Introduction

Navigating the complexities of tax obligations can feel overwhelming. We understand that managing an IRS installment plan balance is no easy task. This financial tool can be a lifeline for those struggling to meet their tax debts, allowing payments over time. Yet, many taxpayers find themselves uncertain about how to effectively utilize it.

What strategies can you employ to stay on track and avoid the pitfalls of missed payments or unexpected fees? This guide unpacks five simple steps to master an IRS installment plan. We’re here to empower you to take control of your tax responsibilities with confidence.

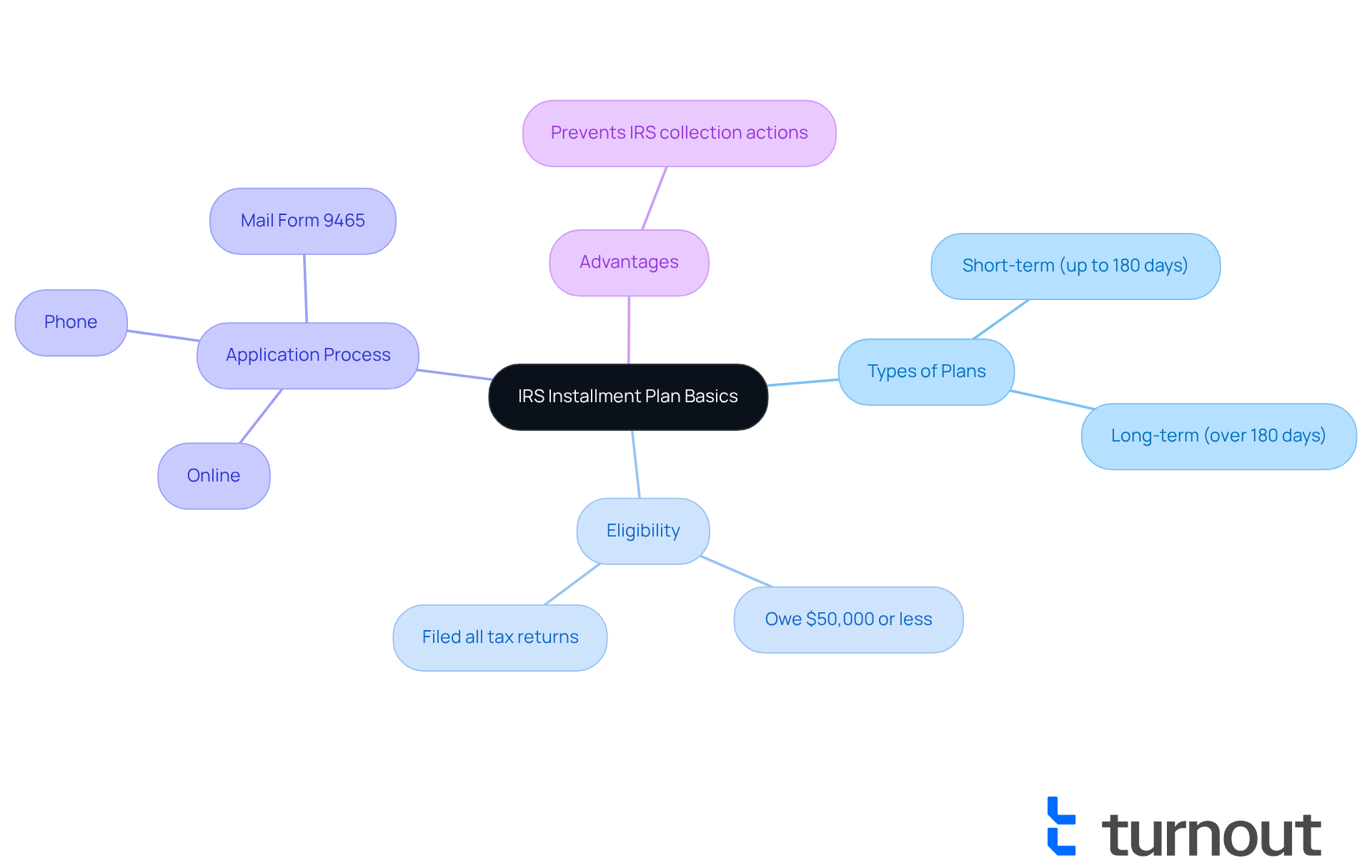

Understand Your IRS Installment Plan Basics

If you're feeling overwhelmed by tax obligations, know that you're not alone. An IRS installment plan balance, which is often viewed as a helpful financing option, enables you to settle your tax debts gradually rather than all at once. Here’s what you need to know:

- Types of Plans: You can choose between short-term plans (up to 180 days) and long-term plans (over 180 days). Short-term arrangements typically don’t come with a user charge, while long-term agreements might have a fee based on how you choose to pay.

