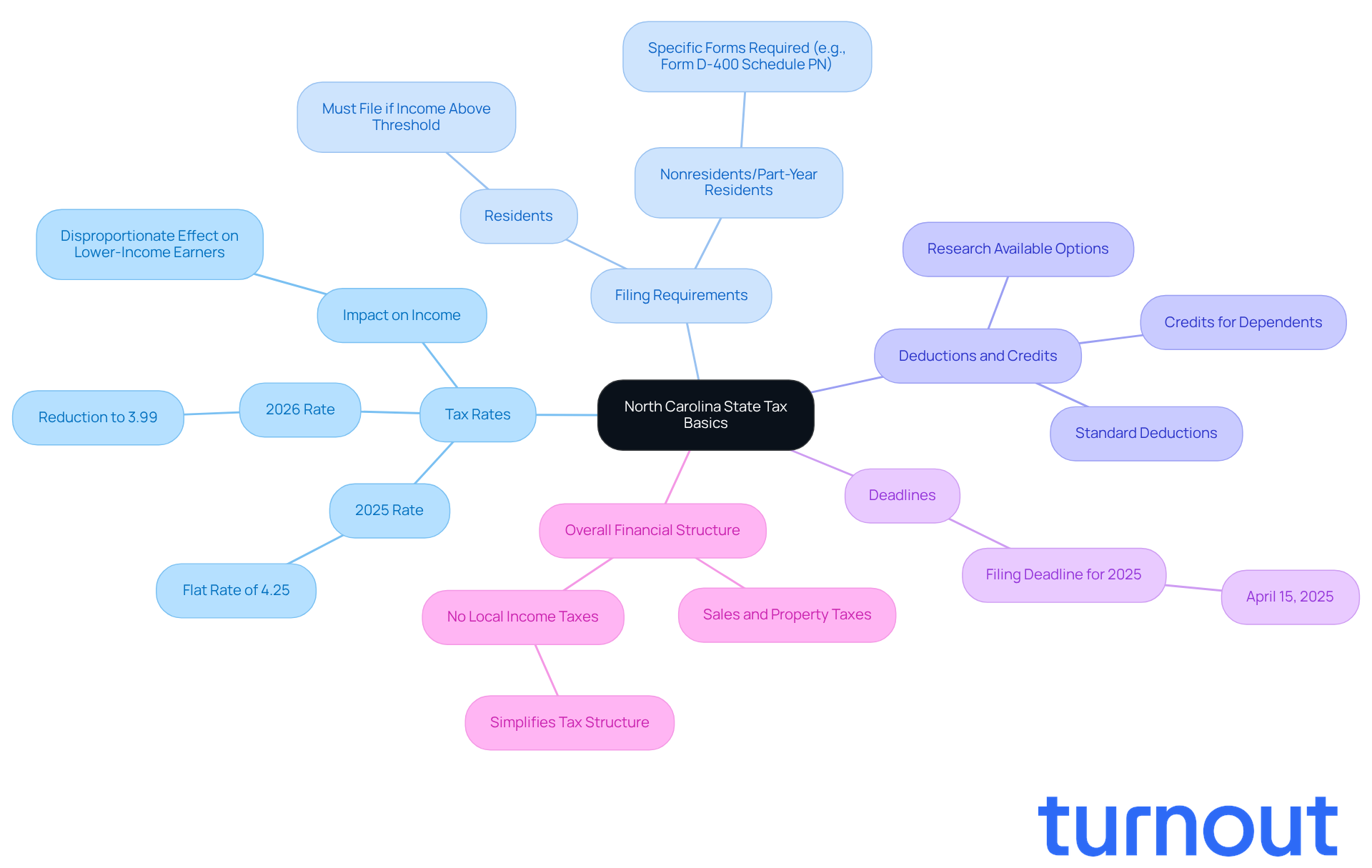

Understand North Carolina State Tax Basics

Before making any nc state tax payment, it’s essential to grasp the basics of state taxes in your area. We understand that navigating tax regulations can feel overwhelming, but knowing the fundamentals can ease your worries. The state has a flat income tax rate, which is set to decrease to 3.99% for the tax year 2026. Here are some key points to keep in mind:

- Tax Rates: For 2025, the individual income tax rate is 4.25%. This rate will drop to 3.99% in 2026, so it’s important to stay updated on these changes. The flat tax rate applies uniformly to all taxable income, which can disproportionately impact lower-income earners.

