Introduction

Navigating tax obligations can feel like an uphill battle, especially when you're carrying the weight of debt. We understand that this can be overwhelming. For many, an installment payment agreement offers a practical solution. It allows you to manage your tax liabilities through manageable monthly payments instead of one large sum.

However, understanding the intricacies of these agreements - from eligibility requirements to potential pitfalls - can be daunting. It's common to feel lost in the details. What steps can you take to ensure a smooth application process? How can you avoid common mistakes that might derail your financial recovery?

We're here to help you through this journey.

Understand Installment Payment Agreements

If you're feeling overwhelmed by tax obligations, you're not alone. An installment payment agreement can be a lifeline, allowing you to settle your tax debts gradually with manageable monthly payments. This installment payment agreement is particularly beneficial for individuals who struggle to pay their tax debts in full due to financial constraints.

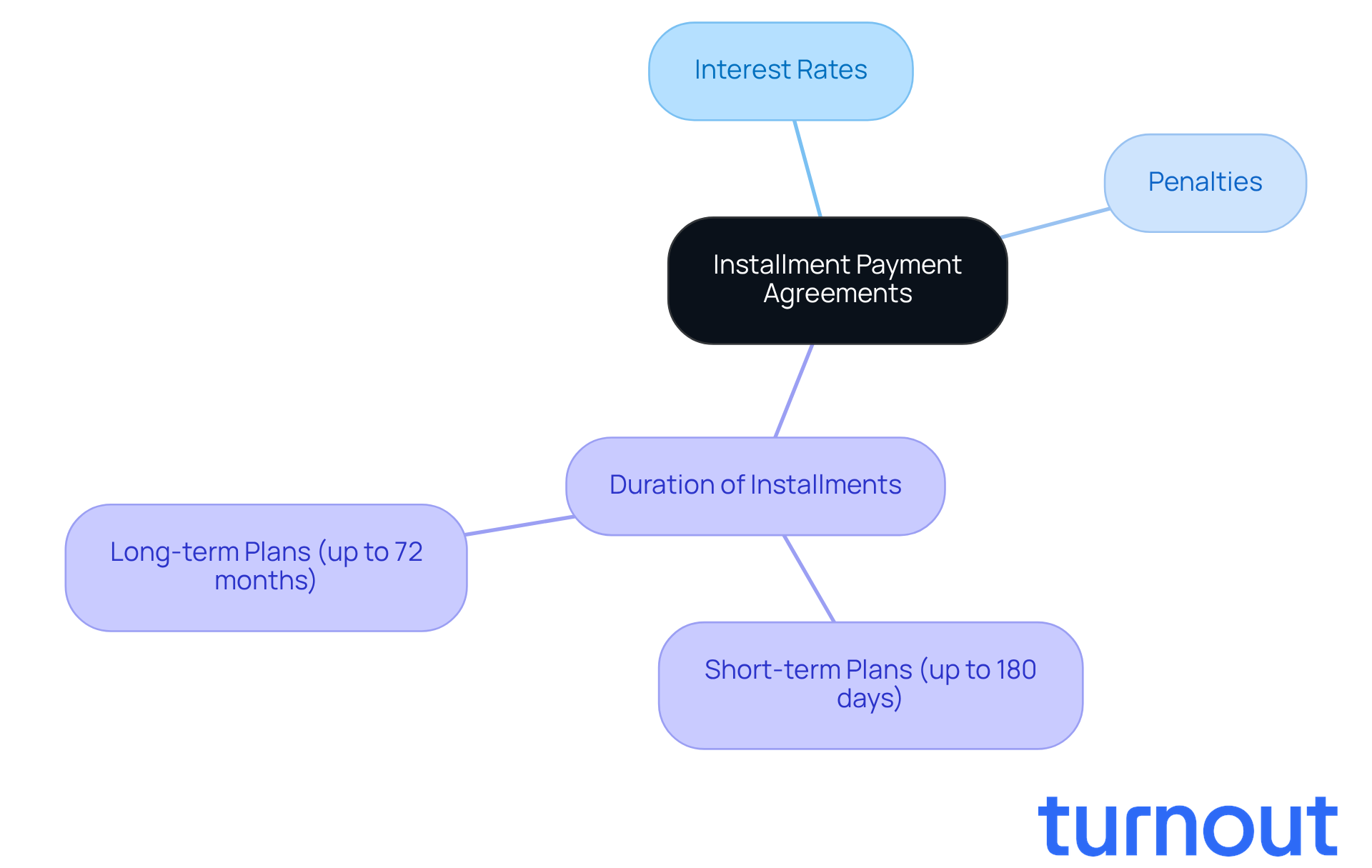

It is essential to understand the terms of the installment payment agreement. You'll want to be aware of:

- Interest rates

- Penalties

- The duration of the installments

Typically, you can choose between:

- Short-term plans (up to 180 days)

- Long-term plans (up to 72 months)

Familiarizing yourself with these details can empower you to navigate the application process more effectively. Remember, we're here to help you through this journey. You deserve support as you take steps toward financial relief.