- Eligibility: To qualify for an IRS installment plan balance, you should owe a total tax amount, including penalties and interest, of $50,000 or less, and you must have filed all necessary tax returns.

- Application Process: Applying for a payment plan is straightforward. You can do it online, by phone, or by mailing in Form 9465. The online route is usually the fastest.

- Advantages: Setting up a payment arrangement can prevent the IRS from taking collection actions, like levies or garnishments, while you work on paying off your debt.

Understanding these key points can help you determine if a payment arrangement is the right choice for your financial situation. Remember, we're here to help you navigate this process.

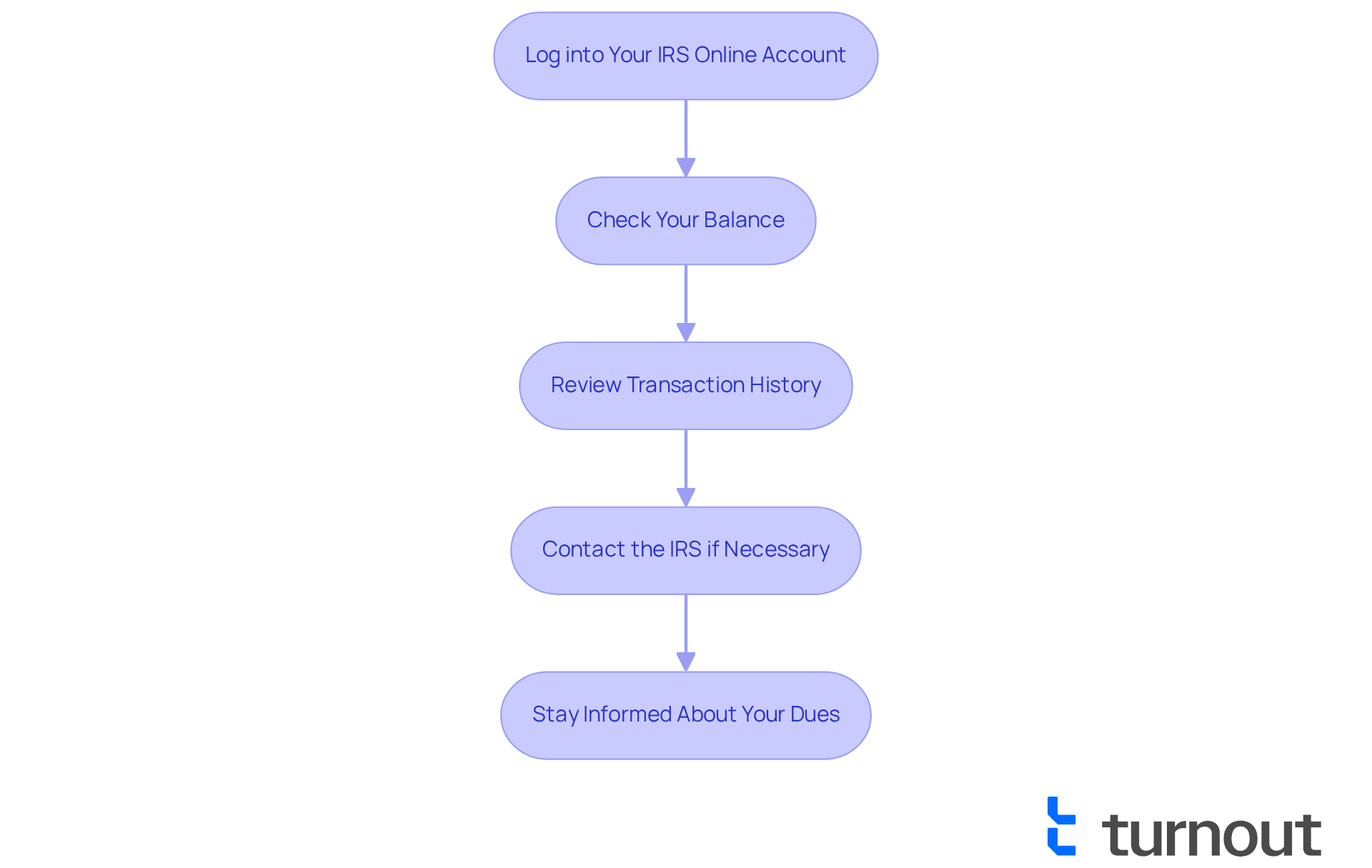

Assess Your Current IRS Installment Plan Balance

Managing your IRS installment plan can feel overwhelming, but knowing your current balance is a crucial first step. Let’s walk through how to assess it together:

-

Log into Your IRS Online Account: Begin by visiting the IRS website and signing in to your account. If you haven’t created one yet, don’t worry! It’s a simple process that just requires your personal information.

-

Check Your Balance: Once you’re logged in, head to the 'Payments' section. Here, you’ll find your current balance, including any penalties or interest that may have accrued. Keep in mind that your balance updates no more than once every 24 hours, so it’s a good idea to check back regularly.

-

Review Transaction History: Take a moment to examine your transaction history. This will show you how much you’ve contributed and what remains. Remember, it can take 1 to 3 weeks for transactions to appear, so patience is key. Understanding your progress can help you plan your future expenses more effectively.

-

Contact the IRS if Necessary: If you run into any issues accessing your account or need clarification on your balance, please don’t hesitate to reach out. You can call the IRS at 1-800-829-1040 for assistance.

By keeping a close eye on your balance, you’ll stay informed about your dues and avoid any unexpected surprises that could jeopardize your installment agreement. This financial arrangement can last up to 10 years, giving you the time to manage your obligations thoughtfully. Plus, with the ability to schedule transactions up to 365 days in advance, you can ensure timely compliance with ease.

Remember, you’re not alone in this journey. We’re here to help you navigate through it.

