Introduction

Navigating the complexities of back taxes can feel overwhelming. Many individuals find themselves unsure of their options, and that’s completely understandable. But there’s hope! By understanding the various back tax payment plans available, you can find a pathway to financial relief and stability.

This guide will walk you through essential steps for mastering a back tax payment plan. We’re here to equip you with the knowledge you need to effectively manage your tax obligations. It’s common to feel the pressure of looming deadlines and accruing penalties. So, what can you do when it seems like even the best-laid plans are at risk of derailing?

Remember, you are not alone in this journey. Together, we can explore the options that can help you regain control.

Understand Back Tax Payment Plans

Dealing with back taxes can feel overwhelming, but a back tax payment plan is one of the options available to help you manage your obligations. Back tax payment plans are contracts with the IRS that allow you to settle your tax debts gradually, rather than all at once. This can be a relief for many taxpayers.

Typically, there are two main types of arrangements:

- Short-term financing options, which last up to 180 days

- Long-term installment contracts, such as a back tax payment plan that can extend for several months or even years

Understanding these choices is crucial for effectively managing your tax debts through a back tax payment plan and avoiding additional penalties.

Each option comes with specific eligibility criteria, fees, and implications for interest accrual. We understand that navigating these details can be daunting, but you are not alone in this journey. In the following sections, we will discuss these arrangements in detail, providing you with the information you need to make informed decisions. Remember, we're here to help you every step of the way.