- Filing Requirements: All residents must file a tax return if they earn income above a certain threshold. If you’re a nonresident or part-year resident, there are specific forms to complete, like Form D-400 Schedule PN.

- Deductions and Credits: Understanding available deductions and credits can significantly affect your tax liability. Research what applies to your situation, such as standard deductions or credits for dependents. Familiarizing yourself with these options can help reduce your overall tax burden.

- Deadlines: Be aware of important deadlines for nc state tax payment and filing to avoid penalties. For 2025, the due date for individual income tax returns is April 15, 2025.

It’s also important to note that North Carolina’s overall financial burden includes sales levies and property levies, which contribute to the state’s income. The absence of local income levies simplifies the financial structure, making it easier for residents to understand their responsibilities. By grasping these fundamentals, you’ll feel more prepared to navigate the tax submission process effectively. Remember, you’re not alone in this journey; we’re here to help!

Choose Your Payment Method

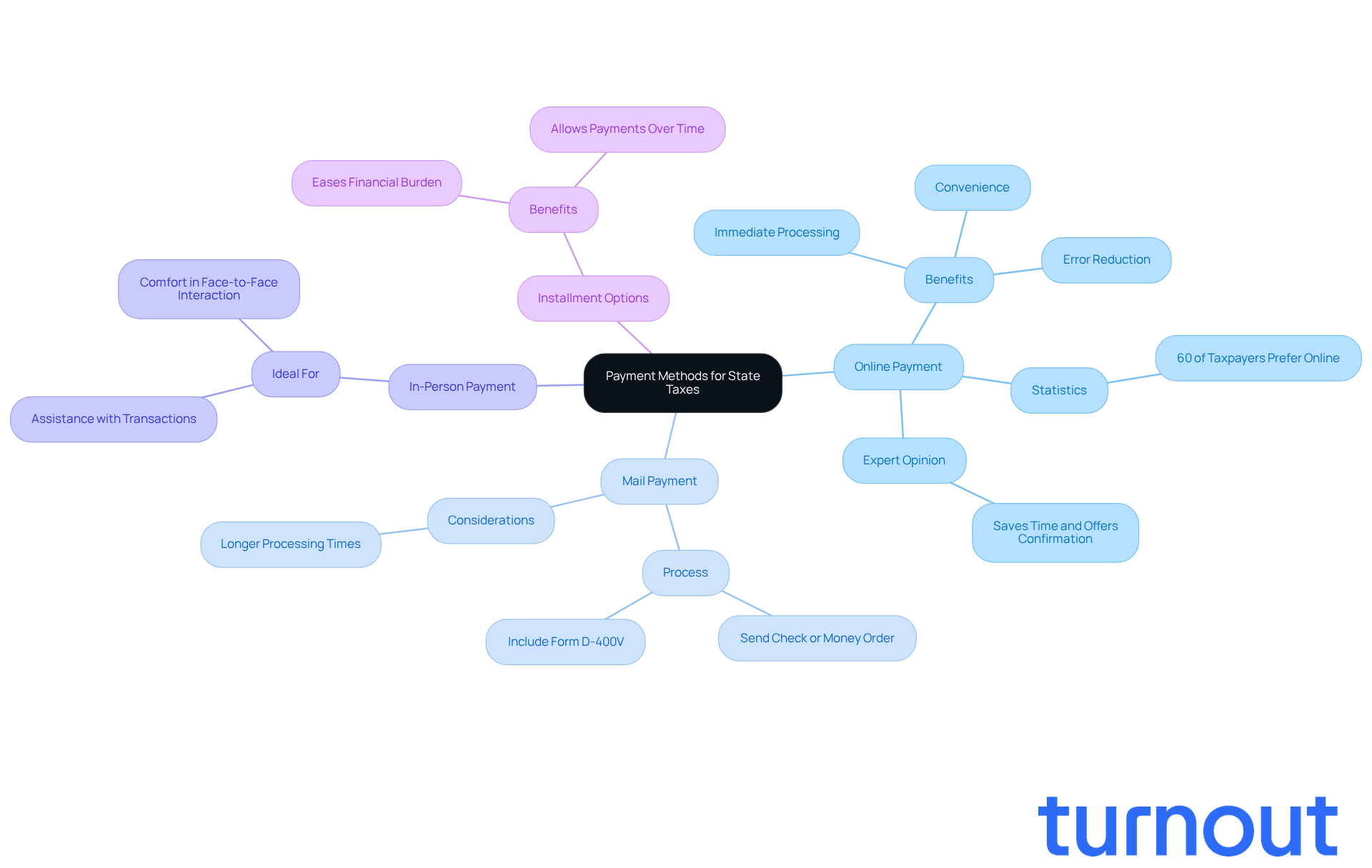

Once you grasp the fundamentals of state taxes in your area, the next step is to choose how you want to handle your transactions. We understand that this can feel overwhelming, so let’s explore your options together:

-