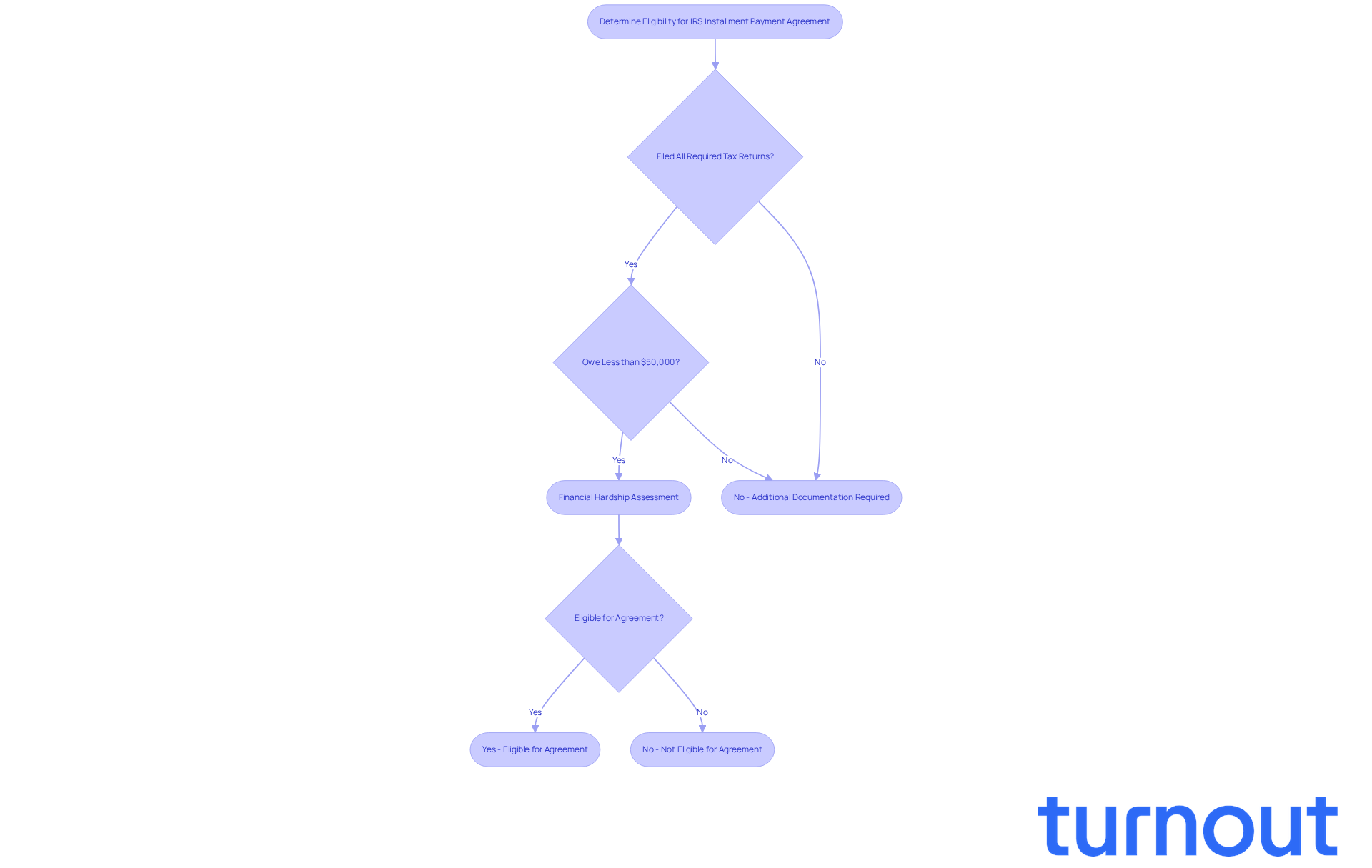

Determine Your Eligibility for an Agreement

If you're feeling overwhelmed by tax debt, you're not alone. To qualify for an IRS installment payment agreement, there are specific criteria you need to meet. Generally, you should have filed all required tax returns and owe less than $50,000 in combined tax, penalties, and interest. If your tax debt exceeds this amount, don’t worry - you may still qualify for an installment payment agreement, although it might require some extra documentation.