Determine Your Eligibility for a Payment Plan

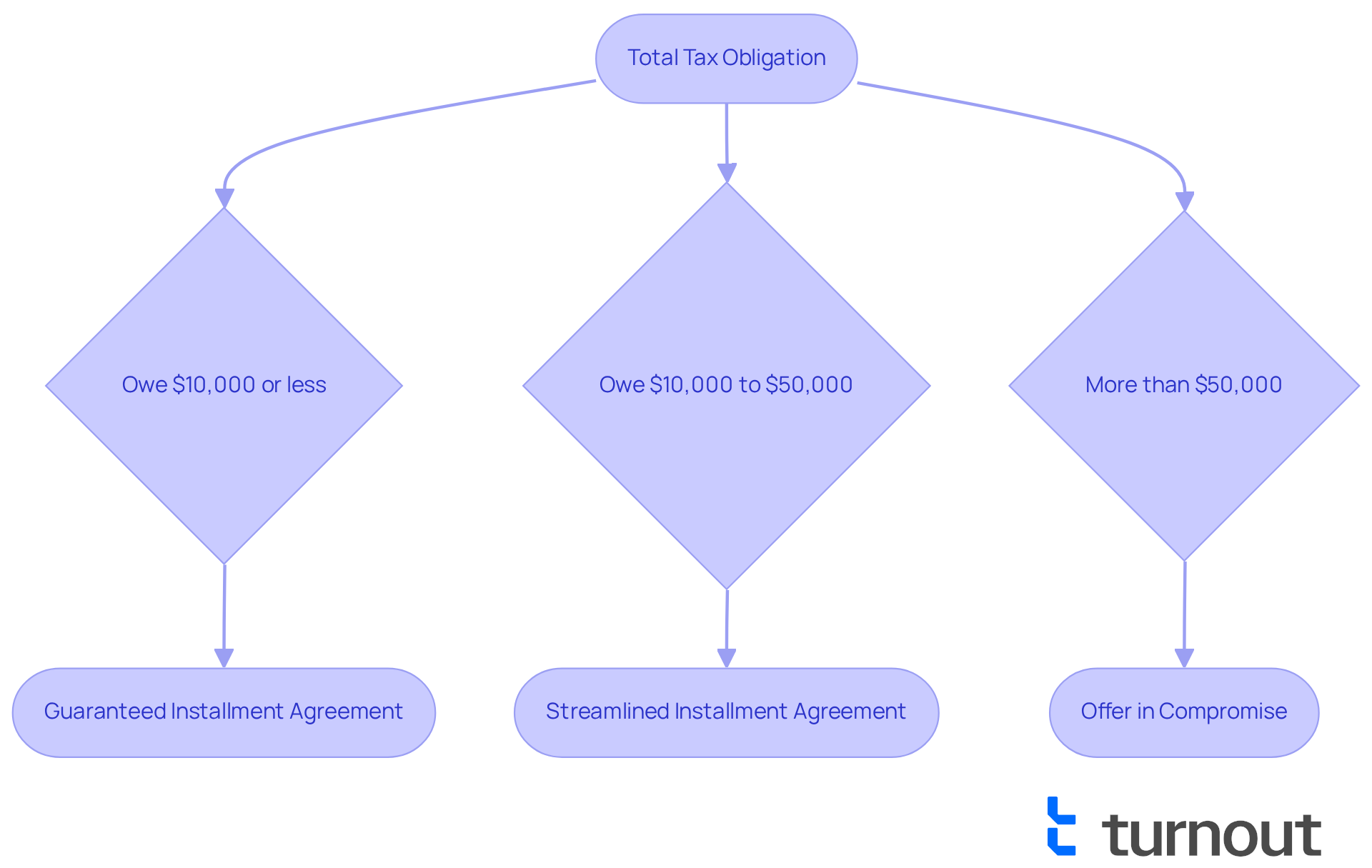

Are you feeling overwhelmed by your tax obligations? You're not alone, and we're here to help. To assess your eligibility for a back tax payment plan, start by reviewing your total tax obligation. If you owe $10,000 or less, you may qualify for a Guaranteed Installment Agreement, which can simplify the process significantly.

For debts ranging from $10,000 to $50,000, consider applying for a Streamlined Installment Agreement. Just ensure that all required tax returns have been filed and that you're current on your tax obligations. In fact, in 2025, about 88% of individual taxpayers owe less than $25,000, making the Streamlined Installment Agreement a viable option for many.

If these agreements don’t fit your situation, you might explore the Offer in Compromise. This option allows some taxpayers to settle their tax liabilities for less than the total amount owed. However, it's important to remember that penalties and interest continue to accrue during any delay in settling the amount, which can increase your overall debt.

To check your eligibility, visit the IRS website or use their online tools. They offer guidance tailored to your financial situation. Just keep in mind that there may be setup fees linked to creating a back tax payment plan online. Staying informed about your obligations and utilizing available resources can help you navigate the complexities of tax debt management effectively. Remember, you are not alone in this journey.