Online Payment: The North Carolina Department of Revenue (NCDOR) provides an online payment portal where you can pay using a credit/debit card or bank draft. This method is not only convenient but also allows for immediate processing of nc state tax payment, making it a popular choice among many taxpayers. In fact, recent statistics show that over 60% of taxpayers in North Carolina now prefer online methods, reflecting a growing trend towards digital transactions. Tax experts emphasize the benefits of online payments for making nc state tax payment, noting that they simplify the process and reduce the chance of errors. As one expert shared, 'Online transactions not only save time but also offer immediate confirmation, giving taxpayers peace of mind about their nc state tax payment.'

-

Mail Payment: Alternatively, you can send a check or money order to the NCDOR. Just make sure your remittance includes the right forms, like Form D-400V, and is sent to the correct address to avoid any delays. While this method may take longer due to processing times, making an nc state tax payment through this option is still valid.

-

In-Person Payment: If you prefer face-to-face interactions, you can make payments in person at designated NCDOR offices. This option might be ideal for those who need assistance with their transactions or simply feel more comfortable speaking to someone directly.

-

Installment Options: If paying your tax bill in full feels daunting, don’t hesitate to ask about setting up an installment plan with the NCDOR. This option allows you to pay your taxes over time, easing the financial burden.

Consider the convenience, fees, and processing times associated with each method. Remember, we’re here to help you find the best option for your situation.

