Overview

The article titled "Master Your IRS Installment Agreement: A Step-by-Step Guide" is designed to help you navigate the often overwhelming process of setting up and managing IRS installment agreements. We understand that dealing with tax debts can be stressful, and this guide aims to provide you with the support you need to find financial relief.

In this comprehensive overview, we explore the benefits of IRS installment agreements, the different types available, and the eligibility requirements you must meet. We also outline the necessary documentation and application procedures, ensuring you have all the information needed to take the next steps.

Additionally, we offer valuable tips for maintaining compliance with your agreement, so you can feel confident in your journey towards resolving your tax obligations. Remember, you are not alone in this process, and we’re here to help you every step of the way.

Introduction

Navigating tax obligations can often feel like an overwhelming challenge, especially when the thought of a significant bill from the IRS looms large. We understand that this can lead to anxiety and uncertainty. Fortunately, the introduction of IRS installment agreements has offered a lifeline for many taxpayers. These agreements allow you to manage your debts through manageable monthly payments, bringing a sense of relief and control.

In this guide, we will explore the different types of installment agreements available, the eligibility requirements, and the step-by-step process to apply for one. It’s common to feel apprehensive about financial commitments, especially when unexpected hurdles arise. Understanding how to effectively manage an IRS installment agreement is crucial for maintaining your financial stability and avoiding default. Remember, you are not alone in this journey; we’re here to help you navigate these challenges.