Apply for Your Back Tax Payment Plan

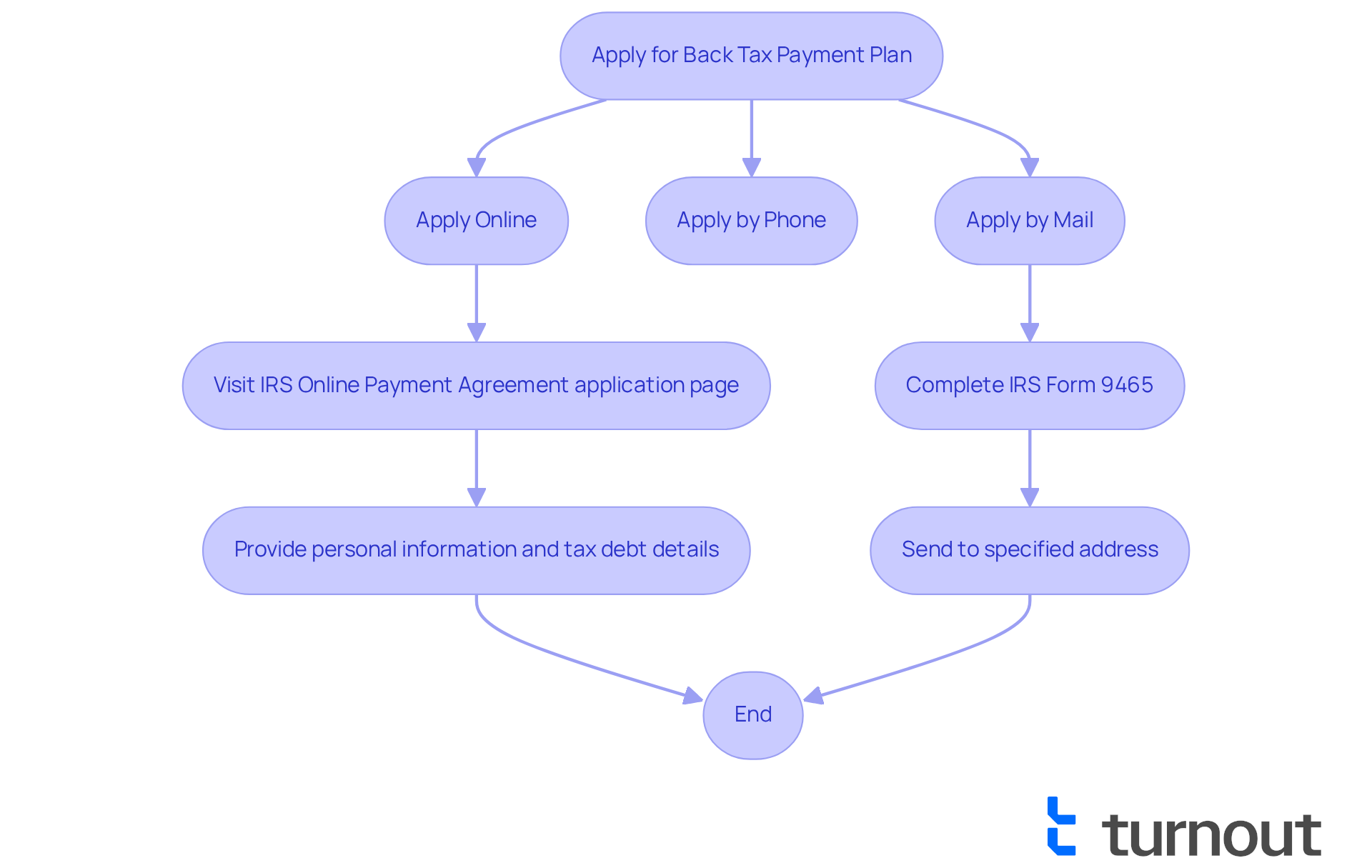

Applying for a back tax payment plan can feel overwhelming, but we're here to help. You can take this step online, by phone, or through the mail. To apply online, simply visit the IRS Online Payment Agreement application page. You'll need to provide your personal information, including your Social Security number, along with details about your tax debt.

If you prefer to apply by mail, complete IRS Form 9465, Installment Agreement Request, and send it to the address specified for your state. Remember to include any required financial information to support your application. After you submit your request, the IRS will review it and typically respond within 30 days.

It's common to feel anxious about this process, but a back tax payment plan with streamlined installment agreements is available for debts of $50,000 or less. This option allows you to make contributions over a period of up to 72 months without extensive financial disclosures. In fact, almost 70% of all financial arrangements fall under this category, making it a popular choice for many taxpayers.

Additionally, keep a record of your application and any correspondence with the IRS. Verify the date of information before relying on it. Tax professionals emphasize the importance of following up on your application to ensure timely processing and to address any potential issues that may arise.

Be aware that penalties and interest may accrue during any delay of collection until the full amount is paid. By remaining organized and proactive, you can manage the back tax payment plan with increased confidence and ease. Remember, you are not alone in this journey.