Complete Your Tax Payment

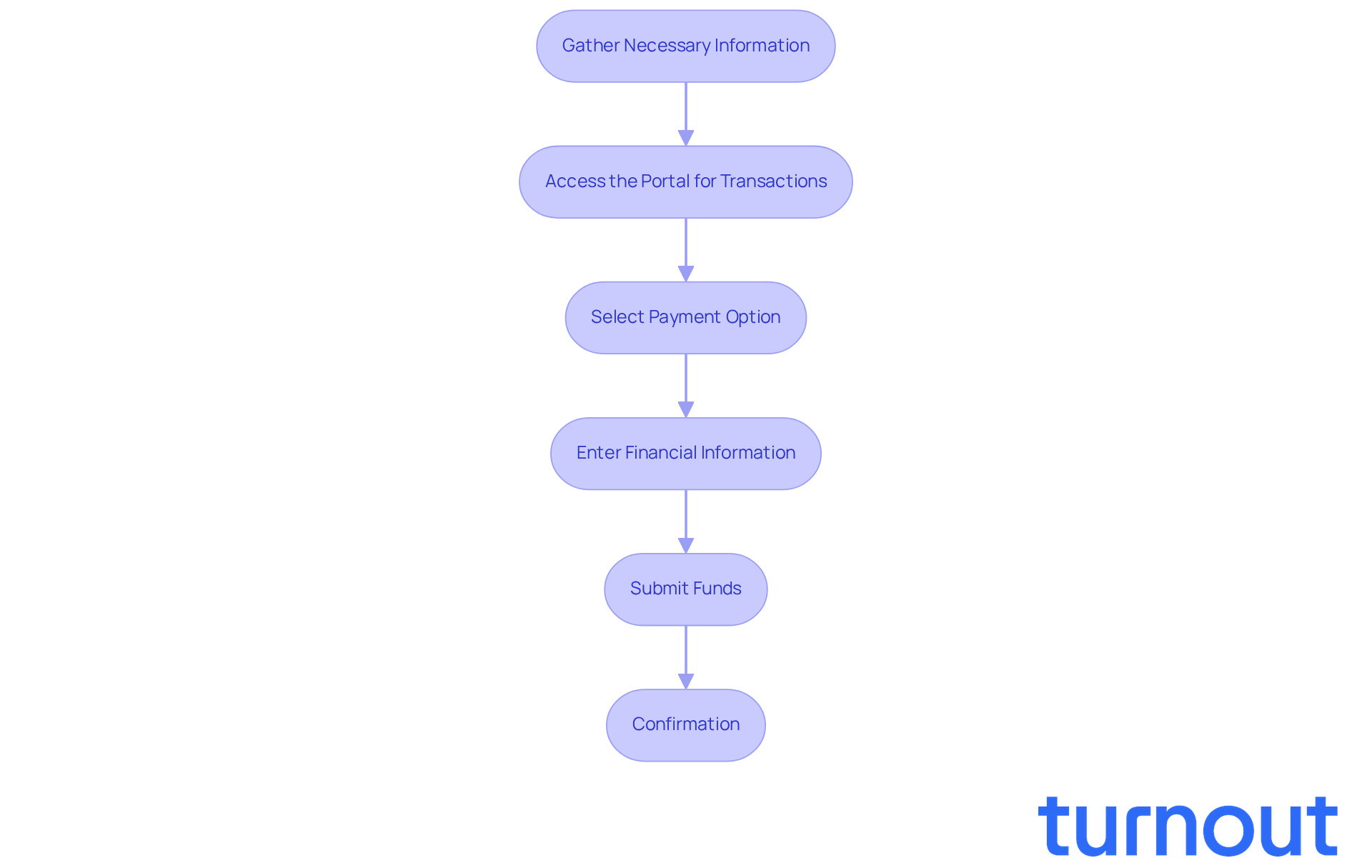

To successfully complete your North Carolina state tax payment, follow these essential steps:

-

Gather Necessary Information: We understand that getting started can be overwhelming. Begin by locating your tax reference number for the NC state tax payment, typically found on your tax documents or notices. This number is crucial for processing your transaction accurately.

-

Access the Portal for Transactions: For online transactions, visit the North Carolina Department of Revenue (NCDOR) website to complete your nc state tax payment. To begin your nc state tax payment, navigate to the 'File & Pay' section and select 'Pay Original Individual Income Tax'. It’s common to feel unsure about where to go, but you’re on the right path!

-

Select Payment Option: Choose your preferred option for making your nc state tax payment, either credit/debit card or bank draft. Just a heads up: be mindful of any convenience fees linked to card transactions, as these can increase your total cost.

-

Enter Financial Information: Input the required details, including your tax reference number, amount due, and personal information. Accuracy is key; double-check all entries to prevent processing delays. We know it can feel tedious, but this step is vital for a smooth process.