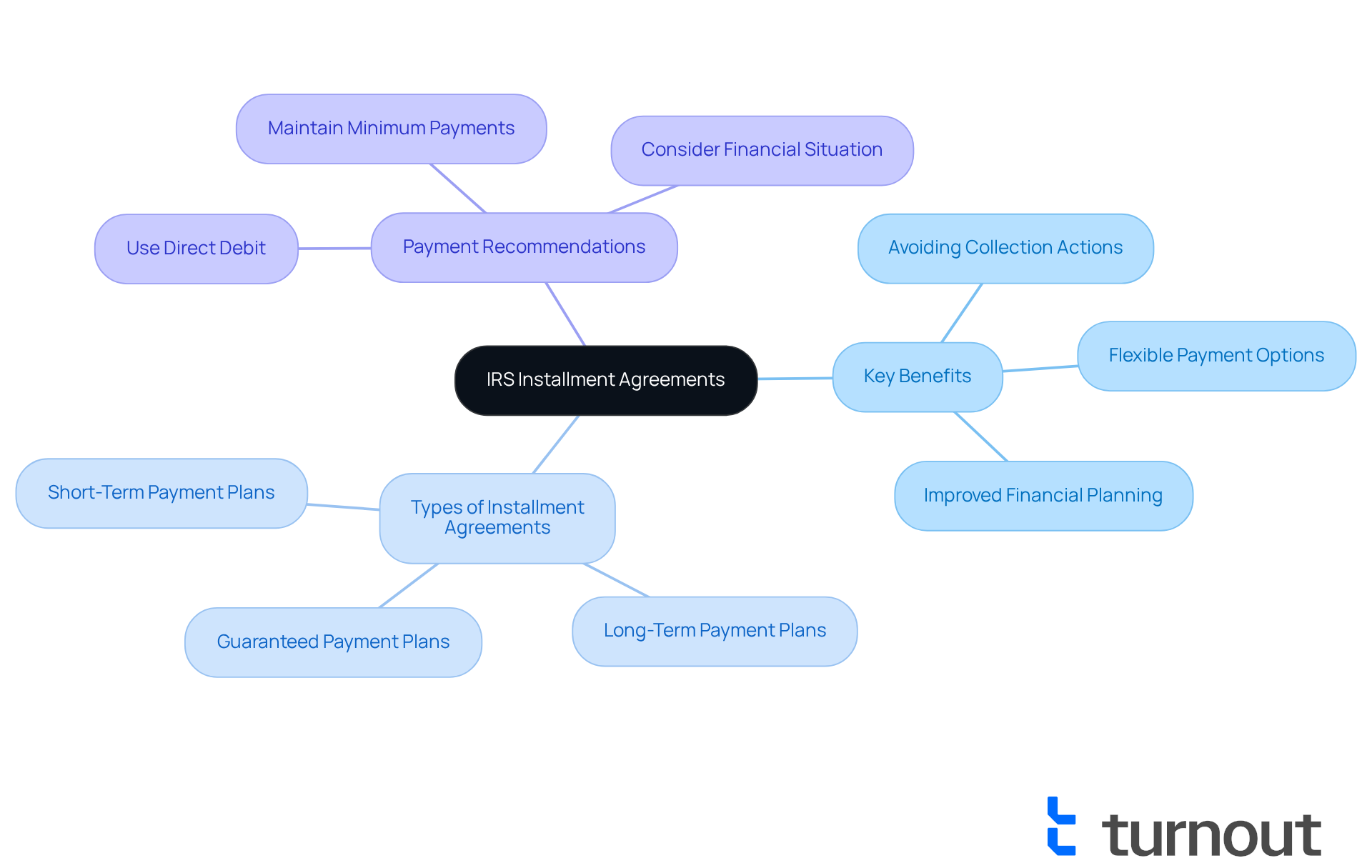

Understand IRS Installment Agreements

An is a structured arrangement that enables taxpayers to gradually resolve their tax obligations through manageable monthly payments. This option is especially advantageous for individuals who may feel overwhelmed by the prospect of paying their tax bill in full by the due date. We understand that comprehending the different kinds of installment agreement IRS plans can greatly alleviate the anxiety linked to tax obligations and assist in avoiding harsh collection measures.

Key Benefits of IRS Installment Agreements:

- Avoiding Collection Actions: Entering into an agreement can effectively halt , including wage garnishments and bank levies.

- : Taxpayers can select a payment amount that aligns with their budget, facilitating better financial management.

- Improved Financial Planning: Knowing the monthly payment amount aids in budgeting and financial forecasting, allowing taxpayers to plan their expenses more effectively.

Types of Installment Agreements:

- Short-Term Payment Plans: Designed for those who can pay their balance within 180 days, these plans offer a quick resolution to tax debts.

- Long-Term Payment Plans: For balances requiring more time to pay off, these plans typically extend up to 72 months or longer, depending on the amount owed. Taxpayers with balances below $50,000 can qualify for simplified arrangements, which ease the process and remove the requirement for extensive financial disclosures. Furthermore, these arrangements necessitate the taxpayer to consent to settle the tax obligation within 72 months or prior to the end of the 10-year collection period.

- Guaranteed Payment Plans: Taxpayers who owe less than $10,000 and fulfill certain criteria can set up a guaranteed payment plan, which does not necessitate extensive financial information.

In 2025, it was reported that a considerable number of taxpayers are utilizing the , with over 90% of individual taxpayers with tax debt eligible for some type of payment plan. This trend emphasizes the increasing accessibility of these arrangements, enabling individuals to handle their tax responsibilities more efficiently.

Tax experts highlight the significance of installment agreements with the IRS, pointing out that they provide support for individuals encountering financial hardships. As one specialist mentioned, 'A that enables you to settle your tax liability in manageable monthly payments.' This flexibility can be crucial for individuals navigating challenging financial situations.

It is also important for taxpayers to consider using direct debit for their payments, as this method is encouraged by the IRS to reduce the chance of default. By grasping the advantages and varieties of IRS payment plans, taxpayers can take proactive measures to , ensuring compliance while preserving their financial well-being. Remember, you are not alone in this journey; we’re here to help.