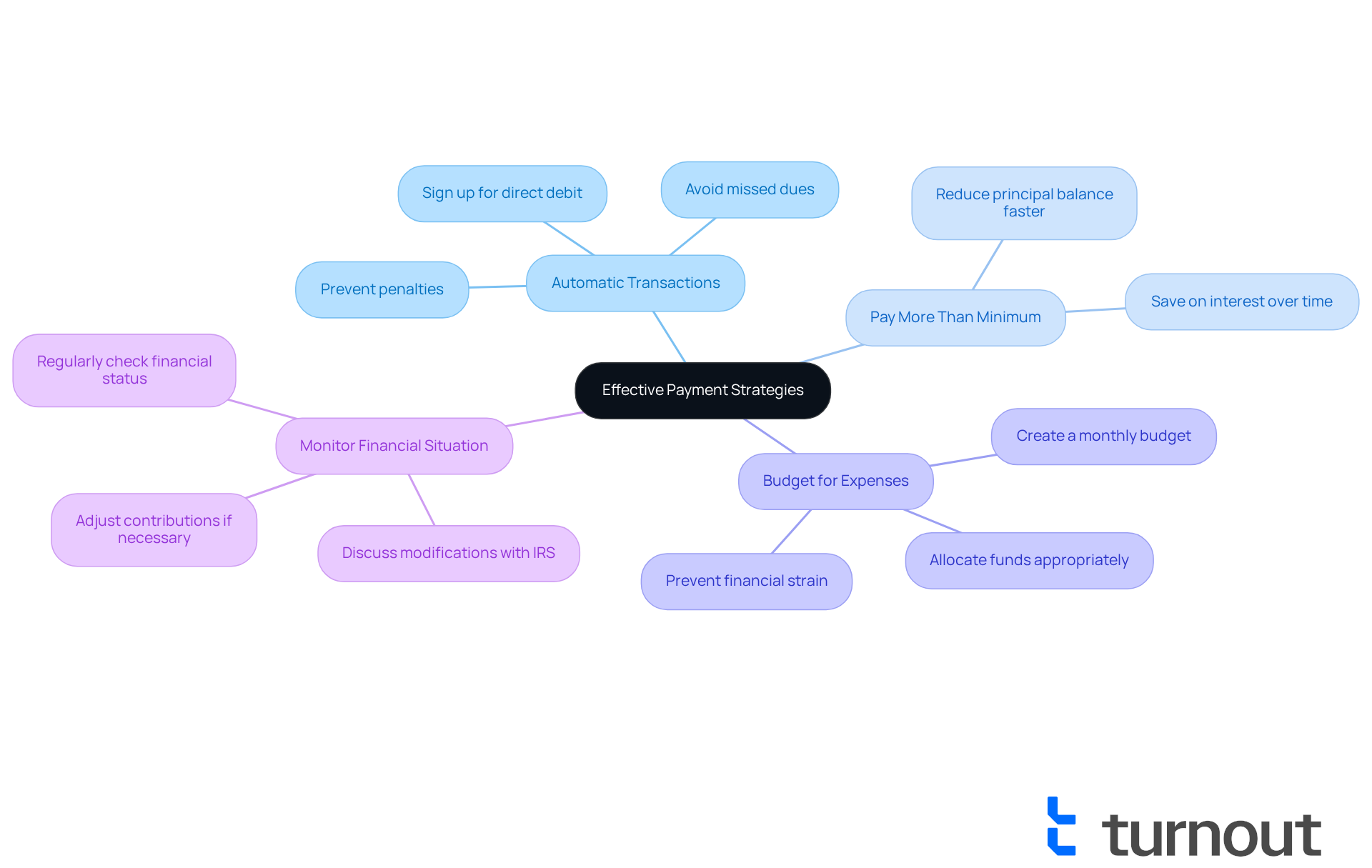

Implement Effective Payment Strategies

Managing your IRS installment plan balance can feel overwhelming, but you’re not alone in this journey. We understand that navigating financial obligations can be stressful, so here are some caring strategies to help you manage your payments effectively:

- Establish Automatic Transactions: If possible, consider signing up for direct debit. This way, your payments are handled automatically each month, helping you avoid missed dues and potential penalties.

- Pay More Than the Minimum: If your budget allows, think about paying more than the minimum required amount. This can help reduce your principal balance faster and save you money on interest over time.

- Budget for Expenses: Creating a monthly budget that includes your installment payments can be a game changer. It allows you to allocate funds appropriately and helps prevent financial strain.

- Monitor Your Financial Situation: Regularly check in on your financial status and adjust your contributions if necessary. If you notice a change in income, don’t hesitate to reach out to the IRS to discuss modifying your payment arrangement.

By applying these strategies, you can take control of your IRS payment arrangement and work towards settling your tax obligation more efficiently. Remember, we’re here to help you every step of the way.

