Introduction

Navigating tax obligations can feel overwhelming, especially when the thought of owing money to the IRS looms large. We understand that this can be a stressful time, and knowing your options is crucial for regaining control over your financial situation. This guide is here to provide you with a clear roadmap to mastering IRS tax owed payment plans.

You’ll find insights into eligibility criteria, application processes, and effective management strategies. But how can you ensure that you choose the right plan? It’s common to feel uncertain, but with the right information, you can minimize stress and avoid penalties. Remember, you are not alone in this journey; we’re here to help.

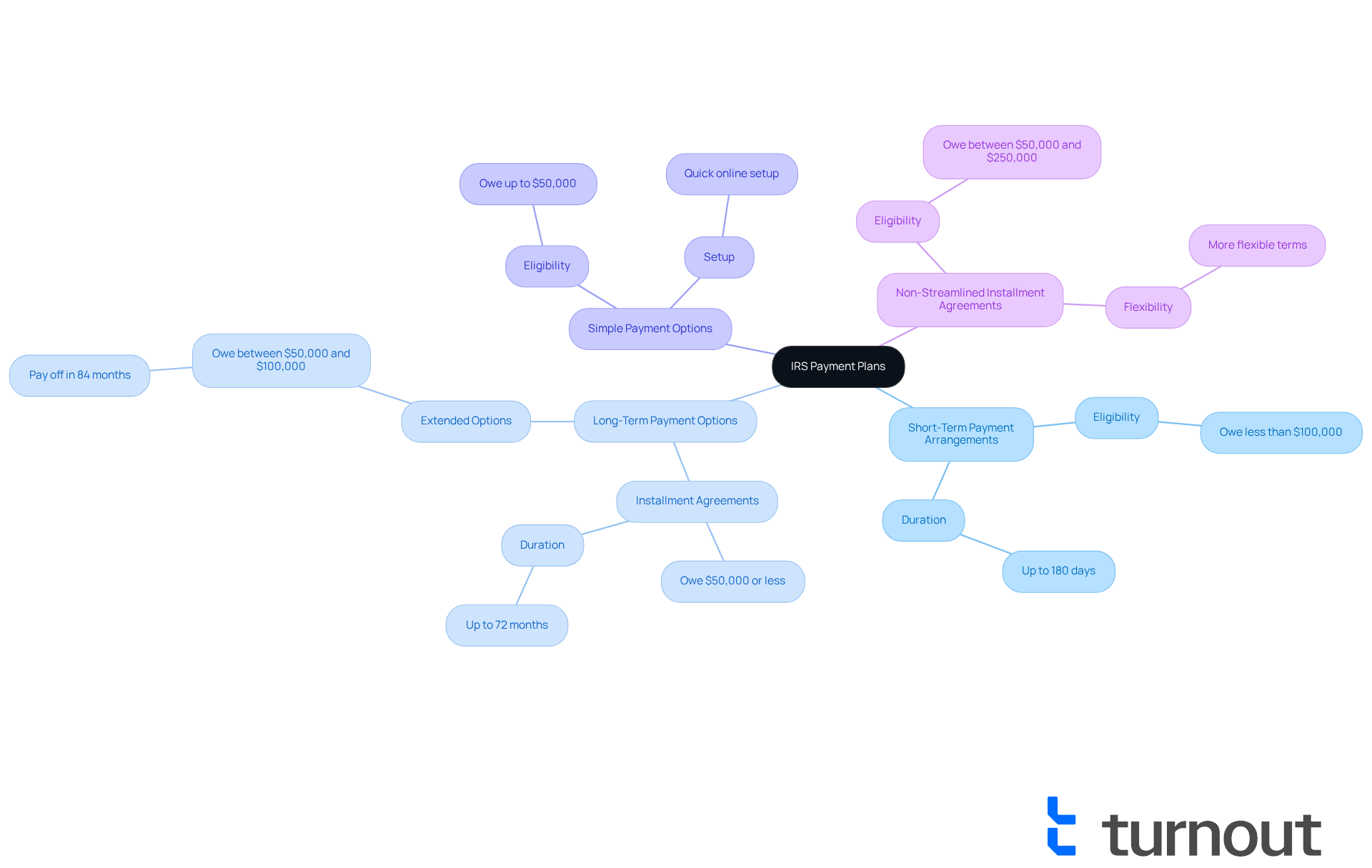

Understand IRS Payment Plans

The IRS provides various financial arrangements, such as an IRS tax owed payment plan, to assist you in managing your tax obligations. We understand that navigating these options can feel overwhelming, but knowing what’s available is the first step toward resolving your tax concerns. Here’s a look at the main types of payment plans:

-

Short-Term Payment Arrangements: If you owe less than $100,000 in total tax, penalties, and interest, you can set up a short-term payment plan. This option gives you up to 180 days to pay your balance in full, providing some breathing room during a stressful time.

-

Long-Term Payment Options (Installment Agreements): For those who need a bit more time, an IRS tax owed payment plan allows you to pay your tax debt over an extended period-typically up to 72 months-if you owe $50,000 or less. This can make a significant difference in managing your finances.

-

Simple Payment Options: Recently introduced, these options are designed for individual taxpayers who owe up to $50,000 and can be set up quickly online. It’s a straightforward way to get started on your repayment journey.

-

Non-Streamlined Installment Agreements: If your debts range between $50,000 and $250,000, this option offers more flexible terms to accommodate your situation.

Understanding these strategies can empower you to choose the best financial option, such as an IRS tax owed payment plan, for your circumstances. Remember, you’re not alone in this journey, and we’re here to help you find the right path forward.

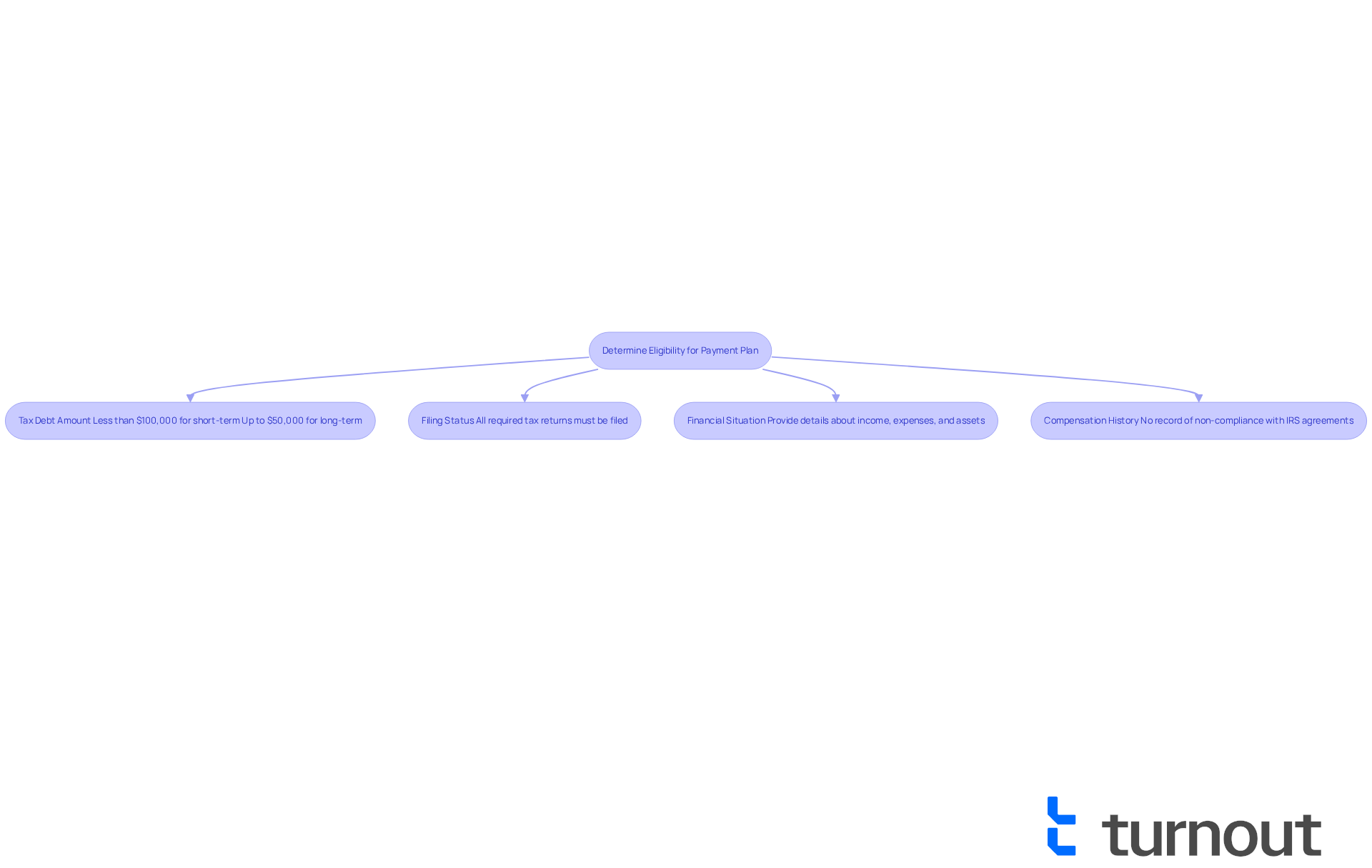

Determine Eligibility for a Payment Plan

Before you apply for an IRS payment plan, it’s important to confirm your eligibility based on a few key criteria. We understand that navigating tax obligations can be overwhelming, but knowing what to look for can make the process smoother.

-

Tax Debt Amount: Your total tax obligation should fall within the limits for the type of arrangement you’re considering. For short-term arrangements, the debt should be less than $100,000. If you’re looking at long-term options, those are available for debts up to $50,000.

-

Filing Status: It’s essential that all required tax returns are filed. The IRS won’t accept a settlement arrangement if there are any unfiled returns, so make sure you’re up to date.

-

Financial Situation: Be ready to share details about your income, expenses, and assets. The IRS will assess your ability to pay based on this information, so transparency is key.

-

Compensation History: If you have a record of non-compliance with IRS compensation agreements, it could affect your eligibility. We know this can be a concern, but understanding your history can help you move forward.

Did you know that over 90% of individual taxpayers with a balance due qualify for an IRS tax owed payment plan? This makes it crucial to verify your eligibility, helping you streamline the application process and avoid unnecessary delays. As tax lawyer Nick Nemeth points out, grasping these criteria can greatly simplify the procedure of establishing a repayment arrangement.

Additionally, establishing direct debit is a smart move. It can reduce fees and help prevent missed transactions. Remember, prompt remittances are vital to keeping your agreement in good standing. You’re not alone in this journey; we’re here to help you every step of the way.