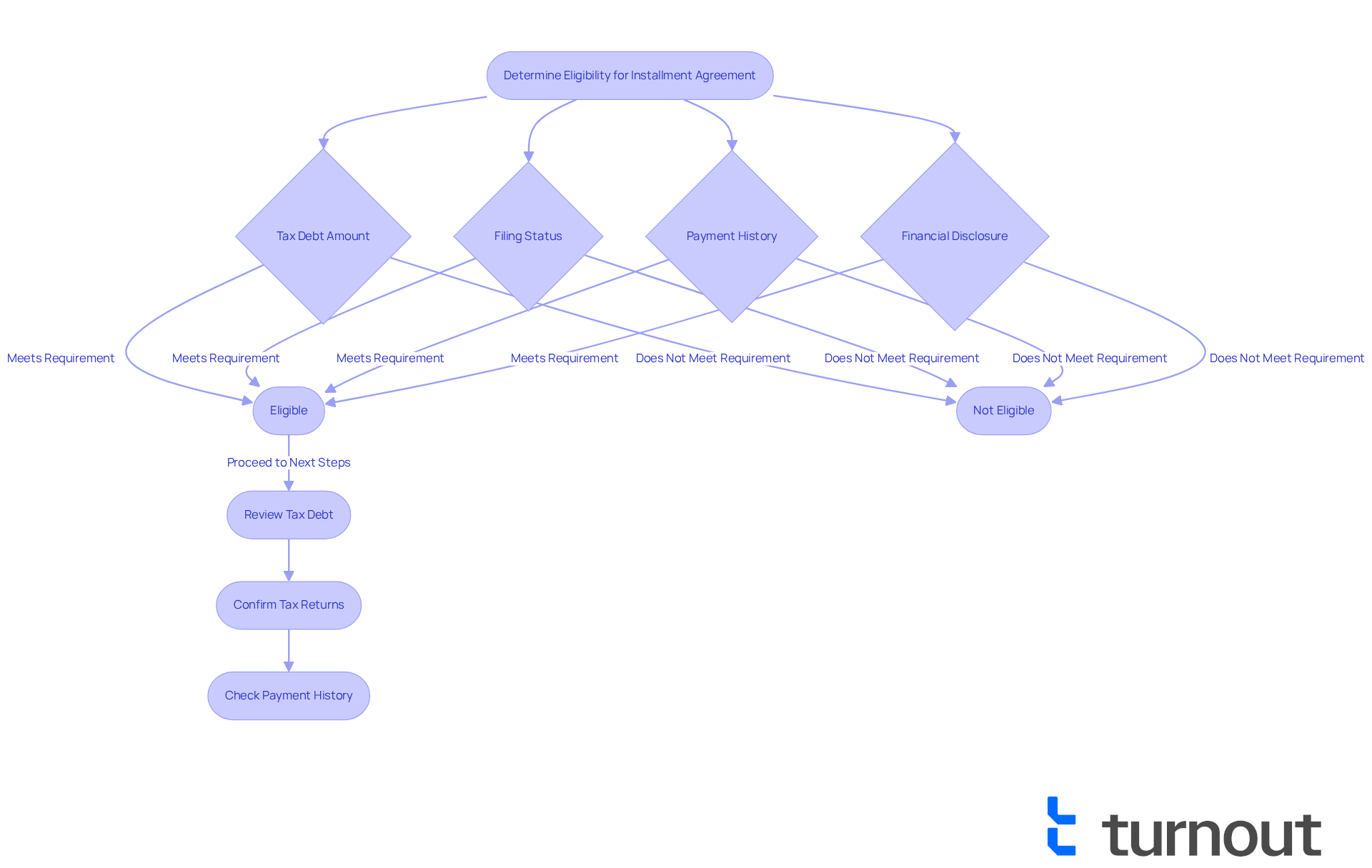

Determine Your Eligibility for an Installment Agreement

To qualify for an , taxpayers must meet specific requirements. We understand that navigating can be challenging, so here are the key eligibility requirements to consider:

- Amount: Typically, you must owe $50,000 or less in total tax, penalties, and interest to qualify for a simplified payment plan. For non-streamlined arrangements, the limit may be higher.