-

Submit Funds: Review your transaction details carefully before submission. If you opt to pay by mail, ensure your check or money order for your nc state tax payment is made out to the 'NC Department of Revenue' and includes your tax reference number for proper identification. Remember, taking a moment to double-check can save you from future headaches.

-

Confirmation: After submitting your transaction, retain a copy of the confirmation for your records. If sending your funds, consider using a tracking service to confirm its delivery. This can help avoid potential issues with late transactions, giving you peace of mind.

By following these steps, you can manage the tax submission process with assurance, reducing the likelihood of typical problems that taxpayers frequently face in the state. Remember, timely filing is crucial to avoid penalties. The IRS advises that failing to file on time can lead to additional charges. Stay informed about the latest changes in the 2026 tax guide to ensure you are compliant with current regulations. We’re here to help you navigate this journey!

Access Resources and Troubleshooting Support

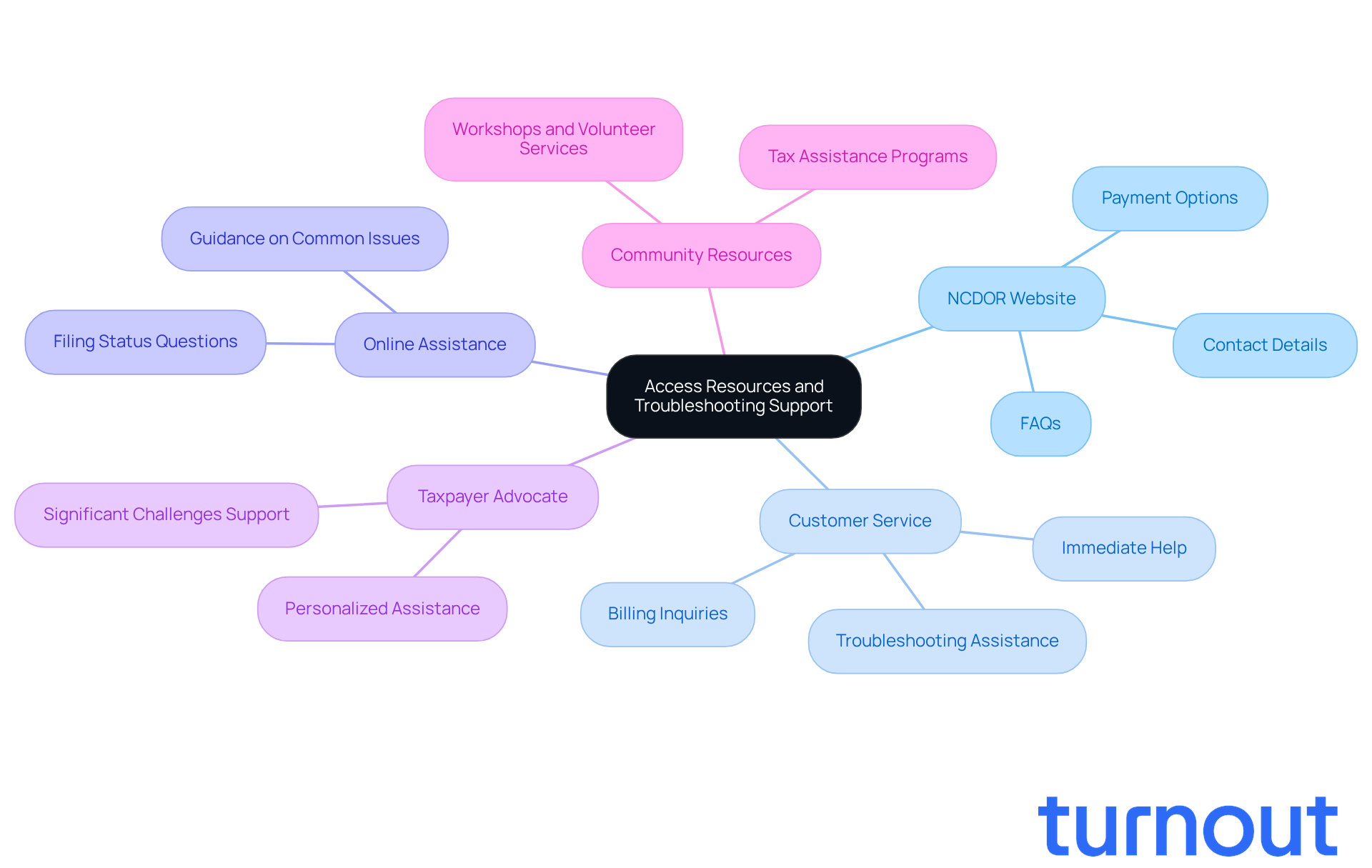

If you're facing challenges with your nc state tax payment, know that you're not alone. There are many resources available to help you navigate this process:

- NCDOR Website: The North Carolina Department of Revenue (NCDOR) website is a valuable resource. It features FAQs, various payment options, and contact details for further assistance.

- Customer Service: For immediate help, you can call the NCDOR at 1-877-252-3052. Their friendly representatives are ready to assist you with billing inquiries and troubleshooting.

- Online Assistance: The online assistance section on the NCDOR website provides guidance on common issues, such as transaction processing errors and questions about your filing status.

- Taxpayer Advocate: If you encounter significant challenges, consider reaching out to the Office of the Taxpayer Advocate. They offer personalized assistance tailored to your situation.

- Community Resources: Local organizations often provide tax assistance programs, especially during tax season. Look for community workshops or volunteer tax preparation services that can offer additional support.

By utilizing these resources, you can confidently tackle any challenges that arise during your nc state tax payment. Remember, effective customer service is crucial in ensuring you feel supported and informed throughout your experience. We're here to help you every step of the way.

Conclusion