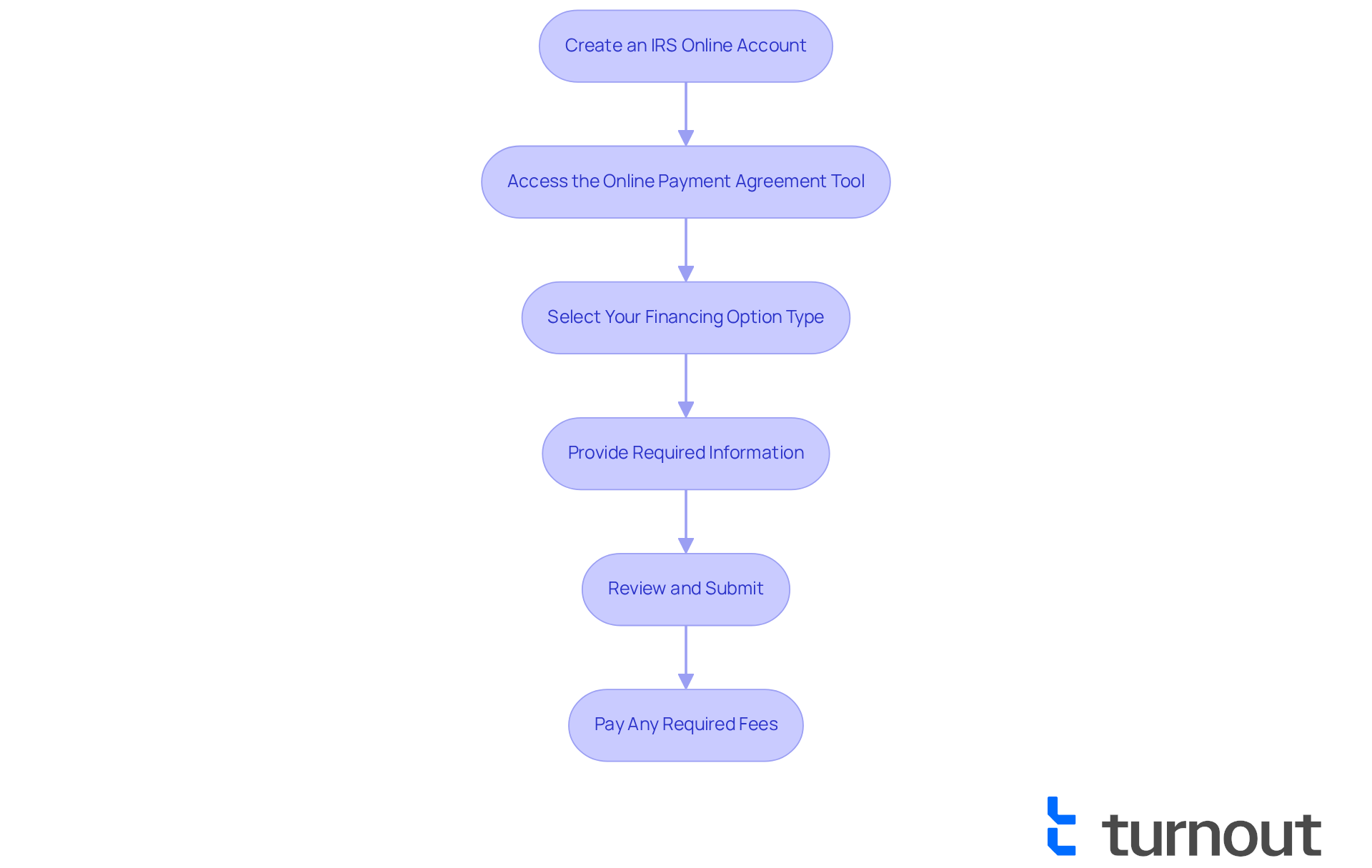

Apply for a Payment Plan Online

If you're feeling overwhelmed by your tax responsibilities, know that you're not alone. Applying for an IRS tax owed payment plan online can be a straightforward process, and we're here to guide you through it step by step.

-

Create an IRS Online Account: If you haven’t set one up yet, visit the IRS website to create your account. You’ll need some personal information, like your Social Security number, date of birth, and filing status.

-

Access the Online Payment Agreement Tool: Once you’re logged in, head over to the Online Payment Agreement tool on the IRS website. This is where the process begins.

-

Select Your Financing Option Type: You have options! Choose between a short-term arrangement, which gives you up to 180 days to settle balances under $100,000, or a long-term plan for balances under $50,000 that can extend up to 72 months. If your debt is between $50,000 and $100,000, you can pay it off in 84 months or within the collection statute with minimal questions from the IRS.

-

Provide Required Information: Fill out the application form with your tax details, including the amount owed and relevant financial information. Most individual taxpayers can qualify for an IRS tax owed payment plan through this online process, which doesn’t require extensive financial disclosures for balances under $250,000. However, if your debt exceeds $100,000, you’ll need to provide more detailed financial information.

-

Review and Submit: Before you hit submit, take a moment to carefully review your application for accuracy. You might receive immediate approval or a confirmation that your application is being processed.

-

Pay Any Required Fees: Keep in mind that setup charges may apply, depending on the billing arrangement you choose. These fees can vary, so it’s a good idea to check the IRS website for specific details.

If you find yourself unable to pay, you can also request a temporary delay in the collection process. Just remember, penalties and interest will continue to accrue until the full amount is settled.