Manage Your Payment Plan Effectively

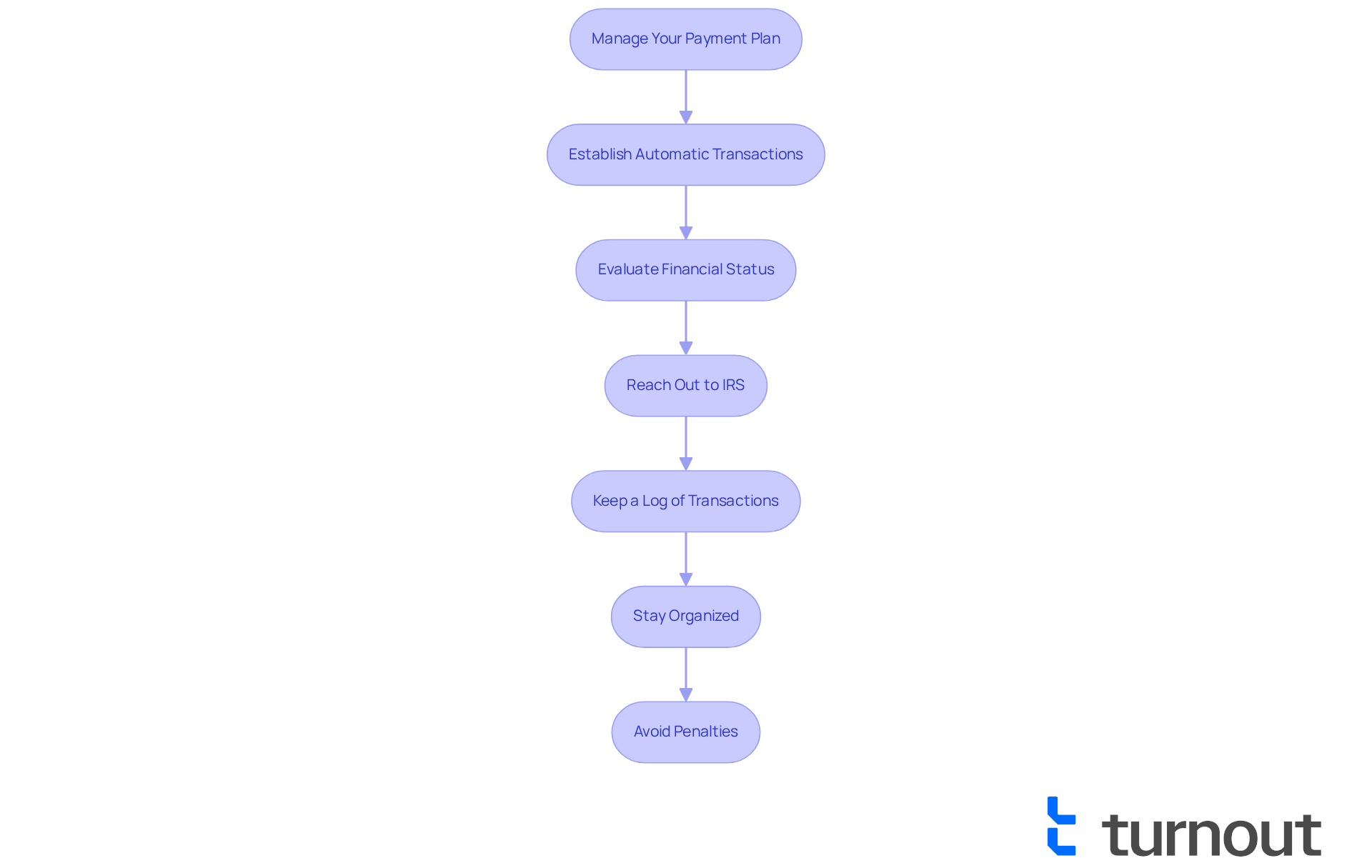

Effectively overseeing your back tax payment plan is crucial for preventing penalties and ensuring compliance. We understand that managing tax obligations can feel overwhelming at times. One simple step you can take is to establish automatic transactions. This straightforward action can help you avoid missed due dates, which often lead to default and extra penalties.

In 2025, the average number of adjustments requested for IRS financial arrangements highlights the importance of being adaptable. It’s common to feel uncertain about your financial status, so make it a habit to frequently evaluate your situation and adjust your budget to prioritize tax obligations. If you find yourself facing financial difficulties, don’t hesitate to reach out to the IRS to discuss a back tax payment plan. They’re there to help you explore options for your back tax payment plan.

Keeping a thorough log of your transactions and any communication with the IRS is essential. This practice not only helps you monitor your responsibilities but also tracks your progress. Financial advisors stress that maintaining automatic transactions simplifies the process and nurtures a sense of responsibility.

Real-life instances show that individuals who actively oversee their financial arrangements often experience less stress and achieve better outcomes. For example, those who stay organized and informed can navigate their tax obligations with confidence, avoiding the pitfalls of non-compliance. Remember, if you default on your payment plan, you may receive a CP523 or Letter 2975, indicating that you have 30 days to act to avoid termination of your agreement.

You are not alone in this journey. We’re here to help you take control of your financial future.

Conclusion

Navigating the complexities of back tax payment plans can feel overwhelming. We understand that understanding the available options is essential for regaining your financial stability. By breaking down the process into manageable steps - like determining eligibility, applying for a plan, and effectively managing payments - you can take control of your obligations and avoid the stress that often comes with tax debt.

Key insights reveal the importance of knowing the types of payment arrangements available, such as short-term and long-term plans. Understanding the criteria for eligibility can significantly impact your financial journey. Additionally, practical tips for applying and managing these plans - like setting up automatic payments and keeping organized records - can lead to more successful outcomes and less anxiety.

Ultimately, mastering a back tax payment plan isn’t just about settling debts; it’s about fostering a sense of empowerment and responsibility over your financial future. By taking proactive steps and utilizing available resources, you can transform your tax obligations into a manageable process. This paves the way for a more secure financial landscape.

Embrace the tools and knowledge shared in this guide. Remember, you are not alone in this journey. Take the first steps toward financial clarity and peace of mind today.

Frequently Asked Questions

What is a back tax payment plan?

A back tax payment plan is a contract with the IRS that allows taxpayers to settle their tax debts gradually rather than all at once.

What are the types of back tax payment plans available?

There are two main types of arrangements: short-term financing options, which last up to 180 days, and long-term installment contracts that can extend for several months or even years.

Why is it important to understand back tax payment plans?

Understanding these choices is crucial for effectively managing tax debts and avoiding additional penalties.

What should I consider when choosing a back tax payment plan?

Each option comes with specific eligibility criteria, fees, and implications for interest accrual that should be considered when choosing a plan.

Can I get assistance with navigating back tax payment plans?

Yes, there is support available to help you understand and navigate the details of back tax payment plans.