It's essential to show that an installment payment agreement for your tax liability would cause you financial hardship if you were to pay it in full. Take a moment to review your financial situation, including your income, expenses, and any assets. This will help you determine your eligibility. Remember, to qualify for an individual streamlined payment plan, you must not have had a back tax debt or any installment payment agreement in the last five years.

We understand that navigating tax issues can be daunting. If you're unsure about your situation, consider reaching out to a tax professional for personalized guidance. They can help you find the best path forward.

Looking ahead, modifications for 2026 introduce Simple Payment Plans, which require no financial disclosures. This change is designed to make it easier for qualified taxpayers to set up arrangements. You're taking a positive step by seeking information, and we're here to help you through this journey.

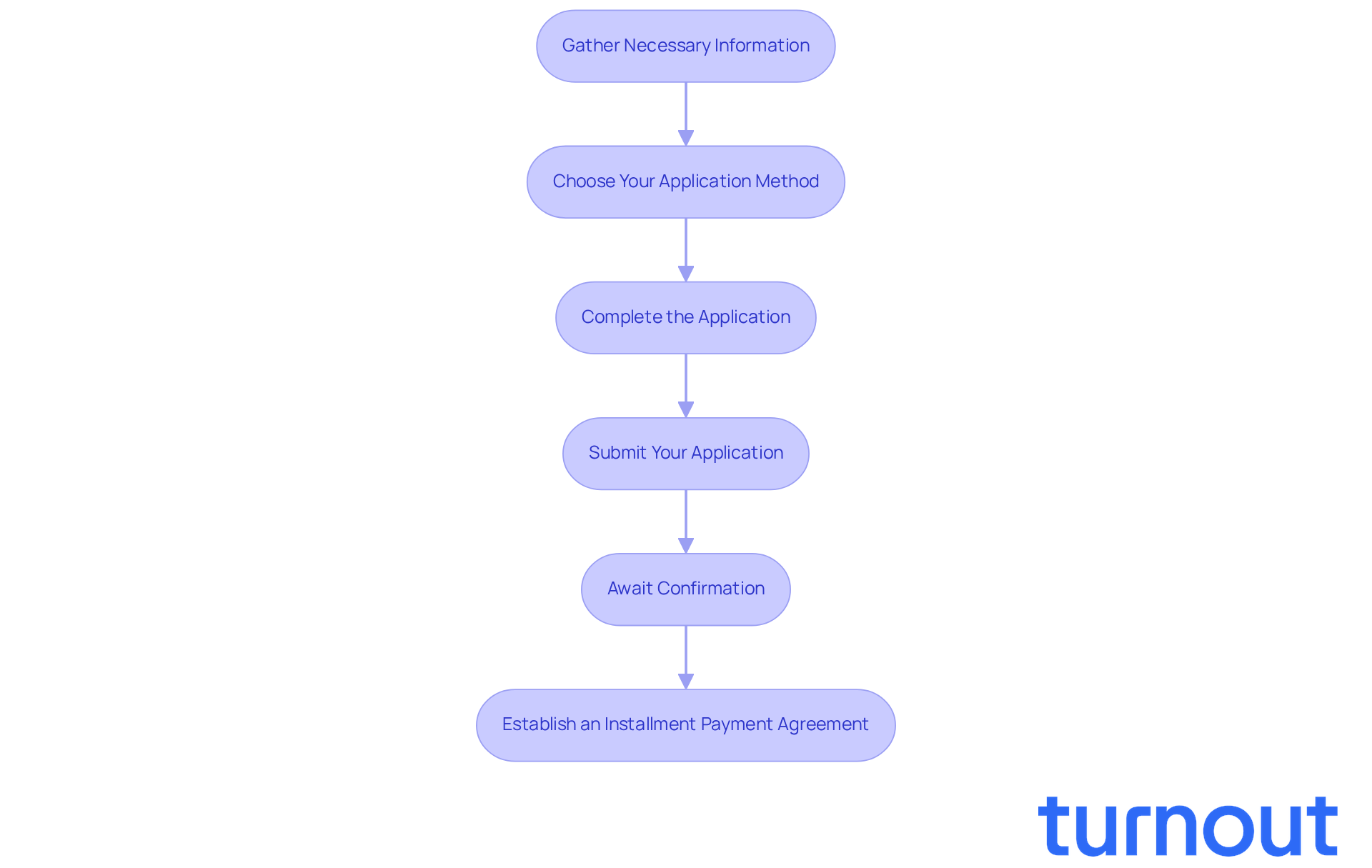

Apply for Your Installment Payment Agreement

Applying for an installment payment agreement may seem overwhelming, but we are here to assist you throughout the process. Follow these steps to make the process smoother:

-

Gather Necessary Information: Start by collecting your personal details, like your Social Security number, tax return information, and financial data, including income, expenses, and assets. We understand that this can be a lot to handle, but having everything ready will make the next steps easier.

-

Choose Your Application Method: You have options! You can apply online using the IRS Online Payment Agreement tool, by phone, or by mailing Form 9465, the Installment Agreement Request. If you choose to apply online, you’ll likely get a faster response, which can ease some of your worries.

-

Complete the Application: If you’re applying online, just follow the prompts to enter your information. If you’re using Form 9465, make sure to fill it out completely, addressing all required fields for the installment payment agreement. It’s common to feel unsure about this part, but take your time to ensure accuracy.

-

Submit Your Application: Once your application is ready, submit it through your chosen method. If you’re mailing it, double-check that you’re sending it to the correct IRS address based on where you live. This small step can save you from potential delays.

-

Await Confirmation: After you submit, the IRS will review your application and let you know their decision. This can take several weeks, so be patient. We know waiting can be tough, but rest assured that you’re on the right path.

-

Establish an installment payment agreement: If your application is accepted, you will need to set up your monthly payment plan based on the terms outlined in your agreement. Staying on top of your payments is crucial to avoid default, and we believe you can do this!

Remember, you’re not alone in this journey. If you have questions or need support, don’t hesitate to reach out for help.