By following these steps, you can confidently establish your financial arrangement online. This way, you can manage your tax responsibilities with greater ease and peace of mind.

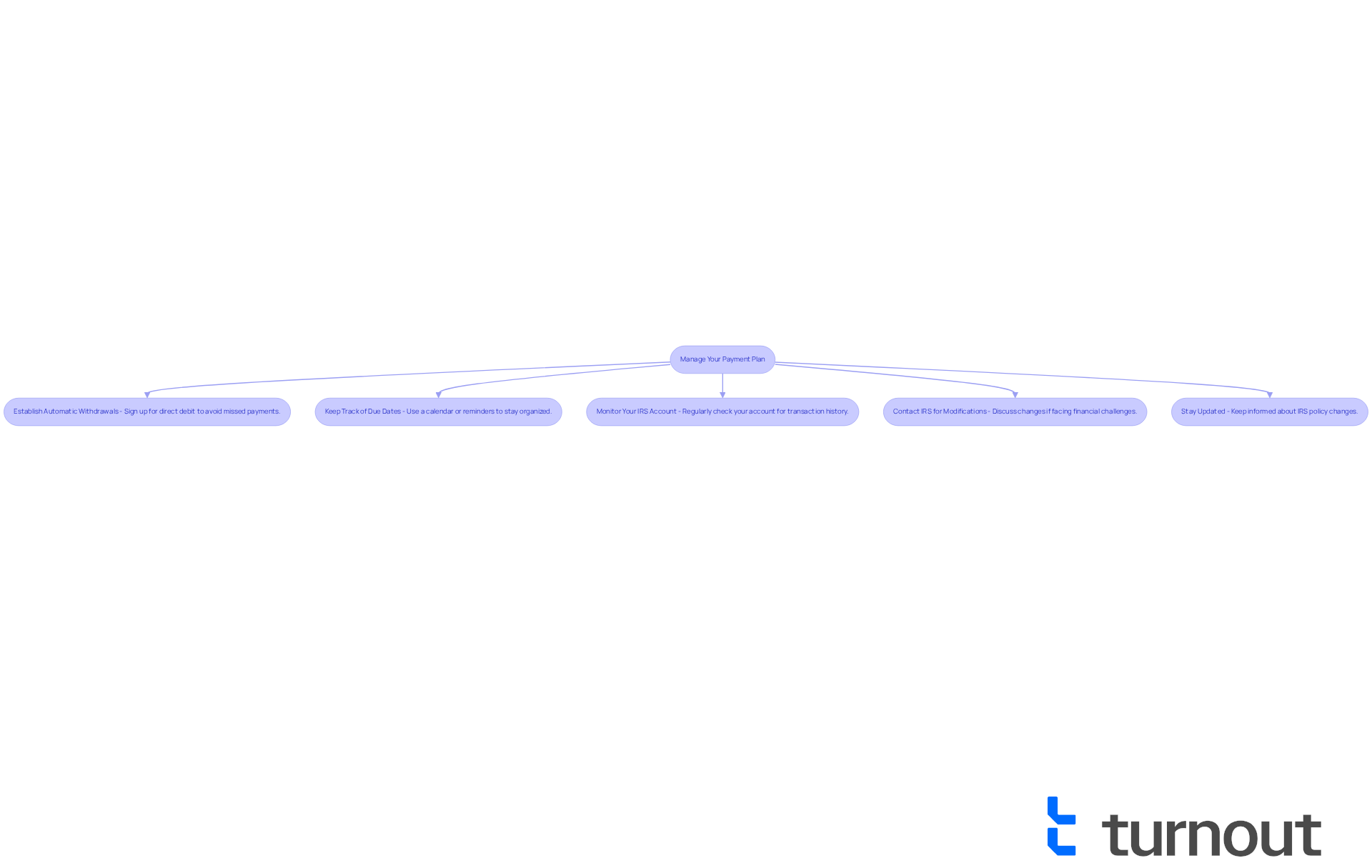

Manage Your Payment Plan Effectively

Once your IRS tax owed payment plan is established, managing it effectively is crucial to avoid penalties and ensure compliance. We understand that navigating these waters can be challenging, so here are some supportive tips to help you:

-

Establish Automatic Withdrawals: Consider signing up for direct debit to automatically deduct your monthly fee from your bank account. This simple step can significantly reduce the chance of missed transactions. In fact, about 88% of taxpayers opted for automatic withdrawals as part of their IRS tax owed payment plan arrangements in 2025. Plus, with the IRS interest rate for installment arrangements hovering around 7% in 2025, having an IRS tax owed payment plan and making timely contributions is even more important to prevent extra interest from piling up.