- Filing Status: You must have filed all required tax returns. If you have unfiled returns, the IRS may ask you to submit them prior to approving a payment plan.

- : It's important that you have not defaulted on any prior installment arrangements. If you have, the IRS may deny your application.

- : Depending on the amount owed, you may need to provide financial information to demonstrate your ability to pay.

Steps to Check Eligibility:

- Review your total tax debt and ensure it falls within the limits.

- Confirm that all tax returns are filed and up to date.

- Review your payment history with the IRS to ensure adherence to prior commitments.

Recent changes have made it easier for individual taxpayers who owe up to $250,000 to access a simplified process for setting up . This enhancement supports your ability to resolve tax issues effectively. Most taxpayers qualify for an installment agreement IRS, which makes these payment arrangements accessible.

Tax advisors emphasize the importance of understanding these criteria to avoid unnecessary complications in the application process. Remember, you are not alone in this journey. Additionally, you can utilize the Offer in Compromise Pre-Qualifier Tool to check your eligibility and prepare a preliminary proposal. It's essential to act swiftly, as unpaid tax bills grow over time, and be mindful that penalties and interest persist in accumulating on unpaid obligations during the payment plan.

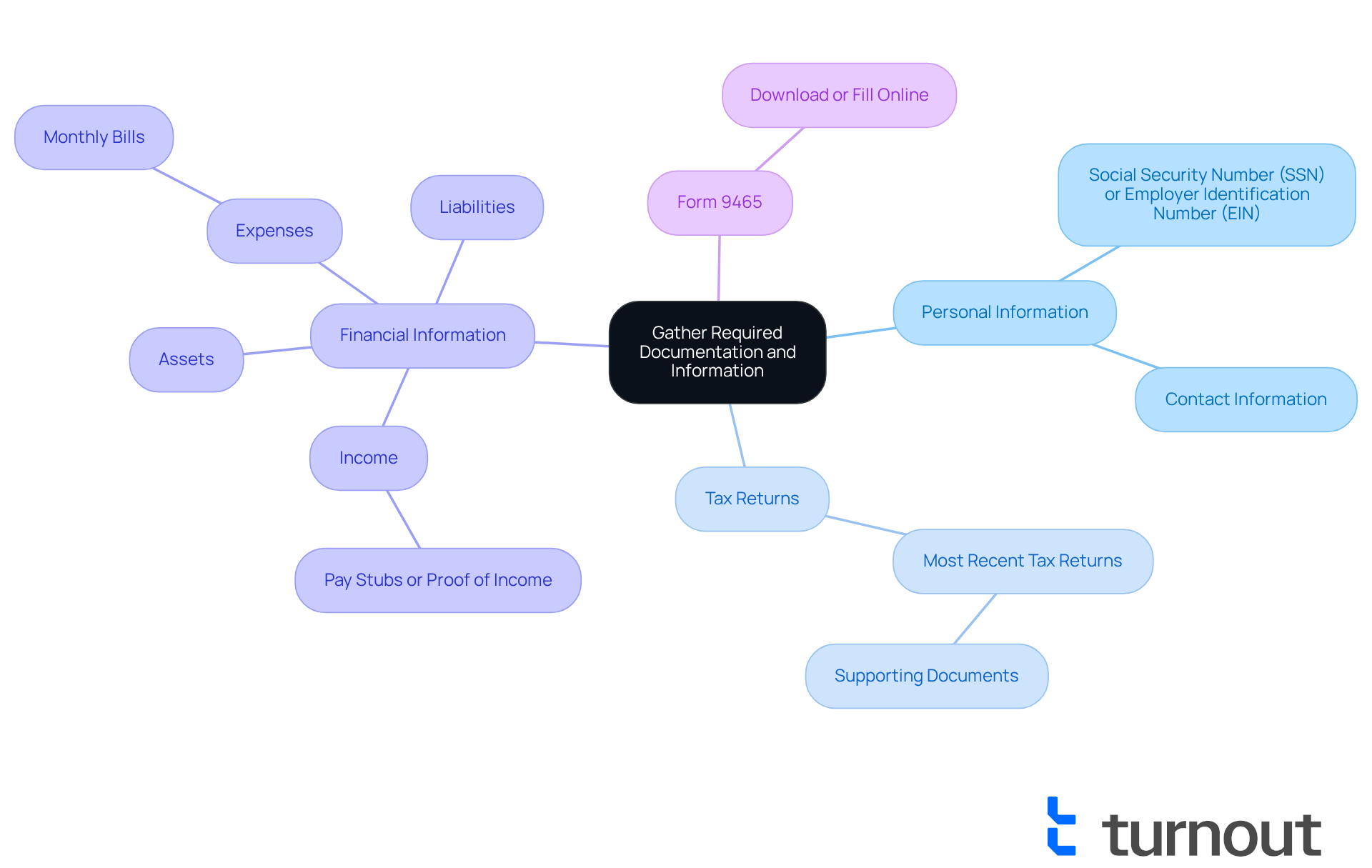

Gather Required Documentation and Information

Before you request an , it’s important to gather all essential documentation. We understand that this can feel overwhelming, but having everything ready will make the process smoother. Here’s what you will need:

- Personal Information: Your Social Security number (SSN) or Employer Identification Number (EIN), along with your contact information.

- Tax Returns: Copies of your most recent tax returns, including any supporting documents.

- Financial Information: A detailed list of your income, expenses, assets, and liabilities. This may include:

- Pay stubs or proof of income

- Bank statements

- Monthly bills and expenses

- . You can download it from the or fill it out online if applying through the Online Payment Agreement tool, which provides immediate notification of approval.

Tips for Gathering Documentation:

- Organize your documents in a folder for easy access.

- Ensure all information is accurate and up to date to avoid complications during the application process.

Tax professionals emphasize how crucial it is to have all required documents ready before starting the . It’s common to feel uncertain, but statistics show that almost 88% of individual taxpayers owe less than $25,000, making a feasible choice for many. If your balance falls between $25,000 and $50,000, direct debit payments may be required to help reduce the chance of default. By preparing your documentation thoroughly, you can facilitate a smoother application experience and increase your chances of approval. Remember, if your financial situation changes, you can always renegotiate the conditions of your contract based on your capacity to pay. We’re here to help you through this journey.