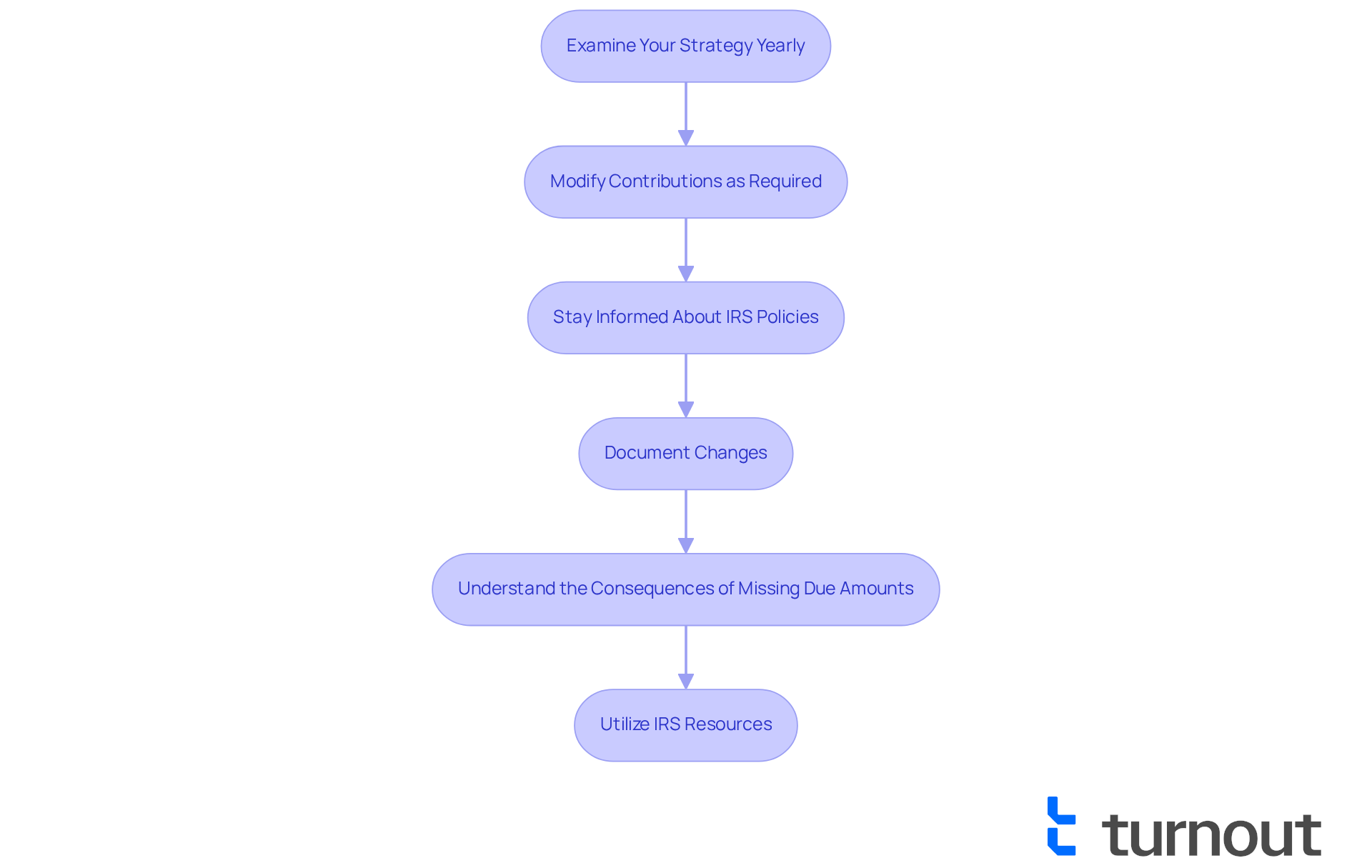

Monitor and Adjust Your Payment Plan Regularly

Regularly monitoring and adjusting your IRS installment plan balance is crucial for effective management. We understand that navigating tax obligations can be overwhelming, but you’re not alone in this journey. Here’s how to take control:

-

Examine Your Strategy Yearly: At least once a year, take a moment to assess your financial arrangement. Does it still align with your current monetary circumstances? Consider your income, expenses, and any changes in your tax obligations. This reflection can help you stay on track.

-

Modify Contributions as Required: Life can change unexpectedly. If your financial situation shifts, whether for the better or worse, adjust your monthly contribution accordingly. You can easily request a modification through the IRS online portal or by contacting them directly. In fact, by 2025, around 30% of taxpayers are expected to modify their financial arrangements to better fit their economic situations.

-

Stay Informed About IRS Policies: It’s common to feel uncertain about IRS policies. Keeping up with any updates regarding installment agreements can empower you to make informed choices about your financial plan. Knowledge is a powerful tool.

-

Document Changes: When you make adjustments to your financial plan, document these changes carefully. Retain records of all communications with the IRS. This practice not only protects you from potential disagreements but also ensures transparency in your transaction history.

-

Understand the Consequences of Missing Due Amounts: Missing a due amount can lead to default, which may result in the termination of your agreement and aggressive collection actions by the IRS. If you anticipate missing a payment, it’s crucial to communicate with the IRS promptly. They’re there to help you navigate these challenges.

-

Utilize IRS Resources: For assistance, don’t hesitate to reach out to the IRS at 1-800-829-1040 for individuals or 1-800-829-4933 for businesses. Additionally, consider exploring the IRS Fresh Start Program, which offers relief options for those struggling with tax debts.