Understanding the complexities of North Carolina state tax payments can feel overwhelming. We know that navigating this process is essential for all residents to ensure compliance and avoid penalties. This guide has aimed to equip you with the knowledge needed to approach tax payments with confidence, from grasping the basics of state taxes to choosing the best payment method for your situation.

Key points we've discussed include:

- The flat income tax rates

- The importance of staying informed about upcoming changes, like the reduction to 3.99% in 2026

- Various payment options: online, mail, and in-person

- The importance of gathering necessary information and double-checking transactions for accuracy

Remember, you're not alone in this; resources and troubleshooting support are available to help you overcome any challenges you might face during the payment process.

By taking proactive steps to understand and manage your state tax obligations, you can alleviate stress and ensure timely compliance. Engaging with available resources, such as the NCDOR website and community assistance programs, can enhance your experience. Ultimately, mastering the North Carolina state tax payment process not only fosters financial responsibility but also empowers you to navigate your fiscal duties with confidence. We're here to help you every step of the way.

Frequently Asked Questions

What is the current individual income tax rate in North Carolina for the year 2025?

The individual income tax rate in North Carolina for 2025 is 4.25%.

When will the income tax rate decrease, and what will the new rate be?

The income tax rate in North Carolina is set to decrease to 3.99% for the tax year 2026.

Who is required to file a tax return in North Carolina?

All residents must file a tax return if they earn income above a certain threshold. Nonresidents or part-year residents must complete specific forms, such as Form D-400 Schedule PN.

How can deductions and credits affect my tax liability in North Carolina?

Understanding available deductions and credits can significantly reduce your tax liability. It’s important to research what applies to your situation, such as standard deductions or credits for dependents.

What is the due date for individual income tax returns in North Carolina for 2025?

The due date for individual income tax returns in North Carolina for 2025 is April 15, 2025.

Are there local income taxes in North Carolina?

No, North Carolina does not have local income taxes, which simplifies the financial structure for residents.

What other types of taxes contribute to North Carolina's overall financial burden?

North Carolina's overall financial burden includes sales levies and property levies, which contribute to the state's income.