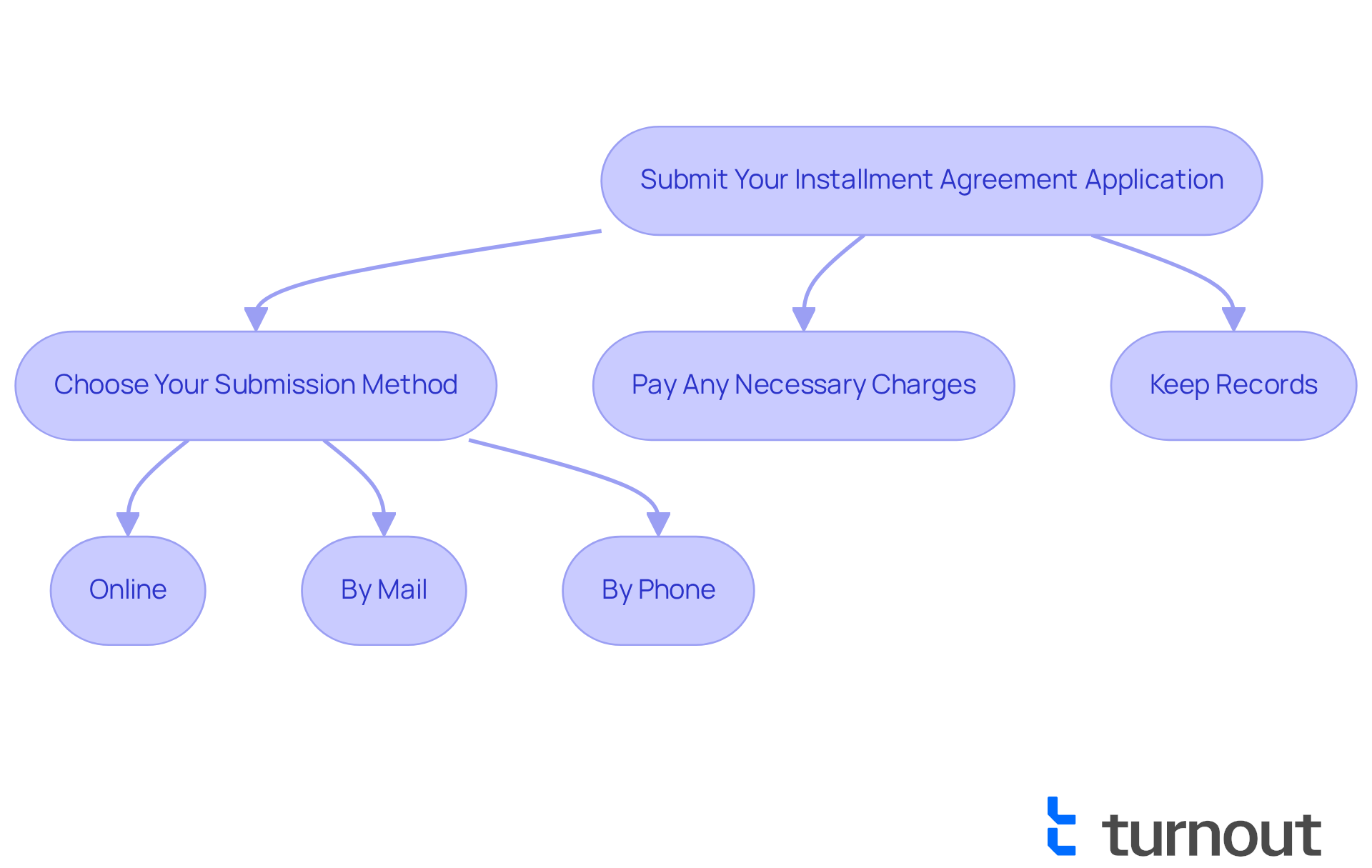

Submit Your Installment Agreement Application

Once you have gathered all the necessary documentation, you can confidently submit your . Here’s how to navigate this process:

-

Choose Your Submission Method:

- Online: The fastest way to apply is through the . If you don’t already have one, you’ll need to create an . Many have found this method to be highly effective, as the average processing time for online applications is significantly shorter than for paper submissions.

- By Mail: If you prefer submitting a paper application, complete Form 9465 and mail it to the address specified in the form instructions. Please ensure you send it to the correct address based on your location to avoid any unnecessary delays.

- By Phone: You can also apply by calling the IRS at 800-829-1040. During the call, you will need to provide your personal information and details about your tax debt.

-

Pay Any Necessary Charges: Depending on your chosen method, there may be a . This fee can vary based on your income level and the type of arrangement you select. It’s important to consider that the costs associated with the payment plan may be lower than the interest and penalties charged by the IRS under federal law, so please weigh your options thoughtfully.

-

Keep Records: After you , be sure to retain a copy along with any correspondence with the IRS. This documentation will be invaluable if you need to follow up on the status of your application.