By actively monitoring and modifying your payment strategy, you can maintain a manageable approach to settling your tax debt, particularly in relation to your IRS installment plan balance. This proactive stance helps you avoid penalties and ensures compliance with IRS requirements. Real-life examples show that taxpayers who oversee their strategies often experience less stress and improved results. Remember, we’re here to help you navigate your tax obligations with confidence.

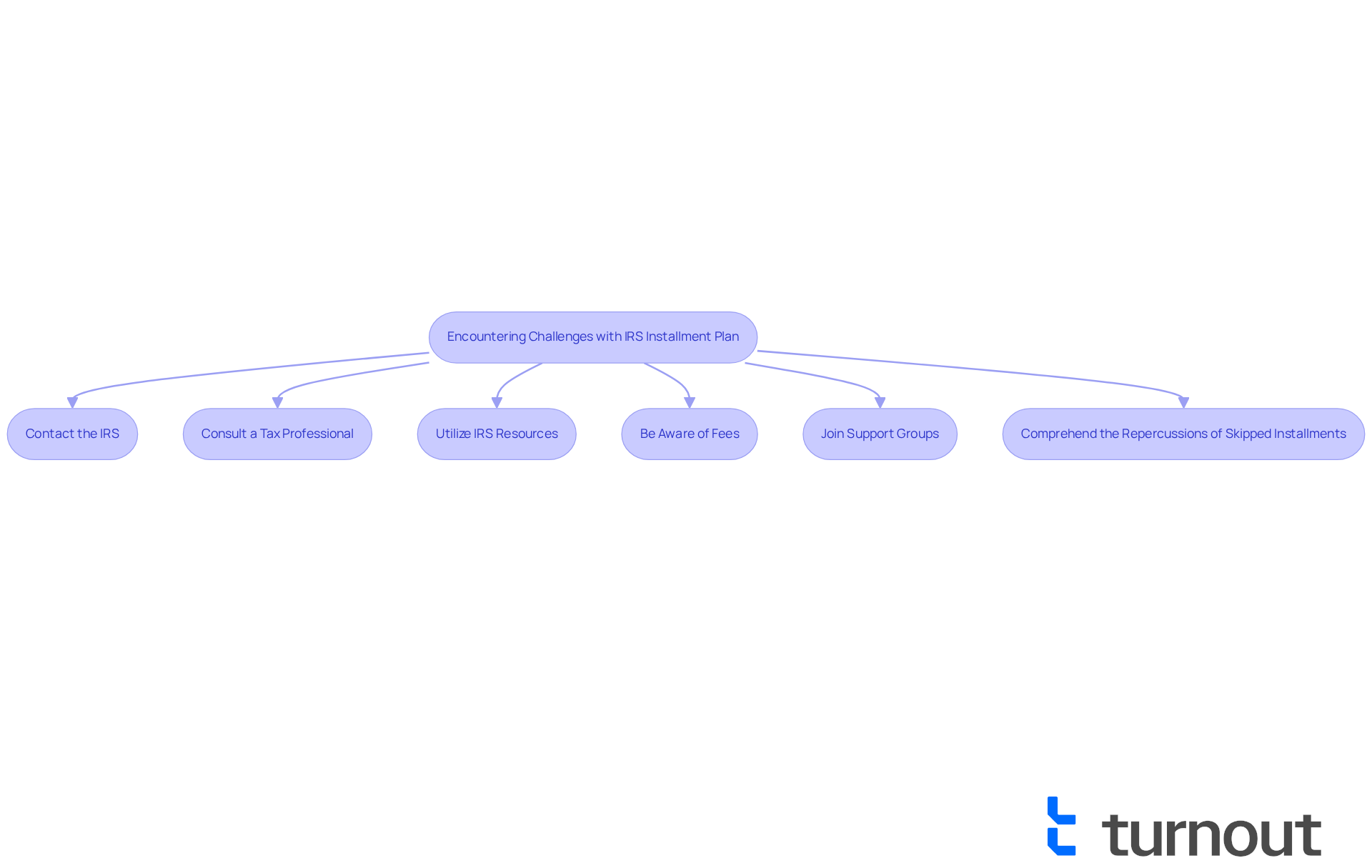

Seek Help When You Encounter Challenges

If you're having a tough time managing your IRS installment plan balance, remember, you’re not alone. We’re here to help. Here’s what you can do:

-

Contact the IRS: Struggling to make payments or have questions about your plan? Don’t hesitate to reach out to the IRS directly. They can offer guidance and may provide options for modifying your agreement, especially if your debt is under $50,000 and can be paid back within 72 months.