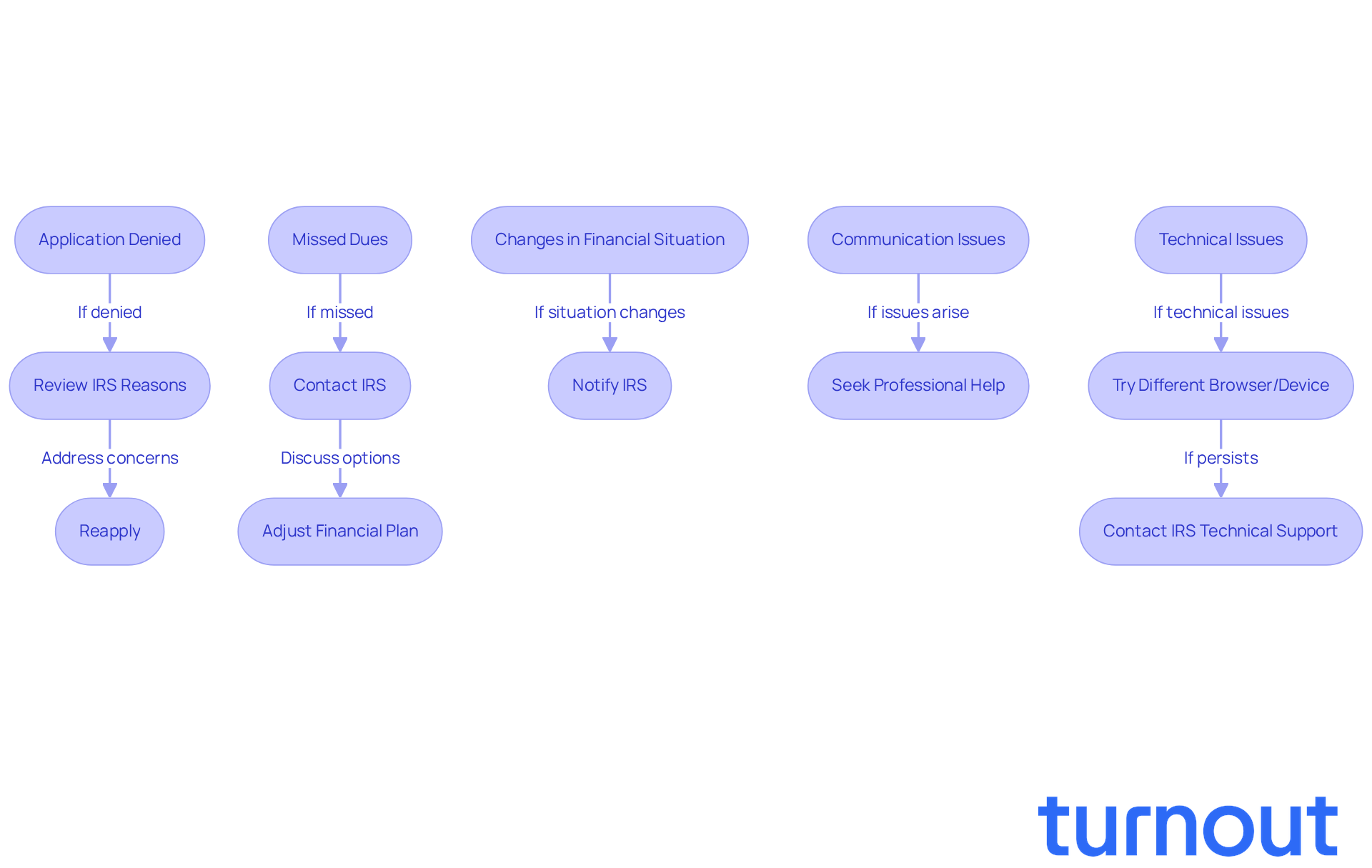

Troubleshoot Common Issues During Setup

While establishing your installment payment agreement, you may commonly encounter some challenges. We understand that navigating these issues can be stressful, so here are some helpful troubleshooting tips:

-

Application Denied: If your application is denied, take a moment to review the reasons provided by the IRS. Often, this can be due to incomplete information or not meeting eligibility criteria. Address these concerns, and don’t hesitate to consider reapplying. Remember, you’re not alone in this process.

-

Missed Dues: If you miss a due date, reach out to the IRS as soon as possible to discuss your options. You might be able to adjust your financial plan or request a temporary decrease in amounts based on your current situation. It’s important to communicate openly about your circumstances.

-

Changes in Financial Situation: Life can throw unexpected challenges your way, like a job loss or sudden expenses. If your financial situation changes, let the IRS know about your installment payment agreement. They may allow you to adjust your payment plan to better fit your new reality.

-

Communication Issues: If you’re having trouble reaching the IRS or understanding their responses, consider seeking help from a tax professional or a consumer advocacy group. They can clarify your options and facilitate communication, ensuring you feel supported.

-

Technical Issues: Experiencing technical difficulties while applying online? Try using a different browser or device. Make sure your internet connection is stable, and if problems persist, don’t hesitate to contact IRS technical support for assistance. We’re here to help you through this process.

Conclusion

Mastering installment payment agreements is essential for anyone grappling with tax debt. It offers a structured path to financial relief, allowing you to manage your obligations without the stress of overwhelming payments.

We understand that navigating this process can feel daunting. By grasping the terms, determining your eligibility, and effectively applying, you can take significant steps toward regaining control of your finances. Start by familiarizing yourself with the details of installment payment agreements, including interest rates and potential penalties. Assess your personal eligibility and gather the necessary documentation before you apply.

It's common to face challenges, such as application denials or missed payments. But don’t worry - there are practical solutions to help you overcome these hurdles and ensure a smoother experience.

Taking charge of your tax obligations through an installment payment agreement can lead to a brighter financial future. Remember, you’re not alone in this journey. By seeking guidance and staying proactive, you can navigate the complexities of tax debt. Embracing this process not only eases immediate stress but also lays the groundwork for long-term financial stability. We're here to help you every step of the way.

Frequently Asked Questions

What is an installment payment agreement?

An installment payment agreement is a plan that allows individuals to settle their tax debts gradually through manageable monthly payments, especially beneficial for those who cannot pay their tax debts in full due to financial constraints.

What should I understand about the terms of an installment payment agreement?

It is essential to be aware of the interest rates, penalties, and the duration of the installments when considering an installment payment agreement.

What are the options for the duration of the installment payment plans?

You can typically choose between short-term plans (up to 180 days) and long-term plans (up to 72 months).

How can understanding the details of the installment payment agreement help me?

Familiarizing yourself with the details can empower you to navigate the application process more effectively and make informed decisions regarding your tax obligations.

Where can I find support while applying for an installment payment agreement?

There are resources available to help you through the process, ensuring you receive the support you need as you take steps toward financial relief.