-

Keep Track of Due Dates: It’s common to feel overwhelmed, so marking your obligation due dates on a calendar or setting reminders on your phone can be a lifesaver. Staying organized helps you maintain your agreement and avoid unnecessary penalties.

-

Monitor Your IRS Account: Regularly checking your IRS online account allows you to review your transaction history and ensure your contributions are being applied correctly. This proactive approach can help you catch any discrepancies early, giving you peace of mind.

-

If you find yourself facing financial challenges and unable to meet a financial obligation, don’t hesitate to contact the IRS to discuss an IRS tax owed payment plan. They may allow you to modify your financial arrangement, offering flexibility during tough times. Remember, the failure-to-pay penalty decreases from 0.5% to 0.25% for timely submissions, reinforcing the importance of staying on track.

-

Stay Updated: Keeping an eye on any changes to IRS policies regarding financial arrangements is essential, as these can impact your agreement. Understanding the latest guidelines can help you navigate your obligations more effectively. As Jim Buttonow, Senior Vice President for Post-Filing Tax Services at Jackson Hewitt, noted, individual taxpayers with debts up to $250,000 now have a simpler path to an IRS tax owed payment plan.

By following these management strategies, you can uphold your financial plan and work towards resolving your tax debt. Additionally, think about the potential savings from shortening your repayment period; for instance, reducing a 60-month installment agreement to 36 months could save you thousands in total interest. As financial advisors often emphasize, every payment you make brings you closer to stability, and staying informed is key to making smart financial decisions. Remember, you are not alone in this journey, and we're here to help.

Conclusion

Navigating the complexities of IRS tax owed payment plans can feel overwhelming. We understand that managing tax obligations is a significant concern for many. However, knowing the available options is essential for finding a path forward. By exploring different payment arrangements, like short-term and long-term plans, you can discover a solution that fits your financial situation, making it easier to resolve outstanding debts.

This article highlights key aspects of IRS payment plans, focusing on:

- Eligibility criteria

- The application process

- Effective management strategies

From confirming tax debt limits to setting up automatic withdrawals, these insights empower you to take control of your financial responsibilities. Did you know that over 90% of individual taxpayers qualify for some form of payment plan? Understanding these options is crucial for your peace of mind.

Ultimately, being proactive in managing IRS payment plans is vital for achieving financial stability. By following the outlined steps and tips, you can ensure timely payments, reduce penalties, and work towards a debt-free future. Taking charge of your tax obligations not only alleviates stress but also fosters a sense of empowerment in navigating financial challenges. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What types of IRS payment plans are available for managing tax obligations?

The IRS offers several payment plans, including short-term payment arrangements, long-term payment options (installment agreements), simple payment options, and non-streamlined installment agreements.

What is a short-term payment arrangement?

A short-term payment arrangement is available for individuals who owe less than $100,000 in total tax, penalties, and interest. It allows you up to 180 days to pay your balance in full.

What are long-term payment options?

Long-term payment options, also known as installment agreements, allow individuals who owe $50,000 or less to pay their tax debt over an extended period, typically up to 72 months.

What are simple payment options?

Simple payment options are designed for individual taxpayers who owe up to $50,000 and can be set up quickly online, providing a straightforward way to begin repayment.

What are non-streamlined installment agreements?

Non-streamlined installment agreements are available for individuals whose debts range between $50,000 and $250,000, offering more flexible terms to accommodate different financial situations.

How can understanding these payment plans help taxpayers?

Understanding these payment plans empowers taxpayers to choose the best financial option for their circumstances, helping them manage their tax obligations effectively.