-

Consult a Tax Professional: It might be beneficial to connect with a tax professional or an advocate who specializes in tax issues. They can offer personalized advice and help you navigate complex situations, ensuring you fully understand your options and obligations.

-

Utilize IRS Resources: The IRS website is a treasure trove of resources, including FAQs and guides on managing payment agreements. Take advantage of these tools to find answers to your questions. Just remember, while your payment plan is active, you must continue to file and pay all taxes due.

-

Be Aware of Fees: Setting up an IRS repayment agreement may involve fees ranging from $31 to $225, depending on the type of arrangement and transaction method. Understanding these costs is crucial for effective financial planning.

-

Join Support Groups: Consider looking for online forums or local support groups where you can connect with others facing similar challenges. Sharing experiences can provide valuable insights and encouragement.

-

Comprehend the Repercussions of Skipped Installments: Missing a payment on your repayment arrangement can lead to default, triggering collection measures like asset confiscation or wage deduction. It’s vital to stay on top of your payments to avoid these serious consequences.

By seeking help when needed and being proactive about your obligations, you can better manage your IRS installment plan balance and work towards resolving your tax debt. Remember, you’re not alone in this journey.

Conclusion

Mastering your IRS installment plan balance isn’t just about meeting obligations; it’s about regaining control over your financial situation. We understand that navigating tax responsibilities can feel overwhelming. That’s why it’s essential to know the types of plans available, assess your balance, implement effective payment strategies, and monitor your progress. By taking these steps, you can approach your tax responsibilities with confidence and clarity.

Key insights from this guide emphasize the importance of knowing your current balance, establishing a budget, and being proactive in adjusting your payment plan as your circumstances change. Remember, utilizing resources like the IRS website and seeking help from tax professionals can empower you to manage your obligations effectively. It’s common to feel anxious about missed payments, but staying informed and engaged with your installment plan is crucial.

Ultimately, the path to managing an IRS installment plan is paved with knowledge and support. Whether it’s reaching out for help or utilizing available resources, taking proactive steps can lead to a smoother experience and a more manageable tax burden. Embrace these strategies to transform your IRS installment plan from a source of stress into a stepping stone toward financial stability. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is an IRS installment plan?

An IRS installment plan allows taxpayers to settle their tax debts gradually rather than all at once, providing a financing option for those feeling overwhelmed by tax obligations.

What types of IRS installment plans are available?

There are two types of plans: short-term plans (up to 180 days) and long-term plans (over 180 days). Short-term arrangements typically do not incur a user charge, while long-term agreements may have a fee based on the payment method chosen.

What are the eligibility requirements for an IRS installment plan?

To qualify for an IRS installment plan, you must owe a total tax amount, including penalties and interest, of $50,000 or less, and you must have filed all necessary tax returns.

How can I apply for an IRS installment plan?

You can apply for a payment plan online, by phone, or by mailing in Form 9465. The online application is usually the fastest method.

What are the advantages of setting up an IRS installment plan?

Setting up a payment arrangement can prevent the IRS from taking collection actions, such as levies or garnishments, while you work on paying off your debt.

How can I assess my current IRS installment plan balance?

To assess your balance, log into your IRS online account, navigate to the 'Payments' section, and check your current balance, including any penalties or interest.

How often is the balance updated in my IRS online account?

Your balance updates no more than once every 24 hours, so it’s advisable to check back regularly.

How can I review my transaction history for my IRS installment plan?

After logging into your IRS online account, you can examine your transaction history to see how much you’ve contributed and what remains. Transactions may take 1 to 3 weeks to appear.

What should I do if I encounter issues accessing my IRS account or need clarification?

If you have issues accessing your account or need clarification on your balance, you can contact the IRS at 1-800-829-1040 for assistance.

How long can my IRS installment agreement last?

An IRS installment agreement can last up to 10 years, providing ample time to manage your tax obligations. Additionally, you can schedule transactions up to 365 days in advance to ensure timely compliance.