Many of the for its ease of use. In fact, numerous taxpayers have shared their success stories, often receiving approval notifications within just a few days. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Manage Your Installment Agreement and Avoid Default

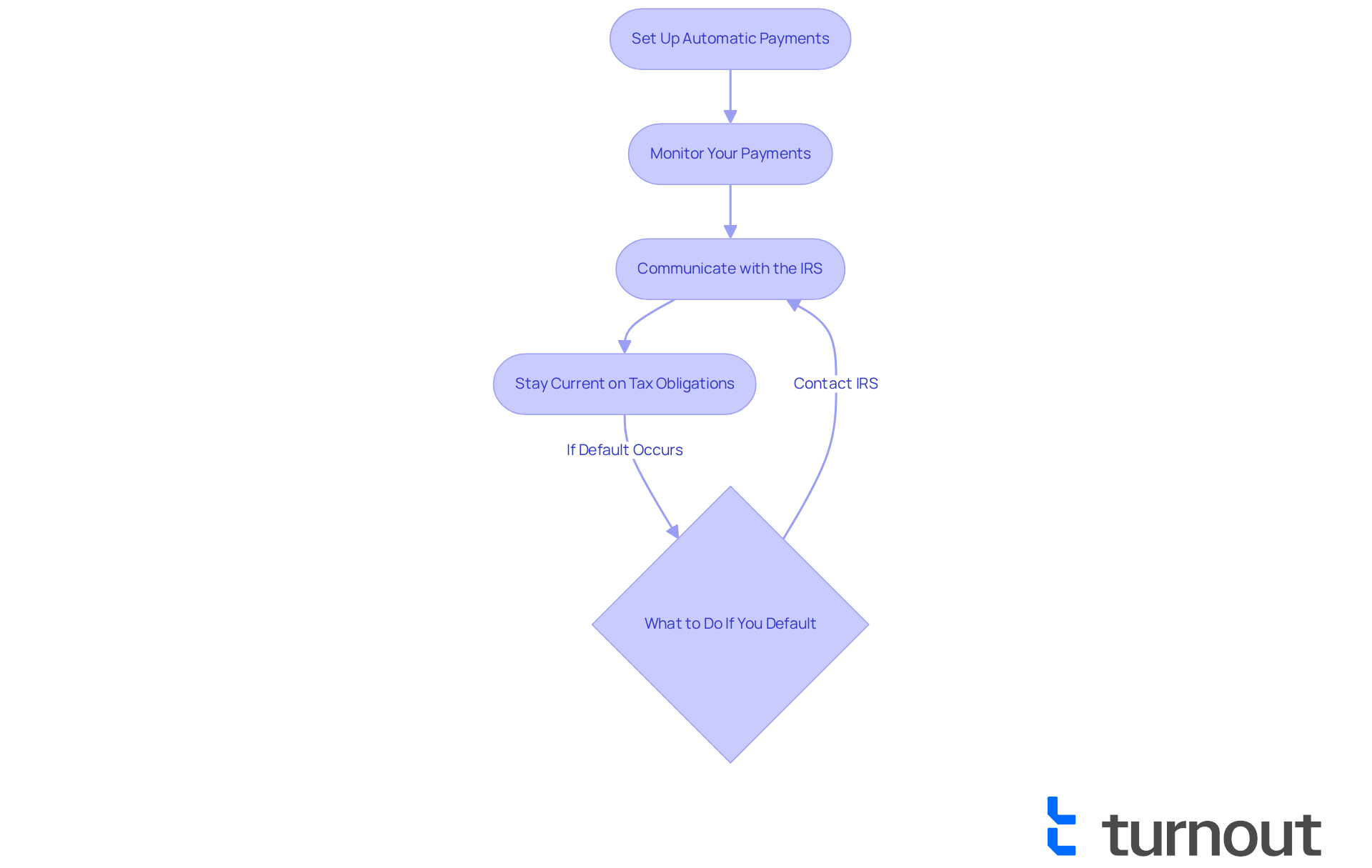

Once your payment plan is approved, handling it efficiently is essential to prevent default. We understand that managing finances can be challenging, and we're here to help. Here are some essential tips:

- : Establishing automatic payments can help ensure you never miss a due date. This reduces the risk of penalties and keeps your account in good standing, providing peace of mind.

- Monitor Your Payments: Regularly review your payment history and account status through your . This practice keeps you informed about your balance and upcoming payments, allowing for timely adjustments if necessary.

- Communicate with the IRS: If you face financial difficulties that may impact your ability to make payments, reach out to the IRS immediately. They may offer choices to alter your contract or temporarily halt payments, assisting you in avoiding default.

- : Ensure that you file all future tax returns on time and pay any new tax liabilities promptly. Remaining in adherence to these responsibilities is crucial for upholding your payment plan.

What to Do If You Default:

If you miss a payment, contact the IRS as soon as possible to discuss your options. You may be able to or .

Statistics show that taxpayers who actively oversee their payment plans and keep in touch with the IRS have a notably higher compliance rate, decreasing the chances of default. For instance, many individuals who set up direct debit payments successfully avoid default, as this method automates their monthly obligations. By following these guidelines, you can navigate your installment agreement IRS with confidence and minimize the risk of complications. Remember, you are not alone in this journey; we are here to support you every step of the way.

Conclusion

Navigating the complexities of IRS installment agreements can indeed feel overwhelming. However, understanding this structured payment option can significantly lighten the load of tax obligations. By breaking down the process into manageable steps, you can regain control over your finances while ensuring compliance with the IRS. This guide has illuminated the various types of installment agreements available, the benefits they offer, and the essential eligibility requirements that you must meet.

It's important to gather the necessary documentation, submit your application correctly, and proactively manage your payment plan to avoid default. The flexibility of installment agreements—ranging from short-term to guaranteed plans—empowers you to choose a solution that aligns with your financial situation. Moreover, focusing on direct debit payments and maintaining consistent communication with the IRS can help mitigate risks and enhance compliance.

Ultimately, understanding and utilizing IRS installment agreements is not just about meeting tax obligations; it is a crucial step toward achieving financial stability. We encourage you to take action by assessing your eligibility, preparing your documentation, and submitting your applications. By doing so, you can transform the daunting task of settling tax debts into a structured, manageable journey, paving the way for a more secure financial future. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What is an IRS installment agreement?

An IRS installment agreement is a structured arrangement that allows taxpayers to gradually resolve their tax obligations through manageable monthly payments, helping to alleviate the stress of paying the full tax bill by the due date.

What are the key benefits of an IRS installment agreement?

The key benefits include avoiding collection actions (such as wage garnishments and bank levies), flexible payment options that align with one's budget, and improved financial planning by knowing the monthly payment amount.

What types of installment agreements are available?

The types of installment agreements include: - Short-Term Payment Plans for those who can pay their balance within 180 days. - Long-Term Payment Plans for balances requiring more time, typically extending up to 72 months or longer for amounts below $50,000. - Guaranteed Payment Plans for taxpayers who owe less than $10,000 and meet certain criteria.

What are the eligibility requirements for an IRS installment agreement?

To qualify, taxpayers must typically owe $50,000 or less in total tax, penalties, and interest, have filed all required tax returns, not have defaulted on prior installment arrangements, and may need to provide financial information based on the amount owed.

How can taxpayers check their eligibility for an installment agreement?

Taxpayers can check their eligibility by reviewing their total tax debt, confirming that all tax returns are filed and up to date, and reviewing their payment history with the IRS to ensure compliance with prior commitments.

What recent changes have affected the installment agreement process?

Recent changes have made it easier for individual taxpayers who owe up to $250,000 to access a simplified process for setting up IRS payment plans, increasing the accessibility of these arrangements.

Why is it important to understand the criteria for installment agreements?

Understanding the criteria is crucial to avoid unnecessary complications in the application process and to ensure that taxpayers can effectively resolve their tax issues.

What should taxpayers keep in mind regarding penalties and interest while in a payment plan?

Taxpayers should be aware that penalties and interest continue to accumulate on unpaid obligations during the payment plan, making it essential to act swiftly on unpaid tax bills.